It's Wednesday and I discuss a number of topics today. First, the 'million simulations' that…

Lower deficits now, undermine our grandchildren’s future

It been quite a few weeks for the prophets of doom. R&R revealed they can’t handle a simple spreadsheet competently, and then try to claim a positive number is really a negative number. And who said they said there was a threshold of debt anyway? They now deny there is a threshold. History tells us this is a new denial. Then their Harvard colleague, the so-called historian throws himself off a cliff – again – with his remarks about JMK. Again? Joe Weisenthal has – Ferguson’s Horrible Track Record on display. He reports that Ferguson has “self-immolated a number of times trying to fight an ant-Keynesian battle”. What is it about Harvard? Has there been an internal inquiry set up to consider whether R&R committed academic fraud or were just incompetent? Why do they still continue to employ Ferguson after his homophobic remarks? It is not as if he displays any acumen when it comes to economic commentary. How much does he receive in appearance fees for telling all and sundry what is not going to happen, even though he says it will? I guess as an historian, Ferguson might know one thing. Fools have a habit of reappearing and repeating the nonsense that prior fools claimed was the truth.

The following graphic is purportedly the interchange Ferguson had with one Paul McCulley in Q&A on May 3, 2013 (Source)

Nice guy all round.

But irrespective of his florid remarks (and quite apart from whether the above “transcript” is verbatim or interpretive), Ferguson is plain wrong when it comes to intergenerational transfers.

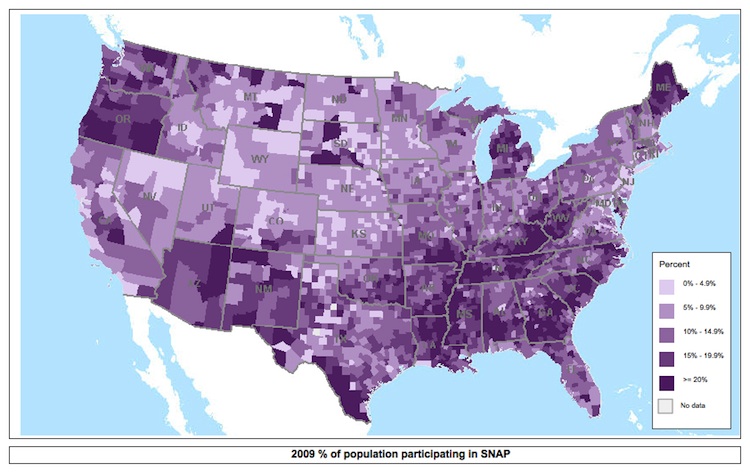

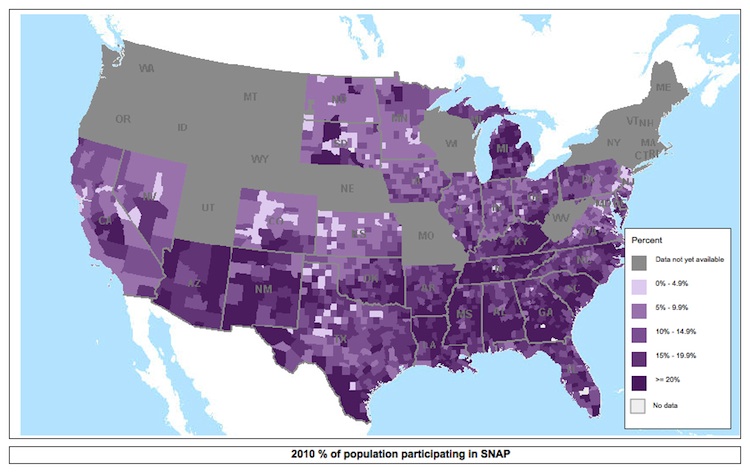

Here are three maps produced from the excellent time series data archive – US Supplemental Nutrition Assistance Program (SNAP) Data System – provided by the US Department of Agriculture.

