I have received several E-mails over the last few weeks that suggest that the economics…

Public ownership rules airport rankings!

I saw this story in the Melbourne Age today World’s best airport named. I knew it wouldn’t be Sydney or Melbourne where I am often in and out of much to my displeasure. So I scanned the list. Sure enough a whole lot of airports some of which I regularly fly and know to be excellent in terms of ease of use, charges and available facilities. Anyway, I had intended to write a blog today about trends in world foreign exchange markets (see digression below) but the airport rankings attracted my interest because I am also thinking about infrastructure provision at present.

Before we get to the rankings let’s just vent a bit about Sydney Airport. Its users do not appear to be very happy with it if the Skytrax Reviews are anything to go by. The new parking station at the international terminal is exhorbitant and the free buses that used to take one from the long-term car park (where my little Renault got totalled by a hail storm a few years back!) have been abandoned by the owner, Macquarie Airports.

Who owns Macquarie Airports? According to their WWW site, “MAp is listed on the Australian Securities Exchange (ASX) as a top 50 ASX company with a market capitalisation of approximately A$4 billion and over 35,000 investors, including some of the world’s largest pension funds.” But the investment funds (listed in Bermuda) appear to be managed by Macquarie Bank.

This article argues that “prices for short-term parking in Australia are among the world’s most expensive”:

Taking into account modest delays, you may need an hour’s parking to collect a friend. In Melbourne that will cost $12, at London’s Heathrow, £4.10 ($8.50) and New York’s JFK, $US6 ($8.70). For a clearer picture of what an hour’s parking costs, try the Big Mac index: in Melbourne it is equivalent to 3.48 Big Macs but only 1.79 in London and 1.68 in New York. Even worse is Sydney airport, where an hour costs $15 – or 4.35 Big Macs.

They quoted Choice (a consumer watchdog sort of organisation) who said that Macquarie’s expansion plans into Britain were met with “a lot of warnings to UK airports that Macquarie had gouged Australians on parking … [it was feared] … that the privatisation of airports causes prices to significantly rise.”

The Australian Competition and Consumer Commission reported that the airports charging structures are “consistent with airports having a monopoly position.”

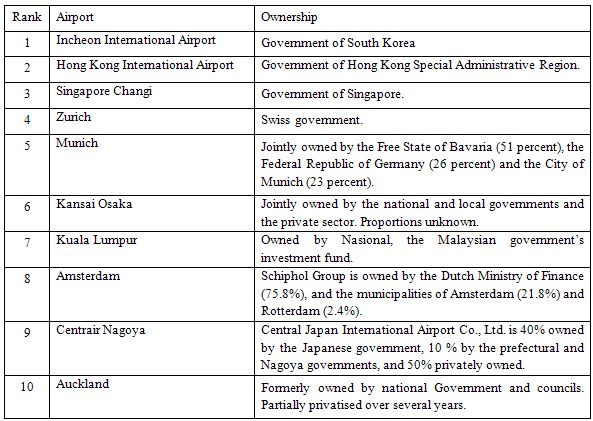

Anyway, I became curious about who owns the top 10 in the latest World Airport rankings. Given the privatisation lobby has always claimed that one of the essential advantages of private ownership was that the resource would be more efficiently used (given the need to satisfy the share market discipline on performance), we should expect all the top airports to be privately owned.

Well for those who considered privatisation to be one of the biggest smoke-and-mirrors redistribution of wealth to the rich that the neo-liberals invented (as I did) then the answer will come as no surprise. A few minutes research at lunch time came up with the following details. Mostly the top 10 are government owned. Only 1 is privately-owned (10th).

I will write some more about public infrastructure provision in coming blogs.

There is a lot of research now available which shows that the gains from privatisation have been largely illusory. I recalled this piece from Ken Davidson who wrote in 2006 about the Victorian Government’s County Court PPP development:

… the details of the County Court PPP contract … [were] … censored from the committee report. Fortunately, the main elements of the contract can be put together from official documents … These show that the private partner (project financier ABN Amro) was given a 99-year lease on the site on the corner of Lonsdale Street and William Street for a peppercorn rental of $1 for 99 years. In return, it was required to build and operate the County Court, to be leased to the Government over 20 years for $533 million, for a structure that cost $140 million to build … At the end of the lease period, the Government will have nothing. If the Government in 2022 decided to buy an equivalent building, it would cost about $500 million, given the inflation in land and building costs … By contrast, the owners of the County Court will have a building with a depreciated value of $108 million on prime land in the CBD-leased site for a further 79 years, for a peppercorn rent … The deal is a scandalous waste of taxpayers’ money, and the major beneficiary was the Packer family’s Challenger Financial Services Group.

Apparently the Victorian Government had received a consulting report from Ernst & Young which said the County Court deal “ranks as one of the most innovative – the state purchases court facilities on the basis of time used, i.e. the volume risk is transferred to the private sector, and the facility does not revert back to the state at the end of the contract, i.e. residual risk is also transferred”.

Davidson’s contempt is clear. He wrote:

Yes, you read correctly. Taxpayers have been spared the risk of having a redundant building on their hands if crime abates.

As I have written previously – see Public infrastructure 101 – you cannot transfer the risk.

The standard argument against PPPs is that the private sector has to price its debt in the market whereas public debt prices at the long-term bond rate. Given that there is typically a 3-5 per cent difference between private and public funds, the PPP can never be cheaper unless services (employment) are cut dramatically or construction quality reduced. But the PPP lobby say that the differential is non-existent because it merely reflects the transparency of the risk that the private sector entity has which is suppressed in the public borrowing charges.

