It’s Wednesday and I just finished a ‘Conversation’ with the Economics Society of Australia, where I talked about Modern Monetary Theory (MMT) and its application to current policy issues. Some of the questions were excellent and challenging to answer, which is the best way. You can view an edited version of the discussion below and…

Unemployment and Inflation – Part 8

I am devoting today’s blog time to the continuation of our textbook draft. Tomorrow the Australian Labour Force comes out. The alternative today was going to be an analysis of the lying statements of David Cameron and George Osborne but I will have more of them next week undoubtedly. It will give me more time to examine my “austerity” database, which I wrote about yesterday. So best use of the time today (after a long flight) is to advance our textbook.

This is the continuation of the Chapter on unemployment and inflation – the series so far is:

- Unemployment and inflation – Part 1

- Unemployment and inflation – Part 2

- Unemployment and inflation – Part 3

- Unemployment and inflation – Part 4

- Unemployment and inflation – Part 5

- Unemployment and Inflation – Part 6

- Unemployment and Inflation – Part 7

I am now continuing Section 12.6 on the Phillips Curve …

Chapter 12 – Unemployment and Inflation

MATERIAL HERE NOT REPEATED

[PICKING UP FROM THIS POINT … NOTING THAT I HAVE EDITED SOME OF THIS TEXT FROM LAST TIME AND CREATED A MORE COHERENT DIAGRAM TO REPLACE LAST WEEK’S VERSION]

There were two basic propositions that Friedman asserted in his attack on the Phillips curve.

First, he asserted that there is a natural rate of unemployment, which is determined by the underlying structure of the labour market and the rate of capital formation and productivity growth. He believed that the economy always tends back to that level of unemployment even if the government attempts to use fiscal and monetary policy expansion to reduce unemployment.

Friedman (1968: Page 8 ) wrote:

At any moment of time there is some level of unemployment which has the property that it is consistent with equilibrium in the structure of real wages. At that level of unemployment, real wage rates are tending on average to rise at a “normal” secular rate, i.e., at a rate that can be indefinitely maintained so long as capital formation, technological improvements, etc., remain on their long-run trends. A lower level of unemployment is an indication that there is excess demand for labor that will produce upward pressure on real wage rates…. The “natural rate of unemployment”, in other words, is the level that would be ground out by the Walrasian system of general equilibrium equations, provided there is imbedded in them the actual structural characteristics of the labor and commodity markets, including market imperfections, stochastic variability in demand and supplies, the cost of gathering information about job vacancies and labor availabilities, the costs of mobility, and so on.

He later noted (Friedman, 1968: 9) that the natural rate of unemployment is not “immutable and unchangeable” but is insensitive to monetary (aggregate demand) forces. That is, he considered increasing nominal aggregate demand would not reduce the natural rate.

He also considered that the natural rate was, in part, “man-made and policy-made”. For example, Monetarists argued that imposing minimum wages and providing unemployment benefits would increase the natural rate.

The basic idea of the “natural rate of unemployment” that Friedman developed follows straightforwardly from the Classical labour market that we developed in Chapter 11. The Monetarist approach was an attempt to promote ideas that Keynes demolished in the 1930s. Friedman asserted that real wages were the relevant object of concern from the perspective of firms and workers rather than money wages. Workers supplied labour based on the price of leisure, which in that model is the real wage.

Similarly, firms employed labour to advance their profit-maximisation aims, and that required they set the real wage equal to the marginal product of the last worker employed.

In that context, it was considered that real wages would adjust to ensure the labour market cleared at the “natural rate” level of unemployment. While there might be temporary deviations around that rate, for reasons we will explore next, over time, the economy would always be tending back to the natural rate.

The natural rate was thus conceived as being the level of unemployment that arose as a result of natural frictions in the labour market and had no cyclical component. In other words, it did not arise as a result of a deficiency in aggregate demand. Friedman considered that these frictions could include the distortions arising from policy noted above.

But the natural rate of unemployment was considered invariant to aggregate demand changes, which meant that governments could not reduce it through an aggregate demand expansion.

Second, that the Phillips curve is, at best, a short-run relationship that can only be exploited as long as workers suffer from money illusion and confuse money wage rises with real wage rises. In other words, any given short-run Phillips curve is dependent on workers assuming that price inflation is stable. Under that assumption, there is no role for price expectations in the Phillips curve.

However, Friedman and others argued that eventually workers would realise that their real wage was being eroded in price inflation outstripped money wages growth. In doing so, they would start to form expectations of continuing inflation.

As a consequence, workers would build these inflationary expectations into their future outlook and pursue real wage increases, which reflected not only the state of the labour market (relative strength of demand and supply) but also how much they expected prices to rise in the period governed by the wage bargain.

The Monetarists argued that if the government attempted to reduce unemployment below the natural rate, then as the inflation rate rose, workers would demand even higher money wages growth to achieve their desired real wage levels. Ultimately, all that would result was an accelerating price level.

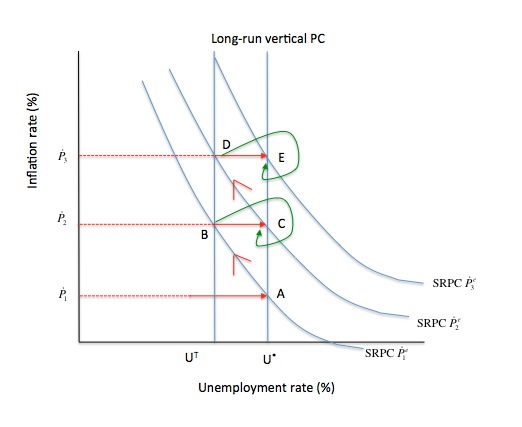

Figure 12.11 captures the accelerationist hypothesis. The short-run Phillips curves are shown conditional on a specific expectation of inflation held by the workers. The superscript e denotes “expected” inflation. We use the terminology, expectations are realised to denote a state where the expectations formed are equal to the actual outcome.

