I have received several E-mails over the last few weeks that suggest that the economics…

Neo-liberals can’t even identify self-interest when it is staring at them

The British Prime Minister gave a – Speech – to the Confederation of British Industry Conference on November 19, 2012, where he outlined how tough his government had been in terms of imposing fiscal austerity. In other words, he was taking responsibility for Britain’s appalling dive back into (double-dip) recession, although it is hard to find that confession in his actual words. Over the English Channel, the EU is busily preparing the champagne and fine foods for its upcoming summit on the 2014-2020 EU Budget. The EU leadership is talking tough and proposing large cuts in EU-level spending not the least being harsh cuts in the Overseas Development Aid (ODA) budget. The cuts are, of-course, based on false premises – that the economies are broke and have to live within their means – even though millions of workers lie idle. The idiocy is exemplified though in the failure to understand that ODA, while perhaps provided for ethical reasons, actually improves the outcomes of the donor nation. So these so-called free marketeers cannot even identify self-interest when it is staring them in the face. So they busily go about cutting their noses off!

Here is a little starter for today. Imagine you were worried each night that the Japanese government’s public debt ratio was rising and they had been running deficits of considerable size (and increasing) for 2 or more decades and you believed that any day soon – like even today – thinks could go awry and the whole world would come crashing down, mainstream economic textbook style!

You go to the Japanese Ministry of Finance – FAQ – page (in Japanese) to see what recourse you might have in the event of a financial collapse. You select the Fourth option (which in English concerns Government Bonds) and then under the Second Heading (Purchase and management of government bonds) on the next page, select Option 5 (What happens to our bond holds if there is a financial collapse in Japan?) you get the response (which the following graphic shows – in Google-translated English):

Pretty straight-forward. Fairly simple to understand. Categorical. Get &&#$ed deficit terrorists!

That is just context. Now back to the British PM.

In the Speech, the British Prime Minister said:

When this country was at war in the 40s, Whitehall underwent a revolution.

Normal rules were circumvented. Convention was thrown out. As one historian put it, everything was thrown at the overriding purpose of beating Hitler.

Well, this country is in the economic equivalent of war today and we need the same spirit. We need to forget about crossing every ‘t’ and dotting every ‘i’ and we need to throw everything we’ve got at winning in this global race.

– throw everything we’ve got – including deliberately pushing millions of British workers onto the unemployment queue and causing a major reduction in per capita wealth and income (disproportionately borne by the already poorest workers).

The PM was trying to be statesman-like, but the UK Guardian article – David Cameron’s CBI speech was more Private Walker than Winston Churchill – probably summed up the tenor better.

The reference is to the Private Walker in the series Dad’s Army, who “who spivved his way through the second world war armed with silk stockings, illicit petrol and anything else that was in short supply”.

I thought a better military/war-time reference was produce by Ambrose Evans-Pritchard in his UK Telegraph article – Merkel’s day of reckoning as taxpayer haircut on Greece looms – (November 19, 2012).

He wrote that:

The fond hope of EU leaders and commissars is that the North-South chasm in competitiveness will be closed by “internal devaluations” in Club Med states before their democracies blow up. This morally indefesible policy relies on pushing unemployment to such traumatic levels that it breaks labour resistance to pay cuts, and as we can see from the youth jobless rates in Greece (58pc) Spain (55pc), Portugal (36pc), Italy (35pc) it can take carpet-bombing to achieve effect.

Which is closer to what is going on at the moment. The EU and its Troika mates (the ECB and the IMF) are deliberately – carpet-boming – their workforces and most vulnerable citizens in search of a pipedream that will never be realised – the so-called “fiscal contraction expansion”.

Carpet-bombing refers to the nasty military tactic of “large aerial bombing done in a progressive manner to inflict damage in every part of a selected area of land” – it aims to get everybody and thing within its scope. It aims to saturate and obliterate.

As I have written before the consequences of this scorch-the-earth strategy that the neo-liberals are employing will have short- and longer-term (intergenerational) costs. It cannot be construed in any way as a reasonable and well-considered strategy for economic adjustment. It is a brute force strategy that reinforces the dynamics which caused the crisis in the first-place.

