I have received several E-mails over the last few weeks that suggest that the economics…

New economics – not much will change at the current rate

My upcoming book about Europe is tentatively called ‘European Groupthink: denial on a grand scale’. I have covered the concept of Groupthink before but I have been thinking about this in relation to the economics curriculum, given our textbook is entering its final stages of completion. When I was at the iNET conference in Toronto in early April, there was much to-do about the so-called ‘exciting’ new developments in economics curricula being sponsored by iNET at their Oxford University centre (CORE). Forgive me for being the ‘wet blanket’ but the more I spoke to people at the conference the more I realised that the neo-liberals were reinventing themselves as ‘progressive’ or ‘heterodox’ and hi-jacking the reform process. I mentioned this to one of the iNET Board members who I shared a flight with back to San Francisco. He seemed taken aback. My expectation is that very little of substance will change in this new approach to economics. It will dispense with the most evil aspects of the current dominant framework but will remain sufficiently engaged with it that we will not see a truly progressive teaching approach emerge that can deal with evidence and real world facts. People are scared to break out of the ‘group’.

I have been reading the work of – Solomon Asch recently. He was an Polish-American psychologist in the 1950s, who pioneered work in prestige suggestion, conformity whereby the group pressure radically alters the way individuals act.

His research program was influenced by his experience during World War II where propaganda was used to get people to believe in things that would be alien to them without the intervention.

This also fed into his so-called ‘conformity experiments’, which he conducted at Swarthmore College in the US in 1951. 50 Male students participated in a ‘vision test’. Each group had 8 participants, 7 ‘confederates’ and a ‘naive’ person.

The confederates were part of the experimental team and had been trained to answer the questions in specific ways including outright lying. The ‘naive’ person in each experiment was blithe to that reality and assumed they were all in the room on an equal basis.

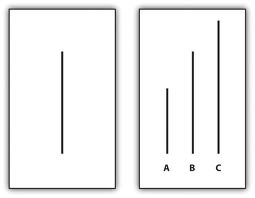

The ‘vision test’ took the form of a graphic being put up on a board (see an example below), which comprised a ‘reference’ line (left hand single) line and three ‘comparison’ lines, marked A, B and C. The participants then had to openly state which of the comparison lines matched the target line. The group was organised so that the ‘naive’ participant answered last.

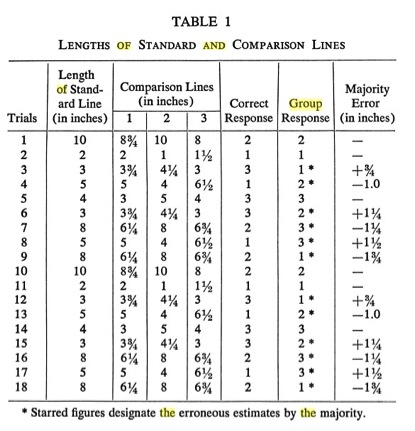

Asch conducted 18 trials (different graphics were shown) and the ‘confederates’ gave the incorrect response (lied) in 12 of the trials (which Asch called the ‘critical’ trials). The hypothesis being examined was whether the ‘naive’ participant would under the pressure of group dynamics conform to the overwhelming view that was being presented before they had a chance to answer.

The following graphic is taken from his original article and describes the parameters of the 18 Trials.

Source: Asch, S.E. (1951) ‘Effects of group pressure on the modification and distortion of judgments’, in H. Guetzkow (ed.), Groups, leadership and men, Pittsburgh, PA, Carnegie Press, 177-190.

He concluded that the “quantitative results are clear and unambiguous … There was a marked movement towards the majority”. 32 per cent of the participants conformed to the obviously incorrect response that the majority gave at the critical trials. 75 per cent of the ‘naive’ participants conformed at least once and only 25 per cent never conformed.

There was a control group, which had no insiders among the participants, and in those trials less than 1 per cent gave the wrong answer.

Here is a recreation of the test:

Asch questioned the ‘naive’ participants after the trials and many admitted they knew the answers were wrong but conformed for fear of being humiliated. Some said they began to doubt their own capacities and yielded to what they concluded was the superior knowledge of the group.

