The – Battle of Sedan – in September 1870, was a decisive turning point in the relationship between France and Germany, which still resonates to this day and has influences many subsequent historical developments. When I was researching my 2015 book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale (published May 2015) –…

Options for Europe – Part 90

The title is my current working title for a book I am finalising over the next few months on the Eurozone. If all goes well (and it should) it will be published in both Italian and English by very well-known publishers. The publication date for the Italian edition is tentatively late April to early May 2014.

You can access the entire sequence of blogs in this series through the – Euro book Category.

I cannot guarantee the sequence of daily additions will make sense overall because at times I will go back and fill in bits (that I needed library access or whatever for). But you should be able to pick up the thread over time although the full edited version will only be available in the final book (obviously).

Part III – Options for Europe

[THIS IS THE LAST SUBSTANTIVE CHAPTER – IT INTRODUCES THE APPROACH THAT THE EURO LEADERS HAVE TAKEN AND WHY A DRAMATIC CHANGE IN POLICY IS REQUIRED – IT LEADS INTO THE FINAL SEVERAL CHAPTERS WHICH DISCUSS THE SPECIFIC OPTIONS – WHICH YOU HAVE ALREADY READ. I WILL FINISH THIS CHAPTER BY THE END OF THE WEEKEND AND THEN NEXT WEEK WRITE THE INTRODUCTION AND START CHECKING]

Chapter 18 The European Groupthink – failing to take the correct path

[PRIOR MATERIAL HERE]

[NEW MATERIAL TODAY]

The export-led growth mania

The release of the United Nations Conference on Trade and Development (UNCTAD) annual Trade and Development Report, 2010 in September 2010 (UNCTAD, 2010) provided some sober assessment of the dominance of export-led growth strategies among policy makers and multilateral agencies such as the IMF and the OECD. UNCTAD considered that a reliance on such strategies combined with the imposition of fiscal programs will worsen growth and increase poverty. UNCTAD concluded that a fundamental rethink has to occur where policy is reoriented towards domestic demand and employment creation. At the time of writing, as the European polity was imposing deep austerity measures on troubled economies, UNCTAD considered that an expansion of fiscal policy was essential to avoid an extended period of recession and economic stagnation.

The current policy orthodoxy in the euro-zone is at odds with this advice. The European policy makers have conjured up the argument that if government deficits (that is, spending in excess of tax revenue) are cut and nations embark on so-called ‘internal devaluation’, which means cuts to wages and other production costs, two sources of growth will emerge as a result. First, there would be a ‘Ricardian’ domestic spending boom from private consumers and business firms, as discussed earlier. Second, even if domestic spending does not pick up, it is claimed that the process of wage and price deflation brought on by the attacks on unions and public sector entitlements (the ‘internal deflation’) will increase the external competitiveness of the economies in question, close the gap with Germany and spawn an export-led return to economic growth. The fancy talk among policy makers is that ‘re-balancing’ is required.

The evidence suggests the internal devaluation route to growth does not provide a sound basis for growth. There are two reasons for this. First, it is a ‘race to the bottom’ strategy which drives drives down unit costs via cuts in wages with the effect of also damaging worker morale and motivation. It is unclear whether competitiveness actually increases. It is the low productivity path, which will never support significant increases in the real standards of living for the citizens. The massive costs for nations being subjected to these austerity programs in the form of millions of jobs that have been lost and the very high youth unemployment are much higher in the long-term than any benefits that might arise. The policy makers have clearly eschewed the high-wage-high productivity route to increased competitiveness. Second, the imposition of domestic austerity and a reliance on net exports for growth cannot work for all nations. To understand that point, we need to introduce the rather impressive sounding concept of a fallacy of composition.

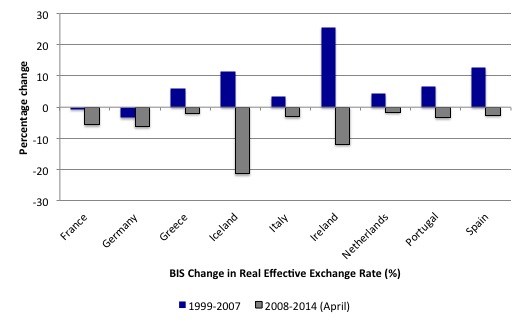

The first question to answer is whether internal devaluation increases external competitiveness? The Bank of International Settlements (BIS) publish monthly ‘effective exchange rate indices’ – for 61 countries from January 1994 (BIS, 1993, 2006). Real effective exchange rates (REER) are internationally accepted measures of international competitiveness that adjust nominal exchange rates with other data on domestic inflation and production costs. The BIS (1993: 51) note that “changes in the REER thus take into account both nominal exchange rate developments and the inflation differential vis-à-vis trading partners”. The technical details of how the BIS calculates this data need not concern us here. Suffice to say that if the real effective exchange rate rises (falls) for a nation, then it signals a loss (gain) in its international competitiveness.

Figure 16.2 shows movements in real effective exchange rates since January 2009 until April 2014 for selected euro-zone nations and Iceland. The sample is divided in to two: January 1999 to December 2007 and January 2008 to April 2014, roughly coinciding with the period of growth and the period of recession. The data shows that after the euro was introduced and leading up to the crisis all the nations shown experienced declining international competitiveness overall and relative to Germany, which enjoyed modest gains. Following the crisis, the general tendency has been for real effective exchange rates to decline. However, the real effective exchange rate for Greece was only 1.9 per cent lower in April 2014 than in January 2008 despite the massive austerity program it has endured. By comparison, the real effective exchange rate for Germany fell by 6.1 per cent since the beginning of 2008. Of these euro-zone nations, only Ireland has improved its position relative to Germany since the onset of the crisis. The rest of the so-called PIIGS have seen their real effective exchange rate fall only marginally during the austerity period.

