During the recent inflationary episode, the RBA relentlessly pursued the argument that they had to…

A return to full employment in Australia will require significantly higher deficits

Last week, the Australian Labor Party (the federal opposition) released a new policy platform, which it hopes will give it some electoral leverage in the upcoming federal election. The Party announced that they would be attacking poverty and inequality by restoring full employment. The UK Guardian political editor opined in her article on Friday (March 18, 2016) – A shift in political thinking is giving Labor a sense of purpose – that the announcement by Labor was a policy breakthrough and a recognition that the neo-liberal claims about free markets etc, that emerged in the 1980s, are no longer a viable basis on which to base policy. I agree. I also agree that a currency-issuing government should always pursue full employment. But the reality is that this pledge from the ALP is going to be as hollow as all the other value statements it makes in an attempt to convince the electorate that it is a progressive party looking out for the workers and the disadvantaged. A lot of jobs have to be created to restore true full employment, which will require significantly larger fiscal deficits. Meanwhile, the ALP is claiming it will return the fiscal balance to surplus.

The Policy release – Growing Together: Labor’s agenda for tackling inequality – says that a Labor Government would “put jobs first” and that:

Our goal should be full employment.

When it comes to jobs and the economy, our goal should be making sure everyone who can work is able to work to their full capacity.

This means putting full employment at the centre of our policy agenda.

There are longstanding arguments over what full employment really means, whether it is desirable and whether it is achievable. Regardless of these debates, we should never be completely satisfied with an economy where hundreds of thousands of Australians are unemployed, and many more are underemployed. Our ambition should never fall lower than finding work for all those who want it.

The objective of full employment in the Australian context is underpinned by a strong safety net and decent wages. Importantly, the Australian full employment goal must prioritise improving living standards and household incomes.

Which is music to my ears and at face value, the achievement of full employment is one of the basic functions of a currency-issuing government. If it fails to achieve and sustain that goal then it has failed to use its currency-issuing capacity responsibly.

The UK Guardian article – A shift in political thinking is giving Labor a sense of purpose – claims that the Labor Party is coming to terms with the fact that there is:

… a growing wave of thought that the economic challenges of the 2010s cannot be solved by the old 1980s political consensus – the consensus that said economic growth is best achieved by market deregulation and lower taxes and lower spending that generate growth, and allow “all boats to rise” by providing the revenue for governments to pay for social programs and do something or other about poverty.

Which is not before time, one might add!

The article says that the Labor Party’s ‘Growing Together’ is recognition that it is “digestive these views” and a sign that it is finally gaining “a sense of purpose”.

However, leopards do not change their spots so easily.

When you put the full employment statement together with continued statements from the Shadow Treasurer that a future government will “put the budget on a sustainable path back to surplus” (Source) you have to wonder whether they have any clue at all.

The Shadow Treasurer also has said:

Paying down debt and reducing our national interest bill increases the capacity for a Labor Government to make those sorts of vital investments. Keeping our AAA credit rating from all three ratings agencies is important here. Our AAA credit rating means our interest bill is lower than it otherwise would be, meaning more resources are available for important initiatives for future Labor governments.

There is nothing right-wing about a prudent fiscal approach.

We understand that tough decisions are necessary to return the budget to surplus over time … We are not ashamed to say that both spending and revenue measures need to be on the table …

Which tells you that he is just playing sop to the neo-liberals and a future Labor government that followed that fiscal approach would never achieve full employment and would probably also never achieve a fiscal surplus because it would maintain excessive fiscal drag and undermine economic activity.

As a matter of fact:

1. Running surpluses (to reduce public debt and reduce the “national interest bill”) do not increase “the capacity” of a currency-issuing government to invest in public infrastructure. Budget surpluses take net spending out of the economy and therefore reduce spending growth.

They are only justified if the external sector is driving growth and the private domestic sector is saving overall at its desired level and there are first-class public services and infrastructure being provided.

In those instances, surpluses might be required to keep the economy within its inflation ceiling. Otherwise, they will reduce growth.

But moreover, a fiscal surplus does not increase the capacity of the government to spend in the future. A currency-issuing government can always purchase whatever is for sale in its own currency at any time, irrespective of whether it is run fiscal surpluses or deficits in the immediate past.

It is a total falsehood to claim otherwise.

2. It is a lie to claim that the nation’s credit rating conditions the interest that the currency-issuing government pays on its outstanding debt. Such a government (which includes both the Treasury and the central bank) can always manage the yield that is paid on any public debt that is issued.

The government can simply instruct the central bank to purchase its debt at whatever yield it chooses including a zero yield, which would be tantamount to just crediting bank accounts on the government’s behalf.

So when an electorally-challenged Opposition party, with a federal election looming (probably in July 2016), starts talking about full employment when for years it has been playing the neoliberal ‘we will achieve a fiscal surplus game’, we have to be sceptical.

