According to the International Coffee Organization (ICO), the price of coffee has risen for 17 consecutive months and the sector is being hit with sequential shocks, the latest being the Ukrainian conflict, which is having impacts on both the demand and supply sides. I was talking with a friend over the weekend just gone and…

Timor-Leste – beyond the IMF/World Bank yoke

I am hosting a workshop in Darwin today, the first CofFEE event since we established a branch of our research group here at the University in October 2012. The topic is the Economic Prospects for Timor-Leste and the discussion is oriented to broaden the economic narrative beyond the rigid and growth-restricting fiscal rules that the IMF and the World Bank have pushed onto the Timor-Leste government. The aim of my work generally is to develop more inclusive and equitable approaches to economic development, which emphasise full employment, poverty reduction and environmental sustainability. A complete understanding of Modern Monetary Theory (MMT) allows one to see the agenda of the multilateral organisations in a clear light. So while Timor-Leste has a major struggle ahead to achieve its strategic goals of becoming a middle-income nation by 2030, it would be advised to scrap its present currency arrangements and use its massive oil wealth to introduce unconditional and universal job guarantees as the starting point for a more coherent and inclusive development path.

The Workshop Program is as follows:

- 13:00 Introduction and Welcome – Professor Bill Mitchell, CofFEE Director

- 13:10-14:00pm Professor Daniel Kostzer, Senior Economist with the UN Secretariat in Timor-Leste – Topic: The socio-economic structure of the first republic of the 21st Century: Timor-Leste.

- 14:00-14:40 Avelino Maria Coelho da Silva, Secretary of State for the Council of Ministers, Government of the Democratic Republic of Timor Leste – Topic: Evaluating the economic and employment progress of Timor Leste and a proposal for co-operative self-sufficient agricultural development. He is also the Leader of the Socialist Party in Timor-Leste.

- 14:40-15:00 – Afternoon Tea

- 15:00-15:40 – Martin Hardie, Lecturer in Law, Deakin University, former solicitor, barrister and advisor to the East Timorese resistance and government – Topic: Personal reflections on the role of the UNTAET in setting the economic fundamentals of the East Timorese economy.

- 15:40-16:20 – Prof Bill Mitchell – Topic: Currency sovereignty and the need for employment guarantees in developing nations.

- 16:20-17:00 – Panel Discussion and Open Floor

We are trying to stream it live and I will make a link available if that proves to be possible. There will be a full video of the event available in the coming days though.

The struggle against the Indonesian invasion, which resulted in independence in 2002, was very costly in terms of the destruction of real resources in Timor-Leste. The Indonesian army and its sycophantic rebel militias deliberately destroyed a significant proportion of the economic infrastructure in the nation towards the end of 1999 as it became clear that the UN was supporting the independence struggle.

Roads, water supply systems, the power supply, houses and school buildings were targetted as a malicious last act of an illegal colonisation by the Indonesians.

The Government of Timor-Leste has developed a nation-building plan in 2011 – the Strategic Development Plan (SDP) – which aims to fast-track the development of public infrastructure and human capital development. It is a massive task.

It is devoting considerable resources – mainly from the Petroleum Fund – to fulfill this task.

The nation is rich in petroleum resources although the Australian government has been doing its best to deprive the Timorese of what their fair share in the Timor Gap resources should be. Australia has been manipulating its national borders and withdrew from the relevant international jurisdictions, which would have resolved the disputes concerning ownership just before official independence was granted. The cynicism is exemplified because these withdrawals were only on issues concerning maritime boundaries.

Australia’s behaviour with respect to Timor-Leste has been poor from the time that it sided with the Indonesians when they invaded the small nation. This is despite the people of East Timor (at the time) suffering awful consequences from the Japanese during the Second World War as a result of extending succor to Australian troops who were fighting the Japanese invasion throughout the islands.

There is only elementary frameworks in place at this time for gathering meaningful social and economic statistics in Timor-Leste and so it is still difficult to fully document how the economy is travelling.

We know that its non-oil economy has been growing strongly over the last five years as a result of strong public infrastructure spending. There is, however, widespread illiteracy, malnutrition, unemployment and poverty, all interrelated.

The UNDP report – One Instrument, Many Targets: Timor-Leste’s Macroeconomic Policy Challenge – estimated that the “share of people living under the national poverty line increased from 36 per cent in 2001 to 50 per cent in 2007”. it also showed that the “maternal mortality ratio remains unacceptably high” and around a “half of the children are underweight”.

Further, it estimated that in the capital (Dili) “58 per cent of the youth” were unemployed in 2009. Timor also has high rates of illiteracy and very low per capita income.

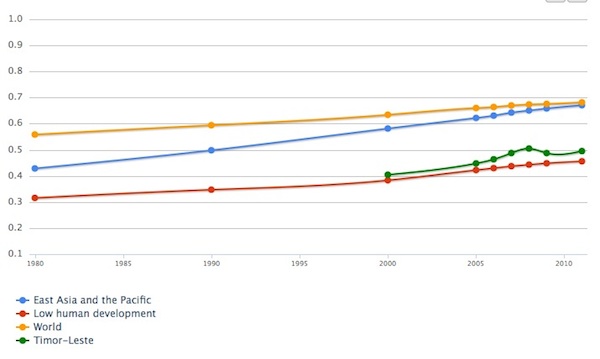

You can access some summary data for Timor-Leste from the – UN Human Development Indicators.

The following graph presents trends in the UN’s Human Development Index from 2000 to 2012. Timor was moving quickly away from the “Low Human Development” path, prior to the financial crisis but took a substantial hit during the crisis. The strong public infrastructure spending, however, has helped it resume its improvement.

It obviously has a long way to go in reaching its SDP goals, which if successful, would see the nation achieve upper-middle income status by 2030.

The multilateral agencies operating in Timor-Leste, the most influential being the IMF and the World Bank, however, are critical of the pace of government spending.

