The IMF and the World Bank are in Washington this week for their 6 monthly…

Australian inflation outlook – plenty of scope for a needed fiscal boost

The Australian Bureau of Statistics released the Consumer Price Index, Australia data for the June-2013 quarter today. The quarterly inflation rate was 0.4 per cent and this translated into an annual rate of 2.4 per cent, down on 2.5 per cent in the March-quarter 2013. However, if we acknowledge the inflation spike in the September-quarter 2012, and consider the annual trend, the annual inflation rate is more like 1.6 per cent, which puts it well below the lower-bound of the RBA’s inflation targetting range (2 to 3 per cent). The Reserve Bank of Australia’s preferred core inflation measures – the Weighted Median and Trimmed Mean – are now well within the inflation targetting range and are probably trending down. This suggests that the RBA will probably consider the inflation outlook to be benign or “too low” and will instead have to shift their focus to the failing labour market, which in the last month showed signs of considerable deterioration after a flat 18months.The evidence is suggesting that the economy is slowing under the weight of the federal government’s obsessive pursuit of a budget surplus. The benign inflation outlook provides plenty of room for further fiscal stimulus.

The summary results for the June-quarter 2013 are as follows:

- The All Groups CPI rose by 0.4 per cent compared with a rise of 0.4 per cent in the March-quarter 2012.

- The All Groups CPI rose by 2.4 per cent over the 12 months to the June 2013, a fall from the annualised rise of 2.5 per cent over the 12 months to March 2013.

- The All Groups CPI, seasonally adjusted rose by 0.5 per cent in the June-quarter 2013 and by 2.3 per cent for the 12 months to June 2013.

The Fairfax (Melbourne Age) article (July 24, 2013) – SLow inflation keeps door open for rate cut – emphasised the monetary policy implications of the results, as did the The ABC News article July 24, 2013) – Inflation slows to 2.4 per cent in the June quarter.

The Fairfax report said that:

Inflation figures for the second-quarter have remained benign, paving the way for a possible interest rate cut by the Reserve Bank next month.

And there followed a host of quotes from bank economists all singing the same song. “Softer than expected … very benign … inflation is running along the bottom of the RBA’s inflation target band …”

At present, the impact of the declining Australian dollar is yet to manifest in the CPI figures – next quarter we will see the beginning of that impact. But I don’t expect it to be substantial given the weakening real economy and the subdued labour market. Businesses will squeeze margins (in the case of imported goods) to maintain market share in the face of weak aggregate demand.

Further, workers will find it hard pushing higher nominal wage claims to protect real wages, given the rising unemployment and underemployment.

The RBAs inflation target range is defined as 2 to 3 per cent annualised inflation. As I show below the current inflation data is suggesting that inflation is actually below the lower bound of 2 per cent, although all the commentators are focusing on the 2.4 per cent figure and concluding that inflation is in the middle of the RBA range.

Trends in inflation

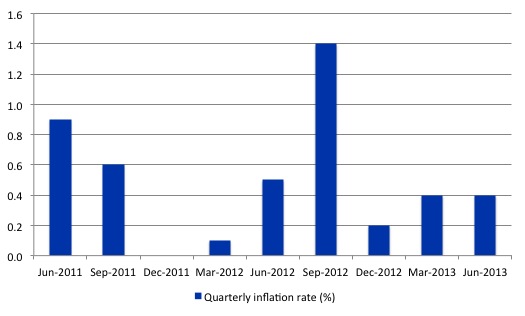

The headline inflation rate increased by 0.4 per cent in the June-quarter 2013 translating into an annualised increase of 2.4 per cent for the year to June 2013 which is down from the March-quarter 2013 result of 2.5 per cent.

What does it mean for monetary policy?

The Consumer Price Index (CPI) is designed to reflect a broad basket of goods and services (the “regimen”) which are representative of the cost of living. You can learn more about the CPI regimen HERE.

The ABS say that:

The CPI is a temporal price index for consumption goods and services acquired by Australian resident households. It is an important economic indicator, providing a general measure of price change … The principal purpose of the Australian CPI is to measure inflation faced by consumers to support macroeconomic policy decision making. This is achieved by providing a measure of household consumer inflation by the acquisitions approach.

There are various ways of assessing the general movement in prices depending on the purpose that the measure is being used for. The document I linked to above details some of the approaches. One of these approaches – the “acquisitions approach” – attempts to measure “household consumer inflation” and defines the basket of goods and services as “consisting of all consumer goods and services actually acquired by households during the base period.” The ABS use “market prices for goods and services” (including taxes etc) and make no imputations for “non-monetary transactions” (such as imputed rents). They also exclude “interest rate payments”.

