I have received several E-mails over the last few weeks that suggest that the economics…

Elementary misuse of spreadsheet data leaves millions unemployed

Remember, earlier this year, when the IMF admitted they had made errors in their modelling of expenditure multipliers. They had been tramping into countries with their jackboots telling all and sundry that fiscal austerity would promote growth because their multiplier estimates told them so. Millions of job losses later, they came clean. It turns out that when they revised their multiplier estimates exactly the opposite was the case. Now they acknowledge that spending multipliers are in range of 1.5 1.75, meaning that increasing government spending adds at least 150 cents in the dollar spent extra to the economy. Now, the darlings of the austerity cultists – Rogoff and Reinhart – has been exposed for poor research standards – to wit, errors in spreadsheet coding. Meanwhile, Cyprus is being driven into oblivion. Who is ever going to take responsibility for these travesties?

I have discussed the problem of poor IMF forecasting in the past. For example – Governments that deliberately undermine their economies.

Earlier in the year (January 3, 2013), the IMF published a paper – Growth Forecast Errors and Fiscal Multipliers – which attempted to explain why the planned fiscal austerity measures in advanced economies have been more damaging than they and their fellow mainstream economists had predicted.

Forecast errors are a fact of life and are not in themselves a reason for considering the forecaster deficient. But the IMF and other major neo-liberal inspired organisations produce systematic errors – which mean they do not arise from the stochastic nature of the underlying forecasting process.

It is easy to trace these systematic mistakes to the underlying ideological biases, which shape the way they create their economic models.

The IMF admitted that the spending multipliers were, in fact, “larger” than they had predicted and which they had used in their modelling. These models underpin their policy advice and have been instrumental in the imposition of fiscal austerity on many nations.

The IMF admitted that:

… a significant negative relation between fiscal consolidation forecasts made in 2010 and subsequent growth forecast errors. In the baseline specification, the estimate … [implies] … that, for every additional percentage point of GDP of fiscal consolidation, GDP was about 1 percent lower than forecast.

In more accessible language, the larger was the planned fiscal consolidation at the start of 2010, the larger the actual decline in real GDP relative to what the IMF thought it would be.

Millions of workers have lost their jobs as a consequence of these forecasting errors.

The IMF forecasts are always systematically wrong because they use flawed macroeconomic approaches, which allow ideology to triumph over understanding.

But while we are on forecasting errors, lets go to Cyprus for a moment.

There was an interesting article in the Cyprus Mail (April 15, 2013) – Our view: Exiting the euro is a debate we must have.

The austerity troglodytes have been successful in convincing people, particularly the Cypriots, that there is no other solution to the banking problem than the measures imposed upon the nation by the Troika.

Some of us clearly think differently.

It emerged last week that the revised forecasts for the contraction in real GDP (as of April 2013) are nearly 2.5 times higher than the EC had projected in February 2013.

On February 22, 2013 (yes, just two months ago), the European Commission released their updated – Winter Forecast 2013 – under the title “Winter forecast 2013 – The EU economy: gradually overcoming headwinds”

So these were the most updated thoughts on how things would turn out.

The specific country forecast and analysis for – Cyprus – predicted that real GDP growth would be -3.5 per cent in 2013 and -1.3 per cent in 2014. This is a total shrinkage in the Cypriot economy of 4.8 per cent.

On April 9, 2013, the EC produced a report – Assessment of the public debt sustainability of Cyprus. I was sent a provisional draft of the Report – unofficially, of-course. It was not published publicly by the EC.

The Macroeconomic projections (in Table 1) show that the Troika were forecasting a fall of -8.7 per cent in real GDP in 2013 and -3.9 per cent in 2014 a total decline in the size of the economy by 12.6 per cent over the two years.

The internal Troika briefing is an extraordinarily cold-blooded document outlining the assassination of a nation.

We read about an “ambitious but achievable fiscal adjustment path … Is essential to contribute to the sustainability of Cyprus’ public debt”.

The aim is to achieve a 3% of GDP primary surplus by 2017, a fiscal shift of around four percentage points of GDP between 2013 and 2016.

The document admits that the consolidation targets will be challenged by the economic conditions they create.

For example, Paragraph 17 says:

The fiscal consolidation implies that the improvement in the primary balance over 2013-14 will contribute to reducing the debt ratio substantially within the programme period, in spite of the rather strong debt-increasing effects from interest expenditure and the projected recession.

