I have received several E-mails over the last few weeks that suggest that the economics…

The deficit is undermining our welfare – because it is too low!

The new Australian federal government released its – Mid-Year Economic and Fiscal Outlook – today and this gave the media something to salivate about and led to sensationalist headlines and presenters oohing and aahing about impending meltdowns and unsustainable government spending and the rest of it. But in terms of actual detail all it really told us was that the government deficit is higher than expected. The issue of focus should have been the expectation rather than the reality – why did the Treasury expect it to be lower given they had overseen an unprecedented fiscal contraction in 2012-13 which reduced economic growth and undermined their tax base? Why didn’t the press focus on that and ask the new Treasurer how cutting government spending now, as the economy is slowing and unemployment is rising is in any way responsible or good economics. Not a word. The message the citizens get is that Australia has a dire government deficit emergency that will undermine our welfare for years to come. The truth is that the deficit is undermining our welfare because it is too low. That is my headline.

The ABC News headline is captured in the following graphic.

The story – MYEFO reveals deficit of $123b over forward estimates, Joe Hockey warns wasteful spending will be ‘eliminated’ – carried the URL (scroll over the link) that said “paints dire picture of economy deficits”.

Which just about tells you how far the ABC, as our national public broadcaster, has bought into the neo-liberal myth-making machine.

The first paragraph went:

The Abbott Government’s first budget statement has revealed an economy in dire trouble with historically deep deficits, more people out of work, slower wage growth and massive revenue write-downs.

But then the article entertains the Treasurer’s claims that massive spending cuts are required to restore the fiscal balance to surplus.

Why didn’t the ABC report bother to ask about the basic rule of macroeconomics – spending equals income? Perhaps they don’t know the basic rule. In which case, why are they reporting on macroeconomic affairs.

The MYEFO document is full of loaded language of the sort that was absent in government fiscal papers in the 1950s and 1960s. We now have to put up with erroneous and misleading statements such as:

It outlines the size of the task to return the budget to sustainable surpluses and to reduce government debt.

There has been a marked deterioration in the fiscal outlook …

The underlying cash balance has deteriorated by $16.8 billion in the 2013-14 year and by $68.1 billion over the forward estimates …

The deterioration in the budget position …

And so it goes on – there is no meaning in the terminology – deterioration – when applied to the federal government fiscal balance.

Deterioration means a worsening. A government balance cannot become worse or better – it is what it is. Employment growth or unemployment – things that matter – can deteriorate and that would present a problem. But a rising government deficit is of no concern in its own right. We should understand it in the context of other events in the economy which matter – in that sense, the shifts in the fiscal position are reflective rather than being intrinsically interesting.

Further how can we view a rising deficit as a deterioration when it is clearly providing spending support for some growth?

In fact, all that has happened is that the estimated government deficit for 2013-14 in the Pre-Election Economic and Fiscal Outlook (PEFO) (August 2013) was $A30.1 billion (1.9 per cent of GDP) and this has been revised to $A47 billion (3 per cent of GDP), a larger estimated deficit of $A16.8 billion.

All the estimates of the government deficit further out have been revised upwards and the numbers provided have created sensationalist headlines in the news media (which reflects the ignorance of the media reporters).

The MYEFO Report lists the factors which have led to the change in the fiscal position since the 2013 update in August 2013.

The factors identified are:

– Slower growth in real GDP, together with softer domestic prices and wages, have resulted in significantly lower nominal GDP, which has largely driven the reduction in tax receipts by more than $37 billion over the forward estimates.

– The softer economic outlook, coupled with changes in demand-driven programmes and the revised assumption for projecting the unemployment rate, has increased total payments by $11.3 billion over the forward estimates.

– Actions by the Government to address the legacy issues inherited from the former Government have impacted on the budget position over the forward estimates, with the largest of these elements being the $8.8 billion grant to the Reserve Bank of Australia.

So a mix of economic facts and political hoo-ha.

The growth effect has reduced estimated tax revenue in 2013-14 from $A369.5 billion in the PEFO to $A364.9 billion in the MYEFO, a fall of $A4.6 billion.

