Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

Saturday Quiz – July 19, 2014 – answers and discussion

Here are the answers with discussion for yesterday’s quiz. The information provided should help you understand the reasoning behind the answers. If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern Monetary Theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

Modern Monetary Theory teaches us that one of the dangers of public spending is that it can crowd out private spending.

The answer is True.

The question relates to the meaning of the term “crowding out”.

The normal presentation of the crowding out hypothesis which is a central plank in the mainstream economics attack on government fiscal intervention is more accurately called “financial crowding out”.

If I had have used the term “financial crowding” out then the answer would have been false.

At the heart of this conception of financial crowding out is the theory of loanable funds, which is a aggregate construction of the way financial markets are meant to work in mainstream macroeconomic thinking. The original conception was designed to explain how aggregate demand could never fall short of aggregate supply because interest rate adjustments would always bring investment and saving into equality.

In Mankiw, which is representative, we are taken back in time, to the theories that were prevalent before being destroyed by the intellectual advances provided in Keynes’ General Theory. Mankiw assumes that it is reasonable to represent the financial system as the “market for loanable funds” where “all savers go to this market to deposit their savings, and all borrowers go to this market to get their loans. In this market, there is one interest rate, which is both the return to saving and the cost of borrowing.”

This is back in the pre-Keynesian world of the loanable funds doctrine (first developed by Wicksell).

This doctrine was a central part of the so-called classical model where perfectly flexible prices delivered self-adjusting, market-clearing aggregate markets at all times. If consumption fell, then saving would rise and this would not lead to an oversupply of goods because investment (capital goods production) would rise in proportion with saving. So while the composition of output might change (workers would be shifted between the consumption goods sector to the capital goods sector), a full employment equilibrium was always maintained as long as price flexibility was not impeded. The interest rate became the vehicle to mediate saving and investment to ensure that there was never any gluts.

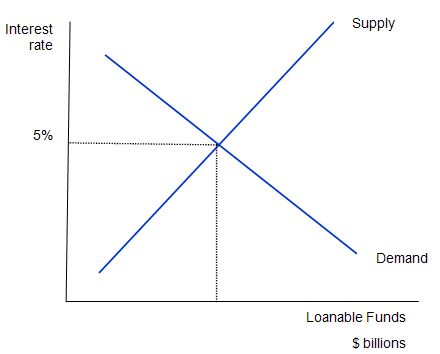

The following diagram shows the market for loanable funds. The current real interest rate that balances supply (saving) and demand (investment) is 5 per cent (the equilibrium rate). The supply of funds comes from those people who have some extra income they want to save and lend out. The demand for funds comes from households and firms who wish to borrow to invest (houses, factories, equipment etc). The interest rate is the price of the loan and the return on savings and thus the supply and demand curves (lines) take the shape they do.

Note that the entire analysis is in real terms with the real interest rate equal to the nominal rate minus the inflation rate. This is because inflation “erodes the value of money” which has different consequences for savers and investors.

Mankiw claims that this “market works much like other markets in the economy” and thus argues that (p. 551):

The adjustment of the interest rate to the equilibrium occurs for the usual reasons. If the interest rate were lower than the equilibrium level, the quantity of loanable funds supplied would be less than the quantity of loanable funds demanded. The resulting shortage … would encourage lenders to raise the interest rate they charge.

The converse then follows if the interest rate is above the equilibrium.

Mankiw also says that the “supply of loanable funds comes from national saving including both private saving and public saving.” Think about that for a moment. Clearly private saving is stockpiled in financial assets somewhere in the system – maybe it remains in bank deposits maybe not. But it can be drawn down at some future point for consumption purposes.

Mankiw thinks that fiscal surpluses are akin to this. They are not even remotely like private saving. They actually destroy liquidity in the non-government sector (by destroying net financial assets held by that sector). They squeeze the capacity of the non-government sector to spend and save. If there are no other behavioural changes in the economy to accompany the pursuit of fiscal surpluses, then as we will explain soon, income adjustments (as aggregate demand falls) wipe out non-government saving.

So this conception of a loanable funds market bears no relation to “any other market in the economy”.

Also reflect on the way the banking system operates – read Money multiplier and other myths if you are unsure. The idea that banks sit there waiting for savers and then once they have their savings as deposits they then lend to investors is not even remotely like the way the banking system works.

This framework is then used to analyse fiscal policy impacts and the alleged negative consquences of fiscal deficits – the so-called financial crowding out – is derived.

