It’s Wednesday and I just finished a ‘Conversation’ with the Economics Society of Australia, where I talked about Modern Monetary Theory (MMT) and its application to current policy issues. Some of the questions were excellent and challenging to answer, which is the best way. You can view an edited version of the discussion below and…

IS-LM Framework – Part 6

I am now using Friday’s blog space to provide draft versions of the Modern Monetary Theory textbook that I am writing with my colleague and friend Randy Wray. We expect to complete the text during 2013 (to be ready in draft form for second semester teaching). Comments are always welcome. Remember this is a textbook aimed at undergraduate students and so the writing will be different from my usual blog free-for-all. Note also that the text I post is just the work I am doing by way of the first draft so the material posted will not represent the complete text. Further it will change once the two of us have edited it.

Previous Parts to this Chapter:

- The IS-LM Framework – Part 1

- The IS-LM Framework – Part 2

- The IS-LM Framework – Part 3

- The IS-LM Framework – Part 4

- The IS-LM Framework – Part 5

Chapter 16 – The IS-LM Framework

[PREVIOUS MATERIAL HERE IN PARTS 1 to 5]

16.6 Introducing the price level – the Keynes and Pigou effects

[CONTINUING FROM LAST WEEK – WITH REVISED DIAGRAM AND PIGOU EFFECT ADDED]

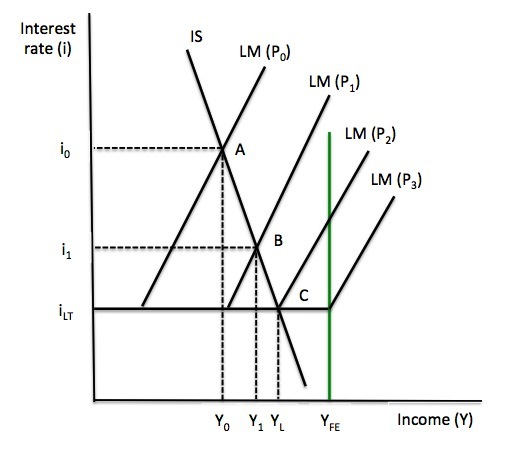

Figure 16.10 depicts a family of LM curves with each individual curve corresponding to a different price levels (P0 is the highest price and P3 is the lowest price).

The introduction of the price level now means that the interest rate-income equilibrium is now contingent on the price level. If there is a different price level, the equilibrium changes as noted.

This means that within this framework, the national income equilibrium can shift without any change in monetary or fiscal policy settings if the price level changes.

Figure 16.10 The Keynes Effect

This observation was central to the debates between Keynes and the classical economists during the 1930s, which we examined in detail in Chapter 15.

Assume that the economy is currently at Point A, where the interest-rate is i0 and national income is Y0. The general price level is P0.

The full employment output level is at YFE, so that the current equilibrium corresponds to what Keynes would refer to as a underemployment equilibrium.

At Point A, the product and money markets are in equilibrium but there is an output gap and there would be mass unemployment in the labour market as a consequence.

Keynes considered this to be the general case for a monetary economy and depicted the neo-classical model as a special case in which the equilibrium that emerged was also consistent with full employment. For Keynes, a monetary economy could be in equilibrium at any level of national income.

The neo-classical response to this was that unless we impose fixed wages on the model, the persistent mass unemployment would eventually lead to falling nominal wages and prices.

While this might not lead to a fall in the real wage (if nominal wages and prices fall proportionately), which would negate the traditional neo-classical route to full employment via marginal productivity theory, the fact remains that the lower price level increases real balances in the economy.

The reasoning that follows is that the reduction in prices leads to a decline in the transactions demand for money at every level of income because goods and services are now cheaper.

With the nominal stock of money fixed, the expansion of real balances combined with a decline in the demand for liquidity, results in a decline in the rate of interest.

As long as future expectations of returns are not affected adversely by the deflationary environment, the reduction in the rate of interest, stimulates investment spending, which leads to increased aggregate output and income via the multiplier effect.

As long as there is an output gap, deflation will continue and the interest rate will continue to fall until the economy is at full employment.

The link between real balances and the interest rate was referred to as the Keynes effect.

In terms of Figure 16.10, the LM curve shifts outwards as the price level falls and the rising investment is depicted as a movement along the IS curve.

For example, if the price level fell to P1, the LM curve would shift and a new IS-LM equilibrium would result at Point B, with the interest rate at i1 and national income is Y1. Under the circumstances depicted this is not a full employment level of national income.