The Troika demand that the budget be presented to the “before submission to the House of Representatives”. No democracy here!

What happens if the automatic stabilisers accompanying the recession increase the debt ratio?

That’s easy. The Troika has the answer (Paragraph 18):

In the event of underperformance of revenues or higher social spending needs, the Cypriot government has committed to stand ready to take additional measures to preserve the programme objectives, including by reducing discretionary spending, taking into account adverse macroeconomic effects.

At that point, you realise that we are dealing with sociopaths. They are morons, but worse, they actually seem to enjoy their jobs.

In terms of the “bail-in” package, the revised growth forecasts mean that the amount of Euros Cyprus will need to salvage its banks and are 23 billion euros rather than the original estimate of 17 billion euros.

The Troika will continue to provide 10 billion euros ( European Stability Mechanism (ESM) €9 billion and IMF €1 billion) under the agreement. Cyprus now has to come up with an addition 6 billion on the 7 billion it originally agreed to.

The Cypriot government as a lackey of the Troika will abandon public purpose by:

1. Stealing depositors money in their banking system.

2. Increasing taxes at a time that the economy is collapsing.

3. Privatisation of state-owned (that is, people-owned) assets.

4. Sale of Gold reserves (at a time that the price is plummeting – Austrian schoolers go suck it).

5. Allowing private (productive) investment to collapse by a staggering 41.5 per cent (estimated) over 2013-2014

6. Requiring a fall in domestic demand of 19.8 per cent over 2013-14.

Interestingly, but not surprisingly, in the 8-page document, there is only ONE mention of unemployment – we read that under macroeconomic developments that “unemployment rose” (page 3).

At least the EC Winter Forecast 2013 thinks the unemployment rate will rise from 12.1 per cent in 2012 to 13.7 per cent in 2013 and 14.2 per cent in 2014. Remember it was 5.5 per cent in 2009.

They will be wrong though. When they started bullying Greece into austerity the unemployment rate there was 7.7 per cent (2008).

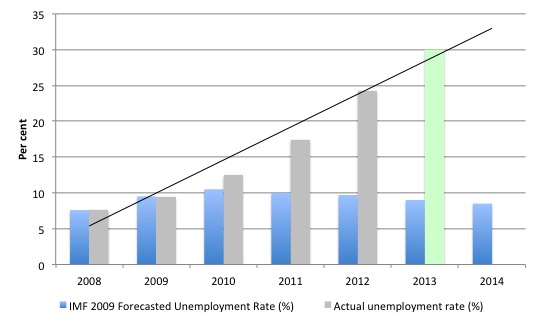

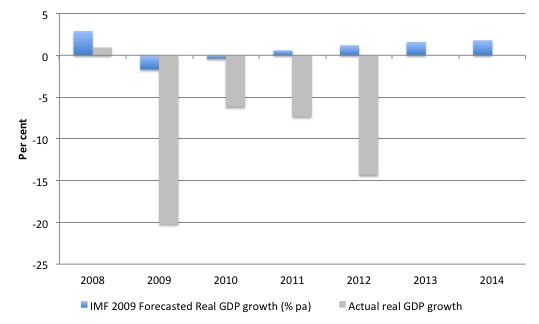

In August 2009, the IMF issued its updated – Country Report – for Greece with their latest forecasts out to 2014. They claimed the unemployment rate would peak at around 10.5 per cent in 2010 and then drop away. They also claimed that real GDP growth would be positive in 2011 and become stronger from then.

The following graphs (constructed from those forecasts and the actual outcomes) should illustrate how poorly the IMF has performed on this front. The Greek unemployment recently was published at 27.20 percent in January 2013 up from 25.7 in December 2012 with no ceiling in sight. By now the IMF claimed it would be 9 per cent.

The light-green bar in the unemployment graph is my estimate of where we will be at year’s end. It is conservative. The IMF have been grossly mistaken because they do not understand how the economic system operates.

They deploy deeply flawed macroeconomic models and impose socio-pathic and ideological assumptions, which will always generate these gross errors.

This graph is for the real GDP forecasts.

The same goes for Cyprus. The unemployment rate is already at 14.7 per cent (February 2013) and is rising fast. It will chase the Greek experience over the course of 2013 and be closer to 20 per cent by the end of the year if not 25 per cent.

When the EU economic affairs commissioner Olli Rehn was asked about the major errors in forecasts for Cyprus he had this to say (Source):

I don’t deny that there is uncertainty about the precise figure whether it will 10 percent, 12.5 percent or 15 percent,

As if we are playing for pennies!

