It’s Wednesday and I just finished a ‘Conversation’ with the Economics Society of Australia, where I talked about Modern Monetary Theory (MMT) and its application to current policy issues. Some of the questions were excellent and challenging to answer, which is the best way. You can view an edited version of the discussion below and…

Keynes and the Classics Part 9

I am now using Friday’s blog space to provide draft versions of the Modern Monetary Theory textbook that I am writing with my colleague and friend Randy Wray. We expect to complete the text during 2013 (to be ready in draft form for second semester teaching). Comments are always welcome. Remember this is a textbook aimed at undergraduate students and so the writing will be different from my usual blog free-for-all. Note also that the text I post is just the work I am doing by way of the first draft so the material posted will not represent the complete text. Further it will change once the two of us have edited it.

I am currently working on Chapter 11 which opens like this:

Chapter 11

11.1 Introduction and Aims

In Chapter 10, we discussed issues relating to labour market measurement. In this Chapter we will focus on theoretical concepts that underpin the measurement of economic activity in the labour market and the broader economy.

The Chapter has five main aims:

- To explain why mass unemployment arises and how it can be resolved.

- To develop the concept of full employment.

- To consider the relationship between unemployment and inflation – the so-called Phillips Curve.

- To develop a buffer stock framework for macroeconomic management (full employment and price stability) and compare and contrast the use of unemployment and employment as buffer stocks in this context.

- To more fully explore the concept of a Job Guarantee (employment buffer stock) approach to macroeconomic management.

NOTE:

The Keynes and Classics series so far is:

- Keynes and the Classics – Part 1 – explains how the Classical system conceived of labour supply and demand and how these come together to define the equilibrium level of the real wage and employment.

- Keynes and the Classics – Part 2 – explains how the labour market determines the level of employment and real wage, which in turn, via the production function set the real level of output.

- Keynes and the Classics – Part 3 – tied the previous conceptual development into the denial that there could be aggregate demand failures (Say’s Law), introduced the loanable funds market and discussed the pre-Keynesian critique (Marx) of the Classical full employment model.

- Keynes and the Classics – Part 4 – which began Keynes’ critique of Classical employment theory.

- Keynes and the Classics – Part 5 – continues the critique of Classical employment theory.

- Keynes and the Classics Part 6 – considers Keynes’ critique of the Classical Theory of Interest.

- Keynes and the Classics Part 7 – introduces the preliminary concepts in developing a macroeconomic theory of labour demand.

- Keynes and the Classics Part 8 – developed the three cases underpinning the possible shape of a macroeconomic theory of labour demand.

Today I complete the conceptualisation of a macroeconomic labour demand curve and go onto more modern interpretations of Keynes and the General Theory.

11.16 The macroeconomic demand curve for labour

MATERIAL HERE FROM LAST WEEK and YESTERDAY.

NEW TEXT FOLLOWS

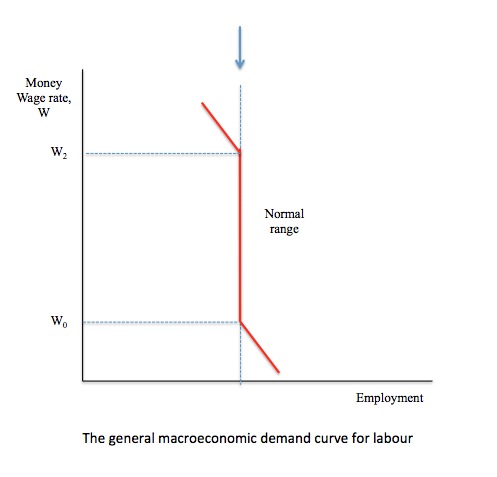

Figure 11.15 depicts a generalised macroeconomic demand curve for labour and you can identify three distinctive segments. The blue arrow signifies that employment is a function of effective demand, which is determined outside of the labour market.

Focusing on the solid red line, the interpretation is that when money wages rise above W2, further rises in the money wage reduce employment – which is the “classical case” identified above. This would arise because aggregate supply (Z) was shifting upwards faster than aggregate demand (D).

How might we explain that? At higher money wages (which might be associated with a higher price level), fiscal and monetary policy might be tightened to head-off an inflationary spiral. The resulting negative impact on aggregate demand is likely to reduce the point of effective demand below the previous level at W2.

