It’s Wednesday and I just finished a ‘Conversation’ with the Economics Society of Australia, where I talked about Modern Monetary Theory (MMT) and its application to current policy issues. Some of the questions were excellent and challenging to answer, which is the best way. You can view an edited version of the discussion below and…

Keynes and the Classics – Part 5

I am now using Friday’s blog space to provide draft versions of the Modern Monetary Theory textbook that I am writing with my colleague and friend Randy Wray. We expect to complete the text during 2013. Comments are always welcome. Remember this is a textbook aimed at undergraduate students and so the writing will be different from my usual blog free-for-all. Note also that the text I post is just the work I am doing by way of the first draft so the material posted will not represent the complete text. Further it will change once the two of us have edited it.

I am currently working on Chapter 11 which opens like this:

Chapter 11

11.1 Introduction and Aims

In Chapter 10, we discussed issues relating to labour market measurement. In this Chapter we will focus on theoretical concepts that underpin the measurement of economic activity in the labour market and the broader economy.

The Chapter has five main aims:

- To explain why mass unemployment arises and how it can be resolved.

- To develop the concept of full employment.

- To consider the relationship between unemployment and inflation – the so-called Phillips Curve.

- To develop a buffer stock framework for macroeconomic management (full employment and price stability) and compare and contrast the use of unemployment and employment as buffer stocks in this context.

- To more fully explore the concept of a Job Guarantee (employment buffer stock) approach to macroeconomic management.

NOTE:

The Keynes and Classic series so far is:

- Keynes and the Classics – Part 1 – explains how the Classical system conceived of labour supply and demand and how these come together to define the equilibrium level of the real wage and employment.

- Keynes and the Classics – Part 2 – explains how the labour market determines the level of employment and real wage, which in turn, via the production function set the real level of output.

- Keynes and the Classics – Part 3 – tied the previous conceptual development into the denial that there could be aggregate demand failures (Say’s Law), introduced the loanable funds market and discussed the pre-Keynesian critique (Marx) of the Classical full employment model.

- Keynes and the Classics – Part 4 – which began Keynes’ critique of Classical employment theory.

Today, we finish the critique by John Maynard Keynes of the Classical labour market and extend his overall attack on Say’s Law by considering his theory of interest.

NEW TEXT STARTS TODAY HERE

Keynes believed that the Classical economists had fundamentally misunderstood how “the economy in which we live actually works” (page 13). In particular, he argued that if a money wage reduction occurred, it was likely to lead to lower prices because marginal costs would be lower (ignoring shifts in productivity due to issues relating to workforce morale).

Imagine that money wages fell by 5 per cent and the price level fell by 5 per cent, then the real wage would be unchanged. This was the basis of Keynes’ argument.

He wrote that the idea that money wage cuts would lead to real wage cuts was:

… far from being consistent with the general tenor of the classical theory, which has taught us to believe that prices are governed by marginal prime cost in terms of money and that money-wages largely govern marginal prime cost. Thus if money-wages change, one would have expected the classical school to argue that prices would change in almost the same proportion, leaving the real wage and the level of unemployment practically the same as before, any small gain or loss to labour being at the expense or profit of other elements of marginal cost which have been left unaltered.

Keynes’ fundamental objection of Classical employment theory thus was that even if workers agreed to work for lower money wages this did not necessarily guarantee a real wage cut.

Before we consider what this means in terms of Keynes’ own construction of the labour market, we should note that by accepting the marginal productivity rule (the first Classical postulate) in the General Theory, Keynes was agreeing with the proposition that for employment to rise the real wage had to fall. As we will see, the causation that Keynes invoked to explain that association between employment and the real wage was different to the Classical theory. But in the General Theory, Keynes considered that the firms were always “on” their demand curve and aggregate demand fluctuations shifted employment up and down that curve.

As a result, he argued that the best way to engineer reductions in the real wage was not to try to tinker with money wages (for all the reasons we have just considered) but rather to generate some inflation by stimulating aggregate demand. He thought that as demand for goods and services rose, firms would expand production and encounter increased marginal costs and so push up the profit-maximising price level.