A lost two decades in a year. At least it took a decade for Japan to lose only one decade and then the losses were nothing like this at all.

What does it mean?

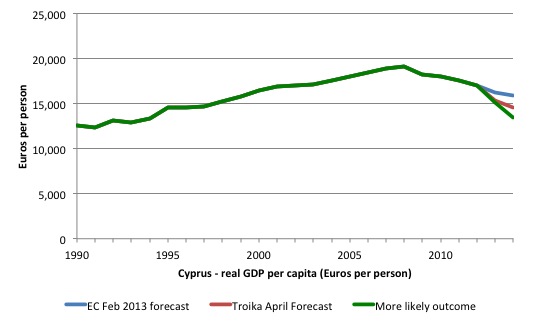

The following graph, which shows real GDP per capita, based on three different growth assumptions. The blue line is based upon the February 2013 EC winter forecasts. The red line is based upon the April 2013 Troika estimates. The green line is the more probable outcome (and in my view is conservative).

I used the data from the latest – IMF WEO April 2013 database.

Population growth has been running at an average annual rate of 1.8 per cent, although in 2012 it slowed to just 1.2 per cent as the implications of the crisis started to become obvious.

I have assumed that the population growth rate will slow further to 1 per cent per annum over the next two years. I have also assumed that real GDP will contract by 9 per cent per annum over the next two years.

As you can see, the euro experience has done nothing for Cyprus in terms of improving real living standards (on average). If the current green scenario is realised then real living standards in Cyprus will be back to their 1991 levels.

In addition, the Troika will have demolished most of the productive capacity of the economy and decades of immiserisation await.

The Cyprus Mail article notes that the economy is “in free-fall and has yet to hit the bottom”. The reality is that the bottom just got deeper as a result of the bail-in and will not be seen for some years.

I agree with their assessment that:

Friday’s announcement that the “Eurogroup is confident that determined action in line with the reform measures spelled out in the MoU will allow the Cypriot economy to return to a sustainable path based on sound public finances, balanced growth and financial stability,” could at best be described as wishful thinking and, at worst, a joke.

I also agree that the “chances of macroeconomic targets being met are almost non-existent”.

They then conjecture:

Perhaps the economy’s interests would be better served if Cyprus exited the eurozone, defaulted on its debts and re-adopted the Cyprus pound. The government has taken a dogmatic stand against such a move, citing all the obvious negative effects, but the option needs to be explored and studied in-depth by experts. The government should either hire a top consultancy firm or put together a team of economists, market analysts, technocrats, etc to carry out studies of the short- and medium-term effects of leaving the euro.

My research centre will do the job for cheap! But based on my analysis to date, there is no way that staying in the Eurozone will end up being better than leaving it now. There are huge costs either way, but the costs incurred by the exit will be borne within a growth environment. Under current forecasts, there will be no sustainable growth for years. Just look at Greece across the water!

Which brings me to the austerity cultists biggest authorities – Rogoff and Reinhart – and their paper – Growth in a Time of Debt – which is without doubt one of the most cited academic papers in modern times.

On their WWW site, Rogoff and Reinhart have been very keen to point out how many journalists, media programs etc have been citing their work – Growth in a Time of Debt homePage.

While one can understand the self-promotion by Rogoff and Reinhart, it seems that none of these media outlets or journalists did much checking.

A paper came out this week (April 15, 2013) – Does High Public Debt Consistently Stifle Economic Growth? A Critique of Reinhart and Rogoff – from the Political Economy Research Institute (at University of Massachusetts) – written by Thomas Herndon, Michael Ash and Robert Pollin.

It is a devastating critique of Rogoff and Reinhart because it exposes major errors in their basic handling of the data. I will come back to that.

In this blog from last week (April 10, 2013) – It’s simple math – I considered the Rogoff and Reinhart paper in question. I noted that Rogoff and Reinhart’s paper – Growth in a Time of Debt – talks extensively about “debt intolerance limits” arising from “sharply rising interest rates” – and then “painful fiscal adjustments” and “outright default”.

I also pointed out that they seem fit to engage in correlation analysis but leave the causality issue hanging. All the financial journalists and politicians – right up to the top – have not told the world that R&R were providing correlations. They treated the results as if they were causal – from public debt ratios to growth.

