The IMF and the World Bank are in Washington this week for their 6 monthly…

US Federal Reserve should not increase interest rates

Greetings from London in the early morning! If we went back a few years and dug out all the predictions and scare campaigns that were being issued by mainstream economists and their conservative ‘think tank’ conduits about the impending disaster that would accompany the near zero interest rate regimes that the US Federal Reserve Bank had implemented it would make a great comedy sketch. There should be no surprise with the massive predictive failures of the mainstream economists in this regard. They clearly did not understand the underlying dynamics that govern the way the central bank interacts with the commercial banks. The problem is that these conservative forces are so dumb they don’t have adaptive learning mechanisms and so even in the fact of evidence contrary to their Groupthink they keep pumping out the same nonsense. The other problem is that they tend to be well funded by the right-wing establishment that they exhibit disproportionate influence on the public policy debate. That influence has turned to demands that the US Federal Reserve Bank (the central bank) increase interest rates and reverse its quantitative easing – apparently because hyperinflation is just around the corner. Nothing could be further from the truth. At present the US economy is some way into a very slow and relatively tepid recovery. But it has still some way to go and while interest rate changes have a relatively weak impact on overall growth any anti-growth noise is undesirable. It is also not justifiable given the central bank’s own logic.

As an example of the hysteria, the inimitable Peter Peterson Foundation wrote on August 11, 2010 – Budgetary Impact of the Fed’s Actions During the Financial Crisis that:

Instead of merely supervising financial markets, the Fed is now a key participant … in markets. Now that the Fed is so intertwined with the financial system, it may face “exit strategy” issues: if it pulls out of markets too quickly, it threatens to create deflation, leading to another decline in the economy; if, on the other hand, it pulls out too slowly, the economy is at risk of hyperinflation that would destroy the value of savings and place a hardship on Americans.

And just to be clear I use the descriptor ‘inimitable’ in the sense of being ‘impossible to copy’ how bad their analysis has been. Although perhaps I overstate their uniqueness (a characteristics of being inimitable). There are heaps of ‘think tanks’ funded by corporate vested interests who are just as bad!

While attention seems to be abnormally concentrated on the share market gyrations – the casino having a tantrum – the other focus of the conservatives is the upcoming interest rate decision of the US Federal Reserve Bank at its September meeting – will it hike or not.

I sincerely hope it doesn’t hike.

It would be better for humanity if it left rates at their current level (or adjusted the cash rate down to zero – that is, abandon the range between 0 and 0.25 per cent), called up the Treasury and told them they were seeking a merger and proceeded to scrap the entire federal reserve system.

I rarely agree with Laurence Summers but his conclusion in the recent Financial Times Op Ed (August 23, 2015) – The Fed looks set to make a dangerous mistake – is reasonable.

He said that:

… a reasonable assessment of current conditions suggest that raising rates in the near future would be a serious error that would threaten all three of the Fed’s major objectives – price stability, full employment and financial stability.

What should we be looking at?

We came into this era of inflation targetting as a consequence of the Monetarist policy bias that central banks should ‘fight inflation first’, which was code for using unemployment as a policy tool rather than a policy target that it was during the full employment (non neo-liberal era).

So do the inflation dynamics justify a rate rise?

Inflation rate

I don’t want to get into an esoteric discussion about the nuances of the US Bureau of Labor Statistics consumer price index data. The BLS has recently improved the accuracy of its data “estimation system for the Consumer Price Index” (first time in 25 years).

They provide an excellent – Comparison of BLS Price and Spending Measures – which is worth consulting if you are interested.

I remind readers that the US Federal Reserve has an inflation target. It tells us in this response – Why does the Federal Reserve aim for 2 percent inflation over time? – that and inflation:

… rate of 2 percent (as measured by the annual change in the price index for personal consumption expenditures, or PCE) is most consistent over the longer run with the Federal Reserve’s mandate for price stability and maximum employment.

How does it judge whether the target is being met or not?

In this document – What is inflation and how does the Federal Reserve evaluate changes in the rate of inflation? – we learn that the Federal Reserve considers several measures of the CPI which can send “diverse signals about inflation”.

