It's Wednesday and I discuss a number of topics today. First, the 'million simulations' that…

The US government can buy as much of its own debt as it chooses

The hoopla over the US government voluntarily imposed debt ceiling is about to begin again with the US Treasury Secretary predicting that the government will run out of money in mid-October. He must have been listening to his President who told an audience at the State University of New York the other day, that in the face of rising demands for more government expenditure of education “At some point, the government’s going to run out of money” (Source). It is not the first time he has made that claim. Please read my blog – The US government has run short of money – for more discussion on this point. The debt ceiling is one of those ridiculous conventions that government introduce which from time to time provide some quaint, if not bizarre, theatre. But none of the conservatives will have the intestinal fortitude to really drive the US government artificially broke anyway. Anyway, all this was amusing me as I read the latest – US Federal Reserve Flow of Funds – data the other day. That data tells us that the US government can buy as much of its own debt as it chooses. Game over!

This relevant data comes out on a quarterly basis with the latest publication being August 22, 2013. Other related data from the US Treasury (noted below) fills out the picture. The data reveals some interesting trends in terms of US federal government debt issuance over the last 12 months. It shows that the dominant majority of federal debt issued in 2011 was purchased by the US Federal Reserve. Some conservative commentators have expressed horror about this trend. As a proponent of Modern Monetary Theory (MMT) I simply note that the trend demonstrates the nearly infinite capacity of the US government to spend.

According to this story (August 27, 2013) – US to hit debt ceiling in mid-October – the US Treasury secretary has written to the US Congress urging them “to raise the limit from the current $US16.7 trillion ($A18.5 trillion)” apparently because if they didn’t it would “would cause irreparable harm to the American economy”.

Apparently, the US government has been gaining increasing revenue, which has meant the ceiling has not become operational in the administrative sense.

But he claimed that:

… if investor demand for US government debt declines, the country could face an immediate cash shortfall.

How likely is that? Not very likely. And should the private sector choose not to buy debt that was issued there is always the central bank. It can buy unlimited amounts of public debt should it so choose.

Here is an update on some research I did in this regard a few years ago which appeared in these blogs – The nearly infinite capacity of the US government to spend and When the government owes itself $US1.6 trillion.

There are a few data sets that you can pull together to break the total US public debt outstanding into various categories. The US Treasury Department provides an extensive data resource – for example, Ownership of Federal Securities. The US Treasury also provide data which provides a Foreign breakdown.

The US Federal Reserve provides Consolidated Balance Sheet data.

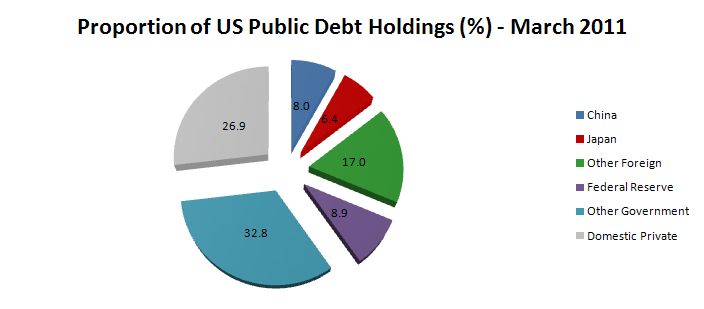

The following pie-chart shows the proportions of total US Public Debt held by various “interesting” categories as at March 2011. This chart tells you that the government sector held about 42 per cent of its own debt in March 2011. These holdings were either in the intergovernmental agencies or the US Federal Reserve.

The Chinese holdings were around 8 per cent of the total and hardly consistent with the rhetoric of the deficit terrorists that China was bailing the US government out.

The three largest foreign US debt holders at March 2011 were China (8 per cent); Japan (6.4 per cent) and Britain (2.3 per cent). The total foreign held share was equal to 31.4 per cent in March 2011.

The US Federal Reserve held 8.9 per cent of total US public debt in March 2011 – that is, more than China. The total holdings were around $US 1,274,274 million.

