It's Wednesday and I discuss a number of topics today. First, the 'million simulations' that…

US problems are cyclical not structural

Last week (March 28, 2013), the – US Bureau of Economic Analysis – released the – revised (third estimate) – fourth-quarter 2012 US National Accounts data, which showed that real GDP grew by 0.4 per cent in the December quarter and 1.7 per cent for the 12 months to December 2012. The estimates were revised upwards from a quarterly growth rate of 0.1 per cent, largely due to higher estimated consumption and investment growth. In the six years to the December-quarter 2007 (the most recent real GDP peak) the average quarterly growth rate was 0.62 per cent. The US economy is still labouring with a huge cyclical output gap. That doesn’t stop a range of commentators from arguing otherwise. Other than the hysterical (and inaccurate) – David Stockman blast – there was a somewhat more measured article by Jeffrey Sachs in the New York Times (March 31, 2013) – On the Economy, Think Long-Term – which claims that the US problem is not cyclical but structural. For non-economists, that means that the policy solutions are quite different. In the absence of hysteresis, fiscal and monetary policy cannot solve a structural problem. The only problem with Professor Shock Therapy’s hypothesis is that it doesn’t stack up with the evidence. The evidence does not support the assertion that job polarisation in the US is constraining economic growth. The evidence continues, unequivocally, to support the view that the US economy is suffering from a major cyclical downturn (output gap) and needs a carefully targetted, aggregate demand stimulus.

Jeffrey Sachs in the – Shock Therapy – guy (the term “shock policy” originated with Milton Friedman.

His shock therapy for Russia was a disaster and led to government price controls being abandoned and state enterprises being privatised. Not only did inflation rise quickly, but unemployment soared and individuals and households lost the savings that they had worked hard the years to build up.

During the period he was consulting for the Russian government the health care and social services system collapsed, life expectancy went backwards (which was unprecedented for an advanced nation), real GDP fell by around 50 per cent and poverty rates increased by a factor of 10.

In relative terms, the economic losses alone in the post-Soviet economies that embraced the Shock Therapy path were more than twice as large as the losses in America and Western Europe during the Great Depression.

Given the bias of the weestern media it is no surprise that we really don’t understand how bad things became in Russia and the satellites after the fall of the Soviet system and the introduction of Sach’s-style therapy.

I have been doing some work in Kazakhstan over the last few years (through the Asian Development Bank) and the situation there after 15 odd years of neo-liberal free market therapy of the type Sachs endorsed was abysmal. Fortunately these nations have changed course and are seeing the value of government-led growth strategies.

So Jeffrey Sachs does not have a great record for sound judgement when it comes to appraising the plight of a nation.

Interestingly, here is Jeffrey Sach’s own account (March 14, 2012) – What I did in Russia. Egregious at best.

During his Shock Therapy days, he claimed that his approach was providing a long-run solution and that poor short-term outcomes were to be expected.

The problem is that the long-run is just a sequence of short-runs and shock therapy meant that a vast number of older members of the population, who had worked all their lives to achieve a modest, but secure, standard of living now faced poverty in the midst of lost pension schemes, market-based rents and rising unemployment.

It also leads to the potential growth path falling because investment suffers as a result of the depression that is caused. This sort of policy shock was applied in many countries once the Soviet system fell with similar, disastrous, results.

I wrote about Jeffrey Sachs in this blog – Who should be sac(k)ed?

In his latest New York Times article, he is back on the long-run theme.

He begins with the self-evident truth:

THE 2009 economic stimulus package has come and gone. So, too, have the temporary payroll tax cuts of 2011-12. Most of the Bush-era tax cuts, in addition, have been made permanent. Yet the lasting effects of these policies have been meager.

Which is clear if the data is understood. I provide some analysis of the latest US national accounts data below.

But the fact that there was a stimulus and there is still an output gap doesn’t tell us that the stimulus failed. The recovery following the stimulus tells me that the economy was heading in the right direction but the stimulus wasn’t initially large enough and has been tapered too early.

The US government is now undermining growth according to the December-quarter national accounts. The contribution of overall government spending to real GDP growth in the December-quarter 2012 was -1.6 percentage points. Had they maintained the stimulus the output gaps, which I analyse below would have been much lower.

