I have received several E-mails over the last few weeks that suggest that the economics…

Animal spirits – optimism that may not last

Its winter here in Newcastle! Today my shark-o’clock morning surf expedition was freezing! Full wetty and still cold! But for northern hemisphere readers pleased be warned that freezing means a water temperature of 19 degrees celsius and air temperature of 14 celsius. Anyway, the sudden sensation of cold reminded me of my mortal origins. One thing led to another and I was soon thinking of animal spirits! This is what JM Keynes said drives the business cycle up and down. And today (and yesterday) we have been reminded of the role that sentiment might play in economic life. The news is probably good and suggests that this downturn might be more moderate for Australia than the global experience would have indicated. But it might also be bad. Ahh, economics!

In the 1936, The General Theory of Employment Interest and Money, Keynes used the term ‘animal spirits’ to show that macroeconomic activity is driven by optimism which then gives way to pessimism. The famous paragraph (pages 161-162) state:

Most, probably, of our decisions to do something positive, the full consequences of which will be drawn out over many days to come, can only be taken as the result of animal spirits – a spontaneous urge to action rather than inaction, and not as the outcome of a weighted average of quantitative benefits multiplied by quantitative probabilities.

As an aside, among the progressive economics clan I am one of those who disliked the General Theory. Most progressives eulogise it. I rather thought it was poorly written and more importantly, intrinsically compromised by its Chapter 2 concession to neoclassical labour market constructs. By the 1940s, this compromise had spawned the so-called “synthesis” (IS-LM analysis) which really retarded the development of macroeconomics and gave way to the modern forms which are used by neo-liberals to dump on fiscal activism.

But the point is that confidence is a powerful motivator in itself and can drive self-fulfilling outcomes. If you believe something will happen then you start acting as though it will and by those actions you reinforce the likelihood that it will happen. When consumers and investors are pessimistic they start to adopt behaviours that similarly lead to negative economic outcomes which then ratifies their belief systems and things go from bad to worse.

This was one of the basic messages of Keynes and became the raison d’etre for large national government intervention – to break into the expectations cycle by filling the gap left by the pessimists and demonstrating that pessimism was not a sensisble sentiment to maintain. So when times are bad large fiscal stimulus packages not only fill the spending gap and underwrite employment but also raise suspicions among the doubters that things might be getting better after all and so it is time to get on the train. So consumers start to have less fear that their jobs are about to evaporate and investors start to form the view that they can cash in on the next boom by getting in now and building productive infrastructure. Optimism replaces pessimism and the private sector starts to spend again and the deficit starts to diminish as the automatic stabilisers kick in.

That is the logic of getting in with fiscal policy early and strongly. It is a very powerful argument and in the last two days we have seen some evidence that things might be working out in that manner.

Yesterday, the National Bank released its Monthly Business Survey and showed that confidence among business in Australia had risen sharply. They noted that:

The improvement in confidence has developed more momentum – no doubt helped locally by the Budget and globally by improving sentiment and equity / commodity markets. The stimulus from the Federal Budget has clearly raised hopes of a government investment-led recovery, with construction industry confidence leading the way.

I won’t show the graph but it is V-shaped bottoming out at a score of -30 odd in the last three months of December and now rising to -13 in March, -14 in April and now -2 in May. The most optimistic sectors, however, were retail which according to the NAB report “has been particularly helped by the Government cash payments” and mining which has “recovered somewhat due to an improving sentiment in commodity markets.”

But this is all animal spirits! The underlying index of business conditions from the NAB survey “has stalled in most industries at below average levels” in most industries. Only retail and mining have registered improvements which probably accounts for why they are optimistic.

The second bit of news that suggests optimism is that home loan approvals were also up for April – the seventh month in a row that they have risen. According to the latest data from the ABS, “the total value of dwelling finance commitments excluding alterations and additions increased 2.6%” in trend terms and by 3.6 per cent in seasonally adjusted terms. Investment housing and owner occupied housing commitments were both up. Clearly low interest rates and government stimulus (first home-buyers scheme probably) have had some effect in this market.