Subsequent research found that people conform more quickly to the group opinion if there is a person of high status (prestige) present. In work situations, if the boss is at the meeting and offers an opinion that is clearly wrong, then conformity will be high irrespective of the incorrect response.

For a bit of fun, here is a version of the Asch experiments – the so-called Elevator Experiment from 1962. It was featured on the US program ‘Candid Camera’ episode titled ‘Face the Rear’.

While this is all pretty dire stuff, Asch also found that if he tweaked the composition of the group and the ‘confederate’ was told to go against the majority by providing the correct responses then this significantly influenced the ‘naive’ participant to sail against the majority.

Groupthink was introduced into the literature by the work of Irving Janis in 1972. He identified communities of scholars working within a dominant culture, which provides its members which a sense of belonging and joint purpose but also renders them oblivious and hostile to new and superior ways of thinking.

The group dynamics becomes a sort of ‘mob-rule’ that maintains discipline within paradigms. Conformity is required if one wishes to remain within the group and benefit from it personally.

Janis said their were eight “symptoms” to look for:

1. An illusion of invulnerability.

2. A collective rationalization.

3. The belief in inherent morality.

4. The capacity to hold stereotyped views of out-groups (anyone who disagrees in free markets must be a socialist!).

5. Direct pressure on dissenters.

6. The capacity to self-censorship.

7. The illusion of unanimity.

8. Self-appointed mind guards.

Groupthink is a “mode of thinking people engage in when they are deeply involved in a cohesive in-group, when the members striving for unanimity override their motivation to realistically appraise alternative courses of action” (Janus, 1982: 9) and “requires each member to avoid raising controversial issues” (Janis, 1982: 12).

It has also been defined as “a pattern of thought characterized by self-deception, forced manufacture of consent, and conformity to group values and ethics” (Merriam-Webster on-line dictionary).

Groupthink becomes apparent to the outside world when there is a crisis or in Janis’s words a ‘fiasco’.

For those who have been through a graduate program in economics and have rejected the major body of ‘learning’ (aka in this context, propaganda) you will be able to directly apply the 8 symptoms to the economics profession.

A recent Op Ed by David Hendry and Grayham Mizon (both econometricians) – Why DSGEs crash during crises – is illustrative of what goes on in my profession.

The dominant ‘modelling’ framework – that is, the way in which economists set up a problem to be solved, structure it with starting assumptions and then use analytical techniques (mostly second-rate mathematics) to come up with the deductions – use called ‘Dynamic Stochastic General Equilibrium (DSGE)’ models.

This is the standard New Keynesian theoretical tool, which is taught as a matter of fact in universities and used by many central banks and government departments to conduct their research, policy analysis and their forecasting.

Have you ever wondered why the banks get it so wrong?

In my review of the BIS Annual Report this week – The BIS remain part of the problem – I had the unpleasant experience of going back to read their 2011 Annual Report – in particular Chapter 4 – Monetary policy challenges ahead. I had taken a lot of notes when it came out on how they couldn’t get beyond their ‘central banking groupthink’ to see out the window of their well-appointed offices.

Recall it was when the deficit terrorists were reorganising in the face of successful fiscal interventions and started to rail against the central bank operations during the GFC, which resulted in very large increases in the reserves held with them by the commercial banks.

Remember what they all said – that the banks would go on a lending frenzy and drive up inflation and perhaps send central banks broke.

The BIS claimed:

However, the balance sheets are now exposed to greater risks – namely interest rate risk, exchange rate risk and credit risk – that could lead to financial losses. Rising long-term interest rates may result in actual losses if central banks sell bonds from their portfolios, or in potential losses under mark to market accounting. Central banks with large holdings of foreign currency-denominated assets are especially vulnerable to exchange rate risks: a sharp appreciation of the domestic currency would translate into losses on their foreign exchange reserves. Credit risks have been increasing since the onset of the international financial crisis as central banks have purchased (or lent against) lower-quality assets, such as asset-backed securities.

All of which was irrelevant given that the central banks cannot go broke anyway and the nominal ‘losses’ are of no significance.