Mankiw says:

One of the most pressing policy issues … has been the government fiscal deficit … In recent years, the U.S. federal government has run large fiscal deficits, resulting in a rapidly growing government debt. As a result, much public debate has centred on the effect of these deficits both on the allocation of the economy’s scarce resources and on long-term economic growth.

So what would happen if there is a fiscal deficit. Mankiw asks: “which curve shifts when the fiscal deficit rises?”

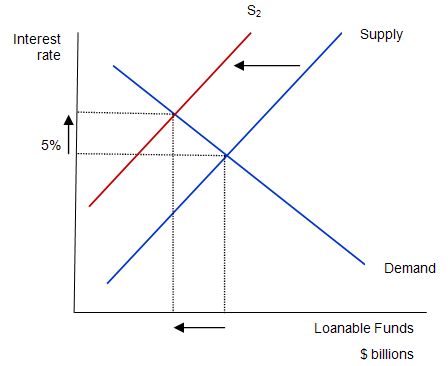

Consider the next diagram, which is used to answer this question. The mainstream paradigm argue that the supply curve shifts to S2. Why does that happen? The twisted logic is as follows: national saving is the source of loanable funds and is composed (allegedly) of the sum of private and public saving. A rising fiscal deficit reduces public saving and available national saving. The fiscal deficit doesn’t influence the demand for funds (allegedly) so that line remains unchanged.

The claimed impacts are: (a) “A fiscal deficit decreases the supply of loanable funds”; (b) “… which raises the interest rate”; (c) “… and reduces the equilibrium quantity of loanable funds”.

Mankiw says that:

The fall in investment because of the government borrowing is called crowding out …That is, when the government borrows to finance its fiscal deficit, it crowds out private borrowers who are trying to finance investment. Thus, the most basic lesson about fiscal deficits … When the government reduces national saving by running a fiscal deficit, the interest rate rises, and investment falls. Because investment is important for long-run economic growth, government fiscal deficits reduce the economy’s growth rate.

The analysis relies on layers of myths which have permeated the public space to become almost “self-evident truths”. Sometimes, this makes is hard to know where to start in debunking it. Obviously, national governments are not revenue-constrained so their borrowing is for other reasons – we have discussed this at length. This trilogy of blogs will help you understand this if you are new to my blog – Deficit spending 101 – Part 1 | Deficit spending 101 – Part 2 | Deficit spending 101 – Part 3.

But governments do borrow – for stupid ideological reasons and to facilitate central bank operations – so doesn’t this increase the claim on saving and reduce the “loanable funds” available for investors? Does the competition for saving push up the interest rates?

The answer to both questions is no! Modern Monetary Theory (MMT) does not claim that central bank interest rate hikes are not possible. There is also the possibility that rising interest rates reduce aggregate demand via the balance between expectations of future returns on investments and the cost of implementing the projects being changed by the rising interest rates.

MMT proposes that the demand impact of interest rate rises are unclear and may not even be negative depending on rather complex distributional factors. Remember that rising interest rates represent both a cost and a benefit depending on which side of the equation you are on. Interest rate changes also influence aggregate demand – if at all – in an indirect fashion whereas government spending injects spending immediately into the economy.

But having said that, the Classical claims about crowding out are not based on these mechanisms. In fact, they assume that savings are finite and the government spending is financially constrained which means it has to seek “funding” in order to progress their fiscal plans. The result competition for the “finite” saving pool drives interest rates up and damages private spending. This is what is taught under the heading “financial crowding out”.

A related theory which is taught under the banner of IS-LM theory (in macroeconomic textbooks) assumes that the central bank can exogenously set the money supply. Then the rising income from the deficit spending pushes up money demand and this squeezes interest rates up to clear the money market. This is the Bastard Keynesian approach to financial crowding out.

Neither theory is remotely correct and is not related to the fact that central banks push up interest rates up because they believe they should be fighting inflation and interest rate rises stifle aggregate demand.

However, other forms of crowding out are possible. In particular, MMT recognises the need to avoid or manage real crowding out which arises from there being insufficient real resources being available to satisfy all the nominal demands for such resources at any point in time.

In these situation, the competing demands will drive inflation pressures and ultimately demand contraction is required to resolve the conflict and to bring the nominal demand growth into line with the growth in real output capacity.

So, it is this context that the proposal in the question is True.

Further, while there is mounting hysteria about the problems the changing demographics will introduce to government fiscal balances all the arguments presented are based upon spurious financial reasoning – that the government will not be able to afford to fund health programs (for example) and that taxes will have to rise to punitive levels to make provision possible but in doing so growth will be damaged.