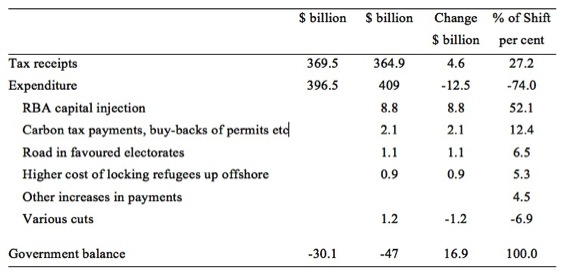

I put together the following table to account for the fiscal shift of $A16.9 billion. It shows that absolute change in the key items and the last column shows the percentage of the shift attributable to that factor.

74 per cent of the increase in the estimated government deficit is attributable to increased expenditure, of which more than half of the total shift is due to the ridiculous capital injection that the Treasurer put into the central bank.

That was a pure political stunt.

27.2 per cent of the shift is due to the cyclical slowdown reducing expected tax revenue.

In terms of the cyclical effect, the current government has every right to blame the previous federal regime (kicked out in September 2013) for the decline in tax receipts.

The actual underlying cash balance was $A18,834 million in 2012-13 or 1.2 per cent of GDP. That represented a massive fiscal contraction of $A24,526 million or 1.7 per cent of GDP, which in the history of public finance data (back to 1971-72) was the largest fiscal tightening at a time when the economy was contracting.

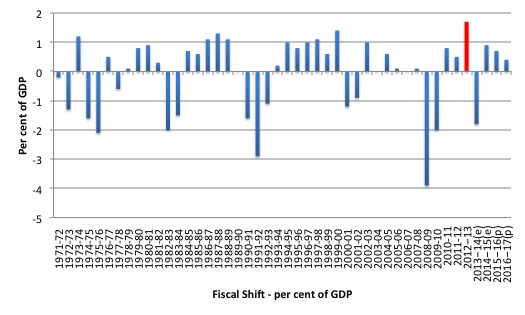

The following graph reflects the updated fiscal estimates and shows the fiscal shift between fiscal years (a positive bar indicating a tightening of fiscal policy).

Even though the previous government failed to achieve its surplus obsession the scale of the fiscal tightening in the last fiscal year (red bar) was historically unprecedented.

You can see that the forward estimates still imply a tightening of fiscal policy when growth is forecast to remain below trend and unemployment is rising.

That is how bad this all is.

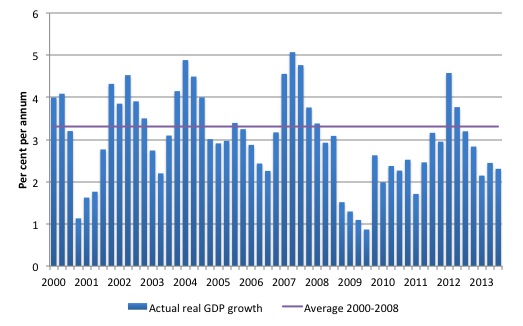

The result: The economy tanked – real GDP growth fell from 4.6 per cent in the March-quarter 2012, then 3.8 per cent (June-quarter 2012), then 3.2 per cent (September-quarter 2012), 2.8 per cent (December-quarter 2012), 2.1 per cent (March-quarter 2.1 per cent), 2.4 per cent (June-quarter 2013) and 2.3 per cent (September-quarter 2013).

So in a period of 18 months the real GDP growth rate has halved because the government tried to pursue a fiscal surplus at a time when private spending growth was declining and

The following graph shows real GDP growth (annual) since the March-quarter 2000 to the September-quarter 2013 with the indigo line indicating the trend growth between 2000 and the decline in 2008. The economy is without doubt performing well below its potential and the fiscal movements reflect that.

In terms of the RBA capital injection, the MYEFO statement says:

The strong and sustained appreciation of the Australian dollar from 2009 caused the RBA to record large financial losses in 2009-10 and 2010-11 as the value of its foreign currency assets declined in Australian dollar terms. This coincided with global interest rates declining to historical lows, reducing the RBA’s underlying earnings.

The resultant losses were absorbed by the Reserve Bank Reserve Fund (RBRF), reducing the balance to significantly below the level now considered prudent by the Reserve Bank Board based on its most recent assessment of the risks to the RBA’s balance sheet …

The low level of the RBRF has not posed an immediate risk to the solvency of the RBA and has not impaired its operations. Nevertheless, on current projections, it would take many years to build the RBRF to the level deemed prudent by the Board – 15 per cent of assets at risk – through the usual channel of retaining profits, leaving the RBA financially exposed in an uncertain global environment.

