It's Wednesday, and as usual I scout around various issues that I have been thinking…

The fiscal role of the KfW – Part 1

This is the first part in what might be several blogs. I will see where my curiosity takes me. Today I want to invoke that well-known piece of inductive reasoning the – Duck Test. We all should know how that goes. But consider this reasoning. We have an institution that is 100 per cent government owned. It borrows millions and its liabilities are 100 per cent guaranteed by the federal government. It spends, I mean lends millions each year at very low rates to all manner of firms, organisations and even builds infrastructure. It also takes equity positions (provides capital) to a range of enterprises. It pays no tax having the same status as the central bank. It is not a duck but looks very much like a government fiscal entity. Welcome to the Kreditanstalt für Wiederaufbau (Reconstruction Credit Institute) or as it is now known the – KfW. This bank was created in 1948 as a German vehicle to faciliate the infrastructure rebuilding under the Marshall Plan. It has since grown (and diversified) into one of the largest banks in Germany (taken its main business units into account) and pumps millions of Euros in the domestic economy and the export sector (via IPEX, its 100 per cent owned subsidiary). It is a major reason why the public debt ratio in Germany is 80 per cent rather than close to 100 per cent. It is a major reason why the federal deficit has been reduced without scorching the German economy. It is a story about smoke-and-mirrors accounting, German-style.

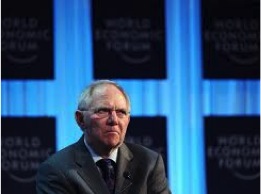

On November 14, 2013, the German Bundesfinanzminister (Federal Minister of Finance), Dr Wolfgang Schäuble was in Brussels discussing the role that the Eureopean Stability Mechanism (the Eurozone bailout fund) might play as a direct lender to European banks in a new banking union. At present it can only lend to member-state governments. The other Euro finance ministers seemed to be moving towards some deal but the good Dr told the media that “The German legal position rules it out now. That’s well known. I don’t know if everyone has registered that”

But what is legal under the German system is for the Federal Government to own 80 per cent of a development bank and use it as a fiscal instrument.

Spot the difference test

|

|

First some background.

According to the – Law Concerning Kreditanstalt für Wiederaufbau

The nominal capital of KfW amounts to three billion seven hundred fifty million euros. 2The Federal Republic (Bund) participates in the nominal capital in the amount of three billion euros, and the Federal States (Länder) in the amount of seven hundred fifty million euros.

So 80 per cent Federal government owned and 20 per cent residual owned by the States of Germany.

Under Article 1a Guarantee of the Federal Republic:

The Federal Republic guarantees all obligations of KfW in respect of loans extended to and debt securities issued by KfW, fixed forward transactions or options entered into by KfW, and other credits extended to KfW as well as credits extended to third parties inasmuch as they are expressly guaranteed by KfW.

Not quite risk free because the German government still faces default risk as a result of using the Euro (a foreign currency) but low risk.

Under Article 2 Functions and Business we learn that the KfW has a broad lending (spending) agenda, which includes “small and mediumsized enterprises, liberal professions, and business startups”, “housing”, “environmental protection”, “infrastructure”, etc

Article 4 Procurement of Funds details that it can “issue debt securities and take up loans”.

The company is run by an Executive Board who are “appointed and dismissed” by the Board of Supervisory Directors (Article 6).

Guess who is the Chairman of the all-powerful Board of Supervisory Directors?

None other than our sudoku-playing Bundesfinanzminister (Federal Minister of Finance), Dr Wolfgang Schäuble. The Board is packed with Federal government ministers, which is appropriate given the bank is state-owned.

Other features of the legal status of KfW:

1. It distributes no profits but allocates surpluses to reserves attributable to the shareholders (government) (Article 10).

2. It has the same status as the central bank with respect to taxes – that is, it doesn’t pay them.

The Kfw is thus unambiguously a state institution and provides loans at lower than commercial rates because its bonds are considered of equal status to the German government’s own debt-issues.

