As part of a another current project, which I will have more to say about…

When you’ve got friends like this – Part 11

I received two E-mails yesterday informing me that at the upcoming NSW State Labor Conference (this weekend) the delegates would be asked to vote for the inclusion of a Federal Job Guarantee, along the lines that I have been working on since 1978 (more or less), in Labor Party policy. For readers abroad, the Labor Party is the major federal opposition party at present having lost government in 2013. It began life as the political arm of the trade union movement. Anyway, that was a pleasing development I thought. A little later, I received an E-mail and a follow up telephone call telling me that the same conference, the delegates would be asked to vote on a motion put forward by the Australian Manufacturing Workers’ Union, which is the strongest ‘left-wing’ union in Australia, that says that the ALP “should be focused on maintaining government solvency” and maintaining “low and stable Deficit to GDP ratios” and ensure the “tax base is adequate to fund Labor’s priorities”. Then I read a news report from the UK from earlier in the year about the Labour Party’s commitment in the upcoming election to shore up its “fiscal credibility” by eliminating the fiscal deficit with the leader Ed Miliband claiming that “When we come to office … there won’t be lots of real money to spend, things will be difficult”. Bloody hell! This is progressive politics – neo-liberal Groupthink style. At least there are a few truly progressive people who see that a federal Job Guarantee is the way forward as a first step.

Previous entries under the – When you’ve got friends like this – series.

One thing that progressive thinkers know is that neo-liberals will always propose policy positions that cement the influence and improve the outcomes of the industrial and financial elites. In the recent decades even the industrial elites play second-fiddle to the investment bankers and their related hangers-on.

The bigger problem is that the political parties that purport to represent the opposition to the conservatives are so captured by the same neo-liberal Groupthink that the diversity of political choice is very limited.

In essence, they all sing off the same hymn sheet when it comes to economic policy, with nuanced differences around the edges that turn out to be inconsequential as a result of the larger picture constraints they all voluntarily impose on government.

The ‘progressive parties’ think they are putting a financially responsible position to the voters, which just reflects their ignorance and deep insecurity about their own understanding of economic matters.

Somehow, the neo-liberals have convinced everyone that they are knowledgable about these matters. The reality is that they are crackpots trading on theories that lost currency and validity in the 1930s and do not advance prosperity.

Note, the conservatives are not really conserving anything. For example, the neo-liberal banksters are content to ravage the natural environment and support climate denialists. I also do not consider the majority of ‘progressive’ parties in the advanced world to be progressive at all.

The neo-liberal Groupthink renders them all a homogenous blob arguing only about whether taxes should be higher or spending lower – as if either options are relevant when there is persistent mass unemployment, rising underemployment, participation rates well below recent peak (age-adjusted or not) and rising inequality and poverty.

Why British politics is in such a mess

Reuters reported earlier in the year (January 19, 2014) that –

Labour says it wants budget surplus if it wins next UK election.

If that wasn’t bad enough the Opposition leader Ed Miliband also claimed that Labour would also “want to get the current account into balance … and see debt falling”. Presumably he was meaning public debt.

And he also told the BBC TV interviewer that:

When we come to office, if we come to office after 2015, there won’t be lots of real money to spend, things will be difficult. The task for the next Labour government will be to earn and grow our way to that higher standard of living not being able to engage in lots more spending.

If you can make sense of that good luck! Its Groupthink talk – nonsensical statements that have no internal consistency.

I will return to this.

To finish the catalogue of nonsense, he said that Labour would make “planned spending cuts in 2015/16 in a fairer way”. Eek!

The more moderate-austerity appeal! Groupthink gibberish.

In this blog – Pre-crisis dynamics building again in Britain – I considered the state of the British economy and showed that the first-quarter 2014 Current Account deficit was 4.4 per cent of GDP. The deficit has averaged 1.5 per cent of GDP since the early 1970s and been in that state 88 per cent of the time over the last 40 years. There was a run of surpluses in the early 1980s but never since.