Up until now, their work has also been widely discredited by other economists for conveniently manipulating the way they conducted the analysis to suit their conclusions, for picking “the 90% figure almost arbitrarily” and most of all, in the context of my previous comments, for not admitting that “it’s much more likely that causality runs in the other direction” (quote from paper).

The causality issue is crucial because it is more likely that countries with rising public debt to GDP ratios are those which are facing recession. The denominator (GDP) falls while the numerator (outstanding debt) rises, given the cyclical response of the budget balance (independent of any discretionary fiscal stimulus that such a nation might enjoy).

Madam Reinhart responded to a Washington Post article (April 8, 2013) – Why do people hate deficits? – which had criticised their work, saying that:

We’re quite aware that you have causality going in both directions …

But not aware enough to qualify their analysis in the paper? There were no standard causality tests presented.

In this 2010 blog – Watch out for spam! – I also noted that in other related work, R&R are content to conflate nations that operate within totally different monetary systems (gold standards, convertible non-convertible, fixed and flexible exchange rates, foreign currency and domestic currency debt etc).

They seem oblivious to the fact that there can never be a solvency issue on domestic debt issued by a fiat-currency issuing government irrespective of whether the debt is held by foreigners or domestic investors.

R&R pull out examples of sovereign defaults way back in history without any recognition that what happens in a modern monetary system with flexible exchange rates is not commensurate to previous monetary arrangements (gold standards, fixed exchange rates etc). For example, Argentina in 2001 is also not a good example because they surrendered their currency sovereignty courtesy of the US exchange rate peg (currency board).

Their 2010 American Economic Review paper, which is now the subject of renewed scandal, also fell into the error of conflating monetary systems. I concluded last week that the fact that such a tawdry bit of work gets published in this journal tells me that the AER has no status in the context of “knowledge dissemination”. It is just another medium via which the ideological message of a degenerative paradigm (in the Lakatosian sense) uses to maintain its hegemony.

The same point was made in an excellent analysis from my friends – Randy Wray and Yeva Nersisyan – http://www.levyinstitute.org/pubs/wp_603.pdf.

But all those criticisms aside, some of which might be contestable (such as the way averaging was done), things have deteriorated very badly overnight for Rogoff and Reinhart.

As is now widely-known, the PERI paper is devastating for the credibility of Rogoff and Reinhart – it shreds it!

I should note that when the paper came out in 2010, I immediately tried to replicate the results and failed. I wrote to Carmen Reinhart because I had met her a few years earlier at a function in the US. I requested the data. It appears I was in a queue of researchers asking for the data. I received no reply.

As a long-standing researcher you learn that if an author will not send you their data then something is wrong. Perhaps they were too busy. Perhaps they didn’t want anyone getting their exact dataset because they knew what might be found.

Whatever! But the upshot was that I couldn’t be sure that something was empirically at fault because there are several data sets that one could reasonably assemble in the context of their enquiry which would generate slightly different and perhaps even substantially different results. It wasn’t clear to me how they generated their results despite attempts to reverse engineer them. But without having the exact dataset it becomes meagre surmise and legal considerations then prevent one from shouting fraud!

It does bring into the frame the long-standing debate about the policies of academic journals.

In some academic disciplines, it is a requirement that data sets be provided to the journal editors and be made publicly available as a condition of publication.

This clears up any issues of replicability. It is also useful because simple mistakes are sometimes made by researchers, no matter how experienced they might be.

As an academic referee for many journals I have often asked the editors to provide the supporting data sets for articles I’ve been asked to review so that I can be sure of the results in advance.

The problem is, that in most cases, economics journals do not have any such requirements. Some do, but most do not.

A long time ago there was an article entitled “Let’s Take the Con out of Econometrics” by equally by Edward Leamer (1983 American Economic Review). Sadly, the American Economic Review has not taken his advice.

However, the Rogoff and Reinhart work is not even an econometric study. It was much more basic than that – some simple spreadsheet formulas.

While it seems many researchers were unable to get their exact data, one lucky team of researchers (at PERI) it seems, did succeed and were thus in a position to replicate the results of Rogoff and Reinhart.

Now we know, courtesy of the PERI paper, that the results they generated from their spreadsheet were not legitimately derived from the data they used.

The PERI authors initially failed to replicate the results. Upon further investigation they discovered the reason for being unable to replicate the results lay in “mistakes” made by the original authors.

The PERI work is summarised in this article – Researchers Finally Replicated Reinhart-Rogoff, and There Are Serious Problems.

