I have received several E-mails over the last few weeks that suggest that the economics…

Witchdoctors and shamans

Australia is in the midst of a federal election campaign (the election is September 7, 2013), which while short by, say US standards, is no less asinine. The sophistication of economic commentary from both sides of politics is non-existent even though every day there is a mountain of such commentary. It is a very trying period and I have been trying to avoid engaging with it as much as possible bar the almost daily press interviews about the latest announcement of release. Here are a few examples of what a sane economist like me has to put up with. The problem, of-course, is not that my sensibilities are being upset. Precious me! The real problem is that the public are continually being confronted by economics editors, professors and others who provide misleading and/or incorrect economic analysis, which distorts the way in which peope (who vote) think and act. We are really in flat earth territory at the moment and the future generations will not think of us very kindly for both our ignorance and the damage we leave for them.

Here are three examples.

Nonsensical claims about the deficit

In yesterday’s Melbourne Age article (August 14, 2013) – – written by its economics editor Tim Colebatch, the topic is the so-called – Pre-election Economic and Fiscal Outlook.

The – 2013 PEFO Report – was jointly released yesterday by the Departments of Treasury and Finance and Deregulation.

The shift in ideology of the Government over the years is exemplified by the name of the Ministry of Finance and Deregulation. It used to be called the Ministry of Finance.

The so-called PEFO is a curious neo-liberal contrivance. It was defined under 1998 Federal legislation invoked called the – Charter of Budget Honesty Act 1998 – which embodied the neo-liberal myths about budgets by purporting to provide “a framework for the conduct of Government fiscal policy”.

This framework specifies that the “Government’s fiscal strategy is to be based on the principles of sound fiscal management”, which are:

(a) manage financial risks faced by the Commonwealth prudently, having regard to economic circumstances, including by maintaining Commonwealth general government debt at prudent levels; and

(b) ensure that its fiscal policy contributes:

(i) to achieving adequate national saving; and

(ii) to moderating cyclical fluctuations in economic activity, as appropriate, taking account of the economic risks facing the nation and the impact of those risks on the Government’s fiscal position; and(c) pursue spending and taxing policies that are consistent with a reasonable degree of stability and predictability in the level of the tax burden; and

(d) maintain the integrity of the tax system; and

(e) ensure that its policy decisions have regard to their financial effects on future generatio

These objectives are interpreted predictably as eulogising budget surpluses and reducing national (public) debt. The absence of any explicit commitment to full employment exemplifies the ideological shift away from the national government taking responsibility for that policy goal.

And so, the Government, without even hanging its head in shame, announced recently that it was forecasting the unemployment rate to rise from 6.25 per cent (from its current level of 5.7 per cent – and 2.25 per cent above the low-point rate of the last economic cycle).

They then declared this was responsible fiscal management. So the whole process is an awful joke.

Under the Act, the PEFO is designed “to provide updated information on the economic and fiscal outlook” upon which the election offers made by the major political parties can be fully costed and compared.

The whole process is largely a joke. The PEFO is based on forecasts from Treasury, which have proven to be very inaccurate over the last few years. Apart from some very minor changes, the PEFO mirrors the information we received earlier in the month from the Treasury in the Government’s – Economic Statement.

I discussed the Economic Policy Statement in this blog – Australia – the good and bad of the Economic Policy Statement.

Anyway, all that is background and you will have the gist.

After the release of the PEFO, we read in Tim Colebatch’s column (this is an influential column and widely read), that the PEFO indicates:

To the experts in charge, the budget is not out of control. Australia’s fiscal position is not good but it is manageable and it is heading in the right direction.

And in those two sentences the public is immediately mislead into thinking that larger deficits are “not good” and smaller deficits are “heading in the right direction”.

Colebatch’s assessment is in actual fact (when one understands the intrinsic nature of the monetary system in Australia) meaningless at best and something more insulting at worse.

A budget outcome can never be “out of” or “under” control. The government of the day is unable to guarantee any particular controlled outcome for the budget over any period.

The final balance at any point in time depends on the spending and saving decisions of the non-government sector. The government can influence those decisions but cannot control them under normal circumstances.

Further, there is no sense in the statement that a higher deficit is “not good” and a lower one is “heading in the right direction”. In other words, Colebatch seems to be suggesting that a surplus is good.

This is a lie. The budget balance is like the canary in the mine. Once we understand the underlying policy settings, the balance tells us the state of the real economy.