It is one of Germany’s largest banks (assets in 2012 of 510,707 million Euros (see Annual Report 2012).

Many nations have development banks that are state-owned. In Italy, it is the Cassa Depositi e Prestiti (CDP) and in France the Banque publique d’investissement (BPI). I am currently investigating their operations to see if they have been acting in the same way as the KfW in Germany. Hence several parts in this theme might emerge but will certainly appear next year in a book I am writing about deficits.

There are three reasons to look closely at the KfW:

1. It played a role in the Deutsche Telekom (so-called) privatisation, which helped the German government slip out of an embarassing excessive deficit procedure in 2004. Sleight-of-hand is the best description for what happened.

2. It is certainly playing a major role since the onset of the crisis in acting as a fiscal agent on behalf of the government which allows the latter to record lower deficits and public debt ratios for the level of public stimulus that the KfW has facilitated.

3. Recently, it has done a deal with the Irish government that coincided with the Irish government announcing it was leaving the conditionality of the bail-out packages that have been crucifying its economy.

I have documented what to anyone but a German government or central bank official would represent astounding hypocrisy in these blogs –

Bundesbank showed the way in 1975 and The hypocrisy of the Euro cabal is staggering.

The main issue traversed in those blogs is the way the German government escaped excessive deficit procedures in 2004 after systematically violating the Stability and Growth Pact rules from 2001 to 2005.

I discuss that in this blog – The hypocrisy of the Euro cabal is staggering.

The so-called corrective arm of the Stability and Growth Pact is called the excessive deficit procedure (EDP) which the EU’s ECFIN calls the “dissuasive arm”.

ECFIN write that:

The EDP is triggered by the deficit breaching the 3% of GDP threshold of the Treaty. If it is decided that the deficit is excessive in the meaning of the Treaty, the Council issues recommendations to the Member States concerned to correct the excessive deficit and gives a time frame for doing so. Non compliance with the recommendations triggers further steps in the procedures, including for euro area Member States the possibility of sanctions.

The Treaty allows for fines and other sanctions on governments that do not conform to the required fiscal austerity conditions.

Germany was one of the first nations to trangress these rules – that they had been instrumental in establishing.

On November 25, 2003, the Economic and Financial Affairs Council (ECOFIN) of the European Commission refused to endorse the EC recommendations to pursue excessive deficit procedure action against France and Germany under the Stability and Growth Pact (SGP) rules.

Under Article 104 of the Maastricht Treaty the excessive deficit procedure had begun in early 2003 as a result of France and Germany violating the 3 per cent deficit to GDP limit in 2002.

In November 2003, the specified adjustment period elapsed and both nations remained in violation. Neither France nor Germany had implemented the EC’s deficit reduction strategies (determined in January 2003).

The Eurocrats in the EC then moved in late 2003 to enforce the provisions and two recommendations were made to the ECOFIN to penalise France and Germany. At the November 25 meeting of the ECOFIN, a qualified majority was required to enforce the recommendations.

While a simple majority succeeded, the large nations did not support the recommendations and a qualified majority failed.

The ECOFIN decided not to act against France and Germany. This led to court challenges and much angst. But the Deutschers got away with it.

You can read the entire story in the minutes of the – 2546th Council Meeting – Economic and Financial Affairs – Brussels, November 25, 2003.

Notable statements (which seem missing from the way Greece has been treated in more recent times) include:

1. With respect to France – “the worsening in cyclical developments was abrupt and unexpected and made the effort to bring the deficit below 3% of GDP in 2004 much greater than expected in June 2003” (page 16).

2. “too great a consolidation effort in a single year might prove economically costly, in particular in the light of the downward revision of growth forecasts, should be given the appropriate relevance” (page 16).

3. The ECOFIN (acting as a EC Committee) concluded “The Council agrees to hold the Excessive Deficit Procedure for France in abeyance for the time being”. (page 17).

