It was only a matter of time I suppose but the IMF is now focusing…

A Greek exit could not be more costly than the current path

It appears the Germans (with their Finish and Slovak cronies) have lost all sense of reason, if they ever had any. Germany has the socio-pathological excuse of having suffered from an irrational ‘inflation angst’ since the 1930s and has forgotten its disastrous conduct during the 1930s and 1940s and also the generosity shown it by allied nations who had destroyed its demonic martial ambitions. Finland and Slovakia have no such excuse. They are just behaving as jumped-up, vindictive show ponies who are not that far from being in Greece’s situation themselves. Sure the Finns have a national guilt about their own notorious complicity with the Nazis in the 1940s but what makes them such a nasty conservative ally to the Germans is an interesting question. It also seems to be hard keeping track with the latest ‘negotiating offer’ from either side. But the trend seems obvious. The Greeks offer to bend over further and are met by a barrage of “it is going to be hard to accept this”, followed by a Troika offer (now generalised as the Eurogroup minus Greece which is harsher than the last. And so it goes – from ridiculous to absurd or to quote a headline over the weekend – From the Absurd to the Tragic, which I thought was an understatement. There are also a plethora of ‘plans’ for Greece being circulated by all and sundry – most of which hang on to the need for the nation to run ‘primary fiscal surpluses’, with no reference to the scale of the disaster before us (or rather the Greek people). It is surreal that this daily farce and public humiliation (like the medieval parading of a recalcitrant in stocks) is being clothed as ‘governance’. Only in Europe really.

We now know that the Eurogroup is not content to destroy the credibility of the Greek government and have the Greek prime minister come cap in hand begging for money and agreeing to turn his back on the sentiments of his own people, expressed so strongly last Sunday.

The latest document from the Recession Cult “has demanded even deeper measures from Athens, which Euclid Tsakalotos has apparently acceded to” (Source).

They now want a “primary surplus target of 3.5 percent of GDP by 2018”, much deeper pension cuts, widespread product market deregulation, a more comprehensive privatisation program (so that the northern capital owners can get their hands on Greek assets for cheap), massive deregulation of the labour market, wind-back legislation since the beginning of 2015 “which have not been agreed with the institutions and run counter to the program commitments” and put all of that on top the harsh austerity that has already been pushed leading into the referendum.

The sentiment is that Germany is not going for an exit for Greece but “total … submission and probably a new government by … end of the week”.

Well that document was then overtaken by the public release (via leak) of the “four-page document that … [proposed] … Greece leaving the euro temporarily by taking a “time-out” from the currency bloc” and sequestering more than “€50bn worth of assets as collateral for new loans and for eventual privatisation.”

But the ‘climax’ of the public ‘caning’ (torture, whatever you want to call it), came late yesterday, when the German Chancellor proposed that Greece:

… surrender of fiscal sovereignty as the price of avoiding financial collapse and being ejected from the single currency bloc. (Source)

The process yesterday whereby Tsipras and his Finance Minister were subject to threats, moral lectures and ultimate humiliation was described by a “senior EU official” as an “exercise in extensive mental waterboarding”.

The same senior EU official said the increased harshness of the measures was “payback for the emphatic no to the creditors’ terms delivered by the snap referendum that Tsipras staged a week ago.”

Vengeance by the powerful elite. A most venal strategy to destroy the weak.

So finally, the Troika will “occupy” Greece, the first time that a foreign power has occupied an advanced European nation since you know when.

The Troika’s creepy, mindless, neo-liberal Groupthink-besotted economists and officials will parade around Athens in their expensive suits lording it over a suffering nation as part of the occupation and take-over.

Apparently, this is to “monitor the proposed bailout programme”.

The Troika would edit “legislation before it is presented to parliament” and force timetables of policy change through the Greek legislature.

But soon the Greek government will be no more – Tsipras’s stupidity has engineered a massive split in his ranks and the Guardian is now reporting that the rejection of the bailout by many of his MPs has stripped “his government of a working majority”.

The Troika chalks up success number X – they wanted regime change all along. There were photos of the New Democracy leader from Greece swanning around Brussels during the weekend’s torture, presumably telling the Troika that he would deliver whatever they wanted with relish. Appalling.

Tsipras, seemingly on another planet, is still talking about all this as a “compromise”. He obviously is not up to it.

What led them into all this, way back then, was the Franco-German rivalry, that is a long-standing thorn in the side of European prosperity and cooperation. Its permeated into the Eurozone design once the US Monetarists took over the brains of the French economists in the 1970s.

The French had previously understood that statehood was about advancing the well-being of all citizens and providing jobs and economic security for them. Once they became infested with the Monetarist-neo-liberal Groupthink, it was easy for a wannabee like Jacques Delor to sell out to the Germans and come up with the Maastricht plan.

Well, the Franco-German rivalry is still apparent and that will be an on-going Act in this Tragedy as the supremacy of the Germans (backed by those pitiful Finns and Slovaks) strengthens in the face of the Greek capitulation.

Two weeks ago, Merkel was running around like a headless chook – having had her bluff called by the referendum call. Now she is the boss lady along with Madame Lagarde.

The former boss of the German Social Democratic Party (SDP) – Oskar Lafontaine – who became German Finance Minister for a short period (October 27, 1998 to March 18, 1999) in the first government of Gerhard Schröder after he helped undermine Helmut Kohl’s Chancellership in the 1998 Federal elections, has pronounced (Source):

Der Euro ist gescheitert …

In English, “the euro has failed”.

For those not familiar with the history of the late 1990s, Lafontaine, as German Finance Minister, led the German charge against the British Euroskeptics.