It has three basic steps in their evaluation process:

1. To avoid month-to-month variability, it considers “average inflation over longer periods of time”.

2. It examines “the subcategories that make up a broad price index to help determine if a rise in inflation can be attributed to price changes that are likely to be temporary or unique events”.

3. It examines “a variety of ‘core’ inflation measures to help identify inflation trends. The most common type of core inflation measures excludes items that tend to go up and down in price dramatically or often, like food and energy items.”

This process is followed by central banks almost everywhere.

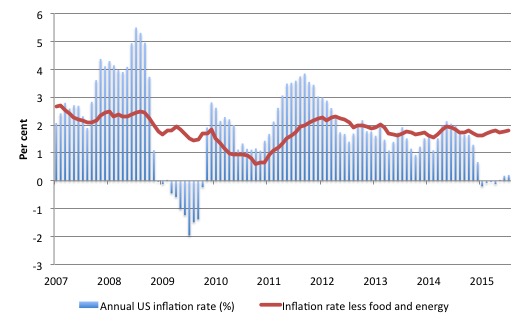

The following graph shows the annual rate of growth in the CPI All Urban Consumers (U.S. city average) series (blue columns) and the same series excluding food and energy prices (red line) for the period January 2007 to July 2015.

The red line gives a measure of the underlying inflation rate and the recent divergence is largely due to the decline in oil prices.

We learn that inflation in the US is very low at present (0.2 per cent per annum) but the underlying ‘core’ rate is a steady rate varying between about 1.6 and 1.8 per cent. It has been stable for the last three years at least.

The core rate is below what the US Federal Reserves considers to be its desirable ‘target’ rate and shows no signs of deviating from that level.

Lawrence Summers notes (in article cited above) that:

The biggest risk is that inflation will be lower than this – a risk that would be exacerbated by tightening policy. More than half the components of the consumer price index have declined in the past six months – the first time this has happened in more than a decade. CPI inflation, which excludes volatile energy and food prices and difficult-to-measure housing, is less than 1 per cent.

What about price expectations?

The Federal Reserve Bank of Cleveland provides the most current series on inflationary expectations and the real interest rate that is available.

In October 2009, the Bank released a discussion paper outlining – A New Approach to Gauging Inflation Expectations.

It is a non-technical version of this 2007 paper – Inflation Expectations, Real Rates, and Risk Premia: Evidence from Inflation Swaps.

The latest data from the US Federal Reserve Bank of Cleveland current to August 2015 – Cleveland Fed Estimates of Inflation Expectations – suggest that the:

… 10-year expected inflation is 1.82 percent. In other words, the public currently expects the inflation rate to be less than 2 percent on average over the next decade.

The data spans the period from January 1, 1982 to August 1, 2015.

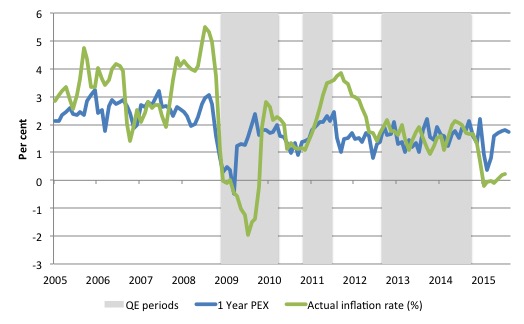

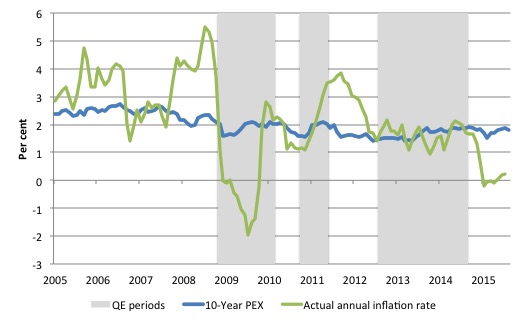

The three major rounds of QE in the US were dated as follows:

- Quantitative Easing 1 (QE1, December 2008 to March 2010) – This was announced on November 25, 2008. The program was expanded on March 18, 2009 as described in this FOMC press release.