Was it a simple spreadsheet coding error? Or was it a case of academic fraud? We will never be in a position to distinguish between incompetence or fraud. At the very least it is very sloppy work.

Randy Wray has provided a recent critique (April 17, 2013) – No, Rogoff and Reinhart, This Time is Different! Sloppy research and no understanding of sovereign currency.

So I won’t write much more.

But I will emphasise this. Apart from all the other issues that the PERI authors take issue with Rogoff and Reinhart (which I largely agree with), the substantive point, which ties in with the IMF multiplier errors, is that the policy advice forthcoming from the Rogoff and Reinhart work is exactly the opposite to the policy advice that would have been implied if they had used the data appropriately.

The PERI authors found that nations who have public debt to GDP ratios that cross the 90 per cent threshold experienced average real GDP growth of 2.2 per cent rather than -0.1 per cent as was published by Rogoff and Reinhart in their original paper.

That is the same quality of error as the IMF using multipliers below one when in fact, they are somewhere between 1.5 and 1.75.

In the IMF case, fiscal austerity would have been growth conducive using their flawed multiplier estimates where is, in fact, as they were forced to admit, fiscal austerity destroyed growth. It also means that fiscal expansion would increase growth by 1.7 dollars per 1 dollar spent (or thereabouts). In other words, fiscal expansion is required to address the malaise not austerity.

In Rogoff and Reinhart’s case, those who believed their results, would conclude that if a nation could reduce their public debt ratio below the 90 per cent threshold through fiscal austerity, then they would stimulate growth and avoid the real GDP contraction that Rogoff and Reinhart claimed would accompany any lingering above the 90 per cent threshold.

This type of conclusion has been fundamental in driving austerity policies throughout the advanced world and has been the cause of millions of workers losing their jobs.

In their reply today (April 16, 2013) – Reinhart-Rogoff Response to Critique – Madame Reinhart seems oblivious to this fact. Arrogant to the core.

First, is interesting that they do not acknowledge their empirical errors. I find that level of arrogance uncompelling.

Second, they claim that the PERI authors “also find lower growth when debt is over 90%”. And so they do.

But, notwithstanding the causality and other conceptual issues noted above, there is a world of difference between an economy that slows from 3.1 per cent to 2.4 per cent when their public debt ratio rises from 89 per cent to 90 per cent, and an economy that goes from 2.8 per cent per annum real GDP growth to a -0.1 per cent negative position when they cross the same threshold.

A policy maker would hardly support a fiscal strategy that would devastate their economy for years and drive unemployment rates up towards an over 30 per cent, just because their growth rate might fall from 3.1 per cent to 2.4 per cent. It would make no sense at all.

Rogoff and Reinhart know damn well that they left the indelible impression on policy makers that such a strategy would, in fact, increase growth and avoid an overall contraction.

Conclusion

The PERI work is devastating for the mainstream fiscal austerity putsch. The cultists have been relying not only on the flawed macroeconomic theories of the mainstream but also, as we now know, on shoddy empirical research. Whether that research is the product of incompetence or deliberate academic fraud is one issue that should be explored.

But independent of the answer to that question, it destroys the credibility of those who raise the work as an authority for their destructive policy positions.

Congratulations to the PERI team!

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

These guys are not interested in the labour thingie.

In their eyes it can always be bypassed and or replaced.

Only capital (see oil based capital) is important to them.

They are running a global plantation , its a matter of transferring capital to the most efficient fields even if you have to run down the plantation owners house (Europe).

The German car market is now down and out with the rest of us (except the UK of course)

http://www.acea.be/images/uploads/files/20130417_PRPC-FINAL-1303.pdf

Of the large car markets in March its the worst hit at -17.1 % and -12.9 % January to March.

Already thats a decline of 100,000 vehicles from the same period last year.

Also of the medium to small markets the former strongmen of the North in Finland & Holland seem to be the worst hit.

March reg

Finland : – 58.6 %

Holland : – 31.4%

The sacrifice of Cyprus is not enough to bail these little monsters out with Cypriot car reg down – 58.9% in March with just 405 cars…………

More cars were sold in Iceland…

Thanks for the link to the R&R analysis paper by Herndon and co-authors. It includes the R replication code which is very useful.

Replicability should be the standard for publishing of quantitative economic research but it rarely is. Not so long ago I had a go at extending a historic dataset provided by two authors of a widely quoted economic paper and it became apparent that for several countries the data was incorrect (for a country the key variable studied had a difference equivalent to 100% of GDP which could not be justified by a definitional difference between the historic and the current data). Let’s say that the ensuing interaction with one of the authors was less than satisfactory. At least let’s give some kudos to R&R for supplying the data.