The BIS was calling for interest rates to rise (so-called ‘normalisation’) because they claimed that there was a growing inflation risk and if rates remained low then the risk of “overheating” was high. This was in 2010-11 remember when the world economies were still in recession and/or in states of very fragile growth with massive pools of unemployment.

The BIS also claimed that “statistical measures of global output gaps indicate that a substantial narrowing, if not outright closure, is in train”. That is, they were claiming the advanced economies were near full employment despite millions more being unemployed at the time than, say, three years earlier.

They had the audacity to claim that:

The rise in the unemployment rate was due in large part to structural changes in labour markets. The slowdown in economic activity was mistakenly attributed mainly to insufficient demand rather than to a substantial slowing of potential output growth.

Which is a nonsensical statement. If there had been no collapse in aggregate spending then output would not have fallen. The other option is that inflation would have gone through the roof. Yes and No happened, in that order.

This is BIS Groupthink! Their conclusion at a time that the world was still mired in recession:

Tighter global monetary policy is needed in order to contain inflation pressures and ward off financial stability risks. It is also crucial if central banks are to preserve their hard-won inflation fighting credibility, which is particularly important now, when high public and private sector debt may be perceived as constraining the ability of central banks to maintain price stability. Central banks may have to be prepared to raise policy rates at a faster pace than in previous tightening episodes.

If you search the publications of the BIS and other central banks you will see how common DSGE models as the basis of their analysis.

Hendry and Mizon note that the “supposedly ‘structural’ Bank of England’s Quarterly Model (BEQM) broke down during the Financial Crisis”. That is a common experience. None of the DSGE models were capable of understanding the build-up to the crisis, the crisis and its resolve.

Hendry and Mizon demonstrate how bad these models are when faced with real world outcomesand argue that when confronted with changes in circumstances people “consequently change their plans, and perhaps the way they form their expectations. When they do so, they violate the key assumptions on which DSGEs are built.”

They conclude that:

General equilibrium theories rely heavily on ceteris paribus assumptions – especially the assumption that equilibria do not shift unexpectedly. The standard response to this is called the law of iterated expectations. Unfortunately, as we now show, the law of iterated expectations does not apply inter-temporally when the distributions on which the expectations are based change over time … dynamic stochastic general equilibrium models are inherently non-structural; their mathematical basis fails when substantive distributional shifts occur.

And:

Like a fire station that automatically burns down whenever a big fire starts, DSGEs become unreliable when they are most needed.

But DSGE models are at the heart of the neo-liberal economics Groupthink. There has been a major effort among the profession to resurrect the standard DSGE model, which failed dramatically to predict the crisis.

hey accomplish this by adding what they call “financial frictions” and then add some variations on the standard “marginal prior distributions” that the previous DSGE models used – what they call a “looser prior, one that has less influence on the model’s forecasting performance”.

They also “fix parameters” to make the theoeretical model tractable as a state-space representation.

In English? The original made up priors (beliefs about model parameters) clearly give shocking forecasting outcomes so they had to loosen them up a bit to get better forecasting performance.

In other words, fudge after fudge with no theoretical or behavioural justification provided for the values they chose.

The capacity to produce whatever is desired increases in a DSGE framework because of all of the numerical priors that can be imposed on the model solution and produced results.

Please read my blog from 2009 – Mainstream macroeconomic fads – just a waste of time”>Mainstream macroeconomic fads – just a waste of time – for more discussion on DSGE modelling and New Keynesian economics.

There was an interesting Bloomberg Op Ed (August 21, 2013) – Economists Need to Admit When They’re Wrong – by the theoretical physicist, Mark Buchanan, who has taken a set against my profession in recent years.

He concluded that:

If economists used more realistic assumptions, the theorems wouldn’t work and claims to any insight about public welfare would immediately fall apart. Take a few tiny steps from mathematical fantasy into reality, and you quickly have no theory at all, no reason to think the market is superior to alternatives. The authority of the profession goes up in a puff of smoke.

This is a point not often understood. The real world is nothing much like the theoretical world that mainstream economists hide out in collecting their pay in secure jobs. Talk about inefficiency and unproductive pursuits!

