Edward Elgar, my sometime publisher, is interested in me updating my 2015 book - Eurozone…

Eurozone has failed – a major shift in direction is needed

The central bankers of the World met at Jackson Hole, Wyoming last week for their annual gathering far from the madding crowd. And as far away from the mess they have helped to create as you could imagine. Out of sight out of mind I guess. The ECB boss felt it his purpose at the gathering, which you can guarantee is plush in all respects (catering, wines, etc), to urge politicians to introduce more “growth-friendly policies”. He claimed in his speech – Unemployment in the euro area – that the so-called “sovereign debt crisis” had disabled “in part the tools of macroeconomic stabilisation”. Which is only true if one accepts that a central bank should play no role in supporting fiscal policy and that fiscal policy should be constrained by innane rules that deliberately prevent it from having sufficient latitude to meet foreseeable crises. Which is about as inane as one could get. But then none of these central bankers are accountable for anything much. They can swan around to meetings and issue ridiculous statements about growth-friendly policies, while supporting austerity, and nothing much happens to them personally.

I recall a speech by the European Parliament President Martin Shultz – Jobs for Europe – (in German) – where he railed against the European Commission policy makers.

He wondered why Brussels did not attack unemployment with the same fervour that it attacks budget deficits (“Warum werfen wir uns in Europa nicht mit derselben Inbrunst in den Kampf gegen die Arbeitslosigkeit, mit der wir den Kampf gegen Haushaltsdefizite angehen?”).

He also said that his visits to Greece, Spain and elsewhere had left the impression that the legitimacy of the EU was increasingly threatened because it was seen as an anonymous bureaucratic power handing out austerity and dismantling the welfare state (“Gerade in den Ländern, die von der Krise besonders hart getroffen sind, wird die EU zunehmend als anonyme bürokratische Macht gesehen, die Sparmassnahmen und den Abbau des Sozialstaats diktiert”).

That sense of impersonality and unaccountable bureaucracies which pump out the TINA mantra is the hallmark of neo-liberalism. Who is to blame? It is hard to find anyone who will accept responsibility for the catastrophic policies that have been introduced.

The central bankers and politicians seem to retire with handsome superannuation benefits

Recall Christine Lagarde’s claim that the crisis was payback time for the Greeks and that despite not paying any taxes herself, the Greek “parents have to pay their tax” (Source). This was from a person who is not accountable to any of the voters that the IMFs policies are inflicted upon and who enjoys – – $US467,940 per annum plus an allowance of $US83,760 for which she has not accountability, all other expenses for entertainment connected to the job reimbursed, per diem travel allowance plus all travel and hotel expenses.

She gets hotel and travel for her spouse/partner. All of this is tax free and indexed annually. Her superannuation plan is more generous than most and there are other benefits for her spouse/partner.

So no worries for her when the IMF makes massive forecasting errors which leave millions of workers without jobs and steadily impoverishes them through austerity.

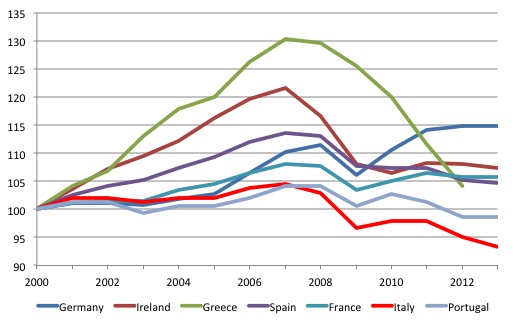

The following graph shows real GDP per capita from 2000 to 2013 (Eurostat annual data – table nama_aux_gph). It is one measure of real standard of living but only from a material perspective. It does not show the psychological torment that accompanies unemployment for example.

It is clear that the Eurozone has not worked for the vast majority of nations. 14 years after the common currency came into operation, most nations are barely better off in terms of real income per capita. Italy is in disastrous shape with the index at 93.3 (compared to 100 in 2000).

As an average measure, it also doesn’t account for the distributional characteristics and we know that the growth that has emerged in various nations since the crisis has not been shared anywhere near equally/proportionately. The high income earners have taken a massive share of the growth proceeds while the middle class have been increasingly hollowed out and the low income earners left behind in increased poverty.

This UK Guardian report (June 6, 2014) – The fault in our starry-eyed ‘recovery’: 2014 looks like we’re going bust again – provides some insights there.

Draghi’s version of “growth-friendly policies” qualified any notion that there remained a massive cyclical shortage of spending by introducing the usual neo-liberal ‘get out’ clause that “a significant share of unemployment is also structural”.