Earlier, during Britain’s manufacturing heyday there were a sequence of surpluses in the 1960s but these came to an end in the early 1970s.

The question then is how the hell will a new national government bring the external sector into a balance (a current account of zero)?

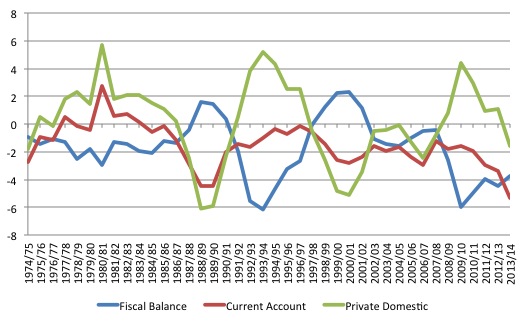

The following graph of the UK sectoral balances is for the period 1974/75 to 2013/14. The final quarter for the financial year 2014 is an estimate.

The traditional near-mirror image between the fiscal balance and the private domestic balance is evident over this relatively long period. When the government deficit rises, the private domestic sector is able to save overall, which means that household saving is greater than investment. The opposite happens when the public sector goes into surplus (look at what happened in the late 1990s.

At present the public deficit is being squeezed by the attempted austerity and the current account is expanding as exports fail to deliver the growth premium forecasted by the Government.

The private domestic sector is now back in deficit. So if Miliband thinks he will get British public debt down he is also clearly desiring to push private debt up to substantially. With an external deficit, it is one or the other.

But the other reality in the UK at present is that despite all the austerity talk, the fiscal deficit is still substantial and supporting growth. That is a fact that should be emphasised. The austerity cycle has not been severe enough to eliminate that on-going fiscal support.

Despite all the talk by both sides of politics in the UK about stimulating an exports boom – IMF-style – the reality has not been cooperative.

Remember when George Osborne said in the Budget 2012 Statement – that:

We want to double our nation’s exports to one trillion pounds this decade.

As I have noted previously, this is the stuff of dreams. There is no hope that British exports will go close to that target by 2020. In 2012, total exports were £495,284 million. By 2013, they were £505,634 million. Based on the first-quarter 2014, the full-year figure would be £493,488 million and heading in the wrong direction.

As UK Guardian writer Larry Elliot said when the December-quarter trade data came out in March this year (Source):

Forget Harold Wilson and the jumbo jets that allegedly cost Labour the 1970 election. Forget Nigel Lawson and the import binge of the 1980s. Britain has never seen bigger current account deficits than those it is notching up right now.

The “past 15 years have seen the UK’s share of world trade decline by 25%” and “unlike in previous cycles, a big depreciation of the currency has failed to lift the UK back into the black”.

One of the issues Britain faces goes back to the Monetarist days under Margaret Thatcher. She oversaw the export of a vast amount of productive manufacturing capital to places like Italy. Even with a cheaper currency, a nation has to have the productive capacity to exploit it.

Investment in productive capital in the UK has been poor and swamped by speculative financial capital flows. The result? How can Britain increase its industrial capital quickly enough to respond to the increased international competitiveness in an environment where most capital goods now have to be imported? All the dynamics are wrong for Miliband’s aspirations.

If you examine the current account in more detail, then it is clear that the trade component will be in deficit for many years to come – that is the normal outcome. Miliband won’t alter that.

What about the income component, which records payments received from and sent to the rest of the world for interest, dividends, profits, etc)? That has been in deficit since the crisis and doesn’t look like altering course in the foreseeable future.

Larry Elliot also suggests that:

On past form, Britain’s manufacturers would not use the 31% depreciation to expand market share, but would plump up their profit margins instead

So forget the balanced current account. Which means that if the government is driving its deficit down through austerity it will not only undermine growth but squeeze the private sector. The income shifts will drive up private debt or there will be an almighty recession (and/or both)!