It is the latter that matters not the budget balance. A deficit equal to 5 per cent of GDP might indicate a bad situation or a good situation. A surplus of 2 per cent of GDP might be signal things are in good shape but it also might indicate that the economy is about to collapse under the weight of excessive private sector debt.

It is much more complex than bigger deficit bad, lower deficit better, surplus best.

If there is an external deficit (as in Australia of about 3.5 per cent of GDP) and the private sector has no thirst for ever-increasing debt levels, then the only way the economy can grow under these circumstances is for the government to run deficits to offset the spending drain coming from the non-government sector.

This could require a 10 per cent deficit, a 3 per cent deficit or some other deficit. By providing the spending support to the production process to generate national income, these deficits would not only fund the private sector saving but also maintain high levels of employment and the obvious welfare gains that flow from that.

I would think of that as a virtuous state.

A currency-issuing government has a choice – maintain full employment by ensuring there is no spending gap which means that the necessary deficit is defined by this political goal. It will be whatever is required to close the spending gap.

However, it is also possible that the political goals may be to maintain some slack in the economy (persistent unemployment and underemployment) which means that the government deficit will be somewhat smaller and perhaps even, for a time, a budget surplus will be possible.

But the second option would introduce fiscal drag (deflationary forces) into the economy which will ultimately cause firms to reduce production and income and drive the budget outcome towards increasing deficits.

Colebatch thinks a deficit outcome (smaller) that pushes up unemployment would be heading in the right direction. I disagree.

Ultimately, if a government pursues smaller deficits when non-government sector is insufficient to maintain full employment, the spending gap will be closed by the automatic stabilisers because falling national income ensures that that the leakages (saving, taxation and imports) equal the injections (investment, government spending and exports) so that the sectoral balances hold (being accounting constructs).

But at that point, the economy will support lower employment levels and rising unemployment and unutilised productive capacity. The budget will also be in deficit – but in this situation, the deficits will be what I call “bad” deficits. Deficits driven by a declining economy and rising unemployment.

Fiscal sustainability requires that the government fills the spending gap with “good” deficits at levels of economic activity consistent with full employment – which I define as 2 per cent unemployment and zero underemployment.

Fiscal sustainability cannot be defined independently of full employment. Once the link between full employment and the conduct of fiscal policy is abandoned, we are effectively admitting that we do not want government to take responsibility of full employment (and the equity advantages that accompany that end).

It makes no sense to look at a fiscal outcome number and conclude large negatives are bad and so on. It clearly all depends and at present the budget deficit in Australia is – too small by a few per cent of GDP at least.

Another nonsensical claim about the deficit

The second example relates to commentary from a former RBA Board member and professor of economics recently on the Government’s plan to introduce a levy on bank deposits as a means of forcing the costs of bank collapse back onto the shareholders.

The interview was on ABC Radio National Breakfast segment (August 2, 2013) – Government to introduce new bank deposit levy.

From 2016, the Government will impose a levy of 0.05 per cent on deposits of up to $A250k and the money will be put into a so-called Financial Stability Fund to be used in the event of a bank collapse.

I won’t comment on the logic or validity of the bank levy. In general, my view is that banks are public-private partnerships and the risk and return of the partnership should not be asymmetrically shared (risks borne by the public and the returns borne by the bank shareholders).

The bank levy is one way of forcing the risks back onto the owners or depositors in proportion of the incidence of the levy.

Anyway, a discussion of the levy will wait for another day.

The interview asked so-called economics expert, Warrick McKibbin, about the levy and among other things this gem of mythology was provided – bound to mislead the public.

He said the fund should be an independently-managed fund and not used to bolster the current budget position (which is a myth in itself).

He was asked why it should be in a separate fund he replied:

Well again this is for a crisis which could be very big in scale and if you don’t have the funds put aside and have to take them out of considated revenue in the future as an expenditure item that could create a fiscal crisis as well as a banking crisis.

We saw that happen in Spain and Portugal at various stages over the last five years. That’s what you want to avoid. That’s why you wneed to have this fund building independently of government current spending because it is there for a rainy day.

He invoked the Future Fund, which the previous government established. Please read my blog – The Future Fund scandal – for more discussion on this point.

What would a Modern Monetary Theory (MMT) response be to Prof. McKibbon?

The Australian government uses its own currency and can purchase anything that is available for sale in that currency any time it likes. Further it can make transfer payments (to say bank deposit holders) up to any limit if it so desires. Whether it should make any payment or spend any money depends on the circumstances.