The one way to test that is to introduce a Job Guarantee where every local authority, backed financially by the ECB, would provide work for anyone who wants it at some socially-acceptable mininum wage. There is an almost limitless number of productive activities that could be furthered with this sort of workforce – and jobs could easily be designed for the most unskilled.

How low do you think the unemployment rates would go? Answer: extremely low. The structural explanation is just an excuse for the unwillingness of governments to provide sufficient jobs in the face of a refusal of private employers to take on extra labour. The latter are motivated (constrained) by profit considerations, the former are constrained by mindless neo-liberal Groupthink.

Europe’s unemployment problem could be solved within a few weeks if they introduced a Job Guarantee.

Even Draghi had to admit that:

… estimates of structural unemployment are surrounded by considerable uncertainty …

The models that are used to estimate it provide ridiculously large standard error ranges.

He called for an expansion in “aggregate demand policies” but claimed that:

… since 2010 the euro area has suffered from fiscal policy being less available and effective, especially compared with other large advanced economies.

Which is misleading. It has been very effective – in a destructive way – austerity has been effective in killing off growth and causing millions to lose their jobs.

The other “large advanced economies” were not as constrained by the fiscal rules and a lack of a federal fiscal capacity. There is nothing deficient about fiscal policy. It is just that the Eurozone elites have deliberately straitjacketed it and prevented it from doing what it is designed for.

Extraordinarily, he admitted that:

This is not so much a consequence of high initial debt ratios – public debt is in aggregate not higher in the euro area than in the US or Japan. It reflects the fact that the central bank in those countries could act and has acted as a backstop for government funding. This is an important reason why markets spared their fiscal authorities the loss of confidence that constrained many euro area governments’ market access.

Yes, the difference between sovereign states that are always solvent in all the liabilities they issue in their own currency and non-sovereign states that choose to use a foreign currency (the euro) and prevent the currency issuer (the ECB) from underpinning the use of that currency.

But Draghi defended the Stability and Growth Pact “which acts as an anchor for confidence and that would be self-defeating to break.”

It was broken in a most public way in 2003 when France and Germany defied the European Commission after failing to bring their deficits down below the SGP thresholds.

It has always been claimed that part of the justification for the strict SGP rules is to assuage concerns in the amorphous financial markets so that governments can continue to borrow at affordable interest rates.

But even though the European Council rejected the Commission’s recommendations in November 2003 plunged the SGP into crisis, there was no reaction from the financial markets to the resulting impasse.

The ten-year government bond spreads relative to Germany, which are meant to reflect the risk of government default, moved by less than 0.03 per cent between 2003 and 2005. Even when the Italians threatened to leave the European Union in March 2005 there were no major deviations.

The Financial Times reported at the time that the financial markets saw the Ecofin rejection of the Commission’s recommendation as a positive sign for growth in the EMU. A related Financial Times concluded that:

If the European Union’s fiscal rules died yesterday – at least in their strictest version – few in the financial markets mourned their passing.

That article quoted a Goldman Sachs executive as saying:

Our view is that it is not that big a deal. It’s a good thing that the stability pact in its strictest interpretation is dead … its interpretation is moving in the direction of allowing more cyclical leeway for budget deficits during economic downturns, and that is something we think should have been there from the beginning.

Draghi’s claims are just part of the scaremongering. The Securities Market Program brought in by the ECB in May 2010, which involved it buying public debt in massive volumes, forced the private bond markets into submission.

There is no hint that if fiscal deficits in the Eurozone nations rose with ECB backing that there would be a “loss of confidence”.

Given the parlous state of private spending and stagnation, the rising deficits would stimulate growth and spur a renewed sense of confidence in the future – at least until people were reminded of how moribund the basic structure of the Eurozone is.

But even within the constrained logic, Draghi made it clear that “it would be helpful for the overall stance of policy if fiscal policy could play a greater role alongside monetary policy”.

That is obvious.

The UK Guardian article (August 24, 2014) – The eurozone needs an alternative solution to its economic woes – concluded that:

The ECB now accepts it would have been better for Europe to have followed the American approach, which seemed to involve getting the economy back on its feet before worrying too much about how much money the Federal Reserve was printing or the size of the budget deficit.

What is required immediately is:

1. Overlook the SGP rules – allow nations to exceed the deficit and debt thresholds (encourage them to do so) – they can invoke the emergency let outs in the Treaty.

2. Announce that the ECB will buy any government debt. This can be done within the Treaty via the secondary markets. That will eliminate any problems with bond markets and higher yields. The ECB can guarantee solvency implicitly in this way and still stick within the legal constraints.

3. Announce a massive public employment and public infrastructure program throughout Europe. That would eliminate unemployment and spur growth in private spending.

4. Do not waste time introducing a quantitative easing program. All bond purchases should be tied to increasing fiscal deficits.

