For years, those who want selective access to government spending benefits (like the military-industrial complex…

Friday lay day – George Osborne talks tough but is saved by ridiculous forecasts

It’s my Friday lay day blog and I am wading through a pile of documents tracing the evolution of internal French cabinet discussions in the 1960s. That sounds like fun doesn’t? What doesn’t sound like fun is reading through the documents provided by the Office for Budget Responsibility to accompany the so-called Autumn Statement. The – Economic and fiscal outlook – November 2015 – is one of those extraordinary neo-liberal documents that is in denial of reality. The upshot is that the ridiculously optimistic forecasts from the OBR in the latest round of spending revisions are giving George Osborne the opportunity to once again talk tough (as an ideological warrior) but avoid ‘walking the walk’ for the time being any way. Politically, extreme austerity of the Conservative kind will not go down well in Britain right now.

Rather than studying the latest “Economic and fiscal outlook” from the OBR, it is interesting to reflect on the – Forecast Evaluation Report October 2015 – which they released on October 13, 2015.

These evaluation reports are required by the Budget Responsibility and National Audit Act 2011 (Section 8) and are presented to the British Parliament on an annual basis.

I agree with the OBR when they say that:

Forecasts provide an essential basis for setting policy. But since the future can never be known with anything approaching precision, forecasts are surrounded by significant uncertainty and will inevitably prove to be wrong in many respects.

The point is to ensure that one’s forecast errors do not reflect systematic biases, a problem that, for example, the IMF is continually facing.

The OBR also fails in this respect.

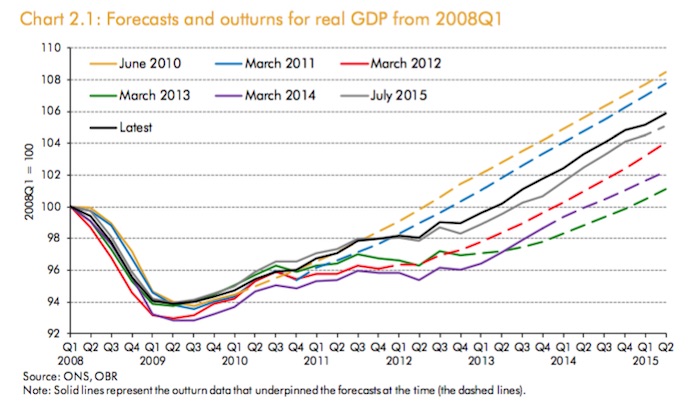

They have consistently failed to accurately forecast real GDP growth. When they released their first forecasts in June 2010, to accompany the rabid austerity program outlined by the newly-elected Conservative government, their real GDP forecasts were ridiculously optimistic.

In their Evaluation Report 2015 they say “the level of real GDP was significantly lower than we had forecast in 2010”. This was no surprise because the mainstream approach always underestimated the damage that austerity would cause.

It was these optimistic forecasts that allowed politicians and economists from the multilateral organisations such as the IMF to start touting nonsensical notions such as ‘growth-friendly austerity’ and the other stupidity, ‘fiscal contraction expansions’.

The forecasts were wrong because the underlying economic models were wrong and the policies that were designed from these models and forecasts were similarly wrong. There was no surprise that real GDP would tank in Britain after the Conservatives took power and it took them until 2012 to realise that they would lock the economy into sustained recession unless they reversed their austerity policies.

The fact that the UK fiscal deficit is still relatively high and is risen in the last year at the same time that economic growth is positive, even though private investment expenditure remains weak, vindicates the macroeconomic decision to more or less abandon overall austerity.

That is not to say that certain groups have not been punished severely by public sector cutbacks and other expenditure cuts.

The following graph (Chart 2.1 in the Evaluation Report) shows the changing forecasts at different points in time since June 2010 for real GDP growth. The solid black line is the actual real GDP index.

The cumulative errors in real GDP forecasts increased in late 2011. Their forecasts of nominal GDP were even more divergent given day or so severely overestimated the inflation rate that would prevail.

This poor forecasting performance bears on the way we view George Osborne’s latest fiscal statement.

First, his so-called U-turn on tax credits was really a recognition that he had built a coalition of opposition comprising interest groups the can barely talk to each other much less form a coherent resistance to targeted attacks on low-income people in the nation.