The ridiculous aspects of this injection are two-fold:

1. The RBA doesn’t even need capital and the Reserve Bank Reserve Fund (RBRF) is just an accounting gimmick. The RBA can create Australian dollars at will by crediting any bank accounts it chooses, just like any central bank. Various voluntary rules and constraints might stand in the way of them doing that easily but intrinsically, freed from these political restraints, the currency issuer has no financial constraints. Its balance sheet is never at “risk”. Pure nonsense.

2. The Treasury actually borrowed from the private sector an equivalent amount to that which was put back in the Reserve Bank Reserve Fund (RBRF). This reflects no operational necessity but at a time when the conservatives are seeking to reduce welfare for the disadvantaged and cut into public education etc, they feel it is necessary to hand out $A8.8 billion in treasury bonds to the parasites in the financial markets.

So more corporate welfare for those who do nothing productive but spend their time shuffling wealth.

To understand the current position we need to appreciate the broader context.

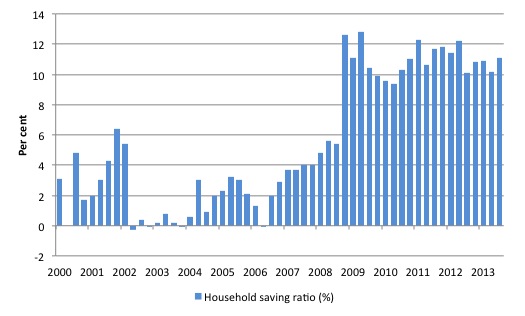

First, the household sector is now carrying record levels of debt as a result of the credit binge leading up to the crisis and we are unlikely to see a return to the low saving ratios that were evident in the period 2000 to 2005.

Households are now saving around 11 per cent of disposable income and that ratio is relatively stable.

That means that government surpluses which were associated with the credit binge, and only were made possible by the unsustainable credit binge are untenable in this new (old) climate. The Government needs to learn about these macroeconomic connections.

A return to higher saving ratios is surely signalling a need for a return to more or less continuous government deficits, depending on what happens to the external sector.

That is what the overall real GDP growth slowdown and rising unemployment is telling us – very clearly. So clearly that the neo-liberals fail to see it!

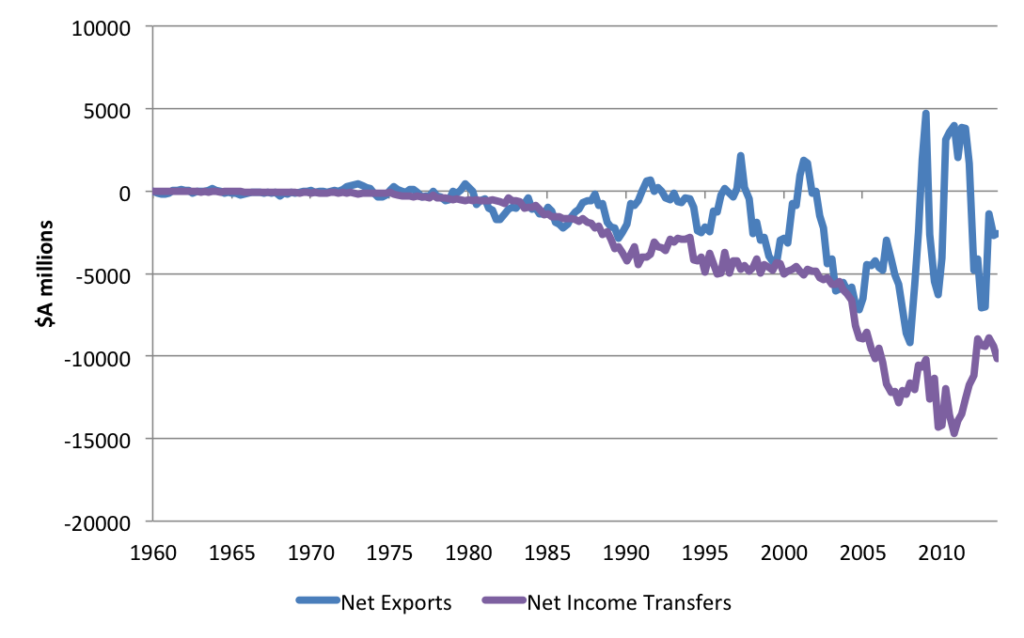

Second, the following graph shows the components of the Current Account balance in $A millions from the March-quarter 1960 to the September-quarter 2013. The blue line is the difference between merchandise exports and merchandise imports of goods and net services – that is, the balance on goods and services. The indigo line is the net income transfers, which are the sum of primary and secondary income.

