Yesterday (April 24, 2024), the Australian Bureau of Statistics (ABS) released the latest - Consumer…

Friday lay day – Eurozone, lessons have not been learned

It’s my Friday Lay Day blog and my head is firmly in the 1960s and being helped along by music from the early 1970s. I’m currently trying to trace the evolution of intellectual ideas in the French Ministry of Finance as it gained ascendancy in the late 1960s over the Planning Ministry, which was Keynesian in outlook. It is no easy task. The current situation in Europe is approaching laughable in a sort of tragic sense, given the millions of people who are unnecessarily unemployed as a consequence of the incompetence and folly of the political class. The latest manifestation of this folly was the Monetary Policy decision released by the European Central Bank yesterday (December 3, 2015) which was met with derision from commentators and the financial markets responded by pushing the value of the euro up, which will further exacerbate the ECB’s claim that it wants to increase the inflation rate.

Eurostat reported this week that unemployment remains at elevated levels (10.7 per cent), producer prices are falling, the Eurozone annual inflation rate remained at 0.1 per cent in November 2015, and the volume of retail trade in the Eurozone was down by 0.1 per cent in October 2015.

The declining retail sales in October followed a similar decline in September and no growth in August 2015. Hardly a sign that spending is robust.

This time last year, the annual inflation rate in the Eurozone was 0.3 per cent and over the course of the last 12 months it is declined further and is now stuck around 0.1 per cent. See Eurostat report (December 2, 2015) – Euro area annual inflation stable at 0.1%.

The ECB’s charter is laid out in the Treaty on the Functioning of the European Union and Article 127(1) of the Treaty defines the primary objective of the Eurosystem as:

The primary objective of the European System of Central Banks … shall be to maintain price stability.

The ECB is also responsible to contribute “to the achievement of the objective of the union as laid down in Article 3 of the Treaty on European Union”.

Article 3 of the Treaty of European Union says that “the sustainable development of Europe” is “based on balanced economic growth and price stability, and a highly competitive social market economy, aiming at full employment and social progress”.

The ECB also provides a – Quantitative definition of price stability – as follows:

Price stability is defined as a year-on-year increase in the Harmonised Index of Consumer Prices (HICP) for the euro area of below 2% …

the definition makes clear that not only inflation above 2% but also deflation (i.e. price level declines) is inconsistent with price stability …

Inflation rates of below, but close to, 2% are low enough for the economy to fully reap the benefits of price stability.

So whichever way you look at – whether it be the primary objective of “price stability” or the broader objectives of helping the European Union achieve sustainable development which includes “full employment and social progress” – the ECB has been a dramatic failure as a monetary policy institution.

While its currency issuing capacity has saved the Eurozone from total financial collapse, the conduct of monetary policy more generally has failed to meet its own objectives.

Eurozone inflation is now lingering around zero with deflation (that is, falling price levels) threatening. And this is after the ECB has been engaged in a large-scale Qualitative Easing program since it introduced the Securities Markets Program in May 2010.

There have been several iterations of the same sort of bond-buying program, marketed under different names (currently the Outright Monetary Transactions program), which was announced on August 2, 2012.

On December 3, 2015, the ECB released its latest – Monetary policy decision – where it announced that:

… the interest rate on the deposit facility will be decreased by 10 basis points to -0.30%, with effect from 9 December 2015.

The European banks already are paying the ECB for holding their cash reserves. Yesterday’s decision means they will pay more. The logic is that the banks will seek to reduce their reserves to avoid this penalty rate.

The evidence is that the move will not lead to any significant increase in bank lending to the private sector. After all bank loans are not constrained by the volume of reserves that the banks have. Rather they are determined by the demand for loans by credit-worthy borrowers and with conditions so bleak in the Eurozone at present, that class of firm or person is rather scarce.

It was expected that the ECB would also ramp up its qualitative easing program to around €80 billion per month. The ECB kept its current purchase program unchanged at around €60 per month, although it indicated it would maintain the program for at least a further six months and would broaden the bond categories that it would be purchasing.

None of this is going to have any substantial effect on real output growth in the Eurozone and the evolution of the unemployment rate there.

The quantitative easing program is an asset swap (reserves for bonds) and can only really impact upon aggregate spending via its effect on yields on the asset class being bought and then the associated decline in rates at those maturities for other investment assets.

In other words, qualitative easing reduces long-term interest rates which may encourage investment if the cost of capital is the only difference between a project being profitable or not.