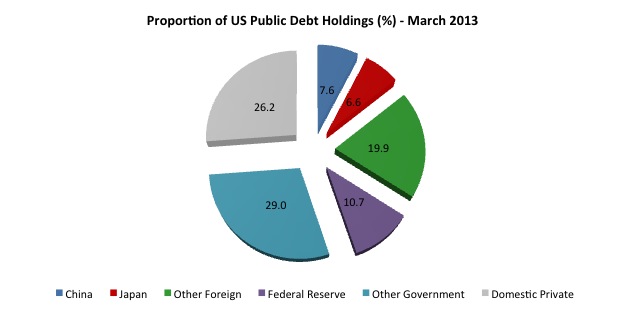

The following pie-chart represents the situation in March 2013, two years later. This chart tells you that the government sector held about 39 per cent of its own debt in the March-quarter 2013 and the private sector held the rest.

The Chinese holdings had fallen to 7.6 per cent which has been about constant since the end of 2011.

The three largest foreign US debt holders at March 2013 are China (7.6 per cent); Japan (6.6 per cent) and the so-called Caribbean Banking Centers, which include Bahamas, Bermuda, Cayman Islands, Netherlands Antilles and Panama (1.7 per cent). The Oil Exporters come next (1.6 per cent). The Oil Exporters include (Ecuador, Venezuela, Indonesia, Bahrain, Iran, Iraq, Kuwait, Oman, Qatar, Saudi Arabia, the United Arab Emirates, Algeria, Gabon, Libya, and Nigeria).

The impact of the British austerity is noticeable. In March 2011, Britain was the third largest holder of US public debt (at 2.3 per cent of total US public debt). By March 2013, this had dropped to 0.95 per cent. They shed $US166 billion worth of US treasury securities in that 24 month period).

The total foreign held share of outstanding US public debt was equal to 34.1 per cent in March 2013 – which is a relatively stable proportion.

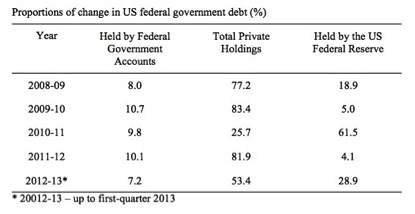

The following Table shows the proportions of the total change in US federal government debt for the calendar years 2009 (so the change is between 2008-09 and so on) to 2012-13 accounted for by the main holders – Federal Government Accounts, Total non-government (public), which is, in turn, decomposed further into US Federal Reserve holdings. There are other components not included.

In 2011, the increases in the US Federal Reserve’s holdings accounted for 62 per cent of the total increase in US federal government debt. That fell away to 4.1 per cent in 2012 and so far this year the proportion has risen again to 29 per cent.

There was a dramatic shift in the mix of debt holders other than Federal Government accounts in 2011. The central bank can alter this proportion whenever they choose and that includes to purchase any debt that the private sector chooses not to purchase.

In other words, the US government (consolidated Treasury and central bank) can always assume the role as its own largest lender. That is, the Government can always borrowing from itself!

That is how nonsensical these voluntary conventions are. They sound robust but in the end the currency-issuer is the currency-issuer and can always work around the so-called constraints.

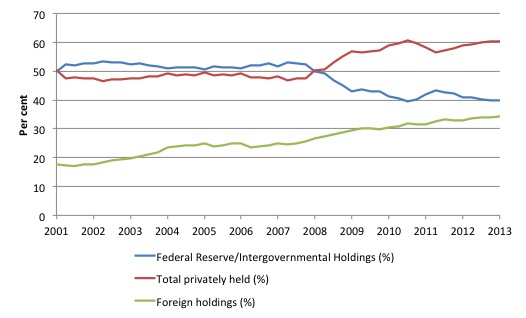

The next graph shows the evolution from March 2001 to March 2013 of the US public debt by private, public and foreign holdings (%). The foreign holdings are a subset of the private series.

There are some interesting points to note. At a time when the US public debt ratio has risen beyond what the mainstream claim is the danger point (80 per cent) – the point after which those spreadsheet mavens claim insolvency is nigh (Rogoff etc) – the private demand for US public debt has risen.

Private markets know that there is no substantive default risk involved in holding the US Treasury debt.

The other point, in relation to the rising foreign share is that you cannot conclude that the foreigners (China, Japan etc) are “funding” the US government. The US government is the only government that issues US currency so it is impossible for the Chinese to “fund” US government spending.