Figure 12.11 The expectations-augmented long-run Phillips curve

Start at Point A, where the inflation rate is Pdot1 and the unemployment rate is at its so-called “natural rate” (U*). At this point, the inflationary expectations held by workers (Pdote1) are consistent with the actual inflation rate Pdot1. According to Friedman, the labour market will be operating at the natural rate of unemployment, whenever inflationary expectations are realised.

To see how the accelerationist hypothesis plays out, we assume that the government is under political pressure and forms the view that U* unemployment rate is too high. It believes it can use expansionary fiscal and monetary policy to achieve a lower target rate of unemployment, UT. They also think they can exploit the Phillips Curve trade-off and move the economy to Point B, with an inflation rate of Pdot2 as the “cost” of the lower unemployment rate.

As a consequence government stimulates nominal aggregate demand to push the economy to point B. The increased demand for labour pushes up the inflation rate (to Pdot2) and money wage rates also rise in the labour market. The accelerationist hypothesis assumes that the price level accelerates more quickly than money wages and as a consequence the real wage falls.

The Monetarists resurrected the Classical labour market and placed it at the centre of their attack on Keynesian macroeconomics. Accordingly, firms will offer more employment because the real wage has now fallen and they can still profit maximise at the lower level of marginal productivity.

Why would workers supply more labour if the real wage was falling? In the Classical labour market it is assumed that labour supply is a positive function of the real wage so workers will withdraw labour if the real wage falls.

The Monetarist approach overcome that seeming problem by imposing asymmetric expectations on the workers and firms. The firms were assumed to have complete price and wage information at all times so they knew what the actual real wage was doing at any point in time.

However, the workers were assumed to gather information about the inflation rate in a lagged or adaptive fashion and thus could be fooled into believing that the real wage was rising when, in fact, it was falling.

Thus, workers are assumed to be initially oblivious to the rising inflation – that is, their inflationary expectations do not adjust to the actual inflation rate immediately. As a consequence they mistake the rising nominal wages for an increasing real wage and willingly supply more labour even though the real wage has actually fallen.

The central proposition of the Classical labour market is that workers care about real wages not money wages. The accelerationist hypothesis added the idea that workers form adaptive expectations of inflation, which means that it takes some time for them to differentiate between movements in money wages and movements in real wages.

Monetarists asserted that Point B is unstable and can only persist as long as workers are fooled into believing the money wage increases they received were equivalent to real wage increases.

But inflationary expectations adapt to the actual higher inflation rate after a time. Once the workers increase their inflationary expectations to Pdote2 then the SRPC shifts out and the labour market settles at Point C when the new expectations catch up with the higher inflation rate (Pdot2).

The green curved arrow linking Point B and Point C is the hypothetical adjustment process that the accelerationist hypothesis considers the labour market follows to reinstate the natural rate of unemployment.

[MORE TO COME HERE ON FRIDAY]

|

Advanced material – The Adaptive Expectations Hypothesis

The assumption that workers formed their expectations of inflation in an adaptive manner allowed the Monetarists to conclude the government attempts to reduce the unemployment rate would only cause accelerating inflation and that the economy would always tend back to the natural rate of unemployment. The only way the government could sustain an unemployment rate below the natural rate using aggregate demand stimulus would be if they continually drove the price level ahead of the money wage level and forced the workers to continually misperceive the true inflation rate. The Adaptive Expectations hypothesis is expressed in terms of the past history of the inflation rate. The assertion is that the workers adapt their expectations of inflation as a result of learning from their past forecasting errors. The following model expresses this idea: The left-hand side of Equation 12A is the expected inflation rate in the next period (t + 1) formed by workers in period t. Equation 12A has to components on the right-hand side. First, Pdott is the actual inflation rate in the current period. Thus, workers use the current inflation rate as a baseline to what they think the inflation rate in the next period will be. Second, the term λ(Pdott – Pdotet) captures the forecast error from the previous period. Pdotet was the inflation expectation that workers formed in period t-1 of inflation in period t. The difference between that expectation and the actual rate than occurred is the size of their forecast error. The coefficient λ measures the strength of adaption to error. The higher is λ, the more responsive workers will be to actual conditions. MORE LATER HERE |

Conclusion

This will be continued on Friday.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

Why don’t you say ‘the following formula expresses this idea’ instead of using the term ‘model’. It would be clearer philosophically. The term ‘model’ is being bandied about indiscriminately nowadays.

Bill,

You’ve shown various versions of the Phillips Curve. It may be usefull to have two boxes alongside or below each of these descriptions which lists in short phrases:

– the features of each version,

– valid criticisms of each.

Kind Regards

Bill,

Looking forward to your labour market analysis tonight.

Cheers.

Don’t forget the promise to expose the lying Cameron and Osbourne next week .. please!

In the adaptive expectations model, isn’t the only for it to work is workers never learning from expectations? otherwise the coefficient λ will keep moving towards one as workers learn to expect better, which means that every subsequent iteration of the left hand side is closer to the actual inflation level, which in turn means that

(P.t – Pe.t) moves closer to zero since they are able to harness their innate ability of super calculation (hence moving closer to the JEDI master stage of humanity). Hence at some point the curve will cease to shift since expected inflation is equal to the actual one. Is does logically follow, or am I missing something (as usual)??