I have received several E-mails over the last few weeks that suggest that the economics…

California IOUs are not currency … but they could be!

I seem to be stuck in the US at the moment – blog-wise. I can assure you I escaped their shores at the weekend and am now freezing in Newcastle, NSW. But I still have reading left over from hanging around US book shops last week. One story that is very interesting at the moment is the plan by the Californian State Government to begin issuing IOUs (reserved warrants) because it has “run out of cash”. As far as I can work out the IOUs will not become a second currency (alongside the USD) but one simple extra announcement by the State would be enough to allow California to be sovereign in their IOUs. What do you suppose that extra complication might be?

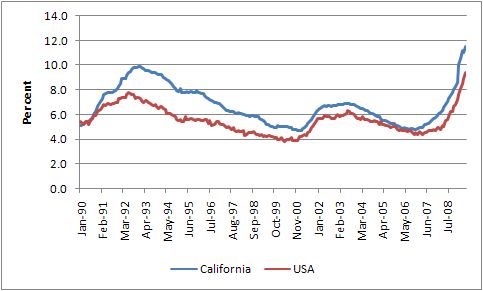

First, consider the following graphs. The first shows the Californian and US unemployment rates since 1990 (monthly seasonally adjusted available from the BLS). The chart shows the sharp deterioration in the US and Californian labour markets since the onset of the current crisis. The official unemployment rate in California for May was 11.4 per cent while it stood at 9.4 per cent for the US as a whole.

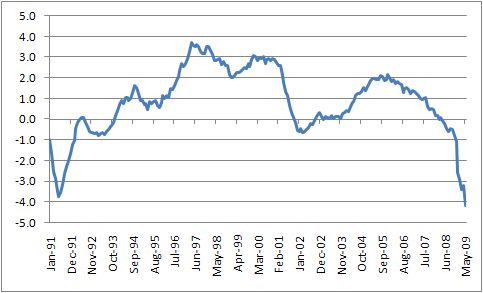

The second graph shows the annualised percentage employment growth rate for California since 1991 using official BLS data. The graphs are nearly mirror images because unlike the neo-liberal version. unemployment is driven by employment growth (that is, labour demand). The claims that rises in unemployment reflect shifts in the supply of labour and reflect preferences of workers for more leisure have never been supported by the data. These claims (as all neo-liberal claims) belong in fantasy land which in fact is located in Southern California – the regional focus of this blog.

Whenever you get this degree of economic deterioration the fiscal unit involved (state or nation) will see the automatic stabilisers that are built-in to the budget process drive the fiscal balance into deficit. For a sovereign nation that is not an issue – in fact, it is a good thing – demand is automatically being injected into the economy to stabilise the downturn.

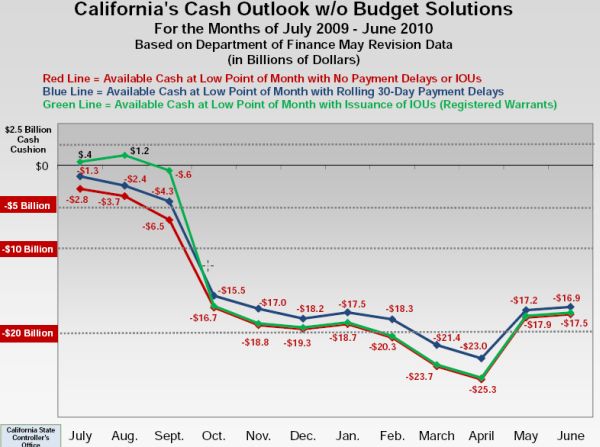

In California the fiscal deterioration has been particularly severe. The deficit ($US24.3 billion) rose after economic activity ground to a halt and tax revenue fell off a cliff. The State Controllers Office, which is California’s independent fiscal watchdog, has provided a nice graph to show the cash crisis that the State is facing, which I reproduce below. Clearly a resolution is required or the Government would face the situation that it would not be able to pay its bills (in USD).

