Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

Saturday Quiz – September 12, 2015 – answers and discussion

Here are the answers with discussion for yesterday’s quiz. The information provided should help you understand the reasoning behind the answers. If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern Monetary Theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

The private domestic sector will always be spending less than it earns in situations where the government fiscal balance is zero and the nation runs continuous external deficits.

The answer is False.

Note that this question begs the question as to how the economy might actually succeed in balancing its government fiscal position each year. It assumes that they do. Whatever behavioural forces were at play, the sectoral balances all have to sum to zero. Once you understand that, then deduction leads to the correct answer.

To refresh your memory the balances are derived as follows. The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

From the uses perspective, national income (GDP) can be used for:

GDP = C + S + T

which says that GDP (income) ultimately comes back to households who consume (C), save (S) or pay taxes (T) with it once all the distributions are made.

Equating these two perspectives we get:

C + S + T = GDP = C + I + G + (X – M)

So after simplification (but obeying the equation) we get the sectoral balances view of the national accounts.

(I – S) + (G – T) + (X – M) = 0

That is the three balances have to sum to zero. The sectoral balances derived are:

- The private domestic balance (I – S) – positive if in deficit, negative if in surplus.

- The Budget Deficit (G – T) – negative if in surplus, positive if in deficit.

- The Current Account balance (X – M) – positive if in surplus, negative if in deficit.

These balances are usually expressed as a per cent of GDP but that doesn’t alter the accounting rules that they sum to zero, it just means the balance to GDP ratios sum to zero.

A simplification is to add (I – S) + (X – M) and call it the non-government sector. Then you get the basic result that the government balance equals exactly $-for-$ (absolutely or as a per cent of GDP) the non-government balance (the sum of the private domestic and external balances).

This is also a basic rule derived from the national accounts and has to apply at all times.

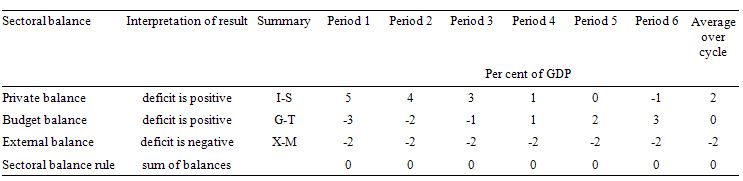

To help us answer the specific question posed, the following Table shows a stylised business cycle with some simplifications. The economy is running a surplus in the first three periods (but declining) and then increasing deficits. Over the entire cycle the balanced fiscal rule would be achieved as the fiscal balances average to zero. So the deficits are covered by fully offsetting surpluses over the cycle.

The simplification is the constant external deficit (that is, no cyclical sensitivity) of 2 per cent of GDP over the entire cycle. You can then see what the private domestic balance is doing clearly. When the fiscal balance is in surplus, the private balance is in deficit. The larger the fiscal surplus the larger the private deficit for a given external deficit.

As the fiscal balance moves into deficit, the private domestic balance approaches balance and then finally in Period 6, the fiscal deficit is large enough (3 per cent of GDP) to offset the demand-draining external deficit (2 per cent of GDP) and so the private domestic sector can save overall. The fiscal deficits are underpinning spending and allowing income growth to be sufficient to generate savings greater than investment in the private domestic sector.

On average over the cycle, under these conditions (balanced public fiscal position) the private domestic deficit exactly equals the external deficit. As a result, the private domestic sector will always be spending more than they earn (becoming increasingly indebted) if such a fiscal rule was enforced for external deficit nations.

The private domestic sector overall can only save in these circumstances if the government runs a deficit.

The following blogs may be of further interest to you:

- Barnaby, better to walk before we run

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

Question 2:

If a national government receives advice that the estimated output gap for their nation was less than previously thought, then other things equal, its discretionary fiscal austerity would have to be intensified to achieve a zero structural fiscal balance if it was currently in deficit.

The answer is True.

The “other things equal” qualifier refers to other information that is necessary to compute structural fiscal balances, such as, the fiscal sensitivity to the output gap. The question is thus seeking a comparison between a true output gap and one that is biased downwards and how that influences the estimation of the structural fiscal balance.

