It's Wednesday, and as usual I scout around various issues that I have been thinking…

Ireland – the quantity-adjusting recovery

There was an interesting – Letter to the New York Times – last week (August 3, 2015) from an Irish academic (Stephen Kinsella) in response to an Op Ed by the German economist Hans-Werner Sinn (July 24, 2015) – Why Greece Should Leave the Eurozone. I found it interesting because for the last few weeks, since the latest – Irish national accounts data (July 30 2015) showed Ireland to be the fastest growing Eurozone nation I have been investigating what has been going on. The Op Ed by Sinn did not appear to accord with the data that I was examining. The subsequent ‘Letter’ confirmed that. The bottom line is that Ireland is not an example of a “supply-side” internal devaluation inspired recovery. In fact, it is an example of a straightforward “Keynesian” quantity adjustment aided by Ireland’s very open economy and the fact that is has been favourably disposed to growth elsewhere supported by on-going fiscal deficits.

At the outset, I agree with a key aspect of Sinn’s article – that the “third bailout program, in which Greece will receive a rescue package worth 86 billion euros (about $94 billion) in return for additional austerity measures” will “drag Greece through three more years of a long-lasting, costly experiment that has so far failed miserably”.

That would appear to be beyond doubt. It is hard to imagine how anyone who understands anything about macroeconomics could think that the policy stance the Eurogroup has adopted in relation to Greece could think it would result in anything but an on-going disaster.

After all, the Troika are not interested in recovery for Greece. They want its compliance to be a lesson for France, Italy and other nations that might not want to heel to the austerity.

But I disagreed with his rejection of what he terms the “solution favored by leftists”:

No doubt, enormous government spending would bring about a Keynesian stimulus and generate some modest internal growth. However, apart from the fact that this money would have to come from other countries’ taxpayers, this would be counterproductive, as it would prevent the necessary devaluation of an overpriced economy and keep wages and prices above the competitive level.

Greece will not recover via a so-called ‘internal devaluation’. That will just impoverish workers and fixed income recipients (pensioners etc) and will not generate the necessary spending boost that is required to stimulate production and employment.

There is nothing ‘leftist’ about applying the basic rule of macroeconomics – that spending drives output and employment which generates income growth. What the government does with the spending might reflect its ‘values’ (left or right) but either end of the political spectrum cannot avoid that basic rule.

Government spending on tanks and rocket launchers will stimulate growth just as much as spending on building new schools, hospitals and better public transport!

If the Greek government introduced a Job Guarantee, it would see growth immediately and that growth would spread and be sustainable.

At this point, Sinn gets ahead of himself, which provoked the ‘Letter to the Editor’ cited in the Introduction, although it is unclear whether the ‘Letter’ was ever published by the NY Times. Sinn holds out Ireland as the model for Greece to follow:

Take the case of Ireland. Like Greece, Ireland became too expensive, as interest rates fell sharply during the introduction of the euro. When the bubble burst, in late 2006, no fiscal rescue was available.

The Irish tightened their belts and underwent a drastic internal devaluation by cutting wages, which in turn led to lower prices for Irish goods both in absolute and relative terms. This made the Irish economy competitive again.

The ‘Letter to NY Times’ responded by arguing that no such adjustment has actually occurred in Ireland.

1. There was a fiscal response “but it wasn’t enough. Irish debt relative to GDP went from about 35% in 2006 to about 124% in 2013.”

2. Wages did not fall “drastically … According to Ireland’s Earnings, Hours and Employment Costs Survey, private sector wages fell by about 4% while public sector wages fell by about 3% over the crisis”.

3. “What actually happened was employers reduced their wage bills by reducing employment and average hours worked per employee.”

4. What really has happened “in the Irish economy is a Keynesian adjustment in quantity of labour and not a neoclassical wage-rate adjustment, implying the ‘cure’ for Ireland’s problems was not so much a supply-side set of ‘reforms’ but … an … increase in demand, first from the rest of the world thanks to Ireland’s remarkable openness as an economy, and then from a demand response following the end of austerity in 2013–not 2010.”

5. “Dr. Sinn gets the most important part of his diagnosis wrong. His prescription is likely to kill the Greek patient”.

By way of background, an excellent introduction to the idea of quantity and price adjustment in macroeconomics can be found in the 1981 book by Arthur M. Okun Prices and Quantities: A Macroeconomic Analysis, Brookings Institution. I don’t agree with all of Okun’s propositions but his general framework is sound.

The issue is how the economy responds to changes in spending over the economic cycle. The neo-classical free market view, which dominates textbook treatments of the subject, posits that wages, prices and interest rates adjust over the cycle in response to variations in total spending.

