I have received several E-mails over the last few weeks that suggest that the economics…

Trickle down economics – the evidence is damning

The condition known as – Schizophrenia – describes “a mental disorder often characterized by abnormal social behavior and failure to recognize what is real”. Then again, the condition known as – Dissociative identity disorder – describes a condition where a person has “at least two distinct and relatively enduring identities or dissociated personality states that alternately control a person’s behavior”. If these states can be applied to institutions, then the OECD needs urgent medical attention. The OECD released a working paper yesterday (December 9, 2014) – Trends in Income Inequality and its Impact on Economic Growth – by Federico Cingano. It provides evidence that destroys the basic tenets of neo-liberal economics and supports a wider social and economic involvement of government in the provision of public services and infrastructure, particularly to low income groups. The fiscal implication is that deficits need to be higher.

I wonder whether the OECD has bothered to check the message in the paper against its other ideologically-motivated public stances relating to the need for fiscal surpluses, deregulation, structural reform, etc.

As an organisation, the total ‘product’ doesn’t add up.

If you don’t want to read the whole Working Paper, then there is a convenient – Four-Page Summary – which avoids the technicalities but delivers the message.

You can also access the underlying – Tables and Data – for the report.

The main conclusions and implications are:

1. “In most OECD countries, the gap between rich and poor is at its highest level since 30 years. Today, the richest 10 per cent of the population in the OECD area earn 9.5 times the income of the poorest 10 per cent; in the 1980s this ratio stood at 7:1 and has been rising continuously ever since.”

2. “However, the rise in overall income inequality is not (only) about surging top income shares: often, incomes at the bottom grew much slower during the prosperous years and fell during downturns, putting relative (and in some countries, absolute) income poverty on the radar of policy concerns.”

3. The “analysis suggests that income inequality has a negative and statistically significant impact on subsequent growth … what matters most is the gap between low income households and the rest of the population”.

4. The reason that inequality harms growth relates to educational attainment – “increased income disparities depress skills development among individuals with poorer parental education background, both in terms of the quantity of education attained (e.g. years of schooling), and in terms of its quality (i.e. skill proficiency)”.

5. “policies to reduce income inequalities should not only be pursued to improve social outcomes but also to sustain long-term growth”.

6. “Redistribution policies … are a key tool to ensure the benefits of growth are more broadly distributed and the results suggest they need not be expected to undermine growth … it is also important to promote equality of opportunity in access to and quality of education … promoting employment for disadvantaged groups”.

7. The implication is that the major claims relating to ‘trickle-down’ theories, which underpinned the rise of neo-liberalism and the policy shift in favour of privatisations, labour market deregulation, entrenched unemployment, cuts to public funding of health, education and public infrastructure (transport etc) have been shown to be unsupported by the evidence. They are just mindless ideology without an evidence base. The evidence suggests the swing to these policies has undermined economic growth and dented the prospects of millions of people around the world.

When does the economics profession acknowledge this and abandon its blind faith in the so-called ‘free market’, which, of course, is not free as in the textbook at all, but a loaded system where wealth and high income buys increasing advantage at the direct expense of those without and as this working paper demonstrates, at the expense of the socio-economic system overall.

The OECD paper is motivated by two questions:

Is inequality a pre-requisite for growth? Or does a greater dispersion of incomes across individuals rather undermine growth?

It documents the rise in inequality since the 1980s.

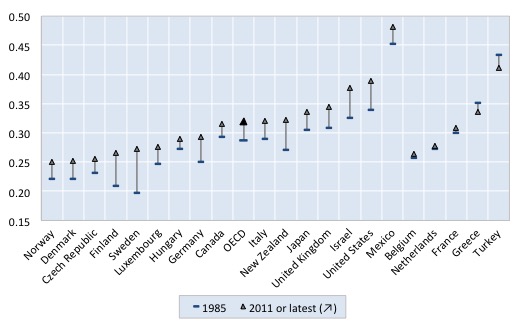

Figure 1 (reproduced below) shows the – Gini Coefficients – for a selection of OECD nations in terms of disposable income. If the Gini coefficient is zero it means that everyone in the income distribution has the same income. The ceiling is a value of 1 (perfect inequality or one person has all the income). So rising values indicate increased inequality.