The problem, of course, was that he needed to scrap the tax credits to reduce government spending, which would allow him, using his flawed logic, to achieve a fiscal surplus by 2020.

He also had to do abandon attempts at cutting police expenditure – which would have been difficult to sustain politically given the recent Paris events.

And, with David Cameron competing with François Hollande to be the modern Napoleon in relation to their warlike statements regarding Syria, further military expenditure had to be allowed for.

So how was Osborne going to maintain his fiscal projections (surplus by 2020) and maintain the austerity mantle, which appeases his ideological support base?

Well, come in spinner! (Note: The term I just used I realised is Australian slang – For meaning).

The OBR has apparently found an (unbelievable) £15.7 billion in extra (previously unexpected) tax revenue for the British government over 2016-17 to 2018-19.

They have also estimated that previously expected interest payments by the government will be £17 billion less now, largely based upon a prediction that interest rates will not rise until at least 2017.

When the extra expenditure is factored in (that is, the amounts on tax credits etc that they thought they would save) the expected fiscal deficit is reduced by around £27 billion over the period to 2018-19.

So with the British economy slowing, mounting opposition to a range of welfare cuts, and increased demands for more public infrastructure spending to underpinning a productivity revival, George Osborne has the perfect veil to go easy on austerity yet keep his ideological support base more or less appeased.

The pain just gets pushed out to later years. Or does it?

The fact is that the OBR real GDP growth forecasts are overly optimistic: 2.4 per cent in 2016 and 2.5 per cent in 2018, then 2.3 in 2019 and 2020.

They believe Britain will be at near full employment next year.

The tax boom predicted is directly related to the over-buoyant real GDP expectations. Any deviation from that expected path (downwards) will blow the fiscal balance forecasts out of the water and just like in 2012 confront George Osborne with the reality – he can’t have austerity and growth.

The director of the British Institute for Fiscal Studies told the Guardian that (Source): that

He has set himself a completely inflexible fiscal target – to have a surplus in 2019-20. This is not like the friendly, flexible target of the last parliament which allowed him to accept a bigger deficit when growth and tax revenues disappointed. This is fixed, four years out.

I agree with the point that the surplus in 2019-20 will very likely not be achievable.

But the claim that this is “a completely inflexible fiscal target” is ridiculous. Just as George Osborne altered direction in 2012 he will do so again in the coming years without the slightest compunction while chanting to the austerity cheer squad that his fiscal plans are on track.

That is about all I want to say about the latest spending statement in Britain. There is clearly austerity being imposed upon certain segments of the British population and local governments, in particular.

This Changes Everything

Last night, I attended a screening of the new film by Naomi Klein and Avi Lewis – This Changes Everything – which is based on Naomi Klein’s book of the same name.

The book profiles several communities around the world who are fighting for climate justice against some of the large transnational corporations in the globe.

This isn’t intended as a review of the film but rather an observation about its message.

One of the things that is very clear in the current research I’m doing for my next book on why the political Left has abandoned a progressive economic’s agenda in favour of weird compromises like the Third Way, New Labour, or rather variations which are now being referred to as austerity-light, neo-liberal stances, is that global capitalism has rendered national boundaries irrelevant.

As a consequence, the capacity of the State to implement domestic policies that advance the well-being of its citizens has been usurped by the power of trans-national corporations and the global supply chain.

The corollary is that the globalisation of finance has meant that a state that tries to buck against the corporate interests of these monolithic companies will be punished through the balance of payments (capital flight, currency sell-off, short-selling, and all the rest of the scary things that are alleged to accompany the wrath of these companies).

My next book will challenge that perception and argue instead that the State which issues its own currency retains the discretion and capacity to maintain full use of whatever productive resources the nation has and, ultimately, the power to curb the abuses of these trans-national corporations.

The film last night demonstrates how abusive trans-national corporations can be brought to heel through organised, systematic and determined grass-roots actions at the local level.

One example was how a group of villagers in the Andhra Pradesh region of India forced the authorities to withdraw permits for a proposed coal-fired power station that would have destroyed the wetlands that the people rely on for their subsistence.

It was a very powerful message and one that the mainstream political Left parties have failed to grasp.

What it tells us is that the political Left has to glean its support from progressive grassroots organisations and in turn reciprocate that support in the political process.

Ultimately, people are more powerful corporations, a point lost on the mainstream politicians, who think that appeasing the ‘markets’ is what political leadership is about these days.

