It's Wednesday and I discuss a number of topics today. First, the 'million simulations' that…

GOP reps – if they had another brain it would be lonely

I have been watching in my spare time (yes) the 2010 first season of the HBO series – The Newsroom – which could be about events in US this week, so persistent has been the moronic behaviour that nations’ polity. There is growing evidence that the US Republicans are now an extremist party with a substantially tenuous grip on reality. They clearly do not understand that an economic depression is likely to follow their refusal to prevent the US Treasury to continue spending according to the current laws that the US Congress passed and which, together with the tax code, determine the current deficit. They clearly do not understand how deficits arise and the function they serve. The US might hold themselves out to be the world leaders in a range of areas but this debate is revealing how stupid the government representatives have become.

Before we start, there was a hilarious segment in Episode Three between the anchor and two starry-eyed Tea Party advocates, which explored where the Tea Party was getting its funding from, given they were representing themselves as a grass-roots swell of ordinary folks determined to regain their freedom from a despotic government.

At one point the two TPs were whether they had heard about Koch Industries. One of the starry-eyed tea partier replied: “Are you talking about Coca Cola?”.

Here is the little 2:16 segment.

When Ronald Reagan announced in his – First Inaugural Address – (at 5:55) that:

… we, as Americans, have the capacity now as we have had in the past – to do what whatever needs to be done – to preserve this last and greatest bastion of freedom. In this present crisis, government is not the solution to our problem; government is the problem

– it was time to squirm and we thought the worst of the free market ideologues had just taken over the largest economy in the world.

But as the 2012 book by Thomas E. Mann and Norman J. Ornstein – It’s Even Worse Than It Looks: How the American Constitutional System Collided With The New Politics of Extremism – tells us, Reagan at least believed in a government.

Their book catalogues how the Republican Party in the US has been taken over by fanatics, out on the fringe of American politics, which leads them to behave in the US Congress in a way that is:

… ideologically polarized, internally unified, vehemently oppositional … [and they are now] … more loyal to party than to country … [with the result that] … the political system has become grievously hobbled at a time when the country faces unusually serious problems and grave threats … The country is squandering its economic future and putting itself at risk because of an inability to govern effectively.

The authors wrote an Op Ed (April 28, 2012) –

Let’s just say it: The Republicans are the problem – to coincide with the publication of their book.

They write that:

The GOP has become an insurgent outlier in American politics. It is ideologically extreme; scornful of compromise; unmoved by conventional understanding of facts, evidence and science; and dismissive of the legitimacy of its political opposition.

When one party moves this far from the mainstream, it makes it nearly impossible for the political system to deal constructively with the country’s challenges.

Now, unlike the script writer for The Newsroom, Mann and Ornstein can hardly be cast as progressives. One works for the Brookings Institution and the other the American Enterprise Institute.

The article provides good examples of the extremism in the Republican Party (in case you have not read their book). For example, the recently ousted Florida Republican representative (Allen West) who claimed that there are “78 to 81” Democrats in Congress who are members of the Communist Party.

Cry your eyes out – these bozos not only consume oxygen but they get into the US Congress.

They document the shift to the right of both major US political parties but conclude that:

While the Democrats may have moved from their 40-yard line to their 25, the Republicans have gone from their 40 to somewhere behind their goal post.

You can read the book if you are interested in their explanation for how this shift to fanatical extremism has occurred but the overwhelming conclusion is that “thanks to the GOP, compromise has gone out the window in Washington” and “gridlock” is the norm.

The Voteview analysis of political shifts in the US provides data on the – The Polarization of the Congressional Parties.

The analysis shows that “polarization is now at a post-Reconstruction high in the House and Senate” and “Voting in Congress is now almost purely one-dimensional” – the “primary dimension is the basic issue of the role of the government in the economy”.

Polarisation “has been increasing steadily over the past 25 years” and “the percentage of moderate Representatives and Senators continues to plummet”.