The fact is that it can.

Portugal and Spain use a foreign currency and cannot spend whenever it wants. The banking system in those countries cannot be guaranteed by their governments because they cannot guarantee they can raise enough taxes or borrow enough money to meet the requirements of such a guarantee.

The Australian government could always bail out the banks should it deem that a sensible policy option.

The Commonwealth’s ability to make timely payment of its own currency is never numerically constrained by revenues from taxing and/or borrowing.

Therefore the purchase of a Financial Stability Fund (or the Future Fund) in no way enhances the government’s ability to meet future obligations. In fact, the entire concept of government pre-funding an unfunded or potential liability in its currency of issue has no application whatsoever in the context of a flexible exchange rate and the modern monetary system. That is, it represents lunacy!

The misconception that “public saving” is required to fund future public expenditure is often rehearsed in the financial media.

In rejecting the notion that public surpluses or sovereign funds create a cache of money that can be spent later we note that Government spends by crediting an account at an RBA member bank.

There is no revenue constraint. Government cheques don’t bounce! Additionally, taxation consists of debiting an account at an RBA member bank. The funds debited are “accounted for” but don’t actually “go anywhere” and “accumulate”.

The concept of pre-funding future liabilities does apply to fixed exchange rate regimes, as sufficient reserves must be held to facilitate guaranteed conversion features of the currency. It also applies to non-government users of a currency. Their ability to spend is a function of their revenues and reserves of that currency.

So at the heart of all this nonsense is the false analogy neo-liberals draw between private household budgets and the government budget.

Households, the users of the currency, must finance their spending prior to the fact. However, government, as the issuer of the currency, must spend first (credit private bank accounts) before it can subsequently tax (debit private accounts). Government spending is the source of the funds the private sector requires to pay its taxes and to net save and is not inherently revenue constrained.

Further, there is an issue with the government becoming a speculative player in asset markets. Why is it desirable for the Government to compete in the private equity market to fuel speculation in financial assets and distort allocations of capital?

Misrepresenting and lying about statistics

There is a new fact checking capacity being exercised this election – PolitiFact – which is interesting but not entirely convincing given that the economic paradigm employed is embedded in the myth that the federal government has some sort of revenue constraint.

Here is one statement by the Leader of the Opposition this morning (during a press conference in Brisbane) that probably won’t get checked but typifies the misleading campaiging that both sides of politics engage in.

You can view the Press Conference in question – HERE. The relevant claims I am dealing with below start at the 18:37 mark of the 23-odd minute conference.

The Opposition leader was outlining savings that his government would make if they were elected next month which would “pay” for the new spending promises. I won’t deal with the falsehood that these spending cuts “pay” for new spending – that is a core lie.

He announced that they would cut the federal public sector payroll by 12,000 jobs (through natural attrition – aka bullying undesirable employees to leave prematurely).

He then said:

Let’s face it, there some 20,000 more on the Commonwealth public sector payroll now than in 2007 and I don’t think anyone would say there’s been a commensurate improvement in the quality of government services.

Clearly he is appealing to the antipathy Australians have towards public employees – all the usual stereotypes of fat cats, lazy shirkers etc. If the value of public services were properly assessed then the public would change their minds about this very quickly but that is another story.

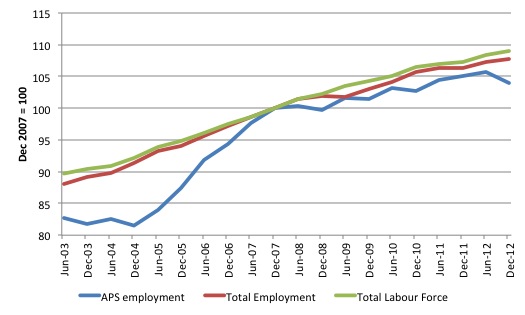

The following graph and related commentary provides the evidence which demonstrates both the fraudulent nature of the Opposition leader’s claim and his blatant misuse of data. He is appealing to ignorance rather than providing a choice to an informed electorate.

The graph draws on the official data from the Australian Bureau of Statistics (for total employment and the labour force) and various editions of the – Australian Public Service Statistical Bulletin – for the the total Australian Public Service employment data.

APS employment data is available on a half-yearly basis (June and December).