Javier

One thing puzzles me: why does Cyprus still have any gold left to sell?

Great post Bill! Enjoyed. Will distribute.

Rogoff and Reinhart next gig at the The Mirage Resort and Casino in Las Vegas?

A great feeling to see their inadequate and fail-worthy paper slammed.

Their defence:

http://images.politico.com/global/2013/04/17/reinhart_rogoff_response_to_herndon_ash_and_pollen_april_17.html

There is a logical problem with replicability in this field. Let me contrast for this purpose economics with ecology. Ecological studies can be divided into roughly two types, experimental and field studies. With experimental studies in most disciplines, with the exception of advanced physics which I will come to later, it is clear what must be done in order to replicate the study. Experimental ecological studies generally satisfy these requirements.

But with field studies, it is not always so clear. Say you are studying a particular insect with respect to a set of attributes in a particular environment. To replicate this study, you need to find another environment that is as similar to the original environment as possible and at the same time of year with the temperature being similar, &c. You can use the same environment the following year for replicability purposes, but this has its own down sides. Strictly speaking, you will not be able to truly replicate the original study, but you may be able to get as close as the theories that are being tested need you to be. And that is what counts.

In experimental physics, you will not generally find true replications. This is because they don’t usually need them. What is sometimes referred to as a replication is actually an attempt to improve on the original experiment, usually in terms of some measure of precision.

What you have in both empirical ecological and physical studies are samples of the relevant populations with all the statistical analytical implications that that brings with it. In economics, however, you are not always presented with data samples. Sometimes you are presented with what I shall refer to as the entire data universe. For instance, say you want to know what banks have in reserve. Instead of a sample of banks qua their reserves, you may be presented with the reserves (many of which may be estimates) of every single bank. This is not a sample but the entire population of bank reserves. This procedure precludes certain standard statistical techniques being used. But as is usually the case in economics, since no statistics are employed, this difference generally makes no difference.

As for the critique of the Reinhart and Rogoff study, I think what we have here is not a true replication, but a reanalysis of more or less the same data. A reanalysis would be undertaken if you thought that either the data were poor or badly organized or that there was an error made in the original analysis. A replication, as opposed to a reanalysis, would involve gathering “new” data of the same kind and subjecting this “new” data to the same or an improved version of the original analysis.

It could be argued, and has been by some, that replications are impossible in disciplines like economics as too many factors change from one temporal interval to another, thereby making it impossible to replicate the same or similar conditions. But since replications (and reanalyses) are tests of relevant theories, if the theories in question are any good, they should be able to “tell” the researcher whether such a replication is possible or fruitful or not. On the other hand, there should exist, in principle, no theoretical obstacles to a reanalysis of the original data set. All such tests take place within a given theoretical context, including those where the theories under test are virtually completely contradictory. This latter circumstance renders the test environment more difficult to specify but not thereby impossible.

With respect to the presentation of data, whether of the entire population or of a sample thereof, it used to be relatively common practice, for instance in the thirties, to include with the data an error estimate, often plus of minus some percentage. This no longer seems to be the case. Statistics has moved on from that period, but confidence intervals or their equivalent were common then and are now. Yet they do not seem to find their way into a good number of economic analyses, whether presented in tabular or in graphical form.

If you are to take these guys at face value (which I don’t as no one could be that stupid)

They may (?) have a lack of understanding for real physical systems , concentrating on debt dynamics which are not real – they are a human construct used in this case to extract a rent.

But to pay these guys a rent we must destroy the physical world…….which is very real for all of us.

Look what happened to Grau de Roi in 2011 when the train from Nimes was subsidized (at 1 euro a ticket) ……. ok there was a huge amount of friction between local shopkeepers and some street urchins …….also perhaps young people having a good time at the beech in a now old society was a bit of a shock to some I imagine.

But things seem to have settled down since then.

http://www.youtube.com/watch?v=iTvVLhT0bDQ

Now RFF are desperately trying to relay this old but now very busy branch line before the summer season !!

We have NODAL CRITICALITY in the towns along this route.