We are seeing the use of the term ‘structural deficit’ more often in the public debate as the weak recovery ensues and the talk has turned to credible ‘exit’ plans for fiscal policy.

The mainstream position that fiscal positions should be balanced or in surplus (and that the deficits being experienced at present will need to be ‘paid’ for by offsetting surpluses then leads commentators to conclude that any estimated structural deficit is a problem. I will briefly come back to that at the end of the discussion here.

But what is a structural deficit? Well it is the component of the actual fiscal outcome that reflects the chosen (discretionary) fiscal stance of the government independent of cyclical factors.

The cyclical factors refer to the automatic stabilisers which operate in a counter-cyclical fashion. When economic growth is strong, tax revenue improves given it is typically tied to income generation in some way. Further, most governments provide transfer payment relief to workers (unemployment benefits) and this decreases during growth.

In times of economic decline, the automatic stabilisers work in the opposite direction and push the fiscal balance towards deficit, into deficit, or into a larger deficit. These automatic movements in aggregate demand play an important counter-cyclical attenuating role. So when GDP is declining due to falling aggregate demand, the automatic stabilisers work to add demand (falling taxes and rising welfare payments). When GDP growth is rising, the automatic stabilisers start to pull demand back as the economy adjusts (rising taxes and falling welfare payments).

The problem is then how to determine whether the chosen discretionary fiscal stance is adding to demand (expansionary) or reducing demand (contractionary). It is a problem because a government could be run a contractionary policy by choice but the automatic stabilisers are so strong that the fiscal position goes into deficit which might lead people to think the “government” is expanding the economy.

So just because the fiscal position goes into deficit doesn’t allow us to conclude that the Government has suddenly become of an expansionary mind. In other words, the presence of automatic stabilisers make it hard to discern whether the fiscal policy stance (chosen by the government) is contractionary or expansionary at any particular point in time.

To overcome this ambiguity, economists decided to measure the automatic stabiliser impact against some benchmark or “full capacity” or potential level of output, so that we can decompose the fiscal balance into that component which is due to specific discretionary fiscal policy choices made by the government and that which arises because the cycle takes the economy away from the potential level of output.

As a result, economists devised what used to be called the Full Employment or High Employment Budget. In more recent times, this concept is now called the Structural Balance. As I have noted in previous blogs, the change in nomenclature here is very telling because it occurred over the period that neo-liberal governments began to abandon their commitments to maintaining full employment and instead decided to use unemployment as a policy tool to discipline inflation.

The Full Employment Budget Balance was a hypothetical construction of the fiscal balance that would be realised if the economy was operating at potential or full employment. In other words, calibrating the fiscal position (and the underlying fiscal parameters) against some fixed point (full capacity) eliminated the cyclical component – the swings in activity around full employment.

This framework allowed economists to decompose the actual fiscal balance into (in modern terminology) the structural (discretionary) and cyclical fiscal balances with these unseen fiscal components being adjusted to what they would be at the potential or full capacity level of output.

The difference between the actual fiscal outcome and the structural component is then considered to be the cyclical fiscal outcome and it arises because the economy is deviating from its potential.

So if the economy is operating below capacity then tax revenue would be below its potential level and welfare spending would be above. In other words, the fiscal balance would be smaller at potential output relative to its current value if the economy was operating below full capacity. The adjustments would work in reverse should the economy be operating above full capacity.

If the fiscal position is in deficit when computed at the ‘full employment’ or potential output level, then we call this a structural deficit and it means that the overall impact of discretionary fiscal policy is expansionary irrespective of what the actual fiscal outcome is presently. If it is in surplus, then we have a structural surplus and it means that the overall impact of discretionary fiscal policy is contractionary irrespective of what the actual fiscal outcome is presently.

So you could have a downturn which drives the fiscal position into a deficit but the underlying structural position could be contractionary (that is, a surplus). And vice versa.

The question then relates to how the ‘potential’ or benchmark level of output is to be measured. The calculation of the structural deficit spawned a bit of an industry among the profession raising lots of complex issues relating to adjustments for inflation, terms of trade effects, changes in interest rates and more.