The first shows the proportion of SNAP recipients as at 2000, while the second shows the proportion at 2009, and the next one, with some incomplete information for the NW states of the US is for 2010. More recent data will further magnify the trend without doubt.

The – SNAP – is also known as the food stamp program and it is:

… the Nation’s largest domestic food and nutrition assistance program for low-income Americans.

It provides financial aid to Americans for food purchases and it funded by the federal government.

I won’t go into the debates about its microeconomic and social impact because it is out of my research scope. But the macroeconomic impacts are fairly clear and widely agreed except for the Ferguson-types who deny everything that is factual when it comes to fiscal multipliers and such.

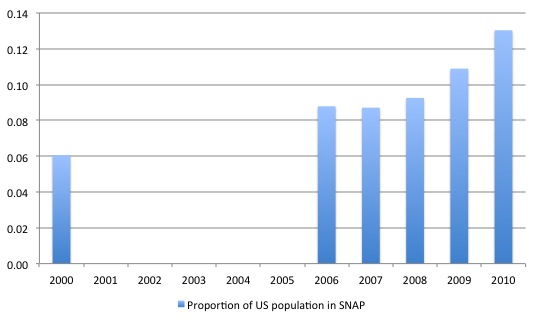

In 2000, the proportion of people in the US receiving food stamps was 6.1 per cent. By 2010, that proportion had more than doubled to 13.0 per cent. The following graph tells the story.

The conservatives have been trying to claim that the rise in food stamp outlays and recipients provides evidence that the stimulus failed.

Then there are those who claim that the SNAP shows that fiscal stimulus is ineffective because according to this “RESEARCH” by the US Republican Party (Source) the:

The Number Of Households On Food Stamps Have Hit Record Levels And The Economy Still Remains Weak

So therefore saying that food stamps puts people to work is a “glaring omission” and thus a lie.

Hmm, this was in relation to the US Secretary of Agriculture telling an MSNBC program that (Source):

Well, obviously, it’s putting people to work …. But I should point out that when you talk about the snap program or the food stamp program, you have to recognize that it’s also an economic stimulus. Every dollar of snap benefits generates $1.84 in the economy in terms of economic activity. If people are able to buy a little more in the grocery store, then someone has to stock it, shelve it, process it, package it, ship it.All of those are jobs. It’s the most direct stimulus you can get in the economy during these tough times.

An assessment that was supported by evidence from Moody’s chief economist Mark Zandi (July 24, 2008) to the – US House Committee on Small Business. He estimated that the:

A $1 increase in food stamp payments boosts GDP by $1.73. People who receive these benefits are very hard-pressed and will spend any financial aid they receive within a few weeks.

That is, an expenditure multiplier of 1.73.

The US Congressional Budget Office provided a useful discussion (April 2012) of the – SNAP.

CBO say that:

The Supplemental Nutrition Assistance Program (SNAP, formerly known as Food Stamps) provides benefits to low-income households to help them purchase food. The program is an “automatic stabilizer,” meaning that its number of beneficiaries and amount of spending increase automatically during tough economic times … … NAP benefits represent a significant supplement to income for many households.

In response to those who claimed the stimulus package motivated the rise in food stamp recipients, the CBO concluded:

The increase in the number of people eligible for and receiving benefits between 2007 and 2011 has been driven primarily by the weak economy. That increase was responsible for about 65 percent of the growth in spending on benefits between 2007 and 2011. About 20 percent of the growth in spending can be attributed to temporarily higher benefit amounts enacted in the American Recovery and Reinvestment Act of 2009 (ARRA). The remainder stemmed from other factors, such as higher food prices and lower income among beneficiaries, both of which boost benefits.

