I have received several E-mails over the last few weeks that suggest that the economics…

The size of the deficit should not be the focus

I read the headline – Aussies don’t understand deficits: MP – in the Canberra Times with interest and after reading the article I returned to the on-going conversation I have with myself – why have we all been so stupid to have been so duped by the neo-liberal agenda? Almost all the public debate about the Federal Budget tomorrow is a total non sequitur. It bears no relation to the important questions that the Budget process has to deal with. Somehow, we are all sidelined by a rhetoric and a focus that conveniently diverts us away from these real issues and, instead, transfixes us on a piece of fiction. But a convenient fiction which maintains the relative power elites and perpetuates disadvantage. I understand all of that … but I still can’t get my head around why we have allowed ourselves to be so conned.

The Canberra Times article reported federal Labor backbencher, Arch Bevis who told the reporter that “most people are unaware that budget deficits were usual during the post-World War II period.” Bevis is quoted as saying:

I’m somewhat bemused by some of the commentary that goes on about budget deficits … If you have a look at some of the figures going back some years, most people don’t comprehend that during that post-war growth, after World War II, the Commonwealth never had a budget surplus … Through all of those golden years of Bob Menzies, that John Howard lovers used to like to talk about, they ran a budget deficit every single year … Not once was there a surplus until the Hawke-Keating governments.

This was a period when our national Government took responsibility for full employment – ensuring there were enough jobs available to meet the desires of the available workforce. It was a time when we accepted that policy must provide paid employment at adequate levels of remuneration as a matter of human rights.

This is contrary to the statements that the vast majority of the economics profession are now making on a daily basis to their students and the general public. It is contrary to the daily missives that come from the majority of the so-called economic commentators. They focus at various times on issues like excessive wages for low skill workers (but never mention executive cream-offs), excessive tax and welfare levels, stifling budget levels that will kill incentive and burden the future generations to a life so bad that …. They also rail against any form of market regulation and claim they stifle flexibility and economic initiative. The more extreme elements argue that unemployment is a chosen state and therefore part of optimising calculus. That is, it is not a policy problem.

They translate these underlying themes then into the budget debate and make nonsensiscal statements about the “budget blowouts” or “the enormous deficits they’re building up” or this gem of ignorance from the Shadow Treasurer:

Ultimately someone will have to pay for all this … It has to be all Australians. They will end up paying higher taxes, higher interest rates, not just for one or two years, but perhaps a decade or more.

This is all nonsense from an economic theory persepctive. But we still fall for the diversion that these erroneous statements create.

The orthodox argument is based on a flawed logic and has not been well supported by empirical evidence. In fact, the GFC is the culmination of the failure of this neo-liberal paradigm and its related policy experiment. The GFC meltdown is a categorical statement that this policy program has failed.

The real source of the persistently high unemployment that has bedeviled OECD economies for more around 35 years or so has very little to do with the reasons advanced by the neo-liberals. The main reason for the unemployment is that a fundamental change occurred in this period in the way governments interact with the community.

In a modern monetary economy, the government operates to redistribute resources from private households to the public sector for use in a variety of collective actions. The desirable size of the government (and the amount of resources that are redistributed) is not an economic issue, but it is rather, a political choice. The question for economists is how the government goes about it role once its scale is accepted.

Unemployment arises because the budget deficit is too small relative to the desires by the private sector to meet its tax obligations, to save and to hold money for transactions purposes, other things equal. As the sole supplier of fiat currency, the government can force the private sector, via the imposition of tax obligations, to provide real goods and services that it desires for its socio-economic objectives. It must however make sure that there is enough currency available to the private sector.

Government spending which adds deposits to the banking system is a primary method of providing these resources and a relaxed interest rate policy is another. But the private sector also has a positive savings propensity and requires cash balances to ease the timing of transactions. If taxes and or interest rates are too high or spending too low then individuals cannot find enough work to meet these obligations and involuntary unemployment results.

