It's Wednesday and we have discussion on a few topics today. The first relates to…

Financial elites win with growth and austerity

I was thinking over the weekend about the concept of post nationalism in relation to the evolution of the Economic and Monetary Union (EMU) in Europe. As I complete my current book project on the euro-zone it is clear that by the end of the 1980s, the European financial and political elites were designing a system that they must have known would undermine the prosperity of their own nations. It was obvious at the time that the EMU would fail badly and so the question arises as to what was motivating them to act in this way. The is where ‘post nationalism’ comes into play. Characters such as Jacques Delors had moved from being a major promoter of French interests within the Franco-German rivalry to pushing the interests of international capital by the time he formed the Committee in 1989 to design the EMU. By then Monetarism, which came out of the American academy, had taken over the policy debate and was usurping national economic interests. The EMU was a major vehicle for transferring national income from workers towards capital interests. It allowed the banksters to reap financial harvests that were unprecedented in history. These ideas, which play out in my book, also links in with recent research published by Oxfam on income and gender inequality.

The Oxfam research helps us trace together who are the winners from the disastrous EMU experiment. In January 2014, they released their report – Working for the Few – which examined why income inequality was expanding and how economic growth no longer worked to advance the interests of all society. Further, it documents how austerity in Europe has redistributed income towards the wealthy.

It is game, set and match for the workers! (that is, they lost outright).

The Oxfam Report is replete with facts and figures and who doesn’t like that!

1. “one percent of the world’s families own almost half (46 percent) of the world’s wealth. The bottom half of the world’s population owns less than the richest 85 people in the world.”

2. “The wealth of the one percent richest people in the world amounts to $110 trillion. That’s 65 times the total wealth of the bottom half.”

3. “In the US, the wealthiest one percent captured 95 percent of post-financial crisis growth between 2009 and 2012, while the bottom 90 percent became poorer.”

4. “Global elites are increasingly becoming richer. Yet the vast majority of people around the world have been excluded from this prosperity.”

5. “the combined wealth of Europe’s 10 richest people exceeds the total cost of stimulus measures implemented across the European Union (EU) between 2008 and 2010 (€217bn compared with €200bn).”

and so on.

Regular readers will know that I blame the financial crisis on the advent of neo-liberalism. The policy shift that followed the intellectual take-over of economics departments by the Monetarists (and later other strands of free marketeers) broke the nexus between real wages growth and productivity growth, which redistributed national income to profits.

That redistribution was captured by the financial markets working for the highest income earners and was the basis of the massive speculative binge driven which pushed credit onto increasingly constrained households and drove the real estate bubble. But while the middle class was competing for ever more expensive houses, the financial markets were repackaging the mortgage debts into exotic financial products that were then on sold.

Not only did this redistribute income away from workers generally, but there was also a polarisation of income towards the high income earners.

The Oxfam Report noted that:

Since the late 1970s, weak regulation of the role of money in politics has permitted wealthy individuals and corporations to exert undue influence over government policy making. A pernicious result is the skewing of public policy to favor elite interests, which has coincided with the greatest concentration of wealth among the richest one percent since the eve of the Great Depression.

As policies favoring corporations gained ascendancy, the bargaining power of labor unions plummeted and the real value of the minimum wage and other protections eroded. It is now harder for unions to organize, and easier for big businesses to suppress wages and erode workers’ benefits. Wealthy interest groups have also used their financial might to influence legislators and the general public to keep downward pressure on top income tax rates and capital gains, and to create corporate tax loopholes. Because capital is taxed at lower rates than income, millions of average working Americans pay higher tax rates than the rich.

From the 1980s onwards, the financial and banking sectors pumped millions of dollars into undoing regulations put in place after the stock market crash and Great Depression of the 1930s. Deregulation has had two major ramifications: corporate executives associated with the banking and financial sectors have become exceptionally wealthy, and global markets have become much more risky, culminating in the global economic crisis that began in 2008.

This was also gathering pace during the period that the European elites were discussing their move to monetary union. It is obvious that those discussions were similarly influenced (dominated) by the free market ideology that had swept the world.

By the way, the term ‘free market’ is not to be taken literally. While the mainstream textbooks ram the perfectly competitive market model down the throats of students in economics as if that it the aim, the reality is that they were not pushing for free markets at all. The elites just wanted deregulation and reductions in oversight so their capacity to manipulate market outcomes in their favour was enhanced. That is a very different thing to a textbook perfect market (which, of-course is largely unobtainable in the real world).

The neo-liberals just believe in making the market easier for the elites to plunder.