I read an interesting psychology paper last week that bears on this issue. The paper – Motivated Numeracy and Enlightened Self-Government – demonstrates how political ideology can destroy basic reasoning capacity and leads to irrational polarisation.

[Reference: Kahan, Dan M. and Peters, Ellen and Dawson, Erica Cantrell and Slovic, Paul, Motivated Numeracy and Enlightened Self-Government (September 3, 2013). Available at SSRN: http://ssrn.com/abstract=2319992 or http://dx.doi.org/10.2139/ssrn.2319992]

The paper tells us that “(c)ollective welfare demands empirically informed collective action”.

The authors acknowledge that “(e)ven after the basic facts have been established, what to do will involve judgments of value that will vary across citizens who hold competing understandings of the pub- lic good”.

They source political conflict in “deficits in the public’s capacity to comprehend scientific evidence” which means that:

Ordinary citizens are thus liable to misunderstand what scientists are telling them and vulnerable to being misled by those trying to deceive them for private advantage.

I am working on a joint paper (to be presented in December) on how the public is mislead about essential propositions about Modern Monetary Theory (MMT) – more about which later (when the paper is finished).

But they also identify another reason for controversy, which they term the “Identity- protective Cognition Thesis” (ICT):

ICT sees the public’s otherwise intact capacity to comprehend decision-relevant science as disabled by cultural and political conflict.

So, otherwise smart people (numerically competent) will fail a basic numerical problem presented to them if the correct answer violates their underlying political ideology. That is the ITC!

They expose the presence of ICT using two examples.

1. They note that “in the absence of divisive cultural conflict, citizens of all levels of science comprehension generally form positions consistent with the best available evidence” and the more competent one is (in terms of scientific capacity) the more likely a “better science-informed” decision will be made. They use examples such as “the utility of antibiotics in treating bacterial infections” which is not a source of public polarisation in the US.

2. But if “a policy-relevant fact does become suffused with culturally divisive meanings, the pressure to form group-congruent beliefs will often dominate whatever incentives individuals have to “get the right answer” from an empirical standpoint”. For example, discussions about climate change, nuclear waste disposal, “the financing of economic stimulus programs” etc.

They study 1,111 people who were asked to disclose their political perspectives and were assessed for their numerical capacities (ability to understand numbers, etc).

They were presented with the results of a made-up scientific study but the same data was presented to the participants in different ways:

1. The study data was purported to be showing how effective a new skin cream was for treating rashes.

2. The study data was purported to be showing how effective a gun control law was which banned people from carrying concealed handguns in public.

They also assigned the respondents to two results for each of the examples, which just reversed the conclusion.

So in one case, the data showed that the rash for 223 patients who used the new cream got worse and 75 got better, whereas another set of data showed that 223 got better and 75 worse. The results were also switched for the gun control example.

A deviously brilliant research design!

They found that:

1. The more numerate respondents were able to more readily supply the correct interpretation of the skin cream data irrespective of the way it was presented.

2. In the case of gun control, the impact of numeracy was different. For the crime increases case, the impact was “minimal” whereas in the case of crime decreases, numeracy was associated with a higher proportion of correct answers. So the study established, initially that something was different in the gun control case.

3. Then they examined political outlooks. There was “no meaningful variation among ‘Liberal Democrats’ (subjects scoring below the mean on Conserv_Repub) and ‘Conservative Republicans’ (ones scoring above the mean) in the skin-rash conditions”. Again, numeracy was associated with the capacity to interpret the data correctly.

4. But the gun control example flushed out the differences:

Liberal Democrats become increasingly likely to correctly identify the result supported by the data as they become more numerate in the “crime decreases” condition; but increasing Numeracy had minimal impact for Liberal Democrats in the “crime increases” condition. Among Conservative Republicans, the pattern was inverted: the impact of higher Numeracy on subjects’ ability to supply the correct answer was substantially larger in the “crime increases “condition than in the “crime decreases” one.