So despite the record terms of trade for our mining exports, the trade account remained in deficit and the deficit on the income account means that the Current Account continues to drain income from the Australian economy.

For those who don’t fully appreciate what I mean by “to drain income” here is another way of looking at it. For every dollar produced in the economy, around 3.5 cents is lost (in net terms) to the Rest of the world either via the deficit on goods and services or the net income transfers abroad. That 3.5 cents doesn’t flow back into the domestic economy each period.

For GDP to remain stable, the external deficit has to be filled by deficit spending from the public sector and/or the private domestic sector.

The other point to note, which is often lost in the debate is that the our exposure to the rest of the world (particularly capital flows) rose after we floated in the early 1980s.

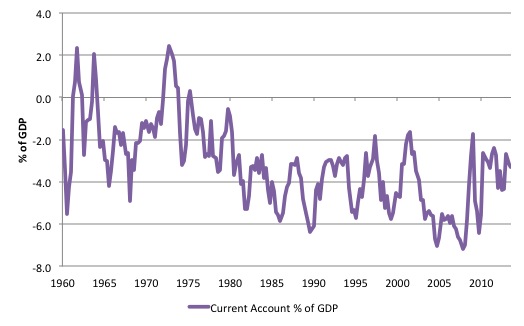

The next graph shows the Current Account balance as percent of GDP from the March-quarter 1960 to the September-quarter 2013.

The forward estimates are predicting this will increase to 4 per cent of GDP (up from an actual 3.3 per cent in the September-quarter 2013.

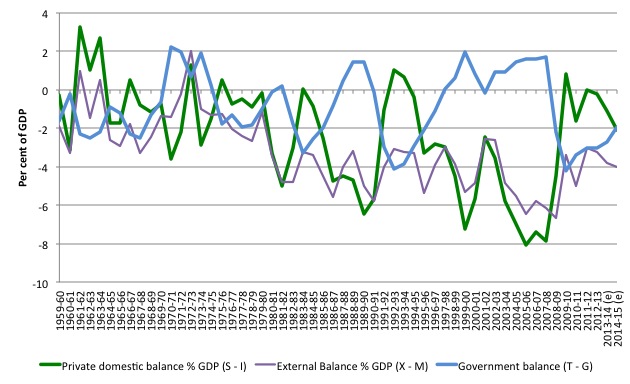

Third, the last graph puts the sectoral balances together from 1959-60 to the 2014-15 (where (e) stands for the latest estimates in the MYEFO. If you use this graph as the basis – then weave a narrative about why the lines have moved in the way they have you will understand why the current deficit is too low despite rising more than expected and why growth is slowing.

The improvement in the External balance was due to imports falling as exports rose and then imports growing more slowly than exports. This was due to the slowing domestic economy.

Further Net income transfers fell during the first slowdown as domestic activity fell and dividends etc were lower.

But the rise in the government deficit in 2008-09 saved the economy from a major recession and accommodated the return (albeit briefly) to surplus for the private domestic sector.

The fiscal retrenchment since then is mirrored in the return to private domestic deficit. In part, the private domestic deficit was being driven by rising investment spending associated with the mining boom. Inasmuch as that returns profits on the borrowing we might think it is unproblematic. But the boom is now tapering significantly.

There is also evidence of increased personal credit as incomes get squeezed by the slowdown and housing affordability falls again. The household debt burden has started to rise again in recent quarters and that is unsustainable.

The point is that the government can do very little about its own balance without undermining the economy given the spending decisions that are being taken by private households and firms and external transactors.

Conclusion

On days like this when basic principles of macroeconomics are discarded and an entire nation is caught up in a nonsensical debate about nothing one wishes that they were a geologist poking around layers of rocks somewhere out of contact!

And I wrote a whole blog about government accounts without referring to the “budget”. Language matters.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

I’ve added my tuppence worth to the ABC debate with a quick lesson on how public deficits are private surpluses etc.

It would be good if others could do the same!

http://www.abc.net.au/news/2013-12-17/myefo-paints-dire-picture-of-economy-deficits/5161466

Nice post Bill,

You’ve made a couple of mistakes:

“Around 3.5 cents is lost”, followed by “that 3.6 cents doesn’t flow back”.

The current account as a % of GPD has “$A Millions” as the descriptor on the Y-axis.