Jeffrey Sachs interprets this data as indicating:

… the fundamental structural challenges to our economy remain. Deeply disruptive forces – rapidly evolving information technology, globalization and environmental stresses – are radically reshaping the jobs market. Decent jobs for low-skilled workers have virtually disappeared. Some have been relegated to China and emerging economies, while others have been lost to robotics and computerization.

The results of these changes can be seen in two starkly different employment figures: since 2008, 3.1 million new jobs have been created for college graduates as 4.3 million jobs have disappeared for high-school graduates and those without a high school diploma.

Again, this is not something I disagree with. But drawing the two observations together to conclude that structural problems dominate is not valid inference.

He thinks so:

It’s time to move beyond such transitory and piecemeal policies. Our underlying economic problems are chronic, not temporary; structural, not cyclical. To solve them, we need a systematic long-term approach.

Which is a familiar refrain and if I had time I could find a similar sentence or two in his earlier Shock Therapy work – that has always been his line. It was the same line that blew up Russia.

His solution is based on “three priorities”:

1. Invest in public infrastructure – for a long-term perspective.

2. Invest in renewable energy – “A clearly laid out federal program to support large-scale solar and wind energy, electric vehicles and other smart technologies – and backed partly by public money – would unlock hundreds of billions of dollars of private investments. It would secure America’s energy future and protect the environment, too.”

3. Invest in “jobs skills” – apprenticeshops etc.

I agree with all of those recommendations but they don’t lead to the conclusion that a fiscal stimulus is not required or that the problems are structural.

It is here that we realise that the structural-cyclical division, which a lot of pro-market economists use relentlessly to justify cutting welfare payments, reducing minimum wages and privatising and deregulating, is somewhat blurred.

Fiscal stimulus should always be targetted and aim to not only stimulate short-term demand but also push the productive potential of the economy out. That way the short- and medium-term growth pushes the inflation barrier ahead of itself. That is a good fiscal strategy.

The three priorities that Sachs identifies are all job creating and will have an immediate impact on national income growth and output growth. The spending to advance these priorities will also allow for major restructuring to occur.

The point that the neo-liberals have never understood (blinded by ideology) is that structural adjustments are best accomplished when the economy is growing strongly and resources (labour and capital) can more easily transit between uses.

When the economy is stuck in an output gap malaise, these transitions are very difficult.

I starting drilling into the data to examine the proposition that Sachs makes about the displaced low wage workers representing a constraint on short-term growth. That is another popular neo-liberal (NAIRU-type) argument.

Fortunately, in terms of saving time, I came across a recent article from some economists at the New York Federal Reserve Bank, who had done, more or less, what I set out to do.

The New York Federal Reserve Bank also provides some interesting – Interactive Labour Market Indicators – which are educative and fun to play with.

The article (March 27, 2013) is available at – Is Job Polarization Holding Back the Labor Market?

The key hypothesis that the NYFRB economists investigate is:

More than three years after the end of the Great Recession, the labor market still remains weak, with the unemployment rate at 7.7 percent and payroll employment 3 million less than its pre-recession level. One possibility is that this weakness is a reflection of ongoing trends in the labor market that were exacerbated during the recession. Since the 1980s, employment has become increasingly concentrated among the highest- and lowest-skilled jobs in the occupational distribution, due to the disappearance of jobs focused on routine tasks. This phenomenon is called job polarization …

That is more or less what Sachs is claiming about the ineffectiveness of short-term fiscal stimulus.

The NYFRB article studies job polarisation by aggregating occupations into “different task groups, with each occupation categorized as either routine or nonroutine.”

The criteria for allocation is predictable and you can consult their definitions is you are interested.

They then define job polarisation as occurring:

… when employment moves to nonroutine occupations, a category that contains the highest- and lowest-skilled jobs.

They find evidence that in terms of employment shares, the “share of routine occupations declined from 60 percent in 1976 to 40 percent in 2012, resulting in job polarization”.

Which is not a surprising result and is well-known.

