It's Wednesday and I discuss a number of topics today. First, the 'million simulations' that…

Huge deficits are the real problem

I am still reeling from the incompetence of the EU, the German’s who pushed the deal, the ECB and the IMF who thought they could get away with stealing ordinary deposits when they had made such a big deal early on in the crisis that guaranteeing deposits below 100k Euros was an essential part of their financial stability reforms. The mind boggles as to how stupid those decision makers are. They are so blinded by ideology that they have lost a grip on their own narrative and certainly on reality. I notice the Troika rats are pointing the blame at each other for the disastrous judgement that was exercised in the package design. And, not one Cypriot politician voted in favour of the package. The bird on both hands (stereo effect) to the Troika. And you will note I haven’t said a word about Russian oligarchs and money laundering. That is a side-show in all of this. Anyway, I needed a rest from that so turned my attention to the US labour market as I was updating the latest February 2013 labour force data and examining where things are at. I did this as I thought about the debates in the US about the budget. I think many of the politicians might have been drinking the same Kool Aid as the Troika. They have also lost a grip on reality.

I had read some pretty crazy budget analyses in the last week. Take the New York Times article (March 18, 2013) – Paul Ryan’s Ax Isn’t Sharp Enough – by a Republican congressman Paul C Broun, Jr.

He considers the ultra mad budget proposal from his fellow Congress member – the former (failed) Republican Presidential running mate Paul D. Ryan – to be a Keynesian, if not socialist path to disaster.

We read that the “most pressing problem facing our nation” (the US) is – wait for it:

… runaway government spending …

He wants to:

… stop spending money we don’t have, an idea I promote every chance I get.

From which I conclude he lies a lot when he is talking to people.

Remember the Speech that the current Governor of the Federal Reserve Ben Bernanke in 2002 to the National Economists Club – Deflation: Making Sure “It” Doesn’t Happen Here. The Governor said:

But the U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.

And, remember the 2009 interview that Ben Bernanke gave Scott Pelley from the US program 60 Minutes. The interview was largely a litany of mainstream statements but at one point the Chairman gives the game away to the interviewer Scott Pelley.

If you listen to the interview (the link will take you to the video and the transcript) you will realise that at around the 8 minute mark Bernanke starts talking about how the Fed (the US central bank) conducts its “operations”.

Interviewer Pelley asks Bernanke:

Is that tax money that the Fed is spending?

Bernanke replied, reflecting a good understanding of what we call central bank operations (the way the Fed interacts with the member banks):

It’s not tax money. The banks have accounts with the Fed, much the same way that you have an account in a commercial bank. So, to lend to a bank, we simply use the computer to mark up the size of the account that they have with the Fed.

Please read my blog – Bernanke on financial constraints – for more discussion on this point.

I know some people out there will say – “well, so what, we all know the government can issue currency at will, why do the proponents of Modern Monetary Theory (MMT) always bang on about that?”

To which I always reply – then stop saying the government can run out of money, or is “spending money we don’t have” and other versions of the same. Stop claiming that the national, currency-issuing government has financial constraints.

Then they say – “but that will just be hyperinflationary”. To which I reply – okay, now the discussion is on sensible grounds – under what conditions will government spending be inflationary? And at that point, when you indicate how much excess capacity the economy is enduring they just mouth some historical revisionist ravings about Germany in the 1920s a moment or two before they introduce the Zim-case. At that point also, I conclude the battle is over, they know nothing.

Anyway, Junior (Mr Paul C. Broun, Jr that is) isn’t happy with Mr Ryan’s proposal to slow spending growth. He wants absolute cuts in US federal government spending:

Just reducing growth in spending does almost nothing. We have to dig deeper and make profound cuts now.

Well, let me say that even reducing the growth in public spending now will have major negative consequences for the US economy. Making absolute cuts will see it go back into a very deep recession and the labour market will deteriorate significantly.

I won’t comment on the number of federal policy or regulative departments Mr Broun proposes to cut. It sort of like a wish list of the policy bodies that promote more equity in public education or regulates to reduce environmental catastrophes and that sort of thing.