Inflation has been rising (now above 10 per cent) but this has been mostly due to the falling value of the US dollar (the economy is dollarised) and, to some extent, rising food prices. Timor-Leste is a net importer of food.

What is often not understood when it comes to the inflation generating process in Timor-Leste is that most of it is imported and stems in no small part from its decision to use the US dollar as its official currency. For example, the nation imports a lot of essentials from Australia (food etc) and in the last decade the Australian dollar has soared against the US dollar (doubling in value).

This has had the effect of pushing the prices of imported products from Australia. But the cure for that is not to impose fiscal austerity but rather insulate the economy from imported inflation by allowing the exchange rate to move. That cannot happen at present as a result of the dollarisation. I will return to this again soon.

In February 2012, the IMF published its Article IV Consultation, which is a standard document that results from its consultations with members (usually on an annual basis).

This document emerges out of “visits” by IMF officials to the nation in question. They consult government officials, usually who are already in the “IMF way” and avoid more widespread consultation. The World Bank is also often involved as they were in the most recent visit.

In the latest briefing the IMF say:

The planned investment in infrastructure is welcome, but given double-digit inflation, staff advised slowing the planned increase in capital spending over the next few years to better align with the absorptive capacity of the economy and administrative constraints. In the absence of monetary policy (Timor-Leste uses the U.S. dollar), sound fiscal policy is key to containing high inflation and sustaining strong growth. Staff supported the government’s plan to reduce the non-oil fiscal balance to a sustainable level over the next 10 years, to provide an anchor for fiscal policy.

Timor has massive petroleum resources which allow it to earn significant export revenue – “Petroleum income accounted for about 270 percent of non-oil GDP, as of 2010” (IMF).

It runs a large current account surplus (“over 50 percent of GDP in 2011”), which has allowed it to accumulate over $US9 billion in foreign investments.

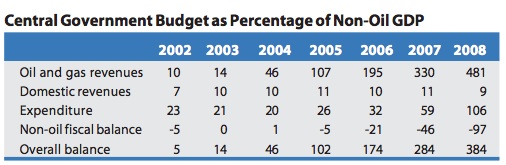

The following Table is taken from the UNDP MDG Report (cited above) and shows the importance of oil revenue to Timor-Leste. As the Report notes, “that without oil and gas revenues, the overall fiscal balance will drop to a deficit of 97 per cent of GDP” and that the “oil sector is an enclave that has virtually no linkages to the rest of the economy. It creates no employment for the domestic work force”.

In the short- to medium-term, the oil revenue is clearly massive and provides ample opportunity for the nation to invest in durable assets, the most important being human capital (education and training).

While it is seeking to build the Petroleum Fund up further to ensure that there are funds for future generations once their oil resources start to decline it has more than enough to fund increased capital infrastructure development and short-term imports of food to alleviate the shortages that have developed.

I will return to the problems of the Petroleum Fund later because it bears on the use of the US dollar as the official currency.

Timor-Leste also needs to invest more in agriculture and I will write more about the competing interests on agricultural development in a separate blog. The World Bank, obviously, favours the agri-business type export model whereas there is a strong case to be made that a co-operative system of small scale subsistence agriculture will help improve food availability. I will write about that another day once I have done more research on the question.

The IMF and World Bank, however, does not have a good track record when it comes to agricultural reform. They have an export-market obsession which not only leads to products flooding the world markets and driving down prices so that farmers have trouble even servicing the debts that are pushed upon them in the name of development, but the conversion into export production undermines the sustainable subsistence characteristics of the agricultural sector. Ultimately, it leads to poor outcomes.

The IMF Briefing notes that:

Large infrastructure spending is mainly to be financed by withdrawals from the Petroleum Fund. The government is also considering other financing options such as borrowing and public- private partnerships (PPPs).

First, the Petroleum Fund is now over $US9 billion – around 90 per cent is invested in US government bonds. There is no need for the government to borrow any funds, given that all of the borrowing would have been in the form of foreign-currency loans. The government of Timor-Leste should relinquish the US dollar as its official currency, a point I take up later.

Second, PPPs should be avoided. As I explain in this blog – Public infrastructure 101 – Part 1 – PPPs are another neo-liberal vehicle for transferring and concentrating public wealth into the private sector.

They can only become cheaper than full public provision at the expense of service quality and in the case of an essential service or infrastructure, the intrinsic risk can never be transferred to the private sector.

Further, they have delivered poor outcomes to date around the world and they effectively transfer the planning of public infrastructure to the private sector who are motivated by profit rather than service delivery.

The underlying premises underpinning macroeconomic policy in Timor-Leste, are, however, typical of the neo-liberal leanings of the IMF and the World Bank.

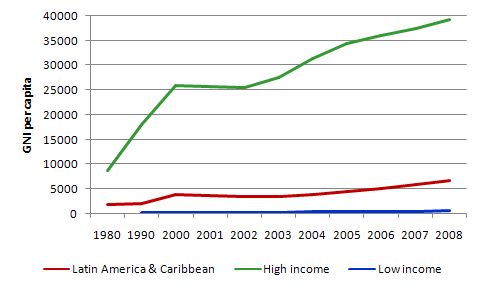

I have noted in the past that the IMF does not have a good track record in developing economies. Please read this blog – IMF agreements pro-cyclical in low income countries – for some data. The following graph, uses data from the World Development Indicators, provided by the World Bank. It shows Gross National Income per capita, which, in material terms is an indicator of increasing welfare.

The overwhelming evidence is that thes IMF structural adjustment programs (SAPs) increase poverty and hardship rather than the other way around. Latin America and Sub-Saharan Africa (which dominates the low income countries) were the regions that bore the brunt of the IMF SAPs since the 1980s.

While the high income countries enjoyed strong per capita income growth over the period shown (since 1980), Latin America (and the Caribbean) has experienced modest growth and the low income countries actually became poorer between 1980 and 2006.

The two trends are not unrelated. The SAPs are responsible for transferring income from resource wealth from low income to high income countries.

