It's Wednesday and I discuss a number of topics today. First, the 'million simulations' that…

There is a class warfare and the workers are not winning

The Politics of Envy – that old chestnut from the neo-liberals – is bandied around every time there is any insinuation that the capitalist system produces distributional outcomes that are not remotely proportional to the effort put into production. Whenever governments challenge the distributional outcomes – for example, propose increasing taxes on the higher income recipients (note I don’t use the word “earners”) there is hell to cry and the defense put up always appeals to the old tags – “socialist class warriors undermining incentive”, “envy”, etc. In the 1980s, when privatisation formed the first wave of the neo-liberal onslaught, we all apparently became “capitalists” or “shareholders”. We were told that it was dinosauric to think in terms of the old class categories – labour and capital. That was just so “yesterday” and we should just get over it and realise that we all had a stake in a system where reduced regulation and oversight would produce unimaginable wealth, even if the first manifestations of this new “incentivised” economy channelled increasing shares of real income to the highest percentiles in the distribution. No worries, “trickle-down” would spread the largesse. We know better now – and increasingly the recognition, exemplified in 2006 by Warren Buffett’s suggestion that “There’s class warfare, all right … but it’s my class, the rich class, that’s making war, and we’re winning” (Source), is that class is alive and well and in prosecuting their demands for higher shares of real income, the elites have not only caused the crisis but are now, in recovery, reinstating the dynamics that will lead to the next crisis. The big changes in policy structures that have to be made to avoid another global crisis are not even remotely on the radar.

I have focused on the distribution shifts characteristic of the neo-liberal period before. Please read my February 2009 blog – The origins of the economic crisis – for an early discussion on this point.

One of the defining characteristics of the neo-liberal period has been the relentless attack on the capacity of the workers to translate productivity growth into real wages growth.

I recently gave a talk in Darwin about this and the working paper to support the presentation is available here – Full employment abandoned: the triumph of ideology over evidence

The deregulation in the labour markets not only created increased job instability and persistently high unemployment but also led to large shifts in national income from wages to profits.

A recent ILO Report written by Englebert Stockhammer – Why have wage shares fallen? A panel analysis of the determinants of functional income distribution – reports similar trends in other advanced OECD nations.

First, the wage share in national income has fallen significantly over the last 35 years in most nations.

Second, in the Anglo nations, “a sharp polarisation of personal income distribution has occurred” (Stockhammer, 2013: 2), with the top percentile and decile of the personal income distribution substantially increasing their total shares. The munificence gained at the expense of lower-income workers manifested, in part, as the excessive executive pay deals that emerged in this period.

Up until the early 1980s, real wages and labour productivity typically moved together. As the attacks on the capacity of workers to secure wage increases intensified, a gap between the two opened and widened. The widening gap between real wages and productivity growth manifested as the rising profit share.

In 1975, the Australian wage share was around 62.5 per cent of factor income. By the end of 2012, it was around 54 per cent. Australian government aided this redistribution in a number of ways: privatisation; outsourcing; harsh industrial relations legislation to reduce union power; National Competition Policy and such.

We know what happened next. Imbued with the, now discredited, efficient markets hypothesis, promoted by University of Chicago economists, policy makers bowed to pressures from the financial sector and introduced widespread financial deregulation and reduced their oversight on the banking sector.

This not only led to a massive expansion of the financial sector, but also, set the stage for the transformation of banks from safe deposit havens to global speculators carrying increasing, and ultimately, unknown risks. The massive redistribution of national income to profits provided the banks and hedge funds with the gambling chips to fuel the rapid expansion of the ‘global financial casino’ expanded.

Increasingly, the Gordon Gekkos strutted the stage as celebrities and were cast as important wealth generators. Private returns were high and the lemming rush unstoppable.

But the reality was different. The vast majority of speculative transactions that occur every day in the financial markets are unproductive, in that they are unrelated to the real economy and advancing our welfare.

A substantial portion of the “wealth” generated was illusory and we subsequently discovered that the socialised losses were enormous as the huge, unregulated gambling casino collapsed under its own hubris, criminality and incompetence.

But the two arenas of deregulation created a new problem – one that Marxists would call a “realisation” problem. The capitalist dilemma was that real wages had to typically grow in line with productivity to ensure that the goods produced were sold.