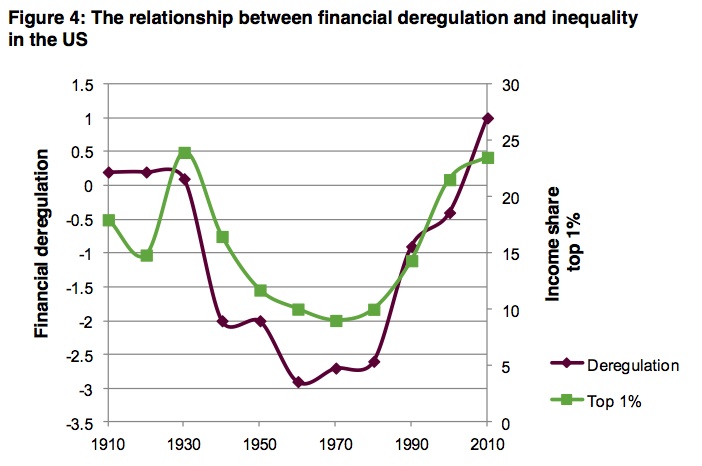

The Oxfam Report produced as Figure 4 this graph, which shows “a direct correlation between financial deregulation and economic inequality in the US”. The pattern is being reproduced throughout the World. It is stark.

The measure for financial deregulation comes from a 2009 NBER paper – Wages and Human Capital in the U.S. financial industry: 1909-2006. Its derivation is beyond the scope of this blog today.

Austerity and inequality

In Europe, the US trends were also apparent before the crisis even as growth continued in the early years of the EMU.

But inequality has accelerated under the austerity programs forced on the weaker EMU nations by the elites. The Troika-led programs have shamelessly concentrated on dismantling the “the mechanisms that reduce inequality and enable equitable growth” (Oxfam Report).

In the same way that the IMF Structural Adjustment Programs (SAPs) concentrated on cutting deeply into public education, health care, and social security and eroding the rights of workers (attacking trade unions, abandoning workplace protections etc), the austerity programs have followed.

The Oxfam Report concludes that:

The poorest sections of society have been hit hardest, as the burden of responsibility for the excesses of past decades is passed to those who are most vulnerable and least to blame.

Even the stimulus packages were loaded in favour of the rich, when in theory they should aim to protect the weakest, first.

Monetarism (which I now refer to more broadly as neo-liberalism) was characterised by redistributing national income to the rich and then cutting the top tax rates so that the highest income earners “not only received a larger share of the economic pie but they also paid less tax on it”.

But then during the bailouts in 2008, the ‘too big to fail’ myth led to millions of dollars in government spending being diverted to the financial sector.

I have noted before that the conservatives, some of whom were direct beneficiaries of bailout packages in the early days of the crisis, soon started using their media power and access to tell us that our governments are bankrupt, that our grandchildren are being enslaved by rising public debt burdens and that hyperinflation is imminent.

This led to the premature withdrawal of the stimulus packages before they had a chance to build employment and wages growth for the majority. Please read my article in the Nation (April 4, 2011) – Beyond Austerity – for more discussion on this point.

The Oxfam Report also notes that whenever public services are increased, inequality falls. And it is the wealthy interest groups who “often challenge efforts to create good quality public services or universal health coverage” because “Such policies are considered threats to maintaining high concentrations of wealth and income levels.”

An interesting aspect of the Oxfam research is to document the “a global network of tax havens” that have grown in the last 30 years and have been major vehicles for increasing income inequality.

While Modern Monetary Theory (MMT) doesn’t consider the lost tax income to be a constraint on government spending, it is still the case, that if governments want to spend without causing inflation there must be ‘space’ available. That means that there must be idle resources that can be brought back into productive use.

The role of taxation is to create that ‘space’ by ensuring the non-government sector has less purchasing power. So tax havens are a problem in that regard. Of-course, the austerity mindset has created massive fiscal space (given the unemployment and idle capital) and so the disappearance of taxable income and wealth is not a constraint on governments reducing unemployment.

But, of-course, in typical neo-liberal ‘double-whammy’ style, the lost tax revenue is held out as a reason why fiscal deficits have to be cut. Meanwhile, the rich are ordering new yachts and whatever from their ill-gotten gains.

Euro Post Nationalism

The early years of discussion of monetary union in Europe were done through strictly national lenses – advancing national interests. It is in this context that we understand the age-old Franco-German rivalry.

The cultural and historical aspects of the Franco-German rivalry are permanent constraints on European progress. When the Gauls and the Prussians began hating each other is a matter of history, but it was a long time ago. Historians create all sorts of revisionist narratives to suit their own angle, but it is clear that the two ‘nations’ were at odds after Napoleon incorporated German-speaking areas such as the Rhineland during the First Republic.