So we have to recognise that the difference in borrowing rates reflects project risk and lower public rate implies that government will rescue a failing project by tax hikes. Therefore the PPP is seen as an efficient transfer of risks from public to private and the critics are dismissed as being ignorant of this risk transfer argument. The gains are alleged to arise from the private sector being better able to manage risk – largely because they have a higher incentive to do so – private profit.

The real problem with the PPPs in this regard is that is a falsehood that the risk shifts from the public to the private sector. Who ultimately bears the risk? The risk premium in private financing is based on the fact that a private entity can become bankrupt with its product and service exiting the market. With an essential public service it is a fantasy to say that the PPP contract transfers risk to the private sector. If the private partner defaults, the public always has to pick up the pieces. There is no real risk transferred.

There is substantial empirical evidence, particularly from the UK that shows that PPP partners in the private sector profiteer from the “risk” transfer component built into the contract payments. The private provider aims to minimise financing costs over the life of the contract by early repayment and refinancing existing loans at lower interest rates. The risks are typically high in construction phases and drop to near zero once service operations begin.

The private partner reduces costs by refinancing at lower rates once construction is completed. The private partner captures these gains at the expense of the social good. The PPP contract may be able to prevent this from happening but then it reduces the incentive of the profit-seeking private provider to enter the contract.

The problem is that the concept of making private profit on public infrastructure is in our viewed a flawed one. Why should the public payments include a profit margin? Is ownership or management the key to sound project outcomes? This is a rehearsal of the privatisation debate which failed to show ownership mattered.

The question of national infrastructure provision however goes beyond these concerns. It also encompasses who is responsible for planning out future national projects to advance the public purpose – Macquarie Group in pursuit of their own profit or the Government who should be in principle looking out for all of us. The trend in recent decades has been to cede this public responsibility to the large private investment groups which has devalued our community resources.

I will write more about that another day.

Digression: Foreign exchange movements

This was going to be the main topic today but as I noted above I became distracted and have only limited blog writing time. The point is as follows. in a Bloomberg financial market’s report today the headline was interesting – BRICs Add $60 Billion Reserves as Zhou Derides. So who are the BRICS – none other than Brazil, Russia, India and China – all emerging economic powers.

The article notes that:

The BRICs are buying dollars at the fastest pace since before credit markets froze in September, protecting exports even as leaders of the biggest emerging

markets consider alternatives to the U.S. currency. Brazil, Russia, India and China increased foreign reserves by more than $60 billion in May to limit currency gains as the first global recession since World War II restricted exports, data compiled by central banks and strategists show. Brazil bought the most dollars in a year, India’s reserves gained the most since January 2008 and Russia added the most foreign exchange since July.

So what is that all about? Well they clearly want to keep their own currencies devalued against the USD to improve their export market shares. They all consider the way out of the economic crisis is to export more. To achieve that they want to keep the terms of trade strongly in their favour. They also now hold so many USDs that if it depreciates it will devalue their holdings.

Anyway, the strategy is working. The USD has strengthened against each of the BRIC currencies in recent days.

So why should we care? Well the current US strategy is very confused. Firstly, the US government would prefer the USD to be sinking right now to stimulate their own export demand. But on the other hand, because they are stuck in the mistaken belief that they have to “finance” the huge deficits that are now apparent, they want the foreigners to buy the USD and purchase US Government debt. The two strategies are at odds with each other and reflect how badly things can turn out when you follow erroneous neo-liberal approaches to government finance.

The problem for all of us is that US exports will stall now and coupled with rising crude oil prices, US expenditure will increasing head to imports doing nothing at all for domestic demand.

And with the The US President claiming they are “running out of money” (can you believe that?), you can expect there to be an effort to “reign in the deficit”. Not a good outcome for the US or the rest of us.

Digression: Strange things at the ABS

The Australian Bureau of Statistics released their International Merchandise Trade: Confidential Commodities List today with the updated list of what sneaks in and out of the country without being traceable by researchers.

In their explanatory document, the ABS says:

There are many reasons for requests for confidentiality, for example:

– a claimant may not want the total value and/or unit values of their imports or exports to be known, as such knowledge may be damaging to their business

activities;– a claimant may want to protect details of the volumes they trade or the countries from which they import or to which they export;

– an imported commodity may be the subject of an anti-dumping inquiry; or exports to or imports from certain countries may be politically sensitive and the

claimant may be concerned that disclosure of the country of origin/destination may provoke protests or boycotting from other countries or some sections of the local community.

So if you are exporting nasty items that you know will ruin your business standing in Australia you can apply for exclusion under the the so-called Confidential Commodities List (CCL). Some (like me) might argue that this is a pretty dubious way to hide from your social responsibilities to the community.

Anyway, one item that caught my interest. Item 9021210017 Artificial teeth listing on the CCL was renewed in May 2009 and involves trade with Canada, France, Germany, Slovakia and the UK.

Wonder what is going on there?

Dear Bill,

Your discussion of PPP sounds like the GSEs in the US . . . no transfer of risk (obviously, since the Treasury picked up the pieces), just a higher rate on the bonds and a higher profit margin.

Regarding the BRICs and the US$, I’ve been pointing out the schizophrenic $ policy of the US govt for a few years now to my students (we want China not to manipulate its currency to keep the $US weak, but we want them to keep buying Treasuries and keep the $US strong). Good to see it finally getting some press so my students can see I wasn’t the crazy one.

Best,

Scott

My dear premier Anna obviously does not agree. I wonder if the foreshadowed price hikes for electricity in QLD are at all related to the plan to flog the (currently) state government owned coal haulage business. Are the generators (around one-third or one-half privately owned) expecting to be forced to pay more for thermal coal?

Hey there,

Just wanted to let you know – it is Khazanah Nasional (Khazanah), not Nasional, who owns Kuala Lumpur International Airport.

Regards.