As a result of this observation, the neo-classical economists argued that an underemployment equilibrium was a special case when wages and prices were fixed given that flexible prices could reduce the output gap and unemployment via LM curve shifts.

The view that Keynes’ underemployment equilibrium was a special case of the more general flexible price model became known as the Neo-classical synthesis. This approach recognised that aggregate demand drove income and employment (the so-called Keynesian contribution) but that the economy would tend to full employment if wages and prices were flexible (the Classical contribution).

Note that the capacity of the Keynes effect to deliver output and employment gains is limited. If there is a liquidity trap (iLT) then the maximum expansion in national income that is possible via falling prices would be YL at Point C (where the IS curve intersects with the flat segment of the LM curve.

At that point, there would still be unemployment and if wages and prices were flexible and behaved according to the Classical labour market dynamics, the price level would continue to fall, say to P3.

The LM curve would continue to shift out but there would be no further expansion in national income beyond YL because the increase in real balances would not reduce the interest rate below iLT.

The classical route to full employment thus would require the full employment level of national income to lie at a point where the intersection of the IS-LM curves produced an equilibrium interest that that was equal to or above iLT.

The Keynes effect is so-named because the expansion that follows a reduction in the price level occurs through a rise in aggregate demand – first, through the interest=rate stimulus to investment, and, second, through the standard expenditure multiplier inducing higher consumption expenditure.

However, as we learned in Chapter 15, Keynes did not support wage and price cuts as a way to achieve full employment. He considered the social consequences of wage cuts to be unacceptable and instead advocated increasing the nominal money supply as the way to increase real balances.

But the limits to expansion posed by the possible existence of a liquidity trap dissuaded Keynes from considering the Keynes effect to being a plausible route to full employment.

There are several other arguments that militate against a reliance on the Keynes effect for achieving full employment.

Keynes’ General Theory, – Chapter 19 – which is devoted to the impacts of money wage changes on aggregate demand – presented several such arguments.

Among other impacts, Keynes argued that lower money wages and prices will lead to a redistribution of real income (FIND PAGE NUMBERS):

(a) from wage-earners to other factors entering into marginal prime cost whose remuneration has not been reduced, and (b) from entrepreneurs to rentiers to whom a certain income fixed in terms of money has been guaranteed.

He concluded that the impact of “this redistribution on the propensity to consume for the community as a whole” would probably be more “adverse than favourable”.

Moreover, falling money wages will have a (FIND PAGE NUMBERS):

… depressing influence on entrepreneurs of their greater burden of debt may partly offset any cheerful reactions from the reduction of wages. Indeed if the fall of wages and prices goes far, the embarrassment of those entrepreneurs who are heavily indebted may soon reach the point of insolvency, – with severely adverse effects on investment.

Overall, Keynes concluded that there was “no ground for the belief that a flexible wage policy is capable of maintaining a state of continuous full employment”.

The debt-deflation argument was also recognised by other economists such as Irving Fisher in 1933, Michal Kalecki in 1944 and Hyman Minsky in 1982).

The Classical view proposed an additional mechanism that could generate full employment as long as wages and prices were flexible.

The so-called – Pigou effect – was named after Keynes’ principal antagonist at Cambridge University, Arthur Pigou, whose work exemplified the Treasury View during the Great Depression. The Pigou effect is also known as the Real Balance effect.

While the Keynes effect worked via interest rate responses to changing real money balances then stimulating investment, the Pigou effect was based on the view that falling prices would stimulate consumption expenditure.

It was argued that the real value of household wealth rose as prices fell and this reduced the need to save. As a result the consumption function shifted upwards (higher levels of consumption at each income level) and this would shift the IS curve outwards.

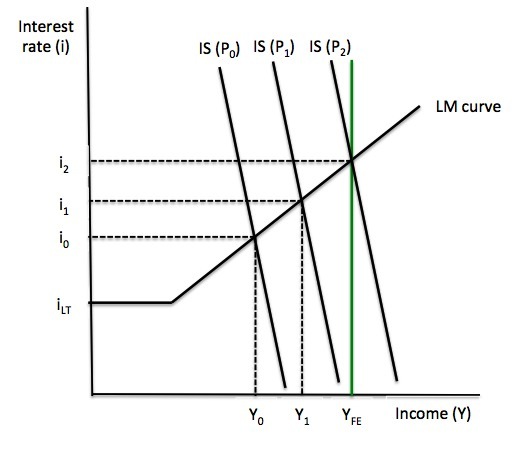

Figure 16.11 captures the Pigou effect. Note we abstract from any impacts on the LM curve of the falling price level to highlight the shifting IS curve.

