It's Wednesday and I discuss a number of topics today. First, the 'million simulations' that…

Chained-CPI COLAs – another conservative smokescreen

The conservatives are always dreaming up new attacks on the most disadvantaged people in our societies. in the US, the front line of the war on the poor is the on-going attacks on the Social Security system. As I’ve noted in the past this entire debate is based upon the around the’s claim that the system can go broke. I dealt with that issue in these blogs – Social security insolvency 101 and The time has come to tell the American people the truth – among others, and I won’t repeat the points. They are clear – the US Social Security Trust Funds are just elaborate accounting smokescreens that ultimately mean nothing if one comprehends the financial capacity of the US government. They represent a case of a government creating a farcical structure to administer some program and then elevating the structure to a false level of importance that actually leads them to introduce policies which undermine the initial purpose of the program – and all without any basis. The determinants of future standards of living will be the availability of sufficient real goods and services of an acceptable quality. If they are available the US government will be able to purchase them with the stroke of a computer key. But because the conservatives have everyone thinking the funds will go broke, they can then force ridiculous time-wasting concepts into the public debate. One such attack is the proposal to use Chained-CPI measures as the Cost-of-Living-Adjustment (COLA) index in social security pensions.

Last week (November 4, 2013), the Republican Chairman of the US Congress “Committee on Ways and Means” did some fact-checking. The only problem is that he revealed himself to be unqualified to undertake the specified task.

You can read his pitiful attempt – FACT: Chained CPI Would Result In a Larger COLA Increase for 2014 – for yourself (but I am sure you have better things to do).

He was attempting to reject the claim that if the 2014 Social Security increases were based on the US Bureau of Labor Statistics Chained-CPI measure the recipients would receive a lower increase in their nominal entitlements.

This is one of the very technical issues that are thrown in to the public debate without due care. The overarching point is that the chained measure is typically lower than the currently used CPI measure in the COLA and would thus result in a lower pension increase over time.

This page – Cost-of-Living Adjustment (COLA) Information for 2014 – explains how things work in the US Social Security system.

We learn that:

The purpose of the COLA is to ensure that the purchasing power of Social Security and Supplemental Security Income (SSI) benefits is not eroded by inflation. It is based on the percentage increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from the third quarter of the last year a COLA was determined to the third quarter of the current year. If there is no increase, there can be no COLA.

The determination of the CPI-W index is the responsibility of the US Bureau of Labor Statistics, which in my experience is one of the best statistical agencies in the world for transparency and dissemination of data and technical support and research.

The conservatives claim that the Chained-CPI measure is a more accurate reflection of the cost of living changes and should be used instead of the CPI-W. It clearly helps their case that it would reduce pension payments substantially over a typical persons’s retirement.

What is a Chained-CPI measure and how is it different to the standard CPI?

The so-called – C-CPI-U – (Chained-CPI) measure uses what is known as:

… a Tornqvist formula and utilize expenditure data in adjacent time periods in order to reflect the effect of any substitution that consumers make across item categories in response to changes in relative prices.

What does that mean? I won’t go into the technical details because we would lose most of my readership. The BLS provides a comprehensive set of – Background documents – about the Chained-CPI for those interested in the formulas etc.

In words, the problem the chained index attempts to measure is what economists call “commodity substitution bias”.

If we wanted to measure the true cost of living change we would use some fixed level of well-being or satisfaction and then trace changes in the cost of obtaining that level over time.

The CPI doesn’t do this (given it is unmeasurable) but rather measures the cost of maintaining a fixed basket of goods and services over time.

It is argued that the latter measure is biased because it fails to account for consumer substitution. This relates to the belief that consumers will substitute items purchased in the fixed basket of goods and services as some become relatively more expensive than others – that is, they will increasingly purchase the relatively cheaper goods and services.

This page – An Introductory Look at the Chained Consumer Price Index – provides an excellent, easy-to-understand introduction to these indexes.

The BLS tell us that:

… the CPI was considered an upper bound on a cost-of-living index in that the CPI did not reflect the changes in consumption patterns that consumers make in response to changes in relative prices

The chained measure only considers substitution between goods and services within basket categories rather than between separate categories in the basket.