However, MMT dismisses these “financial” arguments and instead emphasises the possibility of real problems – a lack of productivity growth; a lack of goods and services; environment impingements; etc.

Then the argument can be seen quite differently. The responses the mainstream are proposing (and introducing in some nations) which emphasise fiscal surpluses (as demonstrations of fiscal discipline) are shown by MMT to actually undermine the real capacity of the economy to address the actual future issues surrounding rising dependency ratios. So by cutting funding to education now or leaving people unemployed or underemployed now, governments reduce the future income generating potential and the likely provision of required goods and services in the future.

The idea of real crowding out also invokes and emphasis on political issues. If there is full capacity utilisation and the government wants to increase its share of full employment output then it has to crowd the private sector out in real terms to accomplish that. It can achieve this aim via tax policy (as an example). But ultimately this trade-off would be a political choice – rather than financial.

Question 2:

National accounting shows us that a government surplus equals a non-government deficit. But that doesn’t mean that if fiscal austerity ends up generating a fiscal surpluses that households and firms taken together will be running deficits.

The answer is False.

The point is that the non-government sector is not equivalent to the private domestic sector in the sectoral balance framework. We have to include the impact of the external sector.

So this is a question about the sectoral balances – the government fiscal balance, the external balance and the private domestic balance – that have to always add to zero because they are derived as an accounting identity from the national accounts. The balances reflect the underlying economic behaviour in each sector which is interdependent – given this is a macroeconomic system we are considering.

To refresh your memory the balances are derived as follows. The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

From the uses perspective, national income (GDP) can be used for:

GDP = C + S + T

which says that GDP (income) ultimately comes back to households who consume (C), save (S) or pay taxes (T) with it once all the distributions are made.

Equating these two perspectives we get:

C + S + T = GDP = C + I + G + (X – M)

So after simplification (but obeying the equation) we get the sectoral balances view of the national accounts.

(I – S) + (G – T) + (X – M) = 0

That is the three balances have to sum to zero.

You can also write this as:

(S – I) + (T – G) = (X – M)

Which gives an easier interpretation (especially in relation to this question).

The sectoral balances derived are:

- The private domestic balance (S – I) – positive if in surplus, negative if in deficit.

- The Budget balance (T – G) – positive if in surplus, negative if in deficit.

- The Current Account balance (X – M) – positive if in surplus, negative if in deficit.

These balances are usually expressed as a per cent of GDP but that doesn’t alter the accounting rules that they sum to zero, it just means the balance to GDP ratios sum to zero.

Using this version of the sectoral balance framework:

(S – I) + (T – G) = (X – M)

So the domestic balance (left-hand side) – which is the sum of the private domestic sector and the government sector equals the external balance.

For the left-hand side of the equation to be positive (that is, in surplus overall) and the individual sectoral components to be in surplus overall, the right-hand side has to be positive (that is, an external surplus) and of sufficient magnitude.

This is also a basic rule derived from the national accounts and has to apply at all times.

The following graph and accompanying table shows a 8-period sequence where for the first four years the nation is running an external deficit (2 per cent of GDP) and for the last four year the external sector is in surplus (2 per cent of GDP).

For the question to be true we should never see the government surplus (T – G > 0) and the private domestic surplus (S – I > 0) simultaneously occurring – which in the terms of the graph will be the green and navy bars being above the zero line together.

You see that in the first four periods that never occurs which tells you that when there is an external deficit (X – M < 0) the private domestic and government sectors cannot simultaneously run surpluses, no matter how hard they might try. The income adjustments will always force one or both of the sectors into deficit.

The sum of the private domestic surplus and government surplus has to equal the external surplus. So that condition defines the situations when the private domestic sector and the government sector can simultaneously pay back debt.

It is only in Period 5 that we see the condition satisfied (see red circle).

That is because the private and government balances (both surpluses) exactly equal the external surplus.

So if the British government was able to pursue an austerity program with a burgeoning external sector then the private domestic sector would be able to save overall and reduce its debt levels. The reality is that this situation is not occuring.

Going back to the sequence, if the private domestic sector tried to push for higher saving overall (say in Period 6), national income would fall (because overall spending fell) and the government surplus would vanish as the automatic stabilisers responded with lower tax revenue and higher welfare payments.