And, after eliminating several departments and programs, which will pull trillions of US dollars out of the spending stream he says:

To cap all this off – literally – I have proposed a balanced-budget amendment that would force Congress to stick to the principle of not spending more than we take in.

At which point, you realise he doesn’t understand macroeconomics at all.

And while his attack on Paul Ryan’s budget suggestion was ultra, it is was not much more than the “pot calling the kettle black”. We are only talking degrees of madness here.

In that context I have to agree with Robert Reich, who in his March 13, 2013 article – The Contest Over the Real Economic Problem – sought to remind Americans (and everyone else) what the real issue facing the US economy is.

I don’t share Robert Reich’s glowing assessment of his days as an advisor to President Clinton and what he claims that regime achieved. My view is that Clinton set the US economy up for recession and started the private debt binge. That Administration also enacted some harsh social policy changes.

But in the current debate, Robert Reich is correct when he says:

The biggest problems we face are unemployment, stagnant wages, slow growth, and widening inequality – not deficits. The major goal must be to get jobs and wages back, not balance the budget.

He is correct when he notes that:

Paul Ryan’s budget plan – essentially, the House Republican plan – is designed to lure the White House and Democrats, and the American public, into a debate over how to balance the federal budget in ten years, not over whether it’s worth doing.

It is the same sort of trap that I discussed yesterday where one neo-liberal economist after another comes up with niftier ways of assessing which Eurozone member state will fall foul of the Excessive Deficit Mechanism and when without questioning the basis tenet of the whole debate.

Robert Reich correctly points out that:

The government’s finances are not at all like a household’s. In fact, it’s when American families can’t spend enough to keep the economy going, because too many of them are unemployed or underemployed and have run out of money, that government has to step in as spender of last resort – even if that means taking on more debt. If government doesn’t fill the spending gap, an economy can collapse into deeper recession or depression, pushing unemployment far higher. Look at what austerity economics has done to Europe.

No, today we are abstracting from what is happening in Europe thanks.

This is basic macroeconomics. Spending equals income. If you cut one component of aggregate demand growth will falter unless it is replaced. None of the Republican budget proposals tell us where the extra spending will come from. They blather on about confidence and self-reliance and freedom – all fine things – but where are the jobs?

Motherhood (or whatever) statements don’t generate spending which is needed to create jobs. The Ricardian gang who tried to run the “fiscal contraction expansion” line have been blasted out of the water by several years of data now. They have no credibility at all.

As Robert Reich states:

Republicans want Americans to believe government budgets are like family budgets that must be balanced because the analogy helps their ideological aim to “drown the government in a bathtub,” in the memorable words of their guru, Grover Norquist.

But the reality facing America is not that proposed public spending cuts would need to be replaced by private spending. The problem is much more serious than that.

The real deficit is calibrated in terms of employment. There is a massive jobs deficits and they are the deficits that matter. At this present time there is a need for a substantial injection of net public spending – that is, an increase in the deficit of several percentage points of GDP.

Even considering slowing the growth of public spending would be a disaster.

Here are some calculations I have been doing over the last several days as I updated my databases. The data is seasonally-adjusted labour force data from the – US Bureau of Labor Statistics – one of my favourite WWW sites (tragic isn’t it – such is the life of a data junkie).

To hold the unemployment rate constant with the participation rate at its peak, employment has to expand at a rate equal to the new entrants into the labour force. That is, has to keep pace with the underlying growth in the working age population

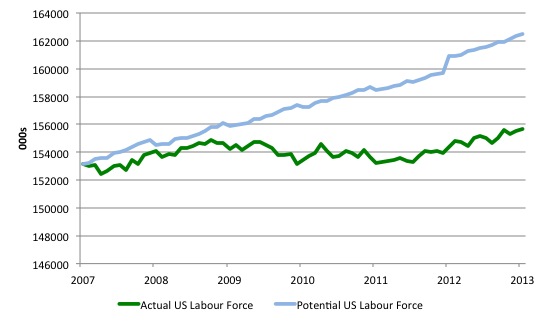

The following graph shows the actual labour force since January 2007 (green line), which reflects the declining labour force participation rate and contrasts it with what the labour force would have been if the participation rate had have remained at its January 2007 peak of 66.4 per cent (blue line). The blue line is thus driven by the underlying changes in the working age population.

