The – Battle of Sedan – in September 1870, was a decisive turning point in the relationship between France and Germany, which still resonates to this day and has influences many subsequent historical developments. When I was researching my 2015 book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale (published May 2015) –…

Options for Europe – Part 1

The title is my current working title for a book I am finalising over the next few months on the Eurozone. If all goes well (and it should) it will be published in both Italian and English by very well-known publishers. The publication date for the Italian edition is tentatively late April to early May 2014. The book will be about 180 pages long. Given the time constraints I plan to devote most of my blog time over the next 3 months to the production of the book. I will of-course break that pattern when there is a major data release and/or some influential person says something stupid or something sensible. I hope the daily additions will be of interest to you all. A lot has to be done! Because the drafting has to be tighter than the normal stream of consciousness that forms my usual blogs, the daily quotient is likely to be shorter. I also have some happy new year comments at the end today! But if you get bored before then – Happy New Year!

Rough Table of Contents

1. Define the challenge for the Eurozone in terms of current policy failure and the viable options.

2. Discuss the basis and rationale for the current structure of the monetary system and the options it provides.

3. Brief overview of MMT – basic principles but specifically applied to Eurozone.

4. Juxtaposition of the two viable options: (a) abandon Euro; (b) keep Euro with fiscal authority

5. Discuss pragmatic option – Overt Monetary Financing – using the ECB as a fiscal vehicle and a monetary authority to overcome the restrictions that would prevent 4a and 4b.

Introduction

Europeans have long suffered from the chicanery of organised confidence tricksters. The recent television series – Borgias – where the religious sanctity of the Papacy in Rome in the C15th was really a front for a sophisticated and brutal organised crime racket that fed the rich at the expense of the common folk is a stark reminder of the veils that elites erect to disguise their wantonly corrupt and lascivious use of power. The behaviour of the Roman church throughout history is testament to how this veil of power is exercised to exploit the innocent, the ignorant and those that accede to elite authority without question.

While not in Rome and less clothed in mystery and ceremony than the Roman Church, the European political elite, principally ensconsed in Brussels and Frankfurt, could also be characterised as confidence tricksters in the same mould. Their methods are more sophisticated and the dominant religion is now neo-liberalism with the economy as a deity that the common folk have to sacrifice and serve penance to. Not much has really changed.

[MORE HERE BY WAY OF SCENE SETTING ETC]

How did Europe get itself into this dysfunctional mess? What are its options now that it has the complex legislative and institutional machinery in place that many believe makes the decision to adopt the Euro irreversible? Is exit a choice now for any member-state?

To understand where Europe is at present, one, not surprisingly has to cast back in time. The idea of a common currency was not born in the late 1980s with the Delors Plan or the Treaty of Maastricht. The idea of a common currency in Europe was in vogue at the time the Post World War 2 Bretton Woods system of fixed exchange rates collapsed in August 1971, after President Nixon suspended the convertibility of the US dollar into gold.

Various currency arrangements followed the formal abandonment of Bretton Woods system in March 1973. Most nations freely floated their currencies against other currencies, which means their values are determined by the forces of supply and demand in foreign exchange markets. Other nations opted to peg their currency to another currency or perhaps to a basket of other currencies while others adopted a foreign currency outright (for example, nations that “dollarised” by accepting the US dollar as their domestic currency).

In the C19th, when Europe was undergoing the unification of states, the introduction of a common currency was seen as an essential element. Germany in 1834 united its states and formed the German Customs Union (or Zollverein) with a common currency the Vereinsmunze, later in 1876 to become the Reichsmark once the German Reichsbank took control of all currency issuance (see Holtferich, 1995).

The Italian unification of 1861 was also accompanied by the creation of a unified lira monetary unification.

Similarly, in 1848 the Latin Monetary Union was formed between France, Belgium, and Switzerland. They were joined in 1867 by Italy, Greece and Bulgaria. While there was no common currency introduced, each nation’s currency (gold and silver coins) was freely accepted across the Union (see Flandreau 1995, 2000; Einaudi 2000; Flandreau and Maurel, 2005).

The Scandinavian Monetary Union was established in 1873 between Sweden and Denmark with Norway joining two years later. Again no common currency was introduced but, like the Latin Monetary Union, the currencies of the member nations were freely exchangeable (see Bergman et al., 1993; Henrikson and Kaergard, 1995).