You can see that income inequality increased in most of the nations. Belgium, France and the Netherlands were relatively unchanged while Greece and Turkey experienced reduced inequality.

In the late 1970s and early 1980s, the likes of Margaret Thatcher and Ronald Reagan started talking about so-called – Trickle Down Economics or supply-side economics.

The idea was that if you redistributed national income to the high income groups, their enterprise would generate jobs and income opportunities for everyone. It was no different to the stupidity in Ayn Rand’s Atlas Shrugged.

The underlying view is that the rich are the enterprising souls in our nations and the rest of us rely on their endeavours to eke out an existence.

The opposite is more likely to be the truth. The low income earners have higher marginal propensities to consume (the proportion of each extra dollar spent) than the higher income groups who save more. Giving more income to the poor will increase spending per dollar of extra income generated than giving it to the rich.

But behind trickle-down was a nasty neo-liberal plot to undermine state activity and rewind the gains made by the workers under the welfare states and unionism over the course of the C20th.

Why does inequality undermine growth?

The paper considers several reasons, which I will leave to you to read. In summary:

1. Rising inequality undermines social stability and could reduce the incentive to invest.

2. Poorer groups under invest in so-called human capital accumulation (skills development, education etc) which reduces the productivity and growth potential of a nation.

3. If high inequality undermines aggregate spending, then certain technological innovations which rely on “a minimum critical amount of domestic demand” will be thwarted.

The evidence is firmly in favour of the conjecture that inequality is bad for growth, thus rejecting the major postulates of neo-liberalism which have dominated policy design over the last 30 odd years.

The technical aspects of the paper, though of interest to me and no doubt others who are trained to read econometric discussions, are not covered in this blog. You can read them at your leisure if interested. My assessment is that the work is technically sound, although in any studies of this type there is room for debate.

The paper finds that:

The impact of inequality on growth turns out to be sizeable ….

The paper then estimates the counter-factual – what would real GDP growth have been if inequality was unchanged between 1990 and 2010. This is the weakest part of the paper given it uses a Solow growth model to estimate the unknown alternative growth rates. But more sound growth models would not differ much over this horizon anyway.

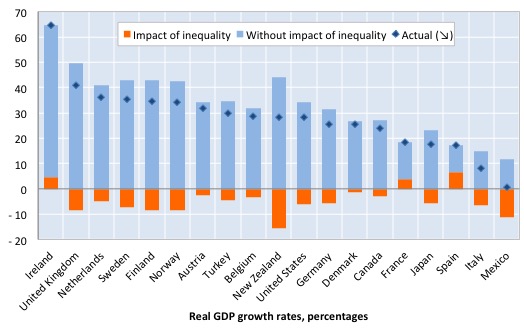

The following graph is taken from Figure 3 in the Paper and shows the “Estimated consequences of changes in inequality on cumulative per capita GDP growth (1990-2010).

The Paper concludes that:

Rising inequality is estimated to have knocked more than 10 percentage points off growth in Mexico and New Zealand. In the United States, the United Kingdom, Sweden, Finland and Norway, the growth rate would have been more than one fifth higher had income disparities not widened. On the other hand, greater equality helped increase GDP per capita in Spain, France and Ireland prior to the crisis.

We learn that “income inequality is negatively associated with average educational attainment”. More detailed analysis shows that the nations with “widening income disparities” endure lower “outcomes of individuals from low socio-economic backgrounds” although “medium and high background individuals” seem to be unaffected.

Thus “higher inequality lowers the opportunities of education (and social mobility) of disadvantaged individuals in the society, an effect that dominates the potentially positive impacts through incentives.”

The effect is intergenerational. The “estimated probability of graduating from university is highest for individuals who have highly educated parents”. Children from disadvantaged backgrounds are unlikely to complete tertiary education.