4. With respect to Germany – “too great a consolidation effort in one single year might prove economically costly in view of the prolonged stagnation in Germany over the last three years and the expected slow recovery”. (page 18).

The European Commission was furious with the European Council’s decision to let France and Germany off the hook (see page 22). They entered the following (in part) into the Council minutes:

The Commission deeply regrets that the Council has not followed the spirit and the rules of the Treaty and the Stability and Growth Pact that were agreed unanimously by all Member States. Only a rule-based system can guarantee that commitments are enforced and that all Member States are treated equally.

Interestingly, in 1995 when the “rules” were being worked out, the then German Finance Minister Theo Waigel had argued for automatic sanctions to be triggered if the deficits exceeded 3 per cent in his famous – 1995 memorandum – which proposed the “Stability Pact”.

Note that the term Growth was not in his original proposal. It was just to be the Stability Pact.

He argued that:

The deficit must not exceed the 3% limit set in the Treaty of Maastricht – even in economically unfavourable periods.

At the time, Waigel was criticised for trying to impose the German “stability culture” (aka: extreme paranoia regarding inflation) on the emerging monetary union.

The 1996 EC conference that determined the form of the SGP added “Growth” to the title to appease France because the then Juppé government was facing rising unemployment and needed some political capital to convince the French people to adopt the Euro.

What emerged in the Treaty was that the Council was able to vote and in that regard the European Commission could always be defied.

So what has all this to do with the KfW bank. Answer: a bit.

The bank itself provides an – Overview of it the share transactions in relation to DT.

As at June 27, 2013, KfW owned 17.4 per cent of DT, the Federal Government owned 14.5 per cent and the remainnig 68.1 per cent of the total was owned by the private holdings.

They started acquiring the shares in December 1997 by taking a 13.5 per cent stake as part of the so-called privatisation. In November 1998, KfW acquired a further 11.2 per cent to sit on 24.7 per cent of the DT capital.

That is, they “bought” these shares from the federal government. So the “government” sold shares to itself and shifted assets and cash flow between the accounts that count for the SGP (Maastricht Treaty) and those that are outside of that vigilence.

A month later (December 1998), a further 1.2 per cent was added to take the total shares to 709.2 million.

On June 2000, KfW off-loaded 200 million DT shares (6.6 per cent) and made a further allocation of bonus shares (5.3 million). At that point, it held 16.6 per cent of the total DT shares.

On October 11, 2004, the German government announced they were selling 7 per cent of its stake in DT. The sale was “managed” via KfW and reduced the government stake to 36 per cent.

With the German federal government running foul of the European Commission in 2003-04, the ante was stepped up. KfW bought 198.9 million DT shares off the federal government (4.7 per cent of DT’s share capital) to take its stake to 16.7 per cent.

As things started to get ugly for the German government, the KfW off-loaded that tranche of shares (actually a little more 199.3 million) in October 2004.

Two months later (December 2004) they gave the German federal government enough cash to purchase an additional 3.3 per cent of the DT share capital (now holding 15.3 per cent of the total).

They sold 22.1 million shares (on Exercised warrants) in April 2005 but a few months later (July 2005) injected further cash into the Federal coffers when they bought 307.8 million shares (7.3 per cent). At that stage, its holdings stood at 22.1 per cent.

This fell to its current level after a sale in April 2006 of 191.7 million shares. KfW now holds 17.4 per cent of the total share capital in DT.

Selling public shares to a government-owned vehicle such as the KfW and the retention of some shareholding, has allowed the German government to retain control of DT. While I don’t want to get into analysis the performance of DT over this period, there have been consistent complaints about its high domestic prices.

There is no secret there. It is clearly in the interests of the controlling shareholder to keep prices high, which bolster profits and boost the value of its share holding.