Periods 7 and 8 show what happens when the private domestic sector runs deficits with an external surplus. The combination of the external surplus and the private domestic deficit adding to demand drives the automatic stabilisers to push the government fiscal balance into further surplus as economic activity is high. But this growth scenario is unsustainable because it implies an increasing level of indebtedness overall for the private domestic sector which has finite limits. Eventually, that sector will seek to stabilise its balance sheet (which means households and firms will start to save overall). That would reduce domestic income and the fiscal balance would move back into deficit (or a smaller surplus) depending on the size of the external surplus.

So what is the economics that underpin these different situations?

If the nation is running an external deficit it means that the contribution to aggregate demand from the external sector is negative – that is net drain of spending – dragging output down.

The external deficit also means that foreigners are increasing financial claims denominated in the local currency. Given that exports represent a real cost and imports a real benefit, the motivation for a nation running a net exports surplus (the exporting nation in this case) must be to accumulate financial claims (assets) denominated in the currency of the nation running the external deficit.

A fiscal surplus also means the government is spending less than it is “earning” and that puts a drag on aggregate demand and constrains the ability of the economy to grow.

In these circumstances, for income to be stable, the private domestic sector has to spend more than they earn.

You can see this by going back to the aggregate demand relations above. For those who like simple algebra we can manipulate the aggregate demand model to see this more clearly.

Y = GDP = C + I + G + (X – M)

which says that the total national income (Y or GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

So if the G is spending less than it is “earning” and the external sector is adding less income (X) than it is absorbing spending (M), then the other spending components must be greater than total income.

Only when the government fiscal deficit supports aggregate demand at income levels which permit the private sector to save out of that income will the latter achieve its desired outcome. At this point, income and employment growth are maximised and private debt levels will be stable.

The following blogs may be of further interest to you:

- Barnaby, better to walk before we run

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

Question 3:

The payment of a positive interest return by the central bank on overnight bank reserves does not eliminate the need for it to conduct open market operations to ensure its policy rate is sustained (ignore any reserve requirements).

The answer is True.

This question tests your knowledge of central bank operations – in particular, its liquidity management operations that are used to maintain its target rate of interest in a modern monetary economy.

Mainstream macroeconomics textbooks tell students that monetary policy describes the processes by which the central bank determines “the total amount of money in existence or to alter that amount”. However, this is not what happens in the real world.

In Mankiw’s Principles of Economics (Chapter 27 First Edition) he say that the central bank has “two related jobs”. The first is to “regulate the banks and ensure the health of the financial system” and the second “and more important job”:

… is to control the quantity of money that is made available to the economy, called the money supply. Decisions by policymakers concerning the money supply constitute monetary policy (emphasis in original).

How does the mainstream see the central bank accomplishing this task? Mankiw says:

Fed’s primary tool is open-market operations – the purchase and sale of U.S government bonds … If the FOMC decides to increase the money supply, the Fed creates dollars and uses them buy government bonds from the public in the nation’s bond markets. After the purchase, these dollars are in the hands of the public. Thus an open market purchase of bonds by the Fed increases the money supply. Conversely, if the FOMC decides to decrease the money supply, the Fed sells government bonds from its portfolio to the public in the nation’s bond markets. After the sale, the dollars it receives for the bonds are out of the hands of the public. Thus an open market sale of bonds by the Fed decreases the money supply.

This description of the way the central bank interacts with the banking system and the wider economy is totally false. The reality is that monetary policy is focused on determining the value of a short-term interest rate. Central banks cannot control the money supply. To some extent these ideas were a residual of the commodity money systems where the central bank could clearly control the stock of gold, for example. But in a credit money system, this ability to control the stock of “money” is undermined by the demand for credit.

The theory of endogenous money is central to the horizontal analysis in Modern Monetary Theory (MMT). When we talk about endogenous money we are referring to the outcomes that are arrived at after market participants respond to their own market prospects and central bank policy settings and make decisions about the liquid assets they will hold (deposits) and new liquid assets they will seek (loans).

The essential idea is that the “money supply” in an “entrepreneurial economy” is demand-determined – as the demand for credit expands so does the money supply.

As credit is repaid the money supply shrinks. These flows are going on all the time and the stock measure we choose to call the money supply, say M3 (Currency plus bank current deposits of the private non-bank sector plus all other bank deposits from the private non-bank sector) is just an arbitrary reflection of the credit circuit.

So the supply of money is determined endogenously by the level of GDP, which means it is a dynamic (rather than a static) concept.

Central banks clearly do not determine the volume of deposits held each day. These arise from decisions by commercial banks to make loans. The central bank can determine the price of “money” by setting the interest rate on bank reserves. Further expanding the monetary base (bank reserves) as we have argued in recent blogs – Building bank reserves will not expand credit and Building bank reserves is not inflationary – does not lead to an expansion of credit.