A very foolish strategy.

He would be better off using the time in opposition to reeducate the public about the role of fiscal deficits and the nonsense involved in blind statements about pursuing balanced budgets. But then he would need to be educated himself before he could achieve that useful public purpose.

Moroever, statements like “The task for the next Labour government will be to earn and grow our way to that higher standard of living not being able to engage in lots more spending” demonstrate how little education he actually has on matters he claims to express opinions about.

Economic growth requires lots more spending. He might be thinking the private sector is about to unleash a major spending spree as the government takes some 4 per cent out of GDP (the current deficit). Why would they do that with the prospect of rising unemployment and lost incomes?

Why not assess what the current private spending gap is relative to the total spending that is required to drive growth sufficient to achieve full employment and then promise to maintain public spending at that level?

That would be the responsible thing to do – link fiscal policy to its function and ignore irrelevant debt to GDP ratios and deficit to GDP ratios.

Why Australian Labor is in such a mess

Which is advice the AMWU in Australia might also like to heed.

This link will take you to the – Full Policy and Agenda Report for the upcoming 2014 NSW Labor State Conference.

On Page 65, Agenda Item 13 under “Our Economic Future” we read that:

Conference recognizes that for too long the ALP has accepted the conservative orthodoxy that government debt is inherently bad, budget surpluses are inherently good and government spending should be minimized. There is no inherent economic justification for these views or the current ‘surplus fetish’ trend.

That sounded good.

Then, the horror story unfolds as you work out what they are on about. They want the Conference to reject the current Federal Labor view that it “will not increase taxation”, which in itself is okay until you know what their motivation is.

Accordingly, the largest “left” union in Australia wants the ALP policy to:

… be focused on maintaining government solvency, not a blind goal of eliminating net debt or deficits while providing the social and economic investments that underpin a fair and prosperous society. Low and stable long run debt to GDP ratios or Deficit to GDP ratios are two better measures of prudent fiscal management than surpluses or zero net debt.

What they want is for taxes to rise as a means of bringing the deficit down rather than spending to be cut. They think that is a “fair and disciplined” strategy.

Which is buying into the neo-liberal Groupthink holus bolus.

Any focus on what the deficit should be is missing the point. Taxation should only rise if the government wants the private sector to have less purchasing power. It should never be increased to ‘give the government more money to spend’.

The Australian government issues its own currency. It doesn’t need taxation revenue to spend.

Further, why should the progressive side of politics be wanting the Party to be “focused on maintaining government solvency” when, by definition, the Australian government never faces insolvency. It issues the currency, stupid!

Why even buy into the solvency-run-out-of-money hype that the neo-liberals pump out to reduce the capacity of government to maintain full employment? The reason is that they also need educating. I am told the conference is going to be being briefed on this agenda by a self-styled progressive who as far as I can tell from his public statements continuously mouths mindless neo-liberal statements about fiscal policy.

The Federal Labor Party should tell the Australian people that it stands for full employment and equity and that it will ensure its spending is sufficient to meet that lofty goal. Whatever it takes. It should never mention aspirations to have “Low and stable long run debt to GDP ratios or Deficit to GDP ratios” given that it cannot control those ratios anyway.

Which is why the Agenda Item 37 on Page 85 and Agenda Item 46 on Page 86 under the heading “Prosperity and fairness at work” are so important.

They are identical items brought to the conference by a committed group of younger party members who have taken the time to start understanding how fiat monetary systems work and the opportunities that are available to a currency-issuing government within those systems.

The Agenda Items are:

Conference supports the implementation of a Federal Job Guarantee programme that provides employment at the minimum wage to anyone who is unable to find work. NSW Labor calls on the National Labor Party Conference to adopt this policy and work towards its implementation under the next federal Labor Government.

Recommendation: Refer to National Conference.

