It was only a matter of time I suppose but the IMF is now focusing…

Growth and jobs are things governments can buy and summon

I left out the word not between the words “are” and “things” and replace the “or” with “and” between buy and summon. Otherwise this would have been the latest piece of insight offered by the outgoing EU Council President Herman Van Rompuy, who appears to be intellectually stretched when it comes to the most basic macroeconomic concepts despite regularly making comments that appear to be of a macroeconomic nature. Let me remind him: spending equals income and output. Growth in spending when there is massive (and rising) excess real productive capacity will generate growth in income and output. Growth in income and output almost certainly generate growth in employment. And, just in case we might be worried that any crowded-in productivity growth reduces the employment dividend and, cogniscant of the fact that there are millions of relatively unskilled workers without jobs in Europe at present, governments around the region could employ all of them if they introduced an unconditional Job Guarantee. Governments can create extra real growth and jobs anytime they choose unless the economy is already at full employment. Then they would not want to anyway. So the question that Mr Van Rompuy should be answering is why he is overseeing government machinery that refuses to give the governments this capacity. That is a question none of them will answer.

The following graphic came from a political leaflet that the political party of Van Rompuy’s – sister – issued during a 2009 election campaign in Belgium.

The sticking point was the Belgian government’s bungling attempt with Van Rompuy as Prime Minister to privatise the public health system. The party also opposed the neo-liberal politics of Van Rompuy and opposed the EU’s policy approach that pushed the costs o the crisis onto ordinary people, while leaving those who had caused the crisis unscathed.

Van Rompuy will retire from his extremely well-paid EC post on a secure pension and, presumably, various other sinecures that come with the positions he has held. But in terms of his policy effectiveness, the positions he has supported have been highly destructive.

There is a long line of these Euro elite bureaucrats in the EC, EU and the ECB who have similarly wreaked havoc on the fortunes of the ordinary folk.

The self-styled “top international economics think tank” (talk about having tickets on yourself) – Breugel – claims it:

… is a European think tank specializing in economics. Established in 2005, Bruegel is independent and non-doctrinal. Our mission is to improve the quality of economic policy with open and fact-based research, analysis and debate.

I think they are defiling the name of the Flemish painter and printmaker – Pieter Bruegel the Elder.

I was checking back on saved snippets this morning and recalled this gem – Chart of the week: fiscal deficits in the euro area under the new forecast – which is a detailed discussion of “how far each euro area member was likely to be from its own deficit target” as a precursor to assessing the degree of risk each had “of being sanctioned for an excessive deficit in 2013” under the “Excessive Deficit Procedure” rules governing Eurozone nations.

The article was aiming to predict which nations would “face sanctions” under these rules. The authors – both academics – which means they are probably holding well-paid and secure positions – actually thought it was a useful way to spend their days calculating whether the eurozone nations are undertaking enough fiscal cutting to avoid the Excessive Deficit Procedure sanctions.

Not a word about whether the fiscal austerity was a sensible macroeconomics strategy. They both claim to be experts in macroeconomicsws on fiscal policy is equally depressing, and even more predictable (see the final section of this). The public discussion is not about whether further austerity is appropriate. Instead it is whether countries are undertaking enough fiscal contraction to avoid the sanctions that are part of the Eurozone’s excessive deficit procedures

The authors had the temerity to write (seriously I presume) the following:

Excessive deficits may stem either from the lack of discretionary government measures or from lack of growth.

Which just about tells you what is wrong with the whole European monetary system governance structure.

If I was writing that article, instead of the quoted passage above, I would have written something like this:

|

Given the way the EU defines an “excessive deficit” lack of growth can easily push a nation into this category. But all that tells us is that the concept of excessive used by the EU as part of the Stability and Growth Pact is highly problematic.