Although I did notice your frequent usage of the phrase “government balance”, the budget metaphor was still engage simply through your ample use of quotes. Something to think about.

Thanks Andrew

Fixed now.

best wishes

bill

Peter,

A noble gesture but in my experience by the time your comment is approved and by the time you go back there are a hundred things you need to respond to that emanate from your comment and then it is not worth the effort or if you do a plan to respond in one fell swoop by the time you are ready the comments are closed.

If the moderator didn’t have to approve every comment, the service in being able to comment would be more effective.

Great post Bill.

On a seperate point, will you write a submission to the financial services enquiry? For the sake of the Country, it needs a rational voice.

Deficits are probably ALWAYS too low because the central bank is allowed to usurp the fiat creation authority of the monetary sovereign (e.g. US Treasury) for the sake of what SHOULD BE entirely private banks.

Well, enjoy the fascism unless you’re willing to euthanize those ultimate rentiers, the banking cartel.

an entire nation is caught up in a nonsensical debate about nothing

Yes, its very frustrating to hear so-called highly paid experts on the TV spouting such nonsense. It must have been like this in the middle ages when Copernicus and Galileo struggled to convince everyone that the Earth was a planet in orbit around the sun!

Do you think it would help get the message across if you chained yourself to the gates of Parliament and went on hunger strike until everyone listened? 🙂

PeterMartin, I dropped by your comment on ABC.net.au and sadly noticed how comments before and after blithely continued their politically-biassed slogfest, avoiding at all costs the matter under discussion.

The “entire nation” might well be geologists as they all seem to have rocks in their heads.

Sadly, Phill, the notion of “revenue” is also firmly embedded in their heads.

There might’ve been only one comment, apart from Peter’s, hinting at MMT insights.

But take some comfort that the great majority were going after Hockey with baseball bats. The moderator certainly snapped comments off rather abruptly. Obviously not what they were hoping for.

The whole exercise has gone down like a lead balloon.

Sorry for being that guy. However.

I looked at the ABC page and there is an error in Peter Martins analysis. With respect to the governments deficit he said:

“Its a simple accounting identity that if the public sector are in deficit then the non government sector are in surplus. They can’t both be in surplus simultaneously”.

This statement is only true in a closed economy without an external sector or if the external sector is in deficit.

I noticed this comment in another ABC article today: ” just about everyone agrees that fiscal policy should to be moved to a sounder structural footing and with small underlying budget surpluses more desirable than not over the course of the business cycle.”

http://www.abc.net.au/news/2013-12-18/koukoulas-hockey-is-saving-the-good-news-for-may/5163646

Stephen Koukakis isn’t too bad, as economic journalists go, but someone should tell him that phrases like

“just about everyone agrees that…” are a big no-no in scientific circles.

If he thinks a budget surplus is a good thing he should try to explain why in a rational manner.

Dear Alan Dunn (at 2013/12/19 at 12:54)

The statement made by Peter Martin is accurate for an open economy. You will note he used the term “non-government sector” not the private domestic sector. The non-government sector includes the external sector.

best wishes

bill

Alan Dunn,

I did realise that when using the term ‘non-government sector’ that many people would mistakenly take that to mean the domestic private sector. But I was trying to keep it simple and encourage a bit more thought from first principles.

For a country like Australia which does consistently run current account deficits (ie the overseas sector is in surplus) the effect of the confusion is to actually understate the extent of the problem that the imposition of any government surplus would impose on the private sector. Not only would the private sector deficit have to accommodate that, it would have to be even larger to accommodate the overseas sector too.

Hardly anyone understands that though. Its a big problem.

oops. I should know better. I had a brain fade and as Peter said – I associated non-government to mean private domestic sector.

I have placed myself in the sin bin for 10mins.

Dear Alan Dunn,

It is true that the domestic private sector can still be in surplus when then public sector is in surplus if the external sector (basically, exports minus imports) is sufficiently in surplus. But tell me in what way it makes sense for a nation to net export (give up more useful stuff to foreigners than it receives in return) in order to allow the domestic private sector to satisfy its spending and net savings desires? Wouldn’t it be better for the central govt (assuming it is a monopoly owner and issuer of the nation’s currency, which rules out EU central govts) to deficit spend, hence provide the net financial assets that the domestic private sector needs to satisfy its spending and net savings desires, and, upon acquiring the useful stuff that would have been given to foreigners (net exports), be directed by the central govt to provide hospitals, schools, universities, and other useful infrastructure with public goods characteristics that the central govt can distribute to the nation’s citizens free of charge?

