I have received several E-mails over the last few weeks that suggest that the economics…

Living in the Land of Smoke and Mirrors – aka La-La-Land

Australians have a history of being prone to a syndrome, which social anthropologists refer to as – cultural cringe. It’s a very nasty condition an “internalised inferiority complex which causes people in a country to dismiss their own culture as inferior to the cultures of other countries”. Not very attractive. Some might say it is a “fundamental element of Australian self-identity”. I don’t intend to write about that though – just observe that it exists and explains why scores of Australians have to “go overseas” and then come back again before recognition is forthcoming (for example, do PhD programs abroad when there is no evidence that they are better). Anyway, this syndrome revealed itself again this week when our politicians clearly felt they were being too sane and so decided to follow the lunacy of the politicians in the US and beat up our own little debt ceiling crisis. It just confirms that we are all living in the Land of Smoke and Mirrors and the Martians are embarrassed for us.

The term entered the lexicon in 1950, when Melbourne writer – A.A. Phillips – published his four-page article – The Cultural Cringe – in the Australian literary periodical Meanjin.

[Reference: Phillips, Arthur. The Cultural Cringe [online]. Meanjin, Vol. 9, No. 4, Summer 1950: 299-302 – http://search.informit.com.au/fullText;dn=692761906212773;res=IELLCC – link if you have access to the Informat Database through your institutions library]

Phillips began thus:

The Australian Broadcasting Commission has a Sunday programme, designed to cajole a mild Sabbatarian bestirment of the wits, called ‘Incognito’. Paired musical performances are broadcast, one by an Australian, one by an overseas executant, but with the names and nationalities withheld until the end of the programme. The listener is supposed to guess which is the Australian and which the alien performer. The idea is that quite often he guesses wrong or gives it up because, strange to say, the local lad proves to be no worse than the foreigner. This unexpected discovery is intended to inspire a nice glow of patriotic satisfaction.

The point is that Phillips considered that we were deeply biased against accepting our own artists, musicians, performers and writers as being of equal skill to those of, principally, the old “homecountry”. The deep colonial oppression penetrated our way of seeing ourselves.

The public were continually being bombarded with stuff from Britain (and later the US) which led Phillips to conclude that “(t)he Numbers are against us, and an inevitable quantitation inferiority easy looks like a qualitative weakness …”

He also identified two manifestations of the syndrome:

Such a situation almost in every two bleep produces the characteristic Australian Cultural Cringe – appearing either as the Cringe Direct, or as the Creams’ in the attitude of the Blatant Blatherskite, the God’s-Own-Country and I’m-a-better-man-than-you-are Australian Bore.

What is this got to do with anything? Come in Joe Hockey, Australia’s brand-new federal treasurer (as of the September federal election). And come in our debt ceiling!

He is looking like he is the schizoid embodiment of both aspects of the syndrome.

This mysterious ceiling made it to the headlines this week after staying submerged in one-line Reuters press releases in the past, whenever the relevant legislation was amended.

This is the legislation that covers the “debt ceiling” – Commonwealth Inscribed Stock Act 1911. A related piece of legislation is the – Loans Securities Act 1919

The first defines the authority to borrow. Section 5 of the Act outlines the “Limit on stock and securities on issue” and the most recently amended version of the bill (Amended to take effect on November 18, 2012) – (Section 5(1)) says “The total face value of stock and securities on issue under this Act and the Loans Securities Act 1919 at any time must not exceed $300 billion”.

Section 5 was amended in 1915 (a minor word change) and then repealed in a 1963 Amendment (No 18 of the Bill), when discussion in Hansard was all about making it easier for Australians to invest small amounts in Commonwealth Government Securities (CGS).

Then – as far as I can tell the – Commonwealth Securities and Investment Legislation Amendment Bill 2008 – added back Section 5 to the 1911 Act.