The peak participation rate occurred in January 2007 (66.4 per cent). It has steadily fallen since then and in February 2013 was 63.5 per cent.

The 2.9 per cent decline in the participation rate from its peak amounts to 7,103 thousand workers who have left the labour force as a result of the cyclical sensitivity of the labour force. It is hard to claim that these withdrawals reflect structural changes (for example, a change in preference with respect to retirement age, a sudden increase in the desire to engage in full-time education).

In January 2007 (at the peak participation rate), the US unemployment rate was 4.6 per cent (which was slightly higher than the 4.4 per cent lowpoint recorded a month earlier in December 2006. It didn’t start to increase quickly until early 2008 and then the jump was sudden.

We can have a separate debate about whether 4.4 per cent constitutes full employment in the US. My bet is that if the government offered an unconditional Job Guarantee at an acceptable minimum wage there would be a sudden reduction in the national unemployment rate which would take it to well below 4.4 per cent without any significant inflationary impacts (via aggregate demand effects). So I doubt 4.4 per cent is the true irreducible minimum unemployment rate that can be sustained in the US.

But we will use it as a benchmark so as not to get sidetracked into definitions of full employment. In that sense, my estimates should be considered the best-case scenario given that I actually think the cyclical losses are much worse than I provide here. For those mystified by this statement – it just means that I think the economy was not at full employment in December 2006 and thus was already enduring some cyclical unemployment at that time.

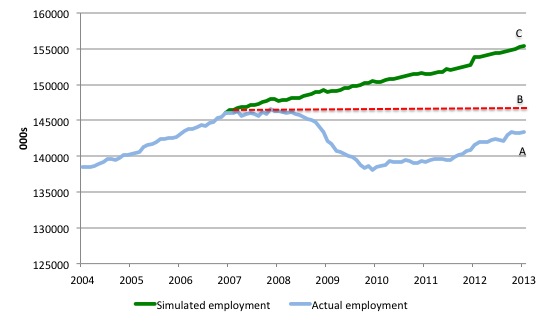

We can compute a necessary employment series which is defined as the level of employment that would ensure only 4.4 per cent of the simulated labour force remained unemployed. This time series tells us by how much employment has to grow each month (in thousands) to match the underlying growth in the working age population with participation rates constant at their January 2007 peak.

The following graph compares that necessary employment series with the actual US employment. The former series starts at January 2007. The actual employment data is graphed from January 2003 to show perspective.

This allows us to calculate how far below the 4.4 per cent unemployment rate (constant participation rate) the US employment level is.

There are two deficits captured in the graph:

- First, the actual loss of jobs since the employment peaked in November 2007 – a fall of 3,103 thousand jobs. This is the AB gap at February 2013, which is shown on the graph. The dotted red line is an extrapolation of the peak employment level at November 2007.

- Second, the loss of the jobs that would have been generated had the demand-side of the labour market kept pace with the underlying population growth – that is, with the participation rate at its peak and the unemployment rate constant at 4.4 per cent. That loss amounts to 8,876 thousand jobs. This is the segment BC at February 2013.

The total jobs that would need to be created to unwind the cyclical damage caused by the crisis is thus 11,979 thousand (approximately 12 million). This is the sum of the segments AB + BC or simply segment AC.

Conclusion

That jobs deficit could be expressed in output terms – which would tell us: (a) the monthly loss of real national income that the US economy (and American citizens) are enduring as a result of the macroeconomic policy failure to generate enough work, and (c) how much spending growth – added aggregate demand – would be required to close the jobs deficit.

I haven’t time today to do that next calculation but it is a shocking figure even if we assume that the productivity of those 12 million jobs is low. A stunning, daily waste of national income is occurring in America because its politicians don’t know what day it is.

These losses are permanent – they can never be regained. It represents shameless profligacy. And the national income losses are just the tip of the iceberg. The social costs of the jobs deficits are huge and will span generations. Like the EU bureaucrats and the other Troika partners – those who oversee these losses are just plain stupid (as well as other more venal things).