The neo-liberals continually chatter about the intergenerational impacts of fiscal deficits and justify cutting public spending on education at all levels, yet public provision of first-class education is one of the best ways of promoting income growth for the nation as a whole.

Cutting public spending on education undermines prosperity for all.

Children from lower income households achieve poorer outcomes in terms of numeracy and other measures.

Further, higher inequality lowers the amount of opportunities available to disadvantaged individuals in the society. Studying the labour market outcomes of different individuals confirms this.

The paper concludes that:

The analysis above suggests that higher inequality may lower the inflows of human capital in an economy, as low background individuals see their educational outcomes worsen. A permanent increase in inequality has therefore the potential to lower the stock of human capital.

The paper recommends a change in policy emphasis in OECD nations to focus on reducing income inequality and providing more employment and education opportunities for low income households.

There should be cash transfers, more access to public services, particularly, health and education.

This is exactly the opposite to the current policy thrust in most nations.

As inequality increases in a nation, the probability of a person from a low income household being employed falls sharply.

The first thing a government should do is introduce a – Job Guarantee – to ensure there are always opportunities for everyone to earn a reasonable income that will be sufficient to allow the individual to participate meaningfully in society.

There is absolutely no excuse for governments tolerating mass unemployment. It is a large driver of the increased inequality in advanced nations. The distribution of unemployment is highly biased towards a disproportionate impact on low income households.

Then there is the issue of redistribution. Many progressives instinctively see the solution as taxing the rich to give to the poor. From a Modern Monetary Theory (MMT) perspective that instinct is misplaced.

First, the ‘tax to give’ concept implies that the government needs to raise revenue to distribute to other more worthy groups. Wrong. The government can give as much tax relief as it likes to the poor without having to raise revenue from the high income groups.

Second, the only reason the government might want to tax anyone is to deprive them of purchasing power. Is it a progressive solution to deprive anyone of the chance to enjoy material pleasures? I doubt it. It sounds more like a religious notion to me based on some puritanical instinct.

Third, it might be that the economy has too much spending and high inequality, which suggests that to allow the lower income groups to spend more the high income groups have to spend less. Then a tax hike on the high income groups makes sense.

But it is not to raise money for the government so that the poor can spend more. It is to create more real resource space (free up real resources previously used by the high income groups) to allow them to be used by others. I am talking in abstract terms here rather than literally handing over the lambos!

So progressive groups have to work through these concepts before jumping to their instinctive conclusions. The OECD Working Paper found that raising the floor helps growth but depriving the rich of income does not.

Conclusion

Another piece of the evidence jigsaw against neo-liberalism. I am sure very few academic economists will have cause to rethink what they teach today. They will wheel out the mainstream textbooks and teach the same rubbish – indoctrinating their students in an approach that kills prosperity and has no basis in reality.

Things have got to change.

I have a meeting today with representatives of a new movement in Australia – the Australian Progressives. They have political pretensions. They are interested in basing their policy formulations (as far as I can tell from a prior meeting in Melbourne last Friday) using the understandings they glean from MMT. In other words, they will aim to educate the public initially about the opportunities a currency issuing government has to advance public welfare by increasing sustainable forms of employment, enhancing public services, etc.

All of which would reduce unemployment and increase real GDP growth. The OECD confirms that last conclusion in their latest Working Paper!

That is enough for today!

(c) Copyright 2014 William Mitchell. All Rights Reserved.

Thanks for the clarification about taxing the rich, Bill! I posed the question a few blogs ago with and didn’t get a response to the comment, but now I see I was confusing the policy reasons from the economic modeling. If I’m now understanding things properly, it would be correct to say: Irrespective of who you are levying a tax on, if the end result is insufficient aggregate demand, the tax was not necessary/appropriate in an economic sense, though it may have served an ideological/policy purpose.

I agree that what is often referred to as the “free market’ is currently (and has been for a long time) not a level playing field, but is rigged in favour of the interests of the most powerful players – the 1% – at the expense of everyone else

The trickle down idea is the glue that holds modern-day capitalism together. If people gave up on it …

I have a University education and earn $37k per annum.

