Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

Saturday Quiz – January 2, 2016 – answers and discussion

Here are the answers with discussion for yesterday’s quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern Monetary Theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

Issuing government debt reduces the risk of inflation arising from deficit spending because the private sector has less money to spend.

The answer is False.

The mainstream macroeconomic textbooks all have a chapter on fiscal policy (and it is often written in the context of the so-called IS-LM model but not always).

The chapters always introduces the so-called Government Budget Constraint that alleges that governments have to “finance” all spending either through taxation; debt-issuance; or money creation. The writer fails to understand that government spending is performed in the same way irrespective of the accompanying monetary operations.

They claim that money creation (borrowing from central bank) is inflationary while the latter (private bond sales) is less so. These conclusions are based on their erroneous claim that “money creation” adds more to aggregate demand than bond sales, because the latter forces up interest rates which crowd out some private spending.

All these claims are without foundation in a fiat monetary system and an understanding of the banking operations that occur when governments spend and issue debt helps to show why.

So what would happen if a sovereign, currency-issuing government (with a flexible exchange rate) ran a fiscal deficit without issuing debt?

Like all government spending, the Treasury would credit the reserve accounts held by the commercial bank at the central bank. The commercial bank in question would be where the target of the spending had an account. So the commercial bank’s assets rise and its liabilities also increase because a deposit would be made.

The transactions are clear: The commercial bank’s assets rise and its liabilities also increase because a new deposit has been made. Further, the target of the fiscal initiative enjoys increased assets (bank deposit) and net worth (a liability/equity entry on their balance sheet). Taxation does the opposite and so a deficit (spending greater than taxation) means that reserves increase and private net worth increases.

This means that there are likely to be excess reserves in the “cash system” which then raises issues for the central bank about its liquidity management. The aim of the central bank is to “hit” a target interest rate and so it has to ensure that competitive forces in the interbank market do not compromise that target.

When there are excess reserves there is downward pressure on the overnight interest rate (as banks scurry to seek interest-earning opportunities), the central bank then has to sell government bonds to the banks to soak the excess up and maintain liquidity at a level consistent with the target. Some central banks offer a return on overnight reserves which reduces the need to sell debt as a liquidity management operation.

There is no sense that these debt sales have anything to do with “financing” government net spending. The sales are a monetary operation aimed at interest-rate maintenance. So M1 (deposits in the non-government sector) rise as a result of the deficit without a corresponding increase in liabilities. It is this result that leads to the conclusion that that deficits increase net financial assets in the non-government sector.

What would happen if there were bond sales? All that happens is that the banks reserves are reduced by the bond sales but this does not reduce the deposits created by the net spending. So net worth is not altered. What is changed is the composition of the asset portfolio held in the non-government sector.

The only difference between the Treasury “borrowing from the central bank” and issuing debt to the private sector is that the central bank has to use different operations to pursue its policy interest rate target. If it debt is not issued to match the deficit then it has to either pay interest on excess reserves (which most central banks are doing now anyway) or let the target rate fall to zero (the Japan solution).

There is no difference to the impact of the deficits on net worth in the non-government sector.

Mainstream economists would say that by draining the reserves, the central bank has reduced the ability of banks to lend which then, via the money multiplier, expands the money supply.

However, the reality is that:

- Building bank reserves does not increase the ability of the banks to lend.

- The money multiplier process so loved by the mainstream does not describe the way in which banks make loans.

- Inflation is caused by aggregate demand growing faster than real output capacity. The reserve position of the banks is not functionally related with that process.

So the banks are able to create as much credit as they can find credit-worthy customers to hold irrespective of the operations that accompany government net spending.

This doesn’t lead to the conclusion that deficits do not carry an inflation risk. All components of aggregate demand carry an inflation risk if they become excessive, which can only be defined in terms of the relation between spending and productive capacity.

It is totally fallacious to think that private placement of debt reduces the inflation risk. It does not.

You may wish to read the following blogs for more information:

- Why history matters

- Building bank reserves will not expand credit

- Building bank reserves is not inflationary

- The complacent students sit and listen to some of that

- Saturday Quiz – February 27, 2010 – answers and discussion

Question 2:

A nation can export less than the sum of imports, net factor income (such as interest and dividends) and net transfer payments (such as foreign aid) and run a government sector surplus of equal proportion to GDP, while the private domestic sector is spending more than they are earning.