Any reasonable understanding of the way the automatic stabilisers work would disabuse anyone from concluding that a cyclically-induced rise in the budget balance should be considered “excessive” in any way. What is excessive in this situation is the rise in unemployment that the cyclical downturn has caused. The rise in the deficit is merely providing a minimum level of support to aggregate demand to stop the collapse in spending being worse. In these situations discretionary increases in the deficit are indicated and warranted in terms of sound fiscal practice. |

Which is light-years away from the emphasis given by the academics who are close to the EU bureaucracy. One of them (Sapir) is a member of European Commission President Jose Manuel Barroso’s Economic Policy Analysis Group.

But, of-course, Bruegel is non-doctrinal. Not! The whole article (and others like it) take it as given that the fiscal rules are non-contestable and to be used as starting points for analysis only.

However, the fiscal rules have no foundation in fact or even economic theory. As I noted yesterday, they were made up in one hour to satisfy the (neo-liberal) political imperatives of the Mitterand government.

Another snippet I dug out while meandering through my archives was this statement from the former boss of the ECB. The gave an interview on September 3, 2010 to the US CNBC network – Austerity Equals Confidence: Trichet – after the ECB had announced its latest monetary policy settings.

He told the network that the ECB:

We encourage all countries to be absolutely determined to go back to a sustainable mode for their fiscal policies … Our message is the same for all, and we trust that it is absolutely decisive not only for each country individually, but for prosperity of all … Not because it is an elementary recommendation to care for your sons and daughter and not overburden them, but because it is good for confidence, consumption and investment today …

On the same day, Jean-Claude Trichet told – Le Figaro that:

We believe that the problem of debt in the industrialised countries affects all economic agents, and particularly governments. The recent grave crisis was largely set in train by unusual over-indebtedness. This is particularly evident in the case of public debt. Major efforts must be made by all the euro area countries, including France. This is essential for a lasting recovery. Governments must convince households, firms and savers that they are implementing policies aimed at reducing their debt to sustainable levels. This is a prerequisite for the return of confidence and the consolidation of growth.

In the three (nearly) years since he made those statements conditions for the “sons and daughters” of Europe have indeed deteriorated. The Euro elites couldn’t have managed that outcome any better than they have.

How do these “austerity-will-lead-to-confidence” merchants explain the following outcomes in terms of their “sons and daughters”?

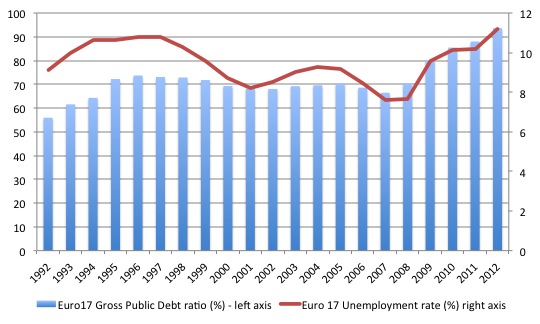

The following graph uses – IMF WEO – data and shows the general government public debt ratio (% of GDP) for the Eurozone 17 nations since 1992 (noting the aggregation precedes the introduction of the common currency) and the unemployment rate for the same nations (red line – right-hand axis).

From a Modern Monetary Theory (MMT) perspective, the data makes perfect sense. As the unemployment rate fell (as a result of economic growth), budget deficits shrank due to the automatic stabilisers and the debt ratio fell (the growth in the denominator outstripped the growth in the numerator).

With the downturn causing that dynamic to go into reverse and then the imposition of fiscal austerity accelerating the deterioration of economic growth and lost tax revenue it isn’t a surprise that the unemployment rate is rising and each month reaches a new record high for the Eurozone.

it is also not surprising that one of the key goals of the austerity – to reduce the public debt ratio – is also rising. Such is the self-defeating nature of fiscal austerity. Such is the culpability of these Brussels elites and the paid consultants that write articles that provide authority to the destructive policy framework.