They also “further classify occupations “into cognitive and manual categories based on the amount of mental or physical activity required of the job: cognitive jobs require mostly mental activity; manual jobs, mostly physical.”

Once again, consult the paper if you are interested in specific examples.

The evidence shows that:

… the share of routine jobs has been steadily decreasing for the cognitive and manual categories since the 1980s, and the decline accelerated during the 1981-82 and 2007-09 recessions. Most of the rise in the employment share of nonroutine jobs reflects the increase in cognitive nonroutine occupations.

Then it is hypothesis time:

The rise in job polarization during the most recent labor market slowdown can potentially account for why the labor market recovery has been sluggish. In particular, it can explain the persistently high unemployment rate and the rise in long-term unemployment. If this is the case, we should see weakness in the segments of the labor market that involve routine jobs.

Which is Sachs’ claim.

The NYFRB economists examine that idea by “looking at different labor market indicators for different occupation groups in the current labor market downturn”.

The indicators include unemployment, long-term unemployment, and transition probabilities.

1. Unemployment: “Between May 2007 and May 2010, the unemployment rate for routine occupations rises by 130 percent, while it rises by 103 percent for nonroutine occupations. However, this behavior is matched by a more sizable and rapid decline in the unemployment rate for routine occupations relative to nonroutine in the recovery”.

The “larger increase in the unemployment rate for routine occupations during the recession reflects mostly cyclical factors”. They examine specific sectors where job losses were large and find that it is not the case that the “unemployment rate among routine jobs” fell “more slowly than the rate among nonroutine jobs”, which is an essential prediction of the job polarisation hypothesis.

They conclude that job polarisation is not the reason for the sluggish recovery.

2. Long-term unemployment: They point out that if “job polarization is causing long-term unemployment, we should expect long jobless spells to be more common among workers with routine occupations”.

The evidence they present shows this hypothesis is not supported by the datea. They find that the “the duration of unemployment spells increased significantly during the recession for all occupation groups, and has remained high for all groups”.

This indicates a lack of jobs overall rather than a major structural imbalance between the labour supply and the demand for labour. There is a major shortage of jobs in the US. That is a cyclical phenomena.

3. Job-finding rates: This relates to how easy it is for an unemployed person to find a job. The data shows that the “main reason why the unemployment rate has been persistently high is the slow recovery of the rate at which unemployed workers find jobs”.

The evidence is that there is no difference in rates among routine and non-routine workers. They find that “all job-finding rates are recovering similarly”.

4. Occupational Transitions: They note that if “job polarization is depressing the prospects of the unemployed, we should see more occupational transitions from routine to nonroutine jobs after the recession”.

If that was so then people would “be incentivized to retrain and search for work in nonroutine occupations”. The evidence is that “this isn’t the case-in both the pre-recession and recession periods, only 22 percent and 23 percent, respectively, of unemployed workers moved from routine to nonroutine jobs. This means that three-quarters of unemployed workers in routine occupations who found jobs remained in routine occupations.”

So there is no dispute that job polarisation is on-going and is something that the policy agenda should be addressing to ensure that worker who are losing relevant skills are offered transitions.

But what is desperately needed in the US at present is more jobs. That is a cyclical issue.

It means the national deficit could be at least 2-3 per cent of GDP higher than it currently is.

I also did some updating of the new US National Accounts data, which bears on this topic.

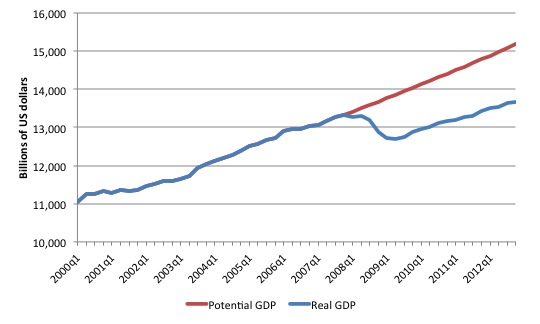

The first graph shows the actual real GDP for the US (in $US billions) and an estimate of the potential GDP. There are many ways of estimating potential (given it is unobservable). There is a whole industry involved in this endeavour and while the various techniques developed are interesting to characters like me who like econometric and statistical puzzles I am sure a detailed treatment would leave most readers wanting less.

