I have received several E-mails over the last few weeks that suggest that the economics…

Strong public benefit from tertiary education in Australia

There was an interesting article this morning in the Fairfax press (September 29, 2014) – OECD figures show public benefits more than individuals from tertiary education – which used the recently released – Education at a Glance 2014 – to compare private and public (social) returns from tertiary education. The results are that private net returns outweigh social returns in the majority of nations but not for the UK, Australia, Japan and Korea. The results have implications for the debate about who should fund tertiary education – the private individuals (or families) of those undertaking it or the government. They also highlight that one should be somewhat protean in outlook and avoid falling into Groupthink.

In this era of fiscal austerity, the Australian government has been cutting back its contribution to public education, either directly by imposing more user pays onto students and their families (particularly tertiary education), or, indirectly via the cuts to the State government-run Tertiary and Further Education (TAFE) sector, which is the main provider of vocational and technical education in Australia.

The TAFE system has been cut severely and the funding is now open to private competition, where cherry-picking shop front private ‘training’ providers undercut public TAFE campuses, who provide full campus facilities including libraries, welfare support and more.

Given the challenge for the future is that the rising dependency ratio is offset by a declining workforce that is more productive than the existing workforce, cutting funding to technical skill development and university education is a recipe for disaster.

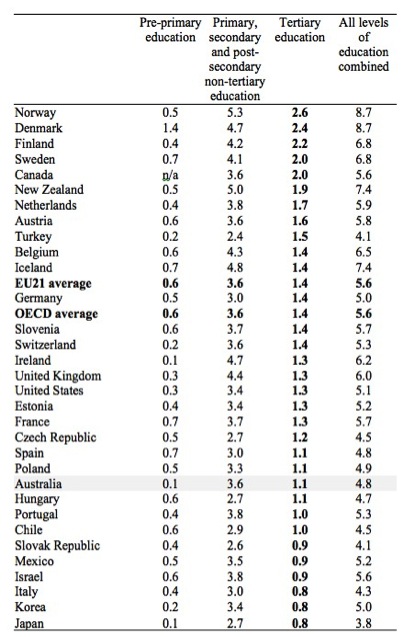

Australia ranks poorly in terms of “Public expenditure on education as a percentage of GDP” (see table below) (Data Source). The data measures direct public expenditure on educational institutions plus public subsidies to households and other private entities, as a percentage of total public expenditure and as a percentage of GDP, by level of education.

The government contribution to pre-primary is well below the OECD average as is the public contribution to Tertiary education.

The Fairfax article reports that the current round of austerity will “see the government’s share of spending fall” in education.

Public expenditure on education as a percentage of GDP – 2011

The situation is even worse when you consider the mix of public spending in terms of public and private schools. In Australia, while the university system is overwhelmingly public, the secondary school system is mixed.

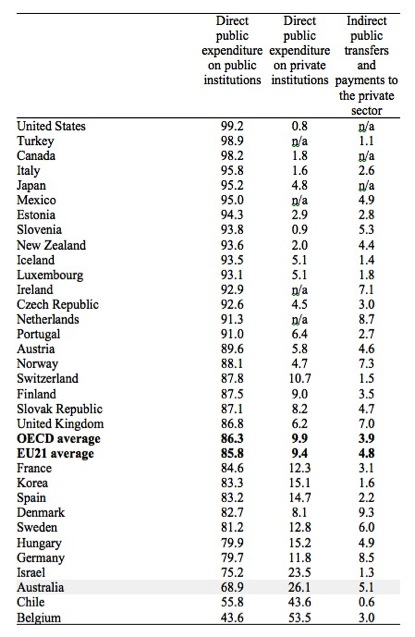

The following table shows how much public spending goes to the private and public primary, secondary and post-secondary non-tertiary education.

The data shows public expenditure on education transferred to educational institutions and public transfers to the private sector as a percentage of total public expenditure on education, by level of education.

Australia is towards the bottom of the stack and, while this is not the topic for today, the increased bias towards channelling public funding into profit-seeking and exclusive private secondary schools, in one of the reasons income inequality in Australia is increasing.