- Quantitative Easing 2 (QE2, November 2010 to June 2011) – The FOMC announced on – On November 3, 2010 – that it “intends to purchase a further $600 billion of longer-term Treasury securities by the end of the second quarter of 2011, a pace of about $75 billion per month.”

- Quantitative easing 3 (QE3, September 2012 and expanded on December 2012 and terminated in October 2014) – The FOMC announced on – September 13, 2012 – that it “agreed today to increase policy accommodation by purchasing additional agency mortgage-backed securities at a pace of $40 billion per month”. This would continue “If the outlook for the labor market does not improve substantially”. This phase was expanded on – December 12, 2012 – such that the FOMC “will purchase longer-term Treasury securities … initially at a pace of $45 billion per month”. QE was terminated in the US in October 2014.

Those phases are depicted by the shaded areas in the following graphs.

The graphs show the evolution of inflationary expectations (PEX) and the actual annual inflation rate from January 2005 to August 2015. The first graph shows the one-year ahead inflationary expectation while the second shows the expectation over the 10-year horizon (in other words, what people in the US think inflation will be over the next decade).

It is hard to mount an argument that the QE episodes have increased inflationary expectations. The last phase (QE3) didn’t alter short- or long-run inflationary expectations one iota – they remain low and anchored despite the massive increase in the asset-side of the Federal Reserve balance sheet and the commensurate swelling of bank reserves.

1-year ahead inflationary expectations

10-year ahead inflationary expectations

Lawrence Summers noted that “If the currencies of China and other emerging markets depreciate further, US inflation will be even more subdued”.

So, even on the narrow ‘inflation-first’ charter the actual inflation rate and the expected inflation rate over the next decade (which may influence private sector behaviour) shows that the Federal Reserve is not achieving its target, which in its logic means that the interest rates are ‘too high’.

Labour Market

The US Federal Reserve Bank does not run a strict ‘inflation target’ where it focuses exclusively on the inflation rate.

From the Federal Reserve Act – Section 2A Monetary Policy Objectives – we learn that the:

The Board of Governors of the Federal Reserve System and the Federal Open Market Committee shall maintain long run growth of the monetary and credit aggregates commensurate with the economy’s long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.

In other words, it has to consider the state of the US labor market in making its decisions. This has been reflected in the last several years by the Federal Bank

On November 19, 2013, the then Chairman of the Bank gave a speech – Communication and Monetary Policy – where he reiterated that no interest rate rises would occur until the US economy sustained a low unemployment target:

In particular, even after unemployment drops below 6-1/2 percent, and so long as inflation remains well behaved, the Committee can be patient in seeking assurance that the labor market is sufficiently strong before considering any increase in its target for the federal funds rate.

An unemployment rate of around 5 per cent was considered to be a ‘long-run’ policy target. We can disagree with that assessment (see The dreaded NAIRU is still about!) but within the Bank’s own logic, it is hard to argue that the ‘low’ unemployment rate has been breached from above.

The aggregate unemployment remains at 5.3 per cent (July 2015) and has been slowly falling for the best part of 18 months. Earlier in the recovery it fell quite quickly.

But if we dig deeper all isn’t that rosy in the US labour market.

I considered the behaviour of the participation rate in this blog (July 22, 2014) – Decomposing the decline in the US participation rate for ageing. I sought to understand what was underlying the dramatic drop in the US participation rate since the early 2000s, but since the GFC in particular.

I decomposed the drop to expose the impact of the ageing workforce – so the decline might be driven by a simple composition shift to older workers who have lower participation rates. If there are proportionally more of those workers in the labour force, then the aggregate participation rate will decline (it is an average after all) because the labour force age weights have changed.

In other words, no behavioural shifts would have occurred.

I estimated that the shift in the age composition of the working age population accounted for a fall in the LFPR of 2.7 percentage points, which is about 60.1 per cent of the actual decline.