The reality is that forward-looking expectations in the Eurozone remain highly pessimistic and the current capital stock is probably more than sufficient to meet the growth in sales and so there is little incentive to engage in large-scale capital investment projects at whatever cost of capital.

It is for that reason that qualitative easing programs in the US, in the UK, in Japan, and now in the Eurozone failed to act as a broad stimulus for economic activity. There is some evidence that they stimulate certain asset markets but full employment depends upon growth in real goods and services not the growth in prices of real estate, for example.

The fact that the inflation rate is skating around zero at present and unemployment is stuck around 10.7 per cent is indicative of the point that Modern Monetary Theory (MMT) proponents make about the ineffectiveness of monetary policy interventions.

Quite simply, the Eurozone is relying on the wrong policy tools to stimulate its stagnant economy and that reliance is indicative of the stubborn denial that comes with neo-liberal Groupthink.

The policymakers are so stuck in their Monetarist-type thinking that they have placed their most effective policy tool – that is, fiscal policy – in a straitjacket and continue to play around with the impotent monetary policy tools at their disposal.

The ECB would make an almost instant contribution to growth if it posted out a ‘package of euros’ to every unemployed person in Europe. That fiscal intervention would immediately stimulate sales and possibly provide the basis for some crowding in of private investment spending.

Some commentators are arguing that the ECB Council has been bullied by the Bundesbank into moderating its qualitative easing program. For example, the UK Guardian article (December 3, 2015) – Mario Draghi’s big bazooka turns into a peashooter – said that:

The second – and far more likely – explanation is that Draghi wanted to do more but had been prevented from doing so by divisions on the ECB council. It has been clear for some time that the Bundesbank president, Jens Weidmann, opposes an expansion of QE, and his was probably not the only dissenting voice.

Weidmann gave a speech in Paris recently (November 12, 2015) – At the crossroads – the euro area between sovereignty and solidarity – to the Sciences Po where he continued to articulate the neo-liberal line that the crisis was the result of “reckless behaviour” of the Southern Member Nations of the Eurozone.

He said that it would be preferable if the “fiscal rules” were more rigid and vigorously applied and that “it would therefore be best if the application of the rules would be transferred to a new, independent fiscal council” – in other words, taking fiscal policy out of the domain of elected political officials.

The lessons have not been learned.

ECB Scandal

The ECB has recently been mired in a scandal relating to the potential provision of inside information to strategic financial market players prior to policy decision-making meetings.

On December 3, 2015, the European Ombudsman wrote a letter to ECB boss Mario Draghi – Response from the European Ombudsman to correspondence from the President of the European Central Bank outlining steps to improve ECB transparency.

This followed an earlier letter in May 2015 where the Ombudsman sought information regarding the reports that the European Central Bank had been holding secret meetings with hedge funds prior to their policy meetings.

The December letter followed up on replies to the Ombudsman’s office from the ECB outlining the so-called “transparency steps” that the bank would take in relation to this matter. The ECB said that it will no longer “meet or talk to the media, market participants or other outside interests on monetary policy matters in the week leading up to monetary policy meetings”.

The bank also indicated it would be “drawing up speaking engagement guidelines as well as the intention, in Spring 2016, to start publishing the list of meetings of Board members with a three-month time lag”.

The issue came to public light when the diaries of ECB officials were obtained under freedom of information procedures and revealed that the bank was regularly meeting with key hedge fund players in the days leading up to making decisions about monetary policy in the Eurozone.

In one instance, the Reuters report (November 27, 2015) – Watchdog urges ECB to stop banker meetings before policy decisions – noted that:

Benoit Coeure, an influential member of the ECB’s executive board, met BNP Paribas in September 2014 just hours before cutting the deposit rate … Separately, Coeure had told an audience including hedge funds this May about plans to accelerate bond buying.

The euro fell when it was announced to the public the following day and some investors cried foul. The ECB said the delayed publication of his speech was accidental.

Another mass murder and the Republicans pray

As someone who lives outside the US it is hard to fathom why people can buy military style weapons with unlimited stocks of accompanying ammunition with no real restrictions.

The so-called Right to Bear Arms, which is embedded in the US Constitution and many of the state constitutions, may have seemed appropriate several hundred years ago but appears to be a crazy freedom that leads to massive despair among innocent people including children.

The response of those who claim the sanctity of the Second Amendment of the US Constitution is for kids to tote weapons to school to defend themselves. It’s a surreal argument really – the idea that the prospect of a shoot out with kids and teachers will deter the villains.

The National Rifle Association in the US is one of the most powerful lobby groups and spends millions of dollars every year lobbying politicians to maintain the so-called gun ‘freedoms’. See – OpenSecrets.Org – for detailed analysis and data of the way in which the NRA influences US government policy and legislation.