The belief is that these price adjustments will ensure that the economy remains at full employment levels in the face of rises and falls in nominal spending.

So if, for example, total spending falls in dollar terms, the solution is to allow prices to adjust – whether it be wages to fall to encourage firms to hire more workers – interest rates to adjust to divert consumer spending into investment spending – or prices of goods to fall to encourage more spending.

I don’t intend to go into detail about the way the neo-classical macroeconomists claimed the system operated. The last paragraph captures the basic idea of price adjustment.

So the concept of ‘internal devaluation’ which is featured in the Troika’s vision of a Eurozone recovery is that a nation suffering a major economic contraction but which cannot alter its exchange rate (as in Greece) has to adjust to the negative situation by cutting wages and prices.

These price adjustments would, so the argument goes, lead to an increase in international competitiveness, which then provides the source of increased spending to overcome the recession.

An economy is considered to be a quantity adjuster if producers respond to changes in nominal spending (aggregate demand) by adjusting income (output and employment) adjustments.

Keynes’ dispute with the Classical economists over the capacity of the economy to recover from Great Depression highlighted the difference between price adjustment and quantity adjustment.

Keynes rejected the view that unemployment was a price failure (the money wage being too high relative to the price level – that is, excessive real wages – above the full employment productivity level).

When the Great Depression began, economists were dominated by a belief in the efficacy of price adjustment (so-called laissez-faire) and rejected government intervention.

But Keynes argued that mass unemployment would not be solved through wage and price cuts (which were tried in the early 1930s and made matters worse).

Rather, mass unemployment was a quantity-adjusting response by firms to a collapse in effective demand (spending desires backed by cash) which could only be resolved with government intervention in the form of a spending stimulus.

The neo-classical economists at the time (the modern variant being neo-liberals) claimed that if investment spending fell, interest rates would fall and saving would be discouraged. As a result, consumption expenditure would rise to fill the spending gap.

Alternatively, if households decided to consume less of their income (saving rose), interest rates would also fall (as there would be an excess of savings relative to investment) and investment would rise to fill the spending gap.

The price of goods and services would also fall as noted above to stimulate further spending.

Keynes rejected these adjustment possibilities. He demonstrated that when there was a failure of spending, the inventory cycle would drive firms to lay off workers (to avoid building up any further unsold inventories), which then triggered further spending shocks via the multiplier as incomes fell generally across the economy.

Firms adjust to the spending collapse by reducing quantities – output and employment.

When everyone adopts the view that spending is weak, price cuts will not stimulate sales or provoke firms to invest more in building productive capacity.

The solution is to provoke positive quantity adjustments via increased spending and if the non-government sector is pessimistic, then there is only one sector left that can intervene to reverse the malaise.

What does the data tell us?

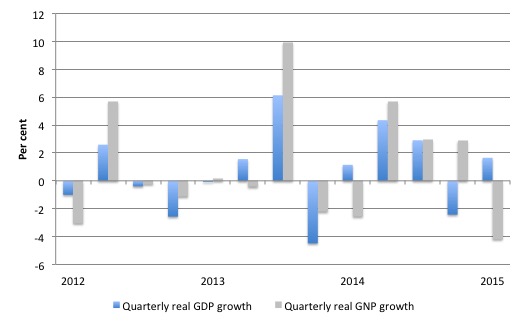

The following graph shows quarterly growth rates in real Gross Domestic Product (GDP) and Gross National Product (GNP) from the first quarter 2012 to the March-quarter 2015.

While real GDP grew strongly in the first-quarter 2015, real Gross National Product (GNP) declined by 4.2 per cent.

What does that mean?

First, one needs understand the difference between GDP and GNP. This is a particularly important point when it comes to understanding the Irish predicament (both before the crisis and now).

You can gain a thorough understanding of these concepts from this excellent publication from the Australian Bureau of Statistics – Australian National Accounts: Concepts, Sources and Methods, 2000.

The two concepts are defined as such:

- Gross domestic product (GDP) is defined as the market value of all final goods and services produced in a country in any given period”.

- Gross National Product (GNP) is defined as the market value of all goods and services produced in any given period by labour and property supplied by the residents of a country.

The Irish CSO publication says that GNP = GDP + Net factor income from the rest of the world (NFI). NFI is defined as:

Net factor income from the rest of the world (NFI) is the difference between investment income (interest, profits etc.,) and labour income earned abroad by Irish resident persons and companies (inflows) and similar incomes earned in Ireland by non-residents (outflows).