To understand the trend shown in the graph more fully we need to appreciate that the rising proportion of foreign-held US public debt is a direct result of the trade patterns between the countries involved (and cross trade positions).

For example, China will automatically accumulate US-dollar denominated claims as a result of it running a current account surplus against the US. These claims are held within the US banking system somewhere and can manifest as US-dollar deposits or interest-bearing bonds. The difference is really immaterial to US government spending and in an accounting sense just involves adjustments in the banking system.

The accumulation of these US-dollar denominated assets is the “reward” that the Chinese (or other foreigners) get for shipping real goods and services to the US (principally) in exchange for less real goods and services from the US. Given real living standards are based on access to real goods and services, you can work out who is on top (from a macroeconomic perspective).

Note that a worker in Detroit who is suffering from unemployment as a result of cheaper imports coming from nations with lower labour standards (pay and conditions) than the US is unlikely to agree with me. In his/her case I wouldn’t agree with me either.

But from the perspective of macroeconomics there is no issue.

Conclusion

As a proponent of MMT, I do not consider there to be a public debt problem in the US so the analysis presented here is out of interest rather than establishing anything substantive.

However, what it shows is that even within the voluntarily-constrained system that regulates the relationship between the US treasury and the central bank, the latter can still effectively buy as much US government debt as it likes.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

This bizarre ritual reminds me of the old Peanuts cartoon. Lucy always goaded Charlie Brown into trying to kick the (American) football, at which point he thought to himself “This time I’m really going to do it.” But Lucy, being incorrigible Lucy, always pulled the ball away at the very last minute, with ensuing hilarity and the inevitable wipeout of poor Charles. Why, even though I know exactly whats going to happen, do I still shake my head and chuckle!?

Letter to Editor, Vancouver Sun (largest daily newspaper in Vancouver, Canada)

Government austerity is a bad idea for Canada and its seniors

Vancouver Sun August 25, 2013

Re: With unavoidable costs looming, it’s time to re-examine seniors’ expendable perks, Don Cayo, Aug. 19

Whether or not our senior citizens are enjoying “expendable perks” is a reasonable debate, but it should never be based on the false premise that the Canadian government is running out of funds. We know that whenever big banks or corporations get into trouble, the federal government can always bail them out because it owns the Bank of Canada, and is the issuer of Canadian currency. Yes, the government can spend too much causing inflation, or spend too little (leaving over a million unemployed as is the case today), but what the Feds can never do is run out of Canadian money.

There are two ways to deal with an aging population.

The responsible path is to use our fiscal capacity and resources to the full today, putting young people to work so that they can make the false teeth, hearing aids and prostheses older people will use, and can offer the medical and physiotherapy services that seniors will need. The irresponsible path is to cut job opportunities and education today through policies of austerity, to fail to build the future medical and health infrastructure, and by pleading penury, to begrudge our seniors a comfortable life by cutting back small privileges and by forcing them to wait longer for their old age pensions.

What slice of the economic pie do our senior citizens deserve? A slice can always be made bigger or smaller through political decision; it has nothing to do with the red herring of what the federal government can afford.

Larry Kazdan

Vancouver

© Copyright (c) The Vancouver Sun

http://www.vancouversun.com/life/Government+austerity+idea+Canada+seniors/8832258/story.html

I agree that a monetarily sovereign government can print money and buy back any amount of its debt that it wants. But there are a couple of provisos.

First, the above amounts to QE, and QE has a mild stimulatory effect. If the economy is already at capacity, that stimulus is not allowable – else it leads to excess inflation. In that situation, government would have to counter that stimulus with a tax hike.

Second, when foreigners raise their holdings of debt, I don’t entirely agree with Bill’s claim that “from the perspective of macroeconomics there is no issue.” I agree that that build-up of foreign held debt is matched by shipments of real goods to the US with the US sending worthless bits of paper in return to put it euphemistically. However, that flow may at some time be reversed: when foreigners make net sales of debt and take their money out of the US.

Getting into debt to foreigners isn’t too clever, though if inflation exceeds the rate of interest, then foreigners are being fleeced, in which case I say “go for it”.