The NRA’s epithet “the only thing that stops a bad guy with a gun is a good guy with a gun” is symptomatic of the mindless level that the proponents of gun ‘freedom’ in the US engage with.

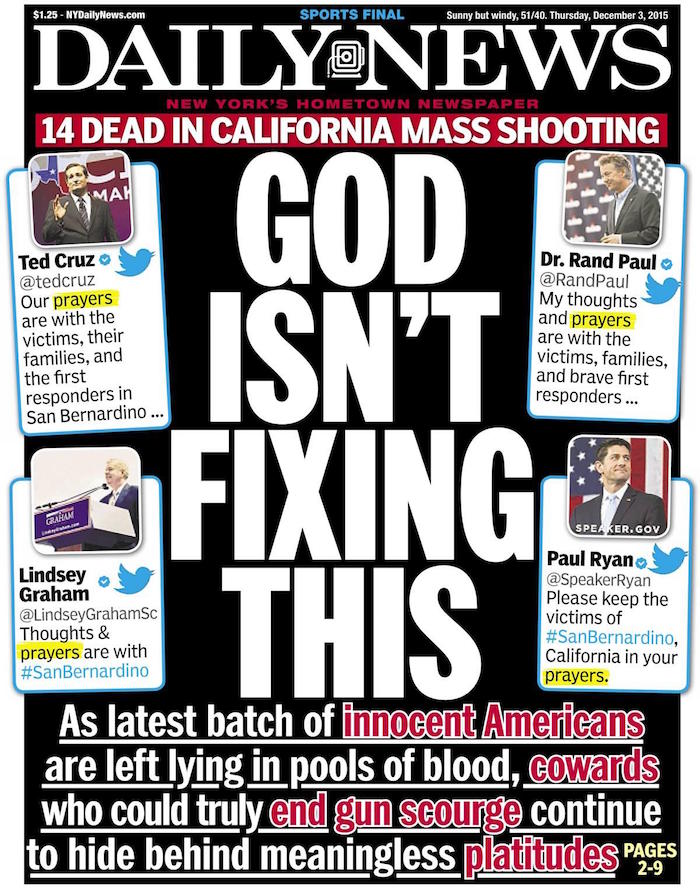

I thought the front page of the New York Daily News and the various pages they have run since the Sandy Hook massacre covering mass gun shootings in the US really touched the nerve.

The latest page below was powerful.

This article from the UK Guardian (December 3, 2015) – The five stages of Republican candidate reactions after mass shootings – tells any reasonable person why the Republicans should be cast into political oblivion.

But then we are dealing with the US here!

Music – Count Ossie

This is what I have been listening to this morning while I have been working.

This classic track – Run One Mile – is on the 1975 album Tales Of Mozambique – from the band Count Ossie and the Mystic Revelation of Rastafari, one of my favourite bands.

Count Ossie was a Jamaican hand drummer (played the Akete) and bandleader. He died on October 18, 1976 at the age of 50 (car accident).

He was a leading musician in the Wareika Hill area to the east of Kingston, Jamaica and set up a Rastafarian community there. In the early 1960s he recorded a lot with trombonists Rico Rodriguez and Don Drummond. Some of his best material came from those collaborations.

In the late 1960s he formed the band The Mystic Revelation of Rastafari, which continued on after his death.

This album featured Count Ossie’s drum team (an array of nyahbinghi drummers) and the band Cedric Brooks’ Mystics (which brought the bass and brass section and soloists). Cedric Brooks is a Jamaican saxophonist who crossed over from bebop jazz to reggae and helped the fusion.

He was a studio player at Coxsone Dodd’s Studio One in Kingston and he was also on the most famous Count Ossie album – Grounation.

If you get a chance to listen to the whole album – Tales Of Mozambique – your time will be well spent. Sometimes it becomes free form jazz with complex African drum patterns – similar to the Art Ensemble Chicago albums.

Beat music for the beat generation.

Almost impossible to remain seated while listening to it. I manage!

Saturday Quiz

The Saturday Quiz will be back again tomorrow. It will be of an appropriate order of difficulty (-:

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.

Dear Bill

It is always people who kill people. It is never their weapons because weapons don’t have a will of their own. So, let’s make sure that citizens have not only the right to own fire arms but are also entitled to posses any weapon at all. Why shouldn’t billionaires have the right to own a fleet of thanks or have their own little private air force if they can afford it. Do tanks or war planes have a will of their own? I don’t think so. If a government monopoly of guns is a threat to freedom, then a government monopoly of heavy weaponry is even more dangerous to freedom. Come to think of it, why should only the government have a police force or an army. It is a dangerous monopoly. Let large corporations have their own private armies and police forces. Competition is good and private enterprise is more efficient than the state.