In other words, political polarisation does not fall among those with well developed “scientific skills”. In fact, the polarisation in interpreting the evidence was “was greatest among subjects highest in Numeracy”.

That is, the issues in Washington right now are not just about dumb Tea Party stooges like those in the video above.

Chris Mooney explains in his article – Science confirms: Politics wrecks your ability to do math – that:

If the wrong answer is contrary to their ideological positions, we hypothesize that that is going to create the incentive to scrutinize that information and figure out another way to understand it … In other words, more numerate people perform better when identifying study results that support their views – but may have a big blind spot when it comes to identifying results that undermine those views.

What’s happening when highly numerate liberals and conservatives actually get it wrong? Either they’re intuiting an incorrect answer that is politically convenient and feels right to them, leading them to inquire no further – or else they’re stopping to calculate the correct answer, but then refusing to accept it and coming up with some elaborate reason why 1 + 1 doesn’t equal 2 in this particular instance.

I have noted it before but when I was an economics student, one professor announced that “if the facts are inconsistent with the theory then the facts are wrong” (straight-faced delivery at the time).

I think this sort of research helps us understand what is going on at present. The stand-off in the US Congress is just plain stupid. The economic consequences are unclear but will be damaging.

The current closure will eventually impact on aggregate demand and slow the economy somewhat. But the failure to lift the debt-ceiling if it occurs will be very serious.

I have previously considered that the Republicans just bluff about these matters. But the more we learn about the fanaticism within that Party and the results from studies I have just discussed the more one might reasonably form the view that these crazies are incapable of realising the damage they will cause.

They are operating in a different universe to the rest of us.

I note that major thrust of the attempts to assess the dangers of a failure to lift the debt-ceiling are are expressed in terms of the financial impacts.

The US Treasury Department just put out a briefing document – The Potential Macroeconomic Effect of Debt Ceiling Brinksmanship – which talks about:

1. Household and Business confidence being eroded – ultimately a negative for aggregate demand.

2. Financial market effects – drop in wealth impacting on aggregate demand.

3. Share market effects – collapsing prices impacting on corporate funding.

4. Corporate bond market effects – rising spreads and increasing costs of funds.

5. Mortgage market effects – likely higher rates due to increasing credit risk.

They conclude that it is likely that there will be:

a large, adverse,and persistent financial shock like the one that began in late 2011 would result in a slower economy with less hiring and a higher unemployment rate than would otherwise be the case … In the event that a debt limit impasse were to lead to a default, it could have a catastrophic effect on not just financial markets but also on job creation, consumer spending and economic growth-with many private-sector analysts believing that it would lead to events of the magnitude of late 2008 or worse, and the result then was a recession more severe than any seen since the Great Depression. Considering the experience of countries around that world that have defaulted on their debt, not only might the economic consequences of default be profound, those consequences, including high interest rates, reduced investment, higher debt payments, and slow economic growth, could last for more than a generation.

However, the bias in the discussions relating to what these “catastrophic effects” might be are towards “financial impacts”.

The most simple calculations are being ignored.

In 2012, the US Federal government deficit was equal to $US1,086,963 million (US Office of Management and Budget).

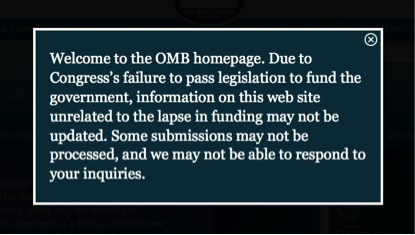

When I went there to get the latest data today I was confronted with this warning:

Yes, its true. The Republicans are stupid!

In the Mid-Session Review (MSR) which was sent by the OMB to the Speaker of the US House of Representatives John A. Boehner (aka Bonehead) on July 8, 2013, we learn that the projected 2013 deficit is projected to be $US759 billion dollars or 4.7 per cent of GDP.