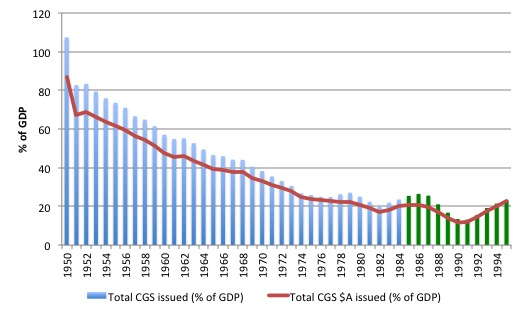

Before we go to the Treasurer, here is the data. The first graph uses historical data from the RBA – Table 2.19: Commonwealth Government Securities on Issue – and shows the total amount of CGS issued from 1950 to 1995 as a percentage of GDP.

The blue (then green) bars are the Total and the red line is the total CGS that were issued in $A. The federal government used to issue foreign currency debt but stopped doing that in the late 1980s. The green bars coincide with the period after the final abandonment of the fixed exchange rate system.

Australia took some years to catch up with the US suspension of convertibility in August 1971, which effectively marked the end of the fixed exchange rate system set down in the Bretton Woods agreement. Out cultural cringe worked in this respect to try to hang onto the old system – via a series of pegged, crawling pegs etc arrangements.

Eventually, we realised that the floating currency was the best option, given that it maximises the permissible fiscal space for a currency-issuing government.

The point of the graph is that our debt ratio was much higher in the early Post-WW2 period as our nation-building endeavours got under way in earnest.

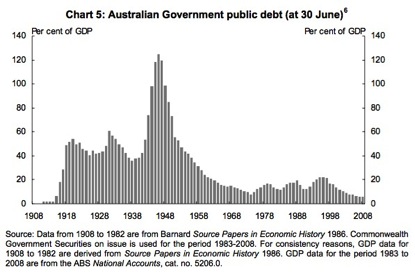

By 1945, the debt ratio was around 130 per cent of GDP. It steadily fell as a result of strong growth and, generally, rose when growth was weak and the automatic stabilisers pushed the budget deficit up.

Here is another (longer) perspective from 1900 (taken from the Treasury paper – “A history of public debt in Australia”.

[Reference: Di Marco, K., Pirie, M. and A-Yeung, W. (2010) A history of public debt in Australia, Budget Policy Division, The Australian Treasury, Canberra]

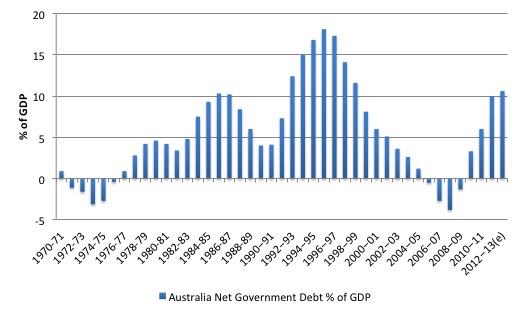

The next graph shows the trend in net debt to GDP from 1970-71 (June 30) to 2012-13 (still only estimated data).

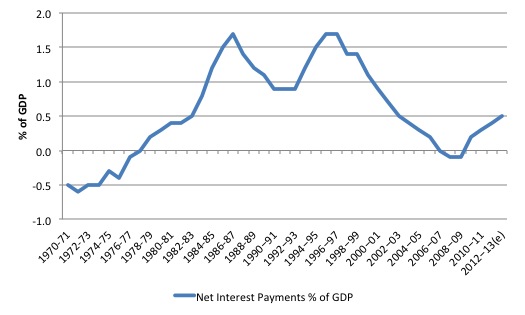

And the next graph shows the Net Interest Payments as a % of GDP corresponding to this debt profile. To put the interest payments into perspective, they currently correspond to about $A3 in every $A100 of government outlays.

All that information is supplied for those who like to see things go up and down. you will appreciate that the data shown spans two quite different monetary systems: the first, being the fixed exchange rate system where the government was financially constrained and had to issue debt to fund deficits; the second, being the fiat currency era, where the Australian government faced no financial constraints but chose for ideological and corporate welfare reasons to continue issuing debt.