The Republican budget proposals (whichever mad version you wish to choose) will just extend the line segment AC.

Central bank independence

As an aside, and back, reluctantly to Europe, the neo-liberal mantra is that central banks have to be independent and not captive to the political process. This is part of story that has seen them elevate the relative ineffective monetary policy to the centre stage and concentrate it on inflation targetting and, at the same time, render fiscal policy a passive supporter of the monetary policy stance.

After the Cypriot government did the right thing and gave the middle finger to the Troika, the European Central Bank issued a statement:

The ECB takes note of the decision of the Cypriot parliament and is in contact with its troika partners. The ECB reaffirms its commitment to provide liquidity as needed within the existing rules.

Note the term – our “troika partners”. One, an unelected and unaccountable swill (the IMF) that systematically destroys economies and the livelihoods of people within them. The other, the political bureaucracy of the EU. That is the anathema of independence.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

The participation rate started declining BEFORE the current recession. Plus that rate has a long way to fall before it gets back to the level that obtained in the 1960s. See:

http://research.stlouisfed.org/fred2/series/CIVPART/

So it’s just conceivable (and I don’t want to put it any more strongly than that) that the decline in the participation rate is some sort of return to somewhere near 1960s level.

But that’s not to detract from Bill’s points about the economic illiteracy we get from Republicans and the rest of the political right.

I heard Schaeuble says the Cypriot parliament better think again or their banks may never be able to re-open. He’s all heart that guy. What is it about Germans and empathy ?

“the neo-liberal mantra is that central banks have to be independent”

They can’t be. Central banks are run by people. And people have political views and can be influenced by lobbying. They also operate in their own little social group which imparts a twisted view of the world.

No central banker has the required Wisdom of Solomon to operate that structure. It reminds me of the ‘Chief Programmer Team’ idea in IT. Very efficient in theory. There’s just one problem – the candidates can never be good enough, never be wise enough and insufficiently omniscient.

So let’s be honest. They are not independent central banks. They are plutocratic central banks.

To use the word “troika” in an official statement is an indication of their mindset.

How will Schauble feel if Cyprus leaves the euro and adopts the Ruble?

Don’t euro plutocrats realize that they’re recreating the “Highland Clearances” all across Europe?

What good is nominal control of “fiat” if the people leave?

You couldn’t make this up. The irony of putting “specialists” in leadership positions? People who know “everything about nothing” are trying to LEAD increasingly complex systems entering increasingly complex situations.

What did our electorates expect?

Methods drive results. If we want different outcomes, we need different METHODS for setting pragmatic national goals, not just random tactics masquerading as national goals.

“I am still reeling from the incompetence of the EU”

Incompetence Bill ?

The EU has pushed enormous national resources upwards into global banks whose only mechanism to make money (they don’t produce anything of value) is global wage / energy arbitrage.

The EU was always a extreme banking lobby , that was and remains its function.

Former countries have thus become far too specialized so as to become efficient (extract capital) in the eyes of these global banks.

Now that Europe has pushed all available resources upwards it has no need for these peripheral players , they can & indeed must be subtracted from the global monetary ether if the banking / global trade artifice is to remain intact.

The EU is at the core of these massive global trade distortions.

In the final Euro push upwards it has built the industrial giant that is China , 19th century England multiplied by a 1,000

Look at trade patterns for God sake.

Nothing like this capital destruction has ever happened before.

This is a replay of Industrial Englands birth with plantation / ranch Ireland supplying the physical surplus but on a scale few can get their heads around.

Its those same banks Bill.

This looks very like that 1914 moment or perhaps it could be even worse then that , the late medieval collapse ?

Thinking, how much worse can it get than the Ryan budget, I actually took a glance at the new Republican Study Committee budget proposal that Bill mentioned but did not detail above. If it hadn’t come from the GOP, I’d have thought it was the script for a stand-up comic or an article from the Onion. Just one item can suffice to illustrate its stupidity: They’re proposing to end the federal highway system.