You can get more information on the timing of interest payments on the outstanding debt etc from the – Bureau of Fiscal Service. The tax data

The US Congressional Budget Office provides some information – Federal Debt and the Statutory Limit, September 2013 – which allows you to assess the scale of not being able to issue any increased debt if the idiots reign supreme.

We learn that the ceiling was reached in May but that the US Treasury has been employing a “well-established toolbox of so-called extraordinary measures that allow it to borrow additional funds without breaching the debt ceiling”. These measures will be exhausted on October 17, 2013. The remaining cash will run out somewhere between October 22 and October 31.

The reality that many people do not understand is that the deficit is a flow of net spending – every day of the year. Under current institutional arrangements, the change in public debt depends on the “on the size of the cash shortfall during that period and on the magnitude of transactions between the Treasury and other parts of the federal government”.

The CBO attempt to itemise these flows and transactions.

They note that Treasury bills are issued each Thursday (recent auctions between $US85-135 billion), Treasury notes on the 15th (around $US55 billion) and last day of each month (around $US117 billion) and Treasury bonds in the middle of each month ($US7-9 billion).

The consequences of not raising the debt ceiling will be that:

… the Treasury will not be authorized to issue additional debt that increases the amount outstanding. (It will be able to issue additional debt only in amounts equal to maturing debt.) That restriction would severely strain the Treasury’s ability to manage its cash and could lead to delays of payments for government activities and possibly to a default on the government’s debt obligations.

You might also like to read this report – Delays Create Debt Management Challenges and Increase Uncertainty in the Treasury Market – published in 2011 by the US Government Accountability Office.

It tells us that:

The debt limit does not control or limit the ability of the federal government to run deficits or incur obligations. Rather, it is a limit on the ability to pay obligations already incurred … Delays in raising the debt limit create debt and cash management challenges for the Treasury …

The problem that is not well understood is that the deficit reflects the law of the US which the Congress enacts. So the deficit today is the product of “previously enacted tax and spending policies”.

The reality is that if the debt limit was not lifted, the US government would have to move towards a balanced budget almost immediately. What do you think the impact of a 4.7 per cent of GDP fiscal retrenchment would be, irrespective of the complexity of changing the required laws to allow the government to do that?

Answer, a depression in 2014.

The problem would get worse because tax revenue, which currently might cover around 60-70 per cent of government spending in 2013, would also collapse. So the fiscal retrenchment required would be significantly higher than the current deficit to GDP ratio.

Spending equals income. The crazies in the Republican party seem oblivious to that most basic fact. They talk as if the budget outcome is divorced from the creation of jobs and income in the US. That level of denial is just plain dangerous.

Let’s also clear another matter up. This whole episode has nothing to do with the financial capacity of the US government to always honour every liability denominated in US dollars. That is intrinsic to its currency-issuing capacity.

The Chinese don’t issue US dollars – only the US government.

This debate is rather about the political willingness of those who form the US government to honour its financial obligations. That is an entirely different level of discussion and focus.

If the US government was forced by its dysfunctional political apparatus to default on any of the US-currency denominated liabilities in the problem lies in the polity not with the fiat monetary system.

Here is another problem that we should clear up too.

It is obvious that if the government establishes some policy benchmark expressed in terms of real GDP or employment (for example, the real GDP will equal potential GDP thus ensuring full employment), then the budget outcome will reflect the spending and saving decisions of the private domestic sector and the net external position of economy.

For example, if at the full employment output level, the private domestic sector was saving overall equivalent to 2 per cent of GDP and the current account was in deficit equivalent to 2 per cent of GDP, then the budget deficit will be 4 per cent of GDP. That has to be the case.

The government deficit is required to fund the net spending withdrawals from the domestic economy by the other sectors.

Now, if the external sector went further into deficit (say 5 per cent of GDP) and the private domestic sector maintained a 2 per cent of GDP overall surplus, for GDP to remain unchanged (at the benchmark level), the budget deficit would have to rise to 7 per cent of GDP.