While this sort of graph would be irrelevant to a sovereign national government it does present a problem for a state within a sovereign nation. For that unit of government, the increasing deficit has to be “funded” because a state government does face a revenue constraint. It has to increase taxes, cut spending or increase its borrowing (state debt issuance) to resolve the fiscal deterioration. In general, it is madness to attempt to uses discretionary policy changes to “fight against” the automatic stabilisers.

Trying to resolve the burgeoing Californian state deficit by increasing taxes and cutting spending at the height of the worst downturn the economy has faced in years is madness. It will almost certainly make matters worse. There is every reason to increase borrowing during this period to finance infrastructure and other projects which will not only provide a fiscal kick-start for the economy but also leave a long-lived legacy of public goods. These infrastructure investments leave a legacy that generations for years to come can benefit from and as such the spreading of the “payment burden” via the debt finance is considered intergenerationally equitable.

The budget austerity route, however, is exactly what the Democrats are trying to achieve. They want a balanced budget law pushed through the Californian legislature. The Democrats, which have a majority in both houses of parliament in California have proposed $11 billion in spending cuts, increasing taxes on tobacco and mining activities as well as increasing vehicle licenses fees. Arnie won’t agree and his compromise is not acceptable to the Democrats. The Democrats move would worsen the budget as economy activity slumped further.

So at present there is a budget stand-off in California which has to be dealt with in the next few days.

The state of California has other options though especially when you consider it is the 8th largest economy in the World. I saw some data from 2005 that did a USD comparison of GDP across many countries. The US (without California) was the largest (GDP = $10834 billion); then Japan ($4567 bn); Germany ($2792 bn); China ($2234 bn); United Kingdom ($2229 bn); France ($2127 bn); Italy ($1766 bn) then California ($1622 bn). Australia was down at $709 billion equivalent. I suspect the relativities might have changed since 2005 a bit but the point is that California is more than twice the size of the Australian economy.

The State is the largest issuer of public debt on the US municipal bond market (the so-called munis) but in recent times has faced higher yields mostly driven by the large demand for US Treasury debt. The LA Times reports that no one seriously considers that California will default on its debt but local counties are facing higher funding costs given the rising yields elsewhere.

So there is a reluctance to continually increase state debt as a solution to the immediate crisis.

Which brings us to the story at hand. The State of California, the worlds 8th largest economy plans to begin issuing IOUs – formally known as registered warrants – to the tune of $3 billion from July 2, to fund its commitments to various suppliers and contractors to government; university students; and welfare and pension recipients.

The IOU terms (interest rate, etc) will be determined by the Pooled Money Investment Board which will meet on July. The IOUs will mature on October 1, 2009. You can find out all about the Californian public finances from the Department of Finance.

This will be the second time in recent history that the Californian Government has issued IOUs. In 1992, when the economy recessed badly it was forced to do the same. See the graphs above to see the correspondence of labour market conditions then and now.

While two of the major banks that operate in California – the Bank of America and Wells Fargo – have said they are uncertain as to whether they will accept the state-issued IOUs in return for cash, they have an incentive to do so because they can then earn the interest payable once the redemption date is up.

Who will get the IOUs? The most disadvantaged – stupid! No other group would tolerate being treated in this way.

The State Controllers Office has some analysis of how the IOU system will work and who will be provided with them in lieu of cash. they also provide a FAQ page for the warrants system. We learn that the largest proportion of the IOUs will go to the aged ($590 million), the unemployed ($495 million), and the disabled ($363 million).

There are two interesting points to note from FAQ page. First, there is no guarantee of convertibility into cash. I say this even though the state will (if it has enough cash) accept them on October 1 for cash. But there is no stipulation that they can be traded in the meantime as if they were cash.

Second, there is no provision that a Californian resident can pay their state taxes using the warrants as contra payments. In other words, the warrants are not currency.