Distribution of total public expenditure on education – 2011, per cent of total education spending

It is clear that public funding for higher education in Australia has been squeezed in the last decade and the situation will get worse in the period ahead. There is now increased user-pays nature of higher education, principally in the form of increased tuition and related fees.

A sovereign government such as the Australian federal government is not financially constrained and therefore the provision of “free” tertiary education is not a financial question. If there is a case to be made for public funding of universities and the real resources exist in the nation to support that funding then the currency-issuer can always ‘afford’ it – that is, it can always purchase whatever available real resources are required.

However, the lack of a financial constraint doesn’t immediately justify public funding. There still remains a situation where students might be expected to pay fees for access to university education.

This has been a long-standing debate in the Australian context where fees were abandoned in the early 1970s by a “Labor” government as an alleged equity measure – to increase participation of lower socio-economic groups whose children warranted attendance at universities but could not afford the fees.

As the neo-liberal era unfolded (from the 1980s onwards) various fees have been increasingly imposed. As of now, it is clear that Australian fees are now among the highest in the world (see Organisation for Economic Co-operation and Development (OECD) 2008b, Education at a Glance 2008: OECD Indicators, OECD, Paris).

In 2008, the then Labor Government set up the so-called Bradley Committee, which published its final report – Review of Australian Higher Education: Final Report – later that year.

The Final Report concluded that:

There has also been a major policy shift towards increasing the contribution students make to the costs of their tuition. This approach recognises the private as well as public benefits of higher education and the advantaged position of higher education graduates.

At the time (2008), I agreed with this statement given the available data at the time. Based on that data, I wrote in this blog – I feel good knowing there are libraries full of books – that the returns to tertiary education are predominantly private – with graduates enjoying superior access to employment opportunities and higher lifetime earnings.

I also wrote that there are social returns but these are dominated by the gains that are ‘privatised’ by the individuals. So the question that progressives have to ask is whether they want the government sector subsidising the rich!

In that situation, it is clear that by abandoning fees, a fully public-funded higher education system leads to a massive redistribution of resources from poor to rich. This arises because the participation of lower-income families in higher education in Australia (and elsewhere) is still very restricted.

So in a free system, the rich are not denied the choice between a family ski holiday in Aspen and a year’s tuition fees for their child – they can have both. Whereas the poor kid doesn’t even get to make that choice – they can have neither.

In a free system, the higher-income parents can pump a lot of resources into private secondary schooling which has higher success rates (but probably less overall educational value – another debate!) and then enjoy the public subsidy for higher education.

I read a book when I was a post-graduate student by Dutch economist Jan Pen (Income Distribution, 1971, Penguin) where he wrote that:

Parents are advanced secret agents of the class society.

This conditioned my thinking on higher education significantly and I realised that it was crucial that the public effort was better placed targetting merit in low-income neighbourhoods at an early age. The message from Pen was that the damage was done by the time the child reached their teenage years.

So the progressive claim that the imposition of fees at the university entry point discouraged disadvantaged children from participation and that abandoning those fees was an equity measure was based on a poor understanding of the constraints. The poor children rarely get to the point where such a choice was to be made.

They are long gone from the education system and increasingly in this neo-liberal era where we waste the potential of our youth and allow them to be idle in unemployment or underemployment (poorly paid, unstable casual jobs) they are not even gaining access to job-specific skill development and workplace experience.

Australia has typically performed poorly in terms of public contribution to early schooling.

Public intervention has to come early in a child’s life to imbue them with the value of education and to overcome (if present) the negative attitudes that the lower-income parents may instil in their children. Resources have to be continually made available in poor neighbourhoods to ensure the children maintain contact with the educational system and gain a thirst for learning.

As the child progresses through primary and secondary education, public schooling should be of the highest quality possible. Well resourced, liberal in value and motivational. It should not be based on “market-values”. The pursuit of music, poetry, literature are all aspects of a high quality education.