With this background in mind, the question is specifically about the dynamics of bank reserves which are used to satisfy any imposed reserve requirements and facilitate the payments system. These dynamics have a direct bearing on monetary policy settings. Given that the dynamics of the reserves can undermine the desired monetary policy stance (as summarised by the policy interest rate setting), the central banks have to engage in liquidity management operations.

What are these liquidity management operations?

Well you first need to appreciate what reserve balances are.

The New York Federal Reserve Bank’s paper – Divorcing Money from Monetary Policy said that:

… reserve balances are used to make interbank payments; thus, they serve as the final form of settlement for a vast array of transactions. The quantity of reserves needed for payment purposes typically far exceeds the quantity consistent with the central bank’s desired interest rate. As a result, central banks must perform a balancing act, drastically increasing the supply of reserves during the day for payment purposes through the provision of daylight reserves (also called daylight credit) and then shrinking the supply back at the end of the day to be consistent with the desired market interest rate.

So the central bank must ensure that all private cheques (that are funded) clear and other interbank transactions occur smoothly as part of its role of maintaining financial stability. But, equally, it must also maintain the bank reserves in aggregate at a level that is consistent with its target policy setting given the relationship between the two.

So operating factors link the level of reserves to the monetary policy setting under certain circumstances. These circumstances require that the return on “excess” reserves held by the banks is below the monetary policy target rate. In addition to setting a lending rate (discount rate), the central bank also sets a support rate which is paid on commercial bank reserves held by the central bank.

Many countries (such as Australia and Canada) maintain a default return on surplus reserve accounts (for example, the Reserve Bank of Australia pays a default return equal to 25 basis points less than the overnight rate on surplus Exchange Settlement accounts). Other countries like the US and Japan have historically offered a zero return on reserves which means persistent excess liquidity would drive the short-term interest rate to zero.

The support rate effectively becomes the interest-rate floor for the economy. If the short-run or operational target interest rate, which represents the current monetary policy stance, is set by the central bank between the discount and support rate. This effectively creates a corridor or a spread within which the short-term interest rates can fluctuate with liquidity variability. It is this spread that the central bank manages in its daily operations.

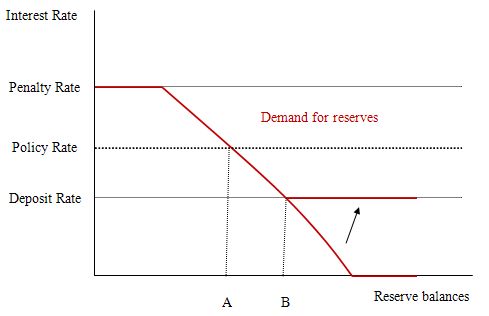

So the issue then becomes – at what level should the support rate be set? To answer that question, I reproduce a version of teh diagram from the FRBNY paper which outlined a simple model of the way in which reserves are manipulated by the central bank as part of its liquidity management operations designed to implement a specific monetary policy target (policy interest rate setting).

I describe the FRBNY model in detail in the blog – Understanding central bank operations so I won’t repeat that explanation.

The penalty rate is the rate the central bank charges for loans to banks to cover shortages of reserves. If the interbank rate is at the penalty rate then the banks will be indifferent as to where they access reserves from so the demand curve is horizontal (shown in red).

Once the price of reserves falls below the penalty rate, banks will then demand reserves according to their requirments (the legal and the perceived). The higher the market rate of interest, the higher is the opportunity cost of holding reserves and hence the lower will be the demand. As rates fall, the opportunity costs fall and the demand for reserves increases. But in all cases, banks will only seek to hold (in aggregate) the levels consistent with their requirements.

At low interest rates (say zero) banks will hold the legally-required reserves plus a buffer that ensures there is no risk of falling short during the operation of the payments system.

Commercial banks choose to hold reserves to ensure they can meet all their obligations with respect to the clearing house (payments) system. Because there is considerable uncertainty (for example, late-day payment flows after the interbank market has closed), a bank may find itself short of reserves. Depending on the circumstances, it may choose to keep a buffer stock of reserves just to meet these contingencies.

So central bank reserves are intrinsic to the payments system where a mass of interbank claims are resolved by manipulating the reserve balances that the banks hold at the central bank. This process has some expectational regularity on a day-to-day basis but stochastic (uncertain) demands for payments also occur which means that banks will hold surplus reserves to avoid paying any penalty arising from having reserve deficiencies at the end of the day (or accounting period).