Figure 16.2 Movements in international competitiveness in the euro-zone, 2007-2014

Source: BIS Real Effective Exchange Rates. http://www.bis.org/statistics/eer/index.htm

The comparison of these fixed exchange rate euro nations with Iceland is striking. The fundamental differences between the euro-zone nations and Iceland are threefold: (a) Iceland issues its own currency while the other nations use a foreign currency; (b) Iceland enjoys a floating exchange rate; (c) Iceland sets its own interest rate. These are the characteristics that differentiate sovereign from non-sovereign nations in terms of the currency in use. Iceland has experienced a massive gain in its international competitiveness since the crisis unfolded with less austerity. Apart from Ireland, the remaining ‘peripheral’ euro-zone nations have not succeeded in significantly increasing their competitiveness despite massive austerity programs. Importantly, their competitive positions have further deteriorated against Germany, thus providing no dynamic to redress any current account imbalances across the euro-zone nations. Internal devaluation has clearly not been an effective route to increasing international competitiveness despite all the neo-liberal claims to the contrary. The costs of such a strategy are too high in terms of lost output, mass unemployment and social breakdown. The austerity strategy looks more like punishment than an economic growth tonic when you see this sort of data.

The results for Iceland are actually conservative because the its percentage gain in competitiveness from its maximum index value (November 2005) and April 2014 was 31.5 per cent. Ireland was next with gaining 15 per cent on its maximum index value in June 2008. Third best on this criteria was Germany, improving by 9.3 per cent on its maximum value in January 1999 compared to April 2014.

For Iceland, the work has been done by the exchange rate depreciation, which made their exports became much cheaper and demand grew rapidly at the same time as import demand fell because of the rise in prices in the newly restored local currency. The same sort of dynamic assisted Argentina in growing after it allowed its exchange rate to drop significantly in 2002. Iceland’s real effective exchange rate in Iceland evened out after its initial plunge. That is a common pattern. After an initial plunge, the nominal exchange rate stabilises as growth returns. The scaremongers who claim that the weaker euro-nations would experience massive and on-going currency plunges are in denial of history.

Further, while the neo-liberal dogma is that a nation that cuts its wages will improve competitiveness is rife, the reality is clearly different. The problem is that if a nation attempts to improve its international competitiveness by cutting nominal wages in order to reduce real wages and, in turn, unit labour costs it not only undermines total domestic spending but also may damage its productivity performance. If, for example, workforce morale falls as a result of cuts to wages, it is likely that industrial sabotage and absenteeism will rise, undermining labour productivity. Further, overall business investment is likely to fall in response in reaction to the extended period of recession and wage cuts, which erodes future productivity growth. Thus there is no guarantee that this sort of strategy will lead to a significant fall in unit labour costs. There is robust research evidence to support the notion that by paying high wages and offering workers secure employment, firms reap the benefits of higher productivity and the nation sees improvements in its international competitive as a result. Eurostat data shows that between 2008 and 2013, while labour productivity per hour worked rose by 1.8 per cent in Germany, it fell in Greece, the worst hit by the austerity, by 8.5 per cent and by 0.7 per cent in Italy. This further demonstrates the failure of the internal devaluation approach.

Iceland’s approach has been less painful and much more effective. Greece and other weaker euro-nations could have enjoyed similar improvements in their external competitiveness if they had have exited the EMU and allowed their currencies to float.

The second issue is whether an almost exclusive reliance on improvement in net exports is a sustainable growth strategy. The austerity approach strips away the capacity of the government to contribute to growth. In the current context, private demand is also very weak because households and firms are trying to reduce their debt exposure and are also fearing the rising unemployment and the weak sales that follows. In other words, the only source of growth that remains for nations in the euro-zone is net exports. That is the logic of the internal devaluation approach. However, clearly, not all nations can enjoy current account surpluses, which are required if the external sector is to be a positive contributor to national economic growth. Germany, for example, relies on other nations running current account deficits so that it can maintain strong exports growth. It also suppresses its imports, which impact on the capacity of other nations to export. Austerity also undermines the capacity of nations to import. These observations tell us that generalised austerity is another example of the concept of a fallacy of composition.

The ‘fallacy of composition’ is an important notion in macroeconomics that is often forgotten by the neo-liberal mainstream when they advocate wage cutting and fiscal austerity. It is a concept drawn from logic, which the Oxford Dictionary says is the “error of assuming that what is true of a member of a group is true for the group as a whole.” While we are not writing about the history of macroeconomics here, the identification by John Maynard Keynes in the 1930s that free market economic theory was riddled with these compositional errors was a central aspect in the development of modern Keynesian theory. Up until then, there was no macroeconomics as we now know it. It was assumed that everything could be understood at the single consumer or firm level (so-called microeconomics) and if economists wanted to talk about the economy as a whole they claimed they could just add up all the individual elements. This led to the identification of the so-called ‘aggregation problem’, which need not concern us here. To overcome the problem, the free market economists invented what they called a ‘representative household’ (which behaved as if it was a single household/consumer) and a ‘representative firm’, which behaved like a single firm. Together they bought and sold a ‘composite good’. In other words, all the theories that were developed to explain how an individual firm might decide on their employment and production levels, and the like, were assumed to apply at the aggregate or macroeconomic level.

A classic example of the logical errors in reasoning that Keynes exposed was the famous ‘Paradox of Thrift’, which describes how individual virtue can become a public vice. In simple terms, if an individual decided to increase his/her individual saving, they would probably succeed if they were disciplined enough. But if all individuals tried to do this en masse, then the decline in consumption spending would force firms to cut output and employment and national income would fall, perhaps plunging the economy into recession. Total saving rises (falls) with national income. So if everyone tries to save more, the economy overall will generate lower saving. The paradox tells us that what applies at a micro level (ability to increase saving if one is disciplined enough) does not apply at the macro level (if everyone increases saving). The term paradox of thrift entered the nomenclature during the Great Depression as Keynes and others saw this particular problem as providing a prima facie case for government deficit spending which could replace the lost consumption as the non-government sector sought to increase its saving.

Another classic fallacy of composition that Keynes exposed related to the recommendation by the free market economists that wage cuts were the solution to unemployment. This argument remains valid today, given the neo-liberals also think wage cuts will improve the growth prospects of a nation. The free market economists claimed that if a particular business firm cut its wages then it could employ more workers given that its costs were now lower. The argument was based on the fact that its sales would not be affected by the wage cuts. Applying this logic to the economy as a whole, the standard textbook then says that a general wage cut would lead to higher employment. However, they failed to see that if all firms did the same thing, total spending would fall dramatically and employment would also drop. Again, trying to reason the system-wide level on the basis of individual experience generally fails. The reason is that wages are both a component of costs and an significant source of income. The mainstream economists ignored the income side of the wage deal. If workers have less income, they spend less.