The multilateral rather than unified national arrangements (Germany and Italy) collapsed for various reasons with World War I being the most significant event.

There were other examples of monetary union in Europe in the C19th (see Bordo and Jonung, 2003).

More recently, the German Foreign Minister, Gustav Stresemann, who had worked assiduously in the inter-war period to reconcile Germany and France, petitioned the League of Nations on September 9, 1929 with the following question, “Where are the European currency and the European stamp that we need?” (European Commission, 2012).

He wasn’t to know that the New York Stock Exchange would collapse into Black Friday just six weeks later and the idea of international currency cooperation in Europe became improbable.

You will note that Stresemann saw the need to bring France and Germany into a close economic working relationship, a theme that has dominated and motivated discussions about the introduction of the euro.

[MORE HERE ON THE LEAD – 1970s DEBATES, MacDouggal Report, The Delors Report etc]

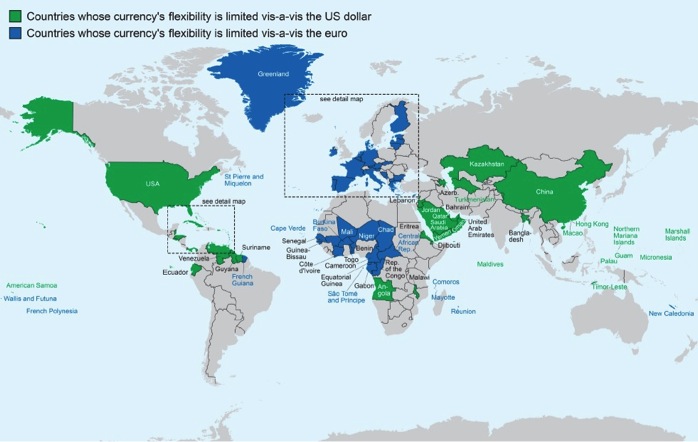

For all its failings, the euro has become a dominant currency. Once the Euro was introduced in 1999, two broad currency blocs formed in the World – the US dollar bloc and the Euro bloc. By 2008, of the 226 nations classified in the IMF’s “Annual Report on Exchange Arrangements and Exchange Restrictions”, 91 had freely floating exchange rates (40.3 per cent), 55 were pegged in some way to the US dollar (24.3 per cent) and 54 were associated with the Euro (23.9 per cent). The remainder had other pegged or multilateral arrangements (for example, the Southern African bloc organised around the South African rand).

The following map shows the division of nations by euro and US dollar.

Source: Fischer (2012: 52).

[TO BE CONTINUED]

References

Bergman, M., Gerlach, S. and Jonung, L. (1993) ‘The Rise and Fall of the Scandinavian Currency Union 1873-1920’, European Economic Review, 37, 507-17.

Bordo, M D and Jonung, L. (2003) ‘The Future of EMU: What Does the History of Monetary Unions Tell Us?’ in Capie, F.H. and Wood, G. (eds), Monetary Unions: Theory, History, Public Choice: International Studies in Money and Banking, Vol 18, London, Routledge, 42-69.

Einaudi, L. (2000) ‘From the Franc to the ‘Europe’: The Attempted Transformation of the Latin Monetary Union into a European Monetary Union, 1865-1873′, Economic History Review, 53(2), 284-308.

European Commission (2012) Towards a single currency: a brief history of EMU, http://europa.eu/legislation_summaries/economic_and_monetary_affairs/introducing_euro_practical_aspects/l25007_en.htm

Fischer, C. (2012) ‘Currency blocs in the 21st century’, BOFIT Discussion Papers 24/2012, Bank of Finland Institute for Economies in Transition. http://www.suomenpankki.fi/bofit_en/tutkimus/tutkimusjulkaisut/dp/Documents/2012/dp2412.pdf

Flandreau, M. (1995) ‘Was the Latin Union a Franc Zone?’, in Reis, J. (ed) The International Monetary System in Historical Perspective, London, Macmillan, 71-90.

Flandreau, M. (2000) ‘The Economics and Politics of Monetary Unions: A Reassessment of the Latin Monetary Union, 1865-71’, Financial History Review, 7(1), 25-43.