In this blog – The sick Celtic Tiger getting sicker – I argued that the so-called “Celtic Tiger” growth miracle was an illusion and was driven by major US corporations evading US tax liabilities by exploiting massive tax breaks supplied to them by the Irish government.

A significant portion of the growth in Irish GDP was in fact “profit transfers” to foreign companies (see the New York Times article (May 20, 2010) – Irish Miracle – or Mirage? – by Peter Boone and Simon Johnson).

In the first-quarter 2015, Net Factor Income flowing out of Ireland rose substantially – by 53.3 per cent – indicating that the incomes generated by the rising GDP were being significantly captured by foreign companies.

This is why real GNP growth was negative in the March-quarter 2015.

So that has to be taken into account when we consider the Irish miracle.

But that is not the story we are interested in today. We are looking for evidence of price and quantity adjustment given there has been a return to growth overall in Ireland in recent quarters.

The issue of who is benefitting from the growth is a related and not uninteresting question but separate to our current inquiry.

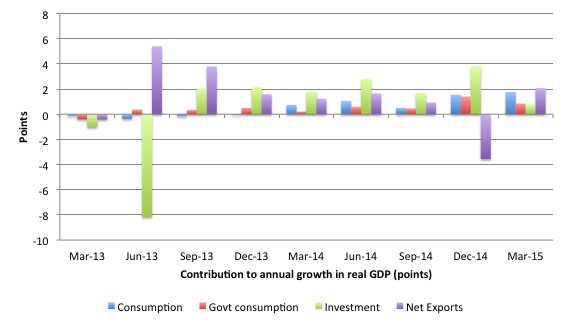

If we examine the drivers of growth an interesting picture emerges. While net exports has clearly had a positive influence on real GDP growth, it could not be considered a dominant source of growth. In fact, private consumption, public consumption and capital formation have also been fairly consistent contributors since late 2013.

The following graph tells the story. It shows the contributions to annual real GDP growth since the March-quarter 2013 to the March-quarter 2015 by source of expenditure.

Given the terms of trade have been fairly constant over this period, this looks like an old-fashioned aggregate demand led (quantity-adjusting) growth cycle.

In terms of the export boost to growth, the Central Statistics Office of Ireland publishes detailed – Trade Statistics (most recent April 2015), which allows is to trace where Irish exports are going.

The first thing to note is that the Irish Terms of Trade have hardly moved since 2011, which means that relative prices have been fairly constant over the period of recovery. There has not been a major improvement in the Terms of Trade.

Since January 2012, exports and import volumes have grown at about the same rate. It is only in the last year that the trade surplus has risen in any significant manner.

Ireland’s major export markets are the US, Belgium, Great Britain, Switzerland, Germany, France, the Netherlands, Japan, Spain, Italy , China then Australia.

In terms of growth in those markets in 2014-15 (April to April), the strongest growth has come from Australia, Japan, Switzerland, Belgium, China and the US.

Contrary to popular perception, the growth in exports to Britain has been very modest over the last year.

The point is that these growth markets are demonstrating ‘income effects’ – they are buying more Irish exports because their nations imports are growing as a result of domestic growth. In each of these cases, fiscal deficits remain fairly significant contributors to domestic growth (and import demand).

Now consider what went on in the downturn and the recovery.

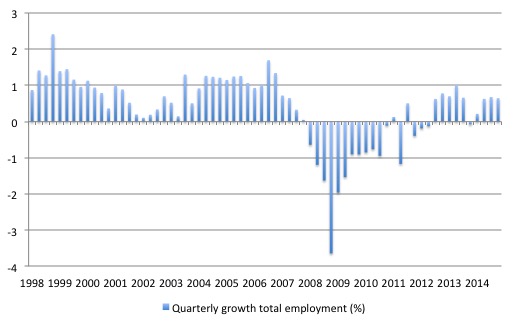

The following graph shows the quarterly growth of total employment in Ireland from the first quarter 1998 to the March-quarter 2015 (in per cent).

Irish firms responded to the crisis by laying off workers in droves and the recovery has seen a modest reversal in that behaviour.

This is a quantity adjustment.

What about hours of work?

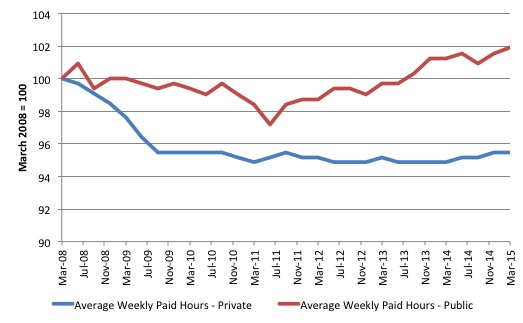

The following graph shows the evolution of average weekly paid hours in the private and public sectors from March 2008 to the March-quarter 2015 (indexed at 100 in March 2008).