Mass unemployment occurs when there are not enough jobs and hours of work being generated by the economy to fully employ the willing labour force. And the reason lies in there being insufficient total spending of which the net spending by government (their deficits) is one source. The erroneous mainstream response to the persistent unemployment that has beleaguered most economies for the last three decades is to invoke supply-side measures – wage cutting, stricter activity tests for welfare entitlements, relentless training programs. But this policy approach, which has dominated over the neo-liberal period, and reflects their emphasis on the individual falls foul of the fallacy of composition problem. They mistake a systemic failure for an individual failure. You cannot search for jobs that are not there.

What has all this to do with export-led growth strategies? The IMF has been pushing export-oriented growth strategies onto developing countries for years, usually supplemented with so-called ‘structural adjustment programs’ (SAPs), which are similar to the austerity programs that the Troika has imposed on Greece and Portugal and has urged other euro-zone nations to implement. It is worth noting that the IMF was initially conceived at the UN Monetary and Financial Conference at Bretton Woods, New Hampshire in 1944 as one of the two major international institutions (along with the World Bank) to rebuild the damaged economies after the Second World War and to ensure (in the case of the IMF) that there would be no return to the Great Depression. The IMF was empowered to be an unconditional lender to nation’s in trouble to ensure there would not be another collapse. It quickly morphed into ensuring the fixed exchange rate system was sustained by providing foreign reserves to nations who were having trouble defending their exchange rates. Its so-called free market credentials now, were not in evidence then.

The collapse of the fixed exchange rate system in 1971 (and formally in 1973) meant that the IMF had no role to play. With considerable deftness and, within the increasingly neo-liberal milieu provided by the popularity of Monetarism, the IMF reinvented itself and established its mission as being the overseer of poor nations who faced pressures to repay foreign debts. The IMF used its lending capacity to become a neo-liberal enforcer. Its lending became increasingly conditional on a country’s willingness to accept these SAPs, which emerged as a response to the debt crisis that engulfed the world in the late 1970s – a crisis that was significantly related to IMF loans in the first place. While the debt crisis was constructed as a crisis for the developing poor nations, it was really a crisis for the first-world banks. The IMF made sure the poorest nations continued to transfer resources to the richest under these SAPs. The SAPs were vehicles by which the IMF forced nations to adopt free market policies, the same sort of policy changes that have created the the crisis in the advanced nations. The poorest nations were forced to privatise state assets, make cuts to education and health services, cut public sector employment and wages, eliminate minimum wages and free up banking to allow speculative capital to come and go more easily. Policies to give private capital privileged access to the nation’s resources were also encouraged (for example, tax concessions etc). The results in all cases was to increase unemployment and poverty, increase income and wealth inequality, and expose the nations to extensive environmental damage.

SAPs forced nations with viable and sustainable subsistence agriculture to convert into ‘cash for trade’ crops. The impact of the increased supply on world markets was to reduce the price below which was necessary to repay the IMF loans. Further loans were then extended with ever more repressive conditions being imposed. Some nations pillaged their natural resources to create export products (for example, timber) to the point where they exhausted their export potential but still were burdened by the onerous IMF loans. In the process, they undermined the viability of their subsistence sector and so world hunger rose.

The obvious measure of the failure of this approach has been that the IMF has not decreased world poverty. In fact, the overwhelming evidence is that these programs increase poverty and hardship rather than the other way around. The IMF has a long-history of damaging the poorest nations. There are many mechanisms through which the SAPs have increased poverty. First, fiscal austerity is almost always targetted at cutting welfare services to the poor – which often means health and education. Moreover, the cuts prevent sovereign governments from building public infrastructure and directly creating public employment. Areas such as the military which do little to enhance quality of life are rarely included in the IMF cuts, in part, because these expenditures benefit the first-world arms exporters. Second, public assets are typically privatised. Foreign investors often benefit significantly by taking ownership of the valuable resources. Third, contractionary monetary policy forces interest rates up which often discriminate against women who survive running small businesses. But the higher interest rates promote speculative investment (hot money) that fails to augment productive capacity. Fourth, export-led growth strategies transform rural sectors which traditionally provided enough food for subsistence consumption. Smaller land holdings are concentrated into larger cash crop plantations or farms aimed at penetrating foreign markets. When international markets are over-supplied, the IMF then steps in with further loans. But the original fabric of the land use is lost and food poverty increases. Fifth, user pays regimes are typically imposed which increases costs of health care, education, power, and in some notable cases, reticulated clean water. Many of the poorest cohorts are prevented from using resources once user pays is introduced. Sixth, trade liberalisation involves reductions in tariffs and capital controls. Often the elimination of protection reduces employment levels in exporting industries. Further, in some parts of the world child labour becomes exploited so as to remain ‘competitive’.

The Japan Bank for International Cooperation published a detailed study of the impact of SAPs on poverty reduction in low-income countries in 2003. The study concluded that in the period where export-led growth strategies were being intensively implemented by the IMF in tandem with SAPs, “Low-income countries experienced little per capita economic growth during 1981-2000 … Between program and nonprogram countries, the overall macroeconomic performances of the former have fallen below those of the latter. Compared to nonprogram countries, program countries have achieved a lower level of real GDP per capita …. accumulated larger external debt as a share of GDP, borne a heavier debt service burden relative to exports, held fewer months of foreign reserves, and adopted a lower pace of trade openness (measured by the sum of exports and imports as a share of GDP)” (Sirai, 2003: 4). Former World Banker official William Easterly (2000: 3) wrote that when growth occurred in nations under IMF and World Bank adjustment lending, the “economic expansions benefit the poor less under structural adjustment”. While the earlier manufacturing export strategies of the Asian tigers (which pre-dated the IMF SAPs onslaught in the last 1970s and on) were successful the research evidence is very clear – most poor nations went backwards under the programs imposed on them by the IMF.

This rich history of failed export-led growth strategies where nations suppress domestic spending through austerity and dismantle their public sectors and then hope for a net exports boom is a cautionary tale for modern European policy makers. While there are clear differences between the poor subsistence nations of Africa that the IMF likes to intimidate and the advanced economies of Europe, the principle remains the same. Not all nations can simultaneously run trade surpluses to external markets, especially when they are often trying to penetrate the same markets and, more significantly, a high proportion of their trade is intra-EMU.