The BLS tell us that:

… the evidence suggests that the C-CPI-U over time will trend slightly lower than the … [traditional measures] …

There are various ways in which to calculate an index number (a single summary measure) from a basket of disparate items. The traditional CPI measures are calculated using a fixed set of quantities (expenditures), as the weights in some base period. They then measures the price changes in the basket weighted by the initial expenditure weights. Clearly, these quantities can become dated if consumption patterns change significantly.

National statistical offices periodically revise the data and link the new index to the old.

A chained index is one where each link in the chain (each time period) is compared only with the preceding one (rather than some base period) and the weights (quantities) and price information is updated each period.

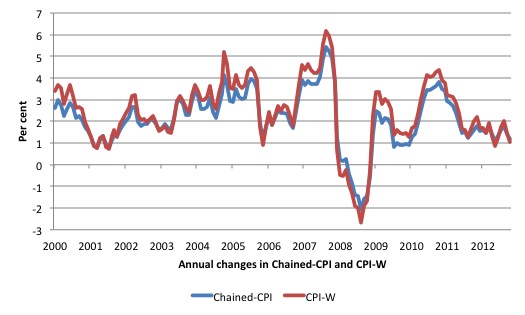

The following graph compares the annual percentage changes since January 2000 in the Chained-CPI measure provided by the BLS (C-CPI-U) and the CPI-W, which is used as the current Social Security COLA index.

Quite clearly, the Chained-CPI delivers a lower measure of the cost of living change than the CPI-W.

Is the Chained-CPI measure a more accurate reflection of cost of living changes?

You know something is dodgy when the Peter G. Peterson Foundation publishes a paper in support of it. In December 2012, this nasty bit of work – Measuring Up: The Case for the Chained CPI – appeared in my E-mail inbox.

There are many reasons for doubting that the Chained-CPI measure is more accurate.

1. Do pension recipients behave in the way economists think? What scope for substitution is there? There are many reasons to believe that substitution is limited within certain important categories such as housing, transport etc. This means the Chained-CPI can give erroneous measures of cost of living changes.

What if you can only travel to work by car and petrol prices rise?

What if an inferior product is cheaper than a superior product (for example, chocolate) and the former inflates faster than the latter? It is possible the relative price compression outweighs the absolute change in prices and one will eat the finer chocolate.

2. The CPI-W measure already accounts for substitution to some extent. The BLS updates the expenditure weights every two years to reflect changing spending patterns.

3. The Chained-CPI measures assumed constant tastes. What happens if we all decide that running is good for our health (it is!) and suddenly all rush out and buy expensive running shoes? This would upset the computation of the substitution effect because the quantity consumed would rise as the price rises (with the companies cashing in on the running boom). The same could happen if we all went off fatty foods – price falls and quantity falls.

4. There are many other technical assumptions that are required to establish that the Chained-CPI is the best measure (an exact-cost-of-living index). For example, income elasticities have to be equal to unity for all goods and services.

Another factor that bears on the accuracy of the Chained-CPI measure is that the BLS publishes three versions of the C-CPI-U – an initial measure; an interim measure and the final measure. This is a very important point that is mostly misunderstood in the public debate.

The different versions of the Chained-CPI indexes relate to how much knowledge the BLS has of the expenditure data. It takes 24 months before they publish the final measures where the expenditure data is most accurately estimated.

The Chained-CPI measure is adjusted two times in a 24-month period. The initial release coincides with the monthly release of the CPI-W and CPI-U. Then, as more spending data is collected and analysed, there is an interim adjustment made in February of each subsequent year followed by a final adjustment 12 months later.

While the differences between the three measures may be small it remains that it takes 24 months before the true expenditure patterns are known.

So in what sense are we going to say that the Chained-CPI is a more accurate measure of the cost of living changes compared to the traditional CPI-W (or CPI-U) measures if in the first 12 months the inflation measure is comparing initial with initial or initial with interim and it takes a full 2 years before we get the true chained measure?

Which version would the Social Security administrators use to make the COLAs?

This is also relevant to the spurious claims made by the Chairman of the House Ways and Means Committee’s noted at the outset.