And, in terms of its own logic, it is self-defeating. The UK Telegraph article tells us categorically:

We know from the IMF’s work on “fiscal multipliers” that austerity has gone beyond the therapeutic dose in all the victim countries. Output loss and damage to the tax base has renedered the policy largely self-defeating. The IMF has raised its 2013 public debt forecast for Portugal over the last year from 115pc to 124pc of GDP, for Spain from 73pc to 97pc, and for Italy 120pc to 128pc.

It would have been so much easier for Euroland, for the Project, for North-South comity, if the ECB had let rip a long time ago with quantitative easing to cushion the blow from fiscal tightening, but that is to suppose a different Europe existed.

North European leaders will now have to live with the consequences of their scorched-earth errors, with destructive effects cascading through the rest of the decade. Haircuts in Greece are just the amuse bouche.

So I do not need to repeat today (I will get too depressed) that damaging the prospects of the youth of Europe now also undermines their prospects as adults in the years to come and that means the European economies will be compromised for years to come and fail the most basic test – to improve the standard of living of each subsequent generation.

But it gets worse. Not only are they carpet-bombing their own populations, but the fiscal austerity drive is seriously undermining the development effort that major advanced nations agreed to many years ago.

In 1970, the 25th Session of the General Assembly of the United Nations passed a – Resolution on Financial resources for development – (Paragraph 43) that said:

In recognition of the special importance of the role that can be fulfilled only by official development assistance, a major part of financial resource transfers to the developing countries should be provided in the form of official development assistance. Each economically advanced country will progressively increase its official development assistance to the developing countries and will exert its best efforts to reach a minimum net amount of 0.7 percent of its gross national product at market prices by the middle of the decade.

The UN agreed that while “developing countries must, and do, bear the main responsibility for financing their development” it was still beholden on each “economically advanced country” to provide substantial resources by way of overseas development aid to assist nations that were less well-off.

Most recently, the – Report of the International Conference on Financing for Development – which emerged out of the Monterrey, Mexico meetings of the United Nations (March 18-22, 2002) said that (Paragraph 42) in the context that “a substantial increase in ODA and other resources will be required if developing countries are to achieve the internationally agreed development goals and objective” and:

In that context, we urge developed countries that have not done so to make concrete efforts towards the target of 0.7 per cent of gross national product (GNP) as ODA to developing countries …

The meeting also noted “that ODA will still fall far short of both the estimates of the flows required to ensure that the millennium development goals are met and the target of 0.7 per cent of gross national product”.

You will also find the resolution re-affirmed at the – World Summit on Sustainable Development – which was held in Johannesburg, August 26-September 4, 2002.

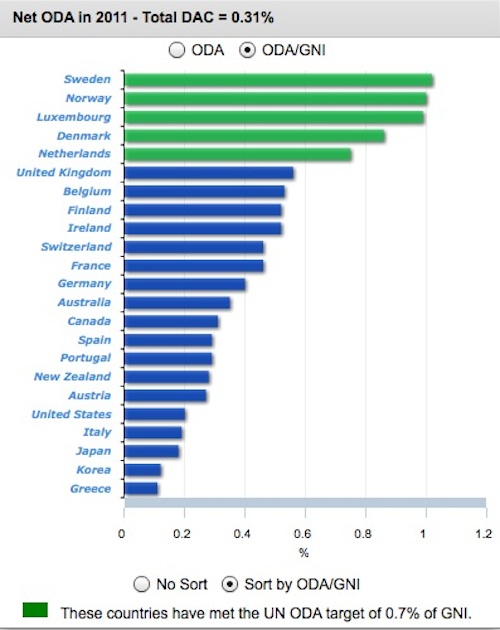

The following graph (produced by the OECD) shows the progress towards this goal (established 42 years ago) among the leading nations. I sorted the data in terms of highest aid contributors and as the legend notes the green bars denote the nations that have achieved the 0.7 per cent target.

Australia is at 0.35 per cent – half the agreed target. I will come back to that later.