In the current era, the right-wing fanatical Dutch politician Geert Wilders has been labelled “Europe’s most dangerous man”.

According the UK Sun newspaper, he competes for that title with European Commission boss Jean-Claude Juncker, who they labelled a “ruthless opportunistt … who admits lying and backs secret debates on European finances”.

But in 1998, the Sun newspaper had a different public enemy No. 1 – Oskar Lafontaine.

All was explained in this ‘Saturday profile” in the British Independent (November 28, 1998) – The Saturday Profile: Oskar Lafontaine: Europe’s most dangerous man?.

The Murdoch press (the Sun) had been raving on about “Gallic-Teutonic monsters” for some time as the spectre of Europe was seen to be a basic threat to British independence. Lafontaine encapsulated that threat.

Most recently, Lafontaine gave an interview to the Magazine section of Der Spiegel (29/2015), which carried the title noted above – Der Euro ist gescheitert.

He said the the Euro is a step backwards in the path to European integration. The people of Europe are not moving closer together but are, instead, becoming more estranged from each other. He cited the rise of extreme right groups, like the National Front in France as a dangerous trend.

He said the crucial error in the formation of the monetary union was not to have first, created a political union. Without a truly European government with fiscal authority, the common currency could not operate effectively.

He says that is what is now patently obvious. With wages flat and growth in Germany being driven by a mercantlist export mania, the neighbouring nations such as France and Italy are slowly losing their industrial market shares. He also said that the German model cannot be the basis for a European agreement.

It is not the first time he has said this. Back in May 2013, he referred to the monetary union as the “catastrophic euro” (Source).

At that point he called for the EMU to be abandoned. He said that the way the monetary union had unfolded was “leading to disaster” and “unemployment has reached a level that puts democratic structures ever more in doubt”.

He particularly though that “Germany’s strong-handed tactics in carrying out internal devaluations in Spain, Portugal, and Greece” were generating catastrophic effects.

In terms of domestic wage freezes in Germany, he considered these were just a “self-serving” strategy “to improve their own export niche”.

He said:

The Germans have not yet realized that southern Europe, including France, will be forced by their current misery to fight back against German hegemony sooner or later …

Hubris and nemesis!

In his latest Jacobin interview (July 10, 2015) – From the Absurd to the Tragic – Greek Syriza politician and leader of the Left platform Stathis Kouvelakis, invokes the ideas from ancient Athenian mythology – hubris and nemesis.

Hubris was the Greek god of arrogance, excessive self pride and self-confidence who engaged in “the intentional use of violence to humiliate or degrade” (Source).

And you know what happened to those who became so full of themselves that they disregarded (according to the Athenians) “the divinely fixed limits on human action in an ordered cosmos”?

In the so-called “shame culture” of Classical Greece, people saw hubris as a guide to avoid “shame” and seek “honour”.

But just in case, there was – Nemesis – the goddess of “distribution”, who brought “divine retribution against those who succumb to hubris”.

Nemesis distributed fortunes according to “what was deserved” – she dished out justice in other words.

There is some role for Nemesis now in this modern Greek tragedy. And one suspects that those up North in Europe are the ones that will ultimately suffer in all of this, but perhaps not to the scale of the suffering they are inflicting on the South.

Humiliation! At least the Italian Prime Minister Matteo Renzi has the courage today to tell Germany that “Humiliating a European partner after Greece has given up on just about everything is unthinkable … the humiliation of Greece must stop” (Source).

There have been several ‘plans’ circulated in the last few days by commentators outside of the so-called negotiations as to how to resolve this human tragedy.

One such plan came from a couple of German-based researchers – A Workable Reform Programme For Greece – which insists that the “rules and regulations” of the Eurozone are maintained and Greek obeys them.

Not a good start.

It wants Greece to continue paying its toxic (my word) public debt obligations and suggests that the EU structural fund stump up €35 billion to provide funding for investment in Greece.

The money, by the way, is due under EU regulations to Greece, but this fund requires euro-for-euro matched commitments by the national government and Greece “simply didn’t have the money” to participate in the scheme.

Why not? Because it was paying back bailout money that was largely going to external interests rather than stimulating the Greek economy.

So this proposal maintains this drain of Greek ‘growth’ dividends (the growth coming from the investment) by claiming that Greece has to “achieve a primary surplus of 2% of GDP” until at least 2019 or 2020.

In recommending that they also note that a “binding step of this kind is subject to economic risks since a worse-than-expected economic environment always brings spending cuts that damage the economy or push up debt”.

Yes, we already know that austerity fails, so why recommend it? They just cannot break out of the Groupthink no matter how ‘helpful’ they want to be.

There can be no legitimate case for the Greek government running primary surpluses at this time. They need substantial fiscal deficits to stimulate growth.

An investment of €35 billion from external funds, while helpful, would not be anywhere near sufficient to get the economy back on a growth path.

Another plan came from the “Left Platform of Syriza” and is labelled – The Alternative to Austerity.

It at least confronts the reality – Greece has to exit and “interrupt” the debt repayments unless austerity within the Eurozone is abandoned.

It recognises that the Troika have resorted to “blackmail” and that the Greek government should instead only agree to:

… a program without any further austerity, providing liquidity, and leading to debt cancellation, or exit from the euro and default on the repayment of an unjust and unsustainable debt.

And moreover, they recognise that austerity is tantamount to any insistence of “primary surpluses and balanced budgets” and that “exit from the euro” and the:

… cancellation of the major part of the debt … are absolutely manageable choices that can lead to a new economic model oriented towards production, growth, and the change in the social balance of forces to the benefit of the working class and the people.