The devil is always in the detail.

In his interview with the ABC television show 7.30 following the policy release – Bill Shorten: Labor would bring unemployment rate to 5 per cent – we realise that the ALP thinks full employment is defined by an unemployment rate of 5 per cent.

The Leader of the Opposition (Shorten) said in reply to a question “What percentage unemployment do you consider to be full employment?”:

Well, I believe this economy functions best when all those people – when you’ve got the right business, economic settings and business confidence to ensure that all those who can work are able to work to their full capacity.

Ducking and weaving.

He was then asked again: “And so what would be your target for the unemployment rate?”.

To which he replied:

Five per cent. But what we’ve got to do when we talk about full employment is also look at … It’s not satisfactory that we’ve got six per cent-plus unemployment: that’s 750,000 people.

But it’s also not satisfactory that we have under-employment of over 1 million Australians, who regularly record they don’t have enough work; they’re dissatisfied with – they’re not getting enough hours; they want to do more work.

It’s also not satisfactory that we’ve got 800,000 people or so on the Disability Support Pension and many of them are excluded from the job market because of discrimination and the unconscious bias against people with disability.

When you total all those numbers up, it’s somewhere between 2 million and 3 million Australians who I think are not fully employed. And that’s the challenge. We’ve got to do more to support Australian jobs.

In the next question and answer he reiterated that the ALP would, in government, cut government spending (to some unspecified per cent of GDP).

The elevated levels of labour underutilisation are the direct result of a lack of spending in the economy. The household sector is carrying record levels of debt and cannot be expected to embark on another credit binge (which was the reason the Federal government was able to record fiscal surpluses after 1996 while economic growth continued).

The Australian government articulated its vision for full employment in the – The 1945 White Paper on Full Employment. I maintain the only searchable, digital version of that magnificient statement of national aspiration.

It was developed following the devastation of the Second World War in an effort to translate the full employment achieved during the war effort in the peace time. Similar grand visions were laid out by other government around the World in the same period.

The White Paper noted that:

Full employment is a fundamental aim of the Commonwealth Government. The Government believes that the people of Australia will demand and are entitled to expect full employment …

On the average during the twenty years between 1919 and 1939 more than one-tenth of the men and women desiring work were unemployed. In the worst period of the depression well over 25 per cent were left in unproductive idleness. By contrast, during the war no financial or other obstacles have been allowed to prevent the need for extra production being satisfied to the limit of our resources. It is true that war-time full employment has been accompanied by efforts and sacrifices and a curtailment of individual liberties which only the supreme emergency of war could justify; but it has shown up the wastes of unemployment in pre-war years, and it has taught us valuable lessons which we can apply to the problems of peace-time, when full employment must be achieved in ways consistent with a free society.

It also says that:

The essential condition of full employment is that public expenditure should be high enough to stimulate private spending to the point where the two together will provide a demand for the total production of which the economy is capable when it is fully employed.

I outline that condition in this blog – The full employment fiscal deficit condition.

An appreciation of history will also inform us that in 1984, just after the ALP was elected to office (in March 1983), the Labor governemnt set about abandoning its commitment to full employment.

For example, in this press release (from an Liberal Opposition employment shadow) – ALP Conference set to water down employment policy – we read that:

The right and centre-unity factions of the Labor Party are planning to abandon a key plank Of the Government’s election platform.

Resolutions due to be put to this week’s National Conference involve a major watering-down of Labor’s commitment to reducing unemployment.

The new employment policy has been carefully worded to lower community- expectation. This continues a process started by the Prime. Minister last year, and continued since by senior Ministers.

The then ALP government started to alter their nomenclature to water down the commitment to full employment – by altering its definition, and deleting any reference in its policy platform about “Australians having the right to work”, which was a key part of the White Paper vision.

The ALP really started abandoning its commitment to full employment years earlier. In the Labor government’s last ‘Budget Speech’ (when they were in power 1972-75), the then Treasurer extolled the evils of fiscal deficits – claiming they were, in part, the cause of the high inflation of the day. The neo-liberal period in Australia really began with that speech.

I wrote about that in this blog – Tracing the origins of the fetish against deficits in Australia.

Prior to that the Australian government clearly understood the need to run continuous fiscal deficits to ensure that there was full employment. Since 1975, the Australian economy has laboured under the fiscal drag of a sequence of governments intent on delivering surpluses.

Also since 1975, and not unrelated, the Australian economy has not returned to full employment – a state which prevailed from the end of WW2 to around 1974. Unemployment rose as the Labor government … then the conservatives (after 1975) started to hack into net public spending because they thought this would be an appropriate way of dealing with a supply-side inflation shock (from the oil price hikes).

It was never an appropriate response but morphed into serving the neo-liberals very well.

