It's Wednesday, and as usual I scout around various issues that I have been thinking…

IMF continues with its wage-cutting line

In November 2015, the IMF released an IMF Staff Discussion Note (SDN/15/22) – Wage Moderation in Crises: Policy Considerations and Applications to the Euro Area – which purports to measure “the short-run economic impact of wage moderation and the implications for policy in the context of the euro area crisis”. It juxtaposes the impacts of the so-called internal devaluation approach with the impacts of Eurozone monetary policy. It recognises that the euro zone countries cannot use exchange rate depreciation to boost domestic demand but argues that instead, “lower nominal wage growth … and lower inflation or higher productivity growth relative to trading partners is needed”. The paper presents the standard mainstream arguments that: 1) wage cuts improve employment through increased competitiveness; 2) interest rate cuts stimulate overall spending; 3) quantitative easing stimulates overall spending. There is very little empirical evidence to support any of these statements, especially when fiscal austerity is accompanying these policy measures. The discussion does acknowledge wage cuts may be deflationary and “work in the opposite direction of the competitiveness affect”, in other words, domestic demand and overall growth declines. The unstated message is that internal devaluation doesn’t really improve competitiveness when it is imposed across the currency bloc and undermines domestic spending, which further impedes any export growth (because domestic income drives import demand).

The IMF paper conducts an experiment whereby it conducts a simulation where there is a:

… a coordinated, exogenous 2 percent reduction in wage (and price) inflation …

They compare the results of imposing that policy on a single Eurozone nation against imposing it on “all crisis-hit economies (which account for some 30 per cent of the euro area total GDP)”.

They also compare these experiments under conditions where the interest rate can fall to offset the declining demand from the wage cuts against a situation where monetary policy is constrained by the so-called ZLB (zero lower bound) interest rates.

They conclude that when interest rates are at their lower bound, wage cuts in the crisis-hit nations undermine real GDP growth in the entire Eurozone.

When monetary policy is constrained by the ZLB, the IMF claim that quantitative easing (QE) can provide a stimulatory policy intervention to offset wage cuts.

I should warn readers that the underlying simulation model (EUROMOD) used by the IMF has a number of assumptions that I believe render its results rather suspect.

I will leave it to those who are interested to explore that issue further.

Essentially, the IMF simulations claim that:

1) “The more countries undertake wage moderation together, the smaller is the competitiveness effect and the larger is the demand effect and thus the smaller the benefits and the larger the costs of wage moderation for these economies.”

2) “In the case of a single euro area crisis-hit economy undertaking wage moderation alone, the net result on output is strongly positive”.

3) “… when all euro area economies moderate their wage and price growth by 2 percent, this action results in a loss in output by about 1 percent by the third year. Put simply, the positive competitiveness effect is now even weaker and the negative demand effect so much stronger that it pulls down output below baseline. The reason for this outcome is that euro area economies trade to a large extent with one another: intra-euro area trade accounts for nearly half of total euro area trade, and euro area countries nowadays exchange goods and services equivalent to about 20 percent of euro area GDP per year”

Now if we took the logic in Point 3) then one could easily argue that with inflation so low in the Eurozone, these results would suggest that an across-the-board wage increase in the Eurozone would have strong positive impacts on growth without undermining any relative competitiveness for any particular nation.

The IMF, of course, doesn’t take the reader down that interpretation of their results because the paper is really designed to justify the existing policy of wage cutting and so-called ‘structural reforms’, which are really about undermining working conditions, job security, Occupational Health & Safety regulations, and other things that make work more tolerable.

It is interesting that their model considers exports and imports to be dependent on the real effective exchange rate (REER).

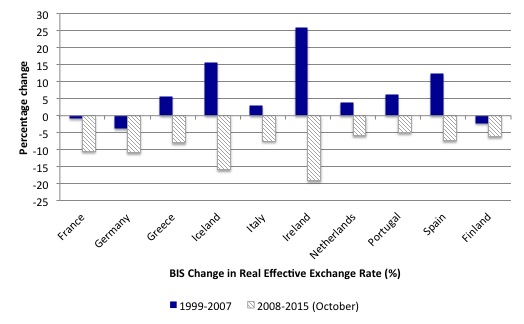

Consider the following graph, which shows the movements in monthly – Effective exchange rate indices – (REER) as produced by the Bank of International Settlements (BIS).

You can learn about this data from their publication – The new BIS effective exchange rate indices – which appeared in the BIS Quarterly Review, March 2006.

There was an earlier publication – Measuring international price and cost competitiveness – which appeared in the BIS Economic Papers, No 39, November 1993.

Real effective exchange rates provide a measure on international competitiveness and are based on information pertaining movements in relative prices and costs, expressed in a common currency. Economists started computing effective exchange rates after the Bretton Woods system collapsed in the early 1970s because that ended the “simple bilateral dollar rate” (Source).