As a consequence with a rigid money wage, even though the real wage would fall, unemployed workers would be prepared to supply more labour to the firms. The unemployment was thus driven by the lack of demand rather than an excessive real wage but the real wage would fall as employment rose. We will return to this argument in the next Section.

The fact that both major theories – Classical and Keynesian – at this stage agreed that there would be an inverse relationship between employment and the real wage makes it difficult to empirically examine the veracity of either even though the underlying causality that creates the relationship is very different. If we observed a fall in real wages accompanying a rise in employment which theory would be correct?

However, as an historical note, by 1939, Keynes had changed his view about marginal productivity. Two separate studies persuaded him that his earlier views on marginal productivity theory were unsupportable by the evidence. One was published in 1939 by the American economist – John Dunlop – The Movement of Real and Money Wage Rates – The Economic Journal, Vol. 48, No. 191 (September, 1938), 413-434) and the other, a year later, by Canadian economist – Lorie Tarshis – Changes in Real and Money Wages – (The Economic Journal, Vol. 49, No. 193 (March, 1939), 150-154).

[NOTE: ON-LINE VIEWERS – THESE LINKS ARE TO JSTOR WHICH IS ONLY ACCESSIBLE IF YOU HAVE ACCESS VIA YOUR LIBRARY – SORRY]

What these articles demonstrated was that there was no definitive inverse relationship between real wages and employment, which meant that the idea that an reduction in unemployment could be accomplished by driving up the general price level to deflate a fixed money wage was unsustainable.

Interestingly, Keynes responded these articles in his own 1939 Economic Journal article – Relative Movements of Real Wages and Output – (The Economic Journal, Vol. 49, No. 193 (March, 1939), 34-51). He said (page 34) that the research presented:

… clearly indicate that a common belief to which I acceded in my “General Theory of Employment” … needs to be reconsidered …

He also agreed (Page 40) it was likely that “the falling tendency of real wages in periods of rising demand” is contrary to the real world evidence and suggested that made the argument about effective demand being the crucial determinant of employment rather than real wages more easy to make.

11.14 Understanding labour supply

We are now in a better position to understand the meaning of the rather difficult definition of involuntary unemployment that Keynes presented in the General Theory (Page 15) which we introduced in Section 11.5:

Men are involuntarily unemployed if, in the event of a small rise in the price of wage-goods relatively to the money-wage, both the aggregate supply of labour willing to work for the current money-wage and the aggregate demand for it at that wage would be greater than the existing volume of employment.

In more straightforward language this means that involuntary unemployment exists at the current money wage level, if employment increased at the same time the general price level rose. This means that workers would increase their supply of labour even though the real wage was lower than before.

You will appreciate from our discussion in the previous Section that this definition was predicated on his view that real wages would be lower at higher levels of employment, a view he subsequently abandoned. The definition is, however, helpful in summarising the point that the money wage level is not the problem when we are trying to understand unemployment.

It also focused Keynes’ attention on the second postulate of Classical theory relating to the claim that macroeconomic labour supply was an increasing function of the real wage and the equilibrium employment level was determined by the equality of labour demand and labour supply.

If workers supplied more labour even though real wages had declined, then this observation seriously compromised these two Classical claims and largely negated their theory of employment.

However, in the strategic context of his debate with the Classics, Keynes’ definition maintained the focus on the labour market, which allowed his essential insight that a credible theory of employment should be based on the principle of effective demand (that is, the product market) to be somewhat obscured.

We can develop a more general definition of involuntary unemployment, which is consistent with Keynes’ later recognition that real wages do not have to fall for employment to rise, and consistent with what we observe in the real world. It is also consistent with Keynes’ second definition of involuntary unemployment which he outlined in Chapter 3 of the General Theory (Page 28).

Accordingly, we might conclude that involuntary unemployment exists:

If when effective demand rises in the product market employment rises independent of what is happening to money or real wages.

You will appreciate that this definition of involuntary unemployment takes the focus of the concept away from the labour market and allows us to understand that employment is driven by shifts in aggregate demand.

