On August 10, 2015, the Library of the Canadian Parliament released one of their In Brief research publications – How the Bank of Canada Creates Money for the Federal Government: Operational and Legal Aspects – which described the operational interactions between the Bank and the Canadian Treasury that facilitate government spending in some detail. It…

Canada – by hook or by crook there will fiscal deficits

The December 2014 – Financial System Review – published by the Bank of Canada presents some chilling data, which tells me that the Canadian government’s embrace of neo-liberal orthodoxy is taking the nation down a dangerous path. The Review was obviously written before the latest global growth trends became apparent to the likes of the IMF who have now finally worked out that the policy structures in place which emphasise internal devaluation and fiscal austerity in most places are killing off growth. Canada is now very exposed because of its policy failures. The problem is that the political class in Canada is obsessed with recording fiscal surpluses and seem unable to understand that the only reason it has been able to reduce the fiscal deficit in the post-GFC period is because the economy has experienced a resources boom which is now over and the household sector incurred unsustainable levels of debt. Both sources of spending growth are now unlikely to continue and business investment is now contracting as the opportunities in the resources sector diminish. The Government and the main opposition party are heading into the national election boasting that each will achieve a fiscal surplus in the coming year. That is now unlikely because the downturn in the economic cycle (Canada is now in recession) will work against the aspirations of the politicians. They will end up with a fiscal deficit whether they like it or not. If they take the (stupid) neo-liberal path and fight against the private spending cycle, Canada will end up with what I call a ‘bad’ deficit driven by the automatic stabilisers – a rising deficit with rising unemployment and declining growth. Alternatively, it can take the sensible path and introduce new discretionary spending programs to allow a ‘good’ deficit to emerge where the public spending supports the moderation in private spending and unemployment does not rise. That is the preferred path but I doubt that either major party in Canada is mature enough and educated enough to take that action.

The IMF released a report yesterday (September 30, 2015) – Lagarde Calls for ‘Policy Upgrade’ to Combat Uncertain Global Outlook – which called “on policymakers to make a policy upgrade to address the current challenges”.

The IMF boss told a meeting in Washington that there were “more than 200 million people … unemployed worldwide” and “inequality is rising”.

In addition to its usual obsession with “structural reforms” (aka trashing worker wages and rights), the IMF now is claiming that governments need to be “supporting demand” and “preserving financial stability”.

An astute student of Modern Monetary Theory (MMT) will understand that these two goals are tightly interlinked.

The austerity obsession with trying to achieve fiscal surpluses and reduce public sector debt (that is, non-government sector wealth) coupled with the real wage suppression that comes with the internal devaluation push (“structural reforms”) has driven a reliance on household consumption to drive growth funded by ever-increasing levels of private debt.

Further, the misplaced reliance on monetary policy (low interest rates) to kick-start growth has also helped fuel real estate booms, which have contributed to the increasing private debt levels.

In turn, the rising household debt has placed the stability of the financial system – particularly the debt-exposed banks – in jeopardy.

We saw it in the 15 years leading up to the GFC. Lessons have not been learned and the policy structures that drove the world into crisis in 2008 are now being used to repair the damage. All that is happening is that we are setting the show up for a bigger crash than before.

Canada is at the forefront of this neo-liberal policy mania.

Canada is somewhat like Australia in that it is a primary commodity exporter and thus faces the cold (and hot) winds of fluctuating commodity (resource) prices. Resource prices undergo – short-term volatility and longer, so-called ‘super cycles’ which reflect technological changes, in addition to shifts in demand and supply.

The resource sector also exhibits the familiar ‘cobweb’ pattern of development where rising demand pushes up prices which then provide incentives for firms to invest and expand supply capacity but with a lag given how long the projects take to come into production.

By the time the extra supply is available, demand may have subsided and the excess supply drives down prices and so the cycle goes.

Then the cycle goes into reverse with declining investment and output and rising unemployment in the resources sector.

Both Australia and Canada regularly endure these fluctuating fortunes which means that domestically-oriented policy initiatives are paramount for stabilising national income swings.

With China now in retreat and re-balancing total production away from the export sector and towards domestic demand, Canada and Australia have faced a major reduction in commodity prices and now declining demand for volume in the commodities markets.

The glut of oil as a result of the expansion of North American production and supply has also driven prices in that sector down, which has exposed Canadian oil companies.

The ‘oil shock’ has seriously undermined growth in Canada.