To understand what is going on not that the diagram is representing the system-wide demand for bank reserves where the horizontal axis measures the total quantity of reserve balances held by banks while the vertical axis measures the market interest rate for overnight loans of these balances

In this diagram there are no required reserves (to simplify matters). We also initially, abstract from the deposit rate for the time being to understand what role it plays if we introduce it.

Without the deposit rate, the central bank has to ensure that it supplies enough reserves to meet demand while still maintaining its policy rate (the monetary policy setting.

So the model can demonstrate that the market rate of interest will be determined by the central bank supply of reserves. So the level of reserves supplied by the central bank supply brings the market rate of interest into line with the policy target rate.

At the supply level shown as Point A, the central bank can hit its monetary policy target rate of interest given the banks’ demand for aggregate reserves. So the central bank announces its target rate then undertakes monetary operations (liquidity management operations) to set the supply of reserves to this target level.

So contrary to what Mankiw’s textbook tells students the reality is that monetary policy is about changing the supply of reserves in such a way that the market rate is equal to the policy rate.

The central bank uses open market operations to manipulate the reserve level and so must be buying and selling government debt to add or drain reserves from the banking system in line with its policy target.

If there are excess reserves in the system and the central bank didn’t intervene then the market rate would drop towards zero and the central bank would lose control over its target rate (that is, monetary policy would be compromised).

As explained in the blog – Understanding central bank operations – the introduction of a support rate payment (deposit rate) whereby the central bank pays the member banks a return on reserves held overnight changes things considerably.

It clearly can – under certain circumstances – eliminate the need for any open-market operations to manage the volume of bank reserves.

In terms of the diagram, the major impact of the deposit rate is to lift the rate at which the demand curve becomes horizontal (as depicted by the new horizontal red segment moving up via the arrow).

This policy change allows the banks to earn overnight interest on their excess reserve holdings and becomes the minimum market interest rate and defines the lower bound of the corridor within which the market rate can fluctuate without central bank intervention.

So in this diagram, the market interest rate is still set by the supply of reserves (given the demand for reserves) and so the central bank still has to manage reserves appropriately to ensure it can hit its policy target.

If there are excess reserves in the system in this case, and the central bank didn’t intervene, then the market rate will drop to the support rate (at Point B).

So if the central bank wants to maintain control over its target rate it can either set a support rate below the desired policy rate (as in Australia) and then use open market operations to ensure the reserve supply is consistent with Point A or set the support rate equal to the target policy rate.

The answer to the question is thus True because it all depends on where the support rate is set. Only if it set equal to the policy rate will there be no need for the central bank to manage liquidity via open market operations.

The following blogs may be of further interest to you:

Bill –

Despite your solution for question 1 being correct, your answer is wrong. The question didn’t ask about resource use, but rather spending therefore it related to financial crowding out.

I think the way you framed question #1 and the way you explained it is just spectacular. In my opinion, showing that the ” loanable funds theory” to be wrong is really the best hope to convince anyone who thinks they know anything about economics to realize they were wrong. But can destroying that theory be even simpler? I mean once you accept that banks can create money by making loans, or that the government or the central bank can create money, doesn’t that logically ruin the loanable funds theory as far as investment is concerned? If you accept that there is any entity that can create spending power by creating money doesn’t it follow that prior savings are not necessary for investment?

I feel cheated on Q2 & Q3. I’m sure that I’m wrong to feel so, but if you could advise me why I’d be very grateful.

Either way, many thanks for all your time and effort. It is much appreciated, and I feel greedy when asking for more.

Q2 Both domestic private and state sectors can be in surplus, if the foreign balance is positive. In practice, it might be hard to sustain. That would depend on the structure of government spending and taxation, and the movement in exchange rates, but what is the theoretical objection ? Okay, we Brits can’t (or don’t want) to do it, but we’re rubbish at many things !

The impossibility seems to depend on other assumptions.

Q3 As you say, when the system has excess reserves up to its nose, and the CB pays the “base rate” on excess reserves, then OMOs aren’t needed. As is the case in the UK and the US. No corridor, just a floor. The only need for OMOs that I can see (outside of a problem with a specific institution) would be to inject bonds back into the system, either to correct a shortage in a specific security or as part of a collateral swap.

With so many excess reserves in the system (which some say may become a permanent feature), and the absence of a penally low rate on the excess, there is no “hot potato” to be passed to another bank.