His disdainful treatment of the German aristocracy, including the various German-speaking monarchs, spawned German nationalism and led to the Franco-Prussian War in 1870. German unification was motivated, in part, by a desire for a German-speaking power to rival that the geo-spatial domination of France.

It is true that this ‘enmity’ evolved in the post World War II period. The diplomacy is less chauvinistic and the prospect of another major European war is minimal. Some have even considered the relationship between the two great European nations to be one of ‘Amitié franco-allemande’.

But despite the handshakes at official meetings and smiles for the cameras, there is always a simmering clash of culture and the legacy of World War II still burns bright.

While the rivalry was intense and open under President de Gaulle, which held back European integration, later, the rivalry was expressed from the French side as a desire to neutralise German power, and, the only way to do that was to create a European state where France dominated.

From the German-side, whether anyone wants to talk about it or not, a deep and silent shame gripped the nation as a result of their actions during the 1930s and 1940s. Their only source of national pride became their economic acumen – their technical and organisation skills and the discipline of their workers.

They wanted the ugly German to become the clever German. European integration became a way the German nation could win back some respect by demonstrating that it could be part of a peaceful Europe and bring its engineering acumen to benefit all.

Reunification accelerated that desire but accentuated the paranoia in the rest of Europe about the ‘German question’. This rivalry and divergent ambitions and motivations dominated the path to monetary union over many decades.

When finally, Mitterand and Schmidt seemed to be working together, the motivations and cultural baggage remained as disparate as it had been when Monnet and Schuman first proposed the ‘European Project’.

These differences suggest that both of the large European nations would be better off pursuing their own economic destinies. But they can only do that if they also free themselves from the vice-like grip of neo-liberal economics

The rise of Monetarism, which originated out of the academy in the US, created a ‘post national’ tension among the European politicians, which cut across the old state-based rivalry between the nations in Europe.

Whereas, the early discussions about union placed the national state at the forefront, by the time Delors and his Committee met, the global capture by the financial elites of the policy process was well entrenched and the promotion of Monetarist economic ideology aided their agenda.

Recall that Delors excluded the national finance ministers from his panel to ensure that the Monetarist perspective would emerge quickly and not become derailed by national political hankering.

It was imperative that the supranational entities, which were created as part of the union, were consistent with this post national ideology.

That is why the fiscal role of the state was so restricted and the primacy of the depoliticised ECB elevated. The old national rivalries persisted but their expression became increasingly channelled by the free market narrative and a monster was created.

That is also why austerity has been so well-targetted to protecting the interests of the high income earners and the financial elites.

What can be done?

It is clear that not much is being done to redress this situation.

The major US reform was the 2010 Wall Street Reform and Consumer Protection Act (the Dodd-Frank Bill). This bill aimed to re-regulate the financial sector to avoid a further crash. It was an attempt to get back towards the Glass-Steagall era, which began during the Great Depression.

The Oxfam Report says that:

… the financial industry has spent more than $1bn on hundreds of lobbyists to weaken and delay the Act’s full implementation. In fact, in 2012 the top five consumer protection groups sent 20 lobbyists to defend Dodd-Frank, while the top five finance industry groups sent 406 to defeat it. Even though Dodd-Frank was signed into law more than three years ago, only 148 of its 398 rules have been finalized, and the financial system remains just as vulnerable to crash as it was in 2008.

There are several things that have to be done before this will change and the state has to be at the centre of the change. That will require us to force them to resist the demands of the elites and return to playing the sort of role that government served in the Post World War II full employment era.

First, the government must outlaw most speculative transactions. Many progressives promote a ‘Robin Hood Tax’ as the answer. But they do so because they have fallen into the neo-liberal mindset that government spending is financially constrained. Further, taxing this activity will never eliminate the inequality it causes and the heightened risk of crisis that it engenders.

This activity is of no productive value and has no place in a more equal, progressive world.

Second, the relationship between real wages and productivity has to be restored such that both grow in proportion with each other. We cannot have sustainable economies where the producers (workers) are receiving a small fraction (if that) of the productivity growth they provide.

This requires a major shift in government role. The Oxfam Report notes that in the period of “Great Prosperity”, when inequality fell as growth accelerated (after WW2):

The government’s role was to maintain the balance between labor and big business.

This role was maintained by governments in most nations and took various forms. But the overall aim was to allow real wages to growth in proportion with productivity so that labour costs did not threaten inflation but also that the national income was distributed more equally.