Instead of repealing the Second Amendment, the Americans should expand it. It should read as follows: “Whereas a government monopoly of arms, weapons or all other lethal instruments of self-defense whatsoever is dangerous to the liberty of the citizens within the realm and an invitation to tyranny, the right of American citizens or other legal persons to own, bear, drive, fly, pilot or remote-control any arm, weapon or other lethal instrument of self-defense whatsoever shall not in any way be abridged within any state of the Union.”

Regards. James

The incident mentioned is very likely Islamist related. Go tell your story about firearms availability to those particular maniacs.

There is a lot wrong socially in the USA just as there is in Australia. The availability of firearms is a minor issue in relation to the social problems. Just about anything can be used as a weapon. At present we have other Islamist maniacs attacking Israeli civilians,police and military with knives,rocks and motor vehicles quite often with fatal results. Would you care to ban knives,rocks and cars? Good luck with that.

What is consistent in all this mayhem is the consistency of the Loony Left in blaming firearms for the actions of the extremist loonys or just the terminally insane as was the case with the recent USA family planning clinic murders.

Instead of jumping to simplistic assumptions and erstwhile solutions start unearthing the real problems. And they are never mentioned in economic treatises,that’s for sure.

It’s interesting reading through the archives of the blog and comparing situations back then with the current state-of-play. I was reading Trichet interview – the cult master speaks! today which has the following passage:

“If you think about the current state of the real economy across the EMU you will realise that the

inflation risk is minimal. They will end up having to fight deflation. The rate of capacity utilisation is as

low as it ever has been. There is currently zero (but probably negative) core inflation and

unemployment rates are above 10 per cent (across the zone) and will worsen as the austerity packages

bite.”

More than 5 years have passed for the workers in the Eurozone and nothing has changed.

“qualitative easing”

There’s a few of these. Are they deliberate irony or a slip of the finger?

“After all bank loans are not constrained by the volume of reserves that the banks have. ”

An ‘interesting’ example from Prof. R. Werner?

“Since banks invent money as fictitious deposits, it can be readily shown that capital adequacy based bank regulation does not have to restrict bank activity: banks can create money and hence can arrange for money to be made available to purchase newly issued shares that increase their bank capital. In other words, banks could simply invent the money that is then used to increase their capital. This is what Barclays Bank did in 2008, in order to avoid the use of tax money to shore up the bank’s capital: Barclays ‘raised’ £5.8 bn in new equity from Gulf sovereign wealth investors – by, it has transpired, lending them the money! As is explained in Werner (2014a), Barclays implemented a standard loan operation, thus inventing the £5.8 bn deposit ‘lent’ to the investor. This deposit was then used to ‘purchase’ the newly issued Barclays shares. Thus in this case the bank liability originating from the bank loan to the Gulf investor transmuted from (1) an accounts payable liability to (2) a customer deposit liability, to finally end up as (3) equity – another category on the liability side of the bank’s balance sheet. Effectively, Barclays invented its own capital. This certainly was cheaper for the UK tax payer than using tax money. As publicly listed companies in general are not allowed to lend money to firms for the purpose of buying their stocks, it was not in conformity with the Companies Act 2006 (Section 678, Prohibition of assistance for acquisition of shares in public company). But regulators were willing to overlook this.”

Money is created vertically. It is not created horizontally. When you say banks create money, you are saying they create it horizontally, which is not possible. Banks don’t create money. They can in certain circumstances request that the Fed create money for them, but even this money comes to the bank as a secured loan that must be paid back. (Fed loans to banks are secured by bank capital. Bank capital is sometimes secured by customer credit.)

“The availability of firearms is a minor issue in relation to the social problems.”

It seems to be the opposite. Availability of firearms becomes a major issue when you also have social problems. Mass shootings highlight the problem with the availability of firearm, but there are huge numbers of single death shootings which is still as much of a problem but do not get the same attention since it’s so common in the US.

” At present we have other Islamist maniacs attacking Israeli civilians,police and military with knives,rocks and motor vehicles quite often with fatal results.”

Which of course isn’t remotely comparably with the US situation, except for there being major social problems where people are forced off land not allowed to work etc. Imagine if the availability of firearm was the same there as in the US. So availability of firearms is a major issue.