During the period when the United Nations Transitional Administration in East Timor (UNTAET) – was steering the creation of the new Timorese nation (from 1999-2002). The IMF and World Bank were also prominent and I will detail more fully the transition in later blogs.

The nation was pressured to adopt the US dollar as its official currency. At the time, I was approached by a lawyer, who had provided legal support for the resistance movement and was also aiding the transition.

He asked me to advise him on the best currency arrangements. Clearly, I indicated that the new nation needed to introduce its own currency from the outset, which would allow them true independence. I strongly urged against the dollarisation of the economy. Obviously bigger voices prevailed.

That decision has been a very poor one for Timor-Leste and as part of its long-term development it should abandon the US dollar as soon as possible.

What are the issues?

First, the dollarisation of the economy is not only unnecessary but it limits the scope of macroeconomic policy making in Timor-Leste. By adopting the US dollar the nation does not have independent monetary or exchange rate policy. It cannot choose its own interest rate and the inflationary implications of that are noted above.

This means that all counter-inflation efforts have to be performed using fiscal policy, which is also entrusted with advancing the economic development, in line with the Millennium Development Goals.

There is a rule in economics that there has to be an equal number of policy tools for the policy targets. How on the one hand can the Timor-Leste government satisfy the development goals when it has to adopt tight spending policies, under the watchful eye of the masters of slash and burn, the IMF?

Any serious attack on inflation via fiscal austerity will be very costly to a nation that desperately needs increases in government spending growth not reductions. And remember that trying to discipline the inflation process, when the origin of that process is mostly due to its currency arrangements (dollarisation) is very costly and, ultimately, doomed to fail.

The solution, from an MMT perspective is clear. Timor-Leste should abandon the US dollar and introduce its own currency and allow it float on the international markets.

Then the nation would de-couple itself from the US monetary policy and exchange rate fluctuations and fiscal policy would be able to target public infrastructure development more fully to not only provide capacity to increase agricultural outputs (reducing its dependency on imported food) but also attract private investment in urban infrastructure (so-called crowd-in effects).

This will also allow the nation to better manage a large-scale public works program to directly address the problem of unemployment and underemployment. That will, in turn, better target poverty reduction.

A newly created central bank would be able to play the dual role of maintaining financial stability (via liquidity management) and acting as a development bank to ensure that private development was adequately funded at stable interest rates.

I will come back to this soon.

Second, the – Petroleum Fund Law 2005 – was drawn up to be consistent with Article 139 on Natural Resources in the 2001 – Timor Leste Constitution. This Article says that all natural resources “shall be owned by the State and shall be used in a fair and equitable manner in accordance with national interests”.

The Petroleum Fund Act in tandem with the dollarisation of the economy undermines that statement of purpose. Articles 14 and 15 of that Act require that 90 per cent of the invested funds be placed in US dollar assets (of various types).

This prevents the Fund from investing in higher yield non-US assets such as Australian government bonds, which are of equivalent no-risk status. So you can see it is also tied in with the fluctuations in the value of the US dollar rather than a true purchasing power measure if the PF was diversified across a range of zero-risk assets (such as the higher yielding Australian government bonds).

This requirement means that the value of the fund fluctuates with the fortunes of the US dollar and during the economic crisis, the Petroleum Fund lost up to 30 per cent of its value as the US dollar depreciated. Clearly, the loss of value is not in terms of the fund’s nominal asset value given it is denominated in US dollars. But in terms of purchasing power the fund is vulnerable from this unnecessary restriction.

The IMF is also promoting what are effectively balanced budgets on the government of Timor-Leste via an unnecessary fiscal rule. In its 2012 Briefing document it stated that:

The government intends to reduce the non-oil fiscal balance to the level implied by the ESI over the next 10 years. Staff supported this goal as an anchor for fiscal policy.

ESI stands for estimated sustainable income, which is defined in the Petroleum Fund Law as “3 percent of Timor-Leste’s total petroleum wealth that is the current Petroleum Fund balance plus the net present value of future petroleum receipts”. There is no economic or financial basis for this 3 per cent rule. It has striking overtones with the 3 per cent Stability and Growth Pact rule that is ruining the Eurozone nations.

It is an arbitrary constraint which prevents Timor-Leste from using the wealth it possesses to advance its development goals. Sure enough there are capacity constraints in the nation that have to be overcome (for example, actually spending the money effectively to ensure all citizens benefit), but the 3 per cent rule is not scaled to reflect those constraints.

It is a typical neo-liberal constraint on government spending. The consequences are predictable and observed by the fact that the vast majority of the population remain in an impoverished peasant state.

The fiscal rules that the Timor-Leste government accepted (crafted by the World Bank and the IMF) force it to justify any withdrawals form the PF beyond the ESI.

So the Government is not only using a foreign currency but is also voluntarily constraining its capacity to use the wealth it possesses to advance the material interests of the population.

The IMF is pressuring the government to spend less when it should be spending more and allowing the other macroeconomic policy tools, which are currently unavailable as a result of dollarisation to lift some of the weight. They are using the inflation bogey to restrict spending when the inflation is mostly tied up with the decision to use the US dollar.

The link between macroeconomic policy and poverty reduction via development (including job creation) is obvious although usually denied by these demands for fiscal balance.

In Making fiscal policy working for the poor, which is a UNDP publication published in 2004, we read:

Macroeconomic policies represent a key ‘entry point’ for the UNDP’s activities to foster human development. In order to present programme countries with viable macro policy options, UNDP seeks to support access to policy advice that presents a menu of feasible options and alternative analyses.

In Timor-Leste’s context, all the notions of fiscal space that the IMF and UNDP wheel out are moot.

The IMF Briefing considered the question of the retention of the US dollar. It said:

Staff supported the authorities’ intention to continue to use the U.S. dollar as its currency. Given the country’s limited capacity for independent monetary and exchange rate policies, the use of the U.S. dollar is appropriate and has provided a nominal anchor. There are no plans to change the exchange rate regime in the medium term, but as indicated in the SDP, the Central Bank plans to study, by 2015, the merits of adopting Timor-Leste’s own currency.