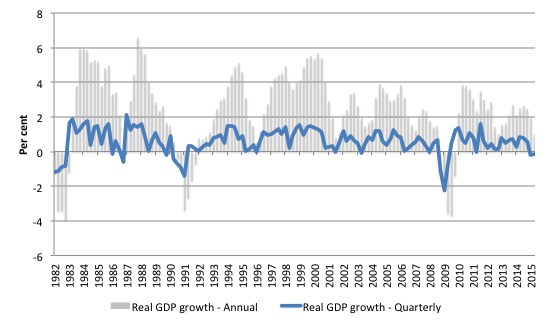

The following graph shows real GDP growth – quarterly (blue line) and annual (grey columns). After recovering relatively strongly after the GFC, growth has now slumped and Canada is now in an official recession (two consecutive quarters of real GDP growth).

Annual growth in the June-quarter 2015 was only 1 per cent after the March-quarter recorded a 0.2 per cent fall and the June-quarter a 0.1 per cent fall.

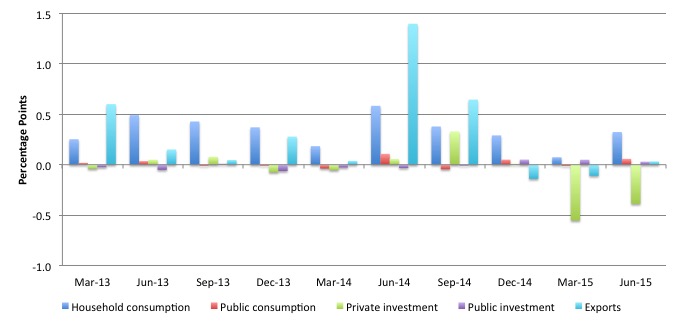

The next graph shows the contributions to real GDP growth of the major expenditure components since the March-quarter 2013. The graph is a classic depiction of the boom-bust cycle that resource exporting nations face.

The Government was able to cut spending in 2013 and 2014 without seriously undermining growth because net exports were so strong as was the accompanying business investment. Support also came from the fairly robust household consumption contribution (more on this later).

With the resources boom over, the only thing that is driving growth now is household consumption.

When the Canadian government brought the 2015 ‘Budget’ down on April 21, 2015, one of the principle promises the Minister for Finance made was to “balance the budget in 2015” (Source).

The Government announced that it would table “Balanced budget legislation … to enshrine in law the Harper Government’s responsible fiscal management policy that is creating jobs and putting more money back into the pockets of Canadians”.

The Minister for Finance said in his – Presentation Speech – that:

This year, we are forecasting a $1.4 billion surplus, and growing surpluses thereafter … a balanced budget is the only way to ensure long-term prosperity for Canadians …

He criticised the previous Government’s response to the GFC:

Their path – the path of spending money we do not have, on bureaucratic programs we do not need – leads to the crushing structural deficits that plagued this country for years … they found themselves in an economic swamp of their own creation.

And by the time they figured out the disaster the country was facing, the only way out was brutal cuts to programs Canadians count on.

So all the standard deficit fetishism.

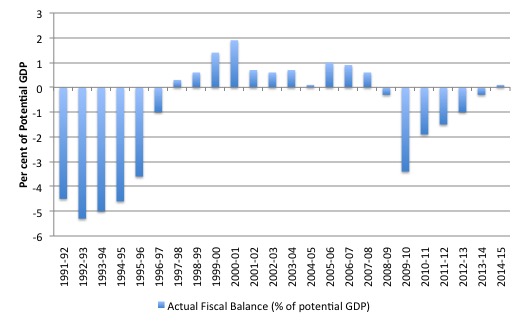

At the height of the GFC, the actual fiscal deficit rose to 3.4 per cent of potential GDP – a fairly modest rise compared to say the cyclical swing in public deficits in the recession of the early 1990s.

Revenue largely held up during the post GFC period because China drove resource prices. The major fiscal shift after the GFC has been in program expenses. They are now 3.6 per cent of GDP lower than they were in 2009-10.

The following graph shows the movement in the Canadian national fiscal balance from 1991-92 to 2014-15.

On September 14, 2015, the Department of Finance issued a press release – Canada Posts Budgetary Surplus of $1.9 Billion in 2014-15 – which said that despite the federal government had recorded a $1.9 billion surplus in 2014-15, a year earlier than their previous estimates.

The financial year in Canada ended on March 31, 2015. So this backslapping was before the nation went into recession in the June-quarter.

However, the end of the resources boom has changed the outlook significantly. The continued forecasts for larger fiscal surpluses will probably not prove to be accurate given the slowdown.

But the slowdown in growth doesn’t seem to be influencing the wild promises the politicians are making as the national election approaches.