Now ask yourself, does this mean the Government is bigger in the second case? The answer is – not necessarily.

A 2 per cent deficit can occur if the government is spending 30 per cent of GDP and taxing 28 per cent of GDP, just as it can arise from a government that is spending 5 per cent of GDP and taxing 3 per cent.

So you always have to separate the understanding of what is the appropriate size of the government’s net spending position (deficit/surplus), which is a technical issue (once the benchmark is set), from the value-laded issue of how big the government should be.

The conservatives fail on this every time as do most progressives.

Conclusion

It is increasingly clear that the Republican politicians in the US Congress do not have the capacity to understand the consequences of their actions. That level of stupidity means they do not reason in the way that we would expect responsible politicians to operate.

Whatever else occurs, if they do not allow the US government to keep spending, there will be an almighty economic downturn.

And China? – they will increase their deficit to divert spending from a falling export market to its domestic market and merrily keep growing.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

Dear Bill

looking forward to your co-authored paper! Will you be enlisting the critical eloquence of Warren Mosler?

warm regards

Em

According to this ‘article’, there has already been a large tightening of fiscal policy?

“It would be splendid if the US were able to shake off the biggest fiscal squeeze since post-Korea demobilisation in the 1950s.”

http://blogs.telegraph.co.uk/finance/ambroseevans-pritchard/100025218/can-the-world-cope-with-a-trigger-happy-fed/

Emily you mean like :

Good luck to us, mates.

The USS Stupidity is going down

Wait until Saturday when the right wing truckers ride into DC and arrest the liberal members of Congress. It should be interesting.

At the penultimate minute couldn’t the Fed announce that a default would blow up its dual mandate and therefore it will forgive 1-2 trillion of debt on its books and continue to buy and extinguish enough newly issued Treasury debt to balance legislated spending and taxation? No doubt all sorts of ill-advised bipartisan legislation would immediately ensue and Bernanke and Yellen would go into protective custody, but the giant lesson in fiat currency would be out there for all time and debt : GDP would be solved to the consternation of many. It would be a suicide mission for Bernanke and the Fed itself, but that’s what patriots do. Viva la Fed!

Cup cakes….crumbly candy bars….

http://www.youtube.com/watch?v=s2n87YKSjrA

Thanks for the reminder – had forgotten about that sketch.

Conservatives can argue that their POV is as scientifically valid as liberals, as long as they have “expert” economists to back them up:

“Americans would be nuts to want Congress to lift the debt ceiling so that the Washington establishment can continue profligate policies that will eventually bankrupt the nation.”

http://www.foxnews.com/opinion/2013/10/08/house-republicans-may-be-countrys-last-hope-to-avoid-financial-ruin/

It’s hard to say whether the GOP is influenced by these characters and their malicious rhetoric, or they’ve specifically enlisted them to build support for their intended dismantling of the economy. Either way the spin doctoring is disheartening to watch–it seems designed to confuse the public, and from my observation point it has partly succeeded, at least on the unsuspecting public who haven’t developed a sufficient BS detector.

It is sad to see the Grand Old Party of Abe Lincoln reduced to the current level.The American political system literally stinks. There are so many areas,administrative and constitutional, that need reform it would be hard to know where to start.Is there a will to do this?

Here in Australia we also have the odd problem or three.Because of wheeling and dealing in Senate voting preferences we now have some really weird Senators in waiting from “microparties”. Clive Palmer and his acolytes have snagged 3 Senate seats with another microsenator possibly coming along for the ride.

Palmer himself may still scrape in for the House of Reps seat,Fairfax. All I can say is that there must be a higher than normal number of twits on the electoral roll on the Sunny Coast.

Palmer is a Victorian turned Queenslander and a paid up member of the White Shoe Brigade. That is,he made his early squillions from real estate development.In short- a member of the rentier class.