The remainder of the decline is largely driven by cyclical effects which at the time I did the analysis accounted for some 4.3 million workers who could reasonably be considered to be extra hidden unemployed.

I will update this analysis again soon but one year ago, the impact on the recorded unemployment rate of adding back in the workers that have dropped out of the labour force because of the weak employment growth was significant.

The official unemployment rate in June 2014 was 6.1 per cent whereas the adjusted ‘unemployment rate’ would have been 8.7 per cent once we take into account the non-ageing part of the decline in the participation rate.

I most recently considered the state of the US employment situation in this blog (August 11, 2015) – US labour market weakening.

The conclusion is that the current labour market is relatively weak (compared to last year). To understand that we note that while unemployment is now lower than last year, the rate of hiring is also slower and the way these factors combine in the index leads to an overall assessment that the labour market is in decline.

In that blog, I updates the Gross Flows analysis that allows us to calculate transition probabilities between labour force states (Employment to Unemployment, etc).

In other words, we can calcuate the probability of a worker who is unemployment will get a job in the coming month as well as the chances of moving between the other states.

The data suggests that the US labour market started to slow a little in mid-2015 as the Employment to Unemployment probability has steadied but the Unemployment to Employment probability has declined.

Moreover, broader indicators demonstrate that the US labour market has still not recovered its pre-GFC position.

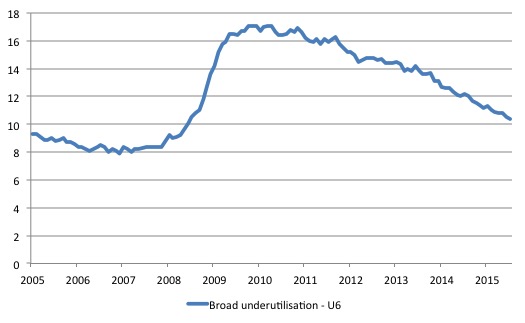

The following graph shows the BLS measure U6 – which is a broad measure of labour underutilisation – noting that the unemployment rate is considered a narrow indicator.

The U6 measure is defined as:

Total unemployed, plus all marginally attached workers plus total employed part time for economic reasons, as a percent of all civilian labor force plus all marginally attached workers.

So it takes into account underemployment and participation effects as well as officially recorded unemployment. In July 2015, it was 10.4 per cent.

Clearly, it has still not returned to its pre-GFC low of around 7.9 per cent which was recorded in December 2006.

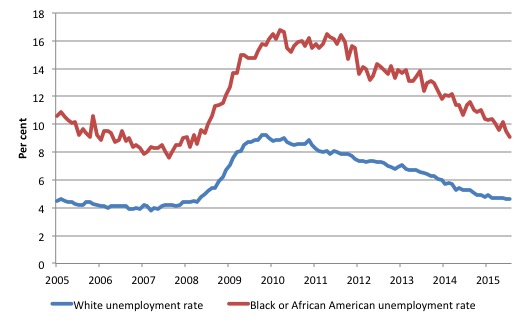

Further examination of the official unemployment data reveals disturbing trends. The following graph shows the White and Black or African American unemployment rates from January 2005 to July 2015.

Neither has recovered their pre-crisis lows. The White unemployment rate is still 0.7 percentage points above its May 2007 low and the Black or African American unemployment rate is 1.5 percentage points above its August 2007 low.

You can also see that the rise in the Black or African American unemployment rate was steeper as the economy slowed down in 2008 was sharper than it was for the Whites.

So any measure that seeks to slow growth down and undermine the relatively modest employment growth overall will impact disproportionately on the most disadvantaged workers in the labour market first.

An interest rate rise would thus increase the already high inequality.

Zero interest rates

The other point that I have made in the past, which is reflective of standard MMT principles, is that – The natural rate of interest is zero!.

In that blog, I explained that Modern Monetary Theory (MMT) theorists consider monetary policy to be a poor tool for counter-stabilisation because it is indirect, blunt and relies on uncertain distributional behaviour.

It works with a lag if at all and imposes penalties on regions and cohorts that may not be contributing to the price pressures.