The Government called the fiscal shift “credible economic stewardship”.

The opposition (NDP) claim that despite the recession, it will “balance the books right away” if elected (Source). Of course, the NDP claim they will balance the books in a fairer way than Harper’s conservatives.

Familiar theme?

The third party (Liberals) at least recognises that the cuts the Conservatives made to get the fiscal balance into surplus have exacerbated the declining external outlook and helped drive Canada into recession. They are not promising to balance the fiscal outcome any time soon and understand that government spending on infrastructure and other services will restore growth and ultimately, the fiscal outcome will take care of itself.

Canadian business is also worried about the deficit fetishism among the political class. In an article (June 23, 2015) – Why the federal government shouldn’t balance the budget – published by Canadian Business, the author says that “the obsession with balanced budgets is a … dangerous delusion”.

The article said:

Nothing can shake Canada’s political class from its obsession with balanced budgets-not even the prospect of a recession …

The article falters in logic but the conclusion is correct. The last thing the Canadian government should be doing right now is targetting fiscal surpluses.

The Government has indicated that it was relying on Canadian households to drive growth.

In its December 2014 Financial System Review, the Bank of Canada said:

Economic activity in much of the world, including Canada, continues to be highly dependent on stimulative monetary conditions. Exceptional monetary policy in many advanced economies has resulted in long-term interest rates near historical lows, some equity indexes near all-time highs, and a reduction in risk premiums and volatility in financial markets. An inevitable con- sequence, however, is the buildup of certain vulnerabilities in the financial system that could be more pronounced than in previous cycles.

The Bank identifies the “elevated level of household indebtedness” as a “key vulnerability” as “strong competition among financial entities is promoting riskier borrowing by some households”.

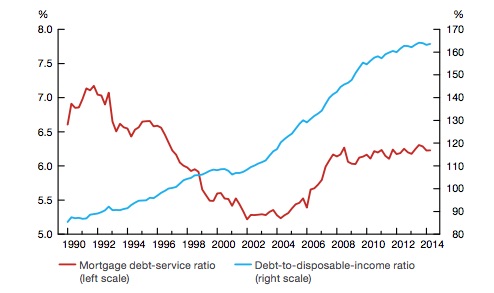

The following graph (replication of Chart 6 in the Review) shows the debt burden facing Canadian households. The Bank notes that “the share of household disposable income allocated to required payments on mortgage debt has not declined over the past several years, despite historically low interest rates”.

But these are aggregate figures for the household sector in total. Lying beneath the aggregate data is the range and distribution of the household debt burden. Things start to look pretty scary when we dig deeper.

The Bank says:

About

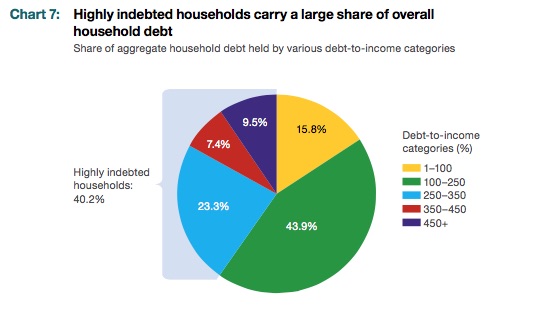

12 per cent of households have a total debt-to-income ratio above 250 per cent, and although this percentage has been steady over the past few years, it is almost double its level in 2000. These highly indebted households carry about 40 per cent of overall household debt.

The following graph (replication of Chart 7 in the Review) show this distribution.

So we have the classic neo-liberal situation arising – again. Private investment is weak. Exports are draining growth. The household sector is seriously indebted and facing worsening labour market conditions (wages and employment). Yet the government thinks that household consumption will not only maintain economic growth but will drive taxation revenue at sufficient rates of growth that it can record and even larger fiscal surplus (and drain spending from the economy) in the coming year.

It is not an optimistic outlook at all.

The Bank also said that the housing market in Canada is overvalued by between 10 and 30 per cent, which is a similar situation to that which preceded the downturns in 1981 and 1990.

But they claim there will be a “a soft landing … stronger Canadian economy will continue to support the housing market”. We will await the update given that since they published the report the economy has gone into recession.

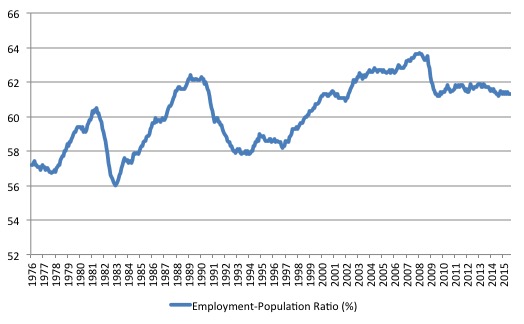

While households struggle under the burden of debt, the labour market is deteriorating. The unemployment rate is back up to 7 per cent and the employment-population ratio is falling after being stagnant since the GFC.