Public support from families at this stage (means-tested) is essential – to ensure children remain at school. The goal is to ensure that the participation in higher education goes to the brightest students irrespective of family income.

I still consider the above logic to be sound. However, in light of the latest data from the OECD, one can argue that there remains a case for public funding of tertiary education attendance in Australia, based on the social benefits that it brings.

That data has changed my thinking somewhat, which is what new evidence should. The framework for appraisal remains solid – that is, the state should not be funding activities that predominantly advantage the private individual and do not advance broader equity and social purpose goals.

Remember, this argument has nothing to do with the ‘capacity’ of government to provide funding.

The Fairfax article today presents two graphs based on the latest OECD Report, which show that Australia runs counter to the trend now and the social (public) net returns to higher education significantly outweigh the private returns.

This is a major result.

In economics, decisions to produce, consume etc are based on some sort of calculations (implicit mostly) about the returns that one should expect. So a private company will invest in projects in order of their capacity to deliver net profits in current dollar terms.

Thus an income and expenditure stream across time will be appraised using techniques from financial accounting (net present value, discounted cash flow analysis etc) to determine whether an investment in a machine or something like that will be worthwhile.

These decisions typically ignore the broader costs and benefits that might be associated with the decision. In economics, these broader outcomes are called ‘externalities’ because they are considered to be ‘external’ to the private activity.

These broader costs and benefits are called public or social costs and benefits and they are borne (costs) or accrue (benefits) to society as a whole.

As an example, a firm might determine that investing in a plant to produce some good or service will deliver larger returns to it (private) across the life of the project than it costs it to provide (private) and on that basis would rank the project positively. If it delivered the best net (private) return then it would be ranked first among alternatives.

But the decision by the firm to invest may be inferior from a society-wide perspective if there are, for example, heavy external costs that the firm doesn’t take into consideration. So if the plant poisons a river, which damages downstream irrigation or pollutes the air, which causes wider health problems or global warming, then the private calculations would lead to an excessive quantity of resources being allocated to that activity at the expense of other more desirable (from a social perspective) activities.

If the external costs are added into the calculation, the price of the good or service would have to rise and the firm may find that the activity is no longer profitable in broad terms rather than purely private terms.

In this case, there is a case for public intervention to fix the ‘market failure’ (excessive investment) arising from the externalities. That is what a carbon tax attempts to do for example, impose the external cost back onto the producer of the pollution so that the consumer is forced to pay more, which usually means demand less of the good or service.

There are other cases where private sector calculations (based on private costs and benefits) may lead to underinvestment in an activity. This is when there are significant social net benefits arising from an activity that the private decision-maker ignores.

So the private firm may decide not to allocate resources to such an activity whereas society would benefit if more resources were so allocated.

In this case, the ‘market failure’ argument leads us to conclude that the public sector should invest in such activities to ensure a socially-optimal amount of resources are allocated to it.

Education is such an activity. This is the justification that economists use for extensive public funding of all levels of education outside of tertiary education.

The evidence has always been fairly clear that the public net benefits of these levels of education easily exceed the private net benefits, which means that it is in the interests of society for governments to predominantly fund participation in these levels to ensure more rather than less people receive education.

The evidence for tertiary education has been suggestive that private returns outstrip public returns, except in a few disciplines, such as nursing. The evidence has been sketchy one would have to admit.

But the recent OECD Report – Education at a Glance 2014 – provides a very comprehensive dataset upon which we can consider these issues more clearly.

The Fairfax article summarises the evidence.

The data is available at – Indicator A7: What are the incentives to invest in education? and Indicator A8: What are the social outcomes of education?.

We can compute the private returns to tertiary education for males and females from Table A7.3a and the public returns from Table A7.4a.