At times, this sort of endeavour is in the realm of “making stuff up”. At other times it is closer to reality. While I could have adopted a much more sophisticated technique to produce the red series (potential GDP) in the graph, I decided that sitting on a train on the way to Sydney was not the place to be bringing the econometric artillery into action.

It was much easier and probably not that much worse anyway, given the inherent “wriggle room” in these matters, to do some simple extrapolation. Which is what I did. The question is when to start the projection and at what rate. I chose to extrapolate from the most recent real GDP peak (December-quarter 2007).

The projected rate of growth was the average quarterly growth rate between 2001Q4 and 2007Q4, which was a period (as you can see in the graph) where real GDP grew steadily (at 0.62 per cent per quarter) with no major shocks. If the global financial crisis had not have occurred it would be reasonable to assume that the economy would have grown along the red line (or thereabouts).

The gap between actual and potential GDP in the fourth-quarter 2012 is around $US1,509 billion. I have seen estimates of this around $US1 billion. The truth is somewhere in between these two I suspect. Qualitative assessment? Enormous gap representing a massive permanent loss of national income every day the gap continues.

But in relation to those who want to claim the problem is mostly structural the graph is damming. If the US problem was mostly structural then it would not have fallen off the cliff as it did in early 2008. Structural deterioration is gradual and cumulative not sudden and sharp.

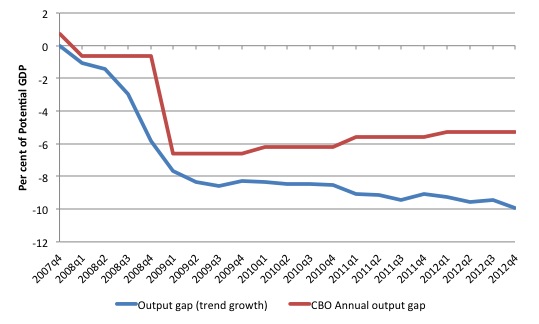

The second graph compares the output gap (percentage deviation of actual from potential real GDP) that is derived from the above graph and the – US Congressional Budget Office – measures.

My version should more accurately be called the incremental output gap because I would not presume that there was full employment in the December-quarter 2007. In other words, my incremental output gap depicts the increase in whatever gap existed at December-quarter 2007. The same interpretation cannot be given to the CBO estimates for reasons I explain below.

The CBO estimates are annual and I just imposed the annual observations on each relevant quarter, which is why the step-wise pattern arises. I could have done some more complex smoothing but, hey, I am on the train and the sun is shining!

By 2012, the CBO estimated an output gap of 5.3 per cent, whereas my estimates are 9.9 per cent. I would bet that my estimates are closer to the mark but even if we split the difference we would conclude the gaps are huge and they opened up very quickly. That is not behaviour that resembles a structural deterioration.

The US Congressional Budget Office (CBO) regularly puts out estimates of the GDP and unemployment gaps as part of their exercise in decomposing the federal budget outcome into cyclical (automatic stabilisers) and structural components. As I note in this blog – Structural deficits and automatic stabilisers – their estimates of the automatic stabilisers are likely to be understated as a result of the estimation technique used by the CBO.

On Page 3 of the CBO document – Measuring the Effects of the Business Cycle on the Federal Budget – we read:

CBO’s estimates of the cyclical component of revenues and outlays depend on the gap between actual and potential GDP. Thus, different estimates of potential GDP will produce different estimates of the size of the cyclically adjusted deficit or surplus. More specifically, the calculations remove the budgetary effects of the economy’s falling below or rising above its potential level of output and the corresponding rate of unemployment.

CBO define Potential GDP as “the level of output that corresponds to a high level of resource … labor and capital … use.

So how do they estimate potential GDP? They explain their methodology in this document.

While the technicalities are not something I will go into in this blog – see my 2008 book with Joan Muysken – Full Employment abandoned for the mathematical and econometric chapter and verse, suffice to say that they CBO uses the standard mainstream method.