They note that exit is a “feasible process” that saves Greece from “the unacceptable programs included in the Juncker package”.

They appear, however, to only see exit in terms of the current bailout discussions rather than the broader issue of the basic dysfunction of the monetary union, as noted above by Oskar Lafontaine. Exit is the option that all Eurozone nations should plan unless the basic architecture of the monetary union is radically altered to create a true fiscal union.

The Left Platform of Syriza appears to be the only Greek political element that understand that exit would:

1. Restore “monetary sovereignty” and allows the financial system (banking etc) to be safeguarded.

2. Provide the capacity to invest in Greek infrastructure and engender employment growth.

3. Aid the development of productive enterprises.

4. Bring “fiscal justice and redistribution of wealth and income”.

5. Accelerate growth and reduce unemployment.

They also understand that being part of the EMU does not mean you are European just as leaving the EMU does not take away a nation’s status as being European.

Last year, I analysed the third-quarter Greek national accounts data to get some perspective on the scale of the problem confronting the nation – in terms of the data. Please read my blog – Greece – return to growth demonstrates the role of substantial fiscal deficits – for more discussion on this point.

To try to understand what an investment injection of €35 billion (as proposed above) would mean, given that the nation would continue to run fiscal surpluses, I spent a bit of time yesterday considering the most recent national accounts, trade and labour force data for Greece.

While it is common knowledge that the Greek economy has shrunk by around 26 per cent in real terms since 2008, it is less understood what a recovery path might look like.

The stark reality is that the Troika’s austerity has inflicted such a scale of damage that even recovery will be decades in the making if there is not a radical change of direction away from austerity.

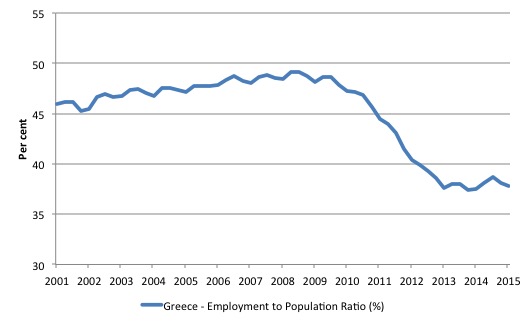

Consider the following graph which shows the Employment to Population ratio (employment as a percentage of the population above 15 years) in Greece from the March-quarter 2001 to the March-quarter 2015 (blue solid line). This is the data drawn from the quarterly labour force survey conducted by the Hellenic Statistical Authority (El.Stat) – Labour Force data.

The ratio has dropped from a peak of 49.2 per cent in the September-quarter 2008 to 37.8 per cent. This is incredibly low by international standards. Nations such as Australia have EPOP ratios around 61 per cent.

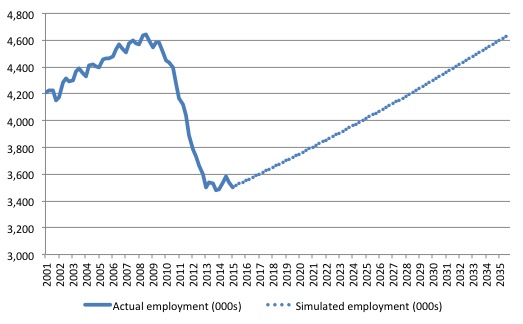

The next graph show the evolution of total employment over the same period.

The peak employment level was 4639.6 thousand achieved in the September-quarter 2008. Then the sudden drop occurred as the Troika closed in on the Greek government and the conservative Greek government surrendered as the pressure was put on them to inflict austerity.

Between the peak quarter (September 2008) and the trough quarter (December 2013), Greece lost 1,159.7 thousand jobs or 25 per cent of their total employment base.

Unemployment rose by 973.2 thousand (27.8 per cent) from 364 thousand (7.3 per cent).

There was a slight reprieve in job loss in mid-2014, but since then the economy has contracted again and employment is falling again.

The dislocation associated with the current craziness will see substantial losses in the coming quarters as Greece sinks back into deep Depression (worse than recession).

But the employment losses are massive already and have been caused by the imposition of the fiscal austerity and the obsession with fiscal surpluses.

There is no doubt that an early exit in 2009, when it was obvious the Eurozone was a failed structure (it was obvious before that – like in 1991 it was obvious it would be), that these employment losses could have been avoided.

I recalculated a prospective future employment growth trajectory as a mental exercise and the result is captured by the blue dotted line.

Suppose that total employment in Greece grows steadily from this point forward (latest data is for March-quarter 2015) at the average quarterly rate of growth that was achieved between the March-quarter 2001 and the peak September-quarter 2008.

In historical terms, that was a fairly robust rate of employment growth – almost what we might call exceptional.

That average growth was 0.3 per cent per quarter. The blue dotted line then simulated total employment growing steadily at that rate – note it is the same slope as the earlier growth period without the little real-world wobbles.

I kept pushing out the projection until the new total employment level was once again equal the September-quarter 2008 peak.

Past 2020 I went, past 2025, past 2030, until the extrapolation ends in the December-quarter 2034.

This suggests that even under very favourable growth conditions (which were evident before the crisis), it will take Greece another 20 years from now to regain the employment lost by the imposed policy austerity.

And by then the population will have continued to grow modestly. The average labour force growth over the 2001-2008 period was 0.2 per cent. So employment growth before the crisis was slightly faster than the underlying population growth which allowed the unemployment rate to fall slightly.

Assuming the labour force growth matched its previous average, then by 2034, when employment finally catches up with where it was in the September-quarter 2008, unemployment will still be 937.3 thousand or 16.8 per cent of the labour force.