“Effectively, Barclays invented its own capital. ”

All banks invent their own capital. That’s how it works systemically.

NatWest lends to a customer, that customer pays somebody at Barclays, they put the money as savings in a pension fund at Lloyds, the Pension Fund then buys NatWest capital bonds.

So NatWest got back the money they created into the bank’s own account with itself. And the initial loan is offset by capital bonds, with the initial deposit now offset with reserves loaned out to some other bank that is short.

Remember that bank capital bonds are just uninsured deposits at a higher interest rate, and bank equity is just uninsured deposits with a variable interest rate.

Those interest rates plus the interest rate paid on insured and uninsured normal deposits represents the cost of funding for the bank which they have to offset with the interest charged on loans.

All the uninsured liabilities are ‘bailed-in’ and represent bank capital for offsetting against bad loans – whether they are called ‘capital’ in Basel terms or not.

Werner is trying to suggest that there is something unusual about Barclays arrangement. There isn’t. That’s how banks work.

Two of your three stories are part of the same corrupt story.

EU reliance on monetary not fiscal stimulus and ecb insider training.

It is not an intellectual failing of mainstream economists it is the

victory of the 1% .

It seems as though this poor old house of cards is stacked so high now, that the slightest breeze could blow it over.

Fewer and fewer people in the developed world, are able to obtain solace by burying themselves in the illusions of self importance that living in the comfortable old normal once provided. At the same time some of those, at whose expense those illusions were provided, blindly lash out in revenge for ruined lives and ruined societies whenever afforded the opportunity.

When you sew seeds of misery you reap everything that brings; and, the neo liberal new world order has sewn so many of those seeds.

The only path to peace is to turn the bad crop under and plant anew. Those who think weapons will solve any problems are all dead at the end of the day; if not physically, both morally and spiritually.

The US is awash in guns. Sane weapons regulation like eliminating availability of assault weapons is definitely called for.

Private banks create money first and look for any reserves later. The central banks of the world are not sovereign, but rather enablers and essentially cohorts of the private banking system.

Every enterprise creates a higher rate of flow of total costs than it does a rate of flow of individual incomes with which to liquidate those costs/prices. Hence the macro-economy is in a continuous state of cost inflation and monetary disequilibrium that can only actually be resolved by out flanking the productive system itself with a direct and supplementary income payment to the individual.

A policy of monetary grace as in the free gift and the philosophical concept of grace as in individual and systemic free flowingness is the new and necessary economic and monetary paradigm the modern world requires to end the dominance of the current paradigm of debt only.

Neil, thanks for that.

Simsalablunder – Your last 2 sentences say a lot about you and your ilk.

You are always looking for excuses for murderous behaviour. But there are no excuses. The behaviour springs from the culture and the culture springs from the religion.

Thanks for the music Bill!

Count Ossie is simply fantastic! Ill investigate this artist further.

Shame about the other news.

Podargus,

Let us take your civilian pro-gun logic at face value. You need to explain whether you literally agree or not with Jame’s Schipper’s (satirical) propositions about unlimited private weapons ownership. That is to say, do you literally agree that private persons should be able to own any weapons they wish to own and can afford? If you don’t agree then you will need to explain why. For example, why should private persons not be allowed to own hand grenades, rocket launchers or APCs (armoured personnel carriers) fitted with heavy caliber chain guns or autocannon? Be careful if you argue that citizens should not own these heavier weapons. The reason I say “be careful” is that the logic that you will necessarily have to use will be the same logic that says small arms should be more restricted than knives.

“The behaviour springs from the culture and the culture springs from the religion.”

So if we follow Podargus own reasoning there aren’t any social problems causing mass shootings or the huge amount of single shootings in the US, instead the ” behaviour springs from the culture springs from the religion”. Perhaps Podargus should reflect over how much that says about you and your ilk.

Quote…. “behaviour springs from the culture springs from the religion”.

This statement is partly true and generally true though not in the way Podargus implied. It is true that part of behaviour stems from culture and part of culture stems from religion. It is also generally true that these part truths apply generally to all cultures and all religions including our own. That being so, we ought to look at what behaviours are stemming from our culture and our religions (including our ideological “religions”).

A certain, possibly mythical or possibly real, historical figure (Jesus) has certain sayings attributed to him. Some of these sayings are quite wise whether you accept them in a religious or a secular-humanist manner.

“Why do you look at the speck of sawdust in your brother’s eye and pay no attention to the plank in your own eye?”

“You are always looking for excuses for murderous behaviour.”

You come to that silly conclusion by conflating explanation with excuse.