CBO say that they:

They start with “a Solow growth model, with a neoclassical production function at its core, and estimates trends in the components of GDP using a variant of a tried-and-tested relationship known as Okun’s law. According to that relationship, actual output exceeds its potential level when the rate of unemployment is below the “natural” rate of unemployment) Conversely, when the unemployment rate exceeds its natural rate, output falls short of potential. In models based on Okun’s law, the difference between the natural and actual rates of unemployment is the pivotal indicator of what phase of a business cycle the economy is in.

The resulting estimate of Potential GDP is “an estimate of the level of GDP attainable when the economy is operating at a high rate of resource use” and that if “actual output rises above its potential level, then constraints on capacity begin to bind and inflationary pressures build” (and vice versa).

So despite saying that their estimate of Potential GDP is “the level of output that corresponds to a high level of resource … labor and capital … use” what you really need to understand is that it is the level of GDP where the unemployment rate equals some estimated NAIRU.

Intrinsic to the computation is an estimate of the so-called “natural rate of unemployment” or the Non Accelerating Inflation Rate of Unemployment (the dreaded NAIRU). This is the mainstream version of “full employment” but is, in fact, an unemployment rate which is consistent with a stable rate of inflation. Please read my blog – The dreaded NAIRU is still about! – for more discussion on why the NAIRU is a flawed concept that should not be used for policy.

Given the history of estimates of the NAIRU, the “steady-state” unemployment could be as high as 8 per cent or as low as 3 per cent. The former estimate would hardly be considered “”high rate of resource use”. Similarly, underemployment is not factored into these estimates.

The concept of a potential GDP in the CBO parlance is thus not to be taken as a fully employed economy. Rather they use the devious shift in definition in mainstream economics where the the concept of full employment is not constructed as the number of jobs (and working hours) that which satisfy the preferences of the available labour force but rather in terms of the unobservable NAIRU.

Policy makers constrain their economies to achieve this (assumed) cyclically invariant benchmark. The NAIRU is not observed and a range of techniques are used to estimate it. Yet, despite its centrality to policy, the NAIRU evades accurate estimation and the case for its uniqueness and cyclical invariance is weak. Given these vagaries, its use as a policy tool is highly contentious.

CBO say that their estimates of the NAIRU are derived from “historical relationship between the unemployment rate and changes in the rate of inflation”, in other words, a Phillips Curve. Please read my blog – The dreaded NAIRU is still about! – for more discussion on this point.

In Full Employment abandoned we provide an extensive critique of the NAIRU concept. You can also read an earlier working paper I wrote – The unemployed cannot find jobs that are not there! which documents the problems that are encountered when relying on the rubbery NAIRU concept for policy advice.

The point is that the estimates the CBO derive are flawed and will typically understate the degree of slack in the economy. With those caveats in mind I had a look at the relationship between the output gap, the unemployment gap and the annual inflation rate in the US to see what room there was for fiscal expansion.

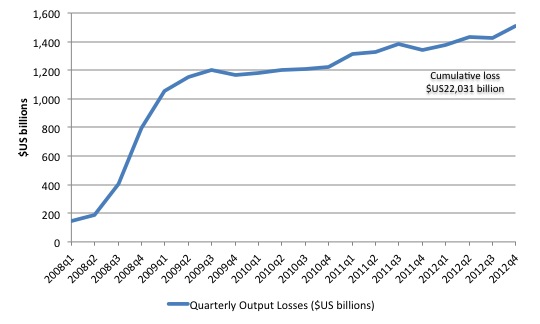

The third graph shows the quarterly losses in real GDP ($US billions) as a result of departing from the previous growth rate. The cumulative loss to date is some $US22,030.8 billion, which is a lot of national income to forego and lose forever.

Thinking about the long-run will just see those losses continue to mount. There is a short-term urgency for the US government to get the millions of unemployed workers back into productive employment. If there have been underlying structural changes then that opens up new opportunities for deploying people.

Just as the Dust Bowl was a huge challenge and provided opportunities for millions of workers to be redeployed from farming into land conservation, national park construction and whatever else the WPA and CCC workers did, there are millions of jobs out there just waiting for the government to pay the wage in areas such as urban renewal, personal care service delivery, and environmental care.