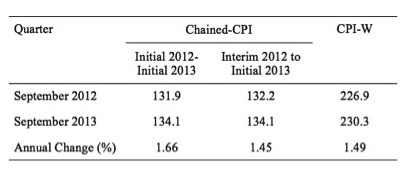

1. It is true that if we compare the change in the Chained-CPI between September 2012 to September 2013 using initial values of each we get an annual change of 1.7 per cent.

2. It is also true that the annual change in the CPI-W (the COLA index) over the same period was 1.5 per cent.

3. So the Chained-CPI rise is higher than the CPI-W rise.

4. But then we also have interim Chained-CPI data for the September-quarter 2012, which is the updated version of that index. The rate of change in the Chained-CPI between September 2012 and 2013, using the initial value for 2013 (the latest) and the interim value for 2012 (the first of the two revisions) was 1.45.

5. So the most revised version of the Chained-CPI gives an inflation rate below the CPI-W result.

The Republican politician didn’t bother to explain this sleight of hand.

The following Table provides the relevant calculations.

Finally, what about a specific cost of living index for the elderly? Some progressive elements have argued that the COLA should be based on a cost of living index that more closely reflects the expenditure patterns of the elderly.

In April 2008, the BLS Monthly Review contained an interesting chapter – The experimental consumer price index for elderly Americans (CPI-E): 1982-2007.

Different age and income groups consume different baskets of goods and services, which means that the standard CPI measure that measures the “average change over time in the prices paid by urban consumers for a representative market basket of consumer goods and services” may be an unreliable guide to the cost of living changes for some specific group.

The BLS publish two traditional measures of price change – the Consumer Price Index for All Urban Consumers (CPI-U), which it estimates “represents the spending habits of about 87 per cent of the population of the United States” and the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which “represents about 32 percent of the U.S. population”.

The CPI-E measure is an attempt to measure the price changes most pertinent to Americans who are above 62 years of age. One might question their use of the term “elderly” to describe a person who is 62 years of age!

The Monthly Review chapter explains in detail the uses and limitations of their experimental index.

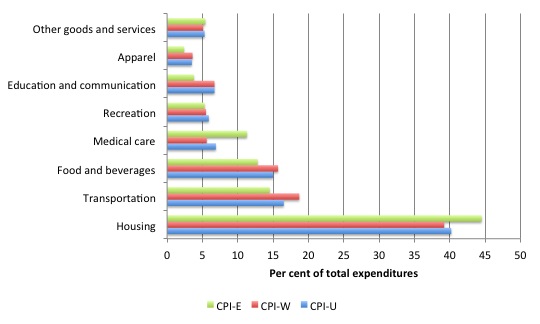

What are some of the key differences? The BLS article (March 2, 2012) – Consumer Price Index for the elderly – analysed the relative importance of expenditure categories in the CPI for the three population groups (CPI-U, CPI-W and CPI-E).

The following graph as at December 2011 shows the differences. The elderly spend more on housing (44.5 per cent of total expenditure) than the other cohorts; less on clothes (2.4 per cent compared to 3.5 for the CPI-U cohort); less on Education and Communication (3.8 per cent compared to 6.7 per cent); less on Recreation (5.3 per cent compared to 5.9 per cent); less on Food and Beverages (12.8 per cent compared to 15 per cent); less on transportation (14.5 per cent compared to 16.5 per cent); but more on Medical care (11.3 per cent compared to 6.9 per cent).

So, for example, if the costs of medical care rise relative to other categories, then the CPI-E will record a higher change than the other two CPI measures.

This New York Federal Reserve article (May 2003) – Social Security and the Consumer Price Index for the Elderly – analysed the use of the CPI-E measure and concluded:

… that if such an index were adopted today, over the next forty years benefit levels would increase and the social security trust fund could become insolvent up to five years sooner than projected.

Which disqualifies the authors from any further credibility given that the social security trust fund can never go broke if the government so chooses.