Further, in an open economy, very high wages might reduce international competitiveness and impinge on export demand, which will also have a negative impact on aggregate demand and shift the point of effective demand to the left of its current position.

Both of these impacts would imply that the macroeconomic demand for labour curve takes a classical shape at high money wage levels. It is highly probable that such a segment would be beyond the range defined by normal wage movements and levels.

Thus, the negatively sloping upper segment is a logical possibility which would be rarely encountered.

Figure 11.15 A generalised macroeconomic demand curve for labour

When money wages are below W0, it is possible that a particular phenomenon which has been named the Pigou effect, after the British economist Arthur Pigou. This effect is also referred to more generally as the real balance effect or the wealth effect.

When Keynes attacked the Classical employment theory he noted that cutting money wages would not likely lead to a fall in real wages because competition would also drive prices down, given that firms now enjoyed lower unit costs, assuming productivity did not fall due to low morale brought about by the money wage decline.

Reluctantly, the Classical economists in the 1930s, which had recommended money wage cuts as the way to engineer the real wage cuts they considered necessary to restore labour market equilibrium, as per the Classical model of the labour market, were forced to acknowledge that if money wages were cut and prices followed the cost reductions, then the real wage might not fall at all. It was possible the real wage could even rise if the fall in money wages was less than the fall in prices.

However, Arthur Pigou responded in a famous 1943 article with a proposed solution to the problem of the economy being stuck in an unemployment impasse. He argued that real consumption spending was also a positive function of the stock of real wealth that individuals possessed. This wealth was held (in nominal terms) in the form of money balances and other financial assets such as government bonds.

[REFERENCE: Pigou, A. (1943) The Classical Stationary State, The Economic Journal, December, LIII, 343-51 – link is to JSTOR if your library has a subscription]

Thus, even if a fall in money wages leads to a equivalent percentage fall in the price level, leaving the real wage unchanged, the lower prices would increase the real wealth of all those who were holding nominal wealth balances. So all wealth holders would feel richer as a consequence and it was argued would thus increase real consumption at each level of income.

The increase in real balances at lower prices thus gave proponents of the the Classical employment theory another conduit through which money wage falls could stimulate employment, in the event that real wages did not move.

In other words, the inverse relationship between money wages and employment was restored by this real balance effect.

It was pointed out that borrowers would feel poorer when prices fell, because the real value of their debt burdens would rise and, using the same logic, this would lead to a reduction in real consumption at each level of income. To some extent this would offset the stimulus that the debt holders might impart.

If most of the debt was in the form of government bonds, then the net effect would probably be larger than if private lenders had provided the majority of the debt held.

Thus, when money wages are very low, Weintraub wrote that:

… those owning “pennies” become “millionaires” – a calamitous prospect! – full employment may well be assured.

In the real world, if prices fell so low that a real balance effect of any significant size was generated, then it is likely that the entire banking system would collapse because while the nominal liabilities held by the banks would not be altered, their real values would rise by so much as to bankrupt most of their borrowers. The mass defaults would, in turn, cripple the financial system.

The empirical evidence is that in normal price movement ranges, the measured real balance or wealth effect is very small and clearly insufficient to remedy a major shortfall in aggregate demand. So while the Pigou effect presents a logical possibility it did not provide the Classical employment theory with the response it required to negate the damaging critique made by Keynes.

Money wage rates between W0 and W2 – denoted the normal range in Figure 11.14 – are likely to lead to no change in the point of effective demand and thus the macroeconomic demand curve for labour will be vertical. For employment to change there has to be a change in the level of effective demand.

The vertical segment could also be positively sloped if there was evidence of an underconsumptionist response in the normal range of money wage movements. It is possible, for example, in poorer nations, that the demand boost from a money wage rate rise will outstrip the supply response arising from the extra unit costs. As a consequence the slope of the macroeconomic demand curve for labour in this relevant range will be positively sloped as depicted in Figure 11.14.