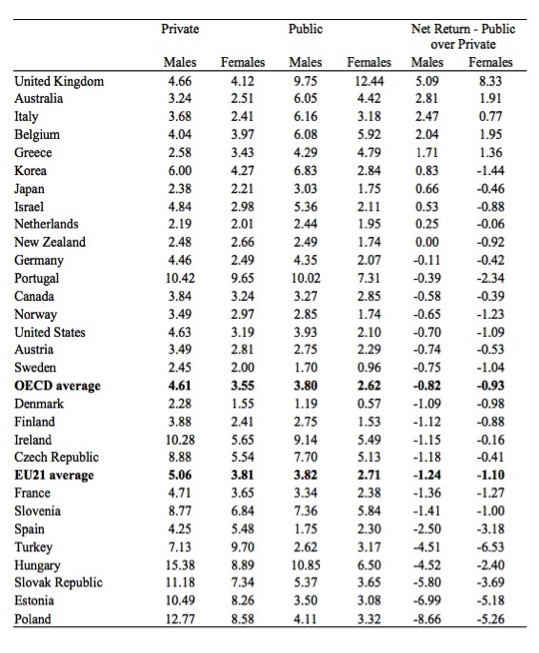

Note the returns shown in the following table are for a person who completes tertiary education as compared with a person “attaining upper secondary or post-secondary non-tertiary education, in equivalent USD converted using PPPs for GDP”.

Some OECD countries were omitted due to lack of data (Chile, Iceland, Luxembourg, Mexico, and Switzerland).

The OECD works out the costs and returns on the following basis:

It assesses the economic benefits of education for an individual by estimating the earnings premiums of higher levels of education, taking into consideration the direct and indirect costs and benefits of attaining those levels of education. Besides higher earnings compared to individuals with lower education levels, the probability of finding work, expressed in monetary terms by the variable called the “unemployment effect”, is also a benefit …

Costs include direct costs, notably tuition fees, and indirect costs due to higher income taxes, social contributions levies, loss of salary because of delayed entry into the labour market, and fewer entitlements to social transfers, such as housing allowances, family allowances or supplemental social welfare benefits. In addition, social contributions and income taxes account for a certain percentage of the income and tend to be higher for individuals with more advanced education because they tend to earn more.

The returns are higher for an individual with a university degree relative to those who only went as far as upper secondary level of education because salaries are higher – and the difference between males and females reflect gender wage inequality (lower pay for equal work), gender segregation (into lower paid occupations even for those that require university degrees for entry), and lower participation (child rearing etc).

On costs, the OECD also say that “In particular, people with tertiary education remain longer in education and thus lose a substantial amount of earnings (foregone earnings) that they could have received if they had joined the labour market earlier.”

In terms of public costs and returns, the OECD says that:

The public returns from tertiary education are substantially higher than the public returns from upper secondary or post-secondary non-tertiary education … because of the higher taxes and social contributions that flow from the higher incomes of those with tertiary qualifications.

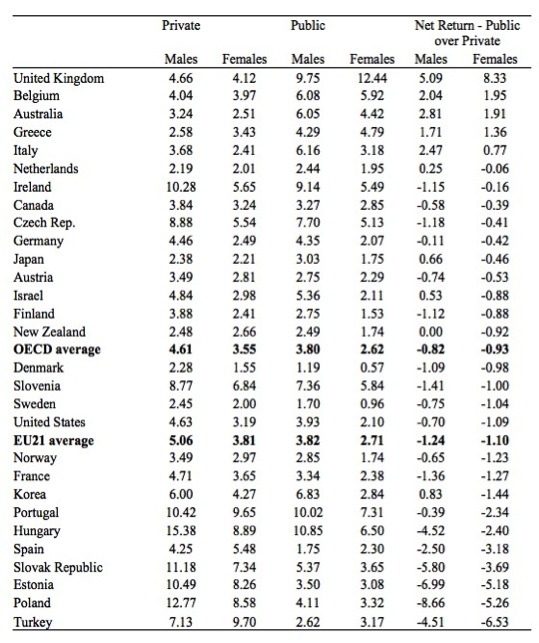

The first Table is sorted on overall net return for Males (highest to lowest), whereas the second is sorted on net return for Females (highest to lowest).

Considering the first Table (sorted for males), there are 9 nations where completion of tertiary education generates greater social returns than private returns. For Australia, the public return is 6.05 per cent whereas the private return is 3.24 per cent.