In this recent BLS update (March 2, 2012) – Consumer Price Index for the elderly – we learn that:

Although the CPI-E generally outpaced the official measures of inflation over the 1983-2011 timeframe, recent trends show different results. From 2006 to 2011, both the all-items CPI-E and the CPI-U rose at an average annual rate of 2.3 percent, while the CPI-W increased 2.4 percent. This turnaround was caused primarily by changes in the relative inflation rates of medical care and shelter, compared with the overall inflation rate. Specifically, the gap between medical care inflation and overall inflation has generally fallen since 2005, and shelter inflation has been rising slightly more slowly than overall inflation over the 2006-2011 period.

The substantive reason why the CPI-E measure is probably flawed as a guide to the cost-of-living changes for the elderly is provided by the BLS itself in their 2008 Monthly Review chapter. They note:

… the index population defined for the CPI-E and the population receiving Social Security benefits are not equal. Specifically, the population covered by the CPI-E includes persons 62 years of age and older. Many Social Security beneficiaries are younger than 62 years of age and receive benefits because they are surviving spouses or minor children of covered workers because they disciple. The spending patterns of this younger group are excluded in the expenditure weights for the CPI-E. In addition, a substantial number of persons 62 years of age and older do not receive Social Security benefits, especially those in the 62- to 64-year range. although these older consumers are included in the CPI-E population, they presumably would be excluded from an index specifically defined to reflect the experience of Social Security pensioners.

Conclusion

I guess the operating principle to emerge out of today’s discussion is that if the Peter G.Peterson Foundation supports something then it would be best to not support it.

The whole literature on price indexes is very complicated and gives economics students headaches every time it is introduced into the undergraduate statistics courses. That is not to say it is uninteresting for those, like me, who are quite partial to these technical and nuanced discussions.

However, in the context of the policy application we’ve considered today the debate is essentially irrelevant. There is no financial imperative to engineer different COLA indexes to adjust Social Security pensions in the US.

And within that context, it is unlikely that the Chained-CPI is a superior indicator of cost of living increases for pension recipients, whatever their age and category.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

I have just discovered your blog, and in the finest traditions of the internet I shall post a comment impolitely disagreeing with you. I shall also assert my lay opinions as uncontested fact, which I am sure will amuse and delight an academic such as yourself.

Firstly, a recurring theme of yours seems to be that governments are unable to go bankrupt if their currency is not pegged and their debts are denominated in the currency they issue. While this is mathematically true in a theoretical sense, there is an underlying assumption that the economy is functioning properly.

Specifically, in this article you say “…the social security trust fund can never go broke if the government so chooses.” While that is true in a numerical sense – the government can just print money to continue paying interest on its debts – it is possible for the economy to become so dysfunctional that the goods and services (indirectly) purchased by the social security fund can no longer be bought for any price in that nation’s currency.

You say that a fiat currency issuer never needs to default on a debts in that currency. True, but that does not guarantee all of the world’s goods and services may be purchased with that currency. If Australia stops making cars, and the government runs up a monstrous debt in AUD, it is possible the the government becomes unable to purchase cars. If pensioners need cars – or even if cars are merely part of the CPI-W, C-CPI-U, and/or CPI-E baskets – then the social security fund has become practically broke, even if it is not numerically broke.

As for how to index social security payments, and which of CPI-W, C-CPI-U, or CPI-E is the better measure, I say ignore all three. Since you are talking about a defined population – social security beneficiaries – the only interesting cost of living is their cost of living. Instead of wasting resources tracking technocratic, intractably incorrect, and out-of-date, CPI indicators, we should only take into account their actual spending: the pensioners make their case politically through the ballot box; or government goes the whole hog, invading their privacy, aggregating their actual spending patterns from eftpos card data.

Dear SomeGuyOnTheInternet (2013/11/13 at 16:53)

I am struggling to see the disagreement. Your attributions of what I say are false.

There is never “an underlying assumption that the economy is functioning properly” in my work. The aim is to make it function properly.

It is possible that inflation arising from spending (from any source) – I say that often.

It is possible that there will be insufficient real goods and services available to guarantee standards of living for nominal pension recipients – I say that often.

Read a bit more before you “impolitely” think you are disagreeing with me.

best wishes

bill

As a long time commenter here with a similar name – I was about to say the same as Bill. SomeGuyOnTheInternet – you only think you disagree with MMT – you don’t.