I indexed the data with the base period (100) being December 2007 (aligned close to when the government changed) and plotted total APS employment against Total Employment and the Total Labour Force.

The points to note are as follows:

1. There was rapid growth in APS employment (outstripping the growth in total employment) between 2005 and late 2007) when the current Opposition was in government. That is a good because it implies better service delivery but we would have to examine in detail where the employment was located before we could draw those conclusions.

2. After the current government was elected in late 2007, total APS employment rose by 6,405 (to December 2012) not “some 20,000” as was claimed by the Opposition leader.

Even if we counted the change between December 2006 and December 2007, we would still only get 15,359. There is no hint that in the last 6 months, APS employment has grown by the amount necessary to reach 20,000. But using this period we would be overlapping regimes given the first election of the current government was November 24, 2007.

3. In terms of ratios, total APS employment was 1.4 per cent of total employment in June 2003, 1.48 per cent in December 2007 (just after the current government took office) and by December 2012 it was 1.43 per cent of total employment.

4. If Total APS employment had have maintained is share of the Working Age Population then it would have risen to 174,725 by December 2012, a difference of 9,127 jobs on the actual December 2012 level of 165,598. The demand for public services rises in proportion with the total population.

Unless there has been major productivity changes in this 5 year period (unlikely) then the contraction in proportionately provides a prima facie case that the service delivery capacity of the Australian Public Service has declined.

This makes statements by the Opposition leader today that total employment in the APS had grown over the period of the current government but he hadn’t observed any increases in service capacity look rather stupid.

5. In terms of index numbers, total APS employment was at 104 in December 2012 (against 100 in December 2007), while total Australian employment was 107.8 and the labour force was 109.1. The difference between the labour force and employment growth is the rise in unemployment that has occured over the period of the current government.

So it is totally false to claim that the current government has overseen a blowout in public sector employment. In fact, it is quite the opposite.

6. More worrying is that at a time that total employment was contracting in the aftermath of the global financial crisis, the government chose note to bridge that the widening employment gap by increasing public sector employment. The result has a totally unnecessary rise in unemployment and lost national income.

Conclusion

We are being bombarded with the banal and wrongful statements by so-called “economists” who distort our judgements towards accepting neo-liberal rubbish.

Many of th economists we are forced to listen to by the mainstream media (for example, the bank and financial market economists) are not independent but say what is in the interests of the corporations that employ them. Unfortunately, we hold these economists out as experts who do understand even if “we” do not.

But in fact, most of the statements that go as expert economic commentary reveal an ignorance of how the modern monetary economy works and how a government with a monopoly in the currency issuance operates.

In that sense, no matter how sophisticated we aspire to be as a society, we are really in the hands of witchdoctors and shamans who circle us with mantras and spells and leave us feeling as though the ship is being run by those who know something that we do not. In that sense, we are a most primitive society.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

Bill –

NO IT IS NOT! It is merely another way of looking at things. Obviously it’s not the way that you favour, but that doesn’t make it untrue.

There are many economic lies that are believed by the majority of the population, hence the opposition’s current popularity. Core lies are the claims such as future generations will have to pay off the debt this goverment is running up or we can’t afford another stimulus. But claiming that spending cuts pay for spending is a convention, not a falsehood. And claiming otherwise prevents you from making more sensible claims such as printing money would be a better way of paying for the new spending promises than the proposed cuts are!

Read this little ditty somewhere recently:

“The bloody, bloody bankers,

that most respected lot.

How many millions have they starved;

how many have they shot?

The bloody, bloody bankers,

since 1694,

booms, busts, Depressions;

and never ending war”.

And their political sluts!

At least the poor witchdoctor often meant well …!

@Aidan

You work for a transportation company. That company has a set of books that describes its fiscal condition. Do you look at the company’s CPA and tell him that those books are just “another way of looking at things”? Of course not. He’d think you were off your rocker.

MMT is NOT another way of looking at things either. It is to macroeconomics what your company’s books are to your company’s fiscal condition, which is to say it is an accurate description of reality which follows accounting conventions. Further, MMT is UNIQUE in that manner among schools of economic thought, which is why it isn’t just “another way of looking at things”. Other ways of looking at things are wrong.

@Aidan,

The claim Bill is making is not simply a convention. A convention is neither true nor false, like a definition. As Bill considers his statement about spending cuts to have a truth-value, it becomes a substantive proposition that can be empirically tested against the “facts”.