The export-led growth proponents like to use the 1990s experience of Canada and Sweden to justify why fiscal austerity can still be consistent with growth. Even the neo-liberal leaning, Economist magazine (2010b) stated that:

The advocates of austerity exaggerate more dangerously still. They base their argument on cases in the 1990s, when countries such as Canada to Sweden cut their deficits and boomed. But in most of these instances interest rates fell sharply or the country’s currency weakened. Those remedies are not available now: interest rates are already low and rich-country currencies cannot all depreciate at once. Without those cushions, fiscal austerity is not likely to boost growth.

While Canada may have, in isolation, been able to offset the public spending cuts by an improving external sector helped along by increased competitiveness via exchange rate adjustments, this solution cannot work if all countries engage in austerity. That is the fallacy of composition. A export-led growth strategy cannot apply for all nations which are simultaneously cutting back on their domestic demand. The only reliable way to avoid a fallacy of composition like this is to maintain adequate fiscal support from spending while the private sector reduces its excessive debt levels via saving. That strategy is also likely to be the best one for stimulating exports because world income growth will be stronger and imports are a function of GDP growth. Austerity not only undermines the rights and welfare of the citizens but also undermines the source of the export revenue – domestic aggregate demand.

UNCTAD (2010: I) concluded that “not all countries can rely on exports to boost growth and employment; more than ever they need to give greater attention to strengthening domestic demand”.

The Securities Market Program – the only thing that held the euro-zone together

When the Greek government effectively lost access to the private bond markets, it was almost certain that they would have to default on their maturing liabilities and be forced out of the euro-zone. The fears were that the Greece exit would be the first domino and the other troubled economies would be next to go. Further, given the exposure of the big French and German private banks to Greek government debt and the linkages between these banks and other banks throughout the European financial system, it was also considered likely that a default would trigger a general financial collapse. There were mixed views on this among the political elites in Europe. By 2012, German Finance Minister Wolfgang Schäuble had taken the view that a Greek exit was preferable and would allow the rest of the nations to “create a firewall” without the distraction of the Greek bailout sagas. Schäuble met the then US Treasury boss Timothy Geithner in July 2012 and indicated that “with Greece out of the picture, Germany would be in a position to provide financial assistance to the rest of the eurozone as the German people would be less reticent about this than they were about bailing out the Greeks” (Ekathimerini, 2014). While this book questions a lot of the logic that was used to generate those public ‘fears’ there is no doubt that the integrity of the euro-zone was under threat in early 2010 as the Greek government approached insolvency. Moreover, the bailout programs, despite all the bluster and damage that they have caused were never going to be sufficient to ensure Greece or any other nation remained solvent. Given the structure of the monetary system, it was obvious that a major ‘fiscal-like’ intervention was going to be required to keep the nations solvent in the face of growing private bond market uncertainty and withdrawal. But while the ratings agencies, whose behaviour leading up the GFC had been exposed as incompetent and corrupt by US Congressional hearings, were circling with downgrades and issuing all manner of spurious briefings about likely insolvency to investors, it became obvious in May 2010 that the ECB would use its ‘currency issuing’ capacity to ensure no Member State became insolvent. Effectively a massive ‘fiscal operation’ would get underway, seemingly in violation of the treaty rules, and, without any doubt, it would save the euro-zone, for the time being.

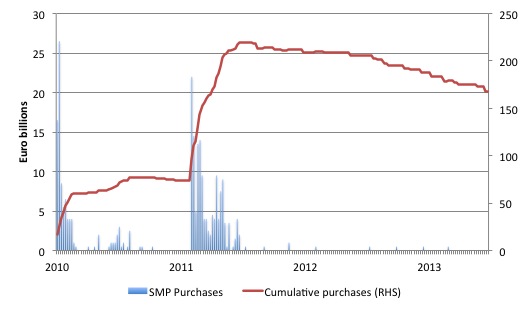

On May 14, 2010, the ECB established its Securities Markets Program (SMP), which opened the possibility that the ECB and the national central banks “may conduct outright interventions in the euro area public and private debt securities markets” (ECB, 2010b: 8), which is central bank-speak for buying government bonds on the so-called secondary bond market in exchange for euros. Government bonds are issued by tender in the primary bond market and then traded freely among speculators and others in the secondary bond market. The SMP also permitted the ECB to buy private debt in both primary and secondary markets. To understand this more fully, the decision meant that private bond investors (including private banks) could off-load distressed state debt onto the ECB. The action also meant that the ECB was able to control the yields on the debt because by pushing up the demand for the debt its price rose and so the fixed interest rates attached to the debt fell as the face value increased. Competitive tenders then would ensure any further primary issues would be at the rate the ECB deemed appropriate (that is, low).

Figure 16.X shows the history of the SMP program, which was formally replaced on September 6, 2012 when the ECB released details of its new program the ‘Outright Monetary Transactions (OMT)’. The bars shows the weekly purchases while the line shows the cumulative asset holdings associated with the program (in billion of euros). Clearly the ECB accelerated their purchases at times when the difference between the yields on some Member State government bonds against the benchmark bond, the German bund (the ‘spreads’) were widening significantly. The initial spike from May 2011 was associated with the escalation in spreads on bonds issued by Greece, Ireland, Portugal and Spain. The second, larger acquisitions began in August 2011 and was mostly associated with the sharp rise in the spread on Italian government bonds, which went from 1.5 percentage points in April 2011 to a peak of 5.2 percentage points in November 2011. The large-scale ECB buying stabilised the spread by the end of 2011 and it has since fallen back to 1.77 percentage points at April 2014. Given the size and importance of the Italian economy to Europe, the ECB was clearly not going to allow the Italian spreads to rise as quickly or as far as the Greek spreads had risen. Of-course, the bailouts effectively allowed the Greek government to ignore the bond markets and so the size of the spreads which came down after ECB intervention were moot anyway.