Rebuilding sections of the line today because of the demand signal.(with the French complaining.)

http://www.youtube.com/watch?v=khg6CCPFOZo

http://www.rff.fr/IMG/pdf/Communique_de_presse_Nimes_-_Le_Grau_du_Roi_FA-3.pdf

I nearly fell out of my chair when I heard Richard Gibbs of Macquarie Group on ‘The Business’ asserted that the IMF ‘wanted to maintain the imperative for structural reform (within the Eurozone) but it acknowledges the risk of reform fatigue. It also acknowledges the risk of things still running off the rails because politicians are at this point in time, excessively involved in th economic reform process’. Presumably meaning any democratically elected government that might object to imposed austerity, debt-burdens, public sector job cuts, wage reductions and privatisations.

Unbelievable.

The report also mentioned that only Japan shows signs of recovery without asking why.

Other isolated rural towns with stations almost ready for closure getting in on the act.

http://www.youtube.com/watch?v=6mYker5uxS8

Ok Ok ok – you may say France is just spending the surplus capital flight from now destroyed Greece , Spain & Italy but the capital needed for these projects is tiny when compared to their bigger projects.

It requires mainly labour inputs.

However they need to spend capital on relaying the rails which are probably 50 ~ years old but not much in the great scheme of things.

http://languedoc-roussillon.france3.fr/2013/04/11/manifestation-d-usagers-pour-la-renovation-de-la-ligne-ter-carcassonne-quillan-233075.html

Why did economists not see that this was a huge stock and flow crisis back in 2007 ?

I don’t believe these people could be that stupid – its simply impossible.

They simply destroyed real physical and human capital to retain claims on now totally destroyed economies.

Pointless in the long run unless you like to see human destruction.

open access, open data, open science

at least the Excel error could have been avoided, if the data would be shared

Open Access to Data: An Ideal Professed but Not Practised

Out of the sample, 435 researchers (89.14%) neither have a data&code section nor indicate whether and where their data is available. We find that 8.81% of researchers share some of their data whereas only 2.05% fully share.

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2224146

@ supermundane

I have never thought that consistency was the IMF’s forte. Perhaps we should go even further and contend that coherence isn’t within the IMF’s intellectual mind set either.

Dear Bill,

you say: “… the Troika were forecasting a fall of -8.7 per cent in real GDP in 2013 and -3.9 per cent in 2014 a total decline in the size of the economy by 12.6 per cent over the two years.”

At the risk of appearing pedantic: If GDP decreases by 8.7 per cent in 2013 and then – from the new basis – by 3.9 per cent in 2014, it should decrease by 12.26 per cent altogether and not by 12.6 per cent. You can’t simply add the numbers for negative growth!

Best wishes, Mellie

“Interestingly, but not surprisingly, in the 8-page document, there is only ONE mention of unemployment – we read that under macroeconomic developments that “unemployment rose” (page 3).”

Could this be because maybe the fate of the workers is not really a concern. But what are liberals expecting to happen with the unemployed?

It is an easy to arrive at answer. The troika will be happy for the unemployed of every European country to simply up sticks and rove around searching for jobs filling gaps as and when needed.

But wont this wreak havoc in those societies. Well yes but do they care?

What will happen when those countries start recovering and demand for labour starts to recover. Will those Cypriots, for example, get their jobs back, get an opportunity to live in their own country again? Well no they wont.

When Cyprus and Greece need extra labour non-europeans will be brought in. The troika wont complain because it doesnt look at things like that and the left cant complain because it will argue that those people are as Cypriots as everyone else in Cyprus.

That in a nutshell is why there is no need to worry about unemployment.

Consistency, honesty and the admission that routinely get it wrong are most certainly not the IMF’s forte. I should clarify that this Richard Gibbs isn’t from the IMF but from Macquarie Group, which is an Australian-based global investment banking and financial services group, He was commenting on the challenges that the IMF faced in Europe in implementing its ‘reforms’. The following was a quote:

The IMF “…wants to maintain the imperative for structural reform (within the Eurozone) but it acknowledges the risk of reform fatigue. It also acknowledges the risk of things still running off the rails because politicians are at this point in time, excessively involved in the economic reform process…”

I was astounded to hear such a frank dismissal of popular representation. These democratically elected governments get in the way of the IMF’s reform process, is what Mr Gibb was saying. He clearly finds the quaint notion that governments ought to be remotely accountable to those they purport to represent problematic. The will of the populous inconveniently gets in the way of economists and bankers running the joint.