The following graph shows the Employment-Population ratio since January 1976. For all the talk about the ‘balanced budgets’ driving growth in jobs, the fact is that since the GFC employment growth has barely kept pace with the underlying population growth and has generally been below it.

The ratio has been falling as the fiscal shift towards surplus has been gathering pace. The fiscal surplus has undermined employment growth.

Conclusion

The delusion that the Canadian government is caught up in is that the growth of the Canadian economy post GFC was driven not just by the resources boom but also by the unsustainable build up in household debt associated with the real estate boom.

The combination of demand drivers allowed the economy to keep growing even though the government was whiteanting spending by moving to surplus. The surplus would not have occurred if the household sector had have adopted a more prudent approach to credit.

The point now is that the fiscal drag will come to the fore as business investment and exports crash. The Government’s hope that households will continue to drive growth and allow the Government to maintain the fiscal drag is delusional.

At this point in the cycle as private spending moderates and households face rising unemployment and static income growth the Government will have to increase its fiscal deficit – by hook or by crook.

By that I mean it can take the neo-liberal path and fight against the private spending cycle and it will end up with what I call a ‘bad’ deficit driven by the automatic stabilisers – a rising deficit with rising unemployment and declining growth.

Alternatively, it can take the sensible path and introduce new discretionary spending programs to allow a ‘good’ deficit to emerge where the public spending supports the moderation in private spending and unemployment does not rise.

That is the preferred path but I doubt that either major party in Canada is mature enough and educated enough to take that action.

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.

Thanks Bill, what’s even more depressing is the fact that most of the growth of all the other countries like Canada and Australia was largely from the Chinese governments stimulus post GFC that helped prop up the worlds economies. It’s bizarre watching all this play out yet no realises that what they’re trying to do doesn’t make sense.

One question that came up today I was hoping someone could help me is with all these surplus countries like China, Arab countries, Norway etc with large surpluses and sovereign wealth funds needing to invest their money somewhere. What happens in MMT if the government deficits soak up most of the excess spending that these surplus funds would want to invest in? Is that possible or even realistic? Hope I’m making sense and don’t sound too naive but that seems like something that people would be concerned about. The reasoning came up today as these funds are building toll roads for countries etc which could be built using government deficits instead. So I’m just wondering how to handle this type of argument on where surpluses would go.

The parallels between Canada and Australia are blindingly obvious.

All four of the currently visible parties in Canada, not just the two that have been in power at the federal level, are waving their neo-liberal flags wildly during this campaign in order to signal their fitness as fiscal managers. The Conservatives are the best players of this game at present, having surpassed the Liberals, while the Ndp and Greens just do their best to imitate the neo-liberal language so as not to fall behind. This makes them look incapable of effecting any meaningful political change on party lines to anyone with a basic MMT understanding or even a half decent intuition about economics. So many Canadians seem to have absorbed the neo liberal rubbish that it’s difficult for any party to talk about much else. As a result there seems to be a statistical dead heat between the Conservatives, Liberals and Ndp. With electoral district gerrymandering that favors Conservatives.

Canada faces a looming problem with it’s population and age distribution as well. In a few years we will have more people aged 65 and over than we have 14 and under. Relatively few young people have been able to find well paid employment regardless of education, for some time now (the higher paid jobs began falling off by the late 1980’s) and so are unable to start families. We are reaping what we have sown as a nation. Not only will private spending for anything outside of health care be in decline but we are getting constrained by labor shortage at the same time.

Little attention seems to be paid to the high unemployment level let alone the massive underemployment.

The finance minister searches for and trumpets every shred of data that might prove we are out of recession and showing tiny but existent growth.

Canadians seem to have been asleep for the past few decades, a luxury afforded only by the comforts resource based trade surpluses supply. Politicians and mainstream media continue to sing lullabies to help keep us that way.

Thanks for taking a look at the Canada situation Bill. You’re analysis is always deeply insightful and this is very helpful.

Dear Bill

About 75% of Canadian exports go to the US, and a lot of those are manufactured products, although not necessarily finished goods. For instance, Canada exports a lot of car parts, and the cars that Canada exports contain a lot of American-made parts. A lot of Canadian industry consists of subsidiaries owned by American corporations. Be that as it may, less than half of Canadian exports consist of primary products.