If we start from an initial underemployment equilibrium at i0 and Y0 with the price level at P0. The argument is that wage and price levels would fall given the output gap (Y0 < YFE) and this would increase real wealth balances and stimulate consumption, thus pushing the IS curve outwards and leading to an expansion in national income.

Eventually, if prices were sufficiently downwardly flexible, the economy would achieve full employment at i2 and YFE, with the lower price level, P2.

You will note that unlike the Keynes effect, whose effectiveness was limited by the possibility of encountering a liquidity trap, the expansionary possibilities of the Pigou effect are unlimited.

The introduction of the Pigou effect provided a theoretical device to combat Keynes’ argument that when aggregate demand was deficient (relative to the full employment level), wage and price flexibility would not guarantee full employment.

However, studies have rejected its practical importance. Wealth effects, where identified in the empirical research literature, have been shown to be small and insufficient to resolve a major recession.

16.7 Why we do not use the IS-LM framework

There have been many critiques of the IS-LM framework over the years. Many have concentrated on whether the approach is a faithful representation of Keynes’ General Theory, as was its initial purpose. Even its originator John Hicks accepted that it was not a valid depiction of Keynes’ theories (see box).

Other critiques have concentrated on issues relation to its static nature and the fact that it can tell us nothing about what happens when the economy is no in equilibrium.

A third focus of objection relates to its denial of the realities of central bank operations and the way in which the commercial banks function.

In this section, we focus on the last two of these lines of attack.

The endogeneity of the money supply

The supply side is the simpler of the two since the money supply is regarded as fixed by some external agent (the ‘policymaker’) and independent of the rate of interest.

First, the IS-LM analysis relies on the assumption that the money supply is “exogenous”, that is, controlled by the central bank and, thus, independent of the demand for funds.

The underlying theory supporting this assumption centres on the money multiplier, which we examine in detail in Chapter 20. The assumption is that the central bank is in control of the so-called monetary base (MB) (the sum of bank reserves and currency at issue) and the money multiplier m transmits changes from the base into changes in the money supply (M).

By setting the size of the monetary base, it is thus asserted that the central bank controls the money supply, as is depicted in the derivation of the LM curve.

As we will learn in Chapter 20, this conceptualisation of the monetary operations of the system are not remotely applicable to the real world.

A senior official in the US Federal Reserve Bank of New York, A.D. Holmes identified what he called “operational problems in stabilising the money supply” as far back as 1969:

The idea of a regular injection of reserves … suffers from a naive assumption that the banking system only expands loans after the System (or market factors) have put reserves in the banking system. In the real world, banks extend credit, creating deposits in the process, and look for the reserves later. The question then becomes one of whether and how the Federal Reserve will accommodate the demand for reserves. In the very short run, the Federal Reserve has little or no choice about accommodating that demand; over time, its influence can obviously be felt.

[Reference: Holmes, A (1969) ‘Operational Constraints on the Stabilization of Money Supply Growth. In Controlling Monetary Aggregates’, Federal Reserve Bank of Boston, 65-77]

The reality, which we will analyse in detail in Chapter 20, is that the central bank sets the so-called official, policy or target interest rate. This is the rate at which they are prepared to provide funds to the banking system on an overnight basis.

This rate then determines the interbank rate that banks apply a margin to, which determines the cost of loans. The interbank rate is just the rate that banks lend to each other to ensure the payments system is stable on a daily basis.

The cost of loans influences the demand for them from private borrowers. Banks then lend to credit-worthy borrowers by creating deposits. The banks then seek the necessary reserves to ensure the withdrawals from the deposits are honoured by the payments system.

While the banks can get the necessary reserves from alternative sources, the central bank supplies reserves on demand to ensure there is financial stability and that they can maintain control of their policy interest rate.

If there is a shortage of reserves, then the competition in the interbank market between the banks for funds will drive up the short-term interest rate above the policy rate and the central bank would lose control of its policy rate. In these cases, the central bank will always supply reserves at the policy rate to maintain control over its policy settings.

Alternatively if there are excess reserves, the banks will try to loan them to other banks at discounted rates and the short-term interest rate would drop to zero. Hence the central bank will either drain the excess by selling interest-bearing government debt or it will pay a return on the excess reserves that eliminates the interbank competition.