They also provided this graph (which I reproduce immediately above) and added this commentary:

Between 1990 and 2011, the number of SNAP participants increased during periods of relatively high unemployment … Even as the unemployment rate began to decline from its 1992, 2003, and 2010 peaks, decreases in participation typically lagged improvement in the economy by several years … Between 2007 and 2011, the number of people receiving SNAP benefits and federal spending on the program increased significantly … The primary reason for the increase in the number of participants was the deep recession from December 2007 to June 2009 and the subsequent slow recovery

The conservatives fail to understand what an automatic stabiliser actually is and does.

Sure enough, the outlay is associated with an automatic stabilisers on the spending side will rise when economic growth falters. That increase in government spending “stabilisers” aggregate demand, which puts a floor into the decline in overall economic activity.

A fiscal stimulus may well be produced at a time when economic activity is in decline. So it is quite normal to observe outlays associated with the automatic stabiliser rising at the same time as discretionary spending initiatives associated with the stimulus package are rising.

An understanding of these two separate effects will disabuse one from reaching the false conclusion that the stimulus caused the rise in the automatic stabiliser component.

Correlation is not causation!

There was a Financial Times article (May 3, 2013) – A silent, dark underbelly of economic pain is stalking America’s current ‘recovery’ – which considered the food stamps program in a tangential manner.

Gillian Tett reported that the crisis has changed the way people shop.

We read that “since 2007, spending patterns have become extremely volatile. More and more consumers appear to be living hand-to-mouth, buying goods only when their pay cheques, food stamps or benefit money arrive.”

This phenomenon exposes what Gillian Tett considers to be a sharp rise in the “financial fragility of the poorest section of US society …. In recent years, as unemployment remains high in real incomes and household wealth fall”.

All that is clear and reasonable description of what is happening.

The article then surmises that this “trend” (increased food stamps etc leading to volatile spending patterns) reveals “intriguing” information:

… about our attitude towards time. During most of the past century, it has often seemed as if a hallmark of modern “progress” is that our planning horizons, as a society, have expanded. Unlike peasants or herdsmen in the pre-modern age, who lacked the ability to measure the passage of time or calculate future risks with precision, 20th-century man appeared to have so much control over the environment that it was possible – and desirable – to take a long-term view. No longer were people destined to scramble in a reactive manner; they could plan ahead, mastering time …

But, as the past five years have shown us, history does not go in a straight line, or proceed homogeneously. If you were to ask wealthy Americans to visualise the future, they might well describe it as a carefully calibrated road along which they expect to travel. But if you ask poorer Americans, who are scrambling from pay check to pay check, they are more likely to perceive the future as a chaotic series of short-term cycles.

While some of the capacity to suspend immediacy has been provided by technological developments such as refrigeration (we can store food more usefully and retail it in shops such as supermarkets), the significant point that the article is making is linked to the varying risk-management capacities of different income cohorts and how the economic cycle impacts on those capacities.

And this point, also has relevance for our understanding of how the expenditure system operates in relation to multipliers and the impact of income changes on household saving.

A pithy summary statement that captures the difference between those who deny a multiplier process arising from government spending and those who consider government spending to be beneficial in a macroeconomic sense is as follows: spending brings forth in its own savings.

Mainstream economists claim that government spending crowds out private spending by pushing up interest rates. The story goes that governments have to borrow to fund their spending and that that borrowing is drawn from a finite pool of savings at any point in time.

As the pool diminishes, the cost of drawing on those savings rises – that is, the interest rate rises.

As a consequence, components of private spending that are sensitive to interest rate rises fall.

The alternative view, which reflects the way the system actually operates, is that a spending increase stimulates aggregate demand, which in turn, boosts output and incomes. The rising incomes generate higher savings.

Further, the capacity of households and firms to borrow from commercial banks is not constrained by the current reserves held by those banks.

In that sense, government borrowing does not limit the capacity of private sector borrowers to access funds at the current interest rates.

Moreover, the funds that the government borrows came from past government spending anyway.

What this crisis has caused, due to its severity, which previous downturns over the last 30 years have not caused, is the massive loss of wealth at the lower end of the distribution.

This has eliminated the capacity of lower income workers to risk-manage at all.