There can also be no doubt that the purchases and sales of DT shares by KfW were more about resolving the federal German deficit issues relative to, first, the convergence criteria in the late 1990s, and, second, the excessive deficit mechanism problem in the 2003-04 than it was about instilling efficiency into the telecom.

Conclusion

Next time – the second part in the KfW story.

Tomorrow the Australian national accounts come out and I will have to look at them.

And also the CofFEE conference starts in Newcastle and I will give a report about that (probably).

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

Dear Bill

In Canada, there is the Business Development Bank, which only provides loans to small and medium-sized businesses. We also have Farm Credit Corporation, which provides loans to beginning farmers. I don’t think that they are very big, but they are not private banks.

Regards. James

James,

I think the Canadian Business Development Bank lends, or at least used to lend just NEW MONEY created by the Canadian central bank. I.e. it is or was what Bill calls a “government fiscal entity”.

Well, that’s a mighty unstable tower of unfounded accusations, with (once again) Germany as a target. Do you not realize, that when you say that:

followed by

you put a hole in your own argument?

If the german government used the KfW to move its actions to the market (Government sells stocks to the KfW, KfW turns around and sells it on the market), then there is absolutely no nefarious action there. The only thing you can blame on the german government is pushing their recognized revenue from the privatisation forward, by using the KfW as an intermediary.

For your conspiracy theories to make any sense, it would have had to involve the government moving stocks to and from the KfW (i.e., both selling and buying back) or the KfW keeping those stocks indefinitely, which would have allowed the german government to appear to sink the deficit, while still keeping possession of the interest in DT. However, this never happened. Instead, the KfW was used as they planned to use it, as a buffer between the government and the stock market, moving the stocks (albeit admitedly slowly) in only one direction, i.e. privatization. Why exactly the government did it this way is up for debate, but it is pretty clear that they intended back then for the DT stock (and the Post, with plans for the Bahn to follow) to become a sort of investment plan for Average Joes, luring them to invest more on the stock market – the average germans are to this day far less likely comparatively speaking to own stocks, compared to more traditional and risk-free forms of savings. That’s why there was (at the beginning at least) no intention or effort in finding large investors that would buy significant stakes – eventually this changed somewhat (with Blackstone in 2006), but that’s what their original plan was. Of course, the stock market downturn of 2002 put quite a damper in that plan anyway!

But even if we leave all that aside, there is plenty more to show that your conspiracy theory has no legs to stand on: a matter of scale. Take for instance the purchase in November 2003, which according to you was done as a result of the pressure from the EU in reducing the deficit. The KfW purchased about 200 Million stocks, wow, sounds impressive… except the actual value of those stocks was only about 2.5 Billion €. The german deficit in 2003 was 89 Billion € or 4.2% of the GDP, so without the KwF buy it would have been… 4.3% (if you round up generously). The KfW buys and sells had no practical relevance for Germany either going below or above the deficit rule of the Growth and Stability Pact – the sums involved were simply not big enough for that.

And even leaving all that behind, for your theory to function, it would have to presume that the KfW operates on a perpetual deficit basis, i.e. consistently taking far more through bond emissions than its day to day operations realize in terms of income / profits. That is, it would be a bank that doesn’t re-finance its operation, but instead finances them, and this would have been going on over decades. Surprise, surprise, it actually does not, so whatever purchases it executes as part of its “conspiratorial” role in the “grand scheme” of german deficit reduction, it must be doing them out of its own capital resources. Does it take advantage of its perfect credit rating in doing that? Sure it does. But that does not mean that its day to day operations actually create deficits.

Dear Andrei Mihailescu (at 2013/12/04 at 3:13)

The problem with your tirade is that it is attacking a straw person.

1. My discussion infers no illegality.

2. I infer no conspiracy.

3. The 2003-04 excessive deficit issue was clearly broadly considered to be a case of France and Germany using their influence to subvert EU rules. The EC thought so too and pursued the Council in the courts if you recall.