The pattern is very clear – firms responded initially to the crisis by cutting average weekly paid hours – through a combination of laying off workers and cutting overtime etc.

Again, this is a quantity adjustment.

What about wage rates?

The next graph shows the average real hourly earnings for the private sector (indexed to 100 at March 2008 and deflated by the CPI). As the ‘Letter’ notes there was not a dramatic cut in real wages.

The decline from peak to trough has been of the order of 5.3 per cent. Moreover in the last 3 quarters they have grown by around 3.8 per cent again as GDP growth has accelerated.

In the scheme of things, it is hard to cast this as a price-adjusting recovery.

Conclusion

I could also have shown graphs depicting movements in real exchange rates, which again do not show anything exceptional on the price relative front. Ireland has improved its competitiveness since 2010 but by less than the Euro area as an aggregate and not much more than Germany. This has mostly come from the shift against the US dollar rather than anything Ireland has done by way of internal devaluation.

The evidence is that Ireland’s recovery has been an old-fashioned quantity adjustment aided by its very open economy and access to other growth markets where fiscal deficits have maintained income growth (the US, China, Australia etc).

There is no evidence that the adjustment has come from so-called internal devaluation.

Advertising: Special Discount available for my book to my blog readers

My new book – Eurozone Dystopia – Groupthink and Denial on a Grand Scale – is now published by Edward Elgar UK and available for sale.

I am able to offer a Special 35 per cent discount to readers to reduce the price of the Hard Back version of the book.

Please go to the – Elgar on-line shop and use the Discount Code VIP35.

Some relevant links to further information and availability:

- Edward Elgar Catalogue Page

- Chapter 1 – for free.

- Hard Back format.

- eBook format.

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.

Ireland inc has simply traded the last of its physical redundancy for GDP “growth” which is simply a excercise in increasing costs.

Recent Energy & electricity growth is clearly a result of increasing activity chasing purchasing power,increasing population of migrants and increased tourism inflows and not mean rises in the standard of living which continue to decline.

This growth was achieved via exports………..(domestic credit growth remains negative)

Provision for depreciation (which absurdly increases growth in good Keynesian fashion) is probably real and if anything underestimated.

When the current export boom turns south (in particular tourism which has a much bigger local impact then the multinational sector ) we will simply be left with even more costs. (Who will be able to afford to drive all those Year 15 airport rental cars which will get in to the second hand market next year ?)

Ireland’s faith is very much like those evolutionary dead ends – the hyper specialists.

A bit like the Spanish Lynx it can now only stomach rabbits.

When the rabbit / external markets get a disease then we will be left with a island of concrete rabbit holes that will not so slowly implode in on itself.

Its all about net national income and those figures will get much much much worse when the second giant revenue collapse arrives.

The Ireland after Nama blog thinks we need 37 ,000 new Houses in Dublin by 2018………..

I mean how does he know what we need when the people don’t, have the purchasing power to buy the existing stock. ????????

All of the house price inflation is a result of external credit inflation as outside buyers search for a “yield” / charge a rent.

This is the last phase of the great Irish fire sale which began first with fisheries post war.

And of course it is impossible for every nation to export its way out of recession.

Also, the little Northern tip of Ireland has a lot of trade with the UK. Wonder why that is. :b

The thing I don’t understand is if you want export led growth exit the euro. Then you can print money and buy forex to export away lots of real wealth and get a pat on the head from the IMF. :b

Again look at tourism…………..

Ireland inc (and not its people which may or may not be able to suck its tit) benefit from a decrease in the size of the euro scarcity engine.

Conflict in the Ukraine , the pyramids off for this remaining century , a little gladio light operation in Tunisia.

Where is the average Brit / Yank to go ?

He has a wad of strong $/£ in his back pocket.

Wants to feel safe and stuff.

What better then a typical Irish corporate holiday on a links course………….

Say we did have an internal devaluation of 5% pa. Interest rates couldn’t go any lower than zero and in practice would be slightly higher than that especially for borrowers. The effective real interest rate would be 6% p.a. for savers and about 9% p.a. for borrowers.

This would give a strong disincentive for anyone to borrow or spend, and a strong incentive to save until they were certain prices as fallen as far as they were going to go.

On the other hand an external devaluation, if that were possible for Greece and Ireland, would create some upwards price pressure especially on imported goods. Effective real interest rates would be much lower and maybe even negative. There would be a definite incentive to spend under those circumstances.