While unemployment arises from a lack of net spending by government this policy failure reflects the fact that our notion of collective will, which prevailed in the immediate Post WWII period, has been replaced by a regime of economic rationalism, which emphasises the individual and doesn’t understand how a sovereign currency functions. It might be that they do understand the options that a sovereign currency presents a government but deliberately obfuscate this understanding because it is not convenient for their policy aspirations – to transfer more wealth to the rich and maintain a solid core of disadvantage as a control device.

In the 1980s, we began to live in economies rather than societies or communities. It was also the period that unemployment persisted at high levels in most OECD countries. The two points are not unrelated. Unemployment arises because there is a lack of collective will. It does not arise because real wages are too high. While full employment requires that aggregate demand be sufficient to match aggregate supply intentions, we have to go further than this to understand mass unemployment such as we have suffered for 35 years in Australia, because the federal government can always ensure that equality is maintained through judicious use of fiscal policy.

The question is: why haven’t they done it? The policy failure arises from the lack of collective will which has been the principal casualty of the influence of economic rationalism.

It is clear that unemployment rates in almost all OECD economies rose after the first OPEC shocks in the 1970s and persisted at high rates almost for the entire period since in most countries. Over that time we have seen excessively restrictive fiscal and monetary policy stances by OECD governments driven by monetarist ideology.

The rapid inflation of the mid-1970s left an indelible impression on policy makers who became captive of the resurgent new-labour economics and its macroeconomic counterpart, monetarism. The goal of low inflation replaced other policy targets, including low unemployment. This resulted in GDP growth in OECD countries generally being below that necessary to absorb the growth in the labour force and labour productivity. The battle against unemployment was largely abandoned in order to keep inflation at low levels.

The pursuit of budget surpluses also narrowed the range of policy instruments used. It is now very difficult to raise income or other taxes to provide flexibility to the budget position. Accordingly, there has been an excessive reliance on monetary (interest rate) policy despite the bluntness of this instrument.

But the underlying cause is that the free market ideology has convinced us, wrongly, that government involvement in the economy imposes costs on us – now and into the future – that we are better off without. There has been a constant cacophony of commentators wheeled out every day to make this point – over and over again. As recession deepens, this chorus has almost gone beyond itself in its daily bleating.

The cacophony though has been spectacularly successful. As a reaction we (the people) have supported governments who have significantly reduced their involvement in economic activity via spending and tax cuts and widespread deregulation and privatisation. We have allowed our governments to worsen the living standards of the most disadvantaged and then punish them for the plight they are in (via welfare-to-work measures). We have stood by as the top-end-of-town has pocketed millions of government welfare payments and rebates (superannuation, private health insurance and the rest of it).

And then as this has started to fall apart … as it had to … the middle class has finally started to see its own wealth shrinking without realising that the governments they supported were the agency that did this to them.

It has been an extraordinary period of self deception, ignorance and myopic behaviour.

The only way we will return to full employment, with everyone sharing in the benefits, is if the public sector dramatically increases its role in the economy.

The lessons from the past are very instructive in this respect. British economists Paul Ormerod in his Faber book Death of Economics wrote in 1994 (pages 202-203) that the the Post-WWII period up to the mid-1970s, which were characterised by strong GDP growth, balance of payments stability, and high investment could have occurred without the low unemployment that was also achieved. He said:

The sole difference would have been that those in employment would have become even better off than they did, at the expense of the unemployed. The higher tax rates and buoyant government sectors allowed the flux and uncertainty of aggregate demand to be shared.

While the bulk of the OECD has abandoned this method of sharing, some economies did maintain high levels of employment into the current period. Ormerod (1994: 203) suggests that Japan, Austria, Norway, and Switzerland, among others have (in their own ways):

exhibited a high degree of shared social values,, of what may be termed social cohesion, a characteristic of almost all societies in which unemployment has remained low for long periods of time … [and most significantly] … the countries which have continued to maintain low unemployment have maintained a sector of the economy which effectively functions as an employer of the last resort, which absorbs the shocks which occur from time to time, and more generally makes employment available to the less skilled, the less qualified.