This suggests that there is a strong case to be made for considerable public spending support to maintain high rates of participation and completion at Australian universities.

On average, across the OECD as a bloc, the conventional wisdom about private returns outweighing public returns is supported.

Net Rate of Return from attaining tertiary education, per cent, Public and Private, sorted by male returns, 2010

In terms of Females, there are less nations where the public return is greater than the private. Australia is one of 5 nations in this category.

This is mainly due to the way the returns are computed in each case as noted above. Females have lower labour force participation than males and thus contribute less in tax revenue.

Net Rate of Return from attaining tertiary education, per cent, Public and Private, sorted by female returns, 2010

There are two final points to make here and they both relate to the fact that the OECD measure of public benefits focuses on the taxation revenue that the government gleans from those with higher education.

First, these benefits do not include a host of other benefits that might accrue from having a highly educated workforce in an increasingly technological and changing world.

The OECD notes:

Both educational attainment and literacy proficiency are associated with higher levels of social outcomes including self-reported health status, volunteering, interpersonal trust and political efficacy. Among individuals with the same level of educational attainment, those with higher levels of literacy proficiency have higher levels of social outcomes.

There is a particularly strong relationship between literacy proficiency and political efficacy among tertiary graduates.

Inasmuch as these benefits exist, the rates of return reported in the tables above will underestimate the overall net public benefits.

Second, and this is the sticking point. From an Modern Monetary Theory (MMT) perspective, one would not normally consider the tax revenue that is gained from the workforce to be a public benefit. Please read my blog – Taxpayers do not fund anything – for more discussion on this point.

While that is conceptually accurate, we need to acknowledge the way the governments think – faulty as it is. For them, tax revenue is a source of funds to permit spending. That is their public narrative anyway and the accounting structures they have put in place support that view.

The MMT version of that view is that the tax revenue provides real (not financial) resource space for the government to spend without having inflationary effects. The government only really needs that ‘space’ when the economy is already at full employment and any further expenditure would squeeze resource availability and the competing demands on the already full utilised resources would generate inflation.

But it remains the case that by reducing the capacity of the private sector to spend the government can create more space for it to spend.

Conclusion

What all this means for who should fund tertiary education is also nuanced. Clearly, there has to be a significant public sector funding involvement in Australia given the latest results which demonstrate that the public return significantly outstrips the private return.

The Australian government should clearly be working to ensure that all those who are capable of gaining a university qualification and who desire to attend tertiary institutions are able to attend indepedent of their means.

More research is needed to assess the scale of the private contribution. Given the capacity of the higher income groups to reduce the taxes they pay there would need to be scrutiny on who gains more privately from obtaining a university degree and who contributes the most socially.

That demographic, cross-sectional analysis would enrich the detail that is now available in this latest OECD Report.

It has changed my thinking a bit, which I take as a good sign.

Recall Paul Samuelson, the American economist who had the most popular ‘Keynesian style’ macroeconomics textbook writing in The Economist Magazine on June 25, 1983 in honour of the centenary of Keynes’ birthday:

Keynes provided his own impeccable defence of being protean. “When my information changes, I alter my conclusions. What do you do, sir?”

Note, the legend is that Keynes said this but no one has been able to document the fact. At any rate, the sentiment is sound and helps guard against being captured by Groupthink.

But on this issue, I am also protean – given the new data.

That is enough for today!

(c) Copyright 2014 Bill Mitchell. All Rights Reserved.

Dear Bill

For poor countries, investment in higher education may not bring such high returns because of the brain robbery proudly practiced by countries like Canada. If most African doctors end up practicing in rich countries, then obviously the return on investment in medical education will be reduced considerably.

The former Soviet Union had an emigration tax, which took educational level into account. I don’t think that was such a bad idea, although it runs counter to the right to emigrate, which so many Westerners consider sacrosanct.

Regards. James

James, re sanctity of emigration, not any more they don’t. In the UK, the new EU rules have resulted in a kind of apoplexy among some of the backbench Tories and Ukip.