The correct answer is True.

Note that the the current account is equal to the trade balance plus invisibles. The trade balance is exports minus imports and the invisibles are equal to the sum of net factor income (such as interest and dividends) and net transfer payments (such as foreign aid). So the question is asking about a current account deficit.

This is a question about the sectoral balances – the government fiscal balance, the external balance and the private domestic balance – that have to always add to zero because they are derived as an accounting identity from the national accounts.

To understand that, in macroeconomics we have a way of looking at the national accounts (the expenditure and income data) which allows us to highlight the various sectors – the government sector and the non-government sector (and the important sub-sectors within the non-government sector).

To refresh your memory the balances are derived as follows. The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

Expression (1) tells us that total income in the economy per period will be exactly equal to total spending from all sources of expenditure.

We also have to acknowledge that financial balances of the sectors are impacted by net government taxes (T) which includes all taxes and transfer and interest payments (the latter are not counted independently in the expenditure Expression (1)).

Further, as noted above the trade account is only one aspect of the financial flows between the domestic economy and the external sector. we have to include net external income flows (FNI).

Adding in the net external income flows (FNI) to Expression (2) for GDP we get the familiar gross national product or gross national income measure (GNP):

(2) GNP = C + I + G + (X – M) + FNI

To render this approach into the sectoral balances form, we subtract total taxes and transfers (T) from both sides of Expression (3) to get:

(3) GNP – T = C + I + G + (X – M) + FNI – T

Now we can collect the terms by arranging them according to the three sectoral balances:

(4) (GNP – C – T) – I = (G – T) + (X – M + FNI)

The the terms in Expression (4) are relatively easy to understand now.

The term (GNP – C – T) represents total income less the amount consumed less the amount paid to government in taxes (taking into account transfers coming the other way). In other words, it represents private domestic saving.

The left-hand side of Equation (4), (GNP – C – T) – I, thus is the overall saving of the private domestic sector, which is distinct from total household saving denoted by the term (GNP – C – T).

In other words, the left-hand side of Equation (4) is the private domestic financial balance and if it is positive then the sector is spending less than its total income and if it is negative the sector is spending more than it total income.

The term (G – T) is the government financial balance and is in deficit if government spending (G) is greater than government tax revenue minus transfers (T), and in surplus if the balance is negative.

Finally, the other right-hand side term (X – M + FNI) is the external financial balance, commonly known as the current account balance (CAD). It is in surplus if positive and deficit if negative.

In English we could say that:

The private financial balance equals the sum of the government financial balance plus the current account balance.

We can re-write Expression (6) in this way to get the sectoral balances equation:

(5) (S – I) = (G – T) + CAD

which is interpreted as meaning that government sector deficits (G – T > 0) and current account surpluses (CAD > 0) generate national income and net financial assets for the private domestic sector.

Conversely, government surpluses (G – T < 0) and current account deficits (CAD < 0) reduce national income and undermine the capacity of the private domestic sector to add financial assets.

Expression (5) can also be written as:

(6) [(S – I) – CAD] = (G – T)

where the term on the left-hand side [(S – I) – CAD] is the non-government sector financial balance and is of equal and opposite sign to the government financial balance.

This is the familiar MMT statement that a government sector deficit (surplus) is equal dollar-for-dollar to the non-government sector surplus (deficit).

The sectoral balances equation says that total private savings (S) minus private investment (I) has to equal the public deficit (spending, G minus taxes, T) plus net exports (exports (X) minus imports (M)) plus net income transfers.

All these relationships (equations) hold as a matter of accounting and not matters of opinion.

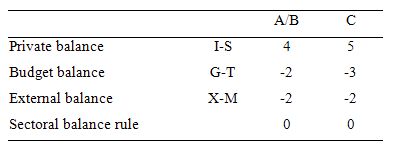

The following Table represents the three options in percent of GDP terms. To aid interpretation remember that (I-S) > 0 means that the private domestic sector is spending more than they are earning; that (G-T) < 0 means that the government is running a surplus because T > G; and (X-M) < 0 means the external position is in deficit because imports are greater than exports.

The first two possibilities we might call A and B:

A: A nation can run a current account deficit with an offsetting government sector surplus, while the private domestic sector is spending less than they are earn

B: A nation can run a current account deficit with an offsetting government sector surplus, while the private domestic sector is spending more than they are earning.