Well,it should be an interesting next 3 years but only for connoisseurs of clusterfucks.

Whats the difference between Tea-party republikans and european Socialdemocrats in economics, they booth want austuerity, balanced or surplus budgets no matter what.

The Age of Enlightenment is now all over. The dark ages is here.

Papal catholic rule with inquisition and witch burning seems as an rational alternative. At least in that rule everybody did have a God given right to exist, albeit in thiere given place. In the neoliberal madness you don’t have any given right to exist if ain’t economic viable.

Bill:

We have not yet seen the final act of this macabre production. Right now we are waiting for President Obama to declare the “debt ceiling” to be un-Constitutional (he can do it, see the recent NY Times article from Sean Wilentz on 2013-1007). Yes, it is in violation of the 14th Amendment because somehow it can cancel out a debt lawfully incurred from prior appropriations. But will he actually have the stones to do it? It would once and for all end these biennial circuses. Of course the TEA folks will scream about tyranny and dictatorships but they are actually a small minority and this would show us just how small they are.

Where I live, you hear some of the more wild-eyed types speak of a second Civil War and armed resistance – to what? If it ever came to that, this might be a way of removing some of the more seditious among us – and then just maybe, we could see that all of this “profligate” spending is actually necessary to keep our economy going and keep people working. The Murdoch and Koch empires will shriek their little heads off, but it’s high time to call their bluff.

In the U.S. we refer to Mr. Boehner as Mr. Boner, or just Orange John.

john,

My reading of the law indicates the Fed is not authorized to to simply forgive the securities on its balance sheet as this would effectively be direct funding of the Treasury. It can hold them until maturity, however.

The TP neo-confederates cannot rule, however, they can subvert the Federal government. It really is the rise of the Confederacy-Redux — the parallels are frightening.

If they cannot get their way, they will destroy the status quo and claim victory.

Maybe it’s time to bring back the trillion dollar coins!

“It can hold them until maturity, however.”

And beyond. And buy up matured Treasuries that have not been paid off yet.

There are radical solutions and they really would serve to (finally) inform the debate. But asking President Obama to do something like that is like asking a pig to fly.

Obama is to the right of where Republicans used to be (as odd as this may sound Richard Nixon would be a communist in the eyes of the ‘Tea Party’. In any case, do not look for courage or boldness on the part of President Obama. That was clear less than a year after he was first inaugurated as President.

Ben,

But the fed could hold debt to maturity in 7 days or 30 years and then rip it up? Just ripping up one tranche of the shortest term would be a lesson for all time. And in one stroke it would stroke out a lot of tea terrorists.

Steve,

That’s exactly the problem. The debate is not informed by the facts in general, and in the case of a currency issuer’s role in an economy, almost nowhere in the political spectrum. There must be a long german word for somebody who knows what they know.

Think we’re stupid, eh?

Right now I’m in cash earning -2.0% real. But I’m looking for 3% risk free, real. And we’ll get it if the government defaults.

I hated TARP. I hated Dick Fuld. I hated Jimmie Cayne. They should have gone to jail. Maybe JPMorgan-Chase will blow up this time, and we can send Jamie Dimon to jail. (Hey; if Martha Stewart can go to jail, why can’t Jamie Dimon?)

So there’ll be a recession. Big deal. I’ve weathered them in the past and I’ll weather the next one. All those guys borrowing up the wazoo at cheapo 4% will crash, and we’ll be there to pick up the pieces.

And just so you don’t think I’m one of those “I got mine; you get yours” kind of guys, it took me years to build up my business, and I didn’t get any help from the New York Fed. I’ll be here when Gordon Gecko and Timmie Geithner are just a dim memory.

Obama? That Wall Street shill? I’m just hoping he sticks to his guns. Then again, he’s such a wimp, who knows.

With regards to ICT etc, this seems to agree strongly with the work of Bob Altemeyer on authoritarianism. http://home.cc.umanitoba.ca/~altemey/