These numbers are not wild guesses and they are on the optimistic end of the scale. It could be that the situation in Greece remains so dire that labour force growth doesn’t occur (it is currently negative) as people leave the nation looking for opportunities elsewhere.

The nasty little Baltic states which are among the shrill chorus berating Greece for daring to challenge their ‘Austerity Path to Oblivion’ model of nationhood, have seen substantial reductions in their population. That is one of the reasons that ratios that put the population or labour force in the denominator (like unemployment rates etc) look better now.

It is certain that if Greece follows the austerity path any longer it will gradually become a geriatric state as its youth abandon the nation in search of better opportunities elsewhere. They along with the skilled workforce.

Given employment growth even under favourable conditions is unlikely to be as high as it was pre-crisis, the situation will remain worse than this simulation might suggest.

Unemployment will remain very high for decades.

But then we know that austerity will not produce such growth rates remotely like those that Greece has achieved before the crisis.

Then the situation becomes more dire than one could imagine. Then Nemesis has to enter the picture but at a much delayed time with the damage done by the hubris irrecoverable.

The other point is that productivity growth is now negative again in Greece despite the massive internal devaluation that has occurred (wage cuts etc).

This brings into question the logic of internal devaluation which is meant to stimulate external competitiveness. But if productivity falls as unit costs are falling, there is no certainty that competitiveness rises.

It is far better to stimulate gains in competitiveness by a high wage, high productivity culture. The exact opposite of austerity and internal devaluation.

On the national account front, the labour market damage is replicated by what is happening to output growth and capital formation.

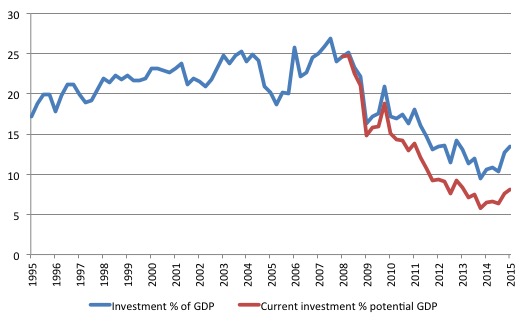

The following graph shows the evolution of the investment ratio (total gross capital formation as a percentage of GDP) since 1995 (blue line). It has dropped from a pre-crisis peak of 25.1 per cent to an abysmal 13.5 per cent.

Of course, that is based on the actual GDP path which, as we know, as declined by 26 per cent since the pre-crisis peak.

If you extrapolate the growth path out based on pre-crisis trend growth rates and recalculate the investment ratio in terms of this ‘potential’ GDP, the current ratio would be 8 per cent.

Almost unbelievable.

If gross capital formation was to once again be 25 per cent of GDP and if GDP had have kept growing on trend, then Greece now has a shortfall of around €13,666.7 million, which makes the €35 billion proposal look decidely wan.

Conclusion

The question remains: Is being able to have a euro in your pocket worth the sort of sustained income losses outlined above?

I cannot construct any situation where you could possible answer yes to that question.

In one news report (Source) – an unnamed European Commission official was quoted as saying:

No one wants to see a North Korea in south-eastern Europe

No, that would conflict with the ‘North Korean-like’ installation in Brussels, Frankfurt and Washington.

An exit is not rocket science. But it surely is better than the future that Greece is facing under the conditions that now appear to forming the latest bailout options.

Advertising: Special Discount available for my book to my blog readers

My new book – Eurozone Dystopia – Groupthink and Denial on a Grand Scale – is now published by Edward Elgar UK and available for sale.

I am able to offer a Special 35 per cent discount to readers to reduce the price of the Hard Back version of the book.

Please go to the – Elgar on-line shop and use the Discount Code VIP35.

Some relevant links to further information and availability:

1. Edward Elgar Catalogue Page

2. You can read – Chapter 1 – for free.

3. You can purchase the book in – Hard Back format – at Edward Elgar’s On-line Shop.

4. You can buy the book in – eBook format – at Google’s Store.

It is a long book (501 pages) and the full price for the hard-back edition is not cheap. The eBook version is very affordable.

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.

It may be true that Tsipras is determined that Greece will not leave the Eurozone. However in my view the reality is that he holds the whip hand in any genuine negotiations with the Troika, which he is refusing to use. I agree with you Bill, that he is simply not up to the job. This is contrary to the perceptions held by most of those who write for the mass media, who are feeding us a storyline about meaningful negotiations taking place.

The reason for this is very simple. The Greek people have much to gain and almost nothing to lose by a Grexit from the Eurozone, while the autocrats who control the European economy have everything to lose if the Greeks decide to repudiate their crushing debt burden. The latter are well aware of this and are brainlessly playing chicken. That is their style, and they are emboldened in this endeavour by the Syriza government’s capitulation on almost every front – grounded in their apparently willingness to do almost anything to remain within the Eurozone.

The “negotiations” are really a sham, because Tsipras is simply unwilling to effectively use the negotiating power that has been handed to him on a plate – care of the referendum result.

You are correct Bill. It has become surreal. Europe is headed for serious trouble at this rate. One dearly wishes the Greeks would have the courage for a Grexit. It’s the only way they have any hope.

After all, there is a blueprint for Grexit: Leaving the euro: A practical guide

4 June 2012

A revised submission for the Wolfson Economics Prize MMXII by Capital Economics

Lead author:Roger Bootle

If they read that and your works it ought to be crystal clear what they need to do. However, I suspect Berlin and Washington have threatened Greece’s leaders behind closed doors with regime change and maybe even the complete destruction of Greece as any kind of economy. There is some untold aspect to this story.