The nation has huge oil reserves and could easily run an independent monetary and exchange rate policy. It is quite different from less developed nations that have large current account deficits and always face currency depreciation.

It is quite clear that the use of the US dollar has not provided a sound nominal anchor. The IMF contradicts its own position here. Earlier in the briefing it argued that the government needs to tighten fiscal policy because high inflation is becoming endemic – that is, there is no effective nominal anchor.

There are hundreds of developing countries that do have currency sovereignty which means they can enforce tax liabilities in the currency that the government issues. It doesn’t matter if other currencies are also in use in those countries, which is common. For example, the USD will often be in use in a LDC alongside the local currency and be preferred by residents in their trading activities. But, typically, the residents still have to get local currency to pay their taxes. That means the government of issue has the capacity to spend in that currency.

So the point is that as long as there are real resources available for use in a less developing country, the government can purchase them using its currency power.

The are hundreds of thousands of people in Timor-Leste who are unemployed. They are real resources which have no “market demand” for their services. The government of Timor-Leste could easily purchase these services with the local currency without placing pressure on labour costs in the country.

Given the oil wealth embodied in the Petroleum Fund, the government could also implement an employment guarantee under existing currency arrangements. But by jettisoning the dollarisation of its economy it frees up monetary and exchange rate policy, which is current hindering development.

Those who might oppose such a development will claim that this policy would place further strain on the food shortage and cause inflation. Given the strength of the current account (as a result of its petroleum exports) it is hard to see any large scale depreciation occurring.

But all open economies are susceptible to balance of payments fluctuations. These fluctuations were terminal during the gold standard for external deficit countries because they meant the government had to permanently keep the domestic economy is a depressed state to keep the imports down.

For a flexible exchange rate economy, the exchange rate does the adjustment. Is there evidence that budget deficits create catastrophic exchange rate depreciation in flexible exchange rate countries? None at all. There is no clear relationship in the research literature that has been established.

If you are worried that rising net spending will push up imports then this worry would apply to any spending that underpins growth including private investment spending. The latter in fact will probably be more “import intensive” because most less developed countries import capital.

But as noted above, the Petroleum Fund gives Timor-Leste an abundance of purchasing power with which it can increase the importation of food without introducing a debilitating currency crisis.

Further, well-targetted government spending can create domestic activity which replaces imports. For example, Job Guarantee workers could start making things that the nation would normally import including processed food products.

Moreover, a fully employed economy with skill development structure embedded in the employment guarantee are likely to attract FDI in search of productive labour. So while the current account surplus might decline from its very heady heights as the economy grows (which is good because it means the nation is giving less real resources away in return for real imports from abroad) the capital account would move into surplus. The overall net effect is not clear but an external deficit in the short- to medium-term is highly unlikely in the the case of Timor-Leste.

Where imported food dependence exists – then there are two considerations. If the nation is not resource rich and cannot generate sufficient export earnings to allow it to import enough food, then the role of the international agencies should be to buy the local currency to ensure the exchange rate does not price the poor out of food. This is a simple solution which is preferable to to forcing these nations to run austerity campaigns just to keep their exchange rate higher.

But Timor-Leste is not in this position. It has sufficient export revenue earning capacity to fund vastly increased imports, including food.

MMT tells us that the reason there is mass unemployment in less developing countries is the same as there is mass unemployment in advanced economies. There are plenty of jobs to do in both types of economies. There is no shortage of work! In fact, in nations such as Timor-Leste there is an abundance of labour intensive work that can be done to improve the public amenity and infrastructure.

The problem is that there is always a shortage of paid work. The solution is to fund the work that needs to be done in all economies. If you have idle labour then that means there is not enough employment funding being injected into the spending system.

The government has the capacity to make up these shortfalls in spending where it is sovereign without imposing higher taxes and without recourse to borrowing. As a starting point it should use its sovereign capacity to buy up all the unwanted labour – that is, introduce an unconditional and universal employment guarantee.

It is clear that skill levels vary and in Timor-Leste there is a paucity of skilled labour. That just means that the public works programs have to be designed in ways that are inclusive to the least-skilled workers.

My work in South Africa (in relation to the Expanded Public Works Program which employed more than a million workers in the first five years of operation) taught me that large-scale public works initiatives can be very successful in alleviating poverty and improving the family dynamic. They are difficult to organise and never “perfect” but they add productive value to the communities and the people that participated in the work.

The other thing it taught me is that there are many ways in which a particular goal can be addressed. My interaction with civil engineers in South Africa was illustrative. The bureaucrats – engineers who had been educated in the US or Britain were horrified that we would advocate labour-intensive road building methods (read: lots of me bashing rocks into the dirt as in the old days). They wanted the best-practice methods that employed hardly anyone per km of road length.

The science indicates that the two methods of road building both produce first-class surfaces that are durable and effective. But for these sort of programs to be successful, they have to be flexible and scale the employment reach to suit the circumstances. So the labour-intensive methods employ more and can be inclusive for the lowest skill workers (who only have to bend their backs!) but they still produce excellent roads.

My experience in these sorts of programs tells me that there are many more examples like this one.

The opponents of universal and unconditional employment programs are usually so obsessed with their erroneous notion of “fiscal room” that they fail to understand the way in which an employment guarantee is part of an overall macroeconomic framework that provides full employment and price stability.

Piecemeal and small-scale employment programs based on some limited international development aid might create a few jobs here and there. Should we be happy about that? Well 1 job is better than none. But in the less developed countries millions of jobs have to be created. In Timor-Leste tens of thousands of jobs are needed in the first instance.

In this context, the problem is a macroeconomic one and the debate has to come to terms with that. The only way that nations are going to be able to successfully create enough jobs is for them to abandon these nonsensical neo-liberal concepts of “fiscal space” and fiscal rules, such as the ESI in Timor-Leste, and come to terms with the fact that most countries do have sovereign currencies and that those that do not should be encouraged and aided to move in that direction.