Which all makes the public debate about tomorrow’s budget very depressing. The reality is that the cacophony is working tirelessly to deflect the debate from the real issues and instead focus on non-issues. Well non-issues in an economic sense. They are clearly very important issues in the on-going struggle to ensure that we do not return to a society that shares the largesse more equally but, instead, maintain public policy parameters that, in their skewed logic, maintain their hold on wealth and power.

I say skewed because the neo-liberal policy regime will always create crises such as we are undergoing. The damage that these episodes cause hurt nearly everyone and could not possibly be the best way to generate wealth – at the top-end or the bottom-end.

Those who are sympathetic to neo-liberal economics because they think they will do better, if these sort of policies are applied, really fail to understand that everyone does better when there is full employment, high wages and high productivity.

Is now the time to be getting tough?

Given all that, the theme going into tomorrow’s budget announcement is that the middle class will have to feel a lot of pain in its hip pocket before the budget will return to surplus.

Access Economics, masters in being able to self promote themselves to the national stage by saying nothing, are putting out regular warnings along these lines. Apparently, they are questioning the “political bravery” of our Treasurer. They were reported today as predicting a Budget deficit of around $60 billion which they claim will be very difficult to wind back into surplus.

But is this a big deficit anyway? Assuming that the IMF growth predictions are correct (-1.3 per cent this year and a modest 0.3 per cent next year), then a $60 billion nominal deficit balance would average out in fiscal year 2009-10 to be only around 4.9 per cent of GDP. In the scheme of things, given the extent of the global meltdown and the inherited high rates of labour underutilisation that we had as we entered this downturn, this is not a high figure. In fact, it is way too small in terms of the overall spending gap that needs to be closed to generate low unemployment rates (and zero underemployment).

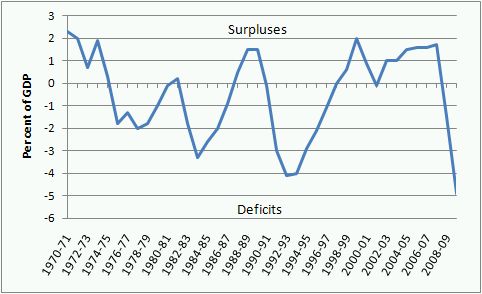

To see this, the following graph shows the history of the budget deficit as a % of GDP since 1970-71. You can clearly see that after each period of budget surpluses the deficit re-emerges. By the way, as a historical fact, the statement by Bevis is wrong. In the early 1970s, the emerging neo-liberals persuaded the Government to pursue harsh fiscal policies and you can see the results!

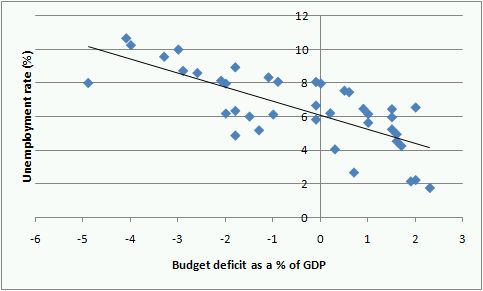

This graph will tell you why. Each time the neo-liberals have tried to force a major withdrawal by the Federal Government (evidenced by a budget surplus), unemployment has risen. The economy just cannot grow if the private sector desires to save and the federal government realised fiscal surpluses. It is not possible to sustain these two things.

Which suggests that all this talk about the Budget – that it needs to chart a path back to surplus – are spurious in the extreme and once again designed to divert us from the need to re-create collective will and restore full employment.

The national accounting is clear – the budget deficit finances non-government saving. If you claim you want to run surpluses as a steady-state aspiration then you must be also saying that you want the non-government sector to be in deficits. A budget surplus – created every day will require the private sector to be in deficit every day. These daily deficits accumulate every week, every month, every year!

Unlike the deficits of the national (sovereign) government, the private sector has to “finance” its deficits. It does this by running down wealth and increasing its borrowing. It has to do this every day that it is in deficit on a cumulative basis. Hence we have seen record levels of household debt in Australia (and increasing household debt burdens) associated with the record surpluses produced by the previous federal regime.