“The Left Platform of Syriza appears to be the only Greek political element that understand that exit would:”

Also Dimitris Kazakis of a small party called E.P.A.M has been saying all this from the beginning. But they are underfunded and blacked out in the Greek media.

I ain’t got no guilt, that my grandfathers fought on the Nazis side, cause other option would have been, that we would have been under Stalin’s umbrella and that would have been much worse. There were only bad options.

But yes, we don’t have any reasons to punish Greece and Germany’s illegal 8 % surplus is much more worse for us and they are trying to cut our summer vacation from about 4 weeks to 2 to boost competitive advantage and make longer working days, so this austerity will make Finns life worse, but most of us ain’t get it just yet, cause there’s too much propaganda and right wing neoliberals are the puppet masters and there’s no real opposition for them.

Reason for our behavior is, that we don’t know better. Export sectors propaganda is too loud and people believe too much TV and propaganda. They ain’t get, that news don’t differ much from The bold and the beautiful. We just don’t get macro economics, cause people think, that everything will be alright if we just tighten the belt, but soon we can’t breath and that’s it. What goes around comes around in the eurozone and soon game will be over if we continue like this. EU will be another sweatshop soon. Then we will need another 1789, thank god we got France and their social security, which is even better than our.

I don’t think, that Greece’s debt burden is too big at the moment, cause it doesnt have to pay interest for the most of it’s debt. Bruegel says, that Greece’s interest payments are 2.6 % of the GDP at the moment and it gets about the same amount of aid from EU every year.

There must be program for growth and there should be end for this austerity. Eurozone countries should together think about how much they are all gonna invest in different things, so then there will be no these beggar thy neighbor fellas, who are trying to give austerity for people to boost their exports. German people ain’t get that export sector is screwing them at the moment and poverty is in a record levels there.

Sickman of the Europe is Germany again and it is poisoning everyone else also, so I ain’t get why we put all the focus into the Greece. Greece ain’t be the reason for our current problems. It’s nazi mentality and Germans who are destroying euroarea.

I also don’t get why Syriza didn’t have a plan to exit euro, so they could have had some leverage against others. Now other euromembers just waited, that Greece ran out of money and then they had to agree on anything.

All right, they struck a deal, Tsipras can go and pocket his check at Deutche Bank. The paye will be the same as usual – the poor, brainwashed and deluded people of Greece. “Trust Can Be Restored”. I don’t understand only one thing – what have these clowns from Syriza achieved except for proving once again that There Is No Alternative? It would be much better for the Greeks to stick to the original plan with Samaras and the technocrats. At least the money spent on the useless referendum and not earned during the shutdown of the banks could have been used to buy vodka for everyone.

Only YV knew when to jump the ship and start drinking.

“Germany has the socio-pathological excuse of having suffered from an irrational ‘inflation angst’ since the 1930s and has forgotten its disastrous conduct during the 1930s and 1940s and also the generosity shown it by allied nations who had destroyed its demonic martial ambitions.”

One of those allied nations been Greece who forgave debt to Germany didn’t receive reparations or the stolen forced loans back and had to rebuild again from death and destruction. After also doing it again from previous wars genocides and ethnic cleansing and loss of land. Then having civil wars forced against them more death more loss of money and having to rebuild again. Then Cyprus the same thing. And now Germany and ‘Europe’ is back in there doing the same thing again.

All through this ‘Europe’ has never been a friend of Greeks. Hell ‘Europeans’ have been against Greek people since the days of the Eastern Roman Empire leaving them to do their dirty work and profiting all along.

When will Greek people stand up and say ENOUGH our lives are worth more then that. Hell if you were Greek why would you even want to be part of ‘Europe’. Why would you want friends like these whose interest always alines with your destruction. And besides as the name Europe is Greek in origin if Greeks leave it will be Europe leaving the barbarians.

Greeks should leave take the name Europe with them and leave the barbarians exposed for what they are. Rebuild again. This time with a foundation of NEVER AGAIN. No more genocides no more ethnic cleansing no more losing of land our money and our property.

The last sentence has me a little confused: “…then Greece now has a shortfall of around €13,666.7 million, which makes the €35 billion proposal look decidely wan.”

Why does a shortfall of 13.6667 Billion make 35 Billion look wan? What am I missing?

Also the Greek EPOP rate peaked at only 49.2% before dropping. Why is the workforce participation rate in Greece so low compared to other countiries? Is there some reason that Greece has such a low workforce participation rate even during the supposed boom times prior to the GFC?

I agree with Bill that Greece certainly should exit the Euro and at least have a chance to recover. I honestly think if they agree with these terms then we will likely still behaving similar discussions as now in 5 years time. I also think that inevitably the Euro will break up unless it has radical change. That radical change looking at history is likely to be another war sadly. It’s crazy!

I think Varoufakis was smart getting out as Tsipras doesn’t seem to understand the problem with the currency union or is they hoping that Germany will leave? It’s frustrating to watch this slow motion nightmare.

Not that I disagree with the content of the post, but I think hateful sentences like ‘Germany […] has forgotten its disastrous conduct during the 1930s and 1940s’ and ‘Sure the Finns have a national guilt about their own notorious complicity with the Nazis in the 1940s’ should be avoided. Germany didn’t pay all her debts, it’s important to state it, but what the Nazis did 80 years ago is besides the point.

The back-flip by Tsipras, leading to ever more debt and austerity in Greece, is likely to split his party and destroy his government. That likely outcome is precisely what the Troika’s wanted from the start. And the recent referendum has been reduced to a farce.