The BIS ‘real effective exchange rate indices’ (REER) adjust nominal exchange rates with other data on domestic inflation and production costs.

The BIS say that:

An effective exchange rate (EER) provides a better indicator of the macroeconomic effects of exchange rates than any single bilateral rate. A nominal effective exchange rate (NEER) is an index of some weighted average of bilateral exchange rates. A real effective exchange rate (REER) is the NEER adjusted by some measure of relative prices or costs; changes in the REER thus take into account both nominal exchange rate developments and the inflation differential vis-à-vis trading partners. In both policy and market analysis, EERs serve various purposes: as a measure of international competitiveness …

If the REER rises (falls) then we conclude that the nation is less (more) internationally competitive.

The graph shows the movement in real effective exchange rates for various Eurozone nations plus Iceland. The two periods are from 1999-2007, that is, the Eurozone period before the crisis; and the period from 2008 to 2015 (October).

I included Iceland because it suffered very badly in the crisis but has its own exchange rate. The bars indicate the percentage change in the REER over the two periods.

The degree of real wage cutting in the sample of nations shown has been quite different in the austerity period. Real wages have been undermined by a combination of nominal wage cuts and tax hikes (for example, the VAT increases in various nations as part of their austerity packages).

Most nations have not cut nominal wages (greece is the standout with wage cuts of between 15 and 25 per cent depending on how one measures it).

Comparing Greece with Iceland we know that according to the AMECO database, Nominal compensation per employee rose in Iceland by 42 per cent over the period 2008 and 2015, whereas they fell by 15.9 per cent in Greece.

Yet, Iceland increased its international competitiveness by more than Greece because its exchange rate depreciated.

At any rate, the graph shows that even though the REER for Greece has indicated it has increased its competitiveness, Germany has made greater gains.

The Eurozone nations tend to move in lockstep and so gains from measures that might be taken internally are lost

Please read my blog – Eurozone unemployment – little to do with international competitiveness – for more discussion on this point.

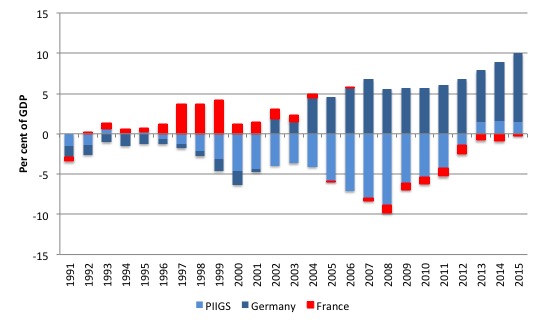

Now consider the following graph, which shows the current account balances as a percent of GDP for Germany (dark blue bars), France (red bars), and the average for Portugal, Ireland, Italy, Greece, and Spain (PIIGS) from 1991 to 2015.

The 2015 result is the estimate from the October World Economic Outlook database from the IMF. It will be close to the final outcome given the database has only just been constructed.

The German current account surplus continues to grow and now stands above 10 per cent of GDP, and is sufficient to warrant a macro imbalance finding under the capital European Commission rules against Germany. Of course nothing will happen.

The other notable feature is that the PIIGS are now as a block back in surplus after significant deficits in the lead up to the crisis.

The individual country results are: Portugal a surplus of 0.7 per cent of GDP, Ireland a surplus of 3.2 per cent of GDP, Italy a surplus of 2%, Greece is surplus of 0.7 per cent, and Spain are surplus of 0.9 per cent of GDP.

The dramatic shift in the outcomes for the PIIGS in the period after the crisis has been hailed by the Troika as the successful response to the austerity policies that were inflicted on these nations and which reduced domestic costs.

But one cannot conclude that the adjustment has been driven by changes in international competitiveness given the information shown in the previous graph.

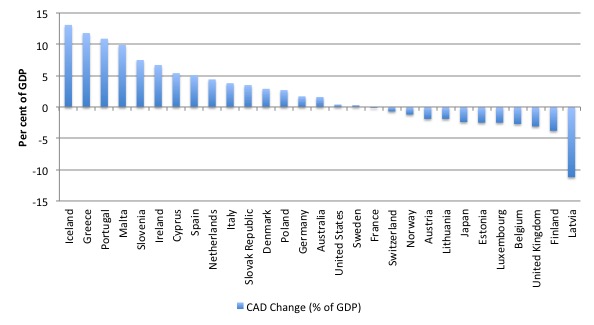

Further, consider the next graph, which shows the percentage point change (as a percent of GDP) in the current account balance for a range of countries. The changes computed over the period 2009 and 2014 and a positive change indicates a movement towards q surplus or towards a bigger surplus.

It is easy to see how large the adjustment has been for the peripheral Eurozone nations.