In April this year, we learned from the OECD that:

Major donors’ aid to developing countries fell by nearly 3% in 2011, breaking a long trend of annual increases. Disregarding years of exceptional debt relief, this was the first drop since 1997. Continuing tight budgets in OECD countries will put pressure on aid levels in coming years.

The title of the URL is telling – it includes “because of recession”. The inference being that nations who are in recession no longer have the means to extend their generosity to the poorer nations.

Which tells you how problematic the macroeconomic debate has become. A nation in recession that issues its own currency has no more or no less financial capacity available to provide ODA than a nation that is growing strongly.

In fact, it is in the interests of a nation in recession to not only introduce counter-cyclical domestic fiscal policy initiatives but also to increase ODA because the poorer countries tend to import from the more advanced. The more income that is produced in the poorer nations the more likely it will be that the exports of the advanced nation will hold up or increase.

So this false idea that a recession reduces capacity is endemic and damaging innocent people everywhere. A nation mired in recession has more real resources available than ever and is living well below its means rather than the way the fiscal austerity proponents like to say (living beyond their means).

At present, the EU is occupied by another ridiculous debate – again based on false premises – about the new EU Budget for 2014-2020. The EU leadership, led by the president Herman Van Rompuy is calling for harsh cuts in spending. The British PM, not content, to carpet-bomb, his own nation is demanding large cuts.

Van Rompuy has produced a proposed budget, which not only would scorch the EU economies and make it nigh on impossible to get out of the current morass, but would also lead to increased world poverty and – by the European Union president Herman Van Rompuy for deliberation at this week’s EU summit allowed for major cuts to the development aid budget. He is calling for a “9.65 per cent cut to external spending” and 11 percent cuts in the European Development Fund (EDF) “despite its focus to the world’s poorest countries”.

Yesterday, Oxfam released a – The effects of EU aid on receiving and sending countries – that has been prepared by the Overseas Development Institute and the National Institute of Economic and Social Research for ONE. See also the Oxfam Press Release.

In terms of the proposed EU budget cuts, the Report presents the “first attempt to quantify such effects of EU aid” by simulating the “EU aid channeled through the European Development Fund (EDF) and the Development Cooperation Instrument (DCI) to developing countries”.

They used a range of scenarios – based on what the ODA could be used for – “(i) debt reduction, (ii) consumption, (iii) infrastructure, and (iv) reducing trade costs”.

I don’t have time today to provide an exhaustive analysis of each option nor a literature review of the normal rates of return on each of their ODA uses. The Report is worth reading in this respect, although the model used is likely to be conservative given some of the macroeconomic assumptions used relating to monetary effects.

The Report concludes that:

… over the 7 year period of the next EU budget, the €51bn investment in development aid would be completely recouped by EU taxpayers, and the effects on the ground would give a clear return on investment. In that time European and global GDP levels will receive a boost of almost 0.1 per cent and over 0.2 per cent respectively, with much stronger benefits accruing to the aid recipient regions.

This is the export effect I alluded to above. So while the motivation for development aid should not be conceived in self-interest terms the old adage that givers become receivers holds true.

So cutting aid reduces the benefits that ODA provides not only the target nation but also the rest of the nations that trade with that nation. A lose-lose outcome.

To put this in context, the EU spends less than “€0.50 per citizen per week” in ODA and remains well below the 1970 UN targets.

Oxfam noted that:

In just six years, EU aid has made a lasting difference in the lives of millions and helped them out of poverty: 50 million people were stopped from being hungry, more than nine million children have enrolled in primary education, more than five million have been vaccinated against measles and more than 31 million people have been connected to drinking water.

There is also research supporting the assertion that ODA promotes “international and national security and stability” – see Report of the Secretary-General’s High-Level Panel on Threats, Challenges, and Change.

And what about Australia. In 2007, in recognition that Australia had dramatically failed to meet is international obligations in meeting the agreed 0.7 per cent target, the Federal Government embarked on a strategy to steadily increase our ODA/GNI ratio to 0.5 per cent by 2016-17 (ever the nasty and mean little nation!). This was a doubling of the existing ratio.

At present the ratio is at 0.35 after a few years of increase after the 2007 commitment. The improvement in the ratio has now stalled.