I will build on that theme in later blogs.

Another example in the film was the struggle by citizens in Halkidiki, which is in northern Greece against a Canadian gold mining company. The development would wreck the local ecosystem and undermine the eco-tourist industry of the region. The company, Eldorado Gold was also accused of avoiding payment of local taxes.

This news site – Hellenic Mining Watch – provides updated information on the struggle.

This SOMO site – Fool’s Gold – also is instructive.

In Naomi Klein’s book (page 297) we read:

In the Skouries forest near Ierissos, the Canadian mining company Eldorado Gold is planning to clear-cut a large swath of old-growth forest and reengineer the local water system in order to build a massive open-pit gold and copper mine, along with a processing plant, and a large underground mine. Despite its remote location, the fate of the Skouries forest is a matter of intense preoccupation for the entire country. It is debated in the national parliament and on evening talk shows. For Greece’s huge progressive movement, it is something of a cause célèbre: urban activists in Thessaloniki and Athens organise mass demonstrations and travel to the woods for action days and fundraising concerts

The book and the film clearly pre-dates recent events.

The previous Greek government had previously fast tracked the approval of the mining project despite the European Commission ruling that he had granted “illegal aid” to the company. The project, however, went ahead.

Syriza campaigned under the banner “Stopping the Halkidiki Gold digging” (Source) but under pressure from the Troika failed to cancel the previous government’s approvals.

After overwhelming evidence of the destruction that the project was inflicting on the region and the fact that the company had not completed required safeguards, the new Greek government withdrew approvals in August 2015.

It was here that the divide-and-conquer characteristics of austerity came to the fore. The company appealed the decision in the Greek courts and were joined in the case by the unions that represented the gold mining workers.

The head of the workers’ union was quoted in the press as saying:

We’re awaiting the court’s ruling which we believe will vindicate us … People in Halkidiki are tired of being unemployed because of unfair decisions.

So it is clearly a case of one set of workers desperate for employment in an austerity-ridden nation undermining the well-being of other workers in the local community.

These sorts of conflicts intensify when a government fails to maintain sufficient employment for all and forces worker against worker.

In October 2015, the court ruled in favour of the company and set aside the decisions of the government. It was argued by some commentators that Syriza’s decision in the first place to revoke was political because it came just as Tsipras called the new elections and he was seeking renewed political support after the disastrous capitulation against the Troika.

One commentator actually said that Tsipras would have been silently happy with the ruling because it gave him a way out. He gets the mine but looks like he opposed it.

Music – Johnny Too Bad

This is what I have been listening to this morning while I have been working.

This version is from American musician Taj Mahal and was on his Mo’ Roots album, which was released in 1974.

The song – Johnny Too Bad – was written by the Jamaicans Delroy Wilson, Winston Bailey, Hylton Beckford and Derrick Crooks.

The song featured in Jimmy Cliff’s movie – the Harder They Come – where it was performed by The Slickers, which was a Jamaican Rock Steady band in the late 1960s and early 1970s.

Derrick Crooks was the mainstay of that band.

Interestingly common Bob Marley’s bass player Aston “Family Man” Barrett played piano on this album.

My band sometimes plays this song even though we predominantly only play original material. The song has some history for us. In the late 1970s, when the movie was released in Australia it first was presented to the public in a series of shows in Melbourne. The format for the night was that my band Pressure Drop would play after the movie had shown. We did a number of shows like that. So to remind us of those days we sometimes play the song.

The original version is better but Taj Mahal’s rendition is also very beautiful. I was playing the album this week after some years of not listening to it because I bought some tickets this week to see the 73-year-old singer-guitarist in early 2016. I recalled how much I liked the songs on the album.

Saturday Quiz

The Saturday Quiz will be back again tomorrow. It will be of an appropriate order of difficulty (-:

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.

Australians don’t have to go to Greece to see the depredations of mining companies supported by corrupt and incompetent governments.

Open cast coal mining and fracking for Coal Seam Gas are the principal offenders in wrecking country,quite often prime farming land. This is all for the almighty export dollar.

There are many grass roots movements in opposition. Lock The Gate is one of the umbrella organizations.

But it is heavy going making headway against the power of governments and their court appointees plus government thugs (police).