Finally, animal spirits were at work again today when the Westpac consumer sentiment survey results came out. The contribution of private consumption to GDP growth in the March quarter (0.32 per cent) may have been modest – see R we or R we not? – but that impact does not take into account the psychological benefits that the stimulus package may be having. It seems that last week’s national accounts escape from hell (the escape from the R-word) has stirred a frenzy of optimism among consumers. The Westpac index of consumer confidence which came out today rose by 12.7 per cent which was the fastest rise in 22 years.

Given it has gone beyond the 100 line (100.1) it is interpreted as meaning that there are more optimists than pessimists. The animal spirits are turning. The spokesperson for the survey said:

It is very likely that the dominant factor behind this extraordinary rise was the release of the March quarter national accounts last Wednesday which registered a small but nevertheless positive growth rate for the Australian economy in the March quarter following the contraction in the economy in the December quarter. That result was widely hailed in the media as indicating that Australia had avoided a recession (defined as two consecutive quarters of negative growth).

So it is likely that the stimulus helped keep private consumption from falling which helped keep GDP growth above the zero line which then gets people thinking that things are not that bad. Animal spirits being manipulated by fiscal policy.

So taken together, this data is telling me is that our economy is not following the path it would have followed given the enormity of the world recession if the federal government had not have come in very early with fiscal stimulus. It also tells me that the emphasis on fiscal policy rather than monetary policy was correct. In the US, there has been an emphasis on monetary policy which in my view has not been as expansionary.

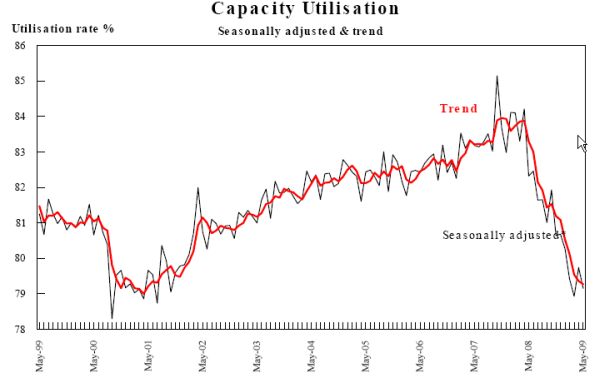

But before we get too ahead of ourselves have a look at this graph taken from the NAB report I referred to above. It shows that capacity utilisation among the businesses survey is now at 79.2 per cent which the NAB says is “increasing the output gap and contributing to downward pressure on inflation”. That gap has to be filled or unemployment will rise. While consumer and business sentiment is one thing it has to translate into spending and all signs are that investment plans are very flat right now and the consumer bubble will run out with the last cent spent of the $900 dollar bonus.

The problem with relying on animal spirits is that they can do U-turns. The nature of the stimulus package to date has been to provide largely ephemeral stimulii which will peter out soon. That is why public infrastructure projects are good because not only do we get useful things that last a long time (for example, the Great Ocean Road in Victoria) but the spending associated with the package ekes out over an extended horizon which provides on-going reinforcement to the “animals”.

So my current assessment is that while the fiscal stimulus is helping we will have to rely on the public investment boom that is just about to unfold to keep pushing optimism. My guess is that they will be positive influences on those animal spirits.

But the labour market situation and the capacity utilisation data also tells me that the size of the gap that needs to be filled if unemployment is not to rise substantially is huge.

I think it goes well beyond the estimated projections that underpin the May Budget. In other words a projected stimulus which will deliver an estimated deficit to GDP ratio of 4.9 is some way short of what is required to get capacity utilisation back up to levels that will support employment growth that is strong enough to reduce labour underutilisation.

Conclusion:

While animal spirits may help get the economy back on course for significant growth they have never underpinned private economic activity (consumption or investment) which has been sufficient to provide enough jobs to fully employ the available and willing labour force. Never! Not ever!

No scale of confidence will be sufficient to achieve that without a significant return by the national government as a direct employer of labour. Unfortunately that historical reality doesn’t even enter the public debate at present and we seem reconciled to accept a forecasted rise of 1 million people unemployed and another 1 million underemployed (or more) because it is better than 1.5 million of each. Getting bashed by a 1 tonne hammer is bad even though it is not as bad (probably) as getting bashed by a 1.5 tonne hammer (can any engineers out there verify this?).

My other conclusion is that the debt fears being paraded everywhere by the conservative press and the politicians it largely supports is not gaining traction in these sentiment surveys. But I don’t take from that that people are smart. Just more focused on what is in their hand today. But they never fear – the debt will not have any negative consequences on them when next year becomes today!