The discussion during the deliberations of the “Commonwealth Securities and Investment Legislation Amendment Bill 2008”, which added Section 5 back into the 1911 Act, noted that (Hansard):

A liquid treasury bond market is an important component to ensure a strong Australian financial market. Currently, the treasury bond and treasury bond futures markets are used in the pricing and hedging of a wide range of financial instruments and in the management of interest rate risks by market participants. Treasury bonds are used as the benchmark to set interest rates beyond the short end of the yield curve because of the risk-free nature of security.

This is not unimportant. You can see from the graphs that outstanding public debt fell to low levels in the late 1990s and early 2000s. This was a time that the federal government was running ever increasing surpluses (and the private sector was building up record levels of debt – the two are linked obviously). The private debt buildup allowed growth to continue in the face of fiscal contraction and the tax revenue growth permitted the surpluses.

That came to an end in 2008.

But at the time, the Commonwealth government was retiring its net debt position as it ran surpluses and were pressured by the big financial market institutions (particularly the Sydney Futures Exchange) to continue issuing public debt despite the increasing surpluses. At the time, the contradiction involved in this position was not evident in the debate.

We were continually told that the federal government was financially constrained and had to issue debt to “finance” itself. But with surpluses clearly according to this logic the debt-issuance should have stopped.

While the logic is nonsense at the most elemental level, the Treasury bowed to pressure from the large financial institutions and in December 2002, Review to consider “the issues raised by the significant reduction in Commonwealth general government net debt for the viability of the Commonwealth Government Securities (CGS) market”.

I made a Submission (written with my friend and sometime co-author Warren Mosler) to that Review.

The Treasury’s (2002) Review Of The Commonwealth Government Securities Market, Discussion Paper claimed that purported CGS benefits include:

… assisting the pricing and referencing of financial products; facilitating management of financial risk; providing a long-term investment vehicle; assisting the implementation of monetary policy; providing a safe haven in times of financial instability; attracting foreign capital inflow; and promoting Australia as a global financial centre.

That is the logic noted above that during the GFC, the liquid and risk-free government bond market allowed many speculators to find a safe haven. Which means that the public bonds play a welfare role to the rich speculators.

The Sydney Futures Exchange Submission to the 2002 Enquiry considered these functions to be equivalent to public goods.

It was very interesting watching the nuances of the federal government at the time. On the one hand, it was caught up in its ideological obsession with “getting the debt monkey off our backs” – which was tantamount to destroying private wealth and income streams and forcing the non-government sector to become increasingly indebted to maintain spending growth).

But it was also under pressure to maintain the corporate welfare. There was no public goods element to the offering of public debt. The argument from the financial institutions amounted to special pleading for sectional interests. Private markets under-produce public goods.

When economic activity provides benefits beyond the space defined by the immediate ‘private’ transaction, there is a prima facie case for collective provision. If CGS markets could be shown to produce public goods that enhance national interest, which cannot be produced in any other (more efficient) way, then this would be a strong, pro-CGS argument.

But we argued in our submission that: (a) the benefits identified by Treasury which are used to justify the retention of the CGS market can be enjoyed without CGS issuance; and (b) more importantly, these benefits cannot be conceived as public goods, and rather, at best, appear to accrue to narrow special interests.

While the maintenance of financial system stability meets the definition of a public good and is the legitimate responsibility of government, the roles identified by IMF (in the paper – IMF (2002) The Changing Structure of the Major Government Securities Markets: Implications for Private Financial Markets and Key Policy Issues, Chapter 4), the Treasury and SFE Discussion Papers among others for the CGS market are not justifiable on public good grounds.

We also argued that:

They appear to be special pleading by an industry sector for public assistance in the form of risk-free CGS for investors as well as opportunities for trading profits, commissions, management fees, and consulting service and research fees.

Furthermore, and ironically, their arguments are inconsistent with rhetoric forthcoming from the same financial sector interests in general about the urgency for less government intervention, more privatisation (for example, Telstra), more welfare cutbacks, and the deregulation of markets in general, including various utilities and labour markets.