11.17 The determination of employment and the existence of involuntary unemployment

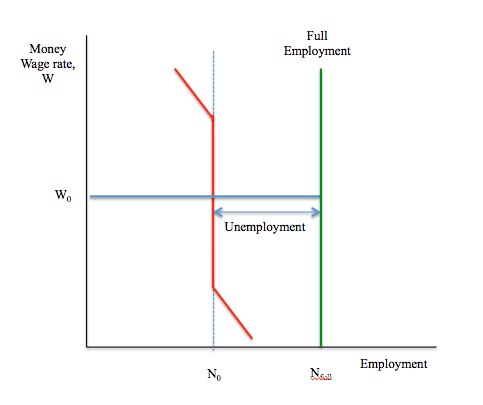

We are now in a position to finish the story having both the demand and supply sides of the labour market explained. Figure 11.8 showed the Keynesian labour supply function, which was a function of the money wage, and changing price expectations would lead to shifts in this function. In Figure 11.8 we determined the total employment level by considering where the vertical macroeconomic demand for labour curves intersects the given money wage rate.

Section 11.16 has now allowed you to acquire a deeper understanding of how that macroeconomic demand curve for labour is driven by the current level of effective demand which is determined in the goods and services market. In other words, you can appreciate that the level of employment in the economy is a function of effective demand rather that the wage rates in the economy.

You are also now able to appreciate that mass unemployment in the economy is also determined by the state of effective demand rather than being a caused by the ascriptive characteristics of the unemployed themselves. The unemployed become powerless to improve their prospect because the shortage of jobs is caused by a systematic failure of aggregate demand (relative to aggregate supply).

In Figure 11.16, total employment is current at N0 and the money wage rate is at W0. The full employment level of employment is at NFull. As a consequence, the level of involuntary unemployment at this level of effective demand is measured by the distance NFull – N0.

The lesson that Keynes taught us, which had been denied by the Classical theory of employment, was that at the current wage rate, W0, a demand stimulus in the goods and services market, which shifted the macroeconomic demand curve for labour outwards, towards the full employment would not only stimulate employment but, at the same time, reduce unemployment, without any change in the money wage (or price level) being required.

Figure 11.16 Employment and unemployment

Mass unemployment is always driven by variations in effective demand and the policy indication is straightforward. For a given level of non-government spending (consumption, investment and net exports), mass unemployment arises because the budget deficit – that is, the level of net public spending (G – T) is not large enough. The cure for mass unemployment, in the event of non-government spending being static is to expand the budget deficit.

This was an important lesson that governments learned in the 1930s and which was placed in a theoretical framework by the work of Keynes and others. The Classical theory of employment distracted policy makers from seeing that the fundamental solution to unemployment was to increase aggregate demand relative to aggregate supply. As a consequence, in the early years of the Great Depression in the 1930s, millions of workers lost their jobs as governments tried to implement the wage cutting solutions proposed by the dominant Classical viewpoint.

It was only when governments expanded their deficits that the Great Depression came to an end.

11.18 A Classical resurgence thwarted

One of the key elements of Keynes’ attacks and ultimate discrediting of the Classical employment theory was his identification of what we call the fallacy of composition.

Prior to the 1930s, there was no separate study called macroeconomics. The dominant theory of the day, characterised by the Treasury View – considered macroeconomics to be an exercise in the aggregation of individual relationships.

The economy was thus seen as being just like a household or single firm only bigger. Accordingly, changes in behaviour or circumstances that might benefit the individual or the firm are automatically claimed to be of benefit to the economy as a whole.

The general reasoning failure that occurs when one tries to apply logic that might operate at a micro level to the macro level is called the fallacy of composition. The identification of such fallacies in Classical models led to the establishment of macroeconomics as a separate discipline in the 1930s, after Keynes published the General Theory.

The insistence in the Treasury View that wage cuts would cure the mass unemployed that arose during the 1930s Great Depression symbolised the fact that their reasoning was based on compositional fallacies.

Keynes led the attack on the mainstream by exposing several fallacies of composition. While these type of logical errors pervade mainstream macroeconomic thinking, there are two famous fallacies of composition in macroeconomics: (a) the paradox of thrift; and (b) the wage cutting solution to unemployment.

The paradox of thrift describes a situation where individual virtue can be public vice. Imagine consumers en masse try to save more and there is no compensating aggregate demand from other sources to replace the lost consumption spending. The theory of effective demand, which we have developed in Chapters 7 and 8 as well as this Chapter, allows us to understand that everyone will suffer in this instance because national income falls (as production levels react to the lower spending) and unemployment rises.