We won’t hold our breath. The so-called ‘left’ in this now LEFT=RIGHT world will block it for sure and probably say things about not being able to afford it. Or ‘how much would it cost’? And the rest of it.

But this sort of policy development is the way forward for the progressive parties and it should be encapsulated in a mass education campaign within and outside of the Party as to why the Job Guarantee is a basic building block in a macroeconomic stabilisation policy structure.

If you want to read more about this please read the blogs listed under this category – Job Guarantee.

Conclusion

Once again a case of when you have friends like this who needs enemies.

I hope that the real progressives in Labor, who are currently in a very small minority and don’t have the resources that the big unions have, start to get traction within the Party.

It is also time that the so-called ‘left’ unions broke out of the neo-liberal macroeconomic Groupthink and started representing their workers more responsibly.

That is enough for today!

(c) Copyright 2014 Bill Mitchell. All Rights Reserved.

Bill, the graph has no y-axis label. So, unless one already knows what is being depicted, interpretation of the graph is rendered more difficult.

My undersanding of the UK Labour party “…will deliver a surplus on the current budget”. Which is not the same thing as a current account surplus, or a budget surplus. Ed Balls has been more specific about this, whilst Miliband seems to be getting the teminology confused. Ed Balls is talking about “day-to-day” spending being frozen (Govt consumption?), but not public investment.

It’s all rather confusing, and that has put me off Labour.

Either way, the thinking and terminology is neoliberal.

The 1st estimate of 2nd quarter GDP for the UK comes out tomorrow (Friday).

Earlier this year I predicted quarter-on-quarter growth for the 2014 to be:

Q1 0.9% (it is now confirmed at 0.8%)

Q2 0.6%

Q3 0.3%

Q4 0.3%

My predictions have so far been a bit too low, and most othe peoples’ have been far too high.

I think export growth will be the main disappointment (due to the higher value of sterling, and poor demand from Europe), with growth in other components easing off slightly also.

my Confusion with MMT ,

while I agree with the analysis that public debt= private surplus and that a government never has to defualt.

But Isn’t MMT overly concerned with inflation by insisting that taxes exist to manage the money supply.Also Doesn’t MMT insist that the interest on National Debt has to be paid off (albeit at a slower rate) which means taxes (which don’ finance revenue really,but for accounting purpose they are supposed to) have to exist.And not only that but as the national interest has to be paid off,government spending is constrained and redirected away from more useful social spending.

these figures from the url below suggest that £51 bn is diverted away from useful govt spending to paying off the wealthy government holders.And MMT support this as it limits inflation?despit the fact that the money just ends up sloshing around the wealthy?

Seems like a completely unnecessary and redudant govt cost which MMT doesnt address.

I never use the words “right” or “left”, even in party political contexts. These labels no longer mean anything. In the same way that the words “east” and “west” used in geopolitical contexts mean nothing (for example, is Turkey east or west?). I do still use the words “conservative” and “progressive” in a general sense, but party labels give little indication of the policy reality.

In recent decades party politics has been turned on its head and parties which used to be characterised as being on the left are now found to be now supporting the neoliberal agenda. In Australia the rot started with Hawke and (especially) Keating. Since then, Labor has moved further and further away from its previous more progressive positions.

When the Federal Government prints and spends money it does not always create inflation, as in times of slack it will mostly suck up unused capacity; however, when the Federal Government prints and spends money it always dilutes the power of Wall-Street hotshots, as it adds “new money” to compete with the power of the hotshots “old money.” This is the real driving force of all the movements across the world that oppose Federal Government deficits. Cries of hyperinflation or acting as if Federal Governments need to borrow money to finance deficits are nothing more than rationalizations.

@larry:

“the graph has no y-axis label. So, unless one already knows what is being depicted, interpretation of the graph is rendered more difficult.”

it has no x-axis label either.