We justified this conclusion by closely examining futures markets, the superannuation markets and related issues. It should be understood that CGS are in fact government annuities.

We asked the question:

Do the proponents of CGS really want the private sector to have access to government annuities rather than be directing real investment via privately-issued corporate debt, as an example? This point is also applicable to claims that CGS facilitate portfolio diversification. Why would Australians want to provide government annuities to private profit-seeking investors? … We would also require a comparison of this method of retirement subsidy against more direct methods involving more generous public health and welfare provision and pension support.

So the continued issuance of debt despite the Government running surpluses was really a form of “corporate welfare” – to provide safe investment vehicles to private investment banks.

We argued that all the logic used by the Government in the Treasury Discussion Paper applies only to a fixed exchange rate regime. With flexible exchange rate, where monetary policy is freed from supporting the exchange rate, there is no reason for public debt issuance.

We argued that in this context the real policy issue was how well the Government was performing relative to the essential goal of full employment. We concluded the macroeconomic strategy had failed badly. So you will see that 9 years ago we were predicting today’s mess (in actual fact I have writing going back to 1996 predicting the crisis).

This is how we put it:

Despite the government rhetoric that the “strategy has contributed to Australia’s sound macroeconomic framework and continuing strong economic performance”, the recent economic growth has been in spite of the contractionary fiscal policy. Growth since 1996 has largely reflected increased private sector leveraging as private deficits have risen. Further, the recent ability of the Australian economy to partially withstand the world slowdown is due to the election-motivated reversal of the Government’s fiscal strategy, which generated the first deficit in 2001-02 since 1996-97.

A return to the pursuit of surpluses will ultimately be self-defeating. For all practical purposes any fiscal strategy ultimately results in a fiscal deficit as unsustainable private deficits unwind. But these deficits will be associated with a much weaker economy than would have been the case if appropriate levels of net government spending had have been maintained.

So the bottom line in this debate (which led to a Treasury Inquiry) was that the demand for continued public debt-issuance even though the federal government was running increasing surpluses appeared to be special pleading by an industry sector to lazy to develop its own low risk profit and too bloated on the guaranteed annuities forthcoming from the public debt.

Nothing much has changed in the 12 years since that Review. The Government still issues debt to feed the profit-seeking motives of the private financial markets and maintains an accounting fiction that it is somehow funding spending, which everyone knows does not need to be funded given the government issues that same currency.

All the rules pertaining to debt issuance (including whether they issue any) is a legislative matter. A matter of politics and ideology.

The decision to maintain a guaranteed pool of welfare for the speculators accompanies budget decisions which make it harder for the unemployed and single mothers and other highly disadvantaged Australians to receive the penurious income support provided by the Government.

That is the context to Section 5 of the 1911 Act.

Anyway, the Treasurer announced that the “debt ceiling” would rise. He was interviewed by the national broadcaster – the ABC’s PM program last night in the segment – Debt limit set to reach record highs.

The ABC PM Interview was a laugh a minute.

The segment introduced the story by telling us that it was about the Government’s decision “to raise Australia’s debt limit to $500 billion”. Okay, so what?

The Reporter then made sure we knew that was bad by introducing the interview with due gravitas – “It was a sombre looking Treasurer and Finance Minister who fronted the media and it’s no wonder – the news wasn’t good.”

Okay, public debt is bad – that is about all you need to know – they could have stopped the interview. Debt is bad, unless, of-course, you are the financial markets who parasitically love the debt. But we don’t hear that side of the story because that would give the game away.

The Treasurer told the journalist that the decision was “unavoidable”, which was a lie.

The journalist said the Treasurer said this and blamed the previous government’s “waste” which has driven the borrowing requirement up to the current allowable limit under Section 5 of the 1911 Act.

The Treasurer, then showing what a big player on the international stage he would love to be (cultural cringe) said:

We need to move quickly to deal with this, particularly in the wake of what has been revealed in the United States in recent times.