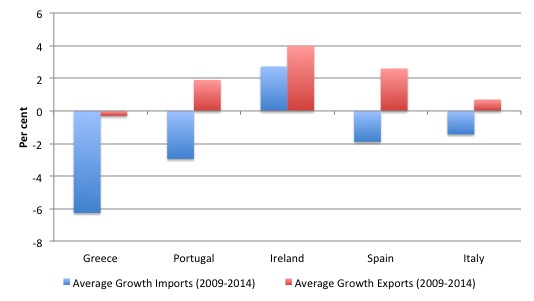

The next graph looks at the average annual growth in imports of goods and services (blue bars) and exports of goods and services (red bars) for the PIIGS over the same time period.

This graph provides us with a better understanding of what has been happening in the peripheral economies of the Eurozone.

All of the current account adjustment that has occurred in Greece has come from the dramatic decline in imports, which is an income affect driven by the Depression that the Troika has imposed on the economy.

It is clear that export growth has on average be negative over this period.

This result casts severe doubt on the veracity of the claims that internal devaluation improves competitiveness and provides a basis for renewed growth via exports.

The situation in Portugal is not dissimilar in the sense that a substantial amount of the adjustment has come from falling imports as a result of falling national income levels due to austerity. The difference is that Portugal has sustained positive export growth over this period, on average.

Only Ireland has sustained positive import and export growth over this period.

Conclusion

It is clear the IMF is persisting with its export-led growth mantra with wage cuts and broader attacks on working conditions being at the forefront.

The empirical evidence would suggest that in most cases this strategy is failing dramatically.

I explain why in detail in this blog – Fiscal austerity – the newest fallacy of composition.

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.

Yeah the IMF is part of the financial business model. They’re not interested in change. What the world needs is a mass movement for individual and small to medium sized business abundance, anti-financial monopoly and peace. Things are beginning to look ominously like the run up to WW II. You keep people in a prolonged state of austerity, frustration and hopelessness and violence is inevitably the result. Look around at the figures and circumstances: tensions all over the place whether it be Europe, the Middle East or America. Every pol in Europe is either deluded by economic orthodoxy of one sort or another which results in lots of heat but no light and virtually no action. I’m not that familiar with Australian politics, but would bet they probably fall into the same mold. In America you get an incredibly derisive fascist like Donald Trump who plays to every frustration the vast majority is feeling. We need to stop trying to influence the bought, the deluded and the disinterested, and join together in awakening the individual and businesses to their self interest in having a goodly additional amount of money continually in their hands….so they can spend it on the business’s products.

Institutions like the IMF and The World Bank have a certain ingrained culture stemming from their creation as facilitators of global corporate capitalism. There is no way to change that culture.

The only solution is for both entities to be taken out and shot,either figuratively or literally.

Glimmer of hope…?

http://www.theguardian.com/commentisfree/2014/mar/22/monetarism-economic-theory-bank-of-england-government

The question is how to counter the constant propaganda from the various Ministries of Truth?

Dear Bill

The larger an economic unit is, the less likely it can stimulate employment growth through trade surpluses. If Sweden or Switzerland run consistent trade surpluses, as they have been doing for many years, then the rest of the world will hardly notice. Germany was able to run large current-account surpluses for so many years only because it is part of the Eurozone and forced many other members of the Eurozone to run current-account deficits, so that the Eurozone as a whole had more or less current-account balance. It is much harder for the Eurozone as a whole to bring about employment growth through trade surpluses.

In any case, employment growth through trade surpluses means more production but not more consumption. What is the point of that? Ultimately, the aim of all economic activity is not employment but consumption. To work a lot and consume very little has been the unhappy lot of slaves throughout history.

In my experience, most people think that trade surpluses are good because they have a mercantilistic view of international trade, so they believe that exports are good. It arises from the fallacy of equating a country with an economy. A company tries to increase its sales (exports), so similarly, a country should try to increase its exports (sales) to the rest of the world. It is overlooked that a company only tries to sell more in order that its owners and employees can enjoy higher incomes and thereby buy more, that is, import more more. As long as the bulk of the population does not understand that the sole function of exports is to finance (current or past) imports, then there will be an obsession with export growth.

Regards. James

Greg,

On a pedantic note, the picture at the top of the Guardian article is the Royal Exchange not the Bank of England. The BoE is on the left at the beginning of Threadneedle Street.

And only a tiny glimmer, I’m afraid. The message is too complex to get through to most people. Believe me, I’m trying.

Nigel, I don’t think it is too complicated, but rather so unfamiliar and not supported by someone with “credentials” that it isn’t believed. I went to a local Labour Party meeting where my table was expected to talk about the economy. When I mentioned that taxes don’t pay for anything at the national level, I was met with incredulity. Even after I had explained how this was the case. They didn’t seem to want to know, something that I am beginning to suspect about Corbyn and McDonnell. And this particular truth isn’t rocket science. I obviously didn’t satisfy Neil’s criterion of countering the propaganda machine that is the Ministries of Truth.