Interesting that the AMWU should come out with this sort of nonsense Flat Earth Economics. It just shows just how far the once progressive Labor Party has diverted to a position not far to the left of Attila the Hun.Apologies to John Hermann for using “left”. Certainly Keating was where the rot set in and he personally was the main reason why Labor lost the 1996 election and allowed The Rodent into the pantry.

I’m afraid that we are going to have to experience a full on economic meltdown before these cretins get the boot (if then).

Take MMT to every high-schooler you know, the current generation in power is too indoctrinated and the next generation has them as idols. Do you reckon Bieber will sing about MMT?

Jake,

A government that issues it’s own currency can both spend on social services and pay off government bonds and their interest without having to choose between either.

You would stop issuing new debt, and just pay off the old. Defaulting on old debt in your own currency is purely optional, and why would you? It might cause more trouble than it’s worth, with legal battles, reputation damage etc.

Since the right controls NSW by virtue of numbers, the left moves motions from a position of weakness. Whether or not the AMWU believes that we have to tax first or not, the bigger disappointment, is that the right faction of the ALP rejects a motion that puts the absolute values of deficit and debt levels in context of our national income generation. Something very reasonable within the household budget framework, please tell me what household considers debt without first considering whether their income can support it?

The fact that the right faction has put a recommendation of “Reject” on this motion, despite the left faction arguing within the neo-classical framework, just leaves our society open to further attacks from the neo-liberals justified through false “budget emergencies”. For those participating in the ALP’s introspection this weekend, what opposition to the Coalition does the ALP represent if we can’t support this?

If the right of the ALP can’t stomach a neo-classically framed incremental motion, it would be impossible for the party to consider an MMT/reality framework.

SHAME!

Why bother with the formality of borrowing and paying back interest.

Fine, the government could finance useful social spending and infrastructure and pay of the interest of national debt holders,by simply continuing to run a deficit.IF MMT says that constraining the money supply through fiscal measures (taxing and spending) can be inflationary(or delationary) why not limit paying off the interest of the national debt and use the money for tax cuts or something else useful,like a basic income.

Governments can afford to pay off interest and social spending ,but if MMT asserts that spending inflationary and taxing is deflationary ,and if balancing the budget is not a legitimate concern but limiting inflation is, don’t you think that the first spending to be dropped should be paying off the interest holders of debt?

Politcally it seems unfair,I mean look at Argentina right now, being pressurised by foreign courts to pay off foreign private equity debt holders.What is the MMT approach to that .the government doesn’t want to use the money to pay the debt holders…are they mistaken, should they just pay it off as

“A government that issues it’s own currency can both spend on social services and pay off government bonds and their interest without having to choose between either”.Granted The debt is in a foreign (US Dollars) currency.why do governments feel the need to borrow in a currency that they do not issue?

Or why not borrow from a government’s central bank as opposed to the money markets(money which could be directed toward tangible capital investment and job creation as opposed to unproductive government debt).Let the debt liability of new money be paid back into the government as it could be held by a central bank or another public agency.A opposed to flowing to wealty pivate interests.

note:the £51 bn spent on paying off interest is larger than Defence (£40 bn),Policing (£31 bn) and Transport (£21 bn)

There is no good justification for issuing bonds. Maybe that practice is ancient relic from times when moneyed interest were able to exert undue pressure to the sovereign. Main reason MMT is not interested in eliminating that practice is that it is monetary system description, not a policy proposal. Paying fixed and small interest on reserves would be much more sensible policy. Interest because that would be the incentive for commercial banks to accept customer deposits because they can earn money on those to cover their costs.

Just speaking for myself, I would find it helpful if such graphs showed the negative of the Current Account, so that the three values sum to zero, and the relation between them is depicted more clearly. 🙂

I don’t know about paying interest on reserves to subsidise private banks,why just have a subsidised public option,that did socially useful investsments aswell.

And another thing,Don’t the right wingers have a point if;As the national debt is never really paid off but instead borrowing adds to it,to finance govt spending.And the goverment pays of the interest payments bu continuee to borrow,increasing the main debt ,then the liability of interest payments only increases,then goverment expeniditure on interest payments can only go up…taking up moe and more of the budget.