An article in the New York Times (January 9, 2009) – An Economist’s Mea Culpa – by Princeton economist Uwe E. Reinhardt discussed the failure of economists to understand that an “economic train wreck” was coming as they advocated even more deregulation and government surpluses. He noted that:

If groupthink is the cause, it most likely is anchored in what my former Yale economics professor Richard Nelson (now at Columbia University) has called a “vested interest in an analytic structure,” the prism through which economists behold the world.

DSGE models are the latest ‘analytic structure’ that the mainstream graduate schools teach and expect students to learn and take with them into the professional world. It stifles free thinking and alternative frameworks. Deviations from it are few in the mainstream literature.

Reinhardt said:

This analytic structure, formally called “neoclassical economics,” depends crucially on certain unquestioned axioms and basic assumptions about the behavior of markets and the human decisions that drive them. After years of arduous study to master the paradigm, these axioms and assumptions simply become part of a professional credo. Indeed, a good part of the scholarly work of modern economists reminds one of the medieval scholastics who followed St. Anselm’s dictum “credo ut intellegam”: “I believe, in order that I may understand.”

Further:

As far as diagnoses of economic trends and predictions about the future are concerned, the profession’s preferred analytic structure and the groupthink it begets might work superbly well on planet Vulcan, whence hails the utterly logical Mr. Spock of “Star Trek” fame.

On Planet Earth … that analytic prism can seriously blur one’s vision.

The point is that the iNET project appears stuck in the same analytical structure with some nuances, designed to sound progressive.

The main proponent is an author of a terrible New Keynesian style textbook in macroeconomics that fails at the most elemental level to understand the role of government in a modern monetary economy.

From what I have seen to date, the Core Economics project will not depart significantly from the framework that is presented in that style of textbook.

These blogs – Learning standards in economics – Part 1 – Learning standards in economics – Part 2 and Learning standards in economics – Part 3 – also bear on the discussion.

Conclusion

My prediction is that the development of a so-called progressive agenda funded by George Soros’ iNET project will be essentially mainstream when stripped down to the basic structures about government and non-government.

It might not tout DSGE modelling but it will perpetuate the same old myths that underlie that sort of modelling.

That is enough for today!

(c) Copyright 2014 Bill Mitchell. All Rights Reserved.

iNET – an Euro Maidan for young economists. It is enough to sponsor the trend-setters. The rest of the herd will follow.

“ZAKARIA: First on Ukraine, one of the things that many people recognized about you was that you during the revolutions of 1989 funded a lot of dissident activities, civil society groups in eastern Europe and Poland, the Czech Republic. Are you doing similar things in Ukraine?

SOROS: Well, I set up a foundation in Ukraine before Ukraine became independent of Russia. And the foundation has been functioning ever since and played an important part in events now.”

(Source: CNN transcripts,”FAREED ZAKARIA GPS” – Sino-Russian Gas Deal Signed; Ukraine Picks New President; Interview with George Soros; The Power of Liberal Arts Education, Aired May 25, 2014 – 10:00 ET)

Obviously a quite common error in macro, increasing in frequency the further right one dwells.

… I noticed straight off when I first ran into articles by INET participants some two or so years back that they seemed to turn immediately hostile at the mention of (or challenge from) MMT. Indeed, I made a comment on another econ professors blog just the other day reviewing a recent INET-linked conference complaining of the exclusion of MMT, and that it seemed like petty academic posturing on their part, and the comment was deleted without response. And this was by a Marxist (who will go unnamed), who should be among the last ones supporting INET. (Although I’ve noticed a similar loathing towards MMT on the part of Marxists, who seem to need something to hate to give them focus.) Are all of academics consistently this petty in that they can’t welcome differing views? Whatever happened to the intellectual curiosity that was supposed to drive this stuff?

Swap out “the boss” with the person who is footing the bill, who is not necessarily the same person. In politics, this could be a campaign contributor, or the funder of a think tank. In academia the sponsor of an academic chair, or high-ranking contributor to the endowment. In both, contributors to an endowed prize fund. [The “Nobel” Prize in Banking (oops, I meant economics) is notable, but hardly the only one. Especially on the Right in the US, such prizes proliferate, and are usually in the +$100K range. Nice work if you can get it.]

Soros would not be funding anything which did not serve his self interest. As he is a multi billionaire financial wheeler dealer there are no prizes for guessing what his interests are.