So Option A says the private domestic sector is saving overall, whereas Option B say the private domestic sector is dis-saving (and going into increasing indebtedness). These options are captured in the first column of the Table. So the arithmetic example depicts an external sector deficit of 2 per cent of GDP and an offsetting fiscal surplus of 2 per cent of GDP.

You can see that the private sector balance is positive (that is, the sector is spending more than they are earning – Investment is greater than Saving – and has to be equal to 4 per cent of GDP.

Given that the only proposition that can be true is:

B: A nation can run a current account deficit with an offsetting government sector surplus, while the private domestic sector is spending more than they are earning.

Column 2 in the Table captures Option C:

C: A nation can run a current account deficit with a government sector surplus that is larger, while the private domestic sector is spending less than they are earning.

So the current account deficit is equal to 2 per cent of GDP while the surplus is now larger at 3 per cent of GDP. You can see that the private domestic deficit rises to 5 per cent of GDP to satisfy the accounting rule that the balances sum to zero.

The final option available is:

D: None of the above are possible as they all defy the sectoral balances accounting identity.

It cannot be true because as the Table data shows the rule that the sectoral balances add to zero because they are an accounting identity is satisfied in both cases.

So if the G is spending less than it is “earning” and the external sector is adding less income (X) than it is absorbing spending (M), then the other spending components must be greater than total income

You may wish to read the following blogs for more information:

- Back to basics – aggregate demand drives output

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

- Barnaby, better to walk before we run

Question 3

If a government wants to reduce the public debt ratio, then it has to eventually run primary fiscal surpluses (that is, spend less than they raise in taxes).

The answer is False.

This question requires you to understand the key parameters and relationships that determine the dynamics of the public debt ratio. An understanding of these relationships allows you to debunk statements that are made by those who think fiscal austerity will allow a government to reduce its public debt ratio.

It also requires you to differentiate between the level of outstanding public debt and the ratio of public debt to GDP. The question is focusing on the latter concept.

While Modern Monetary Theory (MMT) places no particular importance in the public debt to GDP ratio for a sovereign government, given that insolvency is not an issue, the mainstream debate is dominated by the concept.

The unnecessary practice of fiat currency-issuing governments of issuing public debt $-for-$ to match public net spending (deficits) ensures that the debt levels will rise when there are deficits.

Rising deficits usually mean declining economic activity (especially if there is no evidence of accelerating inflation) which suggests that the debt/GDP ratio may be rising because the denominator is also likely to be falling or rising below trend.

Further, historical experience tells us that when economic growth resumes after a major recession, during which the public debt ratio can rise sharply, the latter always declines again.

It is this endogenous nature of the ratio that suggests it is far more important to focus on the underlying economic problems which the public debt ratio just mirrors.

Mainstream economics starts with the flawed analogy between the household and the sovereign government such that any excess in government spending over taxation receipts has to be “financed” in two ways: (a) by borrowing from the public; and/or (b) by “printing money”.

Neither characterisation is remotely representative of what happens in the real world in terms of the operations that define transactions between the government and non-government sector.

Further, the basic analogy is flawed at its most elemental level. The household must work out the financing before it can spend. The household cannot spend first. The government can spend first and ultimately does not have to worry about financing such expenditure.

However, the mainstream framework for analysing these so-called “financing” choices is called the government budget constraint (GBC). The GBC says that the fiscal deficit in year t is equal to the change in government debt over year t plus the change in high powered money over year t. So in mathematical terms it is written as:

which you can read in English as saying that Budget deficit = Government spending + Government interest payments – Tax receipts must equal (be “financed” by) a change in Bonds (B) and/or a change in high powered money (H). The triangle sign (delta) is just shorthand for the change in a variable.

However, this is merely an accounting statement. In a stock-flow consistent macroeconomics, this statement will always hold. That is, it has to be true if all the transactions between the government and non-government sector have been corrected added and subtracted.

So in terms of MMT, the previous equation is just an ex post accounting identity that has to be true by definition and has not real economic importance.

But for the mainstream economist, the equation represents an ex ante (before the fact) financial constraint that the government is bound by. The difference between these two conceptions is very significant and the second (mainstream) interpretation cannot be correct if governments issue fiat currency (unless they place voluntary constraints on themselves to act as if it is).

Further, in mainstream economics, money creation is erroneously depicted as the government asking the central bank to buy treasury bonds which the central bank in return then prints money. The government then spends this money.