These operations tell us that:

- Bank loans create deposits – that is, banks react to the demand for credit from borrowers rather than on-lend deposits.

- The demand for credit depends on the state of economic activity and the level of confidence in the future.

- Bank lending is not constrained by reserve holdings. The reserves are added on demand by the central bank where needed.

- Rather than driving the money supply, the monetary base responses to the expansion of credit by the banks.

- This process means the money supply is endogenously determined and the central bank has no real capacity to maintain any quantity-targets.

The fact that the money supply is endogenously determined means that the LM will be horizontal at the policy interest rate. All shifts in the interest rates are thus set by the central bank and funds are supply on demand elastically at that rate. In this case, shifts in the IS curve would not impact on interest rates.

From a policy perspective this means the simple notion that the central bank can solve unemployment by increasing the money supply is flawed.

If the central bank tries to increase reserves in a discretionary manner this would only result in excess reserve holdings and push the overnight interest rate to zero without actually increasing the money supply. To avoid this the central bank would have pay the policy rate on those excess reserves.

Unemployment is typically the result of a high liquidity preference – people want to hold cash rather than spend it – given uncertainties about the future. In those cases the demand for loans collapses and the banks become more cautious in who they will loan funds to for fear of losses. Under these conditions, there is no way for the central bank to simply increase the supply of money to raise aggregate demand.

In the global financial crisis, central banks have been adding massive volumes of reserves to the banking system via the so-called quantitative easing programs, which we analyse in detail in Chapter 20. The demand for funds was so subdued that credit expansion also slowed dramatically and the banks were content to hold vast quantities of low-interest bearing reserves.

Expectations and Time

[TO BE CONTINUED IN PART 7]

Conclusion

PART 7 next week – FINALISE CRITIQUE OF FRAMEWORK.

Saturday Quiz

The Saturday Quiz will be back again tomorrow. It will be of an appropriate order of difficulty (-:

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

“(P0 is the highest price and P3 is the highest price).”

Which one is the highest price?

“The reality, which we will analyse in detail in Chapter 20, is that the central bank sets the so-called official, policy or target interest rate. This is the rate at which they are prepared to provide funds to the banking system on an overnight basis.”

I know this is later, but it does need to cover the width and depth of the discount window and the effect (if any) of the collateral market.

I know there are lots of criticisms of the MMT approach because it doesn’t appear to address the issue of bank collateral or restrictions in the discount window. (I think the UK being forced to introduce a direct discount window in 2008 for the first time is an interesting case study).

Dear Neil Wilson (at 2013/08/30 at 18:14)

You knew which one was the highest, n’est-ce pas? But thanks for pointing out the error. Fixed now.

best wiwshes

bill

Bill,

Do you think that it might be worth pointing out that the more sophisticated New Keynesians now recognise the flat LM curve?

E.g. David Romer (note especially the footnote where he says that no textbooks have picked this up!)

http://elsa.berkeley.edu/~dromer/papers/JEP_Spring00.pdf

Of course, the dinosaurs are still clueless in this regard:

http://fixingtheeconomists.wordpress.com/2013/08/24/tending-to-his-own-garden-has-krugman-finally-turned-on-the-islm/

Best,

Phil

“Do you think that it might be worth pointing out that the more sophisticated New Keynesians now recognise the flat LM curve?”

Not sophisticated enough to realise that the ‘microfoundations’ quest is a fools errand though.

The obsession with the so-called Lucas Critique reminds of the push for ‘formal methods’ in software development – where everything had to be decomposed to mathematical logic to prevent errors.

It sounded fabulous until you realised that there were perhaps two people in the entire world who could do that and even then they made errors. So it didn’t eliminate bugs any better than the more ugly techniques – but of course it would have excluded a lot of people from the process of software development if the industry had made it a ‘requirement’ before letting them practice.

Now we’re smarter and realise that the limitation is the human capacity of the systems architect and associated developers. We come up with something that might work, try it, and then back it out if it causes unexpected dynamic effects. Fail early, fail often.

There should be a realisation from theoretical economists that they will not discover the correct disaggregation and aggregation formulas because the structure they are looking at is a dynamic self-feedback loop where any change alters the system fundamentally. Nobody alive understands the ‘deep truths’ and never will sufficiently without error within the lifetime of the universe.

As I’ve said before the approach of neo-classical economic theory always reminds me of ‘psychohistory’ in the Asimov Foundation series.