What are these “credentials”? Even having studied economics and social science isn’t sufficient. It appears that part of this is that you have to be someone who is already believed, which means that you won’t come out with heterodox views. So, it would seem that the deck is stacked, though there are some commentators who do not hew to the party line, however, they don’t get much coverage nor is what they write repeated by others. So, the propaganda machine rolls on.

James,

Yes, basic economic philosophical insights like the purpose of production is consumption are what we need to cognite on and then base policy on. Observing and utilizing calculus to see that the flow of costs will always exceed the flow of individual incomes simultaneously produced is also one of those basic insights that point at the need for policy to address that fact.

Larry,

Yes its a catch 22 type situation. So what we have to do is begin at the grassroots level and “sell” a new and more accurate theory to those whose interest it is to have an alternative to the current mess.

@ Larry – someone like Varoufakis who knows the subject deeply, can explain it in simple terms, can relate to other human beings and has a personality. I think Mcdonnell knows in general terms that the MMT approach is largely the correct one – but, and i remember saying this in a post you contributed to btl just after Corbyn’s election, he does not have expertise, he cannot explain the detail in the same way i couldn’t explain the detail if suddenly pressed on the subject. So they regress to the mean, they play it safe, back to the comfort zone.

Ultimately you need someone up front and centre demolishing these arguments one by one – that’s why Varoufakis was so dangerous to, and hated by, the neoliberals, not only could he identify the bullshit, he could tell you *why* it was bullshit and communicate his message simply and effectively. You only had to see how he handled one hour of Question Time on the BBC – not in his native language i should add too !

And it sadly comes back to the main point which is the intellectual hollowing out of the Labour party (and politics in general).

Jeff, I am not convinced that McDonnell knows what he is doing. There was no need for him to utter the deficit mantra of the pre-Corbyn Labour Party at the end of his reply to Osborne. If he doesn’t get it, he should keep quiet until he does. And he could begin a trickle of heterodox econ on the talk shows. But he doesn’t. He doesn’t have that long to begin getting it right before it will be too late. You may be right that he is returning to his comfort zone. Well, he has to stop doing that, if that is what he is doing.

Varoufakis’s command of English is superb and he has been speaking and writing in it for over 25 years. So, I expect him to use it well.

I hope Bill doesn’t mind this “aside”:

Regarding Syria:

Local rebel vs Asad conflict

Wider Suni Shia conflict

ISIS complicating everything

NATO and Russian planes sharing the same air space

No western boots on the ground, but every western leader with testosterone wants it, so it will happen

It will become WW3, and no one will ever remember what started it.

Everyone who wants to pick a fight with anyone else is heading for Syria.

Larry, I think it is complicated. I may be a numbscull, but I was introduced to MMT last February and simply couldn’t at first believe it. I read L Randall Wray and Warren Mosler among many others and then there was a eureka moment when it all fell into place. I find that trying to get it over to people who have been brainwashed into the “must reduce the deficit so our grandchildren don’t have to pay back all that borrowing” line I find to be impossible. They just don’t want to know or even attempt to know. The government must be right, after all. Who am I to contradict?

There are also those who say (not me, of course, honest) that the politicians are all in hock to the global elites. Note how Tsipras changed his spots when in power, and I’d suggest Corbyn and McDonnell are going the same way. Corbyn was on TV at the weekend in a dapper suit and tie for goodness sake.

So EU have fixed its current account “problem” countries (minus CA) with austerity – less import. It would be interesting know to what amount it have affected neighboring countries in primarily MENA and contributed to the unrest in this region.

And probably also poor eastern European countries under EU:s neoliberal economic boot.

Maybe a vicious circle, young and educated in the austerity countries have to flee to other countries to find jobs, people from the poor neighbors is affected and low educated flood in to EU to find opportunities.

EU is more and more a negative economic force for the larger region of Europe and MENA.

With the EMU/Euro growth and prosperity was promised. With the Lisbon 10 year plan to 2010 growth and prosperity was promised. Free movement of labor was the recipe for growth and prosperity. Services Directive and Posted Workers Directive promised to promote it. 2020 agenda ten-year plan was the key to growth and prosperity.

But it have mostly delivered increased poverty levels, high unemployment and meager growth.

Nigel, I am sorry if the way I phrased my reply made it seem as if I was talking down to you. That was not my intention.

Euro seems like social darwinistic project, sold with lies as they all are – social darwinists hate prosperity, as it means anyone can survive. There seems to be whole industry lobbying for destructive ideas, all marketed with empty promises of economic panacea