Figure 16.3 SMP activity, ECB, May 15, 2010 to May 12, 2014, billions

Source: ECB, Open Market Operations, Ad-hoc communications, http://www.ecb.int/mopo/implement/omo/html/index.en.html

After the SMP was launched, a number of ECB’s officials members gave speeches claiming that the program was to maintain “a functioning monetary policy transmission mechanism by promoting the functioning of certain key government and private bond segments” (González-Páramo, 2011). In other words, they were trying to distance themselves from any notion that the program was bailing out government deficits and placing it in the realm of normal weekly central bank liquidity management operations. This was to quell criticisms, from the likes of the Bundesbank and others, that the program contravened Article 123 of the TEU. In early 2011, the fiscally-conservative boss of the Bundesbank, Axel Weber, who was being touted to replace Jean Claude Trichet as head of the ECB, announced he was resiging, ostensibly in protest of the SMP and the bailouts offered to Greece and Portugal. When the SMP was introduced, Weber breached ECB “etiquette … [and] … stridently voiced his dissent on decisions” made by the ECB council since May 2010 (Ewing, 2010). In a notable speech on October 12, 2010, Weber claimed that the SMP was largely ineffective but risked “blurring the different responsibilities between fiscal and monetary policy. As the risks associated with the SMP outweigh its benefits, these securities purchases should now be phased out permanently as part of our non-standard policy measures” (Weber, 2012: 2). Another ECB Executive Board member, Jürgen Stark also resigned from his ECB position in protest over the SMP in November 2011. In relation to the SMP, Stark told the Austrian daily newspaper ‘Die Presse’ that the ECB was heading in the wrong direction by pushing aside the crucial no bailout clauses that were the bedrock of the EMU (“Das Signal, das ich mit meinem Rücktritt an die Europäische Zentralbank und die Politik geben wollte, war: Ihr seid auf dem falschen Weg! Innerhalb weniger Stunden wurde eine wichtige Geschäftsgrundlage der Wirtschafts- und Währungsunion einfach auf die Seite geschoben: Die No-Bail-Out-Klausel”) (Schellhorn and Jilch, 2012). He also said that the ECB had taken on a new role and had panicked by caving in to the pressure from outside of Europe (“Dann hat die EZB begonnen, sich in eine neue Rolle zu begeben – in Panik zu verfallen. Sie hat dem Druck von außen nachgegeben”) (Schellhorn and Jilch, 2012).

Weber’s successor as head of the Deutsche Bundesbank, Jens Weidmann maintained the criticism, albeit in a more muted manner. As the ECB accelerated its SMP purchases in 2011 to quell the rising bond yields on Italian government debt, the head of the Deutsche Bundesbank, Jens Weidmann gave a speech in Berlin (Weidmann, 2011), which reiterated the obsession with inflation that dominates his organisation:

One of the severest forms of monetary policy being roped in for fiscal purposes is monetary financing, in colloquial terms also known as the financing of public debt via the money printing press. In conjunction with central banks’ independence, the prohibition of monetary financing, which is set forth in Article 123 of the EU Treaty, is one of the most important achievements in central banking. Specifically for Germany, it is also a key lesson from the experience of the hyperinflation after World War I. This prohibition takes account of the fact that governments may have a short-sighted incentive to use monetary policy to finance public debt, despite the substantial risk it entails. It undermines the incentives for sound public finances, creates appetite for ever more of that sweet poison and harms the credibility of the central bank in its quest for price stability. A combination of the subsequent expansion in money supply and raised inflation expectations will ultimately translate into higher inflation.

Whatever spin one wants to put on the SMP, it was unambiguously a fiscal bailout package which amounted to the central bank ensuring that troubled governments could continue to function (albeit under the strain of austerity) rather than collapse into insolvency. Whether it breached Article 123 is moot but largely irrelevant. The SMP reality was that the ECB was bailing out governments by buying their debt and taking the risk of default off the private sector. The SMP demonstrated that the ECB was caught in a bind. It repeatedly claimed that it was responsible for resolving the crisis but, at the same time, it realised that it was the only institution in the EMU that had the capacity to resolve it – given it issued the currency. The SMP saved the euro-zone from breakup.

The ECB officials further tried to reduce the inflationary fears by distancing the SMP from so-called Quantitative Easing (QE) and the ‘printing money’ connotation by ‘sterilising’ the intervention which amounted to all the funds spent by the central banks on government bonds being “re-absorbed on a weekly basis so as to specifically neutralise the programme’s liquidity impact” (González-Páramo, 2011). In other words, the ECB was purchasing bonds in the secondary bond market with euros which it creates as the monopoly issuer of the currency. It would then, on a weekly basis, propose a tender to offer deposits with the ECB (with a ceiling of 1.25 per cent yield) up to the volume of outstanding SMP bond purchases. So they swap the euros they ‘spent’ in purchasing the bonds for an interest-earning account with the ECB instead of leaving the interest-earning bond in the hands of the private sector. Economists call this type of swap a ‘sterilisation operation’ because it neutralises the liquidity of the initial bond purchases “by draining the same amount of money from the banking system” (González-Páramo, 2011).

But an astute mind will see the smoke and mirrors here. First, QE was never about giving the banks more money to loan out. In Chapter 17, we will see that bank lending is never constrained by a lack of reserves. Rather lending requires credit-worthy customers seeking loans. At the height of the crisis as banks have tightened their lending criteria given the financial uncertainty there was a dearth of such customers. Quantitative easing is an asset swap designed to bid up the prices of assets in certain maturity ranges and thus keep interest rates in those maturity segments lower. The only way it would have helped alleviate the crisis is if the lower rates stimulated investment growth. However, with the crisis so deep and consumers hunkering down for fear of unemployment and insolvency (given the debt overhang), firms have been able to satisfy demand with existing capacity.

Further, the fact that most central banks have been offering a return on excess bank reserves means that the SMP is virtually indistinguishable from QE. Both strategies keep bond yields lower than otherwise by strengthening demand in the private bond markets and both provide an interest-bearing alternative to the bond-holders. QE added bank reserves (cash) and the US central bank paid interest on excess reserves, whereas the ‘sterilisation’ functions associated with the SMP merely shunted the excess euro reserves created by the bond purchases into a separate ECB account, which earned interest.

Weidmann’s inflation fears were unfounded and reflected the fact that German economists (in the main) and economic policy makers have become locked in a time warp that centres on the 1920s. The neutralising of the SMP purchases was another trick that played on the sort of misunderstandings that the likes of Weidmann perpetuates. Mainstream economists claim that by draining the reserves via the ‘sterilisation’ operation, the central bank has reduced the ability of banks to lend them out, which reduces the money supply and the inflation threat. This is a common misunderstanding. When a government spends and issues a bond to cover that spending (borrows back what it has spent) the reserves in the private banking system are are reduced by the bond sales but the net worth of the private sector is not altered. What is changed is the composition of the asset portfolio held in the non-government sector. There are more bonds and less euro reserves. If no debt is issued then there will be excess reserves in the banking system. If the central bank decides to pay interest on the excess reserves there is still no change in the net worth of the non-government sector. Inflation is caused by aggregate demand growing faster than real output capacity. The banks are able to create credit if they can find credit-worthy customers. All components of total demand carry an inflation risk if they become excessive, which can only be defined in terms of the relation between spending and productive capacity. But the sterilisation operations associated with the SMP didn’t reduce that risk. By offering an interest return on the excess reserves it was identical in outcome to issuing a bond. We consider that issue more in Chapter 21 on Overt Monetary Financing.