Dear bill

Let’s not indulge in anti-German sentiment. The Eurozone has 18 members. If 16 had supported a different policy, then Germany would not have been able to impose its views. If only France, Spain, Italy and Portugal had strongly favored a more lenient approach, then this harsh agreement would not have come about. Silence does not necessarily mean consent, but it isn’t effective. Did the Dutchman Jeroen Dijsselbloem keep his foot down? It doesn’t seem so. In Canada, every commentator seems to feel called upon to denounce the Greeks as irresponsible, profligate wastrels. (Full disclosure: My 2 parents, 4 grandparents and 8 great-grandparents are all Dutch).

Regards. James

Regards. James

Totally and utterly depressing but not unexpected. And now Varoufakis has learned the lesson:

http://www.newstatesman.com/world-affairs/2015/07/yanis-varoufakis-full-transcript-our-battle-save-greece

Too late I might add.

According to some recent comments, Yanis Varoufakis seems convinced (because he was told as much) the German finance minister wants to ease Greece out of the Eurozone and this appears to have been the plan since before Syriza was even elected. Time will tell.

Pretty much all MMT people have said that reintroducing the dramacha would not be the apocalypse that Syriza thinks it would be. But we have comments like(below) that says actually implementing a reintroduction would be a disaster especially in regards with electronic payment.

Some of dismissed the comments below as scaremongering but I have yet to see a complete rebuttal of the points raised below. I’m not saying I believe the Greeks should have submitted to the Trioka like they have, but maybe because they truely believed the scenarios raised below which would explain their insistence on not leaving the euro.

1. http://www.nakedcapitalism.com/2015/07/greece-beware-merchant-services-providers-bearing-ddcss.html

2. http://www.nakedcapitalism.com/2015/07/the-card-system-demystified-and-implications-for-a-grexit.html

“Germany didn’t pay all her debts, it’s important to state it, but what the Nazis did 80 years ago is besides the point.”

Nothing to do with it? It meant there was an excellent case against forgiving German debts. What the Nazis did was not “besides the point.” They slaughtered millions of people and committed war crimes, with nearly every German citizens complicit in this.

Agree with the other points though.

Bill,

The French banks can now re -purchase Greek subsidiaries at a knock down price as part of the asset stripping.

For austerity to produce real growth, two things would have to happen: Less money in the economy would somehow miraculously result in the discovery of new ways to increase productivity, while, nearly simultaneously putting the money in pockets of people who have no credit with which to purchase the increased output of goods. It doesn’t get less realistic sounding than that.

Technology has reduced the value of labour to near zero. The main mode of capitalist accumulation since the early Industrial era no longer exists as the result; there has merely been a shell game going on producing an illusion that it does for some time now. Putting the global labour force on an equal (price) footing through the use of financial attrition in the wealthier regions( by eliminating deficits and allowing offshoring or labour transportability) only kicks the can a little further down the road.

Accumulation by economic rent and interest extraction are the only capitalist modes of accumulation left and even they will wither, dry up and blow away following the neo liberal prescription.

We seem to be at the intermission of a long movie after which the characters (hopefully) stop running around like chickens with their heads cut off, get a grip on the new realities, and forge a viable new way toward a happy ending.

John Hermann, Actually it may not be the Troika per se that wants Greece to leave the Eurozone. According to a recent post on his blog, Varoufakis has stated categorically that the plan is Schaeubles’s. And he is doing this to “put the fear of God into the French”. The French have had enough of austerity and are making his life difficult and he is determined to put a stop to this, apparently no matter what the cost. On the 16th, Varoufakis will have a piece in Die Zeit, which he has said will describe Schaueble’s plan for Europe.

Neither the US nor the IMF want Greece to leave the Eurozone. And both have made noises, along with the French, that the austerity that Schaeuble has been imposing has gone far enough. And the IMF would like some debt restructuring, which seems to be coming from their research department. One sick thing is that the Greeks have to sell about 50M Euros of state assets. Watch it all live in the online Guardian: http://www.theguardian.com/business/live/2015/jul/12/greek-debt-crisis-eu-leaders-meeting-cancelled-no-deal-live.

My reading of Schaeuble is that he is worried that should the Greeks default on their debts, certain important German institutions (there are French and Italian ones but he probably doesn’t care a great deal about them), like Deutsche Bank, will become obviously insolvent and have to be either bailed out or closed down and that other countries will follow Greece’s example. DB’s debt alone is around 20 times the Eurozone’s entire GDP, so a bailout of DB appears to be impossible.

It seems to me that this possibility scares Schaeuble to death. As perhaps it should, for it displays, for all to see, the shaky foundations on which the EMU has been constructed. His way of dealing with this seems partly to have been to engage in ad hominem attacks on Greece and their ministers. As Merkel is not always in agreement with her finance minister, it is unclear why she hasn’t fired him. He may bring about the very thing that she has been at great pains to avoid, the dissolution of the Euro and the resultant possibility, however remote, of the dissolution of the EU. I am not saying this will happen, only that Schaeuble is playing a very dangerous game, which may redound on him and on Germany.

Bill, your LaFontaine link, End is near_ ‘Catastrophic’ euro should be abolished, says its architect.htm, does not seem to exist in this form. This is the one I get: http://rt.com/business/euro-currency-abolition-881/. The title is the one you have given. Its date of publication is 7 May 2013.

If many of the reports are to be believed it was the most austerity driven countries

Germany ,Netherlands ,etc that wanted Greece to leave the Eurozone but the French

side which twisted arms to keep Greece in the Eurozone but of course that was granted

at a terrible cost.It seems the political austerians are truly self deluded.

The madness is of course the package will deliver the same results as previous bailouts.