Finally, this all raises the question as to what the optimum amount of debt is: a question that most of economics profession (MMTers apart) are too dumb to ask. Warren Mosler’s answer is “none”. Ditto Milton Friedman. I agree. For Mosler, see 2nd last paragraph here:

http://www.huffingtonpost.com/warren-mosler/proposals-for-the-banking_b_432105.html

And for Friedman, see paragraph starting “Under the proposal…” (p.250) here:

http://nb.vse.cz/~BARTONP/mae911/friedman.pdf

Here are the footnotes sent with the original letter to the Vancouver Sun:

Footnotes: (Note: Canada and U.S both have fiat currencies.)

1. Current Governor of the U.S. Federal Reserve Ben Bernanke, speech in 2002 – Deflation: Making Sure “It” Doesn’t Happen Here.

http://www.federalreserve.gov/boardDocs/speeches/2002/20021121/default.htm

The Governor said:

But the U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.

2. http://www.usnews.com/debate-club/was-the-treasury-and-the-fed-right-to-to-take-the-1-trillion-coin-off-the-table/the-power-to-mint-a-trillion-dollar-coin-has-always-existed

“[A] government cannot become insolvent with respect to obligations in its own currency. A fiat money system, like the ones we have today, can produce such claims without limit,” said former U.S. Federal Reserve Governor Alan Greenspan in 1997.

3. Growth and jobs are things governments can buy and summon

https://billmitchell.org/blog/?p=23104

> But the starting point is to remember that unlike the clown’s claims that governments are powerless to anything but impose austerity – growth and jobs are things governments can buy or summon.

4. https://billmitchell.org/blog/?p=19887

> The challenge facing the US is not financial. It is to ensure productivity grows fast enough to meet the challenge of the rising dependency ratio and the political demands required to divert real resources from one generation to another. But the political challenge is no different to diverting current resources between competing groups.

I have never understood the argument that the debt is a problem.

For example:

QE operations takes place in plain sight, which, provides real world evidence that a central bank can retire any outstanding sovereign debt (denominated in the local currency) at any point, it only has to choose to.

The enacted machinations of governments, who have currency sovereignty is one thing, however, reality has to count for something?

“First, the above amounts to QE, and QE has a mild stimulatory effect.”

Does it? Or does it just cause more savings due to the collapse in savings rates draining even more money from the circulation.

It’s the amount of borrowing vs the amount of saving that decides what happens.

I’d say it is likely deflationary, and forces up asset prices as everybody chases the reduced income on offer.

“However, that flow may at some time be reversed: when foreigners make net sales of debt and take their money out of the US.”

They can only do that when they decide to abandon their export-led policy. Otherwise they risk collapsing their own economy as the demand for the exports vanishes.

Foreign held savings tends towards being held by foreign sovereign entities – central banks, sovereign wealth funds, etc. There the savings are effectively prisoners of war – frozen and unusable lest they destroy the economy of the state that holds them.

The bigger the importer the more frozen the foreign held savings of that importer.

Dear Bill,

for the sake of completeness: As far as I know the Fed is legally restricted from buying treasuries directly from the treasury. Which isn’t the same thing of course as not being able to.

Erik

Dear Dr. Mitchell,

I believe that commenter Erik Jochem is correct that the Treasury Dept. has to issue a bond to a private party, and the Fed has to buy it from the private party, usually a bank.

This is not the only oddity.

When the Fed buys one of Uncle Sam’s bonds, it does not send it a few blocks to the Treasury Department in an envelope marked “Paid in Full.”

It keeps the bonds it has purchased and collects interest payments from the Treasury!

At the end of each accounting year, it returns those interest payments to the Treasury reporting them as profits of the Fed.

‘ “First, the above amounts to QE, and QE has a mild stimulatory effect.”

Does it? Or does it just cause more savings due to the collapse in savings rates draining even more money from the circulation. ‘

It depends upon where the money goes?