These are accounting relationships that have to hold true – $-for-$. They are not my theories – they are are matters of national accounting. You can deny them but not avoid them.

The problem with private deficits (and the debt buildup) is that they are unsustainable in the medium to longer term. The private sector cannot continually accumulate debt as a percentage of its disposable income.

The federal government, however, can run deficits forever as long as they match the saving withdrawal by the private sector. So statements about “paths back to surplus” are non-economic, ignorant and dangerous.

The real debate surrounding tomorrow’s Budget should be about how well the fiscal position taken by the Government addresses the massive labour underutilisation that it and previous government’s have created. That should be the focus. The deficit outcome that emerges is an ex post accounting artifact of how well the government has met its primary responsibility – to generate full employment. My guess is that it will fail badly in this regard and dress that failure up in the language of the neo-liberal – the need for fiscal discipline and all the rest of that honk.

This is not to say that there should not be a debate about the composition of the deficit. I note that there is some discussion of eliminating so-called “middle class welfare” that the previous government used to buy votes. I have a lot of sympathy for that quest but it doesn’t mean that the budget should be constrained. It just means that if you take spending capacity of some groups (for equity reasons – that is, you don’t want the rich getting free holidays to Aspen from public spending or tax breaks) – then you have ensure that you provide for more spending elsewhere to guarantee that the fiscal position is targetting the main game in town: the closure of the spending gap.

Tomorrow might be so depressing that I might just go surfing all day! Pity though, the forecast is for mainly unruly southern swells and on-shore winds around my way at present! So I guess I will just write another blog about all this stuff!

Unfortunately, I think that (as usual) everything the government says and every action they take will give the public the overwhelming impression that government must borrow to pay for the defict and that the sooner we are back in surplus, the better.

We’ll see what tonight brings – but I’ve got fairly low hopes.

One of the problems I’ve had trying to convince people is that nearly everyone out there – economists, the opposition, the government themselves – strongly give the impression or even directly say, that surpluses are savings which are good and deficits have to be paid for by going into debt which is bad. You can explain the real reasons that government borrows while running a deficit but it is at that point that the debate starts to turn somewhat technical ie interest rate targeting etc and people just seem to switch off. To them, the simple explanation is clear – everyone says the government needs to borrow to deficit spend, the governement themselves gives the impression that they must borrow to deficit spend, the government then goes ahead and borrows large sums while deficit spending (and this is reported by the media) – so anyone who says otherwise is, in their eyes, something of a crackpot.

A poster on Warren Mosler’s blog raised something to this effect.

I think that the idea of the existence of fiat is something that many people have trouble getting their heads around, unfortunately.

Dear Lefty

Yes, I know the point. I have been dealing with it all my professional life. People have been relentlessly conditioned to believe a national government issuing its own currency is identical to a household who uses that currency. It is obviously a nonsensical equation but we still believe it (as a society). I just plug away as an educator and slowly but surely we will separate the ideology (which is reinforcing this nonsense) from the reality. It seems you have personally made a bit of a journey since coming into contact with these ideas. One by one has always been my approach. Every new person who understands it becomes another teacher.

but it is frustrating.

best wishes

bill

Dear Bill,

At a rate of one by one you will never win the fight against these neo-conservative clowns. From the time they begin primary school they are being sold the lies and it is simply too late.

Most of us here never believed in the neo-conservative lies and your work has simply formalised what many of us suspected.

Unfortunately there is not a Che Guevera amoung us to really take the fight to these idiots.

Cheers, Alan

Dear Bill,

what was the ideology back in the “good old days” when the fed gov ran deficits? Was there a debate about this at all? Did anyone think it was a bad thing, encombering future generations etc? Was it all done quite consciously and intentionally? What did Menzies think/say about it? Were politicians just as ignorant of how the economy/money system works as today? If not then what were they thinking? Were the capitalists wiser in some respect than today, knowing that this would also be to their advantage?

