Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

Saturday Quiz – February 7, 2015 – answers and discussion

Here are the answers with discussion for yesterday’s quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of modern monetary theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

Whenever there is an external sector deficit, which is draining overall spending in the domestic economy, the private domestic sector (households and firms) can only save overall if the government sector runs a deficit or balances its fiscal position.

The answer is False.

The answer is false because if the external sector overall is in deficit, then it is impossible for both the private domestic sector and government sector to run surpluses or for the government sector to run a balance. One of those two has to also be in deficit to satisfy the accounting rules.

The national accounts concept underpin the basic income-expenditure model that is at the heart of introductory macroeconomics. We can view this model in two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

So from the sources perspective we write:

GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

From the uses perspective, national income (GDP) can be used for:

GDP = C + S + T

which says that GDP (income) ultimately comes back to households who consume (C), save (S) or pay taxes (T) with it once all the distributions are made.

So if we equate these two perspectives of GDP, we get:

C + S + T = C + I + G + (X – M)

This can be simplified by cancelling out the C from both sides and re-arranging (shifting things around but still satisfying the rules of algebra) into what we call the sectoral balances view of the national accounts.

(I – S) + (G – T) + (X – M) = 0

That is the three balances have to sum to zero. The sectoral balances derived are:

- The private domestic balance (I – S) – positive if in deficit, negative if in surplus.

- The Budget Deficit (G – T) – negative if in surplus, positive if in deficit.

- The Current Account balance (X – M) – positive if in surplus, negative if in deficit.

These balances are usually expressed as a per cent of GDP but that doesn’t alter the accounting rules that they sum to zero, it just means the balance to GDP ratios sum to zero.

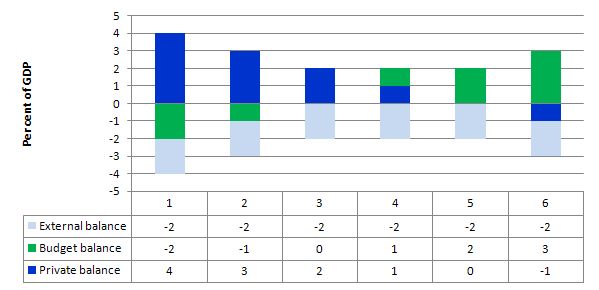

Consider the following graph and associated table of data which shows six states. All states have a constant external deficit equal to 2 per cent of GDP (light-blue columns).

State 1 show a government running a surplus equal to 2 per cent of GDP (green columns). As a consequence, the private domestic balance is in deficit of 4 per cent of GDP (royal-blue columns).

State 2 shows that when the fiscal surplus moderates to 1 per cent of GDP the private domestic deficit is reduced. State 3 is a fiscal balance and then the private domestic deficit is exactly equal to the external deficit. So the private sector spending more than they earn exactly funds the desire of the external sector to accumulate financial assets in the currency of issue in this country.

States 4 to 6 shows what happens when the fiscal balance goes into deficit – the private domestic sector (given the external deficit) can then start reducing its deficit and by State 5 it is in balance. Then by State 6 the private domestic sector is able to net save overall (that is, spend less than its income).

Note also that the government balance equals exactly $-for-$ (as a per cent of GDP) the non-government balance (the sum of the private domestic and external balances). This is also a basic rule derived from the national accounts.

Most countries currently run external deficits. The crisis was marked by households reducing consumption spending growth to try to manage their debt exposure and private investment retreating. The consequence was a major spending gap which pushed fiscal balances into deficit via the automatic stabilisers.

The only way to get income growth going in this context and to allow the private sector surpluses to build was to increase the deficits beyond the impact of the automatic stabilisers. The reality is that this policy change hasn’t delivered large enough fiscal deficits (even with external deficits narrowing). The result has been large negative income adjustments which brought the sectoral balances into equality at significantly lower levels of economic activity.

The following blogs may be of further interest to you:

- Barnaby, better to walk before we run

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

Question 2:

The debt issued by a currency-issuing government in its own currency is not really a liability because the government can just roll it over continuously and thus they never have to pay it back. This is different to a household, which not only has to service its debt but also has to repay them at the due date.

The answer is False.

As a matter of clarification, it was assumed that it was debt issued in the currency of issue which is why I put the qualifier in brackets.

First, households do have to service their debts and repay them at some due date or risk default. The other crucial point is that households also have to forego some current consumption, use up savings or run down assets to service their debts and ultimately repay them.

Second, a sovereign government also has to service their debts and repay them at some due date or risk default. No different there. But, unlike a household it does not have to forego any current spending capacity (or privatise public assets) to accomplish these financial transactions.