Historically, the IMF was never designed to follow the will of any democratic government other than that of the US and its policy makers. That is how it was designed by Harry Dexter White. Which of course wasn’t what Keynes wanted. He wanted to support British imperial ambitions, which were even at the time waning. However, in support of such ambitions, he did create a pair of truly international organizations. While I can not be absolutely certain, I feel that White would consider the actions of the current and recent actions of the IMF as disgraceful if only because such actions have not been in the true interests of the US as he would have understood them.

Addendum:

“current and recent actions” should read “current and recent directors”.

With respect to the dismissal of popular representation, I was neither surprised nor shocked because this has become common currency in the discourse of the social groups in the banking and large corporations. I am with you in finding it completely reprehensible. But unless a few of them go to jail, and soon, this will not change.

Dear Mellie Skorna (at 2013/04/18 at 2:58)

You are absolutely right on the compounding issue. Pedantic is good. I was just running out of time when I was writing the blog up.

You will be reassured though to hear that in the graph I produced on Per Capita Income – both the population estimates for 2013 and 2014 and the real GDP growth estimates for the three different scenarios for 2013 and 2014 are compounded correctly.

Thanks.

best wishes

bill

@Bill

Legitmate question, has there ever been an occasion where a sovereignty is in a ‘foreign debt crisis’, chooses to default on that debt, and then there is an overall negative outcome?

It seems to me that when default occurs, the economy in question gets temporarily isolated via sanctions etc but overall comes out better than it was before.

Which stems the question, why would a nation seriously consider an absurd IMF imposed austerity regime when it can just ignore them completely?

So, the emperor of austerity has no clothes… but then we all knew that. Nice to have it verified though.

Unfortunately, the effect of any later retractions or mea culpas are always relatively muted in comparison with the noise made by the initial lie.

R&R’s job (as establishment courtesans) has been done.

A lack of understanding on display here again (but really can he be that stupid)

He wants bank lending to increase again but seems a bit perplexed these days.

http://blogs.ft.com/gavyndavies/2013/04/17/how-can-the-ecb-fight-fragmentation-of-the-eurozone/

Obviously people need debt free state money in their hands

Not credit.

But I guess fiscal money is better then wasteful bank lending.

Had a look at the Reinhart and Rogoff paper, Even without spreadsheet errors its weak, They stress emerging nations have a bigger problem because their debt is more likely to be denominated in a foreign currency but completely fail to see any difference between the currency situation of Eurozone & countries who issue their own currency. They divide countries as advanced & emerging rather than by monetary system. They actually note with pride that they chucked data from vastly different monetary arrangements in together – you can put chalk & cheese together & get averaged data on the combination but it won’t tell you much about chalk or cheese. They discuss the significant effect of private sector deleveraging on growth but then effectively ignore it. The real killer though is they fail to consider the possibility that growth is affected by countries with high public sector debt levels adopting similar policies rather than the debt itself.

You might find this encouraging/amusing, Dean Baker:

http://finance.yahoo.com/blogs/the-exchange/did-spreadsheet-error-cost-job-193028078.html

I’m inclined to give the IMF much more of a pass on this stuff than Reinhart and Rogoff.

For a start, there was nothing wrong with the empiric study the IMF used for multipliers – it was the failure to acknowledge that it covered a period when much of the world was suffering a depression that was the problem (so the thing that creates small multipliers in small open economies where their trading partners are doing fine – the trade balance – no longer applied). In other words, it was the study’s application rather than the study itself that was the problem. The second thing is that the IMF didn’t just rest on its empiric laurels – they fessed up as soon as it was clear they were wrong. “When the facts change I change my mind, sir – what do you do?” – Keynes

None of which applies to Reinhart and Rogoff. Their study itself, not just its interpretation, was ALWAYS utter crap and clearly only survived peer review because it was not a blind review. Their selectivity in the data to the point of frank dishonesty, their wilful hiding of their data and models when people questioned it, their aggressive and vigorous promotion of the political meaning of their “conclusive” study, and their current outright equivocation when they were found out are all truly shameful, and should see them drummed out of the profession. The Excel error, sloppy as it was, is the absolute least of it.

The IMF made a technical mistake. R&R made an ETHICAL mistake.

@ derrida derider

Agree. ‘Fessing up right way to an interpretive error is forgivable. R & R “sins” went far beyond that and they need to be held accountable by the profession and the media as well. Otherwise, the conclusion will be that economic orthodoxy and the media are complicit in the crime of deception that has resulted huge economic losses that cannot be recaptured and a mountain of social devastation and human misery. At the very least they need to be shamed publicly and kept away from policy influence forever.