This is called debt monetisation and you can find out why this is typically not a viable option for a central bank by reading the Deficits 101 suite – Deficit spending 101 – Part 1 – Deficit spending 101 – Part 2 – Deficit spending 101 – Part 3.

Anyway, the mainstream claims that if governments increase the money growth rate (they erroneously call this “printing money”) the extra spending will cause accelerating inflation because there will be “too much money chasing too few goods”! Of-course, we know that proposition to be generally preposterous because economies that are constrained by deficient demand (defined as demand below the full employment level) respond to nominal demand increases by expanding real output rather than prices. There is an extensive literature pointing to this result.

So when governments are expanding deficits to offset a collapse in private spending, there is plenty of spare capacity available to ensure output rather than inflation increases.

But not to be daunted by the “facts”, the mainstream claim that because inflation is inevitable if “printing money” occurs, it is unwise to use this option to “finance” net public spending.

Hence they say as a better (but still poor) solution, governments should use debt issuance to “finance” their deficits. Thy also claim this is a poor option because in the short-term it is alleged to increase interest rates and in the longer-term is results in higher future tax rates because the debt has to be “paid back”.

Neither proposition bears scrutiny – you can read these blogs – Will we really pay higher taxes? and Will we really pay higher interest rates? – for further discussion on these points.

The mainstream textbooks are full of elaborate models of debt pay-back, debt stabilisation etc which all claim (falsely) to “prove” that the legacy of past deficits is higher debt and to stabilise the debt, the government must eliminate the deficit which means it must then run a primary surplus equal to interest payments on the existing debt.

A primary fiscal balance is the difference between government spending (excluding interest rate servicing) and taxation revenue.

The standard mainstream framework, which even the so-called progressives (deficit-doves) use, focuses on the ratio of debt to GDP rather than the level of debt per se. The following equation captures the approach:

So the change in the debt ratio is the sum of two terms on the right-hand side: (a) the difference between the real interest rate (r) and the real GDP growth rate (g) times the initial debt ratio; and (b) the ratio of the primary deficit (G-T) to GDP.

The real interest rate is the difference between the nominal interest rate and the inflation rate. Real GDP is the nominal GDP deflated by the inflation rate. So the real GDP growth rate is equal to the Nominal GDP growth minus the inflation rate.

An appreciation of the elements of the public debt ratio immediately tells us that a currency-issuing government running a deficit can reduce the debt ratio. There is no need to run primary surpluses and unnecessarily reduce growth. The standard formula above can easily demonstrate that a nation running a primary deficit can reduce its public debt ratio over time.

Furthermore, depending on contributions from the external sector, a nation running a deficit will more likely create the conditions for a reduction in the public debt ratio than a nation that introduces an austerity plan aimed at running primary surpluses.

Here is why that is the case.

A growing economy can absorb more debt and keep the debt ratio constant or falling. From the formula above, if the primary fiscal balance is zero, public debt increases at a rate r but the public debt ratio increases at r – g.

The following Table simulates the two years in question. To make matters simple, assume a public debt ratio at the start of the Year 1 of 100 per cent (so B/Y(-1) = 1) which is equivalent to the statement that “outstanding public debt is equal to the value of the nominal GDP”.

Also the nominal interest rate is 1 per cent and the inflation rate is 1 per cent then the current real interest rate (r) is 0 per cent.

If the nominal GDP is growing at -1 per cent and there is an inflation rate of 1 per cent then real GDP is growing (g) at minus 2 per cent.

Under these conditions, the primary fiscal surplus would have to be equal to 2 per cent of GDP to stabilise the debt ratio (check it for yourself). So, the question suggests the primary fiscal deficit is actually 1 per cent of GDP we know by computation that the public debt ratio rises by 3 per cent.

The calculation (using the formula in the Table) is:

Change in B/Y = (0 – (-2))*1 + 1 = 3 per cent.

The data in Year 2 is given in the last column in the Table below. Note the public debt ratio has risen to 1.03 because of the rise from last year. You are told that the fiscal deficit doubles as per cent of GDP (to 2 per cent) and nominal GDP growth shoots up to 4 per cent which means real GDP growth (given the inflation rate) is equal to 3 per cent.

The corresponding calculation for the change in the public debt ratio is:

Change in B/Y = (0 – 3)*1.03 + 2 = -1.1 per cent.