The Indian company,Adani (of dubious reputation), is proposing to build the worlds largest coal mine in Central Queensland – the Carmichael mine. It has been opposed in every lawful way by various groups for the last 3 years but the Idiots In Charge in both the state and federal governments are obviously determined to press ahead and grant government assistance to this rock show.Even the banks are refusing to fund it.

The only consolation is that it probably won’t be an economic goer given the declining demand for coal – go figure.

But I’m sure there will be a lot of valuable resources wasted and more country ruined in the meantime.

Bill, not only did Osborne talk tough, he also used the occasion to lie outright. With respect to the cuts mentioned in the summer spending review to working tax credits, against which the public rebelled, this time he made a big show of pseudo-generosity when he said that he wasn’t going to phase them in, he was going to do away with them altogether. This was a bare faced lie and every commentator I heard on the day knew this and commented on it, though didn’t call it a lie. These cuts are intended to be reintroduced when universal credit is fully implemented, a program that the civil servants working on it say won’t work, Duncan Smith’s whipping them to get on with it anyway notwithstanding.

Your comments about the sovereignty of nation-states that issue their own currency being able to combat the attacks of transnational corporations and their lackeys in the context Naomi Klein sets out also apply to Obama’s ridiculous TPP treaties for Asia and Europe, though it looks as though they may be a dead duck, at least for now, as the present Congress doesn’t like them. They are so absurd that no one should like them, even those who do.

On last night’s BBC Question Time there was a lively debate about the spending review, but one thing all were agreed upon was that we must get the deficit down and reduce borrowing (as if the two are necessarily connected) so that our children and grandchildren are not saddled with paying back these impossible debts. The participants included Ken Livingstone and Kate Andrews of the Adam Smith Institute.

And McDonnell was on the Andrew Marr show spouting exactly the same nonsense.

The deception is absolute and complete.

Even Corbyn seems to have quietly dropped his (rather unfortunately named) People’s QE.

You are right, Bill, not to waste your time commenting further on the review. Treat it with the disdain it deserves.

Nigel- the situation in Britain is pretty desperate and the level of economic illiteracy profound. I now find the BBC unwatchable and despite the agendas of RT/AL Jazeera they at least offer alternative commentaries on economic thinking.

In Wynne Godley’s and Francis Cripps’ ground breaking book on Macroeconomics form 1982, they state:

“…economics has got into an infernal muddle..unfortunately the confusion extends into the formation of economic policy itself……despite emphatic rhetoric they do not know what the consequences of their actions are going to be. Moreover, in a hugely interdependent world system this confusion extends to the dealings of governments with one another who now have no rational basis for negotiation.”

35 years later…….

Nigel & Simonsky, it is even worse than anyone has said. Recently, both Varoufakis and McDonnell were on a panel in London and the speech given by Varoufakis, for the most part though not entirely, could lead one to think that he was an MMTer. On spending review day, toward the end of his reply to Osborne, you would be forgiven for thinking that he actually wasn’t at that meeting, or that he suffered from deafness on that occasion, or that a Doppelganger had attended instead, as he went on about reducing the debt in a fairer way. I am beginning to believe that both McDonnell and Corbyn are actively resisting taking a heterodox economic approach for whatever reason. They seem receptive to Varoufakis’s political views but reject his economic advice. Whether one agrees with all that he says, what V has to say is sounder than what they have been saying, which is not much different from what Balls said. The Mao Red Book stunt was quite amusing, but McDonnell has to do better than that.

I should add that Osborne was quick up to the mark, as he quickly claimed that the book McDonnell passed to him was his own signed copy.

Simonsky, I also have great difficulty watching the BBC. Execrable economic commentary. The only programs I can watch are Strictly Come Dancing and The Apprentice (and the like) and I prefer them over QT, which is how alienated I am from the BBC. I thought they would improve after the completely inept Stephanie Flanders left for an investment bank, but they put Robert Peston in her slot and he isn’t much better, though he is better. I can’t imagine them improving their economic commentary after he leaves.

Larry / Simonsky

I agree that the degree to which neoliberalism is hegemonic is depressing but I do believe there are cautious grounds for optimism.

I’m a social worker by trade although my first degree was in politics. I came to MMT via Positive Money and have been an avid follower of Bill’s blog (and the comments) for a few months now. I’m learning all the time and am trying to spread the word through friends / social media etc (Stephanie Kelton’s youtube videos are very good for this).