A raft of policies including minimum wage legislation, support for trade unions etc helped achieve this aim.

The following graph is taken from the Oxfam Report (Figure 7) and shows that the attacks on trade unions which have made it “difficult for unions to organize” and gain wage increases aided the rising inequality.

Third, fiscal policy has to be reinstated as the priority macroeconomic policy tool and used to generate full employment with growth in first-class public services. Out-sourcing, Public-Private Partnerships and the like, which all serve to divert public funds into the hands of the rich should be discontinued.

Currency-issuing governments have no financial constraints on their spending. The primary aim of public service is to enhance the well-being of the public not provide extra ways in which the rich can divert resources for their own gain.

The Oxfam Report relates how in Latin American countries, which have undergone a ‘leftist’ swing, “inequality has declined as “governments are increasing tax revenues and spending more on social protection and poverty reduction policies”.

That shift in policy is apposite everywhere.

Fourth, the euro-zone has to be dismantled and national interests restored. Austerity has to be replaced with employment growth and the expansion of pubic services and a revival in public infrastructure.

And those four suggestions are just the beginning.

Conclusion

There was another Oxfam Report that came out today on gender inequality. I will consider that once I have read it in detail. But it is interlinked with the discussion today.

The elites use all sorts of divide and conquer strategies to segment the working class. Race and gender are just two of the more obvious ways that we are trained to turn against each other. This helps hide what is really going on – the plundering of national income by the elites.

That is enough for today!

(c) Copyright 2014 Bill Mitchell. All Rights Reserved.

Bill, your Fig 7 doesn’t have a legend. While it is reasonably clear which vertical axis applies to which line, strictly speaking, it should sport one.

You probably could not be more right when you say we are witnessing the “plundering of national income by the elites”. In 1996, an economist and an historian published books with almost that theme in their titles. They are: John Smithin, Macroeconomic Policy & the Future of Capitalism: The Revenge of the Rentiers & the Threat to Prosperity, and the late Christopher Lasch, The Revolt of the Elites & the Betrayal of Democracy. Similarity of topic approached from slightly different directions separated in time. The temporal element lends the thesis greater gravity I reckon.

I inadvertently left out Piketty. While you, Smithin, and Lasch say it straight out, Piketty seems to hedge a little.

Bill, when you say game, set and match for the workers, don’t you mean the elites?

Dear Larry (at 2014/07/14 at 20:25)

I was thinking that the game was over for the workers – they lost outright! I have amended the text to make it clear.

best wishes

bill

Watched what I consider the greatest sporting documentary of all time on BBc 4 a few nights ago.

The Hell of the North (1976)

Not only is sport more real and less detached then todays ever more coporate spectacle but the film seems to catch the ever further erosion of society as capital rationally decided it had no further need for labour anymore.

In truth nationalism as we understand it in the post Cromwell fascist tribal destructive phase was no less corporate then todays market state – it merely worked over much smaller scales and was therefore less destructive as it perhaps never quite got into peoples souls as in todays strange baptism of advertising without purchasing power entropy.

A must see for cycling fans and indeed others who wish to understand the implosion of western fautasian culture.

https://www.youtube.com/watch?v=ZYe5vdRV8S8

The incredible story of Ingunn Sigursdatter – her efforts to reject Norwegian citizenship through the expression of her own individual sovereignty hits home when the corporate nature of European states has now become obvious.

Not a easy thing to do.

Norway – the best kept animal farm in Europe.

Nothing is out of place…….a clean (sterile) enviornment.

I suspect this is the primary reason for the high instance of suicide up north – its not the bloody weather.

Their inner conciseness understands that something is not quite right – they decide to terminate themselves to simply stop the pain.

https://www.youtube.com/watch?v=dgLZq-5djsI

Ingunn Sigursdatter ” the state will take care of our children”

Selma James using the void in society to tax mothers work while using progressive language.

The state is not about distribution of wealth – its goal is the concentration of power – the will to power in action.

https://www.youtube.com/watch?v=Mlx3UvECDmY

Selma james uses the destruction of purchasing power within the family to create yet another round of gender or class tension by rewarding one favoured group over aniother.

This is the using money to impose a new morality.

This is therefore a new Priesthood.

I don’t think the EU experiment is just to concentrate wealth, but also power. The Eurozone gives nations like Italy and Greece stark choices: they can continue ‘screwing’ their people as they are now in return for going cap in hand to the ECB and Commission, or they can surrender their fiscal policy, in essence their total sovereignty to Brussels. This I see as their end-game. The financial masters in the EU have spoken of fiscal union, but not of leaving the Euro I’ve noticed. The latter option is rarely discussed in the media I notice. When fiscal union is achieved, the United States of Europe will have truly arrived; the dream of ending military conflict in Europe will have been achieved, but at a great cost.