Cheers

Graham

I have never accepted the neo-liberal paradigm so I was always open to alternative ideas. Economics remained largely mysterious to me but I did notice that the writings of some self-made/capitalist types (whose social outlook I strongly disagreed with) nonetheless contained statements such as “you don’t really see money with your eyes or hold it in your hands. Mostly, you see it with your mind”. This constantly had me wondering about the true nature of the medium of exchange. Was the government really that constrained in it’s social/nation building spending? Surely we could do better than perpetually having a pool of unemployed languishing at the bottom.

When I stumbled accross this blog by pure chance, many things I had a “gut feeling” about fell into place.

Thanks once again Bill.

Dear Bill,

and what was their approach to “funding” the deficit? Bonds, borrowing from overseas? I imagine they didn’t have the notion of how a modern money system could handle it. Or maybe they did in the sense that they just wrote it off somehow without really thinking about it?

And just as interesting is how the polies have unwittingly (wittingly for some no doubt) got onto the current bandwagon as described in Brian Toohey’s “Tumbling Dice”.

Cheers

Graham

Hi,

Money creation, Bonds, and borrowing from overseas was how deficits were financed. Unfortunately most treasury economists think the same rumes apply,

In the golden age employment first was the startegy governments followed.

After the first of many incarnations of monetarism (at least 5 versions I could name) gained prominence, the focus was on low inflation.

Hence how budgets were financed is not important because people iup until the late 1960’s would never have accepted the levels of unemplyment / casualisation we have today.

However through modern communication methods the monetarists and other neophiles have convinced the public that low onflation using the unemplyed as a shock absorber is the best method.

Cheers

Alan

Dear Graham

This is a good question for Victor Quirk to answer. He is doing his PhD with me on this topic. I might see if he will offer some insights. Remember though that in this period, the exchange rate was fixed which meant that fiscal policy always was playing bunny to monetary policy which operated differently to how it operates today. Then it has to ensure the demand for and supply of $AUDs was such that the exchange rate stayed at the agreed parities. So for a country like our with a continual current account deficit, there was regular downward pressure on the $AUD which required the RBA to buy the dollars and sell foreign currencies. The contraction coming via the destruction of high powered money then led to slower domestic growth and so fiscal policy was always a balancing act. Now with flexible exchange rates we face no such problems.

best wishes

bill

Hi Bill

Graham’s question goes to the heart of the transformation in public comprehension of economics that accompanied the abandonment of full employment in the 1970s.

The precise methods of abandonment were a credit squeeze implemented by Treasury and Reserve bank officials behind the back of the Whitlam government, followed by cuts to public sector employment in the name of ‘economic efficiency’ under Hayden (1975), Fraser, Hawke, Keating and Howard. This created the 35 year malaise of labour underutilisation that successive governments have manipulated to the present day, according to their electoral and industrial relations requirements.

The shift is exemplified in the logic used by politicians to explain their actions. In 1971 Phillip Lynch (William McMahon’s Minister for Labour and National Service, and Malcolm Fraser’s Treasurer before John Howard) argued that full employment generated the revenue that enabled Australian governments to provide its people with the highest standard of living in our history, while by 1976 he was arguing we could not financially afford to maintain the public sector activity that maintained full employment. The message was hammered into the collective consciousness by a massive economic education program launched in 1976 by a group of corporate-backed marketers, with the assistance of the American consultants who had designed and implemented a similar program for the Nixon administration – the largest marketing campaign in US History.

Post war full employment (average of 1.9% over 25 years) was established within a matter of months by the Curtin – Chifley Commonwealth government during WWII, through large-scale public sector employment, demolishing the arguments maintained throughout the depression by the classical economists and their conservative patrons in business and politics, that deficit spending could not achieve and maintain full employment. In 1949, with a massive radio and cinema advertising campaign, newspaper support, and financial support from the banks, Menzies returned the conservatives to office (largely with the promise to end petrol rationing) and promising that, of course his administration would maintain full employment because they then knew how to do it.

In the privacy of the cabinet room, Menzies and his ministers bemoaned how full employment blunted their attack on the Waterside Workers Federation, by making union de-registration less effective, while McEwan declared ‘it’s a terrible thing to think that the only way to get a man to do a decent days work was to put the fear of unemployment in him’. However, because the public had become habituated to full employment, any increase would be perceived as either deliberate or evidence of gross incompetence, and certain to lead to an utter pulverisation at the next election.