“Myths about quantitative easing

Some of the money for these government expenditures has come directly from “money printing” by the central bank, also known as “quantitative easing”. For over a decade, the Bank of Japan has been engaged in this practice; yet the hyperinflation that deficit hawks said it would trigger has not occurred. To the contrary, as noted by Wolf Richter in a May 9, 2012 article:

[T]he Japanese [are] in fact among the few people in the world enjoying actual price stability, with interchanging periods of minor inflation and minor deflation – as opposed to the 27% inflation per decade that the Fed has conjured up and continues to call, moronically, “price stability.” [9]

How is that possible? It all depends on where the money generated by quantitative easing ends up. In Japan, the money borrowed by the government has found its way back into the pockets of the Japanese people in the form of social security and interest on their savings. Money in consumer bank accounts stimulates demand, stimulating the production of goods and services, increasing supply; and when supply and demand rise together, prices remain stable.”

http://www.atimes.com/atimes/Japan/NI11Dh01.html

Ralph: ‘…However, that flow may at some time be reversed: when foreigners make net sales of debt and take their money out of the US.’

How do they ‘take their money out of the US’? They can sell the debt, then someone else has ‘put their money into the US’, or they can buy something in America.

The only issue I can ever foresee with foreign ownership of debt is they all decide to trade it for real goods…that could cause inflation. On the other hand the workers in Detroit (and elsewhere) might be very happy.

When the Fed buys a bond, the private owner of the bond now has cash but no bond. How is that printing money? Or, if we insist on that, should we also call it ‘bond destroying’ since we are just focusing on the private sector?

I am fascinated by QE in the US and UK.

What is to stop all citizens just stopping working and our governments giving every person 1 million US$ or £625k a year. In theory QE could do this and we would import everything we need including foreign labour to do the little work there was left to do.

If anything is too good to be true, you know the rest.

Didn’t some people think that you could give mortgages to people who couldn’t afford the repayments, they thought the worst that could happen was the poor people would sell their houses for more than the outstanding mortgage, the mortgage company would get their funds back and the poor person would have a few thousand $ left. Who could lose

To me, as an average Joe, QE is like the Ponzi / Pyramid schemes, it’s great until the music stops and someone if left holding the parcel(with just a lot of paper in it) with no clothes on, as the tide goes out

Bob Faulkner, UK says:

“What is to stop all citizens just stopping working and our governments giving every person 1 million US$ or £625k a year. In theory QE could do this”

No it couldn’t. As soon as you did that it wouldn’t be QE it would be “printing money & giving it to people & telling them to stop working”, its outside the Definition & rules of QE.

If you want to discuss an economy based on doing nothing but printing money then that’s fine, provide a sensible argument for how such an economy could or couldn’t function but it isn’t QE

Steve K says: When the Fed buys a bond, the private owner of the bond now has cash but no bond. How is that printing money? Or, if we insist on that, should we also call it ‘bond destroying’ since we are just focusing on the private sector?

Excuse my extreme ignorance on this – I am reading Bill’s blog to teach myself about QE. Surely the answer to that question differs whether the money is already in circulation (ie has a physical existence) or is being “created” – physically or not – for the purpose of the transaction.

As someone without any economic knowledge beyond reading the Fin Review and sites like this, the problem that most people have in getting their head around QE is this link between “real” money and an electronic signature. I know we are no longer backed by gold and have “fiat” currency but if you believe in the laws of physics, then the physical volume of money – the amount of it – must have some impact on its downstream relations, otherwise all theories, all observations, are worthless because there is no definable repeatable formula being followed. I know that is a reasonable description of the real world, but maybe the lack of quantifiable total money supply is the reason that actions attempting to influence the economy such as QE are not working. If that makes any sense at all? Thanks.

All this creation of unending money from the Federal Reserve, at the same time creation of money at the private banks for loans, while the plunge protection team PPT dumps money into the US stock exchange each time it goes down appreciably, implies to me the money racket is just a self-funding Ponzi scheme. Which brings us to the question of actually where this money comes from?, it can’t be government that costs money, it can’t be a privately owned bank with very little equity of it’s own, the Fed is supposed to be government, so when loans are made across the country every day what is the backing for the majority of these loans? The answer is if we are to stop playing games is the taxpayer, domestic borrower, and the consumer, the fundamental building blocks of an economy, that is in the real world and not monopoly money. But here begs the question if money has a price (interest) and the fed and government print as much as it wants, why charge at all for such an easily obtained means of exchange of goods and services? why debt at all?