For example, in an Australian context, when Sydney property prices were booming in the pre-crisis period, regional Australia was forced to bear the higher interest rates, even though there were no sharp upward trend in property prices.

There is also no strong empirical research to tell us about the impact on debtors and creditors and their spending patterns. It is assumed implicitly that borrowers have higher consumption propensities than lenders but that hasn’t been definitively determined.

MMT tells us that fiscal policy is powerful because it is direct and can create or destroy net financial assets in the non-government sector with certainty. It also does not rely on any distributional assumptions being made.

Further, MMT considers the desirable economic state to be full employment which means some irreducible low unemployment, zero hidden unemployment and zero underemployment.

What the irreducible unemployment rate is becomes an empirical question but it is certainly much lower than the official NAIRU estimates provided by the various bodies in difference countries. In Australia, the Treasury claim the NAIRU is around 5 per cent (that is, their measure of the ‘full employment’ unemployment rate) but it would be entirely possible to get down to around 2 per cent unemployment without accelerating inflation.

MMT also tells us that deviations from full employment reflect failed fiscal policy settings – not a large enough fiscal deficit (other things equal).

The size of deficit has to be judged in terms of the desire of the non-government sector to save in the currency of issue. So if the deficit is inadequate and unemployment arises we know the net public spending has not fully covered the spending gap.

We also know that fiscal deficits add to bank reserves and create system-wide reserve surpluses. The excess reserves then stimulate competition in the interbank market between banks who are seeking better returns than the support rate offered by the central bank. Up until the onset of the crisis this support rate in countries such as Japan and the USA was zero. In Australia it has been 25 basis points below the cash rate although there is no theoretical reason for that setting.

It makes much better sense not to offer a support rate at all. In that situation, net public spending will drive the overnight interest rate to zero because the interbank competition cannot eliminate the system-wide surplus (all their transactions net to zero – no net financial assets are destroyed).

So in pursuit of the policy goal of full employment, which we might consider to be a ‘natural’ goal for a collectively-minded society desiring high levels of well-being and inclusion, fiscal policy will have the side effect of driving short-term interest rates to zero.

It is in that sense that MMT concludes that a zero rate is ‘natural’.

If the central bank wants a positive short-term interest rate for whatever reason (MMT advocates against that) – then it has to either offer a return on excess reserves or drain them via bond sales.

The MMT preferred position is a zero interest rate with no government bond sales. In that environment, the government would then allow fiscal policy to make all the adjustments. It is much cleaner and effective that way.

And all those bright sparks in the central bank could be redirected (retrained) to studying cancer cures or engage in something else that is useful.

Conclusion

I could present more evidence to support the case being made here but time is short.

I agree with Lawrence Summers and others who have said that an interest rate rise now would not be in the best interests of the US economy.

I also hope to meet a lot of the British MMT army later tonight in London (it is currently 4 am in London).

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.

Tonight’s event – Reframing the Debate: Economics for a Progressive Politics, London, August 27, 2015

Tickets are sold out but we are planning a really nice event tonight in London. For those unable to attend, a You Tube film of the proceedings will be available soon. Friday, if I can influence things.

I will be talking about how the debate about the economy can be reframed around the things that really matter – people and the environment?

The Event will be held on Thursday, August 27, 2015 from 18:30 to 20:30 (BST).

The location:

John Snow Theatre

London School of Hygiene and Tropical Medicine

Keppel Street

WC1E 7HT London

United Kingdom

WWW site for Registration.

Upcoming Event – Book Launch Maastricht, August 31, 2015

The official book launch for my new book – Eurozone Dystopia – Groupthink and Denial on a Grand Scale – will be held on Monday, August 31, 2015 at the Maastricht University, the Netherlands.

The Launch will be held at the SBE Building, Tongersestraat 53, Maastricht University.

Room: A0.4.

The event will run from 13:15 to 14:30 (drinks to follow).

There will be two excellent speakers:

1. Dr László Andor, former Commissioner for Employment, Social Affairs and Inclusion in the Barroso II administration of the European Commission.