Once you come to terms with that then you can “think big” and work out structures that are capable of supporting the creation and adminstration of millions of public jobs. Then we might get some distance down the road to fighting poverty.

Conclusion

I will have a lot more to write in the coming period about Timor-Leste as I learn more. I am visiting the nation next week and will have more to write after that visit.

This is just a sketch of some of the issues facing Timor-Leste as it gropes its way forward in its early days of nationhood. It is already being squeezed in the vice-like grip of the IMF and the World Bank and has accepted the neo-liberal line of thinking that unjustified fiscal rules (the ESI) deliver stable outcomes.

In the case of Timor-Leste, all these fiscal rules generate is continued poverty, malnutrition and unemployment. They do nothing to develop the self-sufficiency of the agriculture – and most of Timor-Leste remains a peasant, pre-capitalist economy.

The dollarisation also leave it with little room to pursue the development goals that have been set for it.

That is enough for today!

(c) Copyright 2012 Bill Mitchell. All Rights Reserved.

Dear Bill,

What about an even bigger elephant in the room?

What is the influence of population growth (currently about 3% p.a.) on GDP per capita, dependency on imported food, state of the environment and rate of unemployment?

” Timor-Leste has one of the highest fertility rates in the world with each women having on average 6.95 children.” source: UNFPA

Even if all these people are employed, what if the environment is ruined and cannot sustain the population?

Wouldn’t be appropriate to break the post-colonial dominance of the Catholic Church and introduce mass birth control programs? If IMF is evil isn’t the Catholic Church in Timor even worse? Shouldn’t we talk openly about curbing the influence of the oppresive medieval institution treating the human society like a backyard breeding farm?

Ignoring the fact that those large families in poverty don’t get the chance to consume much, raise their living standards (especially public health and nutrition) and watch the fuse on yet another of those ‘timebombs’ (the demographic one) fizzle out.

It certainly worked in the west.

Dear Bill,

Great stuff you get involved in and pity I cannot make it to Darwin. I look forward to your presentation about the currency sovereignty in developing nations, this is not well developed (in my opinion) in the books by Wray or in your book with Muysken.

I was wondering whether Papua New Guinea, which is in the neighbourhood, is a good comparison to Timor-Leste. They have their own currency, the Kina, and the current economic structure is heavily influenced by hydrocarbons. In the 90s internal strife resulted in the Kina losing 70% in nominal terms and a near complete loss of FX reserves. Inflation averaged 15%p.a. and spiked to ~25% p.a. in several occasions. Interestingly GDP per capita increased in real terms during the decade of the 90s (and then literally took off from mid-2005).

I think there are lessons here about the cushion provided by a flexible FX and I wonder if you were covering this in your presentation, or if you disagree with the applicability of the experience.

Regards,

Javier

Paul,

It worked because the surplus of people could migrate away (from Ireland, Poland, Italy, Germany). The waves of migration from Eastern Europe (e.g. Galicia/Галичина) before 1914 were caused by either recurring famine or pogroms.

It won’t fizzle out if the Catholic Church is actively undermining policies educating people about family planning. The same happens in the Philippines. I think that all the talk about raising living standards is similar to prescribing vitamins to a chain smoker. It was the often criticised as draconian One Child policy in China what actually helped them get out from the extreme poverty.

@Adam

According to UNICEF (Source), Total fertility rate, 2010: 6.2

Population annual growth rate (%), 1990-2010 2.1, which may still be high, but is not such a scary number.

As Paul says, people are aware of the high infant mortality rate, and this affects their behaviour.

Timor Leste is in the tropics. There are by now thousands of paper and books addressing the topic of the impact of global warming upon the tropics within the time period to 2030. But Prof Mitchell, like all specialists, unfortunately adheres to what he knows or thinks relevant, in this case labour economics.

The effect of that global warming on infrastructure (road and bridge destruction through flood and storm; agriculture (lower or zero crop yield, whether World Bank model or subsistence); human and animal health impairment from new/increased disease and hence lower productivity, is nowhere addressed.

The question hence arises of what value Prof Mitchell’s policy recommendations for Timor may have. This is because they appear to assume, as in 1960 or 1970, that the climate in which poverty, malnutrition and unemployment are to be alleviated in an agricultural country will be essentially the same as in 1900 or 900 or 9,000 BC. This assumption is however false.

Already in 2006 Nicholas Stern addressed global warming as a mainstream economist.

World Bank is now talking as of yesterday of a 4° C rise in average global surface temperatures. Prof Mitchell does not even factor in the comforting 2 °C rise, which has been specious for some time now.

Timor Leste has a Petroleum ie fossil fuel reserve. Climatology would seem to indicate that this reserve either be left in the ground, thereby condemning Timorese to poverty and early death, or used to produce high value-added synthetics in local plastics factories rather than “flogging it off” to be burnt as is done with Australian coal reserves.

It doesn’t really matter what the weather’s like if you have no means to sustain yourself. In those conditions, not worrying about heating is probably a plus

Adam,

Maybe they are just a little reluctant to have their fertility non problem addressed by others after the world bank funded ‘Programa Keluarga Berencana’.

@Paul: you are truly bizarre. Are you by chance an Enlightenment-driven economist?

Correction 1: you write that it doesn’t matter what the “weather” on Timor is like. I notify your category error: weather is short-term, climate is long-term. Get it? If you don’t, access an agronomist, sonny: he will tell you that subsistence and cash crops are actually plants ( no, not industrial plants as adulated by economists , I mean the ones that grow in the ground) and that they have tolerances of precipitation and temperature.

Correction 2: you write that “not worrying about heating is a plus”.. I have news for you, Timor Leste has more need of A/C than heating. Forget about a 5KWh photovoltaic installation currently costing AUD 25,000 on every Timorese hut: Timor Leste gets cloud cover too.