The paradox of thrift tells us that what applies at a micro level (ability to increase saving if one is disciplined enough) does not apply at the macro level. Thus, if an individual tried to increase his/her saving (and saving ratio) they would probably succeed if they were disciplined enough. But if all individuals tried to do this at the same time, and nothing else replaces the spending loss, then everyone suffers because national income falls (as production levels react to the lower spending) and unemployment rises. The impact of lost consumption on aggregate demand (spending) would be such that the economy would plunge into a recession.

As a result, incomes would fall and individuals would be thwarted in their attempts to increase their savings in total because saving is a function of income). In other words, what works for one (the micro level) will not work for all (the macro level).

The causality reflects the basic understanding that output and income are functions of aggregate spending (demand) and adjustments in the latter will drive changes in the former. It is even possible that total savings will decline in absolute terms when individuals all try to save more because the income adjustments are so harsh.

In our discussion of the macroeconomic demand for labour curve we also saw that the Classical employment theory was be-devilled by compositional fallacy. Recall, that when money wages rise, the aggregate supply curve (Z) shifts up, an observation emphasised by the Classical theorists. However, they overlooked the fact that the money wage is also the significant determinant of income, which means that aggregate demand also shifted when money wages rose. This observation – of the interdependency of aggregate supply and demand – thwarted the simple Classical explanation that a money wage cut would cure mass unemployment.

In terms of the Classical solutions to unemployment, it was believed that one firm might be able to cut costs by lowering wages for their workforce and because their demand will not be affected they might increase their hiring.

However, if all firms did the same thing, total spending would fall dramatically and employment would also drop. Again, trying to reason the system-wide level on the basis of individual experience generally fails.

The relevance of the Keynes versus Classics debate is that the same ideas are in dispute in the current era.

The conservative response to the persistent unemployment that has beleaguered most economies for the last three or more decades is to invoke supply-side measures – wage cutting, stricter activity tests for welfare entitlements, relentless training programs. But this policy approach, which reflects an emphasis on the labour market and particularly, the wage rate falls foul of the fallacy of composition problem.

Policy makers consistently mistake a systemic failure for an individual failure. The main reason that the supply-side approach is flawed is because it fails to recognise that unemployment arises when there are not enough jobs created to match the preferences of the willing labour supply. That requires a system-wide policy response to increase effective demand rather than an individual solution focusing on the characteristics of the unemployed.

|

Case study: the Parable of 100 dogs and 93 bones

Imagine a small community comprising 100 dogs. Each morning they set off into the field to dig for bones. If there enough bones for all buried in the field then all the dogs would succeed in their search no matter how fast or dexterous they were. Now imagine that one day the 100 dogs set off for the field as usual but this time they find there are only 93 bones buried. Some dogs who were always very skilled at finding bones might dig up two bones and others will dig up the usual one bone. But, as a matter of accounting, at least 7 dogs will return homebone-less. Now imagine that the government decides that this is unsustainable and decides that it is the skills and motivation of the bone-less dogs that is the problem. They are not skilled or motivated enough. Thus considering the problem to be an individual one requiring an individualised solution. So a range of dog psychologists and dog-trainers are called into to work on the attitudes and skills of the bone-less dogs. The dogs undergo assessment and are assigned case managers. They are told that unless they train they will miss out on their nightly bowl of food that the government provides to them while bone-less. They feel despondent. After running and digging skills are imparted to the bone-less dogs things start to change. Each day as the 100 dogs go in search of 93 bones, we start to observe different dogs coming back bone-less. The bone-less queue seems to become shuffled by the training programs. However, on any particular day, there are still 100 dogs running into the field and only 93 bones are buried there! The point is that fallacies of composition are rife in mainstream macroeconomics reasoning and have led to very poor policy decisions in the past. |

The Classical employment theory considered unemployment to be a transitory phenomenon – a disequilibrium state – which would be quickly resolved if real wages were allowed to adjust to reflect underlying marginal productivity.

Keynes was adamant that this was not the case. For him, mass unemployment was an equilibrium state, which meant that it could persist indefinitely unless there was some “exogenous” intervention (from government policy).

The Classics allowed for some transitory unemployment when the composition of aggregate output was disrupted. So if there was a shift in demand from product A to product B, workers employed to make product A might find themselves unemployed until they accepted jobs from firms making product B.

The Classics believed that real wage movements would ensure these resource transitions occurred. As we have seen, they denied the possibility of a deficiency in effective (aggregate) demand.