Further, if aggregate demand rises and there are no further increases in employment observed, then the economy would be at full employment. Once again this allows us to define full employment in terms of a number of jobs rather than in terms of some particular real wage. Unlike the Classical Theory of Employment, which considers full employment to be determined in the labour market, our definition here clearly relates the concept of full employment to spending developments in the goods and services market.

To better understand this concept, consider how we might reconsider the macroeconomic labour market. In particular, the labour supply function that is consistent with this concept of involuntary unemployment is quite different to that presented in the Classical model. Instead of being an increasing function of the real wage, based on the assertion that workers face a trade-off between labour and leisure, which is mediated by movements in the real wage, Keynes’ considered workers supplied their labour based on the current money wage level and faced considerable uncertainty about the price level.

In other words, workers knew what the money wage that they were receiving because it was this variable that was determined in the labour market rather than the real wage. The real wage equivalent of the known money wage was uncertain because the price level was not set in the labour market and workers had imperfect information about the current price level.

The relevant labour supply function is thus written as:

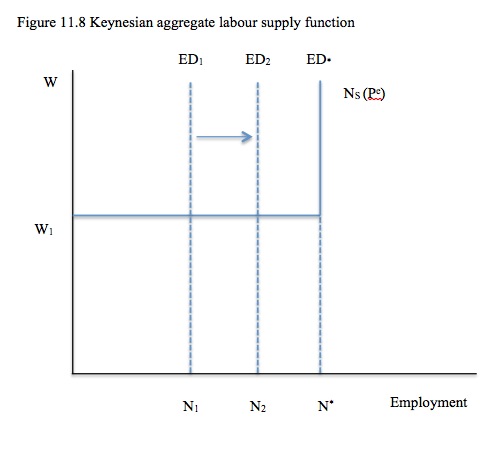

(11.9) Ns = f(W,Pe) if Ns < N* which says that aggregate labour supply (Ns) depends on the money wage level (W) and the expected price level (Pe) up to full employment (N*)

Figure 11.8 shows the Keynesian labour supply function. The first important difference when compared to the Classical labour market depicted in Figure 11.4 is that the money wage is determined in the labour market rather than the real wage. Workers prefer higher real wages to lower real wages, but when they enter the labour market it is the money wage they agree on with the employer not the real wage.

Full employment occurs at N* and beyond that level we might assume that there would be no further increases in labour supply. In the real world, it is likely that rising money wages at the current price level might attract extra workers in to the labour market who would not usually wish to work. In other words, the vertical segment in the labour supply might be slightly positively sloped.

Up to N*, at the current money wage level (W1), workers will be willing to supply whatever labour is demanded.

The vertical lines – ED1 and ED2 – reflect macroeconomic demand for labour curves that are driven by the current level of effective demand which is determined in the goods and services market (that is, outside of the labour market). The ED lines can be thought of as constraints imposed on the labour market, with employment adjusting at the current money wage levels to shifts in these constraints.

Assume that the economy is operating at an effective demand level, ED1 and employment is at N1. How much involuntary unemployment is there at that level of economic activity?

The answer is the distance N* – N1, because if effective demand was at ED*, the labour supply would increase to N*. To see that more clearly imagine that aggregate demand increased and the economy moved to a higher level of effective demand, ED2. With no change in the money wage rate (or the price level), employment would increase to N2 and unemployment would fall by N2 – N1.

This reasoning allows you to understand that the macroeconomic level of unemployment is not exclusively determined in the labour market and variations in unemployment are driven by variations in effective demand.

11.15 The macroeconomic demand for labour curve

TO BE CONTINUED

Conclusion

NEXT TIME WE WILL CONTINUE TO DERIVE THE MACROECONOMIC DEMAND CURVE AND MOVE ONTO THE CRITIQUE OF LOANABLE FUNDS.

Saturday Quiz

The Saturday Quiz will be back again tomorrow. It will be of an appropriate order of difficulty (-:

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

Bill, I realize that the subject so far has been Keynes and the classics, but will you be getting any time soon to Kalecki’s critical review of the General Theory where he corrects features of Keynes’ theory of effective demand?

” . . . but rather to generate some inflation . . . ”

increase the ‘price level’?