Menzies may have been particularly sensitive to any suggestion that he wished to create a pool of unemployment after the war, because of the backlash he provoked at the 1945 Freemantle by-election (held to fill the vacancy left by the death of John Curtin) by telling a public meeting that West Australian farmers would need such a pool to get returned service personnel, with their new trades skills etc, to return to the unattractive conditions of farm labouring in W.A. after the war.

Menzies and his colleagues resented full employment but were stuck with it. They didn’t have a problem with deficits in the least, because that was how full employment was preserved along with their hold on political power, they just resented the full employment and the power it conferred on organised labour.

In 1970, the OECD study ‘Inflation the Present Problem’ suggested a way for governments around the world to avoid the electoral backlash that would be visited upon those which presided over the abandonment of full employment. It argued that if a global exogenous shock occurred that the public would accept as beyond their control, governments could push up unemployment with cuts to public sector employment while blaming the global economic crisis. The OPEC oil shock of 1973 must have seemed made to order for those wrestling with the problem, and well it may have been, since the quadrupling of oil prices was foreshadowed by Henry Kissinger 5 months earlier at a meeting of global oil company heads and western intelligence leaders (the Bilderberg Group). The Saudi Oil Minister at the time (Sheik Yamani) tells the story that the OPEC move came about when the Shah of Iran shifted sides and voted with the radicals on the OPEC board to use oil prices to punish the west for supporting Israel in the Arab Israeli war of 1973. The Shah told Yamani that Kissinger told him to do it. Kissinger is also thought to have gingered up intelligence to both sides of the war in order to ferment it. Why the US would do this is because it ended the decade long pressure on the US to devalue its currency, which was pegged at one ounce of gold = $35, as part of the Bretton Woods agreement. Lyndon Johnson’s expenditure on the Vietnam War, Space Race and ‘War on Poverty’, and the consequent Eurodollar market had left four times as many US dollars on global currency markets than the US had gold to cover. Other countries (whose currencies were pegged to the US dollar) were calling on the US to preserve global currency stability by simply declaring that $70 would buy an ounce of gold, or $140. What Kissinger and Nixon did instead was 1. Declared the US dollar was no longer exchangeable for gold 2. Used the oil shock to massively increase the need for people to obtain dollars (thus making those in circulation more valuable) because the global oil market was solely denominated in US dollars. With the price of oil becoming four times higher, people had to first acquire four times as many dollars as before to buy a gallon of oil. Problem solved.

And, of course, the OECD was given its exogenous shock smokescreen with which to create the global labour underutilisation to undermine the bargaining power of working people around the world, to the great benefit of the global corporations to whom western governments are seemingly beholden.

To keep this agenda in its place, however, it was crucial that policies which were conclusively proven in the post-war period to be essential for establishing full employment, such as large scale public sector expenditure and employment, were equated with economic mismanagement. Thus we have the hallmarks of neo-liberal political economy: small government, low public expenditure, low social and public infrastructure investment, to preserve chronic labour underutilisation. To maximise the disciplining effect of unemployment, harsher welfare policies (eg., the introduction of ‘breaching’ under Brian Howe) and reduced free public provision in health and education, etc. (eg., introduction of HECS by John Dawkins), make social inclusion and opportunity increasingly reliant on a secure pay packet. The net effect of the ideological strictures neo-liberalism places on fiscal policy is the increased willingness of workers to accept less attractive pay and conditions in order to secure and maintain employment.

References

Most of this material is covered in my working papers available on the CofFEE website, particularly ‘The Problem of a Full Employment Economy’ of 2004.

William Engdahl ‘A Century of War: Anglo-American Oil Politics and the New World Order’, has the story of the Oil and dollars strategy of Henry Kissinger.

Alex Carey ; edited by Andrew Lohrey, ‘Taking the risk out of democracy : propaganda in the US and Australia’, University of New South Wales Press, 1995, has details of the economic education campaign in Australia and the USA.