This is a significant issue. We need to put it beyond any doubt and we do not want to have to revisit this issue again.

It is no issue and as the nominal size of the economy continues to increase and the government hangs onto outdated practices (borrowing) the debt ceiling will rise over time beyond recognition (in today’s terms).

The Treasurer then told the journalist that he was commissioning a budget audit process:

We have to fix the budget. We have to fix the budget. I want to emphasise it’s going to be very thorough and very comprehensive. It involves the relationship between the Commonwealth and the state and it has very broad terms of reference.

The budget, by the way, is not a machine that needs fixing. It is not not a piece of broken china that needs to be repaired.

There is no meaning to the statement that we have to “fix the budget”.

The budget is just an accounting statement at the level of numbers. What the government should be aiming to fix is the increasing unemployment and under employment, which is a symptom of low economic growth that is currently not generating enough employment relative to the willing and able labour force.

It all comes down to the goals of macroeconomic policy. The budget balance should never be a goal of government. The budget balance should be whatever it takes to achieve other goals, after taking into account non-government spending and saving decisions.

It is these other goals that matter and need attention from government. These goals relate to the level of economic activity and income generation in the economy and the way in which that income is distributed. Other goals are also relevant and you can fill in the blanks.

It is quite clear that given the state of the real economy in Australia the budget deficit is probably half the size that it should be relative to GDP. The direction of policy is to reduce the budget deficit because successive treasurers have claimed they have to do fix the deficit.

The upshot has been rising unemployment and other associated negative consequences.

Governments need to get back to practising the principles of functional finance which means they would assess the effectiveness of the fiscal position in relationship to how functional it was – that is, how it was allowing the nation to achieve these important real objectives.

Focusing exclusively on some numbers on a bit of paper – the budget balance or the debt ratio – ensures that the government is distracted from its main purpose as noted above.

And if that wasn’t enough!

It was reported today in the Fairfax press (October 23, 2013) – Joe Hockey’s RBA grant hits budget deficit – that the Treasurer (one arm of government) “has pushed up this year’s projected budget deficit from around $30 billion to nearer $40 billion”. Why?

Because he “will give the Reserve Bank … [another arm of government] … a one-off grant of $8.8 billion to strengthen the reserve fund it uses to back up its foreign currency operations”.

The left-hand (or should I say the right) moving $s to the other hand (account) as part of an accounting fiction that the government is financially constrained in $As and that the central bank and the treasury are totally separate units.

The accounting fiction is that the previous Treasurer “took dividends from the bank against its express wishes to prop up his budget” in May 2013.

The RBA use these funds as part of its “capital” and it has been reducing that capital in official transactions as the exchange rate rose.

The Treasurer decided to shift funds from the right-hand to the left-hand and then claim that the budget position was less in deficit than if he had left the funds in the right-hand.

Now the new Treasurer has shifted the funds back to the right-hand (or should that be left-hand) and will claim the budget balance is higher than previous announced by the outgoing government.

He claimed that that shifting the money from one account to another put:

… beyond any doubt the Reserve Bank’s continued ability to perform its core monetary policy and foreign exchange functions.

Which of-course is a fiction unless you believe that the government would deliberately allow the RBA to fail in its function because a number wasn’t in one account or another, when in fact, the government could put as large a number in any of these accounts whenever it chose – given that it might have to change a regulation or two to do it.

But a regulation or two that it set up in the first place.

The Treasurer will also strut around in this Land of Smoke and Mirrors claiming that the fiscal mess left behind by the previous government was larger than we first thought.

But back in the Land of Reality the fiscal mess I see is the rising unemployment and underemployment and stagnating economic growth, which tells me that whatever the Treasurer does with his left- or right-hand (with no insinuation implied) he should be putting more deficit funds in to both and stimulating some employment growth.

The rest is just accounting sleights of hand with little functional significance.

Conclusion

This is all La-La Land stuff and it is amazing how duped everyone is.

But I guess we had to have our own debt ceiling headline or two and some frenzied commentators laying out gloom scenarios.