While the SMP saved the euro-zone from breakup it remained a failed vision for European prosperity because it failed to address the core problem, which was that Southern Europe was in depression and the only way out is for budget deficits to expand. That problem remains a core European challenge. The ECB clearly signalled a willingness to buy unlimited quantities of government bonds if there was the risk of insolvency. But this intervention required that the countries succumb to a fiscal austerity package that ensured their growth prospects are minimal. That problem also remains a core European issue.

[THAT ENDS THIS CHAPTER – NOW MOVING TO INTRODUCTION AND TIDYING UP – WILL BE FINISHED END OF NEXT WEEK!]

Additional references

This list will be progressively compiled.

ABC (2010) ‘Interview with Christine Lagarde’, This Week, October 10, 2010. http://abcnews.go.com/ThisWeek/video/interview-christine-lagarde-france-finance-minister-christiane-amanpour-stimulus-europe-11844525

ABC (2011) ‘Europe on verge of fiscal union: Merkel’, Australian Broadcasting Commission, December 2, 2011. http://www.abc.net.au/news/2011-12-02/europe-on-verge-of-launching-27fiscal-union27/3710252

Australian Treasury (2009) ‘The Return of Fiscal Policy’, Presentation to the Australian Business Economists Annual Forecasting Conference, Sydney, December 8, 2009. http://www.treasury.gov.au/documents/1686/HTML/docshell.asp?URL=Australian_Business_Economists_Annual_Forecasting_Conf_2009.htm

Barber, L. and Barber, T. (2008) ‘Barroso warns on protectionist pressures’, Financial Times, March 2, 2008. http://www.ft.com/intl/cms/s/0/3ab2bf90-e8a1-11dc-913a-0000779fd2ac.html

Berg, A.G. and Ostry, J.D. (2011) ‘Inequality and Unsustainable Growth: Two Sides of the Same Coin?’, IMF Staff Discussion Note, SDN/11/08, April 8, 2011. http://www.imf.org/external/pubs/ft/sdn/2011/sdn1108.pdf

Bild (2010) ‘Verkauft doch eure Inseln, ihr Pleite-Griechen’, October 27, 2010. http://www.bild.de/politik/wirtschaft/griechenland-krise/regierung-athen-sparen-verkauft-inseln-pleite-akropolis-11692338.bild.html

BIS (1993) ‘Measuring international price and cost competitiveness’, BIS Economic Papers, No 39, November 1993. http://www.bis.org/publ/econ39.pdf

BIS (2006) ‘The new BIS effective exchange rate indices’, BIS Quarterly Review, March 2006. http://www.bis.org/publ/qtrpdf/r_qt0603e.pdf

Blinder, A. and Zandi, M. (2010a) ‘How the Great Recession Was Brought to an End’, July 27, 2010. https://www.economy.com/mark-zandi/documents/End-of-Great-Recession.pdf

Blinder, A. and Zandi, M. (2010b) ‘Stimulus Worked’, Finance and Development, December, 14-17. http://www.imf.org/external/pubs/ft/fandd/2010/12/pdf/Blinder.pdf

Blyth, M. (2013) Austerity: The History of a Dangerous Idea, New York, Oxford University Press.

Boone, P. and Johnson, S. (2010) ‘Irish Miracle – or Mirage?’, New York Times, May 20, 2010.

Cassidy, J. (2010) ‘Interview with Eugene Fama’, The New Yorker, January 13, 2010. http://www.newyorker.com/online/blogs/johncassidy/2010/01/interview-with-eugene-fama.html

Cassidy, J. (2013) ‘Why is Europe so messed up? An illuminating history’, The New Yorker, May 20, 2013. http://www.newyorker.com/online/blogs/johncassidy/2013/05/austerity-an-irreverent-and-timely-history.html

Cochrane, J. (2009) ‘Fiscal Stimulus, Fiscal Inflation, or Fiscal Fallacies?’, mimeo, February 27, 2009. http://faculty.chicagobooth.edu/john.cochrane/research/papers/fiscal2.htm

Congressional Budget Office (2011) ‘Estimated Impact of the American Recovery and Reinvestment Act on Employment and Economic Output from October 2010 Through December 2010’, Washington, D.C., February. http://www.cbo.gov/sites/default/files/cbofiles/ftpdocs/120xx/doc12074/02-23-arra.pdf

CSO (2013) ‘Population and Migration Estimates’, CSO statistical release, August 29, 2013. http://www.cso.ie/en/releasesandpublications/er/pme/populationandmigrationestimatesapril2013/#.U3lhlsdy4qw

Daily Dish (2010) ‘Is The UK Worse Than Greece?’, The Atlantic, Published May 3, 2010. http://www.theatlantic.com/daily-dish/archive/2010/05/is-the-uk-worse-than-greece/187479/

Deutsche Bundesbank (2011) ‘The debt brake in Germany – key aspects and implementation’, Monthly Report, October 2011. https://www.bundesbank.de/Redaktion/EN/Downloads/Publications/Monthly_Report_Articles/2011/2011_10_debt_brake_germany.pdf?__blob=publicationFile

do Amaral, J.F. (2013) Porque Devemos Sair do Euro, Lisboa, Lua de Papel.