5. Provide a demogrant of some euro amount to all people in the bottom 3 quintiles of the income distribution funded by the ECB. That would flow straight into the expenditure stream. There is nothing in the Treaty rules that say the ECB cannot do this. They just cannot bail out governments or allow overdrafts to them.

Conclusion

As it stands, the Eurozone is a failed system. It has been for 14 years.

Unless there is a major shift in thinking it will continue to be.

That is enough for today!

(c) Copyright 2014 Bill Mitchell. All Rights Reserved.

What is happening is double whammy of policies: first they put in place mandatory pension saving schemes – tell the private sector you must save this amount of your income – and then refuse to issue the money to fund those savings. European leaders punch their citizens in the face first with the right fist, then with the left.

There should be zero tolerance towards this madness.

On the topic of neoconservative propaganda, if I may bring it back to Australia for minute. I had the misfortune today to watch a bit of The Drum on the ABC. They had Marr, Kelly and Chikarovksy as guest commentators. In a nutshell, the economic segment with these three guests treated the audience to unrelieved, unexamined neoconservative rhetoric and propaganda. All three agreed the budget had to be got back into surplus. The very clear implication was that the budget had to ALWAYS be in surplus and surpluses were ALWAYS good. It was clearly accepted by all, even the host, that it was axiomatic that surpluses are always unquestionably good. There was no discussion of economic cycles, unemployment, youth unemployment or unmet need in society (health, welfare, education, infrastructure). Absolutely nothing was said on any of these issues. The budget balance was discussed in a vacuum.

I wonder where should I lodge a complaint about the strong and blatant neoconservative bias of the ABC? I also want to complain about the one-dimensional, intellectually bankrupt discussion of budget balance numbers without reference to any other macroeconomic, business cycle or social issue.

Mindless (and easily refuted) neoconservatism dominates the MSM (including the ABC) about 99% of the time. It’s as if the GFC didn’t happen; as if junk bonds, Enron, Madhoff, derivatives, mortgage market collapses, Detriot’s collapse, etc. etc. just haven’t happened.

The neoconservatism zombie dances on. It is brain-dead and yet keeps uttering that fallacious bable non-stop.

It’s a total lie forward by Paul Kelly or anyone else to say that Australia has structural issues with Aust. government debt. That is what was said by Paul Kelly on The Drum.

“Australia recorded a Government Debt to GDP of 20.48 percent of the country’s Gross Domestic Product in 2013. Government Debt To GDP in Australia averaged 20.20 Percent from 1989 until 2013… ” – Trading Economics.

US Net government debt as % of GDP (IMF) = 87.86%.

Go and sort countries by debt to GDP ratio on Wikipedia. Australia is waaaaaay low on the list even on 2012 figures.

The Neocons complain about people being alarmist about Climate Change. (I mean what’s a little old Arctic ice cap between friends?) Yet we get this ridiculous alarmism about our government debt when it is very low by world standards. What stunt are they pulling? Do they believe it (all the neocons) or is it just a convenient excuse to cut spending on the poor and cut taxes on the rich? Well , I reckon we know the answer to that one. The ultra neoconservative bias of our whole media including the ABC is just sickening. Their propaganda is blatantly false and so simply refuted by a few facts.

I get a distinct sense of unreality about all this. The world situation is bizarre. The elites a telling lies or in total denial. The great majority of the populations in the West (75% or so) are living in a protected dream land and have no idea what the other 25% are going through. But things are going so bad so quickly it won’t be long before 75% are hurting. The middle class is already crumbling in the US and the pooresy 20% of households are on foodstamps. Part of the EU periphery are in worse shape than that. This state of affairs is unsustainable. There will be a huge crisis coming out of this. The elites won’t listen to reason and they won’t help the unemployed and poor. When that gets too bad the only recourse of the people is active revolution. Is that what the elites want? Sometimes I think they do want it. Then they get to utilise all the repressive apparatus they have been investing in.

I learned very early on in my study of macro that whenever an economist puts an adjective in front of unemployment, they are trying to create an excuse for the failure of whatever their school is to create a sufficient number of jobs to satisfy the demand for them. In my mind, this endless search for excuses all comes down to the quantity theory of money, which is treated as gospel by the right wing, but which requires that involuntary unemployment not exist. Rather than admit that the quantity theory (at best) only works in a special instance of its input data (one that never happens), a generation of economists have successfully found their own employment by chasing the golden fleece of finding the fault of mass unemployment to be anything but a lack of jobs.

Any comments on what is happening now in France? New government will be formed because the Economics Minister, Montebourg declared that German-imposed austerity should end.

Bill (or anybody else for that matter) – If one were to look for a university to study economics in the europe. Where would you go to get that degree?