Our ODA strategy was reviewed in the – The report of the Independent Review of Aid Effectiveness – which was released on July 6, 2011. Here is the link to the Full Report. The aim is shared by both major political parties.

In the lead-up to this year’s Budget, as rumours spread that the Government would cut the aid budget, the Prime Minister was asked about this on the ABC 7.30 current affairs program segment (April 4, 2012) – Australia prepares to sacrifice foreign aid for balanced budget.

The interchange went like this – “Are you committed to keeping this aid increase going so that by 2015 it’ll be in excess of $8 billion a year?”:

JULIA GILLARD, PRIME MINISTER: Well, the Government is committed to the millennium development goals. Once again, Greg, you are inviting me to engage in individual items of speculation about expenditure and I’m not going to do it.

Slippery as ever. Of-course she knew that (a) the 0.5 per cent goal was not consistent with the MDGs, and (b) that the Government would announce cuts in the ODA budget in less than a month after this interview as it pursued its moronic budget surplus obsession.

In the subsequent May 2012 Federal Budget the Government announced it would cut $A3 billion from the ODA budget over the next four years. The Budget allocations are summarised in this – Document.

There you see that the Government allowed for spending to increase from $A4.8 billion to $A5.1 billion (an estimated 4 per cent real increase) but the ODA/GNI ratio would remain static at 0.35 per cent.

So while the aid budget still increased in nominal terms the actual increases necessary to bring the ODA/GNI ratio up to even 0.5 per cent would be twice the amounts actually budgets for over the relevant time horizon.

Those in the development “sector” were grateful for small mercies – given that the EU and other advanced nations were actually proposed cuts to ODA. At least – they said – Australia was just slowing the adjustment path to the 0.5 per cent commitment.

But as noted above – we are well below the 0.7 per cent obligation – and – there is no basis to slow down the rate at which we increase our development aid.

The pretext is the so-called need to push the federal budget back into surplus in the coming year. But with the economy now slowing (our September national accounts will be out in a fortnight) the cut-backs in fiscal policy amount to pro-cyclical policy – the anathema of sound fiscal practice.

Conclusion

The Australian government should be increasing the budget deficit right now and increasing its ODA much faster than it is proposing to get us up to 0.7 per cent as soon as possible. After all we promised to achieve the latter goal in 1970!

Further, 22 of our nearest neighbours are considered to be developing nations. Why would we want to undercut the prospects of our nearest neighbours? Even self-interest tells us that it is foolish to leave our trading partners poor.

That is enough for today!

(c) Copyright 2012 Bill Mitchell. All Rights Reserved.

Re Europe et al – The sheep haven’t been completely shorn yet.But when they are and they are cold,wet and shivering in the depths of winter,they may even organize themselves to deal with the shearers.

But more likely they will bleat and whine before jumping off a cliff individually or in small flocks.

Bill, if you think Cameron was bad, and he was, wait until Osborne gives his December statement. All indications are that it will be awful, a further egregious attack on the poor, with all the usual bullshit justifications.

Bill, on Newsnight tonight, there was a discussion of the purpose of funding universities. The fundamental assumption stated outright was that universities are funded by the taxpayer. And this translated into the question of why the taxpayer should fund courses, like sociology, archeology, and foreign languages which students do not appear to want to take. Birmingham is closing its sociology department. Leeds has already closed its economics department and had some of its faculty absorbed by the business school and other departments. Those who could not be so absorbed or did not want to be were retired.

The one student in the discussion group made the point that universities were a social good and therefore should not be beholden to the short-termism of the market. Paxman testily and patronizingly claimed that she was just making an assertion. The Oxford historian was just able to make the point that the UK is the only European country that no longer funds its universities, at least directly. The loans go to the students.

There was a good deal of confusion about what universities ought to be doing and how they ought to be doing it. No one except the student, and to a limited extent the Oxford historian, attacked the idea of universities being tied to market forces.