The massive rise in youth unemployment across the Eurozone is the clear legacy to the “sons and daughters” of Europe that their “fathers” (and mothers – Lagarde and Merkel, for example) are bestowing on them. The intergenerational damage that is being caused in Europe every day this madness continues is difficult to estimate. Massive social dislocation will accompany the ruined lives and these costs will reverberate for generations to come.

But then the academic sycophants to the austerity spivs just occupy their days calculating which nations will be sanctioned for failing to implement enough austerity (read cause enough havoc) because as they choose to tell us “Excessive deficits may stem either from the lack of discretionary government measures or from lack of growth”.

And while on the subject of sycophants – I refer back to the European Commission document I discussed yesterday – ECFIN Economic Brief (Issue 20) March 2013 – which attempted to dispel the “allegations” (their word) that the EC was imposing unnecessary austerity on the Eurozone in an inflexible and mindless manner. As we learned yesterday, the authors failed to achieve their goals.

But there was one goad in that ECFIN document that was directed squarely at the critics of austerity which I thought was interesting:

Many commentators say the problem is rather that adjustment is overly frontloaded, especially for the euro area periphery … These criticisms rarely give details on their own prescribed course. Running fiscal policies requires operational annual budgetary targets consistent with a credible medium-term plan. Country-specific features are important as well to consider … A sweeping conclusion that fiscal retrenchment is excessive without specifying a detailed alternative is in a sense evacuating the hardest issues faced by policymakers.

Ok. Fair point. It is easy to tear down without knowing what you would put in the place of what you are pulling down.

The alternative policy position down to the last Euro is easy to define and goes back to the opening comments about Van Rompuy. We could cast this alternative policy framework in terms of maintaining the Euro as a common currency or abandoning the Euro and restoring national sovereignty to all member states.

The first option requires that a fully-functional federal fiscal capacity is created and the member states receive sufficient fiscal transfers to satisfy the fiscal rule I will outline next. The second option requires that each member state ensure the following fiscal rule is satisfied.

The appropriate Modern Monetary Theory (MMT) fiscal rule, that defines responsible and sustainable fiscal practice is outlined in some detail in this blog – The full employment budget deficit condition.

In terms of “running fiscal policies”, the net spending position of either the federal capacity (with the Euro) or each member state has to be sufficient to ensure there are no output gaps (properly measured).

If there are positive output gaps – that is, in the way these things are expressed, that would mean the economy in question was operating at above full employment and capacity, then unless the government wants to expand public spending as a proportion of full employment real GDP, it has to cut back on its net spending. Simple enough.

Alternatively if there are negative output gaps – meaning that the economy in question is operating at below its potential capacity and there is a deficiency of aggregate demand – then the government has to expand its deficit.

When there is mass unemployment you know one other thing at least – the budget deficit of the relevant national government (federal authority in the case of keeping the Euro) is too low.

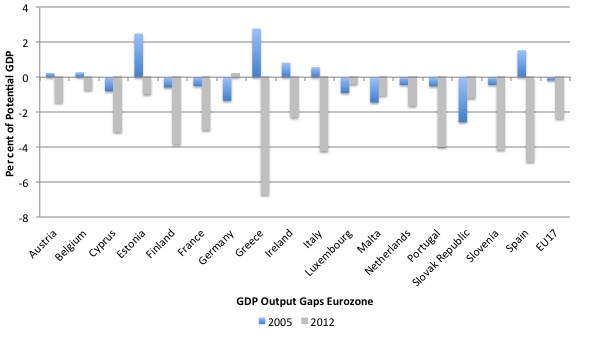

The current IMF output gap for the Eurozone is -2.37 per cent. That is almost certainly an underestimate. They estimated that in 2005 the output gap was -0.181, which is close to their estimate of potential real GDP for that year. In 2005, the EU17 unemployment rate was on average 9.18 per cent. It is inconceivable that a true full employment situation occurs at an average unemployment rate across the Eurozone of 9.2 per cent.

As I have explained in the past, the output gap measures and the resulting estimates of structural deficits computed by institutions such as the IMF or the OECD always err on the side of too small output gaps and excessively high structural deficits.