Keynes showed that involuntary unemployment was an equilibrium state – in the sense that there are no dynamics present that will change the situation. Firms would be producing and hiring at levels that were consistent with their sales expectations and therefore would have no desire to change output levels.

But the Classical economists thought that the unemployed clearly desire higher consumption and would buy more goods and services if they were working. It was hard for them to imagine how an excess supply of labour (unemployment) and an excess demand for goods and services (the desire for more consumption) could co-exist. Surely, price changes would resolve these imbalances.

They claimed that in the labour market the money wage would fall in response to the excess supply of labour, and in the goods and services market, prices should rise in response to the excess demand for consumption goods.

One way of interpreting Keynes’ attack on the Classical theory is to focus on the nature of the excess supply of labour and supposed co-existing excess demand for goods and services.

The fallacy inherent in the Classical faith in wage and price adjustments was first noted by Karl Marx in his Theories of Surplus value where he discusses the problem of realisation of sales when there is unemployment. He was the first to understand the notion of effective demand. He made the distinction between a notional demand for a good (a desire) and an effective demand (one that is backed with cash).

It is obvious, that the unemployed want to consume more but because they have no or little income they cannot translate their notional desires into effective spending. Accordingly, the market, which relies on consumers entering shops with money to purchases goods and services, fails to receive any demand signal from the unemployed and so firms cannot respond with higher production.

This distinction between notional and effective demand was at the heart of the “Keynes and Classics” debate during the Great Depression. It is central in his attack on Say’s law, which claimed that “supply creates its own demand”. As we saw earlier in this Chapter, Say’s law denies there can ever be over-production and unemployment. If consumers decide to save more then the firms react to this and produce more investment goods to absorb the saving. There is total fluidity of resources between sectors and workers are simply shifted from making iPods to making investment goods.

Keynes showed that when people save – they do not spend. Further, they give no signal to firms about when they will spend in the future and what they will buy then. So there is a market failure. Firms react to the rising inventories and cut back output – unable to deal with the uncertainty.

The theoretical push to reassert Say’s Law using the real balance effect as the conduit by which aggregate demand would always adjust to aggregate supply came in the 1950s. But major theoretical work by Keynesians such as – Robert Clower in 1965 [GET REFERENCE] and – Axel Leijonhufvud in 1968 [GET REFERENCE] provided new insights into how we can see the contribution of Keynes and his demolition of Classical theory.

They demonstrated, in different ways, how neoclassical models of optimising behaviour were flawed when applied to macroeconomic issues like mass unemployment.

Clower (1965) showed that an excess supply in the labour market (unemployment) was not usually accompanied by an excess demand elsewhere in the economy, especially in the product market. Excess demands are expressed in money terms. How could an unemployed worker (who had notional or latent product demands) signal to an employer (a seller in the product market) their demand intentions?

Leijonhufvud (1968) added the idea that in disequilibrium, price adjustment is sluggish relative to quantity adjustment. Leijonhufvud interpreted Keynes’s concept of equilibrium as being actually better considered to be a persistent disequilibrium. Accordingly, involuntary unemployment arises because there is no way that the unemployed workers can signal that they would buy more goods and services if they were employed.

Any particular firm cannot assume their revenue will rise if they put a worker on even though revenue in general will clearly rise (because there will be higher incomes and higher demand). The market signalling process thus breaks down and the economy stagnates.

Conclusion

NEXT WEEK I WILL MOVE ONTO THE PHILLIPS CURVE, THE NATURAL RATE HYPOTHESIS WHICH SUSPENDED INTELLIGENT UNDERSTANDING FOR A WHILE AND THE MODERN DEBATES ABOUT WHETHER THERE IS A TRADE-OFF BETWEEN UNEMPLOYMENT AND INFLATION AND WHAT THAT MEANS FOR THE CONDUCT OF POLICY.

Saturday Quiz

The Saturday Quiz will be back again tomorrow. It will be of an appropriate order of difficulty (-:

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

Bill:

In the real world, if prices fell so low that a real balance effect of any significant size was generated, then it is likely that the entire banking system would collapse because while the nominal liabilities held by the banks would not be altered, their real values would rise by so much as to bankrupt most of their borrowers. The mass defaults would, in turn, cripple the financial system.

Isn’t that what we recently witnessed in the US? So the wealth effect has been demonstrated (unfortunately at a time when average net wealth was probably negative).