I would want to at least learn about sectorial balances, endogenous money, how a fiat system actualy works and how to model it. How many places come close to giving people a toolbox that MMT offers?

Conversely: To learn money multiplier, DSGE, equillibrium as historical concepts that failed.

Thanks to anybody in advance!

“first they put in place mandatory pension saving schemes”

The mandatory pension savings schemes are there so that the current crop of pension asset holders can liquidate sufficiently.

Pensions are always a current production issue.

You’ll note that a mandatory savings scheme and exchange of assets at current inflated prices so that current pensioners can draw down is exactly the same operationally as paying those pensioners a state pension and issuing a tax on the working population to cover it.

Except that the latter is more efficient because there are no middlemen asset shuffling commissions to pay.

Germany is the problem. There is a disequilibrium in the euro. France, Spain, Portugal, Greece, and Italy should adopt a new currency, call it the med. They should include better fiscal controls with the med than they had as individual states before the euro. They could then devalue the med with respect to the euro and compete with Germany on exports. They might think about including African countries that meet the proper standards; Africa is where the future economic action will be in the future.

Part of the problem Ikonoklast, is that Paul Kelly and the other chattering commentators and “journalists” are macroeconomic illiterates and have no recognition of that fact. Ignorance is the first penalty of hubris and pride. The second problem is that the broadcasting media ceased, long ago, to be vehicles for imparting real information, analysis or understanding of real world issues. Entertainment is the name of the game, and the media owners intend to keep it that way.

Sam, in the UK, I can tell you where to avoid. Here is a quote from the Guardian from 11 May of this year: “But recently student economists in many UK universities – including Manchester, Cambridge, University College London, Essex, the London School of Economics, the School of Oriental and African Studies – have begun organised protest against the content of their degree courses. They argue that their degrees are not fit for purpose, whether that purpose is preparing students for their future careers in the “real world”, or more broadly, equipping them with a good understanding of real world economies.” (Chang & Aldred)

The only places in the UK that teach political economy that I am aware of are Kingston and Sheffield. Then there is Maastricht in the Netherlands. Bill has an association with that university, and the courses are in English. In the UK, many good economics departments have been absorbed into business schools. I’m sorry I can’t help you more.

Sam,

You can do no better than Kingston University in London. All of the topics that you mentioned are handled in their economics courses.

@sam: you might also consider Franklin University Switzerland. Some info here:

http://www.fus.edu/department-of-economics-and-finance/faculty-and-staff

About Andrea Terzi:

http://www.ateconomics.com/about/

Sam

I’m not qualified to comment but I have an inkling Limerick in Ireland might be worth a look.

In this world Failure is sucess.

In Ireland

Preliminary estimates show that average weekly earnings were €688.15 in Q2 2014, down 1.1% from €695.53 a year earlier. Revised weekly earnings for Q1 2014 showed that average weekly earnings fell slightly to €692.43, down from €692.54 in Q1 2013

Over the 4 year period Q2 2010 to Q2 2014 average weekly earnings across individual sectors show changes ranging between -6.5%, for the Human health and social work sector decreasing from €727.17 to €680.20, and +11.9%, for the Information and communication sector increasing from €915.25 to €1,024.40. See table 1 and graph below

We live in a absurdly complex (bank scaled up) world where a country such as the Philippines depends on Labour remittances for its very survival (much of this in health and social work)

“Remittances in Philippines increased to 1980320.70 USD Thousand in May of 2014 from 1913939.20 USD Thousand in April of 2014. Remittances in Philippines averaged 783733.78 USD Thousand from 1989 until 2014, reaching an all time high of 2154956.20 USD Thousand in December of 2013 and a record low of 64208 USD Thousand in February of 1989. Remittances in Philippines is reported by the Bangko Sentral ng Pilipinas”

(trading economics)

The no 1 country in the world for labour remittances is the Philippines.

What person other then a banker would create such a absurd level of specialization and thus chronic lack of local redundancy.

Imagine what would happen to the Philippines if Europe went national ?

It would implode.

“4. Do not waste time introducing a quantitative easing program. All bond purchases should be tied to increasing fiscal deficits.”

I respectfully disagree. No need to mess with quantities as Mario Draghi demonstrated with “whatever it takes”. Yes there needs to be a backstop but no QE. This is totally MMTish, I was surprised that Bill supports QE.

Thankyou larry, Carlo Vittoli, Andy and John Hermann.

The request is for a family friend whom has a daughter excelling in school especially interested in economics. Whom i have briefly explained the situation about economic realities to.

Its interesting digesting the language used in the syllabus these universities use to describe what they teach. I will endeavour to look further into each option presented. (Note: we’re multilingual here french/english so that will not be a limitation)

thanks for your help!