Please read my blogs – Structural deficits – the great con job! and Structural deficits and automatic stabilisers – for more discussion on this point.

But even on the IMF’s own estimates there is scope for considerable expansion.

The IMF estimate the Eurozone budget deficit to be around 3.4 per cent of GDP in 2012. That will prove to be an underestimate but we can work with it. Their output gap estimate for 2012 is 2.37 per cent of potential real GDP.

Some computations allow us to compute their underlying potential GDP and thus the Euro value of the output gap – around 212 billion Euros (remembering this is a significant underestimate). With some more back of the envelope calculations we would get a budget deficit of at least 5.73 per cent of GDP overall (across the Eurozone economy as a whole) as being required to push real GDP back to the IMF’s estimate of potential in 2012.

In practice, the deficit would probably have to be of the measure of 7-8 per cent of current GDP to be moving close to the MMT fiscal rule.

However, we also need to consider the spatial distribution of the “federal” output gap. That is typically a role played by a properly functioning national fiscal authority with currency issuing capacity.

The following graph shows the IMF output gaps across the 17 (current) Eurozone nations as at 2005 (blue bars) and 2012 (grey bars). Both estimates are conservative for reasons noted above. But there is an added conservatism to the 2012 figure because they are IMF estimates and they have a track record, even within their own logic, of underestimate the damage caused by fiscal austerity.

But the point of the graph is reveal the considerable spatial diversity of the impacts of the crisis across the Eurozone. So the federal authority would have to provide fiscal transfers to ensure the deficits in each of the “states” were scaled appropriately to meet the relevant output gap. So Greece would be supported with significantly larger deficits than say Luxembourg.

I am not naive enough to assume that such transfers would be possible given the historical and political tensions across the zone. That is why I cannot see a solution within the context of maintaining the Euro as a common currency. But I have argued that point before.

In the context of the demand by the ECFIN authors that we get specific – well here is a specific fiscal position down to the last Euro that defines the minimum alternative policy position.

Every national state should introduce a – Job Guarantee – that is, an unconditional public sector job offer at a reasonable minimum wage. Anyone who desires to accept such an offer would become immediately employed.

The scale of the fiscal shift that would emerge as a result of that policy announcement would define the minimum deficit position that the member states should take. The last person who walked through the door of the Job Guarantee office in each of the member states would be define the last Euro that would have to be spent at a minimum to create “loose” full employment.

Then the nations could build from that minimum level by defining necessary public infrastructure projects and other fiscal support for public employment (better schools, hospitals etc).

It is certain, given the scale of the output gaps that the aggregate demand boost that would be associated with the minimum fiscal shift would leave significant room for further fiscal expansion within the inflation barrier.

Meanwhile, the ECB under the keep the Euro option would be tasked with keeping government bond yields low or better still funding the government deficit accounts. Under the preferred option of abandoning the Euro, the member state central banks would regain their sovereignty and work closely with the treasuries of each nation to ensure the deficits were sustained with no impact on interest rates.

Conclusion

If I had more time today I could further outline the alternative policy position which would include major financial market reform (including the elimination of the capacity of banks to take speculative positions and the banning of derivative products not associated with making the real economy more stable) and other regulative changes.

But the starting point is to remember that unlike the clown’s claims that governments are powerless to anything but impose austerity – growth and jobs are things governments can buy or summon.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

Bill,

I don’t think you or Rumpy Pumpy (to judge by the quotes of his you cite) make a clear enough distinction between a monetarily sovereign country and EZ countries.

The EZ core can be treated as monetarily sovereign: i.e. if there is scope for a bigger deficit in Germany, then Germany should go ahead with a bigger deficit. But that’s not the major problem in the EZ. The major problem is the catastrophic levels of unemployment in some periphery countries.

And that problem just cannot be solved in a common currency area by bigger deficits all round. It can only come by making the periphery more competitive vis a vis the core. And that is being done via severe deflation in the periphery.