Much of the debate centred on how to compute the unobserved full employment point in the economy. There were a plethora of methods used in the period of true full employment in the 1960s.

As the neo-liberal resurgence gained traction in the 1970s and beyond and governments abandoned their commitment to full employment , the concept of the Non-Accelerating Inflation Rate of Unemployment (the NAIRU) entered the debate – see my blogs – The dreaded NAIRU is still about and Redefing full employment … again!.

The NAIRU became a central plank in the front-line attack on the use of discretionary fiscal policy by governments. It was argued, erroneously, that full employment did not mean the state where there were enough jobs to satisfy the preferences of the available workforce. Instead full employment occurred when the unemployment rate was at the level where inflation was stable.

The estimated NAIRU (it is not observed) became the standard measure of full capacity utilisation. If the economy is running an unemployment equal to the estimated NAIRU then mainstream economists concluded that the economy is at full capacity. Of-course, they kept changing their estimates of the NAIRU which were in turn accompanied by huge standard errors. These error bands in the estimates meant their calculated NAIRUs might vary between 3 and 13 per cent in some studies which made the concept useless for policy purposes.

Typically, the NAIRU estimates are much higher than any acceptable level of full employment and therefore full capacity. The change of the the name from Full Employment Budget Balance to Structural Balance was to avoid the connotations of the past where full capacity arose when there were enough jobs for all those who wanted to work at the current wage levels.

Now you will only read about structural balances which are benchmarked using the NAIRU or some derivation of it – which is, in turn, estimated using very spurious models. This allows them to compute the tax and spending that would occur at this so-called full employment point. But it severely underestimates the tax revenue and overestimates the spending because typically the estimated NAIRU always exceeds a reasonable (non-neo-liberal) definition of full employment or capacity utilisation.

So the estimates of structural deficits provided by all the international agencies and treasuries etc all conclude that the structural balance is more in deficit (less in surplus) than it actually is – that is, bias the representation of fiscal expansion upwards.

As a result, given the government in the question aims to balance its fiscal position within a certain time frame by imposing fiscal austerity, the impact of the most recent advice (if true) would be to suggest the structural deficit is larger than previously thought.

In other words, the degree of fiscal austerity already in place (based on the larger output gap measures) would be considered to modest and the discretionary cutbacks would have to be intensified to balance the structural fiscal position.

The following blogs may be of further interest to you:

- A modern monetary theory lullaby

- Saturday Quiz – April 24, 2010 – answers and discussion

- The dreaded NAIRU is still about!

- Structural deficits – the great con job!

- Structural deficits and automatic stabilisers

- Another economics department to close

Question 3:

Opponents of continuous fiscal deficits often agree that short-period of deficit spending is not likely to be inflationary when the private demand is weak. Their main concern is that the accumulated stock of spending associated with continuous fiscal deficits eventually increases the risk of inflation. Their concern has validity.

The answer is False.

This question tests whether you understand that fiscal deficits are just the outcome of two flows which have a finite lifespan. Flows typically feed into stocks (increase or decrease them) and in the case of deficits, under current institutional arrangements, they increase public debt holdings.

There is no “accumulated stock of spending” associated with fiscal deficits. The expenditure impacts of deficit exhaust each period and underpin production and income generation and saving. Aggregate saving is also a flow but can add to stocks of financial assets when stored.

Under current institutional arrangements (where governments unnecessarily issue debt to match its net spending $-for-$) the deficits will also lead to a rise in the stock of public debt outstanding.

But of-course, the increase in debt is not a consequence of any ‘financing’ imperative for the government. A sovereign government is never revenue constrained because it is the monopoly issuer of the currency.

This is not to say that in each period the deficit may increase the inflation risk – depending on how fast nominal aggregate demand is growing relative to the real capacity of the economy to respond to it.

The following blogs may be of further interest to you:

Question 2 has me puzzled, or its answer, actually. My assumption is that if the output gap is said to be smaller, that indicates better economic conditions, and less (automatic) pressure towards government deficit. This would all indicate the opposite of the answer given (i.e. less budgetary deficit required for the same net balance). I do not dispute the extensive discussion of the question, only the direction of the premise that founds the question.

Thanks for your tireless work!