2. Professor Arjo Klamer, Professor of Economics of Art and Culture at Erasmus University in Rotterdam, The Netherlands. He “holds the world’s only chair in the field of cultural economics”.

The public is welcome to the event. I hope to see a lot of people there in Maastricht on August 31.

Hi Bill,

Some argue that low rates force investors/speculators to look for higher returns, which inflate bubbles in many sectors. What do you make of it?

Alex

I’m endlessly perplexed as to how any serious economic analysis of inflation can exclude food (especially) and energy. Oh I know the yuck-yak about volatility, but so what if that makes it harder? How on earth can we give out one of our major social benefits programs (SNAP, or food stamps) if we have no idea what the price of food is doing, and especially how can we be slashing this benefit as extravagant when it’s pretty obvious (to me and many others I know, at least) that food prices are being hit with constant increases well above the posted rates. No wonder no one here believes a damned thing the government is doing anymore. The lies are shoved in our faces every time we take a trip to the market.

Dear Bill

Very low interest rates are bad news for people with considerable financial wealth. That may be one reason why conservatives don’t like them. Of course, most wealth in the world is real wealth. Billionaires usually have a lot of real assets but little financial wealth. In my opinion, shares in a corporation are part of real wealth since they are partial ownership of real assets.

Very low interest rates encourage speculative bubbles. If you can borrow money for 2%, then you may be encouraged to borrow in order to buy stock or real estate.

Regards. James

Bill,

If my understanding of MMT (reality) is correct, it seems that the Fed has painted itself into a corner. They’ve been using monetary policy to “fix” the economy, because a fiscal policy solution is off the table. Congress insists – wrongly – that any new federal spending must be “paid for” with cuts to exisiting programs, since new tax revenue is a non-starter. They don’t get that taxes don’t pay for anything, and that is what got the Fed to where it is now.

I don’t get why price indexes don’t include mortgages and rent costs.That’s most people’s main monthly outgoing/expenditure.

Any measurement of inflation should include these basic Household costs.Alongside the consumer price index if not included in the list.

Enjoying the wind in the chestnut tree at my bnb, looking forward the meeting you and much of the UK crew immensely, super excited! 🙂

MMT’s advocacy of zero interest rates needs to take into account the tendency of market forces to equalise interest rates between countries through international capital movements (assuming similar expectations regarding inflation and exchange rate changes). See Wikipedia regarding “International Fisher effect”.

This suggests that zero interest rates are unlikely to be feasible unless either (a) most other countries also have zero interest rates or (b) effective controls are imposed to prevent international capital mobility.

Otherwise reducing interest rates is likely to cause an outflow of capital, depreciation of the currency, higher domestic prices for imports and reduced living standards, quite apart from the possible effects of capital outflows on investment and productivity.

“any anti-growth noise is undesirable”

To be charitable I suppose a great deal depends on what you define as growth. There is a hell of a lot of undesirable growth going on globally and that is just digging ourselves a deeper hole.

It is sad to see economists (and others) who have some progressive views still sucking on the Growth At Any Cost tit.

Hope you make a trip to San Francisco someday, Mr. Mitchell, I would like to hear your lecture.

Just got back from the London gig.

Bill was superb.

Ann & Richard….Well I just hope they learned something tonight.

Once Ann had put her phone down.

Bill,

1. Do you think the Fed was surprised that QE created practically no inflation ?

2. What was the purpose of QE ?

3. Why didn’t QE create inflation ?

– Neil

Bill,

What do you make of Warren Mosler’s and others’ conjecture that higher rates are expansionary as they add interest income which is a stronger effect than their effect on investment (mainly housing) which is weak, especially now?

In answer to Neil Andersons’ questions on QE.

1 With Japan’s experience I doubt the fed were worried by inflationary consequences.

2 Options here to support bank lending because they actually believe in the myth of

the money multiplier(doubtful) .To support the bond market to help deliver fiscal

stimulus(mmm).To support an essentially bankrupt financial sector.