4. I indicated in the blog that I am also investigating the BPI (France) and the CPI (Italy) – so Germany is not targetted.

5. The timing of the shifts of shares between the federal government and the KfW was very coincidental with major fiscal problems the German government had under the SGP. That is a fact.

6. Why is the KfW holding shares for years now if the intent was to privatise? Yes, the share price for DT is suppressed because of its poor performance. But it is also convenient for these shares to be still under German government control but the general government budget to have received the Euros.

7. The principle aim of this series of blogs is to show how governments use creative accounting to undertake fiscal actions which allow them to change their status under fiscal rules. That is not a theory but an analysis of the accounting practices.

8. One doesn’t have to show that the KfW operates continually on a deficit basis to establish it plays a fiscal role at convenient times – such as 2010 and 2011 – wait for Part 2.

Sorry you missed all that.

best wishes

bill

I was always wandering if state ovned developement banks can use Treasuries to increase their nominal capital? Can state debt be used as initial capital to start a developement bank?

HBOR in Croatia (a small developement bank) is borrowing at high rates to lend at lower rates. With fractional reserve requierment of 14% that should be not an issue, but i am wondering why developement banks borrow at all if they could use Treasuries for aditional lending?

I find this topic of outmost importance for countries in developement where outside countries control monetary systems of small countries with currency boards. And also as part of EU, Croatia is about to be subjected to EDP since deficit is above 7% even though it enjoys the smallest debt to GDP in EU of 56%. I would really apreciate the answer. Thank you.

If only other MMT gurus were as mannered when it comes to critics (or even polite questioning from supporters)

MEFO Bills – The Sequel

Bill,

I don’t think I am attacking any strawmen, just the unfounded accusations in your blog post.

I am not a big fan of bullet points, but let’s see:

To your points 1 & 2, when you talk about how “smoke-and-mirrors accounting, German-style”, “Sleight-of-hand”, “astounding hypocrisy” and so on, you obviously accuse. Not sure what’s particularly unclear about it.

To your point 3, not sure what it has to do with what I posted, I wrote nothing about that part of your blog post (not that there isn’t stuff in there to criticize, but we’ll leave that for another time).

To your point 4, yes, you often do that, mentioning in passing by France or Italy, then go back and vituperate Germany for another 2000 words or so. And the pattern repeats itself in the next blog post (see the more recent one where you pretend France had nothing to do with the Euro introduction). But this is somewhat tangential to the point.

To your point 5: coincidental, maybe, relevant for the deficit not. If you can contradict the numbers I posted, please do so directly. If you can’t, then you must admit that the magnitude of the purchases and sales was simply to small to affect the German deficit or push it below or above the deficit procedure limits. *That* is a fact.

To your point 6: that’s exactly the point, neither the German government nor the KfW hold to the stocks. The DT started as 100% state owned enterprise, now the state participation (state and KfW) has been reduced to 32%. The same with Deutsche Post – it too started as a 100% state owned enterprise, it now only has a 21% state participation quote (only KfW). Was it too slow? Maybe, but then again why would the german government hurry? Especially since they had the bad luck (or were too stupid) to try and privatise as the dot.com crash was gaining momentum.

Or let’s put it another way: the KfW has consistently bought the state shares below market price. In fact, the last several transactions had a guaranteed-price clause that obligates the KfW to reimburse the german state for the difference, if they manage to place the stocks at a better price on the market. Not only that, but on the ocasion of the biggest transaction the state even provided the KfW a credit line guarantee for the financing of the transaction (which in turn does register in the federal budget, and therefore contributes to the deficit). If the german state didn’t intend for the KfW to sell the stocks, why would they sell them below market price, give them credits or put such a clause in the contracts?

To point 7, OK, but in this case you seem to make a mountain out of a mole hill.

And finally, to point 8, sure, I’ll wait, but please do try to dig a bit deeper when posting, otherwise Part 2 will be just as unfounded as Part 1.