In no time at all the whole tragic merry go round will be back

Re: Alexandra Hanin

What the Germans did in the 20’s- 40’s is besides the

point.

Well, only if they were not acting like that today.

“Re: Alexandra Hanin

What the Germans did in the 20’s- 40’s is besides the

point.

Well, only if they were not acting like that today.”

Yea, they really have traumas as nation from back there. Nobody have told them, why they had, that hyperinflation. They had to buy foreign currency with their currency to pay debt, which were in foreign currency and they didn’t have enough production to create demand for deutsche marks aboard, so it was basic economics, there were not enough demand and marks skydived. That’s not the problem now, when we should be a reserve currency, but we just don’t act like one. Euroarea is creating current account surpluses all the time.

Somebody should really teach these things for people in schools and not teach some trivial bs, what people will never need. I guess masters ain’t want people to think too much…

Still one chance for grexit not in the greek parliament but in the parliaments of other eurozone

countries that have to ratify the deal.Still parliamentary more difficult for Finnish government

to ratify than the Greek.Madness.

I’m tired of busting this myth. Hyperinflation was the 20s, depression and austerity in the 1930s led to the Nazis coming to power.

The current German government are not fascists, the fascists are Golden Dawn and related far right who will jump on this and gain support. Very scary.

There is a fresh interview with YV in the New Statesman “Yanis Varoufakis full transcript: our battle to save Greece”

Lifting (more than a few) lines from there:

” I never believed we should go straight to a new currency. My view was – and I put this to the government – that if they dared shut our banks down, which I considered to be an aggressive move of incredible potency, we should respond aggressively but without crossing the point of no return.

We should issue our own IOUs, or even at least announce that we’re going to issue our own euro-denominated liquidity; we should haircut the Greek 2012 bonds that the ECB held, or announce we were going to do it; and we should take control of the Bank of Greece. This was the triptych, the three things, which I thought we should respond with if the ECB shut down our banks…. I was warning the Cabinet this was going to happen [the ECB shut our banks] for a month, in order to drag us into a humiliating agreement. When it happened – and many of my colleagues couldn’t believe it happened – my recommendation for responding “energetically”, let’s say, was voted down.

HL: And how close was it to happening?

YV: Well let me say that out of six people we were in a minority of two. … Once it didn’t happen I got my orders to close down the banks consensually with the ECB and the Bank of Greece, which I was against, but I did because I’m a team player, I believe in collective responsibility.

And then the referendum happened, and the referendum gave us an amazing boost, one that would have justified this type of energetic response [his plan] against the ECB, but then that very night the government decided that the will of the people, this resounding ‘No’, should not be what energised the energetic approach [his plan].

Instead it should lead to major concessions to the other side: the meeting of the council of political leaders, with our Prime Minister accepting the premise that whatever happens, whatever the other side does, we will never respond in any way that challenges them. And essentially that means folding. … You cease to negotiate.”

But YV still believes they may be ejected because the Germans don’t want to reduce the debt. I do not share his optimism. They will totally destroy Greek independence and install technocrats. This was the German goal from day one – to buitd a “New Europe” based on totalitarian austerity. I only believe that the best possible outcome for Greece is for Tsipras is to catch an early plane to Moscow TODAY and ask for political asylum there. The farce of “negotiations” (listening to the Prussian diktat) must stop – otherwise the Greece is being transformed into another “Marchia”. Tsipras may ask Yanukovich the former non-president of Ukraine (stripped of his title) how to start writing memoirs. Tsipras was more afraid of hardcore right-wingers in Greece than losing to the Germans what remains from Greek sovereignty. Any normal person who grew up in the reference frame of 20th century will call him a TRAITOR of his own nation.

Regarding lack of love and compassion to the great Prussian nation in some of the comments – I agree that Merkel has nothing to do with what going on in 1930-1940s. Dr Merkel pretends to be a modern and enlightened copy of Otto von Bismarck, the most hated in Poland (and probably in France, too) German politician of the early – second half of the 19th century. Bismarck unified Germany with “blood and iron”. Dr Merkel wants to unify Europe with “unpayable debt and tears”. Her Mitteleuropa roamed by hordes of unemployable economic refugees begging for jobs in Germany and Finland stretches from Aegian Sea to Atlatnic Ocean. Let’s hope the deluded “scientific” Teutonic imperialism is stopped on its tracks again without the need to shed blood again.

ikonoclast,

thanks for the heads up on the paper.

im thinking the latest agreement is dead already, unless the ecb accommodates larger greek fiscal deficits and brings down the yield on greek debt.

the growth rate has to be above the yield on the maturity structure of the debt, or we dont have a sustainable debt service position.

we are going to have a grexit , the question is when not if.

I linked this piece in a discussion thread on Naked Cap and staff writer Nathan Tankus said

‘this doesn’t discuss the issues with an exit at all. handwaving is an economist pastime.

So there!

On a follow-up “summarizing” the interview, Lambert includes these damning paragraphs.

“Days before Varoufakis’s resignation on 6 July, when Tsipras called the referendum on the Eurogroup’s belated and effectively unchanged offer, the Eurogroup issued a communiqué without Greek consent. This was against Eurozone convention. The move was quietly criticised by some in the press before being overshadowed by the build-up to the referendum, but Varoufakis considered it pivotal.

When Jeroen Dijsselbloem, the European Council President, tried to issue the communiqué without him, Varoufakis consulted Eurogroup clerks – could Dijsselbloem exclude a member state? The meeting was briefly halted. After a handful of calls, a lawyer turned to him and said, “Well, the Eurogroup does not exist in law, there is no treaty which has convened this group.”