Homo Saps is a herd animal – big herd,small herd,whatever.The leaders of the herds don’t get to be leaders by going against the groupthink or conventional wisdom of the herd. If you want original thinkers always look outside the herd.

I respectfully disagree with the statement that the main “battle-line” is drawn between the “neo-liberals” and “progressives”. On the ideological front all is quiet.

The real battle-line is between the US / the West and Russia / China. I would say that the oligarchies are playing “paper-scissors-rock” game.

What do the “progressives” stand for? Political correctness and punishing for using the “n” word? Radical feminism (fighting against the traditional marriage and family model)? Gay marriage (fighting for the traditional marriage but among gay people)? Carbon dioxide emission permit trading? “Saving the whale” from becoming a sushi? “Multi-kulti”? Opening up the borders of Australia to asylum seekers / Islamic settlers? Allowing trade-union apparatchiks to rule the state?

I am sorry but I think that the so-called “progressives” stand for nothing and they are brain-dead in terms of the ideology since 1989, the year of collapse of communism. The attempt to re-vitalise the “left” made by Graeber (“Occupy Wall Street”) was met with stiff resistance. This is it. You cannot stand for anything meaningful and at the same time be a post-modern relativist.

—

Another line from the interview with Soros before it descended into old-man’s-babbling:

ZAKARIA: Do you think Ukraine will be able to assert a kind of independence from Russia and an alignment with the West not — but not a specific alignment as NATO but a kind of orientation toward the West or will the Russians always stop them?

SOROS: No. Putin will try to destabilize Ukraine, but the Ukrainians, the large majority of Ukrainians are determined to be independent of Russia. It won’t be easy because Putin has staked his regime on destabilizing Ukraine because it’s a threat to his regime in Russia. If you have freedom, free media and so on and a flourishing economy, that would make his regime unsustainable.

He thinks the Ukrainians can maybe eventually prevail and have “a flourishing economy” like Bulgaria or Romania. He probably doesn’t care, all he wants to do is to stoke tension, he’ll be dead long before it’s all settled. Or it will be settled soon but not in the way he thinks…

So the “paper” is soft ideological power, NGOs, foundations, sweet talk about democracy, movies about the Western Way Of Life which make young Tunisians and Egyptians not sleep for the whole night organising another Arab Spring, Facebook and Twitter used to encourage the unwashed to report themselves to the thought police… but wait, hasn’t it all stopped working?

The scissors are old, rusty, Soviet-made tanks, as in 1989 in China. And we won’t expect a “rock” of economic collapse caused by the inherent ineffectiveness and corruption of the centrally-controlled socialist economy to beat the rusty scissors soon. Socialism is dead except maybe for Cuba and North Korea. (I don’t really care about the nice soft ideas, all I am doing is looking at the real world. Working socialism hasn’t been spotted in the wild for a while, probably since the dismantling of the majority of kibbutzim in Israel). The reason why the scissors are back is purely economic – that’s why I think that this comment still marginally qualifies for this blog. Did the Chinese apply the principles of MMT? Did they care about balanced growth? No, they equally disregarded neoclassical economics, budgetary fiscal constraints and social justice, the interests of the working class. China and Russia are pragmatic oligarchies on the march.

Maybe instead of thinking about the ideal world we need to start describing the reality, the ugly and dirty world of trade wars, mercantilism and counter-attacks mounted by military Keynesians? But who can do it? The majority in the West have been co-opted by the “system” and their brains are on the tight leash held by Soros Foundations. Or political correctness of the “multi-kulti” era.

Here is the answer from Moscow.

I am sorry I don’t have time to translate the whole article, Google will be your friend. It basically says that the hegemony of the US on the global scene is over and it’s time for a new global order.

“МОСКВА, 2 июл – РИА Новости. Гегемония США на мировой арене завершилась, и теперь нужно садиться за стол переговоров по итогам холодной войны, заявил в интервью РИА Новости заместитель секретаря Совета безопасности РФ Евгений Лукьянов.

“Гегемония США на мировой арене подошла к концу, с чем в Вашингтоне, конечно же, согласиться не могут. Но нужно садиться и договариваться по итогам холодной войны”, – сказал Лукьянов.”