So the growth in the economy is strong enough to reduce the public debt ratio even though the primary fiscal deficit has doubled.

It is a highly stylised example truncated into a two-period adjustment to demonstrate the point. In the real world, if the fiscal deficit is a large percentage of GDP then it might take some years to start reducing the public debt ratio as GDP growth ensures.

So even with an increasing (or unchanged) deficit, real GDP growth can reduce the public debt ratio, which is what has happened many times in past history following economic slowdowns.

The best way to reduce the public debt ratio is to stop issuing debt. A sovereign government doesn’t have to issue debt if the central bank is happy to keep its target interest rate at zero or pay interest on excess reserves.

The discussion also demonstrates why tightening monetary policy makes it harder for the government to reduce the public debt ratio – which, of-course, is one of the more subtle mainstream ways to force the government to run surpluses.

Dr. Mitchell,

Regarding question number 1, won’t the debt issuance curtail any secondary spending in the economy? That is, if bank deposits are converted into government bonds, then the funds are no longer available to spend on consumption.

I suppose that government bonds are tradeable, so if an actor wants to spend they can always move back into cash.

Thanks

Bill-

I believe this part could use an edit:

“What would happen if there were bond sales? All that happens is that the banks reserves are reduced by the bond sales but this does not reduce the deposits created by the net spending. So net worth is not altered. What is changed is the composition of the asset portfolio held in the non-government sector.”

To the extent the TSY CDs being purchased are ultimately held by Non-banks, commercial bank deposits are reduced by that amount as the bank’s customers are effectively removing their money from a demand deposit at their private commercial bank and replacing that with a term deposit with the Govt bank. So the NOn-bank TSY CD purchase does not effect the Non-Govt’s net worth, however it does reduce in the process dollar for dollar.

Which is one of the reasons why not classifying TSY CD’s as part of any of the monetary aggregates leads to so much mass confusion. Why is a 12-mo term deposit at Chase or Bank of America considered “money” and included in M2 in the USA, but a 12-mo term deposit at the Fed\Tsy is not considered “money” and thus not included in either the monetary base or M2?

The last line in the first paragraph should read:

“So the NOn-bank TSY CD purchase does not effect the Non-Govt’s net worth, however it does reduce M1 in the process dollar for dollar.”

Dear Joel

Not only are TSY Cds more easily convertible to cash then a Cd at a private commercial bank, but you might have even made a profit which you could never do by cashing in a bank Cd early as there is just about always a penalty.

Furthermore, even if you dont want to consider TSY CDs as “money” like you would “reserves” at any given point of time all reserves are being “saved” and not spent just like TSY CDs. $4 trillion in QE in the USA has left that many reserves in the banking system, the banks cant get rid of those reserves and so they are necessarily being saved at any time you look at the accounting ledger, just like in aggregate nobody can get rid of TSY CDs.

Or maybe think about it like this…..So last year you worked hard and saved $10K. You decide you want to save that money in some other form than a checking account at your commercial bank in order to get a higher rate of interest. So you decide to get a 12-mo Cd for 1%. The bank debits your checking account and credits your CD account. After 1 year, they reverse the process, now are you going to go out and spend your earned savings? Probably not, you could of course but then there would go your savings. This scenario is no different than TSY CDs. Now imagine that banks were not allowed to offer you any other type of deposit other than a checking account and you didnt want to invest in some other riskier product, would you really go out and spend your 10K in savings just because the bank didnt offer you a CD option? Again, this is exactly the same scenario as the Govt not offering TSY CDs for the public. Why would anyone go and spend their savings simply because the Govt stopped offering interest bearing alternatives? They wouldnt and QE definitively proves this, no theory, no assumptions, no models, we’ve tried this and it doesnt work like your question makes it seem like it would.

Bonds are always liquid – particularly Gilts which have a GEMM behind them that is required to give a quote in all market conditions (and HM Treasury will back them in extremis).

As I’ve said before pretty much everybody gets things the wrong way around. Bond markets are as good as cash since they have government backed liquidity whereas currency markets are not – since there is no market maker. I rarely see anybody take the liquidity issue into account, never mind see how policy in that area (no CB purchase of own liabilities *ever*) can help stabilise things.

Bonds are just deposit accounts. And they make excellent collateral for a loan.

Thanks Auburn and Bob. As I understand from your description, the bond issuance will not prevent secondary spending because 1, the bond is a tradable asset, and 2, the market for bonds is highly liquid and easily convertible into cash.