If the State of California, announced that it would accept these IOU vouchers (their face value in $US) as legitimate vehicles to liquidate one’s tax obligations to the State then the situation changes dramatically. To circulate the vouchers, all State employees would receive some (or all) of their pay in the IOUs (bits of paper or via electronic transfer into special voucher banks), which they could then use to pay their taxes. If all Californian citizens could similarly extinguish their tax obligations using these vouchers then there would be a generalised demand for them, which means that State employees would be able to spend the IOUs in shops as they would the $US.

The State of California would have no financial constraint in the IOU vouchers. It would simply spend them (pay its workers) and collect the taxes later as people handed them back to satisfy their legal obligations. Imposing the tax obligation (in vouchers) creates a demand for them and allows them to circulate as a “currency”.

Soon enough, the banking system would develop IOU Voucher Accounts and related products. In this way, the State of California could more easily maintain its level of services without imposing huge costs on the disadvantaged which they are forcing to accept the IOUs. The State could also expand public employment to attenuate the labour market impacts of the recession.

There might be some reluctance to hold the vouchers. In general terms whether Californians would desire to demand the IOUs would depend on how enforceable the tax obligations are. The State of California could probably enforce the tax obligations and allow them to be extinguished using vouchers. This would be sufficient to generate a viable demand for the IOUs as an operating currency. I am not considering any constitutional issues here. Just the logical point.

If the state had have decreed that any resident could extinguish their tax obligations using the warrants then they would become more broadly accepted as an alternative currency in California and the disadvantage that those citizens face who will be forced to accept them in lieu of cash payments would be considerably reduced (or eliminated entirely).

The other point is that with California so large in economic and political terms (it carries 55 electoral college votes), why hasn’t the national government sought to intervene to shore up economic activity there? Apparently, the Obama administration has been approached for temporary assistance but has not responded positively to date. But this would appear curious given their Treasury has bailed out banks and AIG which, arguably, are not as important as an entire state – in employment terms etc.

CNN Finance puts it this way:

The last time a leading municipal bond issuer was on the verge of default was 1975, when New York City was going through its own financial crisis. Then-President Gerald Ford gave a speech vowing to veto any federal assistance for New York — a speech immortalized by the next day’s New York Daily News headline, “Ford to City: Drop Dead.” Even though Ford later approved federal loans to New York, the political damage was done. New York had voted Republican in 1972, but four years later, Ford wound up narrowly losing the state to Jimmy Carter, which ultimately cost him the election. Analysts think Obama is unlikely to make a similar mistake. “The most important factor here is that California has 55 electoral votes,” says Greg Valliere, Washington policy strategist at Soleil Securities. “At the end of the day, that’s why I think Washington blinks.”

However, the counter view is expressed by this commentator who argues that:

The most persuasive objection is that if the Treasury helps California, other state governors will get out their tin cups and march on the Washington Mall. It’s a fair point. So something must be done to make a federal bailout of California sufficiently unpalatable to other state governors. One idea would be that in exchange for federal help, the governor and the top leaders in both parties in the legislature should resign their posts. No one will shed any tears for Arnold Schwarzenegger, and it would underscore that appealing to the Feds for help is truly a last resort. This would be akin to the Treasury tossing out the management at AIG

But the bottom line is that the IOU plan in its current form will further hurt the poor. The simple act of allowing them to be used for tax purposes would reduce this disadvantage considerably.

In lieu of that, perhaps Michael Jackson’s untimely demise will increase economic activity in California and help reduce the need to issue the IOUs!

Excellent point …

… note that one reason for the reluctance to bail out California is that since the “tax revolt” that established rules requiring a super-majority for most tax measures, the State has been undergoing periodic fiscal crises, even while better managed states have been fine. So there is a concern whether bailing out California will become a permanent fixture.

Bill: It’d be a fascinating experiment if California did actually do as you suggest and accept the warrants for tax liabilities. While I agree that having “currency” accepted by Governments for tax is a necessary condition for the currency to become more widely used, I can’t help feeling that it is not necessarily sufficient. To put it another way, I would suspect that these IOUs would still not become widely accepted and would trade at a discount to the dollar. If nothing else, a dollar would retain the advantage of being currency across state borders. Of course, I don’t really know so I’d love to see a real life example played out.