WHilst the government can always payout interest and social spending .Aren’t their considerations about inflation that need to be taken into account.How can I justify increased social spending when eventually the interest payments on the debt will simply mushroom and balloon up.I mean that is the end result of simply continuing to run up the debt .It could end up the largest peice of goverment expenditure.

why not look at alternative ways of financing goverment expenditure like Adair Turner overt monetary financing.Using central bank created money to finance government expenditure.

http://blogs.reuters.com/anatole-kaletsky/2013/02/07/a-breakthrough-speech-on-monetary-policy/

http://www.centralbanking.com/central-banking/news/2242328/uk-s-adair-turner-advocates-stimulus-by-helicopter-money

In defence of the AMWU, it’s motion and its intent seems to be misrepresented above.

The motion clearly aims to change APL policy from its recent obsession with achieving a surplus or eliminating public debt, to one that focuses on public investment and a more equitable tax base. It stated:

“ALP policy should be focused on maintaining government solvency, not a blind goal of eliminating net debt or deficits..” and

“For too long the ALP has accepted the conservative orthodoxy that government debt is inherently bad, budget surpluses are inherently good and government spending should be minimized”, and finally, that the ALP should expand the tax base for

“high income earners, and non-productive corporate activities (speculation, super profits, profit shifting and pollution charges for example) to ensure Australians get the services they need and the investments their prosperity relies on”.

A fuller reading of the motion makes it hard to argue this motion should be called “neo-liberal groupthink”.

Dear tom skladzien (at 2014/07/28 at 9:52)

Thanks for your comment.

The parts of the motion I left out do not alter the interpretation.

Any reference to “government solvency” in the context of a currency-issuing government such as Australia is buying into the basic neo-liberal propositions.

Any reference to having to raise taxes to maintain social programs is similarly buying into the Groupthink.

If the motion had said (for example) – to maintain full employment without inflation, the private sector should have less purchasing power overall and we think it is fairer if the high income earners take a bigger hit of that reduction than lower income earners – then that would have been a totally different narrative.

But the agenda in your motion was to raise money for the government (a basic neo-liberal lie) whereas taxpayers do not actually fund government spending.

best wishes

bill

Thanks for you reply Bill,

I’ll have to respectfully disagree about the interpretation of the motion. It may not adhere to MMT thought, but I still think it a stretch to call it neo-liberal.

In my interpretation, neo-liberal refers to a particular line of thought that denies a central economic and social role for government in society (and therefore seeks to minimise government), seeks to minimise the rights of workers (whether to organise or to decent wages and conditions), promotes markets and private ownership at every turn, and elevates individual and corporate welfare above broader notions of social or public welfare, or even goes to the extreme of denying such notions exist, as Margaret Thatcher did when she claimed there is no such thing as society. I believe this is the common definition of the term.

In contrast, progressive lines of thought counter all of these claims and goals and may rely on various schools of economic thought for insight or policy ideas. They are not restricted to reliance on or owned by one school of economic thought and indeed rise above arguments between economists by being motivated by a shared set of values.

To label all views that do not correspond to MMT as ‘neo-liberal’ or ‘groupthink’ doesn’t appear to me to be productive, especially ones that are progressive in the broader and more common use of the term. Indeed, progressives who do not adhere to MMT (which I suspect are the majority as most do not trouble themselves with finer points of economic theory – they are more likely engaged in on the ground battles for a better society) could find such labelling insulting, which I am sure is not your intent.

Come to think of it ,I always thought that the aproach of cutting back spending to reduce inflation was infact a neo-liberal moneterist postion.

hence dennis heal and james Callaghan in the Uk cutting back spending and eventually Thatcher doing soaswell based on Milton Freidman’s thinking that increase bond issuance means more money supply.