By the way Alan, these questions are not directed at you (since you might feel the same way as me) but to anyone who happens to think that net exporting is a means of justifying public sector surpluses when the domestic private sector is intent on positively net saving out of current income. In my view, international trade should be balanced (exports = imports) and a central govt’s budget should simply accommodate the net savings desires of the domestic private sector. So be it if it means a central govt has to run budget deficits forever. For anyone who thinks that net exporting makes sense, why is it that every simple textbook example provided in an early chapter demonstrating the benefits of trade/exchange always involves balanced trade (e.g., me giving up some surplus apricots to my next-door neighbour in return for some of her surplus peaches)? Extending a simple exchange relationship involving balanced trade to that of “anything to do with trade must be good, including a country net exporting” is yet another example of how the mainstream economics profession uses simple situations involving specific assumptions to justify something more complex and completely out of context.

I made this last point about the stupidity of net exporting in a previous comment. To the clown who responded that it would allow a nation to net import in future (and who might think of responding the same way again), net exports (today) + net imports (tomorrow) = balanced trade!

Phil,

I hope you’ll pardon me jumping in here. You ask the question “in what way it makes sense for a nation to net export ?” I do understand the MMT rationale; but, I must admit its the one part of MMT theory that I do have some reservations about. The Chinese and the Germans obviously think it a good idea. German workers are probably having a better time of it than many of their other European counterparts, just as many Chinese are doing well too. So are the Chinese and Germans stupid to do what they do? Were the Japanese stupid too when they ran high export surpluses?

I’d prefer there to be a more balanced trade on the whole. Warren Mosler in his book, the 7 deadly innocent frauds, allows that there should be some strategic exceptions to the “imports are good” rule but mentions only the steel industry. If there are going to be strategic exceptions, they should include many other industries other than just steel. Like agriculture, telecomms, defence, ….. Its hard to think of an industry that isn’t strategic in some way.

The purist MMT position would be a hard sell in the Holden works at the moment. I do wonder if there doesn’t need to be a bit of a rethink on that.

Yes, Peter, the Chinese are being stupid in doing what they are doing. China has an extremely low consumption/GDP ratio. I’ve estimated that if China raised its consumption/GDP ratio to something similar to that of nations like Australia and the USA, and it distributed its additional consumption goods equitably (the additional consumption being the goods that China would not be ‘net’ exporting to Australia and the USA as it increased its consumption/GDP ratio), China could increase its consumption-related welfare without having to grow its real GDP for 20-25 years. Think what that might do to help alleviate the rise in greenhouse gas emissions!

In any case, you clearly missed my point. Let’s say that nation X’s current exports = $200 million and its current imports are $100 million. Nation X would have net exports of $100 million, which would be $100 million worth of goods and services enjoyed by foreigners (ROW) over and above the goods and services enjoyed by X from importing goods from the ROW. Let’s say that nation X’s exports then fell to $100 million so that its net exports now equal $0. Let’s also assume that, prior to exports falling, there was full employment in nation X. The fall in exports would reduce X’s national income and lead to some unemployment.

Nothing is made or provided without the use of capital, labour, and natural resources. Some capital, labour, and natural resources that would have been used to produce the extra $100 million worth of exports are now idle – hence, why there is now unemployment. The central govt of nation X is the monopoly owner and issuer of the nation’s currency. The currency is a fiat currency and the nation operates a flexible exchange rate regime. The central govt of X therefore has no budget constraint.

The central govt of X can purchase the idle capital, labour, and natural resources (and pay the same price for them). It can then direct these additional resources it has at its disposal to produce schools, hospitals, roads, etc. By paying the same price for the capital, labour, and natural resources as did the once-producers of $100 million of additional exports, national income is unchanged. Full employment is restored, and the domestic private sector can now have its spending and net savings desires met just as well as before the decline in exports. More importantly, the citizens of nation X get to enjoy the benefits of the additional schools, hospitals, etc., instead of the ROW enjoying additional plasma-screen TVs (assuming that is what the net exports consisted of). What’s more, a currency-issuing central govt doesn’t have to recoup the cost of supplying the additional schools and hospitals and so can provide them free of charge to its citizens.

Overall result: Same national income, full employment maintained, and more useful stuff being enjoyed by the nation’s citizens. Overall, nation X is better off.