So is a headline rate of CPI increase of 0.4 per cent for the March-quarter significant? To examine its lasting significance we have to dig deeper and sort out underlying structural inflation pressures and ephemeral price facts.

The RBA’s formal inflation targeting rule aims to keep annual inflation rate (measured by the consumer price index) between 2 and 3 per cent over the medium term. Their so-called “forward-looking” agenda is not clear – what time period etc – so it is difficult to be precise in relating the ABS data to the RBA thinking.

What we do know is that they do not rely on the “headline” inflation rate. Instead, they use two measures of underlying inflation which attempt to net out the most volatile price movements. How much of today’s estimates are driven by volatility?

To understand the difference between the headline rate and other non-volatile measures of inflation, you might like to read the March 2010 RBA Bulletin which contains an interesting article – Measures of Underlying Inflation. That article explains the different inflation measures the RBA considers and the logic behind them.

The concept of underlying inflation is an attempt to separate the trend (“the persistent component of inflation) from the short-term fluctuations in prices. The main source of short-term “noise” comes from “fluctuations in commodity markets and agricultural conditions, policy changes, or seasonal or infrequent price resetting”.

The RBA uses several different measures of underlying inflation which are generally categorised as “exclusion-based measures” and “trimmed-mean measures”.

So, you can exclude “a particular set of volatile items – namely fruit, vegetables and automotive fuel” to get a better picture of the “persistent inflation pressures in the economy”. The main weaknesses with this method is that there can be “large temporary movements in components of the CPI that are not excluded” and volatile components can still be trending up (as in energy prices) or down.

The alternative trimmed-mean measures are popular among central bankers. The authors say:

The trimmed-mean rate of inflation is defined as the average rate of inflation after “trimming” away a certain percentage of the distribution of price changes at both ends of that distribution. These measures are calculated by ordering the seasonally adjusted price changes for all CPI components in any period from lowest to highest, trimming away those that lie at the two outer edges of the distribution of price changes for that period, and then calculating an average inflation rate from the remaining set of price changes.

So you get some measure of central tendency not by exclusion but by giving lower weighting to volatile elements. Two trimmed measures are used by the RBA: (a) “the 15 per cent trimmed mean (which trims away the 15 per cent of items with both the smallest and largest price changes)”; and (b) “the weighted median (which is the price change at the 50th percentile by weight of the distribution of price changes)”.

While the literature suggests that trimmed-mean estimates have “a higher signal-to-noise ratio than the CPI or some exclusion-based measures” they also “can be affected by the presence of expenditure items with very large weights in the CPI basket”.

The authors say that in the RBA’s forecasting models used “to explain inflation use some measure of underlying inflation (often 15 per cent trimmed-mean inflation) as the dependent variable”.

The special measures that the RBA uses as part of its deliberations each month about interest rate rises – the trimmed mean and the weighted median – also showed moderating price pressures.

So what has been happening with these different measures?

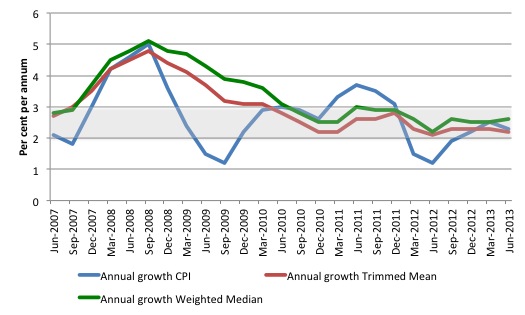

The following graph shows the three main inflation series published by the ABS over the last 24 quarters – the annual percentage change in the all items CPI (blue line); the annual changes in the weighted median (green line) and the trimmed mean (red line). The RBAs inflation targetting band is 2 to 3 per cent (shaded area).

The CPI measure of inflation (at 2.3 per cent is down from 2.5 per cent in the March-quarter 2012) is in the centre of the target band, while the RBAs preferred measures – the Trimmed Mean (2.2 per cent down from 2.3 per cent) and the Weighted Median (2.6 per cent up from 2/5 per cent) – are also well within the RBAs band of 2 to 3 per cent.

But if we dig a little deeper a different picture emerges.

Annualised growth calculations are affected by two things: (a) the current value, and (b) the base or starting value. If there is an unusually low observation in the base quarter then the current annual inflation rate will appear higher than it might otherwise be once we take the influence of the unusually low base quarter.