Therefore, I hardly think that education is the answer.

Did anyone except terminal fools ever believe the trickle down sales pitch?

Re growth,no matter how it is measured – The last time I looked we live on a finite planet. Infinite growth is peddled by the Boosters and their economist shills. It seems schizophrenia is a widespread condition in the halls of power,finance and academia to name a few locations

“they will aim to educate the public initially about the opportunities a currency issuing government has to advance public welfare by increasing sustainable forms of employment, enhancing public services, etc.”

I wish them all the very best of luck with that.

It’s time to start political movements based around these insights and start revealing to everybody how the trick is done – James Randi style.

Eventually it’ll sink in, but it may take a generation or so.

@ Alan Dunn.

I know how you feel, my earning are very similar to yours. However you miss some key points with that one fact:

We arent overly reliant on the state. We (I assume I can include you here!) dont engage in petty thefts or burglary. We arent involved in consumption or distribution of dangerous substances.

And you, probably like me, have broader interests, and have – at least in part thanks to better education (even if much of yours like mine was dissapointing) expanded our minds, and are interested in places like this, and general intellectual exploration.

These things dont apply to many of those who receive a lesser level of education. As Bill has often pointed out, attendance at a university should not simply be commercially oriented.

@Alan Dunn. Yep, usual supply-side slant of the orthodoxy. Anything but the idea that growth might be demand led. They’re using one supply-side argument to counter the other (trickle-down), possibly because they know that’s the only way an argument can be acceptably presented to neoliberals.

Dear Bill

Let’s not confuse 2 things: the size of the pie and the size of the slices. Economic growth can make the make the pie bigger and therefore everybody’s slice bigger, although there is no guarantee of that. However, if we want more equality, then our preoccupation is with the relative size of the slices, not with their absolute size. If we want more equality, not just increase the size of the smallest slices, then we should tax the rich.

Let’s illustrate this. We have have 10 people, who in total have 30 pairs of shoes. One person has no shoes at all, one has 22 pairs and 8 have 1 pair each. Our priority should be to put shoes on the bare-footed person. Let’s say that we can accomplish that by increasing the shoe stock to 31. Then we still have quite an unequal distribution because the rich person still has 71% of the shoes. By taxing 8 of the 22 shoes of the richest person and giving 1 pair each to the 8 in the middle, then the richest 10% now has 45% of the shoes. The ratio of the rich guy to the 8 in the middle has gone down from 22:1 to 7:1. That is more equality.

If a country is very poor, then the priority should be to increase the pie. Once it has reached a certain level of per capita income, equality can be promoted through downward redistribution of income, which can be accomplished through a combination of progressive taxation and social programs for everybody.

If the ratio of the richest quintile to the poorest one is very high, then it is possible to increase the income of the poorest quintile significantly without significantly reducing the share of the richest quintile. Suppose that the richest quintile has 60% and the poorest quintile 3% of national income. If we transfer 3 percentage points from the richest quintile to the poorest one, then we can double the income of the poorest one while reducing the share of the richest one by only 5%. The ratio goes down from 20:1 to 9.5:1.

I think that the progressives are right. If we not only want a bigger pie but also more equal slices, then progressive taxation is inevitable. When transfer payments make up about 30% of national income, then there is no way that they can all be financed through deficit financing. Taxation will be necessary, and that taxation will have to be progressive to insure more equality.

The Queen owns 100 horses. What if every household in Britain had 100 horses. Assuming that there are 20 million households in Britain, then there would be 2 billion horses in Britain. That is clearly impossible. It is nonsense to say that people have a moral right to a level of consumption which it is impossible for everybody to have and which would lead to the destruction of the environment. If the Queen owned 5000 paintings or 500 kilos of gold, that would not be a problem, but horses have a big footprint.

Regards. James

I’m not au fait with MMT. It seems from your blog posts to boil down to giving the state the power to create money and not the private banking system. Thats an interesting idea and I will have to read more about that.