The high commodity prices in recent years drove up the Canadian dollar, with the result that Canadian industry suffered. A lot of industrial jobs have been lost in recent years. The natural-resources sector is very capital-intensive and employs few people. In Canada, natural resources belong to the provinces. That’s in our constitution. Consequently, the royalties that may be collected from natural-resource extraction go to the provincial governments. This means that high commodity prices didn’t benefit most Canadians. In fact, it may have hurt them economically if they were living in industrial areas.

Canada, like Australia again, takes in a lot immigrants. As a result, our population grows steadily despite aging. This means that the economy has to grow at the rate of about 1% per year just to maintain per capita income.

Although the indebtedness of Canadian households has increased significantly since 1990, from about 80% to 160% of household income, debt servicing as a percentage of income has fallen significantly as well because of historically low interest rates.

Regards. James

It’s probably worth noting some of the underlying dynamics of the election campaign underway in Canada, because it is somewhat unusual.

Typically the spectrum in Canada is NDP – Liberal – CPC, left to right. Only the Liberals and and CPC have ever formed government, though the NDP achieved official opposition status in the 2011 election, and were well positioned to form the government in this election.

Historically, the NDP has been a socialist and social democratic party, but it has been moving to the right by leaps and bounds in recent years. This election they went all-in and committed themselves to a balanced budget ideology in a stagnant, even shrinking economy. They have effectively Tony Blaired themselves.

Meanwhile, the Liberals – seeing the NDP’s left flank exposed – have been campaigning on the virtues of running a (probably too modest) deficit. It’s an interesting dynamic, because it was under the Liberals in the mid-90s that Canada went fully down the neoliberal rabbit hole with a massive austerity program. At this point though I am taking what I can get. The Liberals flirting with the idea of virtuous deficits provides an opportunity for conversations that challenge the conventional “wisdom” that balanced budgets are always good and desirable. I would typically be a fairly enthusiastic NDP supporter, but their commitment to neoliberalism and austerity is such a fundamental betrayal, and it leaves me nothing to work with in terms of moving the conversation forward. As a result, I am endorsing the Liberals in this election since they are the only ones who left the door open a crack to achieve public benefits through deficit spending at the federal level, and that at least gives me something to work with, talk about, and bring minds around to a new paradigm of thinking about these things.

http://www.theguardian.com/world/2015/oct/01/zunera-ishaq-veil-canada-election-conservatives

They are all focusing on this. Who cares?

Canada is part of the TPPA discussions, and its Dairy Farmers are very opposed to any concessions being made under this umbrella. Car Parts also appear to be contentious within the negotiations. Scuttle butt has it that the Canadian government may be prepared to give away Dairy in order to break the deadlock. I for one hope that the paralysis is permanent. The TPPA will further cement neo liberal economic paradigms into international trade, in amost insidiously undemocratic way.

The Provincial Premiers in Canada should also be up in arms over the deficit hysteria of the Federal Candidates.

Federal austerity will force most if not all of the Provinces into deficits and then the associated borrowing, cuts and other means to maintain acceptable levels of Public services that are by law delivered by the Provinces. Some like health-care which are funded jointly by the Federal and their Provincial counterpart are queued up for large Federal cuts, which puts the Provinces in a no win situation.

Austerity is pure socioeconomic poison, yet the Political elite of all stripes cannot wait to get their fill.

Dear Bill:

I have been reading your blogs for years and thank you for writing this one on Canada. Several weeks ago the CBC interviewed the 3 Party leaders who were tripping over themselves as to when the Budget should be balanced. I sent the network a note with the link to Paul Samuelson and an excerpt from James Galbraith in 2012. I did not get a response.

Bill, many thanks for your analysis of the Canadian economy! I think the word “delusional” captures it well. On a television panel, the finance spokesperson for the “progressive” NDP stated that the federal government could not afford to build too much bricks-and-mortar infrastructure like hospitals because then we wouldn’t have enough money to pay for doctors. Good thing he wasn’t in charge during the war when we had to build tanks, ships and planes and still have enough left over for generals and soldiers. Anyway, this guy was a provincial finance minister. The Peter principle in action.

______________________________________

Modern Monetary Theory in Canada

http://mmtincanada.jimdo.com/

“The Government announced that it would table “Balanced budget legislation … to enshrine in law the Harper Government’s responsible fiscal management policy that is creating jobs and putting more money back into the pockets of Canadians”.”

Er no. Tax rises and spending cuts take money out of pockets and give it to the govt. Doublethink.