Professor Mitchell,

I note your reply to the first poster above. Interesting. I would have some searching Qs for you also, but some other time. I’ve been reading some Wray stuff. Quite problematic in parts . Arrow of time? Frictional losses? Autarchy v unfettered trade? Commodities v financial derivatives? Wealth v virtual wealth*? Lots to think about. Needs time.

That textbook you’re writing. Twenty-six chapters? I nearly did a double-take. Paul Samuelson’s 1948 ed. has 26 also. Ditto for my undergrad text: ‘Principles of Economics’; McDowell, Thom, Frank and Bernanke (2006). Then there is Blanchard’s ‘Macroeconomics’ – 5th ed., 26 as well. Coincidence or ????. I suggest – actually I would advise, in my professional and technical capacity (a former teaching academic), that you chop the damn thing into 4 units – then chuck three of them away. Undergrads (and postgrads too) are not constrictors – who asphyxiate, crush and swallow a very large ‘meal’ at one go – then lie around as they digest the meal. You DO know how learners learn? OK, so they only use part of the text at any particular time. Fair enough. But undergrads have a very specific learning strategy. And all undergrads are not the same.**

Its not just econ. Biochemistry and Chemistry texts now are x4 and x5 times their ‘size’ as they were in my day. But that’s inflation for yeh! The ‘basic stuff’ – the foundation concepts, still only account for approx 20% of the total cargo of concepts. Stick with those 20% – since it takes 80% of the time to learn them – in any sort of a meaningful manner.

Think: a “modest degree of accuracy rather than a pretentious muddle”. [K. R Popper]

* Frederick Soddy. ** William G Perry, jnr.

Chained-CPI:

The Shut-Up-and-Eat-Your-Catfood Amendment of 2013.

Yes, the best layman’s explanation I read on chained CPI was that it assumed that consumers would substitute cheaper products (whether due to lower quality standards or just because you can’t afford bananas anymore so you’ll settle for oranges) as they became available, essentially degrading the quality of life the CPI assumes, rather than allowing the CPI to rise inconveniently.

Lovely system.

In my view Social Security / Pension benefits should be based upon average household income….

For example:

When I returned from the war in the early 70’s………………..

Petrol cost $0.30/gal

A 1 bedroom furnished flat cost $75 / month

A new Buick Century Automobile cost me $3,000

As a beginning public school teacher, I earned $14,400 / yr

Social Security assured me that I would receive $500 / month on retirement.

Now………………

Petrol costs $3.25 /gal

My wife’s studio apt costs $720/ month

A new car costs $30,000

BUT………..

Social Security does not pay me $5,000 / month………….

A beginning teacher does not make $144,000 / yr.

So it would seem to me that all this nonsense WRT inflation masks the fact that inflation was engineered into

the US financial system such that all goods and services prices went up by an order of magnitude during the past 40 years, while pensions barely doubled, and teacher salaries barely tripled.

So, it seems to me that neo-classical economics has emasculated domestic production of goods and services throughout the OECD to the benefit of importers and traders, at the expense of the rest of us……

INDY

Brain, I feel you are doing Bill and Randy something of an injustice. There are many reasons, which I am sure you know, that push the increased coverage of textbooks. One of these is that many teachers are more comfortable with some parts of the subject than others (in those parts that are selective) and thus select them to teach. This renders the book more useful to a wider range of teachers than it otherwise might. This issue feeds into publishers’ costs, too.

In other fields, you can find longer texts on more limited topics. A classic example is Gravitation by Misner, Thorne, and Wheeler. It is over a thousand pages long and has 44 chapters and it was published in 1973. And it only covers gravitation. Then there is Roger Penrose’s The Road to Reality: A Complete Guide to the Laws of the Universe, which has 34 chapters and is over 1000 pages long, and it is intended as a semi-popular work. The same expansion has taken place in Calculus textbooks. The fields of neuroscience and microbiology are no longer confined to a single introductory volume.

The great and perhaps overriding benefit of a wide coverage is that the reader is exposed to a single framework of interpretation. If chapter selection is good, then alternative views of contentious issues can also be included. And if more than one term is required to cover what is considered essential material, even different teachers with a slightly different slant, teaching from the same book, can be worthwhile.

I don’t feel that the Popper quote applies to this situation. He is talking about something else.