It turns out that the September-quarter 2012 result (1.4 per cent) was such a quarter (check it in the graph below). This distorts the annualised inflation calculation for the next three quarters.

The quarterly growth in the headline CPI (the ALL Groups) for the June-quarter 2013 was 0.4 per cent (compared to the trimmed mean and weighted median growth of 0.5 and 0.7 per cent, respectively). In seasonally-adjusted terms the All Groups CPI index rose by 0.5 percentage points in the June-quarter 2013.

If we erased that outlier from our outlook and considered an annualised extrapolation of the last two-quarters, for example, then the current headline inflation rate would be 1.6 per cent (two successive quarters of 0.4 per cent).

That is, below the lower bound (2 per cent) of RBA’s target range.

If we take the average core rate for the last six months then the annualised core inflation rate would be 2.1 per cent.

That is, at the bottom of the RBA’s target range.

How to we assess these results?

First, there is clearly no upward trend in any of the measures. The “core” measures used by the RBA have been benign for many quarters despite the budget deficit and swings in interest rates (up and down).

Second, it is clear that the RBA-preferred measures are well within their inflation-targeting band. It is unclear whether what the RBA considers when determining their interest rate decision each month, but given inflation is benign, it may turn its attention to the failing labour market and ease interest rates as a result of that.

Not that the real economy is very sensitive to movements in rates anyway, given that it is hard to discern who wins and who loses from rate changes (the distributional effects across fixed income recipients, creditors and borrowers) and hence it is hard to work out the overall impact on aggregate demand. We know the effect is lagged, uncertain and within normal ranges probably small.

Third, the underlying price pressures (say from wages) are within the space provided by productivity growth. There is no inflation threat in Australia arising from wages at present.

Fourth, as noted above, the falling Australian dollar will add some pressure of the domestic price level. How much? Some say around 0.5 percentage points spread over the next two quarters. Which will still keep inflation well within the RBA inflation targetting range. I suspect the international impact will be smaller than that given the slowing economy.

It is highly likely that the RBA will cut interest rates (by 0.25 basis points) in the next two months given the increasingly worrying state of the labour market, the slowdown in real GDP growth and the low and stable inflation rate.

However, the reliance on monetary policy reflects the dysfunctional ideologically-motivated dislike for fiscal policy in Australia (and elsewhere). Like other nations, economists have convinced governments that the counter-stabilisation role should be taken by monetary policy.

The Treasurer’s obsession with getting the federal budget back into surplus has failed but in trying the Government has clearly not supported the emerging recovery. The latest real data (National Accounts and Labour Force data) show that fiscal policy is running in a pro-cyclical direction – that is, making the slowdown in real GDP arising from the slowdown in mining investment and the subdued private household consumption growth worse.

So we are in this situation where the Government is deliberately undermining growth and pushing unemployment up, which is forcing the RBA to use inferior counter-stabilising tools (interest rate management) to stop a recession. The end result is a sluggish economy, rising unemployment and a bias towards pushing up household debt.

The latter point is important. The private domestic sector is presently carrying too much debt and that explains its subdued spending patterns (and the rise in the saving ratio). The Government’s policy is relying on private spending to fill the gap left by the contraction in public spending, given that any expected export revenue growth will be insufficient to drive growth.

The strategy thus relies on the same dynamics that led to the crisis in the first place – too much private debt and inadequately-sized deficits.

What is driving inflation in Australia?

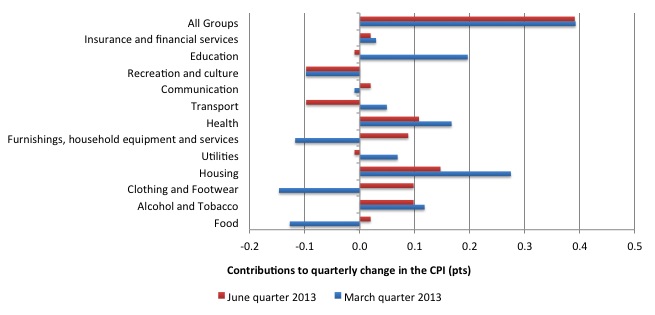

The following bar chart compares the contributions to the quarterly change in the CPI for the March-quarter 2013 (blue bars) compared to the June-quarter 2013 (red bars).

The ABS reports that for the March-quarter 2013, the largest price rises were for “medical and hospital services (+3.4%), tobacco (+3.0%), new dwelling purchase by owner-occupiers (+0.9%), furniture (+4.8%) and rents (+1.1%)”.