Correction 3: the “means to sustain yourself”, given that Mitchell already mentioned subsistence agriculture, those means you mention are a dependent variable ( I have to get mathematical here, this is a hard-nosed economist blog) of climate. Wouldn’t you know it sonny, that climate is getting more independent of your wishful thinking by the day: you want a hard-nosed number? Try the Earth’s energy imbalance measured in watts/m2.

Brilliant, brilliant stuff. I wish I had had this kind of information in the late 1990s, when nothing the UNDP (whom I briefly worked for in Vietnam) put out allowed me to understand what was going on in Asia at that time. Eventually, my confusion led me to an article or two on the Asian crisis by Alain Parguez, which led me ineluctably to MMT and this excellent piece. I am sending it to my (sympathetic) friends at the World Bank.

East Timor is dollarised, so that means that banks in East Timor have right to issue dollars? They have accounts at the federal reserve and excessive lending is covered by automatic finance from US banks?

Sounds pretty dangerous to me since banks in East Timor are not under US legistlation or supervision. Whatever prevents them from taking on huge debts and then defaulting on those debts like banks in Iceland did?

Arrhenius: No matter what the climate is like, is it bad to do arithmetic correctly? That’s what MMT recommendations boil down to. No matter what work needs to be done to avert or mitigate a catastrophe, is it better to force people to not work against it?

Basic MMT macro policies make no assumptions depending on the climate. They’re really a framework for possible policies, more than a specific policy. Only the particular implementations, the particular things a government and society might spend on would depend on such assumptions. Of course it is possible to make mistakes there. But doing nothing, forcing people to do nothing, is almost certainly the worst decision of all.

@arrhenius

@Paul: you are truly bizarre. Are you by chance an Enlightenment-driven economist?

No, why would you think that?

Correction 1: you write that it doesn’t matter what the “weather” on Timor is like. I notify your category error: weather is short-term, climate is long-term. Get it? If you don’t, access an agronomist, sonny: he will tell you that subsistence and cash crops are actually plants ( no, not industrial plants as adulated by economists , I mean the ones that grow in the ground) and that they have tolerances of precipitation and temperature.

I already knew all those things. That wasn’t the point.

Modern, man made economics will have a far greater impact on their lives.

Weather is something you can reliably predict about a week in advance, climate cannot be predicted reliably at all and it changes all by itself. Here in the UK we were told that snow was a thing of the past back in 2008.

Correction 2: you write that “not worrying about heating is a plus”.. I have news for you, Timor Leste has more need of A/C than heating. Forget about a 5KWh photovoltaic installation currently costing AUD 25,000 on every Timorese hut: Timor Leste gets cloud cover too.

Well, thanks for the news. How have they got by all these years without A/C?

Correction 3: the “means to sustain yourself”, given that Mitchell already mentioned subsistence agriculture, those means you mention are a dependent variable ( I have to get mathematical here, this is a hard-nosed economist blog) of climate. Wouldn’t you know it sonny, that climate is getting more independent of your wishful thinking by the day: you want a hard-nosed number? Try the Earth’s energy imbalance measured in watts/m2.

And what is this terrible figure? Are you arguing for a balanced energy budget?

Plaease don’t call me ‘sonny’, after all this Jimmy Saville business, its a little creepy.

dnm, Paul,

The data about fertility and population growth may vary depending on the period. Fortunately these numbers appear to be falling (I checked on CIA Word Factbook – the latest growth rate is 2.49% 2012 est.). I would certainly not include the period of war for independece in the statistics though.

I have already mentioned the environmental factor, this obviously includes the effects of global warming. The Timorese have very little impact on the severity of the global process but they are very likely to suffer. What they can influence is the damage inflicted upon the environment of their own country. If the issue of overpopulation is not addressed we are back to Malthus I am afraid. The population growth not only subtracts 2.5% from the GDP per-capita growth. The absolute limit on the number of people who can be fed using agricultural resources available in the country has already been exceeded for the current subsistence farming mathods. This is not a “non-problem”. Switching to intensive farming methods in Timor even if it was economically possible would have a severe environmental impact and might backfire in the long run, too. Obviously Australian farmers are very happy to sell their product to East Timor, nobody will complain about that in our country. The only problem is that this model is not sustainable in the long run – the oil and gas can run out in 20 years in Timor. (source: Lowy Institute, Will Timor-Leste avoid the resource curse? Gordon Peake – 7 February 2012 ).

Who will feed East Timorese then? We have an ultra-conservative Catholic Tony Abbott as the head of the opposition in Australia. He has a significant chance to become the next PM (hope not). Will he or the people like him invite economic refugees from Timor to settle in Australia? I don’t think so, Abbott shows his other, less merciful face when it comes to “illegal immigration”. Tony Abbott is actually one of the people behind the recent outbreak of the hysteria over boat people.

I fully agree with the analysis provided by prof Mitchell in the main blog. It is good to have an additional lever or two on the dashboard and avoid “financial advisors” acting in their own interest. But this doesn’t mean that the direction of the journey is not to be questioned. I would throw that purple-frocked back-seat driver out, too. East Timor is one of the few remaining countries where Catholic Church is still able to exercise control over the political life.

There is an enlightening text written by Bishop of Darwin Eugene Hurley in “Eureka Street” July 17, 2012, “Contraception not the answer to maternal mortality”. The topic is closely related to one debated in the comments. Bishop Hurley started by criticising our FM, Bob Carr and Melinda Gates for supporting modern family planning methods, then presented his own “solution”.

“… Foreign Minister Senator Bob Carr’s announcement of a doubling in AusAID funding for family planning and the article he wrote with Melinda Gates last week in The Lancet target pregnancy itself as the problem, rather than the lack of good basic health services. This debate comes out of the London Summit on Family Planning which is looking to sign up governments to a huge boost in funding for contraceptives like the long acting injectable Depo-Provera, sterilisation and IUDs. These are methods that once administered are difficult for women in developing countries to reverse.”