No word yet on whether they’ll provide vocational training funds for cartwrights, wheelwrights, or blacksmiths. These will certainly be growth careers in the new Republican Libertopia.

The concept of central bank (credit creators) independence from credit managers (commercial and deposit banks) was an observation of Rev. John McVickar, first chair of economics at Columbia University. He also noted that the presence of “investors” was at cross purposes to the banking objective of managing (the circular nature of) community credit. Brandeis further criticized banking involvement in the running of businesses as investments; where safety, quality control and risk management impair profits. Today it is the hedge fund nature of money center banking that draws criticism. You won’t have full employment unless the nature of investing is addressed.

Ralph Musgrove: 1) notes that the U.S. labor force “participation rate started declining BEFORE the current recession, 2) speculates ” that the decline in the participation rate is some sort of return to somewhere near 1960s level.”

A more nuanced picture emerges using the U.S. Bureau of Labor Statistics employment-population (E/P) ratio controlling for gender and age. 1) The male E/P ratio has been on a decline since the 1960s. 2) the female E/P ratio began moving upward in the early 1970s (coinciding with equal employment opportunity policies put into effect) and peaked in 1990 and has shown a moderate decline since, and 3) 16-19 year olds (both sexes) exhibited the highest E/P ratio about 1980 the second highest about 1990 and the third highest about 2000. Since 2000 16-19 year old E/P ratio have declined below the low levels of the 1960s.

Arthur Wilke

Auburn, AL

Bill –

I hear you, and am aware of your earlier estimate that un(der)employment in the US is a permanent loss of around $10E+10/day(!). Also. thanks as always for the numerical evidence.

However, I’ve an uncomfortable suspicion you air only half the problem. There must be similar destruction of the means of production (middle-aged factories being scrapped, not mothballed) which will never be replaced (like-for-like).

This seems little-discussed, but if large enough could compromise recovery, as the real capacity gap may be far smaller than estimated. It perhaps raises the spectre of stagflation.

Do you know of data sources (or proxies) tracking this?

[btw your title’s a bit ambiguous]

This wiki page does not really mention the true cause of the late Medieval breakdown – free banking poison coming out of Venice (London) Florence (New York) Genoa (Frankfurt / Paris).

http://en.wikipedia.org/wiki/Crisis_of_the_Late_Middle_Ages

Which created a then global free trade system based on luxury rather then staple goods.

But another great crash into entropy looks like whats ahead for us.

The Physiocrats would have recognized the failure of the tap root agricultural economy

Today the tap root is oil.

These kinds of dramatic life support system failures leads almost always towards the imposition of military fiat by some group or another.

http://en.wikipedia.org/wiki/Military_fiat

Great points, Bill … I share your exasperation at the situation in the EU and back here in the USA. It seems nearly every politician must pay lip service to this “reduce the deficit” mania or they receive major disapproval from the uneducated electorate (ironically, the talk-radio hosts refer to those who supported Barack Obama as the “low information” voters – it seems those are hardly the only ones). The only hope we have here is that Democrats refuse to buy into the mania spread by Paul Ryan and his cohorts. Of course, they too pretend to “care” about deficits but instead propose large tax increases. Neither approach will solve the real problem, which is, as you point out, the severe (and growing) job deficit. Even so, there has been some progress and we are starting to see gathering strength in the economy, but if we succomb to the madness, that will be lost.

I have tried to explain MMT to many people over the past year, but aside from looks of incredulity, I get very little response either way. It has been remarked that Americans are woefully lacking in basic economic education (but usually by those who toe the mainstream line), and I simply must agree. However … when people actually discuss the concepts of MMT with me, I am usually met with this:

“If it is true that Washington can just spend without any limit, what’s to stop people from demanding ever greater handouts?”

My best response is to state that the MMT Job Guarantee actually requires someone to work, not sit at home watching television or playing video games, and that yes, I know that many will call this approach “vote buying,” but I believe people should actually vote for the solution that will employ people and see the economy grow. But the mountain is high and I am just a widowed Filipina grandmother in South Florida, and sometimes it gets lonely. I welcome any and all suggestions about how to keep the MMT flag flying high. I sincerely believe in the ideas presented here – the data is undeniable – but there is a rather difficult barrier to be overcome. Why can’t the media give more attention to this view – at least on the financial channels like CNBC? Every time I see that idiot Rick Santelli ranting about this and that economic development (he was a big fan of Trichet) and how we are going bankrupt (his approach would have to be considered Austrian), I yearn to see someone step up to the plate and smack this stuff right over the fence.