After all, our American masters are going through the same lunacy – and at present are not compelling us to illegally invade some nation or two – so we might have a temporary suspension of invasions and have a debt ceiling crisis instead.

The cultural cringe!

It makes one long to be a Martian – I am sure they are, at least, a modicum smarter than all this.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

“The public were continually being bombarded with stuff from Britain (and later the US) which led Phillips to conclude that “(t)he Numbers are against us, and an inevitable quantitation inferiority easy looks like a qualitative weakness …”

It works the other way as well. I grew up on a diet of Skippy. Others on Neighbours and Home and Away – so much so that an entire generation of Brits has an Australian question inflection in their voice.

Dear Bill

ok, I might have missed something as I’ve been on a road-trip with my family (Melbourne to Albany, WA). The sights and sounds and meetings with other travellers are a story for another time…. But I need to ask….. since you are sure, to the point of absolute confidence, that a sovereign Govt cannot go broke, why did Obama and his crowded gallery pretend otherwise? If it IS true, then why is it not made public? It inevitably becomes the frayed fabric of conspiracy theory, and I do NOT wish to consider that your philosophy and hard-won beliefs might be reduced to THAT.

Please help

E

Who in their right mind could have witnessed the three ring circus that American politics descended to and thought “wow that’s a good idea”? I despair.

…in their voice?

Perhaps the most extreme form of cultural cringe is that exhibited by the loony section of the political left and by the politically correct towards Islam.

The PC brigade are always telling us to respect Muslim culture which is odd considering what it consists of: killing the cartoonists and authors one doesn’t like, homophobia, holocaust denial, blowing up churches in West Africa, gouging the eyes of innocent civilians out in shopping malls in Kenya and wearing Burkas and other daft bits of cloth over your face. I could go on, and on, and on. So much more sophisticated than our native European culture: Shakespeare, Goethe, Jean Paul Sartre, Mozart, etc etc.

This lunacy is nicely illustrated by Ken Livingstone, the loony left London politician, who regularly embraces far right homophobic Muslim clerics and politicians, while claiming to deplore the far right.

The US episode was due to a self imposed political constraint. From an economic standpoint a government that is sovereign in its own currency cannot go broke in terms of that currency.

Governments that are sovereign in their own currency do face economic constraints they just aren’t in terms of their own money which they are the monopolist issuer of.

” I could go on, and on, and on. So much more sophisticated than our native European culture: Shakespeare, Goethe, Jean Paul Sartre, Mozart, etc etc.”

Ralph seriously ?

While your much fancied “European Culture” was in its so called “dark ages” the Islamic scholars were experiencing their golden age from the 8th Century to the middle of the 13th Century. Philosophy, science, mathematics, scientific method, medicine, healthcare, art architecture … and so on.

The University of Al Karaouine which was founded in 859, is the world’s oldest degree-granting university in the world. That’s long before Oxford or Cambridge arrived on the scene.

Before your European Universities even had medical degrees the Islamic world had mandatory medical degrees / diplomas for doctors, nurses, and pharmacists….

By the tenth century they had 24hr hospitals which provided care to patients regardless of whether they were able to pay or not.

Stupidity and racism appear to go hand in hand.

@Emily

You have asked a very good question and since Bill and Randall’s textbook isn’t out yet and it might be difficult for you to go systematically through Bill’s posts, I would like to recommend two books that are not too technical but hopefully answer your question to your satisfaction.

My first recommendation is Randy Wray’s Modern Money Theory. The second is Mark Blyth’s Austerity: The History of a Dangerous Idea. Some of Stephanie Kelton’s posts at New Economic Perspectives are also relevant but may be hard to locate – I’m afraid I don’t have the URLs to hand. You can read about both books at Amazon.

Hope this helps.

As for why Obama and members of his successive teams are spouting nonsense, this is a very long story. The short version is that 1) they believe in the neoclassical economic world view (which is akin to believing in Ptolemaic astronomy even after it can be shown to have failed explaining what it is supposed to explain) and 2) there is political point scoring and maneuvering going on between the Republicans and the Democrats. Only some of this is relevant to the issue you raise but it affects it nonetheless.