For now, I disagree with you about taxing the rich. We don’t just have inheritance taxes to fund schools, roads etc. We do it because of what teddy Roosevelt rightly pointed out was a bigger problem – plutocracy.

We cannot have a system where the economic weight of a class means they have an inordinate amount of political power. This will in the long run lead to terrible policy outcomes in all areas of policy – not just economics.

Taxes on the rich are a bit like trimming the bushes in this way. Of course, the taxes cannot be ridiculously high or masochistic. But that isn’t the problem today – most rentiers pay little or no taxes currently.

We are not only depriving a oligarch of buying yachts when we tax him, we are depriving him of the ability to buy politicians and set up idiotic free market thinktanks and buy newspapers.

The logic of trickle-down is that if I am taxed less, I can make the economy grow more, and that’s probably true. But that’s a fallacy by disaccumulation, of type which I’ve found riddles right wing economics. I’ve been forced to come to the conclusion that right wing economics simply can’t (or refuses to) see the macro perspective, and the further right one goes, the greater this hold true.

Bills proposition of forcing people to join the consumer army will no doubt be a disaster for what remains of civilisation.

Its better to live as a monk ( Avoiding consumption that will feed the beast) or as a marthyr ( refusing to pay state taxes or utility bills on natural monopolies )

Bill is a classic socialist – he sees the state as a sentient being

Perhaps it is , but it is certainly not human.

“Bills proposition of forcing people to join the consumer army will no doubt be a disaster for what remains of civilisation.”

“Bill is a classic socialist – he sees the state as a sentient being

Perhaps it is , but it is certainly not human.”

Here’s a tricky question for Libertarians like you. Who shall be the arbiter of enough is enough?

Well a national dividend / inventory would be a good start……

We would then have some idea of a sustainable income without wild banking escapades of capital destruction/ centralization they call growth.

I know that a social credit policy in Ireland would easily reduce capital destruction in half while increasing real end use living standards both of the physical and spiritual kind.

colm mccarthy:

December 5th, 2014 at 2:45 pm

The examples routinely employed in the media are €300,000 or €400,000 houses. In addition to Greg’s point, it is essential to understand that these figures are Dublin figures. €400,000 buys a mansion in most parts of provincial Ireland. €100,000 is enough to buy a decent small semi-d or country cottage in many areas. Anyone who cannot afford a €20,000 deposit in these areas is hardly a viable credit risk.

There is enough empty space around Dublin, the lowest-density urban area in Europe in its size band, to build another city. Opposition to the CB’s proposals is fuelled by an unspoken resistance to facing this issue.’

The words of a well known Irish bank lobbyist who dresses in nationalistic clothes on occasion.

The objective – to inflate the Irish population into the Dublin slum by creating another slum the size of Dublin.

The great advantage of living in Ireland is that you see capitalistic dynamics in a very controlled ecosystem.

Its the galapagos islands of observational economics.

This bank lobbyist will find many socialist friends , I am sure.

In fact I am certain.

Another great project of waste / overproduction awaits us…..,,,

“If we not only want a bigger pie but also more equal slices, then progressive taxation is inevitable.”

That rather assumes that people who get the income currently are actually worth that income and that their income won’t change as the bottom end gets more wages.

Progressives are rather too fond of the ‘holy power of taxation’. They cling to it like a religious icon, and by doing so they foolishly validate the marginal theories of income distribution.

The value of the wealthy is less than the price they charge. You correct the system so that the price they can charge is more in keeping with the value generated. Then you don’t need to tax, because they didn’t get the income in the first place.

How much someone earns is far more influential than their level of educational attainment.

Because I earn around half the average wage it appears that I am assumed to have half the intelligence of the average person – or because I have a degree and earn around half the average wage it is assumed that I am lazy.

Alternatively, A person that earns double the average wage is most likely assumed to be very intelligent and hard working by most people.

THis is whay I cringe when I hear or read about the benefits of education – because overall it’s a complete scam.

The Great White Shark doesn’t rule the seas because it is intelligent. It rules them because it is a narrow minded killing machine. It’s only true enemy is another narrow minded killiong machine known as a human.