Flandreau, M. and Maurel, M. (2005) ‘Monetary Union, Trade Integration and Business Cycles in 19th Century Europe’, Open Economies Review, 16, 135-152.

Henrikson, I. and Kaergard, N. (1995) ‘The Scandinavian Currency Union 1875-1914’, in Reis, J. (ed) The International Monetary System in Historical Perspective, London, Macmillan, 91-113.

Holtferich, C-L. (1993) ‘Did Monetary Unification Precede or Follow Political Unification of Germany in the Nineteenth Century?’ European Economic Review, 37, 518-24.

IMF (2012) Annual Report on Exchange Arrangements and Exchange Restrictions 2012, International Monetary Fund, Washington. http://www.imf.org/external/pubs/nft/2012/eaer/ar2012.pdf

Tsoukalis, L. (1977) The Politics and Economics of European Monetary Integration, London, Allen and Unwin.

Happy New Year

To all the readers of my blog – a happy new year. Thanks for coming along and adding your comments or just being part of the Modern Monetary Theory (MMT) team.

We are growing.

I am not all that keen on “League Tables” (unless my football team is on top!) but in August 2013, the – Top 200 Influential Economics Blogs: Aug 2013 – put out by Onalytica Indexes had this entry:

43. Bill Mitchell – billy blog

I don’t know how we will get to Number 1 (Krugman is there) but we will just keep chipping away.

Other MMT blogs were well-ranked (for example, 45 New Economic Perspectives, 71 The Center of the Universe). That augurs well.

Goals for 2014:

1. Purge neo-liberalism from the minds and souls of all citizens.

2. Create an excitement about full employment and equality.

3. Be helpful.

4. Run and ride plenty of kms.

5. Get to the beach more often (I will be moving back to the East Coast in the early New Year).

6. Play some nice guitar.

7. Finish this Eurozone book by March and the MMT Textbook by June.

There are other goals but I will keep them within my family!

Happy New Year Bill,

Thanks for all the great economic and other enlightenment you have brought throughout the past year. Long may it continue.

Best wishes

“They were joined in 1967 by Italy, Greece and Bulgaria.”

1867?

Note the sequence and dates you mention is different from that described in the LMU Wikipedia entry.

“For all its failings, one could not say the euro hasn’t become a dominant currency.”

Too many negatives!

“For all its failings, the Euro has clearly become a dominant currency.”

Too risky to go anywhere near the bloody beach in the UK currently. Jealous ? Moi ?

Happy new year.

Have a great New Year, Bill.

Happy New Year, Bill. I’ll certainly buy your book. James

Happy New Year Bill! I’m looking forward to the reading the finished books.

Happy New Year Bill and thanks for your always interesting articles.

Luciano Marrocco

Love the goals for 2014. Thanks for writing such a great blog; long may you continue. Your work is always appreciated.

Happy New Year!

Lets all subscribe to Bill’s first goal no matter how crazy and fanatical our friends, colleagues and family think we are.

“1. Purge neo-liberalism from the minds and souls of all citizens.”

Happy New Year !

Bill Mitchell – ‘Uluru’ of the Australian economic landscape!!

Happy new year and thanks for keeping this unbelievable blog up and running, I am literally re-educating myself through readinv this blog…

Happy New Year !

We should establish the true and original Monetary Theory of Production of John Maynard Keynes:

What is a monetary theory of production?

https://monetarytheoryofproduction.wordpress.com/

Happy New Year. Keep Up the good work! I hope you get invited on to the ABC sometime in 2014.

There is different strands to Catholic thought.

Every so often it does reflect on its own teachings / and or the Jesus blokes teachings perhaps for the selfish reason of having and hoping for a sustainable flock.

The distributionist / co- op movement has chiefly come from this spring.

But I guess Bill you are in favour of extreme concentrated capital claims rather then the above given your full employment / never ending economic war footing policy

(a) abandon Euro; (b) keep Euro with fiscal authority

What about doing them both to at least some extent. What if tax authority were to accept either euros or local currency in payment of taxes. At least transition phase out of euro could be made easier by accepting both of them for some time. Starting another currency on the side could be easier thing to sell politically too.

Hi Bill, thx for the good work!

All the best for 2014

Thanks for this very interesting blog.

It may have been due to the Christmas season, but didn’t the New York Stock Exchange collapse on Black “Thursday”?