I’ve noticed more and more comments on the Guardian espousing an MMT understanding and similarly on Labour leaning Facebook pages. As well as trying to influence the top of the party to me it is key to start spreading the word at the grassroots – talking about MMT at ward and then CLP level, something which would be greatly helped if we could get a Labour MMT group set up linked by social media.

I was at an event with Corbyn last night in Sunderland and he said a couple of things which reinforced my optimism. He very clearly said that taxation is about redistribution (which at least is a step on from tax being needed to pay for government spending) and he was also very clear about policy ideas feeding up from the party members.

It’s going to be a long, hard slog to overturn 40 years of neoliberal dogma but at least the first murmurs of a challenge are starting to be heard

Indeed Larry-I got rid of my TV as I didn’t want to finance the b***ards any more, I’m on benefits at present and as the Government seems eugenically obsessed with destroying people in my position for the sin of taking sovereign money I thought I’d save £145 a year and rid myself of the bullshit/bollocks and balderdash!

I agree, Flanders was disgraceful and an insult to anyone with any degree of enquiry left in their mind. Peston is a strange bloke, he talks as if his thoughts are always lagging behind his speech which causes him to draw the length of words out unduly.

I see the BBC as a neo-liberal mouthpiece-perhaps the future lies in non-career/non-flashy presentation of news as demonstrated by The Real News Network.

I know someone who went to the Varoufakis/McDonell meeting. I’m still wondering why McDonell is coming out with this stuff as his advisers (Stiglitz/Pettifor/Blanchflower/Mazzucato) although hardly MMTer’s are certainly not deficit hawks. I wonder if Labour are still cringing before the ‘Overton Window’ .

There’s an interesting bit about sectoral balances in Economic and fiscal outlook – November 2015 where the OBR appears to be covering their backs. It’s the chart on page 87 and how it compares to the equivalent chart on page 77 of Economic and fiscal outlook – July 2015. First of all, there’s a neat description of the balances at paragraphs 3.104 (November) and 3.106 (July):

But then have look at the difference between the charts. Here’s July 2015 (note the household balance hovering around zero):

http://i.imgsafe.org/3a79100.png

Here’s November’s chart (note the whopping household deficit):

http://i.imgsafe.org/4791174.png

The telling bit is what OBR has to say about this at paragraph 3.106:

The use of the words ‘persistent’, ‘unprecedented’ (twice) and ‘uncertainty’ suggest that what they are really saying is:

[Bit of an aside: It would be really useful if OBR would live up to their stated support for Open Government and published individual image files of their charts, rather than burrowing them deep in PDFs and Excel spreadsheets. Then I wouldn’t have to go through all sorts of hoops to refer to them.]

Fundamentally nobody is prepared to say ‘Jehovah’ in public: government spending generates about a 90% increase in taxation and about a 10% increase in private saving in the UK pretty much whatever the tax rates.

Until we get to a point where people realise the total tax take has a different driver to the distribution of that tax take then we’ll get nowhere.

If there is a single thing to keep hacking away at it is this.

Start with an elephant, glue on feathers, duct tape on a large curved beak, paint it pink.

Declare that it will run a surplus by 2020 (it will attain lift just has to reach terminal velocity) and push it off a cliff.

Was that elephant sotck flow consistent.

A luta continua, your transliteration of the OBR’s paragraph 3.106 is virtually what Varoufakis said in the London meeting with McDonnell. Yet, nothing like it from McDonnell so far. In fact, thus far, he hasn’t differed much from Balls, which was viewed as a Tory-lite message. Corbyn knows that this is why Labour did not do so well in the election. And as pointed out by Simonsky, Labour’s advisors are such that they would be rather unlikely to advise putting forward a Tory-lite message. Yet, this is what McDonnell did at the end of his reply to Osborne. Reading Paul Johnson’s body language in the interview following the speeches on the Andrew Neill program, my interpretation was that, while he simply said that the OBR figures were speculative, he didn’t actually believe them. His facial expression particularly suggested this to me. If he thought they were farcical, why didn’t he say so? Perhaps the reason is as Simonsky stated: the Overton window influence. If that is so, then the future doesn’t look too bright.

A luta continua: Cool pseudonym. And, yes, you are right; it must go on.

Larry: You probably know this already. There is a second part: vitória é certa

A luta continua: Yes, but I have become less than certain about this.

A Luta / Larry

The OBR are also expecting the corporate sector to go into deficit towards the end of parliament??????