…

“Families in developing countries have more children when they are poor because that makes sense to them culturally and economically. Reducing people’s poverty may allow parents to decide to reduce the number of children they have because they have a more secure future. Natural family planning for regulating the number of children in a family promotes human dignity and respect between spouses, helping to bring about a better human order in the wider community. Methods like Billings, Sympto-Thermal, Napro-tech or Creighton have similar reliability to oral contraceptives. The Church does not support artificial birth control or abortion as methods of family planning.”

—

What economic school does Bishop Hurley belong to when he claims that having more children makes economic sense to families in developing countries? We all agree that reducing poverty is a solution but I am arguing that the the excessive population growth is itself one of the main factors making sustainable economic growth virtually impossible. The Timorese may have about 20 years to sort their issues out. Will this time window be wide enough or will they share the fate of Nauru, a formely-rich but nowaday economically failed state dependant on foreign aid?

I think that Catholic Church and dependant organisations have had enough time to prove the effectiveness of their family planning methods in these developing countries which have remained under their influence. The same applies to the fundamentalist breed of Islam, too. I would like to hear success stories but there is probably none. These countries which eventually got out of the poverty trap became secularised. I would argue that this is a precondition of any economic change.

The Church had almost as much time to prove its point as to “promote human dignity” by adequate handling of cases of sexual abuse of children by the members of the clergy here in Australia. Another example for “promoting human dignity” was that Savita Halappanavar heard that ”This is a Catholic country’ when she requested abortion in Ireland due to a miscarriage. As a consequence of the refusal she died of septicaemia. This is not just an isolated issue but a symptom of a systemic problem.

It is now high time to get rid of the medieval superstition related to family planning and sexual life in general peddled by the 1700 years old institution. If foreign aid is to be linked with making progress in solving family planning issue, this is not a problem of “imposing foreign liberal values” by global banking institutions. Christian faith was also imposed upon these people.

I did not choose to be baptised by my father or brainwashed by the Church when I was a kid. This brainwashing was a grave violation of my liberty.

Individual people and societies suffer immensely as a result of the activities of often well-intentioned but immersed in dumb and actually evil ideology “little helpers”, still imposing their views on everyone in the countries under their influence.

Smart macroeconomic policy advocated by MMT in Timor will fall short of addressing fundamental issues mentioned above I am afraid.

@Paul: you out yourself as climate warming denialist by never having heard of Earth’s energy imbalance.

Unlike GDP or the definition of poverty or the Gini coefficient of income inequality it is a physical parameter of zero ambiguity.

…”climate cannot be predicted reliably at all and it changes all by itself. Here in the UK we were told that snow was a thing of the past back in 2008.”

Told by whom, Sonny? The Daily Mail or the Torygraph, perhaps? Or your best mate’s cousin, who thinks he saw it on the wide screen at the pub over a jacket potato and beer?

And so you secrete Lord Monktonite denialist claptrap. That will be the difference between real scientists and Julian Simon-style Growth Cornucopian “economic scientists”.

Spare me the PC anti-pederast “Savile” attitudinising: I am not in the UK.

@ Some Guy:

“Basic MMT macro policies make no assumptions depending on the climate… But doing nothing, forcing people to do nothing, is almost certainly the worst decision of all.”

News for you: tropical dwellers such as in Timor are under the de facto C02 hammer of coal exports from Prof Mitchell’s country, No. 1 per capita carbon emitter/exporter in the world. Mitchell has no problem with the use of the Petroleum Revenue fund of Timor. Like Paul he seems to be a tacit climate change denialist. QED.

Any economist applying MMT to Timor has to address the forecast real economy in 2015, 2030, 2050. There will be a choice between minimising the costs of climate-driven death and damage on Timor by leaving Timorese on Timor or allowing them some/all into Prof Mitchell’s country (assuming they want to come) and booking the costs of resettlement to e.g. general AU tax revenue.

“What economic school does Bishop Hurley belong to when he claims that having more children makes economic sense to families in developing countries?”

Try Susan George:

Another baby for a poor family means an extra mouth to feed–a very marginal difference. But by the time that child is four or five years old it will make important contributions to the whole family–fetching water from the distant well, taking meals to father and brother in the field, feeding animals… children are an economic necessity for the poor.

A bit more up to date than the greedy prelate, Malthus. Though he certaainly has his current tribunes in the shape of Buffett, Turner and the Gates family.

@Arrhenius

Ther independent, via the CRU, actually:

“According to Dr David Viner, a senior research scientist at the climatic research unit (CRU) of the University of East Anglia,within a few years winter snowfall will become “a very rare and exciting event”.

Well, its been pretty much non stop excitement since then.

As for real scientists, are Freeman Dyson and Richard Lindzen figments of my imagination?

I certainly don’t take the catastrophic AGW seriously and regret that it has eclipsed just about every other environmental concern.

Your choleric outbursts and condescension are unlikely to change my mind.

PC anti-pederast “Savile” attitudinising

Sorry,I didn’t realise you were pro pederast.

And, please don’t call me ‘sonny’.

Dear Arrhenius

I am close to deleting your comments not for the criticisms but for the tone. If you are new to my blog you might reflect a little on the civility that is displayed by those that take the time to comment and offer their views pro and con. The tone I encourage (and will only tolerate) is one of respect. Off-the-cuff insults will not survive.

As to Timor and the Petroleum: I am on the record as saying that I would close the Australian export coal industry down in 20-30 years as a climate change measure. Societies need transitions to allow the people involved to find other ways. In the case of T-L, I do advocate they use their natural resource to the best of their advantage given it is finite (estimates say perhaps only 15 years of life). In that time, a generation about, they could put in place the building blocks for a non-oil economy. Given the dominance (in people terms) of agriculture that new economy might be based around high yielding permaculture practices and service delivery.