The problems the discussion had could all have been dispelled had it been clear to the discussants that the taxpayers do not fund the universities, that university funding comes out of government coffers with no relationship to the tax base at all. It would then have become clear that the decision to alter how the universities are funded is not determined by economic forces but by political ideology. Paxman should have taken the lead in doing this, but he effectively claimed at or near the beginning of the discussion that public spending is underwritten by taxation, thereby biasing the discussion from the outset.

larry, public spending is underwritten by taxation. That doesn’t invalidate anything.

“larry, public spending is underwritten by taxation. That doesn’t invalidate anything.”

More that taxation is underwritten by public spending.

You can’t pay the tax without public spending.

And the direction of the viewpoint matters.

Aidan, Neil

This is really old hat, I know, but I still like the ‘point of view’ that I think is expressed in Warren Mosler 7DIF. The focus should be on ‘real’ resources, and what you want to do with them, particularly in the public realm. Do you want Universities as part of a public service? If you do then certainly the government can fund them. The connection to taxes is not direct, but if the government simply spends on Universities, etc., then that will drive inflation unless there is a drain of demand from taxation. So, in properly working system they are certainly connected, even if the government doesn’t have to raise the money initially through taxes for spending. And, I am definitely not saying that they have to be balanced. I understand the purpose and benefits of a government deficit.

Adrian,

The functions of taxation are to constrain spending or direct it and to legitimate the sovereign currency, as tax payments are only acceptable in the sovereign currency. Taxation isn’t needed to pay for anything.

SteveK9,

Taxes and spending don’t have to be balanced. And spending on universities will not create an inflationary spiral. It is keeping useful people in work and creating an ‘educational product’. The government does have to make sure that it doesn’t spend beyond what the system can absorb. But a realistic analysis should be able to provide relevant information about this.

What is most important is that government deficits and private surpluses are mirror images of each other. As we have seen, it is not a good idea to let the private sector surplus, especially in a single sector, become too enormous, as this is indicative of something having gone wrong. In the same vein, you can’t let the government deficit become too small, as that indicates that the private sector is stagnating. So, a governmental balanced budget is anything but a good thing.

Aidan, Sorry about calling you Adrian. A brain malfunction.

Larry, don’t worry about it, I’ve been called worse!

In economics, many things can be looked at several different ways. If we look at it in a way that complies with that narrow view of the role of taxation, it underwrites the universities by giving value to the currency that pays for them.

I disagree about government deficits and private surpluses because they’re only mirror images of each other while the external sector is balanced. And sectoral balances are no indication of stagnation – rather they can help determine what the response should be.

I thought it was currency not public spending that was underwritten by taxation- pigeons, meet cat

AQ, without currency there could be no public spending, so your splitting hairs is pointless.

Aidan, when did currency become manna?

Deficit spending by the monetary sovereign is “manna” because it enables the population to pay the interest on their loans from the government-backed credit cartel since: 1) Bank loans only create principal, not interest. 2) Banks do not recycle 100% of the interest they receive by spending it into the economy and even if they did some of that interest would likely “leak” into private savings. 3) Borrowing the interest itself is not sustainable.

AQ, what makes you assume I thought currency is or ever was manna?

Labor gives value to currency. Usurers charge high interest when the labor economy is in dis-array. Safety net programs stabilize the value of money and the functioning of the economy, temporarily. There is no substitute for labor production, output and capability, including mental capability. As money hoarders, the money-getting capitalists do not understand what gives money it’s value. Labor wages, value, and prices are tied at the waist. When exchanging products and services, each man expects a full measure, including a relationship to the money vehicle used in the transaction.

For some reason, capital has declared war on labor around the world, specifically those financial capitalists that hoard money and destroy assets (reverse engineer businesses with fictitious valuations back into cash and unemployed labor). Perhaps they believe their money will increase in value as they accumulate. Perhaps labor is considered just another revenue stream to exploit, like housing. In one case you take money after labor earns it, in the other you take it before labor earns it, cheapening the value of labor.

It is the conversion of earned labor credits into currency that establishes the proportions and value of everything in the economy, not lying analysts, brokers, stock-jobbers and asset strippers, the animal spirits that manipulate the perception of value to their advantage.

Having a group of self-interested, asset stripping bankers and speculators rule the world economy is not nationally sound political economics nor are trade agreements that by-pass national sovereignty.