Donadio, R. and Kitsantonis, N. (2011) ‘Greek Leader Calls Off Referendum on Bailout Plan;, New York Times, November 3, 2011. http://www.nytimes.com/2011/11/04/world/europe/greek-leaders-split-on-euro-referendum.html

Douzinas, C. (2012) ‘What now for Greece – collapse or resurrection?’, The Guardian, March 5, 2012. http://www.theguardian.com/commentisfree/2012/mar/05/greece-collapse-or-resurrection

Easterly, W. (2000) ‘The Effect of IMF and World Bank Programs on Poverty’, World Bank, October 31, 2000. http://www.imf.org/external/pubs/ft/staffp/2000/00-00/e.pdf

ECB (2010a) Monthly Bulletin, June 2010. http://www.ecb.europa.eu/pub/pdf/mobu/mb201006en.pdf

ECB (2010b) ‘Decision of the European Central Bank of 14 May 2010 establishing a securities markets programme’, Official Journal of the European Union, L 124/8, May 20, 2010. http://www.ecb.int/ecb/legal/pdf/l_12420100520en00080009.pdf

Economist (2010a) ‘Fear Returns: Governments were the solution to the economic crisis. Now they are the problem’, May 27, 2010. http://www.economist.com/node/16216363

Economist (2010b) ‘Austerity alarm’, July 1, 2010. http://www.economist.com/node/16485318?story_id=16485318

Economist (2011) ‘Sell, sell, sell’, May 16, 2011. http://www.economist.com/blogs/charlemagne/2011/05/greece_and_euro_1

Ekathimerini (2014) ‘Geithner describes alarm at Schaeuble plan for Greek euro exit in new book’, May 14, 2014. http://www.ekathimerini.com/4dcgi/_w_articles_wsite2_1_14/05/2014_539697

Elliot, L. (2010) ‘IMF has one cure for debt crises – public spending cuts with tax rises’, The Observer, May 9, 2010. http://www.theguardian.com/business/2010/may/09/greece-debt-crisis-imf-european-commission

Elliot, L. (2012) ‘€130bn plaster leaves Greece independent in name only’, The Guardian, February 21, 2012. http://www.guardian.co.uk/world/2012/feb/22/plaster-leaves-greece-independent-name

European Commission (2008) ‘Autumn economic forecast 2008-2010’, IP/08/1617, Brussels, November 3, 2008. http://europa.eu/rapid/press-release_IP-08-1617_en.pdf

European Commission (2011) ‘EU Economic governance “Six-Pack” enters into force’, MEMO/11/898, December 12, 2011. http://europa.eu/rapid/press-release_MEMO-11-898_en.pdf

European Commission (2012) ‘Scoreboard for the surveillance of macroeconomic imbalances’, Occasional Papers No. 92, February 2012. http://ec.europa.eu/economy_finance/publications/occasional_paper/2012/pdf/ocp_92_summary_en.pdf

European Commission (2013) ‘Statement by the European Commission on Portugal’, MEMO/13/307, April 7, 2013. http://europa.eu/rapid/press-release_MEMO-13-307_en.htm

European Commmission (2014) ‘Alert Mechanism Report 2014’, COM(2014) 150, Brussels, March 3, 2014. http://ec.europa.eu/europe2020/pdf/2014/amr2014_en.pdf

European Council (2010) ‘Statement by the Heads of State and Government of the Euro Area’, Brussels, March 25, 2010.

European Council (2011) Statement by the Heads of State or Government of the Euro Area and EU Institutions, July 23, 2011.

European Union (2012) Treaty on Stability, Coordination and Governance in the Economic and Monetary Union. http://www.lexnet.dk/law/download/fiscal-c/Scg-2012.pdf

Ewing, J. (2010) ‘Central Banker Takes a Chance by Speaking Out’, New York Times, November 1, 2010. http://www.nytimes.com/2010/11/02/business/global/02weber.html

Federal Reserve Bank (2007a) ‘Press Release’, August 7, 2007. http://www.federalreserve.gov/newsevents/press/monetary/20070807a.htm

Federal Reserve Bank (2007b) ‘Press Release’, August 10, 2007. http://www.federalreserve.gov/newsevents/press/monetary/20070810a.htm

Federal Reserve Bank (2007c) ‘Press Release’, August 17, 2007.

http://www.federalreserve.gov/newsevents/press/monetary/20070817b.htm

Feyrer, J. and Sacerdote, B. (2011) ‘Did the Stimulus Stimulate? Real Time Estimates of the Effects of the American Recovery and Reinvestment Act’, Working Paper 16759, National Bureau of Economic Research.

G20 (2009) ‘G-20 Leaders Statement’, The Pittsburgh Summit, September 24-25, 2009. http://www.oecd.org/g20/meetings/pittsburgh/G20-Pittsburgh-Leaders-Declaration.pdf

G20 (2010a) ‘G-20 Toronto Summit Declaration’, June 26-27, 2010. https://www.g20.org/sites/default/files/g20_resources/library/Toronto_Declaration_eng.pdf

G20 (2010b) ‘Communiqué, Meeting of Finance Ministers and Central Bank Governors’, Gyeongju, Republic of Korea October 23, 2010. https://www.g20.org/sites/default/files/g20_resources/library/Communique_of_Finance_Ministers_and_Central_Bank_Governors_Washington_D.C._USA_April_23.pdf

G20 (2010c) ‘The G-20 Seoul Summit Leaders’ Declaration’, November 11-12, 2010. https://www.g20.org/sites/default/files/g20_resources/library/Seoul_Summit_Leaders_Declaration.pdf

González-Páramo, J.M. (2011) ‘The ECB’s monetary policy during the crisis’, October 21, 2011. http://www.ecb.int/press/key/date/2011/html/sp111021_1.en.html

Granitsas, A. and Stevis, M. (2012) ‘Greek Party Leaders Urge Yes Vote on Austerity’, Wall Street Journal, February 12, 2012. http://online.wsj.com/news/articles/SB10001424052970203646004577216681345419316

Guardian (2010) ‘Germany joins EU austerity drive with €10bn cuts’, June 7, 2010. http://www.theguardian.com/business/2010/jun/06/germany-deficit-greece-privatisations

ILO (2010) Recovery and growth with decent work, International Labour Conference, 99th Session, 2010, Geneva, June 18, 2010. www.ilo.org/wcmsp5/groups/public/—ed_norm/—relconf/documents/meetingdocument/wcms_140738.pdf

Inequality Watch (2012) ‘The Evolution of Income Inequalities in Germany’, June 4, 2012.

http://inequalitywatch.eu/spip.php?article114

IMF (2010) ‘Greece: Staff Report on Request for Stand-By Arrangement’, IMF Country Report No. 10/110, May. http://www.imf.org/external/pubs/ft/scr/2010/cr10110.pdf

IMF (2011) ‘Statement by the European Commission, the ECB and IMF on the Fourth Review Mission to Greece’, Press Release No.11/212, June 3, 2011. http://www.imf.org/external/np/sec/pr/2011/pr11212.htm

IMF (2012) World Economic Outlook (WEO) October 2012, Washington D.C. http://www.imf.org/external/pubs/ft/weo/2012/02/pdf/text.pdf

IMF (2013a) ‘Transcript of a Conference Call on Greece Article IV Consultation’, Washington, D.C., June 5, 2013. http://www.imf.org/external/np/tr/2013/tr060513.htm

IMF (2013b) ‘Greece: Ex Post Evaluation of Exceptional Access under the 2010 Stand-By Arrangement’, IMF Country Report No. 13/156, June. http://www.imf.org/external/pubs/ft/scr/2013/cr13156.pdf

Issing, O. (2010) ‘Europe cannot afford to rescue Greece’, Financial Times, February 15, 2010.