So you should be careful when you accuse people of all sorts of things before you read all their work and consider the context.

best wishes

bill

Mitchell has no problem with the use of the Petroleum Revenue fund of Timor. Like Paul he seems to be a tacit climate change denialist. QED.

Should the Timorese just abandon their $9 Billion fund as ill-gotten gains? With sufficient ill-will, I could as easily and as soundly prove that Prof Mitchell is a Masonic conspirator, a Maoist or a flat-earther.

You suggest that Timor’s oil reserves .. “be used to produce high value-added synthetics in local plastics factories” rather than “flogging it off” to be burnt. This is entirely the sort of recommendation that Prof Mitchell makes, and he has frequently criticized the Australian “flogging off”. But for a poor nation like Timor-Leste, how is this to be started without some of the current “flogging off” being directed to real development, rather than World Bank / IMF crap?

This blog is mainly about how Timor should control its own resources, by using a sovereign currency to fully employ them to and obtain genuine benefits from its exports. It is hard to see what Mitchell actually says that you are objecting to.

Any economist applying MMT to Timor has to address the forecast real economy in 2015, 2030, 2050. There will be a choice between minimising the costs of climate-driven death and damage on Timor by leaving Timorese on Timor or allowing them some/all into Prof Mitchell’s country (assuming they want to come) and booking the costs of resettlement to e.g. general AU tax revenue.

According to Climate change in Timor-Leste – a brief overview on future climate projections, things do not seem to be that dire for Timor. As usual, Prof Mitchell is just setting up a general framework for and prospects of reform, his special expertise, not ironing out all the details. And he promises more details in more blogs to come.

Bill: lots of me bashing rocks into the dirt as in the old days.

Either: me–> men.

Or: Bill, you work too hard!

“The government has the capacity to make up these shortfalls in spending where it is sovereign without imposing higher taxes and without recourse to borrowing. As a starting point it should use its sovereign capacity to buy up all the unwanted labour – that is, introduce an unconditional and universal employment guarantee.”

Bill, I found this very interesting paper that doesn’t talk in MMT words and isn’t about money but It is in MMT paradigm:

The role of the state in economic growth

http://www.othercanon.com/uploads/state-paper-pdf.pdf

Looking at history from a simple perspective of barter, not production, and

under diminishing returns/single equilibrium/perfect information, the

importance of these policies is lost. In the diminishing return/equilibrium

perspective, any and all factors causing unequal economic growth are lost,

creating the world of artificial harmony and world-wide factor-price

equalisation. As we shall attempt to show later, a most important historical role

of Adam Smith’s was precisely that of laying the ground for “perfect markets”

and “natural harmony” by making the quest for knowledge into a zero-sum

game ± using the metaphor of a lottery ± from the point of view of both the

individual and the State. In this way Adam Smith effectively removed the quest

for imperfect competition through new knowledge which was so important to

Renaissance thinking. This is the root of why new knowledge and new

technology hits today’s mainstream economics as “manna from heaven”.

Pre-Smithian economic thinking takes a holistic starting point ± the People,

the State. A fundamental underlying idea exists that the situation of each

individual can be improved by measures which take into consideration the

collectivity of individuals. In other words, there are systemic effects which

cannot be found if one limits the horizon atomistically to study individuals

alone.

Enjoy!

I haven’t had the time to read through all the comments, but a lot of them (as well as some of the original article) is abstract or theoretical and doesn’t address a lot of Timor-Leste’s reality. This is the second-most oil-export-dependent country in the world (after South Sudan), but the oil and gas could be used up in half a generation. Although the state budget has grown at nearly 40%/year, very little has been done to develop a productive local economy.

Timor-Leste does not have massive petroleum reserves — it is likely that total oil and gas revenue over the next 40 years can support a government budget equivalent to $2 per citizen per day. The Government says GDP is growing at double digit rates, but poverty is also increasing, and is now more than half the population. I wish commentators would pay more attention in-country reality than academic theory, and encourage you to come to Timor-Leste and see how actual people (not only government officials) live. Currency is the least of their problems.

This site is worth consulting – http://www.laohamutuk.org/

Dear Charlie Scheiner (at 2012/11/27 at 10:53)

Currency sovereignty is the only viable starting point for the development process.

best wishes

bill

Charles Scheiner: With all merited respect to your work in & for Timor, I must say “Academic Theory” is sometimes MUCH MUCH MORE IMPORTANT than “in-country reality” – if the Academic Theory is fundamental enough. If the contrary, dominant “Academic Theory” is crazy enough – like “We should sacrifice people at the top of pyramids to appease the gods”. I hope you agree that for most jobs to help the Timorese, “being able to do arithmetic correctly”, “being literate”, “being able to perform correct logical inferences” to the extent that healthy non-impaired humans can, might be more important than some “in-country knowledge” of Timorese conditions.

Modern mainstream academic economics fails in such regard, to the extent that knowledge of it produces the functional equivalent of severe cognitive deficits. But the academic economists are just plague carriers – it is everyone else who suffers from their ridiculous theories. And the media now more successfully than ever before shines the darkness of economic ignorance universally – a far worse problem than having only a self-deluded “elite.”

So I suggest you pay more attention to uh, true “Academic Theory” that makes sense, and maybe less to “in-country reality”. For the “Academic Theory” you view “in-country reality” with makes no sense at all, if you can say that “Currency is the least of their problems.” You cannot understand the economic reality & problems from an absurd perspective. You cannot address problems by removing the most important tools to solve them.

For that amounts to saying “not having the ability, the possibility of solving your own problems yourself is the least of your problems”. It violently, violently contradicts the statement of your organization “La’o Hamutuk believes that the people of Timor-Leste must be the ultimate decision-makers in this process and that this process should be democratic and transparent. “ and to the aims of ETAN. It is stark raving mad. I think Bill might be too hard on you by removing your link, because it is the kind of thing that is only said by those who do not understand what they were saying.

Timor-Leste and Kenya have an acreage per capita that’s more than enough to produce a bumper crop if people are give grants in sovereign currency to grow cheap food.