But the public debt is a legal obligation on government and so is totally a liability.

Now can it just roll-it over continuously? Well the question was subtle because the government can always keep issuing new debt when the old issues mature and maintain a stable (or whatever). But as the previous debt-issued matures it is paid out as per the terms of the issue. So that nuance was designed to elicit specific thinking.

The other point is that the liability on a sovereign government is legally like all liabilities – enforceable in courts the risk associated with taking that liability on is zero which is very different to the risks attached to taking on private debt.

There is zero risk that a holder of a public bond instrument will not be paid principle and interest on time.

The other point to appreciate is that the original holder of the public debt might not be the final holder who is paid out. The market for public debt is the most liquid of all debt markets and trading in public debt instruments of all nations is conducted across all markets each hour of every day.

While I am most familiar with the Australian institutional structure, the following developments are not dissimilar to the way bond issuance (in primary markets) is organised elsewhere. You can access information about this from the Australian Office of Financial Management, which is a Treasury-related public body that manages all public debt issuance in Australia.

It conducts the primary market, which is the institutional machinery via which the government sells debt to the non-government sector. In a modern monetary system with flexible exchange rates it is clear the government does not have to finance its spending so the fact that governments hang on to primary market issuance is largely ideological – fear of fiscal excesses rather than an intrinsic need. In this blog – Will we really pay higher interest rates? – I go into this period more fully and show that it was driven by the ideological calls for “fiscal discipline” and the growing influence of the credit rating agencies. Accordingly, all net spending had to be fully placed in the private market $-for-$. A purely voluntary constraint on the government and a waste of time.

A secondary market is where existing financial assets are traded by interested parties. So the financial assets enter the monetary system via the primary market and are then available for trading in the secondary. The same structure applies to private share issues for example. The company raises funds via the primary issuance process then its shares are traded in secondary markets.

Clearly secondary market trading has no impact at all on the volume of financial assets in the system – it just shuffles the wealth between wealth-holders. In the context of public debt issuance – the transactions in the primary market are vertical (net financial assets are created or destroyed) and the secondary market transactions are all horizontal (no new financial assets are created). Please read my blog – Deficit spending 101 – Part 3 – for more information.

Primary issues are conducted via auction tender systems and the Treasury determines the timing of these events in addition to the type and volumne of debt to be issued.

The issue is then be put out for tender and the market determines the final price of the bonds issued. Imagine a $A1000 bond is offered at a coupon of 5 per cent, meaning that you would get $A50 dollar per annum until the bond matured at which time you would get $A1000 back.

Imagine that the market wanted a yield of 6 per cent to accommodate risk expectations (see below). So for them the bond is unattractive unless the price is lower than $A1000. So tender system they would put in a purchase bid lower than the $A1000 to ensure they get the 6 per cent return they sought.

The general rule for fixed-income bonds is that when the prices rise, the yield falls and vice versa. Thus, the price of a bond can change in the market place according to interest rate fluctuations.

When interest rates rise, the price of previously issued bonds fall because they are less attractive in comparison to the newly issued bonds, which are offering a higher coupon rates (reflecting current interest rates).

When interest rates fall, the price of older bonds increase, becoming more attractive as newly issued bonds offer a lower coupon rate than the older higher coupon rated bonds.

So for new bond issues the AOFM receives the tenders from the bond market traders. These will be ranked in terms of price (and implied yields desired) and a quantity requested in $ millions. The AOFM (which is really just part of treasury) sometimes sells some bonds to the central bank (RBA) for their open market operations (at the weighted average yield of the final tender).

The AOFM will then issue the bonds in highest price bid order until it raises the revenue it seeks. So the first bidder with the highest price (lowest yield) gets what they want (as long as it doesn’t exhaust the whole tender, which is not likely). Then the second bidder (higher yield) and so on.

In this way, if demand for the tender is low, the final yields will be higher and vice versa. There are a lot of myths peddled in the financial press about this. Rising yields may indicate a rising sense of risk (mostly from future inflation although sovereign credit ratings will influence this). But they may also indicated a recovering economy where people are more confidence investing in commercial paper (for higher returns) and so they demand less of the “risk free” government paper.

So while there is no credit risk attached to holding public debt (that is, the holder knows they will receive the principle and interest that is specified on the issued debt instrument), there is still market risk which is related to movements in interest rates.

For government accounting purposes however the trading of the bonds once issued is of no consequence. They still retain the liability to pay the fixed coupon rate and the face value of the bond at the time of issue (not the market price).