Thanks for writing about Ireland Bill

Its worth looking at the emmigration data link to get a picture of whats going on with the exodus of young people from Ireland. Austerity conditions still driving young people out of the country.

http://www.cso.ie/en/releasesandpublications/er/pme/populationandmigrationestimatesapril2014/

Bill,

I slightly disagree. Britain has played a large role in the recent Irish recovery. But Britain’s growth is tied to a massive property bubble that looks like its nearing its peak.

https://qzprod.files.wordpress.com/2014/04/first-time-buyer-gross-house-price-to-earnings-ratio-london-uk-average_chartbuilder.png?w=640&h=360

I think that the fact austerity basically ended two years ago in Ireland also played a role.

What is really interesting is what happens next. If/When the business cycle turns across the world — and we might even be seeing something significant in China right now in this respect — then Ireland will start accumulating large amounts of debt once more relative to income. The Germans will land in Dublin once more. But this time the Irish will say “no” because austerity is politically impossible. What happens then?

Well, the Germans have shown themselves totally intractable. They won’t budge an inch. And now there has been a lot of talk of the viability of a managed exit. So…

And who gets hit hardest in such a scenario? The mercantilist Germans of course! As the other currencies revalue at reasonable levels the German export sector will be steamrolled out of existence.

@Sam

Population flux is very different from the first euro depression of the 1980s.

Today’s young people have left alright but have simply been replaced with lower wage workers.

Ireland’s population growth is the fastest in Europe now as these artificial population bulge 20 and 30 somethings do what comes natural.

Its the island Birmingham experiment.

Social cohesion has broken down.

The only thing keeping the place together is the promise of money

When people fully realize they don’t own the money the island will be set alight.

Just remember the real reason for the recent peace in that previous capitalistic experiment up north is that both Protestant and catholic people exchanged their beliefs for liberal materialism.

It had little to do with Christianity ………………..

Also birth rate declined to a modern low in the mid 1990s as Ireland dumped the every sperm is sacred mantra.

This means that today the Irish born young person in his early 20s would not be very numerous in Ireland even If they decided to stay.

The bulk of the young people it seems are externally born , typically now in their 30s and therefore in peak modern era child bearing range.

Although fertility is perhaps low the sheer scale of this fertile group relative to others is driving Irish childbirth figures

Refer to year 2007.

151.1 thousand people arrived on these shores .

A mere 66.6 thousand was born.

That is some flipping ratio.

Imagine if these figures could be replicated in a larger country , say the US of A.

We are truly the model ranch country.

The apple in Peter Sutherland’s beady little eyes.

The high pasture for the global cattle barons who speak of human rights with forked tongues.

“deficit” spending is horrible semantics for a nation that doesn’t teach it’s avg citizens to parse sophism;

even accountants forget that data (and semantics) are meaningless without context

That said, even aggregate investment (the return on coordination) can be wasted, if too much of the profit goes to non-citizens. There’s a difference between coordination and adaptive coordination. It’s depressing that one even has to remind current politicians & policymakers of that little axiom.

In this case, Ireland should have never publically guaranteed all the risky, bad, private loans that German bankers made. Even to German bankers, capitalism & caveat emptor go together. That’s just consistent semantic logic.

Typical comment on the Irish economy blog in the event of a UK exit .

otto:

August 10th, 2015 at 12:02 pm

If the UK leaves the EU, it is in Ireland’s interest to make sure the UK gets most of the advantages of EU membership nonetheless, esp on trade and investment. On free travel, the Ireland Uk arrangement predates the EU and would likely continue after it too, for Irish citizens at least.

Perhaps the most significant problem for Ireland would be the removal of a voice in favour of liberal capitalism within the EU’s rule-making process, so that policy-outcomes would more contain more e.g. French and Italian policy-thinking, more protectionist and favouring insiders. Not much can be done about that however! Perhaps more pre-policy coordination with the Dutch might help?”

But if you understand liberal capitalism as freedom without a equity stake ( forget the false socialistic promise of equality ) which means in reality freedom for the few.

What then ?

Ireland’s decision is presented as a choice between German style fascism and British style fascism . ie. Almost exactly the same thingy but with different accents.

The true historic Irish nationalistic reaction against these forces of evil which was a a failed attempt at distributionism is not even recognized to have existed.

We have witnessed a extremely successful soviet like attempt to block out history,

The powers want us to enter either of only two doors.

Bill,

You may find this very interesting.

http://mikenormaneconomics.blogspot.co.uk/2015/08/revealing-mystey-belgian-buyer-of-us.html?m=1

Explains the growth.