A longer version would involve going into America’s social fabric, its political culture, and related belief systems.

Alan Dunn,

Thankyou for pointing out the blindingly obvious, namely that Islam was doing well up to about 1200AD. Everyone knows that.

However the RELEVANT point, in 2013 is: what does Europe stand to gain from the mass migration to Europe of Muslims? Given the cultural and scientific backwardness of Islam, I’d say “nothing”.

I thought all that was too obvious to mention [Bill Edited Out Personal Remarks here – half a sentence – no loss of meaning]

Note that Randy Wray’s book, “Modern Money Theory”, was developed as a series of blog posts (@ New Economic Perspectives, under the tab “Primer”. Obviously the book is cleaner and professionally finished.)

@Emily –

Frankly, it hasn’t been made public because the players involved do not understand this. In fact, under a non-sovereign fiat, a government CAN go broke, and it’s simply that no one bothered to notice (except for Bill and the other MMTers) that the conversion to a sovereign fiat offered this benefit. One of the goals of the MMTers is to make this more widely understood.

Joe Hockey is a lawyer and a professional politician. As such he would be no more qualified for the job of Treasurer than Swan , Costello or Keating. Hockey’s real job is to present the advice of his Sir Humphrey Applebys in some sort of form palatable to the sheeple and fulfilling his obligations to the oligarchy.

Joe is probably quite a decent bloke but just don’t buy a used car from him.

“The PC brigade are always telling us to respect Muslim culture which is odd considering what it consists of: killing the cartoonists and authors one doesn’t like, homophobia, holocaust denial, blowing up churches in West Africa, gouging the eyes of innocent civilians out in shopping malls in Kenya and wearing Burkas and other daft bits of cloth over your face.”

If you think Muslims have a monopoly on this type of behaviour Ralph you are kidding yourself.

[Bill edited out personal attack which didn’t add to point – could everyone please not make personally abusive comments. I will not edit them out anymore – but will just delete the comment]

Media control presents an image of Islam which is conducive to the divide and conquer rational which Bill has previously blogged about. Muslims are not inherently a backwards people any more than any other culture living under a military dictatorship would be.

Not sure if this comments as a personal remark or not but I was recently involved in mentoring and tutoring at my local university and one of the programs was focused on exchange students. I found the Middle Eastern and African students to be intelligent and open minded, quite firm in their beliefs, but not inherently opposed to ours. The media focuses on the militant and violent minority, there are atrocities committed in all cultures and religions.

Regarding the blog, the debt ceiling is utterly pointless, the US government has just demonstrated that it exists purely as a political scape goat to create panic about government debt levels which are in and of themselves totally meaningless. The debt ceiling was always going to be increased, there is no such thing as a fiscal cliff and it’s only a matter of time before this becomes commonly known.

Alan,

I’m aware (as is everyone) that Muslims don’t have a monopoly on uncivilised behavior. But they not far off such a monopoly if one goes by the proportion of people in prison in the UK for terrorist offences. About 90% are Muslim, while Buddhists, Hindus, athiests, Catholics etc are scarcely represented. See p.40 here:

https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/116756/hosb1112.pdf

“But they not far off such a monopoly if one goes by the proportion of people in prison in the UK for terrorist offences. ”

Not sure that you’re predilection for data mining and curve fitting is going to help your argument on this forum.

Extrapolating individual behaviour to a group is prejudicial, extremely unpleasant and very bad science.

Bill,

Your submission on the CGS Review is fabulous! I would love to see this in your textbook, if only as an appendix. Thanks for this.

Bill, Have you ever written anything on Australia’s futures fund?

If we consider that Australian dollars are just government IOUs it would seem that there isn’t really any point governments in saving them. It may make sense for anyone else of course.

But what about shares and other assets? Is there any point in governments buying them other than to exercise direct control in an industry?