The person/institution that sells the bond before maturity may gain or lose relative to their original purchase price but that is totally outside of the concern of the government.

Its liability is to pay the specified coupon rate at the time of issue and then the whole face value at the time of maturity.

There are complications to the primary sale process – some bonds sell at discounts which imply the coupon value. Further, there are arrangements between treasuries and central banks about the way in which public debt holdings are managed and accounted for. But these nuances do not alter the initial contention – public debt is a liability of the government in just the same way as private debt is a liability for those holders.

The following blog may be of further interest to you:

Question 3:

The Greek crisis would be significantly eased if it could improve its tax collection arrangements to ensure that it had more financing available to cover its spending.

The answer is True.

The Greek government effectively is like a state in a federal system where the central bank determines the interest rate (which may or may not be appropriate for the conditions in the particular sub-region in the system) and issues currency.

The state-federal analogy is a bit stretched when it comes to the Eurozone (EMU) because federal systems always have a national fiscal capacity which provides the capacity to redistribute spending across regions to meet specific demands. For ideological reasons (conservative economic beliefs), the EMU deliberately did not incorporate such a capacity into its system which is a glaring weakness that is now being exposed in the current crisis.

The Greek government is bound by the same rules that bound nations when there was a gold standard and currencies were convertible. In this case there is only one currency which is not issued by the Greek government.

Under the gold standard as applied domestically, existing gold reserves controlled the domestic money supply. Given gold was in finite supply at the time, it was considered linking the money supply to the quantity of gold available, would provide a stable monetary system.

Shifts in a nation’s gold reserves reflected (largely) trade relationships and deficit nations had to ship gold to surplus nations (as all trade imbalances were reconciled via gold shipments).

Gold reserves restricted the expansion of bank reserves and the supply of high powered money (Government currency). The central bank thus could not expand their liabilities beyond their gold reserves (although it is a bit more complex than that). In operational terms this means that once the threshold was reached, then the monetary authority could not buy any government debt or provide loans to its member banks.

As a consequence, bank reserves were limited and if the public wanted to hold more currency then the reserves would contract. This state defined the money supply threshold.

So a nation with an external deficit was faced with the prospect of persistent domestic recession as they had to shrink the money supply when they lost gold.

The concept of (and the term) monetisation comes from this period. When the government acquired new gold (say by purchasing some from a gold mining firm) they could create new money. The process was that the government would order some gold and sign a cheque for the delivery. This cheque is deposited by the miner in their bank. The bank then would exchange this cheque with the central bank in return for added reserves. The central bank then accounts for this by reducing the government account at the bank. So the government’s loss is the commercial banks reserve gain.

The other implication of this system is that the national government can only increase the money supply by acquiring more gold. Any other expenditure that the government makes would have to be “financed” by taxation or by debt issuance. The government cannot just credit a commercial bank account under this system to expand its net spending independent of its source of finance.

As a consequence, whenever the government spent it would require offsetting revenue in the form of taxes or borrowed funds.

With the move away from the strict gold standard and to US-dollar convertibility, the monetary system which prevailed in the Post World War 2 period up until its collapse in 1971, little changed.

Monetary policy had to defend the currency parity agreed by the nations and so an external deficit country had to endure money supply contractions and domestic recession. Fiscal policy had to ensure it did not compromise the external parity by generating income growth that would drive imports faster than exports. It was a balancing game and for most nations biased towards sluggish domestic conditions.

That is why the system collapsed and was replaced by the fiat monetary system.

But in signing up for the EMU, all member governments reinstated the constraints that were imposed (voluntarily by the system of currency convertibility).

All Greek government spending has to be financed. That can come from taxation or debt-issuance. However, in the current crisis, the bond markets are exacting premium rates (above the benchmark German bond rate) from the Greek government which is further straining their public finances.

It is known that the system of tax collection is fairly inefficient in Greece for various reasons that are not germane to our interests here and for which I am not qualified to speak anyway. So it follows that when a government is revenue-constrained as all the EMU nations are – anything that improves the efficiency of the tax collection process will reduce their need to issue debt (into a hostile market) and ease the fiscal pressures they are facing.

The following blogs may be of further interest to you:

“Comments as usual welcome, especially if I have made an error.”

You made an error or two on the Crikey blog, Bill.

Would be good if you could correct that.

No hurry.

Thanks,

Alan A

Dear Alan Austin (at 2015/02/08 at 10:21)

You said that:

There were no errors in my piece on the Crikey article.