There is, at least in theory, a very quick way of solving the latter problem: organise a 20% or so cut in wages and prices in periphery countries. That would solve the problem overnight.

The latter would be difficult and expensive to implement, but then the costs of the current “solution” are horrendous. Why not discuss the latter “over night” solution?

bill,

The usual narrative from elites fearing loss of control – the floggings will continue until morale improves!

@Ralph

You are falling for the old Gold internationalist argument of the only “real” trade being international.

Domestic trade / commerce seems to be lost on these Belgium non nation state types.

The simple truth is that all these former semi sov states have become extreme entrepot economies of the Amsterdam variety.

You cannot scale up Amsterdam to a continental size and expect it to work………..the external inputs overpower such operations as they simply cannot be supplied.

Think of German car production.

It must import oil / gas, iron ore and other materials to make a input heavy car – it thus adds great value to these materials.

But the very act of making this luxury adds greatly to basic life support input costs throughout the eurozone.

Europe must now sacrifice domestic demand to keep ahead of the entropy posse………as Germany borrows off the entire Eurozone s account to do so.

You thus get this strange event where Italian oil consumption reaches mid 1960s lows (with a much larger population) so that Germany can afford (be competitive) to export cars to China!

The euro money cannot be used for local trade / commerce anymore.

All domestic demand is thus sacrificed to maintain international trade.

This is far more important for real nation state economies rather then the current large international port known as the EU market state.

Remind me again – what is the purpose of economic activity ?

http://epp.eurostat.ec.europa.eu/cache/ITY_OFFPUB/KS-SF-12-051/EN/KS-SF-12-051-EN.PDF

Von Rumpey is desperate to maintain relations with his external hinterland as that is all he sees as economic activity when he closes his eyes.

The Congos resources if you will is everything to the man.

Belgium & now the EU is sacrificed to maintain the colonies.

To use another another analogy – think of the EU market state as the plantation owners house with different rooms / countries.

The hinterland or cotton fields is Asia & Africa.

But something has gone wrong with the business model…………

The owner decides to reduce the wages of his servants so as to free up resources for the fields.

He will most likely never consider that his basic business model is flawed.

He will merely run down the business until it folds.

That’s the problem with a lot of economics, everything is always elsewhere. Foreign Direct investment is to be courted,direct national investment is too prosaic to be contemplated.

If you depress wages do wonderful new export industries pop out of the ground, in some weird hydraulic fashion?

Governments have negative power to cut but no positive power to build?

Creating and spending credits into the economy can create employment but it also creates wealth inequality. Why not regulate investment and circulate the credits in the system that are currently being mal-invested or hoarded? Money or more exactly credits are meant to be a transaction catalyst. It is the nature of the transaction that fosters employment. Adding more catalyst eventually becomes counterproductive. Many economists have commented on the confounding and durable nature of credits.

Ransome, I’ve also been struck by exactly the same point. If the government creates a vast stock of risk free financial assets, then it is hardly surprising when the holders want the value of those assets to be preserved. Risk free financial assets keep their value very nicely in a depression and so there is great political power behind getting the economy stalled.

I’ve never understood why Bill focusses so much more on the size of the deficit rather than the substructure of what types of tax are used. Right back in the 1930s Michal Kalecki wrote about how different types of taxation have vastly different effects on the economy. Michal Kalecki wrote about asset tax (which he called “capital tax”):

” the inducement to invest in fixed capital is not affected by a capital tax because it is paid

on any type of wealth. Whether an amount is held in cash or government securities or

invested in building a factory, the same capital tax is paid on it and thus the comparative

advantage is unchanged.”

If all current taxes were replaced by such a tax it might increase both real investment and consumption even with a balanced budget. Hell it might even allow the euro to stay in one piece. (But I’m sure other EU laws would prohibit it. The EU forced the UK to adopt value added tax when we joined and the EU insists on corporation tax).