So how does economic growth sustain itself when labour productivity growth outstrips the growth in capacity to purchase (the real wage)? This was especially significant in the context of the increasing fiscal drag coming from the public surpluses, which squeezed private purchasing power in many nations during the 1990s and beyond.

The neo-liberal period found a new way. The ‘solution” was found in the rise of so-called ‘financial engineering’, which pushed ever increasing debt onto households and firms. The credit expansion not only sustained the workers’ purchasing power but also delivered an interest bonus to capital while real wages growth continued to be suppressed. Households, in particular, were enticed by lower interest rates and the vehement marketing strategies of the financial engineers. It seemed to good to be true and it was.

The increasing private sector indebtedness – both corporate and household – is another marked characteristic of the neo-liberal period.

In Australia it manifested mostly as increasing household indebtedness. The debt to disposable income ratio stood at 69.1 per cent in March 1996 and by September 2008 had risen to a staggering 153.1 per cent.

Governments, their central banks, and so-called financial industry experts played down any sense of alarm during the pre-crisis period claiming that wealth was growing along with the debt. When the debt bubble burst, significant proportions of the ‘wealth’ vanished leaving many borrowers with massive debts but few assets.

At that point, there should have been a “proletarian” revolt – perhaps via our ballot boxes – to demand that governments stopped acting as agents of capital and, instead, moved back to the role they played during the full employment era as mediators in the class conflict.

But the determination of the elites to stay partying has been profound and governments have generally bowed to the pressure and reinforced the policy structure that helped create the crisis.

In the last week, several articles have appeared in different newspapers, which are picking up on this theme. In the Sydney morning Herald, for example, the economic’s editor Ross Gittins’ article (August 28, 2013) – Rich win big with class warfare in session – argued that the view that “the age of ideology is long gone” does not represent “the whole truth”.

He wrote that:

If you think the class war is over, you’re not paying enough attention. The reason the well-off come down so hard on those who use class rhetoric is that they don’t want anyone drawing attention to how the war’s going … The workers are too busy watching telly to notice the ways they’re being got at …

The article was written in the context of the federal election campaign that is now in its last week. The contention was that, while it’s hard to differentiate between the two major parties in terms of economic policy, the fact remains that the conservatives are pursuing their traditional agenda to redistribute national income, with the assistance of the state, to the upper of the distribution.

I will spare you the detail of the specific policies that justify his conclusion. In closing, Ross Gittins says that once the conservatives are re-elected on September 7, the revisions to national policy will ensure that;

The disadvantaged will soon be back at the back of the queue where they belong.

There was also an interesting article some days ago in the UK Guardian (August 20, 2013) – How low can you get: the minimum wage scam – which focused on the plight of minimum wage earners in the US.

The article noted the irony of a nation that “pride itself on its economic leadership” and eulogises itself as the land of the free but then, increasingly, produce minimum-wage jobs that deny the workers access to a living wage, access to basic health care, and a viable retirement pension.

We read that:

… the federal minimum wage keeps an entire class of people trapped in economic servitude, focusing their attention on survival rather than growth, barring their ability to save enough or pay for education that would allow them to rise to the middle class.

The article points out that because of the appalling remuneration of low paid workers in the US, the provision of safety nets in the form of food stamps etc, means:

… that the government is paying to subsidize company profits: as businesses pay a minimum or near-minimum wage, their workers are forced to turn to government programs to make ends meet.

The author says that with the majority of jobs now being created in the US being low-wage, there is a real need to “raise the minimum wage, and benefits, and so reduce government benefit spending”.

Increasing the minimum wage would not only “boost the economy” but will also redistribute real income to those most in need.

The US data is alarming. Over the last month or so, I’ve been examining employment trends and access to benefits in a number of advanced nations. So this sort of discussion is very apposite.

There has been some very interesting work done by the research economists at the Federal reserve bank of San Francisco on employment trends. Some of that work was reported in this Washington Post article (February 28, 2013) – How the recession turned middle-class jobs into low-wage jobs.

A recent article in the FRBSF journal Economic Letters (August 26, 2013) – What’s Behind the Increase in Part-Time Work? – is also interesting.

This article investigates the idea that the rising part time share in total employment in the US “represents a ‘new normal’ in the labor market”.

The following graphs use data available from the – US Bureau of Labour Statistics.

The BLS define two groups of part-time workers (those who work “1 to 34 hours per week”) (Source):

1. Those who are happy to work part-time – part-time for “noneconomic reasons”, which include “include medical conditions, child-care needs, other family or personal obligations, school or training, and retirement”. Economists consider these workers to be voluntarily working part-time hours.