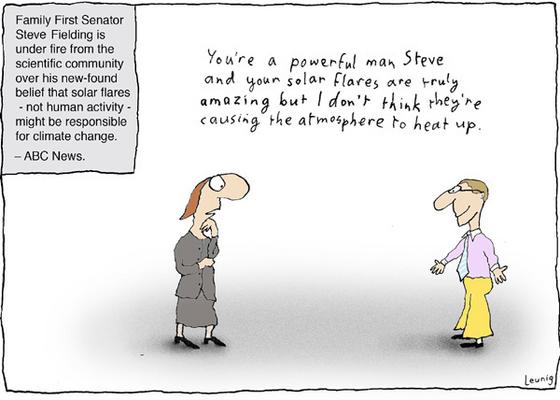

Digression: climate change and idiots

Christine Milne (Deputy Leader of The Greens) came and saw me today to discuss various policy matters. It was an interesting discussion. As she was parting, she told me of a Leunig cartoon in The Melbourne Age today that was worth viewing. It was in the context of the recent statements by the Family First senator, that man of “flair”, Senator Fielding who is now denying the human agency in climate change.

Here it is (original link).

Tomorrow: Labour Force data

Tomorrow, I won’t be the first blogger out there commenting but I won’t be the last either. Given the extraordinary result in the April Labour Force data what are we in for tomorrow? My judgement tells me that the March quarter GDP figures out last week may not reflect what is going on now, if the latest trade data is anything to go by. When it all comes down to it, the positive GDP figure for the March quarter was mostly driven by the decline in imports driven largely by the decline in business investment. So we scraped over the zero line because our economy is very sick. That is a strange anomaly that people who don’t really dig into the national account framework find hard understanding.

So given that, I expect the labour market to deteriorate in the month of May. How much? Trend unemployment will rise!

Dear Bill,

The HET part of this article is a bit of a mixed bag for me.

Many would attribute the development of Keynesian economics to:

J. R. Hicks, Mr. Keynes and the “Classics”; A Suggested Interpretation, Econometrica, Vol. 5, No. 2. (Apr., 1937), pp. 147-159.

Whereby Hick’s pushed his own agenda by passing off his own model as that of Keynes’s General Theory of Employment Interest and Money. In a nutshell IS-LM (or IS-LL) may be Keynesian but it has nothing to do with Keynes.

Unfortunately more people in the 30’s and 40’s seemed to have read the Hicks review than they did Keynes’s book.

Hence, I would tend to think that people following Hicks / Hansen rather than what Keynes proposed is what f%$%^ economics up rather than Chapter 2 of General Theory of Employment Interest and Money.

Besides – Chapter 19 is brilliant and effectively makes up for the errors of Chapter 2 .

Cheers, Alan

Dear Bill

Re, your comment regarding below…

“It also tells me that the emphasis on fiscal policy rather than monetary policy was correct. In the US, there has been an emphasis on monetary policy which in my view has not been as expansionary.”

Much of the credit for the apparent bounce or turnaround in sentiment in other developed countries is attributed to the ZIRP and Queasing monetary policies adopted by central banks lead by the FED and the BoE.

Queasing in particular appears to have encouraged investors to divert investment into what previously were considered riskier markets following the previous risk aversion, and so we’ve seen bounces in stocks and commodities from arguable oversold lows.

So, GFC explodes, there’s a flight to save haven bonds/treasuries, queasing effectively forces down the yields on these safe havens, and have the effect of forcing investors eyes to look at getting good returns from stocks or distressed assets in the credit markets.

so we’ve got a bounce in various asset classes, the ZIRP and fiscal stimulus policies have both needed time to work through the system as they say. Infact don’t they say that it’s normally 12-18 months before IR changes see full effect.

I think much of the current greenshoots is down to figures not being ‘as bad’ as expected. There’s been a lowering of expectations as regards performance indicators in the economies….and when they beat expectations all hail recovereh!!!!

The final aspect appears to have been the bank bailouts, which have been seen as a shrewd move in many quarters. It appears we need to rewrite history and accept that what we had was a liquidity crisis rather than one of solvency. Perhaps. possibly. let’s wait and see.