This might be a piece of Ukrainian propaganda but it is also interesting. It says that the EU did not impose sanctions against Russia because the Russians threatened to openly invade Ukraine immediately after imposing any meaningful sanctions.

See Unian (in Russian), 02.07.2014 21:32

«Почему ЕС не решает с санкциями? В политическом Берлине хорошо информированные источники рассказывают, что высокие российские дипломаты открыто угрожают, что Россия, в случае серьезных санкций, будет чувствовать себя полностью свободной и пойдет прямо на Украину… Если это правда, это объясняет так много”, – пересказала Бек информацию, которая „ходит” по политическим коридорам в Германии.

—

Nothing can be done I am afraid to stop this tragedy because the global overlords fancy another round of chess.

Bill, there are other perhaps more damning examples of your Asch et al. point. One is Asch’s Minority of One in Psych Monographs around 1960. In Asch’s experiments described in the psych journal monograph, he did find that subjects were substantially able to resist group pressure if another member of the group deviated from the “designated answer”. The more that deviated, the greater the likelihood of resistance.

This was also found in another set of studies by Latane and Darley. Another similar subject but dealing with seemingly trivial situations is the set of studies by Latane and Darley described in The Unresponsive Bystander: Why Doesn’t He Help? , though the event that stimulated these studies was far from trivial. What L&D found was that people were more prone to assist someone if others indicated that they were prepared to assist. And the more people in the situation, the less likely the subject would be to assist – for example, helping a young woman pick up a dropped package of coins.

Another is Milgram’s set of experiments on obedience to authority, where the subject would subject a member of the experiment to electric shocks that they never of course received, though unknown to the subject (Obedience to Authority). Just over 60% of the subjects went all the way to about 240 volts, a seriously dangerous level. This experiment has been replicated so many times in so many countries that the results can be considered to be robust. Which is that around 60% of people around you will effectively kill you if the distance between you and them is great enough and the order to do something dangerous to do something dangerous to them is indirect enough and comes from someone in authority.

Another is Zimbardo’s Stanford prison experiment where the experiment had to be shut down after it had hardly begun because the “guards” began torturing the “prisoners” (described in some detail in his book, The Lucifer Effect). This experiment was supposed to run for a few months but only ran for a few weeks. In this particular experiment, the torture was rather direct, and only one “guard” absented himself during these torture sessions. He didn’t object; he just left giving an excuse. The prisoners complained and questions were asked, but no one actually objected to the experiment or its design.

The point that no one rejected the Stanford experiment was made against Milgram’s first experiment in obedience, that since the subject were all Yalies, i.e., Yale undergraduates, they were just doing what they were told. So Milgram took the experiment out of the university setting and conducted it in a large city and obtained his subjects via newspaper advertising. The results were the same. A summary of some of these experiments can be found in Roger Brown’s Social Psychology, 1st and 2nd editions.

All these experiments support the view that group think can be pervasive and is difficult to resist. But they also show that, under certain circumstances, which may be difficult to concoct, it can be successfully resisted.

Podargus, what you say about Soros is not entirely true. He was heavily influenced by Karl Popper’s vision of the Open Society and many of his earlier projects were designed with this in mind. I don’t mean to suggest by this that everything Soros does he does with the Open Society in mind. However, contending that everything he does is in his self interest can become tautological and, thus, devoid of content and, therefore, trivial if unqualified.

larry,

Soros has blood of Eastern Europeans on his hands. It is totally irrelevant whether he is driven by blind hatred towards Russia (like Brzezinski) or by individual greed and thirst for influence and power or by a positive vision of the Popperian Open Society and love for humanity or whether he is just a skilled high-ranking operative of a well known secret agency.

No matter what he says he has blood on his hands and he will never be able to wash it off – and he hasn’t got much time left to his personal day of reckoning.

The slowdown in economic activity was mistakenly attributed mainly to insufficient demand rather than to a substantial slowing of potential output growth.

Dr. Mitchell, you were far more kind to this statement than I think it merits. Another way of looking at this is that “there was a slowdown because there was a substantial slowdown” or ” economic activity slowed because economic activity had to slow.”

These people are not particularly bright.