Welcome to capitalism.

Now to the facts.

Killer Whales can defeat sharks;

the Great White Shark has an advanced y-shaped brain;and may not actually be as stupid as we are led to beleive.

Moreover, is there conclusive proof that brain size is directly related to intelligence?…. and so on.

It’s all about perception and because people perceive the Great White to be the ultimate predator via what they have seen in movies or indeed in sensationalised mass media reports – then that is what they are going to beleive.

Neo-liberalism and the education myth has also been advanced in a similar fashion to the dumb as a box of rocks masses as well.

Few people feared sharks before Jaws and few people feared not having a University education before the Neo-liberals insisted you were nothing without one.

And yet in the next breath the neo-liberals will argue that just because you have a degree that doesn’t entitle you to earn an above average income.

10mins later there’s an ad on TV stating how people with University degrees earn far more than those that don’t…………

Argggggggghhhhhhhhhhhhhhhhhhh

@Alan Dunn

There is an asnwer to your question of whether there is a direct relation of brain size to intelligence. The answer is that there is not. What is important is the ratio of the size/weight of the brain to the size of the animal. This is why porpoises/Orcas and we are more intelligent than whales and elephants. Such animals as ourselves and porpoises have a bigger brain than the respective bodies actually need to function physiologically, which is the explantory hypothesis.

You may well ask how this is known. It is a “derivation” from empirical data and is based on what is known as the mouse to elephant curve (which, technically, isn’t curved – it is a regression line).

Alan, I should have made clear that the regression line re the brain weight/body weight ratio is a standard linear regression line. While there are non-linear regressions, this is not one of them.

Thanks Larry,

So where does the Great White Shark fit into the scheme of things given that it has a brain which is relatively long yet relatively thin / lightweight ?

Nope. The one, and only reason for taxes is to decrease the money in circulation. The government creates the money, spends it into circulation and then taxes it back out to destroy it so as to somewhat control inflation.

I see the better option there of having a maximum income to go with a minimum income (UBI) and, of course, the renationalisation of natural monopolies into state ownership to be run as a government service and not as a profit making machine.

genuine questions for Neil.

What mechanism do you envisage will drop earnings at the

very top to reflect value contributed?

Do not asset price speculations contribute most to the income and

wealth of the elite?

@neil Wilson

How do you get value pricing of wages when shareholders can’t even control the obscene wages gym at CEOs and boards set for themselves? They are out of control and it seems the only way to reduce he incentive for crazy wages is through taxation. What do you think?

@Neil Wilson

“The value of the wealthy is less than the price they charge. You correct the system so that the price they can charge is more in keeping with the value generated. Then you don’t need to tax, because they didn’t get the income in the first place.”

The main issue is the CEO’s and boards are setting obscene wages that even shareholders can’t control. How can we reduce the incentive in any way other than the tax system if the free market can’t do it and the shareholders can’t control it. Warren Buffet has spoken out about the crazy wages these CEO’s are getting, yet when the CEO of coke gave himself a huge wage increase even Buffet couldn’t do anything about it. It’s a big problem and Piketty talks about this and how the USA originally invented progressive taxation purely so they wouldn’t end up with inequality like Europe in the gilded age.

If there’s other ways to achieve this I’d like to hear them

Alan, it isn’t about the shape of the brain that matters so much, but how much it weighs compared against the weight of the body. I don’t remember its precise position in the curve, but I can say that the Great White is stupider than the Orca, which hunts in packs. They are related to the dolphins. With this ratio in mind, it is easy to see why dolphins and porpoises are smarter than whales, whom the Orcas hunt and kill.

Orcas can also hunt and kill dolphins and porpoises. Dumber animals hunt and kill smarter animals all the time. Komodo dragons, crocodiles, sharks etc., have been known to kill tourists and other humans recreating in their territory and/or hunting ranges. Then again are tourists really smarter than komodos or surfies smarter than great whites? One has to wonder when they go blundering into a wild animal’s natural range. 🙂