Major, S. (2010) ‘True sovereigns’ immune from eurozone contagion’, Financial Times, August 16, 2010. http://www.ft.com/intl/cms/s/0/e8a3cc8c-a958-11df-a6f2-00144feabdc0.html

Morris, N. and Andrew Grice, A. (2009) ‘Brown’s assignment for next G20 meeting: a blueprint for IMF reform’, The Independent, April 4, 2009.

Münchau, W. (2009a) ‘Diverging deficits could fracture the eurozone’, Financial Times, October 4, 2009.

Münchau, W. (2009b) ‘Berlin weaves a deficit hair-shirt for us all’, Financial Times, June 21, 2009. http://www.ft.com/cms/s/0/4e63cb22-5e8b-11de-91ad-00144feabdc0.html

Osborne, G. (2006) ‘Look and learn from across the Irish Sea’, The Times, February 23, 2006.

Phillips, L. (2013) ‘Portugal vs the Joffrey Baratheon of economic policies’, EUobserver, April 8, 2013. http://blogs.euobserver.com/phillips/2013/04/08/portugal-vs-the-joffrey-baratheon-of-economic-policies/

Quatremer, J. (2010) ‘Interview with Libération’, July 8, 2010. http://www.ecb.europa.eu/press/key/date/2010/html/sp100713.en.html

Schellhorn and Jilch (2012) ‘EZB bewegt sich außerhalb ihres Mandats’, Die Presse, September 22, 2012. http://www.telegraph.co.uk/finance/financialcrisis/9560102/ECB-in-panic-say-former-chief-economist-Juergen-Stark.html

Sheehan, P. (2010) ‘Greece laid low by its decadence’, Sydney Morning Herald, May 15, 2010. http://www.smh.com.au/federal-politics/political-opinion/greece-laid-low-by-its-decadence-20100516-v66z.html

Shirai, S. (2003) ‘The Impact of IMF Economic Policies on Poverty Reduction in Low-Income Countries’, JBICI Discussion Paper Series, No.4, Japan Bank for International Cooperation, August. http://jica-ri.jica.go.jp/IFIC_and_JBICI-Studies/jica-ri/publication/archives/jbic/report/discussion/pdf/dp04_e.pdf

Sinn, Hans-Werner (2010) ‘How to Save the Euro’, The Wall Street Journal, April 20, 2010.

Spiegel, P., Peel, Q., Jenkins, P. and Milne, R. (2011) ‘EU leaders agree €109bn Greek bail-out’, Financial Times, July 21, 2011. http://www.ft.com/intl/cms/s/0/952e0326-b3af-11e0-855b-00144feabdc0.html

Traynor, I. (2010) ‘Eurozone leaders lock horns over whether to rescue Greece’s economy’, The Guardian, March 25, 2010. http://www.theguardian.com/business/2010/mar/24/eurozone-leaders-greece

Trichet, J.C. (2010a) ‘Stimulate no more – it is now time for all to tighten’, July 22, 2010. http://www.ft.com/cms/s/0/1b3ae97e-95c6-11df-b5ad-00144feab49a.html

Trichet, J.C. (2010b) ‘Central banking in uncertain times: conviction and responsibility’, Speech at the symposium on Macroeconomic challenges: the decade ahead, Jackson Hole, Wyoming, August 27, 2010. www.ecb.int/press/key/date/2010/html/sp100827.en.html

UNCTAD (2010) ‘Trade and Development Report, 2010, United Nations Conference on Trade and Development, New York. http://unctad.org/en/Docs/tdr2010_en.pdf

Walker, M. and Davis, B. (2010) ‘Germany Backs European Version of IMF’, Wall Street Journal, March 8, 2010. http://online.wsj.com/news/articles/SB10001424052748704706304575107814218903120

Weber, A. (2010) ‘Monetary policy after the crisis – a European perspective’, Speech presented to the Shadow Open Market Committee (SOMC) symposium, New York City, October 12, 2010. http://www.bis.org/review/r101018a.pdf?frames=0

Weidmann, J. (2011) ‘Managing macroprudential and monetary policy – a challenge for central banks’, Speech to SUERF/Deutsche Bundesbank Conference 2011/IMFS – The ESRB at 1, Berlin, November 8, 2011. http://www.bis.org/review/r111109g.pdf?frames=0

World Bank (2010) Global Economic Prospects 2010, International Bank for Reconstruction and Development/The World Bank, Washington, D.C. http://siteresources.worldbank.org/INTPROSPECTS/Resources/334934-1322593305595/8287139-1322593351491/GEP2010bFullText.pdf

(c) Copyright 2014 Bill Mitchell. All Rights Reserved.

“It repeatedly claimed that it was responsible for resolving the crisis but, at the same time, it realised that it was the only institution in the EMU that had the capacity to resolve it – given it issued the currency.”

Bill, could there be a “not” missing in the first part of the statement above?

Thanks again for all your posts – most informative and always the highlight of the day!

It is a myth that internal devaluation can lead to export-led growth. Current account balance equals (broadly defined) capital account balance, even in the eurozone:

http://research.stlouisfed.org/fred2/graph/?g=sUs&dbeta=1

Minor deviances can be explained by measuring errors and difficulties.

In practice capital flows determine current account balance, not the price level. Japan for example has cut its wages and prices for years and has not gained any competitive advantage. Only the yen has appreciated.

The Chart with BIS Change in Real Effective Exchange Rate, Iceland (1999-2007) is wrong should be 15%, one line wrong in the excel sheet. 🙂

Dear /L (at 2014/05/29 at 5:36)

Thanks very much. I had extended the sample to January 2008 rather than December 2007 as you note. Much appreciated. Just to ease your concern, as I compile the final draft in the next week or so, all figures will be checked for each graph and table to ensure there are no mistakes like this. But thanks for the scrutiny. Changing from 11 to 15 per cent doesn’t alter the argument though.

best wishes

bill