The ABS reports that for the March-quarter 2013, the “most significant offsetting price falls this quarter were for domestic holiday travel and accommodation (-4.0%) and automotive fuel (-3.1%)”.

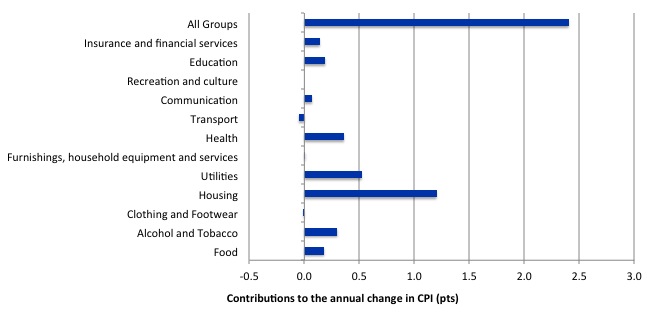

The next bar chart provides shows the contributions in points to the annual inflation rate by the various components.

In the twelve months to March 2013, the major drivers of inflation were housing, utility prices and health costs.

The overwhelming conclusion is that there is no evidence that there is any likelihood of an inflation outbreak in Australia at present.

Which should give the commentators who a few years ago were predicting rising interest rates and accelerating inflation as a result of the two federal stimulus measures which pushed the budget deficit up.

Inflation and Expected Inflation

The fear of inflation, in part, drives this mis-placed faith in monetary policy over fiscal policy.

If we went back to 2009 and examined all of the commentary from the so-called experts we would find an overwhelming emphasis on the so-called inflation risk arising from the fiscal stimulus. The predictions of rising inflation and interest rates dominated the policy discussions.

This May 2009 New York Times article by US monetarist economist Allan Meltzer – Inflation Nation – is representative.

Meltzer claimed that the “printing money” obsession of the Federal reserve and the high deficits “could see a repeat of those dreadful inflationary years”.

In all these terror stories two words dominate “could” and “may”. They impart images of danger and dysfunction to the reader but hedge with these conditional-type words. The fact is that there was no basis for those predictions in 2009 and four years later inflation is benign or falling other than where some cartel controls the supply-price.

Meltzer said:

Besides, no country facing enormous budget deficits, rapid growth in the money supply and the prospect of a sustained currency devaluation as we are has ever experienced deflation. These factors are harbingers of inflation.

When will it come? Surely not right away. But sooner or later, we will see the Fed, under pressure from Congress, the administration and business, try to prevent interest rates from increasing. The proponents of lower rates will point to the unemployment numbers and the slow recovery. That’s why the Fed must start to demonstrate the kind of courage and independence it has not recently shown.

There is a difference between deflation (a negative inflation rate) and a decelerating inflation rate, which the US is experiencing. But the so-called harbingers of inflation have not led to accelerating inflation, which is really what Meltzer is predicting “sooner or later”.

Right around the world, these sort of predictions came to nought because they were made by people who didn’t really understand how the macroeconomy works.

The RBA is now having to deal with providing some support for aggregate spending, which is in retreat, rather than trying to reign spending growth in with higher rates.

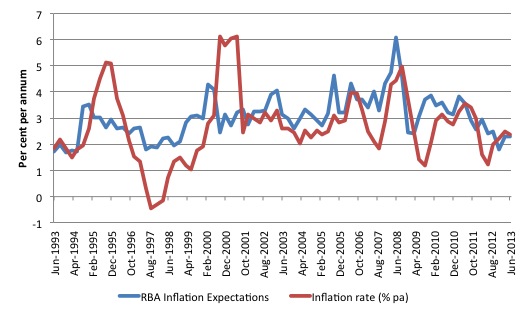

The following graph shows the RBA inflation expectations series and the actual inflation rate (annual percentage changes) from the June-quarter 1993 to the June-quarter 2013.

Notwithstanding the systematic errors in the price expectations series, the price expectations (as measured by this series) are trending downwards in Australia, which will influence a host of other nominal aggregates such as wage demands and price margins.

Conclusion

Inflation in Australia is trending downwards. On an annualised basis, if we take out the spike in the September-quarter 2012, the inflation rate is 1.6 per cent, well below the lower-bound of the RBA’s inflation targetting range.

The data continues to suggest that the national economy is slowing as a result of excessively tight fiscal policy and declining private spending.

That is enough for today!

(c) Copyright 2012 Bill Mitchell. All Rights Reserved.

I agree, Australia could use some fiscal policy to boost its output.