3 Whether spending is inflationary depends on the nature of the market in which the

money is spent ,is there investment in greater productivity,is there scarcity is there

decent competition.State spending is not more inflationary than private spending. If some

of that spending is accounted for by bond issues which are later purchased by central banks

in the secondary market it is irrelevant .

Kevin and Neil

Post Keynesians normally use mark up pricing in the Kaleckian tradition. Some Keynesians use marginal pricing as Keynes did. The old Cambridge Keynesians were Kaleckians as well so it’s not just a Keynesian vs. post Keynesian split. In reality pricing is modal at a micro economic level. There is some mark up pricing; there is some marginal pricing and there is some nominal pricing. This makes it impossible to predict whether spending will be inflationary.

My personal view is that private sector spending is more likely to be inflationary because it’s determined by animal spirits and the profit motive. Keynesians and Post Keynesians all believe in raising aggregate demand by government spending when there is deficient demand; but differing beliefs on price result in different beliefs on outcomes. Marginal pricing would result in a reduction in the real wage, but mark up pricing would not. The real effects of spending are not predictable. Any spending decision faces conditions of Knightian uncertainty but decision methodologies of public vs. private are radically different. The key point here is that governments don’t generally seek to make a profit and instead use domain specific criteria (e.g. assessment of an application for a research grant). There are serious issues in the public sector as well, related to the sociology of power, but that’s going beyond price theories.

Bill generally provides very good answers on inflation.

Hacky i think we can best understand inflation in terms of conflict.

this understanding can include the sociology of power too.Bill has written in these terms

before.I was trying to answer Neils’ questions in regard to QE and its non inflationary

consequences and trying to broaden that a little to the potential inflationary

consequences of stimulus in general.

Kevin

There has been a real wage decline since 1970. In this period there has been high inflation, stable inflation and deflation but the decline in real wage has been a continuous long term trend. Therefore I think there are some issues to unpack.

1. The original question asked about the effect of QE. I skirted around the direct question of QE inflation. MMT are on record about this so there’s already a lot of reading material.

2. How useful is the concept of a general price level?

Wages have gone in the opposite direction to certain asset classes over a long period. Perhaps econometrics should start focussing on measures of variability when talking about the price level.

3. What is the effect of deficit spending on prices?

I’ve only really talked about the real wage which I’ve used as a proxy for living standards. Typically the media will use inflation to infer living standards but I don’t agree with this. Bill has expressed Kaleckian views on the effect of deficit spending on wages. Here Bill cites Tarshis for providing empirical evidence of what Kalecki had already worked out, that deficit spending to increase employment can also raise the real wage. There’s also a quote from Keynes to show that Keynes recognised this insight and relaxed his assumptions in line with the finding.

https://billmitchell.org/blog/?p=20055

The reality of spending is that it’s always uncertain. I’ve mentioned some problems with private sector spending, i.e. the profit motive and pro cyclical animal spirits. There are also problems with government spending. This has traditionally been an information problem due to tendencies to centralise power. Centralisation of decision making reduces the information available for decisions.

Conflict theory is taught as standard sociology in the UK. It’s usually taught as a macro theory due to Hegelian origins as a theory of history. It’s interesting to consider conflict in a micro context as well. For example, what are the relevant conflicts related to centralisation of power in the UK? CRESC have done some great sociology on UK trends. You may have heard of them. If not there’s a lot of info on their website.

http://www.cresc.ac.uk

Oh to agree with the likes of Larry Summers

Doubts doubts much fly in your little head.

One if aware of the scarcity game will become uncomfortable sitting next to such capitalist murderers

Capitalism is essentially a game of pointless expansion (for most)where all life eventually becomes monetary in nature rather then anything based on real humanity.

Inflation is needed for its “logic” to continue be it monetary or the affliction of fiscal stimulus to increase “investment” or War which is essentially waste production as production is lost via depreciation or on the battlefield.

But what if I told you there is a mechanism to print money which would enable deflation and thus increase purchasing power for everybody (without the need to work for the machine) and not just the connected capitalists caste who use deflation as one of its many weapons of monetary war.

The compensated price baby.