I would love to try it myself, but I feel I am not yet sophisticated enough to go toe to toe with someone like John Taylor or Greg Mankiw. The problem is, I don’t think they want our side to be widely understood. It might bring down the entire dishonest game they play. Could someone out there give old Melia a little encouragement? I recently (mid January this year) posted a series of responses arguing our side in the Wall Street Journal website and I think I did fairly well – at least they were reasonably polite in their disagreement. I may have even opened some eyes – they seemed to think I knew someething about what I was writing about, but I have no college background and most of what I know is self-taught. My greatest strength is to always remain open-minded. Two years ago, I would have never understood MMT, but I read an interesting article at Seeking Alpha and eventually learned about who Bill Mitchell and Randall Wray are … the rest has been a thrilling and fascinating ride. To think that I could actually understand the likes of Marx and Keynes and not feel immediate revulsion, simply amazing. I am a woman who has started with very little when I came to the US over forty years ago but became successful in business and later in investment and trading. Most of the way, I was a staunch believer in the likes of Milton Friedman and the “supply side” philosophy. How strange it all seems to me now. Thank you, Bill and also your friend Randall, for enlightening me.

@Melia

MMT is merely a higher circle of hell , its less Hot up there but its still sanctions the private creation of money.

You must cast your mind back to Keynes & MMTs early years……..its 1914

HMT produces Treasury money (at interest) to bail out a deeply underwater BoE.

Once the BoE is bailed out via the destruction of millions of Baldricks it goes back to the old methods of extraction…………….why not ?

MMT advocates want the old Westphalian system back again

But that system was the banks destroying the Kings true potential as a sov power independent of banks.

States do not need Central banks.

The Note is as good as the bond.

Much of what has filled our little heads back then is illusions built on top of a foundation of even deeper illusions.

Does Bill methods force people to work for pointless industrial tasks simply because of inflationary forces.

It strikes me as having elements of the old hamster wheel about it all.

Is it possible to estimate amount of wealth that would be required to close jobs deficit?

Besides jobs deficit we have a wealth deficit. A wealth gap, like output gap, could be estimated. It would be reavealing.

Saving desires could be estimated based on historical trends

Ralph: That rate in the 60’s reflected the fact that women stayed at home. That is not some ‘natural’ rate to which we are returning.

Then they say – “but that will just be hyperinflationary”. To which I reply – okay, now the discussion is on sensible grounds – under what conditions will government spending be inflationary?

I’ve found it very hard to have a reasonable conversation with most of the public about inflation.

The US BLS publishes statistics showing we are presently around 2-3% of inflation. Many people argue it is much higher, without presenting real evidence aside from a few examples. “Show me a competing index and I’ll study it” I say, but they offer nothing.

Cracks like Peter Schiff get media attention by predicting imminent hyperinflation. He revised his prediction to say it’s still coming–but taking longer than he expected. (That was in January 2012.) His reasoning is that it seems impossible that the Fed could print trillions of dollars without incurring massive inflation. It’s amazing people take him seriously.

My favorite are the ones who measure inflation by the price of gold. They’d point to a 300% increase from 2007-2012 and describe this as hyperinflation. Somehow they must believe gold is immune to speculation, unlike any other commodity. Now that prices have leveled off, by this reasoning so has inflation. But I don’t hear them claim the latter.

Whatever the skeptics claim, MMT is not an extreme view of macroeconomics. It’s surprisingly moderate in a land of extremists.

“I’ve found it very hard to have a reasonable conversation with most of the public about inflation.”

It’s the same with house prices.

Throughout most of their lives people actually need house prices to decline or stay low, and are likely unaffected by actual inflation.

The propaganda has got them to believe that high and growing house prices are a good thing and that inflation is bad.

It’s quite clever really.