Dear Sean

There would be an exchange rate obviously between the IOU/USD. Whether it would trade at a discount is arguable but it might given the IOUs would cease to function across the border. But it is such a large economy that I am not convinced of that. The largest constraint I suspect would be the fact that the USD is not under political threat (I doubt any US government – of any political flavour will attempt to change the sovereignty of the USD), the Californian IOU could be. But if it survived Arnie then an IOU that can be used to pay all state taxes should become an attractive bit of paper and freely exchange.

So there are two issues: (a) acceptability – I think the IOU would be widely acceptable; (b) parity with USD – that would depend on supply and demand.

We should start a petition to request the State does make the IOU “tax-empowered” and then we would be able to satisfy our curiosity. It is a perfect chance to empirically demonstrate (and validate) some modern money concepts.

best wishes

bill

That’s the thing about economics: the only real laboratory is history. I’ll have to line up some Californian friends to support the petition!

Jct: There’s nothing wrong with small denomination IOUs if I or anyone else can pay their taxes with them.

When Argentina’s government workers were faced with cuts, their unions talked 6 state governments into paying them with small-denomination state bonds which could be used to pay for state services and taxes and which everyone accepted as useful currency. Best of all, when the local currency is pegged to the Time Standard of Money (how many dollars per unskilled hour child labor) Hours earned locally can be intertraded with other timebanks globally! In 1999, I paid for 39/40 nights in Europe with an IOU for a night back in Canada worth 5 Hours.

U.N. Millennium Declaration UNILETS Resolution C6 to governments is for a time-based currency to restructure the global financial architecture. See my banking systems engineering analysis at http://youtube.com/kingofthepaupers

Too bad California State IOUs won’t be accepted in payment for state taxes and services like state bonds were in Argentina. Too bad California State IOUs will be denominated too big to use as local currency. Too bad Argentina people were smart enough to avoid the tent-cities catastrophe and California people are too stupid to follow their example.

Bill – starting a petition is a good idea! However, since the state would accept both the USD and the IOU as taxes, people may not flock to get that. The IOUs may even be in premium with the dollar in case there is an exchange and the rate, just like currencies the rate may depend on purchasing power, CPI etc.

Ramanan –

True. To really do it right, CA would have declare that only IOUs would be accepted. But if they did that, they would run afoul of legal tender laws. Would make an interesting Supreme Court case!

Does Article One, Section 10 of the U.S. Constitution not apply here?

No State shall … coin Money; emit Bills of Credit; make any Thing but gold and silver Coin a Tender in Payment of Debts;…

Is an IOU not a “Bill of Credit”? From Wikipedia:

Bill of Credit is a phrase from Article One, Section 10, Clause One of the United States Constitution. It refers to a bill issued by a state, on the mere faith and credit of the state, and designed to circulate as money.

What California is doing sounds borderline Unconstitutional to me, but hey, nobody much cares about that old document anyway…

John: that could explain precisely why California does not accept IOUs for payment of taxes. As they stand, they are presumably no more or less unconstitutional than munis.

I PAY TAXES ALL YEAR TO THE STATE OF CA, GET SQUEEZED EVERY TIME I BLINK AND NOW I GET AN IOU FOR MY TAX RETURN.

IT’S TIME FOR A BIG CHANGE……I MEAN “EVERYTHING” IS THE “US” HAS TO CHANGE.

WE ARE BEING ROBBED BLIND BY THE FEDERAL RESERVE SYSTEM AND ALL THE ASSHOLES WHO BENEFIT FROM IT .

It seems that California is already ceasing to issue IOUs. Shame the California money experiment will not take place.

Dear Sean

Yes, they are increasing borrowing and slashing spending. More fool them!

best wishes

bill