2. Involuntary part-time or part-time for “economic reasons” which “includes persons who indicated that they would like to work full time but were working part time (1 to 34 hours) because of an economic reason, such as their hours were cut back or they were unable to find full-time jobs.”

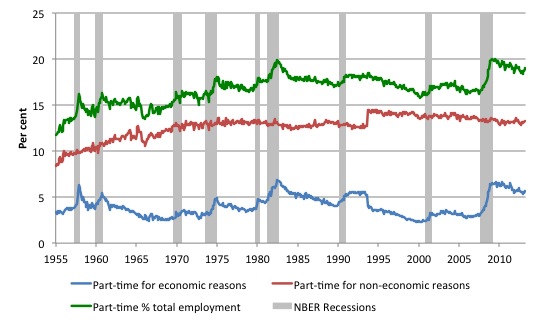

The first graph shows three ratios – that part-time to total employment ratio, the involuntary part-time ratio, and the voluntary part-time ratio – for the period May 1955 to July 2013. The shaded bars denote NBER recession dates.

The pattern is shared by most advanced nations. First, there has been an increasing part-time share in total employment overall. Second, within that steady upward trend there is a visible cycle, during recessions, firms shed full-time jobs and the part-time share rises (generally sharply).

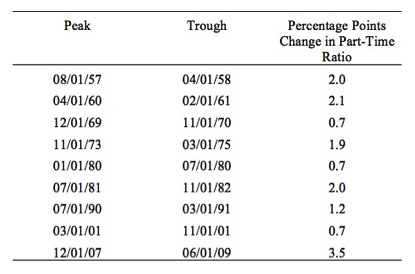

To summarise what was going on during the recessionary periods shown I produced the following table. It shows the percentage point change in the part-time ratio from peak to trough in each of the recessions.

The severity of the 2007-2009 recession is clear enough.

The FRBSF article says that:

Most part-time work is for noneconomic reasons. However, the incidence of this category has been trending down over time. By contrast, part-time work for economic reasons has a substantial cyclical component, rising in recessions and falling in recoveries. The increase in the most recent recession was especially large.

Further, the involuntary part-time employment share has “remained high” and is mostly driven by a lack of hours being offered by the US labour market.

The FRBSF conclude “that general labor market slack remains the key factor keeping part-time employment high”.

There overall conclusion is that while the part-time ratio is trending upwards, the elevated incidence of “part time for economic reasons reflects a slow recovery of the jobs lost during the recession rather than permanent changes in the proportion of part-time jobs”.

The distributional consequences of this drawn out “recovery” are significant.

The Guardian article draws attention to the US Bureau of Labor Statistics – Employee Benefits Survey – which provides detailed breakdowns “on the incidence (the percentage of workers with access to and participation in employer provided benefit plans) and provisions of selected employee benefit plans”.

The most recent recent – Employee Benefits in the United States – March 2013 – (July 17, 2013) paints an ugly picture.

It shows that:

Employer-provided medical care was available to 85 percent of full-time private industry workers in the United States in March 2013 … By contrast, only 24 percent of part-time workers had medical care benefits available …

Retirement benefits followed a similar pattern as medical care benefits. In private industry, 74 percent of full-time workers had access to a retirement plan, significantly higher than 37 percent of part-time workers.

But if you dig further, you will see how stacked the odds are against the low-paid part-time workers, which are an increasing proportion of the total part-time employment pool in the US.

The data tells us that the elite workers, many of who would be described (in old/new class warfare terminology) as occupying a “contradictory class location”, are doing well enough.

But at the other end of the spectrum – nothing good can be seen. And it has been getting worse.

The BLS report that:

1. “In private industry, 64 percent of employees had access to retirement benefits, significantly less than the 89 percent of state and local government employees with access” but “only 49 percent of private industry employees actually participated in a retirement plan”.

2. “retirement and medical care benefits were offered to 99 percent of state and local government workers while only 74 percent of full-time employees in private industry had access to retirement benefits and 85 percent to medical care coverage”.

3. “For private industry employees in the lowest 10 percent of average earnings, employers paid 71 percent of the single coverage medical plan premium. For employees in the highest 10 percent of average earnings, the employer share of the premium was 81 percent”.