The work of Ed Wolff shows that in 1976, the top 1 per cent of Americans held 19.9 per cent of total wealth in the US. In 2007, they held 34.6 per cent and by 2010 they held 35.4 per cent. In other words, the top 1 per cent have increased their share of total wealth. In 1983, the bottom 80 per cent had 18.7 per cent of total net worth. By 2010, that share had fallen to 11.1 per cent.

Further, while the Great Recession has wiped out wealth across the board it has impacted mostly on the bottom end.

[References: Wolff, E. N. (2012). The Asset Price Meltdown and the Wealth of the Middle Class. New York: New York University].

But this is not the same problem that our ancestors faced during the hand-to-mouth phase of our development. They were constrained by knowledge, information, technology and all the rest of it.

They had to learn and discover before they harvest better crops store food for longer than a day or so. They had to develop transport and storage systems (chain supply management) etc.

Their constraints were real and required time to overcome.

The analogy with the current period, where the behaviour of the low income workers is once again resembling the hand-to-mouth practices of the food foragers, fails.

Why? Because the only constraint in the current period is a lack of aggregate demand. There are enough refrigerators, tractors, trucks, workers, and all the rest of the necessary equipment and resources available to provide enough goods and services for the population.

While the distribution of wealth and income is highly problematic it is also not the problem.

The problem is that government policy is deliberately constraining the capacity of the economy to utilise its available resources and knowhow to advance well being.

All of this hand-to-mouth behaviour would disappear very quickly if the US government introduced a large stimulus plan which put people back to work.

As history tells us, the food stamp program would shrink dramatically, total savings would rise, and households would be able to, once again, risk-manage their lives over a period that would extend beyond the next food-stamp receipt.

Conclusion

The longer the crisis continues the greater will be the loss of accumulated saving held by the lower income households etc who are being forced to endure long bouts of unemployment.

For those worried about the future and their grandchildren, such as Niall Ferguson, that should be the biggest worry. It puts a greater pressure on government spending in the future because deliberate austerity is undermining the private sector capacity to provide income security into the future.

With private spending lagging at present, higher deficits are required to stimulate saving and wealth creation at the lower end of the distribution. Higher deficits now will lead to a better life for our grandchildren later.

Exactly the opposite to what is believed.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

I’m pretty sure Ferguson was using the phrase “intergenerational transfers” to refer to the old canard that national debt is a “burden” imposed on future generations – not to anything to do with food stamps. Though that’s not 100% clear from the Streettalklive link in Bill’s article.

Ferguson’s obsession with the intergenerational “burden” is clearer in a BBC article (link below). See para starting “The heart of the matter…”

http://www.bbc.co.uk/news/world-18456131

National debt is not, of course, a burden on future generations because that debt is effectively just a debt owed by one lot of people to another. And owners of that debt pass on an ASSET to the next generation, while non owners pass on a LIABILITY. The two cancel out.

The only exception to that is debt owed to foreign entities. If and when those entities sell their debt (and don’t reinvest the proceeds in the debtor country) then the latter country takes a standard of living hit.

But the moral of that is that the only liability that governments should issue is monetary base (not national debt). Both Milton Friedman and Warren Mosler advocated the latter policy.

> Higher deficits now will lead to a better life for our grandchildren later. <

I would like to add a qualifier. Indiscriminate higher spending will lead to higher consumption resulting in accelerating depletion of natural resources. I doubt that will mean our grandchildren will have a better life in the future. As you had already pointed out yourself, they will have lots of money but nothing to buy with. (Deficit) spending should be directed as investment to reduce resource consumption in the future. Only then our grandchildren may have a better life.

Ralph, Ferguson is an economic ignoramus and his comments about Keynes are outrageous for a supposed historian. Apparently, he “forgot” that Lydia had had a miscarriage. And his understanding of Keynes’ relationship to the Bloomsbury group appear to be non-existent, as is his understanding of K’s relationship with Lydia.