“So,” Varoufakis said, “What we have is a non-existent group that has the greatest power to determine the lives of Europeans. It’s not answerable to anyone, given it doesn’t exist in law; no minutes are kept; and it’s confidential. No citizen ever knows what is said within . . . These are decisions of almost life and death, and no member has to answer to anybody.””

So, the Eurogroup has no legal basis, makes life and death decisions, and its members are answerable to no one. And run completely by Schaeuble, effectively a tyrannical dictator. This is shocking. As for Tsipras, Varoufakis said in the interview that he understood why Tsipras didn’t go along with his [V’s] “plan”; it was because he didn’t think that Greece could manage a Grexit. Given that Varoufakis had been trying to educate Tsipras on economics since 2010, it appears that he has learned very little in five years and, although Varoufakis doesn’t mention it, probably for understandable reasons, seems to be brittle, weak, and easily intimidated. Which, whatever you think of him, Varoufakis is not.

Addendum:

Varoufakis in the interview also contended that Merkel did not quite take Schaeuble’s position. If that is so, why has she kept him in place? I can think of only one plausible reason. She has no alternative narrative that would replace his. Even though his views are repugnant to any democrat and his actions worse, she would not know how to proceed without him. While this in itself is not that unusual, what does seem to me to be unusual is that Merkel does not seem to know of anyone whom she could put in his place. Surely, Germany must have someone in its Parliament who could replace Schaeuble who would be less repugnant to other members. On the other hand, as Bill has pointed out, he does have allies and, perhaps, this set of alliances is infecting Merkel’s thinking about Schaeuble’s seeming indispensability.

I think we have to grasp the fundamentals it is membership of the euro which negates

Greek democracy not Germany and the Austerians.We should not doubt the self delusion

of the groupthink.At the end it was the Greek ,French side of the negotiations which

committed the coup! It is the inevitable consequence of giving up monetary sovereignty .

Germany and the Austerians were willing to let Greece leave the Euro.It is still more likely

that Finnish politicians will grant Greece monetary sovereignty than Greek politicians .

@larry

Your point is crucial. If the Greek government signs up to the latest deal, they give up “monetary sovereignty”, i.e. sovereignty, and democracy ceases to exist at the level of the Greek nation. What replaces it? An amorphous collection of entities (the “institutions”), the most important of which is the Eurogroup, which as you say has no basis in law.

So if/when Tsipras signs on the dotted line, he will be siding against democracy and the rule of law. It is indeed shocking. Irrespective of how bad he thinks the alternative will be, how can he sign, given his stated ideological commitments? After all, he could just resign and take the plane to Moscow, as Adam K states.

We are seeing a sad absence of moral courage in this drama from the actors who should be leading the demos. Schaeuble seems to be about the the most courageous participant, but unfortunately this virtue is put to the service of insane principles.

“Germany has the socio-pathological excuse of having suffered from an irrational ‘inflation angst’ since the 1930s”

Incorrect. As Jörg Bibow argued years back, Germany has the socio-pathological excuse of having suffered from manufactured ‘inflation angst’ since the 1950s, when the Bundesbank waged a PR war against its government, to prevent it from taking over the bank in accordance with economic theory and empirical best practices.

Bill, I have not read your book, but groupthinking of the elites in our world is a big big problem, maybe the biggest. This, I am sure, has also played a bad role in the “negotiations”. It is not that the EC-leaders etcetra are bad, have bad intentions, or are basically incompetent. It is just that they repeat this wrong mantra amongst themselves that restructuring and austerity are the only ways out of the crisis. It is the same kind of mantra in the financial world that making lots of money is good, that risks, if shared, can be piled up, and that bonusses are in order if one speculates with large amounts of somebody else his money.

As a European and a Dutch citizen (in that order) and having studied macro-economics myself, I am very worried about not only the future of the Euro, but also of the EC. The Euro should have been confined to countries with basically the same fiscal policies. For further integration the EC should have expanded at a much slower pace and more selective way. Striving for a United States of Europe is completely irrealistic now and in decades to come. I do not know what is the right thing to do for Greece. On the one hand, I agree with your arguments for breaking away from the Euro, on the other I wonder if the Greeks are able to make a number of reforms that are indeed necessary (and I do not mean privatising the electricity network) without the pressure and the help of the EC.

Hello Paul Nelissen,

You wrote that “It is not that the EC-leaders etcetra are bad, have bad intentions, or are basically incompetent.” and that you are “…a European and a Dutch citizen (in that order)”.

I couldn’t disagree with you more.

By now we have abundant evidence from their actions that these people are evil. Strong word that it is, it’s the only one that matches their actions, year after year (in fact, decade after decade). After this length of time, they are unable to plead ignorance of the consequences of their actions, and they have thereby forfeited any claim to having innocent motivations.

On the other point you made, I’m afraid I must point out that Europe is a continent, not a nation, not a country. Nor is ‘Europe’ a bestower of citizenship. Europe and the EU are two different things. The EU has declared – illegitimately, in many people’s eyes – that we are citizens of the European Union (not ‘Europe’), but that does not make us citizens of Europe, nor does it make a single nationality out of those of us who dwell on the continent of Europe. The EU has not created and cannot create a nationality called ‘European’. Of course we are all free to define ourselves however we wish, but that is a personal matter pertaining to our conception of our own identity, and I’m afraid I must also point out the obvious fact that as individuals we don’t have the power to bring into being ‘European’ as a nationality or a citizenship title either.

Bear in mind that there are countries in Europe which are not in the EU, just as there are parts of the EU which are nowhere near the continent of Europe. ‘European’ is therefore nothing more than a statement about a continent. It is not a statement about a nation, a country, or a State.