4. “Paid holidays were available to 97 percent of management, business, and financial employees in private industry. In contrast, only 53 percent of service employees in private industry were provided paid holidays”.

If we breakdown those aggregates a bit more we find that:

For private-sector workers in the lowest 10 per cent in the average wage distribution, on 28 per cent had access to retirement benefits but only 10 per cent actually took them up.

By contrast, for private-sector workers in the highest 10 per cent, 87 per cent had access and 78 per cent participated.

In terms of medical care benefits, 20 per cent of the lowest 10 per cent in the wage distribution had access and only 10 per cent participated. This is compared to 94 per cent of the top 10 per cent cohort having access and 74 per cent taking the benefits up.

The UK Guardian article summarises the data in this way:

The latest Bureau of Labor Statistics employee benefit survey illuminates how minimum-wage workers make just enough money to survive, but nothing more. Just over a tenth of low-paid workers participated in any kind of healthcare benefits, for instance, and roughly the same amount had life insurance or participated in any kind of retirement plan. One-fifth took sick leave, and only 39% took any kind of vacation.

It’s also more expensive to be poor than it is to be middle-class or rich. If low-wage workers do want to have healthcare, they pay more, relative to their salaries, for medical care premiums.

And when the US President put forth the Obamacare package to reduce some of this inequity, you can recall the scream from the elites.

Conclusion

The public debate about deficits has been dominated by futuristic predictions that the US (and other nations) will run out of money because of the increasing demands on the health and pension systems as a result of the ageing society.

The US federal government, like all currency issuers, does no face a financial constraint on its ability to spend in US dollars.

In meeting the future demand for pensions and health care, it faces a different constraint – the availability of real resources.

As long as there are real resources available, the US federal government will be able to buy them for use in the future. There will never be a financial constraint stopping this. The question about what will be made available in the future and to whom, assuming there are real resources, is a political one and will be resolved accordingly.

But the availability of real resources in the future depends crucially on what happens today.

First, deficit spending now is crucial to create full employment and to fund our educational institutions properly so that productivity growth is not undermined and few workers in the future will be able to produce more environmentally-sustainable output to cope with the rising dependency ratios.

Second, forcing an increasing number of workers into financial oblivion now is not the way to develop a highly productive future workforce.

The trends in the recent decades where the elites have pocketed higher shares of real income are not sustainable. Nothing productive comes from that.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

Dear Bill

You wrote that private indebtedness in Australia went up from 69.1% to 153.1% of household income since 1996. Surely, only part of this can be explained by labor’s falling share of income. Probably, the main causes are the lower interest rates and the much larger number of consumer goods available.

Regards. James

Isn’t this analogous to Organ War, where the brain has placed a tourniquet around the neck, and the body is losing? 🙁

Do the suicidal have an exit strategy?

I don’t believe a proletarian revolt at the ballot boxes would solve anything yet. From what I can see in my corner of the world, even Liberals and New Democrats (former socialists who have recently dropped the word socialism from their mission statement) have historically supported policy pulled directly from the Neo liberal play book. Politicians jump ship from one party, and join another fairly regularly these days, adding to the confusion of voters , with ever increasing voter apathy as a result.

The Green’s seem to have placed participatory democracy into their mission, and I think this is a crucial step moving forward for economic policy reform as well as the environment. In Canada we have an unelected Senate which may be reformed or abolished soon because of corruption.

This would be a good opportunity for adding increased citizen participation in government. I think if we can replace unelected senators with a citizen or two from each province, drawn from a jury like pool at random, who evaluate a single piece of legislation while essentially sequestered, and provided access to research tools, academic inputs etc, we would have a good chance of restoring balance.

I don’t think there is much doubt in voters minds that representative democracy has largely failed. Democratic reform is a much easier thing to communicate an need for at election time than the complexities of the Neo Liberal illusion, because people are already thinking this way. Participatory democracy might well be an easier first battle to fight.

A CEO, a union worker and a tea-partier sit down at a table and a dozen donuts is placed before them. The CEO eats 11, turns to the tea-partier and says ‘watch out, that union guy is going to eat your donut’.

Unfortunately this has been working very well.

The perception of money itself being “wealth,” is the illusion, that Neo Liberals, financial engineers and their historical likenesses have nurtured and maintained. Nothing in the real world, magically increases in real value with the passage of time, when physically capable of doing nothing on it’s own, as we are led to believe money is.

A better understanding of real wealth and it’s historical mis appropriation, is urgently needed.