Given how poor economics courses are these days perhaps the resources would be better spent elesewhere.

I know of one university where one of the clowns on staff has only managed to bring in $568 worth of research funding since 1996, still hasn’t obtained a PhD – and yet is allowed to lecture and tutor students.

I think the publics general perception of success or failure being based upon what someone earns is completely flawed.

Many high paying jobs are in a social sence completely worthless as far as the greater good is concerned. Stockbrokers, Bond traders, fast food industry, alcohol, tobacco … and so on come to mind.

With respect to education it appears that the concensus is not so much about what one learns but more so what one earns as a consequence of that education.

Ivy league schools provide networking opportunities for those willing and able to pay the fees. Whether or not these schools provide future citizens that will make the world a better place is highly debatable.

Unfortunately, I have neither the time or intellect to solve such questions.

Dear Larry

I was talking about emigration, not immigration. All countries restrict immigration in various degrees, but few restrict emigration. During the Cold War, communist countries were strongly denounced for not allowing their citizens to emigrate. There is nothing logical about this because every emigrant is at the same time an immigrant, for the obvious reason that nobody can live on the sea. Both restrictions on emigration and those on immigration hinder the cross-border movement of people.

In my opinion, there is no ethical difference between the 2 types of restrictions. Let’s illustrate this. Pablo is a Mexican laborer who would like to emigrate to the US in order to earn higher wages, but the Americans won’t let him immigrate into their territory, so Pablo has to stay in Mexico against his will. Pedro is a Cuban doctor who would also like to emigrate to the US. The Americans are willing to take him, but the Cuban government won’t let him leave Cuba, so Pedro is forced to stay in Cuba against his will. I really can’t see any ethically relevant difference between the 2 cases. Of course, we shouldn’t confuse the right to emigrate with the right to travel abroad.

If people can leave their country whenever they feel like but the government can never deport any citizen, then we have an asymmetry. It is like a situation in which employees can quit their job at any time but an employer is never allowed to dismiss an employee.

Anyway, this is becoming far removed from economics. Regards. James

In my personal opinion the language has changed about education.

It is neoliberalised in such a way that it reminds me of the supply-demand and rational agent rubbish.

Now university degrees are advertised as giving the ‘individual’ a ‘competitive advantage’ or to appeal to the student with flashy figures like x hundreds of thousands of dollars above average earnings over a lifetime. Now its all about what ‘you’ can get out of ‘your’ investment in education, make the rational decision to maximise your earning over a lifetime (go to a graduation ceremony the language is appauling). The corollorary to my point is that if people only ever see education as a path to earning then they are less likely to support free/subsidized education. (may see it as people getting a free slice of pie so to speak).

The language has changed from the common good, aggregates of students fulfilling need for a given industry or sector of society to continue functioning.

From a macro level for education to be optimised in its functionality it should always be free and have participation from the largest gaumut of socio-economic backgrounds as possible as family wealth is disjoint from students natural ability.

“I think the publics general perception of success or failure being based upon what someone earns is completely flawed”.

Those that earn the money tell us it’s simply “supply and demand”. Remember the example in Ormerod’s “The Death of Economics” of the Salomon Brothers recruit explaining how he earned more money than his sister who taught disabled kids? He believed if less people wanted to teach she’d could demand more. He was conveniently ignoring that there were thousands of applicants for his place within Salomons.

But as Keynes said (also quoted by Ormerod) it’s probably best to allow these pathological types find an outlet in making money lest they turn instead “to careers involving open and wanton cruelty”.

From a macro level for education to be optimised in its functionality it should always be free and have participation from the largest gaumut of socio-economic backgrounds as possible as family wealth is disjoint from students natural ability.

It all gets very personal when, as I heard over the weekend, an OP1 student from a “working class” family gets pipped for a place for Law at UQ by an OP5 whose wealthy parents can pay the 100 grand or whatever it is, upfront. And that’s not even the true “cost” of the tuition, but enough of a hurdle to further embed privilege.

Needless the say, the girl who dipped out is heartbroken.