If A and B are two different ways of looking at the same thing, then, in a formal sense, they should in the best case be equivalent or at the very least consistent with one another. Your two contrasting cases are neither. Hence, I would suggest that only one can be true.

@Aidan,

Addendum: There are conventions in every framework and in Bill’s I think better examples might be MMT’s accounting identities, or a system of national accounting. National accounting systems are neither true nor false; they are only useful or not, like definitions. Adding such conventions or definitions to a set of substantive propositions that have truth-value will yield statements that also possess a truth-value that can in principle be empirically tested. It is this latter situation that, generally, will in principle decide, say, which of two competing national accounting systems proves to be the more useful. In a way, the results of such tests can be viewed as indirect empirical tests (of the workability) of the national accounting conventions.

@Benedict@Large

Different ways of looking at things are possible for many companies, though they’d probably need a chartered accountant.

I agree MMT is more than just a way of looking at things. MMT is valid whichever way you look at things, even though some ways of looking at things are inadequate for showing why some commonly held assumptions ate incorrect.

@larry,

There is no inconsistency. I do not have two contrasting cases.

And if conventions are neither true nor false then any claim that they are lies must be false.

@Aidan,

“if conventions are neither true nor false then any claim that they are lies must be false”;

I quite agree. My point would be that Bill does not treat such statements as conventions but as substantive propositions having a truth-value. If that is so, then Bill’s contention that anyone who utters a statement A that is believed or known to be false but is instead treated as being true is either lying or bullshitting (in Harry Frankfurt’s sense).

Dear Bill,

I refer you to this great piece of work by Mr Gross which I am sure you will enjoy:

http://www.project-syndicate.org/commentary/how-austerity-has-helped-the-eurozone-periphery-by-daniel-gros

I couldn’t help myself writing a comment either, someone needs to.

Regards,

Javier

The idea that some government savings in one place “pays” for spending in another, doesn’t even work as a metaphor, when there is a substantial output gap to be filled.

Not totally au fait with warren-speak but did he just define Govt bonds as currency?

Defining base money

I don’t have a TV but I sometimes listen to ABC radio news. But if I hear some twit posing as an economist holding forth I hit the off button quickly while chanting la la la.

I find print media to be an excellent user friendly provider of information. I can scan headlines and authorship quickly for what interests me and I can then skim an article to see if it is worth reading.

For many years I have been virtually impervious to election campaigns except for amusement value while still remaining interested in policies,such as they are,and outcomes,horrible though they may be.

This is the first election where I am going to have to hold my nose regardless of who I vote for.

I’m getting older,for sure. But surely ever more cynical. We have a long journey down before there will be any hope of a turnaround in collective wisdom,I fear. Such Is Life.

What’s really interesting is that most conventional wisdom is proved wrong and that most economic experts merely spruik their version of (or that of their employer) conventional wisdom…until they can’t any longer.

Economics is the least “scientific” of the sciences – which is why if you ask 20 economists for their opinion you’ll tend to get between 15 and 30 different responses. The fact that behavioural economics has only recently entered the lexicon and become a serious consideration, when in fact it is the only valid form of economic theory (it is our behaviour with money that is at the heart of all economics) and the rest are subsets of it. Keep plugging away, Bill. You may have some effect, even if only when it all goes tits up and someone points out that not all were deluded. As a financial adviser I teach my clients about the wisdom contained in stories such as The Emperor’s New Clothes, as well as what they should have learned from games such as Pass the Parcel and Musical Chairs. Now THEY show economic theory in real practice!

I must have missed the post where MMT advocates printing money.

Why does Aidan get to see these posts and I don’t ?

Exactly my concern.

The same as my concern with the small group running http://budgetaus.net/

@Alan Dunn:

It’s implicit in all the posts. Bill doesn’t like the term “printing money” because it’s got massive negative connotations, but every time he talks about how the Australian government is a currency issuer, that’s what he’s talking about. Even deeper than that, one of the core ideas is that when the government spends, it “prints money”, and when it taxes, it “burns” it. In other words, we are already doing it, we just need to embrace it and do more of it.

I understand the fear of activating knee-jerk visions of money wheelbarrows, but the first critic that comes along will invoke fears of money printing => hyperinflation. Personally I think it’s better to first speak the dreaded words ourselves and control the narrative, otherwise the conservatives can just parrot “printing money” over and over again and win the argument while we split hairs over definitions. Best call it what people think it is and tackle the myths head on.