“..financial industry experts played down any sense of alarm during the pre-crisis period claiming that wealth was growing along with the debt.”

They are only correct to the extent that when an economy relies on “credit-money” for growth, assets do indeed rise alongside liabilities. Though system-wide there are no new net-assets unless the government runs a budget deficit.

I see on the chart of part-time employment that there is a substantial jump around 1994 of the percentage of workers who are part-time for non-economic reasons. What happened here? Perhaps this is a result of a change in sampling methodology? I cannot think of a historical event that may have caused such a shift.

Joel

In my comment at 0:25, I should say apparent abuses rather than corruption. There is a bit of scandal going on regarding some senators locations of residence and travel expenses claims. The demands for reform or abolition have been made at one time or another by various parties mainly because of the unelected aspect of senate seats having the ability to reject legislation drafted by an elected government.

“You wrote that private indebtedness in Australia went up from 69.1% to 153.1% of household income since 1996. Surely, only part of this can be explained by labor’s falling share of income. Probably, the main causes are the lower interest rates and the much larger number of consumer goods available. ”

Even by Neo_liberal standards this is one of the most ridiculous comments I have read.

We have a current account in deficit due to the net income component, and we also have governments hell bent on producing budget surpluses.

Given the state of the external account and the desired budgetary position of the government to be that of a surplus – the only possible outcome is that it is impossible for the non-government sector to spend less than they earn.

No tricks, no ideological bullshit here – it’s a cold hard fact because the national accounting identities do not lie.

Colin Crouch on ‘Post-Democracy:

“Democracy thrives when there are major opportunities for the mass of ordinary

people actively to participate, through discussion and autonomous organisations, in

shaping the agenda of public life, and when these opportunities are being actively used

by them. This is ambitious in expecting very large numbers of people to participate

actively in serious political discussion and in framing the agenda, rather than be the

passive respondents to opinion polls, and to be knowledgeably engaged in following

political events and issues. This is an ideal model which can almost never be fully

achieved, but like all impossible ideals it sets a marker. It is always valuable and

intensely practical to consider where our conduct stands in relation to an ideal, since in

that way we can try to improve. It is essential to take this approach to democracy rather

than the more common one, which is to scale down definitions of the ideal so that they

conform to what we easily achieve. That way lies complacency, self-congratulation, and

an absence of concern to identify ways in which democracy is being weakened.

The issue becomes more intriguing when we confront the ambitious ideal, not

with the simple minimal model of the existence of more or less free and fair elections,

but with what I have in mind as post-democracy. Under this model, while elections

certainly exist and can change governments, public electoral debate is a tightly

controlled spectacle, managed by rival teams of professionals expert in the techniques

of persuasion, and considering a small range of issues selected by those teams. The

mass of citizens plays a passive, quiescent, even apathetic part, responding only to the

signals given them. Behind this spectacle of the electoral game politics is really shaped

in private by interaction between elected governments and elites which overwhelmingly

represent business interests.”

Source: http://www.fabians.org.uk/wp-content/uploads/2012/07/Post-Democracy.pdf

I think this is a misleading view of the situation.

One must look further back me thinks.

To the time when the capitalistic system went into overdrive via the rejection of catholic consumption patterns via Protestant frugality which created so called capital growth….

To Cromwell and the lads………..

What exactly happened to the Royalist land owning class ……they lost their land rights baby.

The state seized their assets.

But eventually they were given the right to buy back their lands – but there was a catch , they had no money.

They had to get a mortgage.

To pay exponential debt you must screw over your vassals……………cue the modern world.

The land owning class has been in a junior position since the treaty of Westphalia ….the banks reward their dumb but loyal Roundheads (banking assets) until they cannot.

We are in this position today.

Just to clarify the rise of western labour productivity is a result of the banking and trade system scaling up……the western workers do not do much of anything , they merely recycle external surplus capacity………..the domestic economies of the west no longer exist.

This is the modern service economy of almost zero local primary Industrial capacity.

If these workers were rewarded for their work the global credit system would jam up as it is not based on the village , market town , Provincial city or even state capital economic hinterland..

Its the ultimate catch 22.

We are all Kevin now , spinning around doing utterly pointless jobs.

http://www.youtube.com/watch?v=iiIOaXJZIS4&list=PLk-DKynzPrkJjYC7e6DOsW8UZgirh8qWe

Starts at 5.00