Conclusion

There is merit in considering the long-run challenges of changing demography and addressing the problems that years of industrial production and poorly managed agriculture have produced.

There is merit in continually monitoring the skills of the labour force and offering transitions for workers who find themselves left behind.

But when output gaps are large and millions are unemployed you know one other thing – the budget deficit is too low. That is a cyclical issue.

Technology Report

I was terribly excited about this latest technology addition until I realised the date.

http://www.guardian.co.uk/technology/video/2013/apr/01/guardian-goggles-video

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

Bill –

If you’d been in Sachs’s place, how would you have dealt with Russia’s hyperinflation problem?

Bill is spot on. I’ve long regarded Jeffrey Sachs as an idiot.

As for the structuralists, we have a crash clearly caused by over-leveraged banks, other financial shenanigans plus irresponsible lending leading to artificially high house prices. And the structuralists claim the problem is inadequate infrastructure spending, inappropriate skills, etc. They’re bonkers.

Dear Bill

In the early eighties, unemployment in the Netherlands rose from under 5% to 17% in a short time. There was then a minister of finance, Onno Ruding, who said that part of unemployment was due to the reluctance of the unemployed to relocate. He didn’t explain why such reluctance caused unemployment to rise so quickly by more than 12 percentage points only then and not earlier. After all, lazy people and people who don’t want to move always exist. Ruding illustrates how liberals always tend to see unemployemnt as a supply problem. I’m sure that in the thirties there were also many liberals saying that people who really want to work will find a job.

If unemployment is due to structural problems, it should rise gradually, not suddenly. I’m sure there are many structural problems in Greece and Spain, but to believe that what these countries need most of all is structural reform is like prescribing an improved diet to a person with a severe infection. Regards. James

“since 2008, 3.1 million new jobs have been created for college graduates as 4.3 million jobs have disappeared for high-school graduates and those without a high school diploma.”

This is completely obtuse. It’s a buyer’s market. If the government were to introduce an increase in employers’ contributions for graduate jobs, we would quickly see an increase in the number of jobs available for non-graduates.

I have read claims that 2 out of 3 jobs do not require higher education. The ‘high tech’ economy is a myth, in terms of job numbers.

Re Jeffrey Sachs: So have I, Ralph. His arrogance and contempt for others is nauseating.

Allegorically millions of Chinese are working in the American economy but live in China. They would not have jobs except for the American economy.

These Chinese folks are paid in dollars converted to yuan. The dollars stay in America and the yuan in China, balanced on the ledgers of each economy. Neat!

Simply expanding the deficit of any economy does not solve the problem of unemployment. It does introduce the potential for loss of lifetime savings through inflation.

The present state of economic theory appears to be very incomplete. Where is the link between the individual job and stable international economies?

However, the US’s ideological and ideational problems are terminal. I give them close to zero chance of digging their way out of their neconservative madness and science denialism. Their gun madness alone will tear them apart in the next 50 years.

@Roger

The present state of economic theory appears to be very incomplete. Where is the link between the individual job and stable international economies?

You are asking for a substantial integration of microeconomics and macroeconomics. At the present state of development of the discipline, this is unrealistic. Even physics, which is the most highly developed discipline we have, it has not proved possible to satisfactorily integrate quantum theory with general relativity, that is, the very small with the very large.

Expanding deficit spending by government does not necessarily lead to inflation. It only does so under certain condition, which presently do not obtain.

The post soviet economic disaster is all the more stark because the USSR had the most highly educated population the world has ever seen. There were hundreds of millions of highly educated people keen to get going, a country with amazing natural resources and yet neo-liberalism succeeded in sending it all down the toilet. It is amazing that the post soviet government didn’t choose to become like a giant version of its neighbours in Scandinavia.

To me the post soviet economies are the classic example of how education may be necessary but is not sufficient for prosperity. If all the educated people are left on the sidelines due to economic exclusion due to wealth inequality, then all of that education will go to waste.

Probably no-one is reading this page now, but just to follow up on my comment above:

The Economy is “Recovering” By Creating More Low-Wage Jobs… Increasingly Filled By Graduates