Excellent blog entry, Professor Mitchell.

The one thing I find infuriating is the willful destruction of society and the complicit nature of our elected officials in that destruction. I think a proper understanding the monetary system isn’t enough, because there is still rampant self interest that leads those in power to continue misdirection and convenient lies to keep their snout in the trough.

Challenging the system means challenging their place in it, and historically that’s been too much of a challenge for many in power.

I agree with Bill’s analysis as far as it goes. I think things are far more ominous than Bill has actually expressed here. What is happening seems consistent with Marx’s overall analysis. Late stage capitalism would burn up and destroy everything else; all other forms of relation and connection would disappear. Only the relations of capital would remain. Nations and nationalism might appear to become more problematic, less likely to endure. I am not sure on that score though. Nationalism might well prove more resilient than trends suggest.

The State remains strong in Russia and China (key examples) albeit these are totalitarian or near totalitarian states. Meanwhile in the US, corporate and family fortune oligarchs are capturing the state which is also being turned into a strong totalitarian security state operating mainly in the interests of the oligarchs. Indeed, it could be argued that Russia, China and the USA are converging by turning into Corporate-Oligarchic Totalitarian states. Indeed, I do argue that. The situation most clearly replicates some of Orwell’s predictions: three blocs which might eventually be in a state of permanent competition and war (or proxy wars).

I am not sure about Marx’s prediction of two neat classes coming about, capitalists and proletarians. Automation (robotic machinery as in automated car factories) cuts the ground from under the traditional industrial proletariat. Rather, we see the super-rich supported by specialist sub-classes of professionals (including executive managers, engineers, software engineers and security professionals plus our bought and suborned professional political class.)

Complicating this mix we have the de-industrialisation of the West, the Rise of the BRICS (especially China) and oncoming catastrophic Climate Change and unavoidable Limits to Growth and Overshoot followed by Economic Collapse. There are not enough world resources left for China to complete its transformation. India has no hope of making a transformation. Brazil might to some extent. Russia has more resources left compared to its population than does any other powerful nation but Russia always seems to find a way to stumble.

World prospects? Absolutely abysmal. The best we Australians can hope is that we are far enough away from all of the places that will implode before we do. However, if the implosions are big enough we will find ourselves inside the global “Event Horizon” and sucked into the general black hole of collapse.

Bill,

Thanks for your article which is spot -on.

You’re making the case, which I’ve made myself but far less thoroughly, for modifying the standard MMT line that taxes aren’t as necessary as the many of the left have traditionally argued them to be. Many MMTers have used the argument that savings can be considered to be a voluntary tax. So, if the ruling classes, go on an ‘investment strike’, ie start hoarding cash piles, it’s really not a problem. Government can just step in and do the spending instead.

Yes of course they can, but that shows a naive attitude. The spending is just not going to happen when the media and main political parties are run by the the hirelings of those who are hoarding those cash piles. They’ll happily spend just a little bit to promote their disinformation. We need to squeeze them where it hurts and make it as politically difficult as possible for them to evade paying their taxes.

Dear petermartin2001 (at 2014/07/15 at 20:53)

I have not modified anything. The point is that tax revenue is not necessary to raise funds that the government spends. But a basic MMT concept is that taxes create real resource space, which can give government scope to spend. The other way we can say that is that taxes create unemployment in the non-government sector, which government spending then eliminates.

That has been in our work from day 1 – and I have never modified it.

best wishes

bill

“But a basic MMT concept is that taxes create real resource space, which can give government scope to spend”.

Which the neo-liberals will define as crowding out and then argue the better option would be for government to tax less and spend less in the first place.

Which brigs us back to the neo-liberal mantra of smaller government being the best solution.

“But a basic MMT concept is that taxes create real resource space, which can give government scope to spend. The other way we can say that is that taxes create unemployment in the non-government sector, which government spending then eliminates.”

Thank you Bill

You describe a war economy and so in the truest sense you are a hyper capitalist – willing to engage in a total war of production no matter what the cost.

This may indeed stop the debt crisis but at a terrible cost.

A distributionist would give a equal capital ration to each individual (via the destruction of the bank scarcity engine) which would allow them to go back to their villages and hearths rather then the trenches and satanic mills or indeed modern call centers.

“I suspect this is the primary reason for the high instance of suicide up north”

It’s a myth and should be well known by now, but obviously not.