I may have confused the process with USG WWII war bonds, which I believe were non-negotiable and so had no secondary market. In that case, would you agree that those war bonds curtailed spending and prevented the spending multiplier from taking effect?

Thanks

“Saturday Quiz – January 2, 2015 – answers and discussion”

2016

Joel-

I would think it wouldnt make much difference, as even with the TSY CDs today, if you sell them to spend your savings or to save in some other type of asset, the person who bought them would still be saving and couldnt or wouldnt spend that money either.

So in the non-tradeable war bond scenario, the original buyer is the only one that is saving and not spending that money, and in today’s TSY CD environment, its not necessarily the original buyer who is saving and not spending that money, its whoever happens to be holding the TSY CDs at the time you look at the accounting information.

However, this would also be true of a reserves only system where at any point in time that you looked at the accounting, whoever held the reserves would also be saving and not spending that money. IOW at any point in time that you look at the accounting you are looking at a stock, and stocks are static in the accounting ledger. Its the flows between accounting periods that drive the economy, and no matter where Govt IOUS flow, the stock is always the same (assuming the Govt doesnt act on it via fiscal policy in the period of course) when you go to look at the accounting.

This is the same fallacy as the “excess reserves getting out into the economy danger” of QE. There is no where for the reserves to go, as they cant leave the balance sheet of the banking system in aggregate. There is also no where for the TSY CDs to go, no matter who holds them presently, someone is always holding them. So while any individual can spend his savings at any point in time, in the aggregate the amount of TSY CDs is fixed.

Thanks Auburn, I will have to read this a few more times to get my head around it.

Auburn,

Forgive me for my slowness, I am not yet a friend of the State! I fail to understand that TSY bond issuance will NOT prevent spending. As evidence, I compare two scenarios, one with TSY bond issuance and one without.

1. With TSY bond issuance: The USG deficit spends. The recipient of the deficit spending sees an increase in deposits. The Treasury issues a bond which is bought by the private sector. The recipient of the bond no longer has the cash, and cannot spend it on goods and services. Since he cannot spend on goods and services, the potential recipients who failed to receive the spending cannot spend, and on and on. Hasn’t the issuance of the Treasury bond prevented this secondary spending?

2. Without Treasury bond issuance: The USG deficit spends. The recipient of the deficit spending sees and increase in her deposits. She has the cash in her bank account. She will spend the cash on goods and services, the recipients of which will also spend a portion on goods and services. There is additional spending in the economy as a result of no bond issuance. If she chose not to spend the cash, the bank may choose to loan out the money to someone who will choose to spend it.

I have this nagging feeling that I am missing something on the macro level, some sort of fundamental principle or wrinkle. I just don’t know what it is.

Thanks, Joel

The deposit is no more likely to be spent.

“If she chose not to spend the cash, the bank may choose to loan out the money to someone who will choose to spend it.”

When banks make a loan they create a deposit and a loan. No prior cash needed. Banks have access to reserves and cash when needed via the central bank.

Firstly a bank creates a loan. So the loan is to person A, and firstly the deposit is to person A as well. At that point the bank is still fine and still fully funded.

What happens then though is that person A wants to pay person B.

If person B is at the same bank, then there is NO problem. The deposit is switched to person B and the bank is still fully funded.

The fun starts when person B is at another bank.

What has to happen that is that bank 2 has to take over the deposit in bank 1 from person A. That increases the assets of bank 2 which then creates a new deposit for person B.

That’s how payment works. Somebody has to take the place of the original depositor in the source bank before you can create anything in the target bank.

Of course at that point bank 2 is taking a risk on bank 1 and will expect to be paid by bank 1 an interest rate to compensate for that risk.

And it also means that if bank 2 isn’t prepared to take a risk on bank 1, that nobody in bank 1 can pay anybody in bank 2.

It’s this latter point that caused the creation of central banks – to make sure that the payment system clears. The theory being that all the banks trust the central bank ‘in the last resort’ and therefore the central bank can ensure payments always clear.

So the cost of funding is really the payments bank make so they can be part of a payment clearing system.

It is the same with cash. Reserves are debited and a deposit no longer exists.

Read Bill’s post on why the money multiplier is false. Banks don’t “lend out” cash or reserves

https://billmitchell.org/blog/?p=1623

Thanks, guys, I think I have a better understanding now.

Joel