The only outstanding issue appears to be that you believe you were the first to comment on the rising federal debt over 2014 and took exception to my statement that there was nothing ‘breaking’ about your article (other than of course it analysed a recently released data publication).

But the mainstream press had already commented on the rising federal debt as part of the MYEFO discussions in mid-December.

You asked me:

There were several references to it in the mainstream business and economics media.

For example, on December 15, 2014, Peter Hartcher wrote about it.

See http://www.smh.com.au/comment/joe-hockeys-myefo-spells-end-of-australian-economic-boom-20141215-127pwh.html

That is all I will say on that matter.

best wishes

bill

Regarding number 3, the question was whether taxation would significantly ease the Greek crisis, not whether it would relieve pressure on government finances. Since the overall problem in Greece is a lack of demand, how would taxation lead to other than a marginal increase in spending and thus fail to resolve the crisis?

Read this authority!

https://billmitchell.org/blog/?p=30037

> The reality is that Greece needs a public stimulus that is way beyond anything that is allowed under the current rules.

>

> A balanced budget position doesn’t resolve that issue.

Question 2: Answer in German – Wenn eine Regierung mit eigener Währung Produkte und Dienste kauft und diese mit eigener Währung bezahlt, dann gibt es nur eine virtuelle Schuld gegenüber der Zentralbank, solange diese die virtuelle Schuld nicht an den Privatsektor oder das Ausland verkauft. Behält die Zentralbank die Anleihe in ihrem Depot, dann gibt es keinerlei Forderungen nach Zinsen oder Tilgung der virtuellen Schulden seitens des Privatsektors oder des Auslands. Solche virtuellen Schulden verwandeln sich real in öffentliches Eigentum, Infrastruktur im weitesten Sinne und müssen nie zurückgezahlt werden. Eine Tilgung solcher fiktiver Schulden ist nur realisierbar, wenn öffentliches Eigentum privatisiert wird, zu Herstellungskosten an den Privatsektor verkauft wird; dann kann die Regierung das eingesammelte Geld an die Zentralbank zurückgeben und damit einen großen Teil der virtuellen Schulden tilgen. Ob das in Zeiten maroder Infrastruktur eine sinnvolle Forderung sein kann, das ist zu bezweifeln.

Great quiz Bill.

Always fun for the whole family.

“It is known that the system of tax collection is fairly inefficient in Greece for various reasons”

I answered [b]false[/b] for question 3 because my thinking was:

If Greece had improved the efficiency of its taxation system to the level of say Germany (twice as efficient also presumably changed the portfolio of the private sector to be made up of less self employed).

It would only have put the government in a fiscal position at best similar to Ireland prior to the GFC.

eg:Ireland went from balance to a 14 percent deficit.

Automatic stabilisers would still have pushed the government into deficit anyway, been insuficcient to halt the downturn and the response was always going to be austerity. And the question says “significantly eased” i would have thought it would just shuffle greece into the middle of the pack for EU states hit hardest by the crisis.

That is the impression i got from:

For example in Options for Europe – Part 55,56

Thanks once again!

Bill,

Yes I was thinking along the similar lines to Sam and answered FALSE for Q3

If Euros are collected as efficiently as they ‘should be’ in the taxation net, doesn’t that mean they stay in the economy longer and enable extra financial transactions which adds a stimulus to Greek economy -albeit the black economy? So, as the official economy contracts, the black economy expands.

I suppose it then a matter of deciding whether the black economy is capable of easing the crisis. It’s probably only that which is enabling many to survive in Greece right now.

What I have noticed about these true/false quizzes is that while they are often great for edification, they are terrible for grading purposes; but, that is irrelevant for us. That is someone who knows the material very well but is tripped up on a fine point or two would score worse that someone who does not know the material at all but has better-than-average luck in guessing. I just hope Bill leaves the true/false tests for us and does not use them with his students.

Dear Gregory Long (at 2015/02/09 at 8:00)

All points taken about True/False testing. I never used them with my students. They are just a bit of fun for the weekend with the main intended pedagogic impact being the extended discussion supplied each Sunday.

best wishes

bill

Hi, the RBA doesn’t buy bonds directly from the AOFM for market operations purposes per se. It used to run the AOFM’s small investor (retail) facility, so the first time the AOFM issued a new bond line, the RBA would buy a small amount as a float for the facility. This facility has closed and has been replaced by chess depositary interests, aka ‘eTBs’. The RBA will, however, regularly hold paper issued by the government as collateral under repo transactions as part of its open market operations. Also, the RBA might buy soon to mature bonds to reduce the impact on system liquidity at maturity. Hope this helps.