The Labor governments (from Whitlam, 1972-75, Hawke, 1983-1996, and then Rudd-Gillard-Rudd, 2007-2011) encouraged a new ‘divide-and-conquer’ nomenclature which vilified the victims in order to reconstruct the public narrative about unemployment.

To his eternal disgrace, the Federal Labor minister, Clyde Cameron coined the term “dole bludger” in 1974 to reinforce the message that the unemployed were lazy and indulgent. We heard of “work-shy lion tamers” exploiting our generosity to avoid work while receiving income support. Then there were cruisers, job snobs, leaners etc

By isolating the unemployed, the Government could cut their real benefits and make their lives hell. Both sides of politics have refused to increase the unemployment benefit above the poverty line.

The Labor Party increasingly bought into the narrative that with the decline of central planning (and ultimate collapse of the Soviet system), the way forward was to ensure the market economy was freed up to be as ‘efficient’ as possible.

By the time Labor were relected in 1983, they had firmly embraced the neo-liberal agenda and eschewed direct government manipulation of the economy and promoted the pursuit of fiscal surpluses to a number one priority.

The Labor governments since that time (Hawke-Keating then Rudd-Gillard) were to the right of the conservatives that ruled for so long in the post-WWII period.

The Labor governments became increasingly full of university educated careerists rather than people who had endured the vagaries of unstable workplaces and periods of unemployment.

That changing demographic is highly significant in the way the Labor party has deteriorated and embraced anti-worker, neo-liberal policies. Lawyers replaced people who had worked more directly face-to-face against capital.

These governments rejected the traditional Labour ambit to maintain full employment and provide those without work for whatever reason with adequate income support until they could get jobs (usually a short period). Instead they bought the full employability myth and deliberately kept the unemployment benefit below the poverty line and inflicted meaningless training programs and pernicious work tests on the recipients.

They also bought in – some might say were trapped into accepting – the priority of the ‘apirational’ voter who had been hardened into believing that the unemployed and poor were different to them because they didn’t work hard or were not motivated enough.

The conservative media bombarded us with these notions – dole bludgers, welfare bludgers etc. Within a decade, the Labor Party here and similar parties elsewhere were promoting individualism and rejecting the notion of collective will and solidarity.

The latter concepts were too tied to ‘socialist’ ambitions of the past and the spin doctors claimed the parties would be vilified by an increasingly anti-socialist media and commentariat. It all became a self-evident truth (not!) when the Wall collapsed and the world embrace ‘free markets’ – or so the spin went.

In Australia, the Labor Party embrace of the consumption-driven middle class saw it undermine income support systems for the unemployed, single mothers, the sick etc – all unworthy in the new narrative. They provided massive funding to elite private schools and starved public schools of funds even though the vast majority of children are still educated in the public system.

They also perpetrated mass infringements of basic human rights – with respect to our own indigenous population (the ‘intervention’) and refugees (locking them up and torturing them on remote Pacific islands).

This was so far removed from the traditional roots of the Party, which was splintering into green groups and other coalitions.

And now – in 2016 – as Labor faces another electoral annihilation despite the federal conservative government being in chaos and demonstrably undermining national prosperity, they are trying to claim they are the party for the workers.

They abandoned the workers and the disadvantaged years ago and having been bobbing around in some sort of neo-liberal oblivion ever since.

What causes mass unemployment?

As I wrote last week in this blog – British Labour Party surrenders … back to its Monetarist roots – mass unemployment occurs when net government spending is too low to accommodate the need to pay taxes and the desire to net save.

Either government spending is too low relative to the current tax receipts or taxes are too high relative to the level of government spending.

This makes the purpose of fiscal policy clear. It is not to balance any financial accounts. Rather, it is to generate full employment.

This analysis also sets the limits on government spending. It is clear that government spending has to be sufficient to allow taxes to be paid.

In addition, net government spending is required to meet the private desire to save (accumulate net financial assets). From the previous paragraph it is also clear that if the Government doesn’t spend enough to cover taxes and the non-government sector’s desire to save the manifestation of this deficiency will be unemployment.

The current circumstances are:

1. The Australian unemployment rate hovering around 6 per cent.

2. Underemployment is around 8.4 per cent (when last measured – November 2015).

3. The participation rate is well below the November 2010 peak – which when you account for changing composition of the labour force (ageing) still means that some 120 thousand workers have become hidden unemployed as a result of the weak and often negative employment growth over the last several years.

4. When we adjust for the slack participation rate and add those discouraged workers back into the labour force the unemployment rate would be around 7 per cent in January 2016 rather than 6 per cent.

5. The broad labour wastage is around 15.5 per cent – a long way from any reasonable interpretation of what a full employment position would be.

6. Inflation is well below the RBA’s official targetting range and has shown no signs of accelerating for some years despite the rather large exchange rate depreciation in recent times.

7. Households have excessively high debt levels.

8. Business investment is set to decline further (and has been falling after the mining boom).

9. The external deficit is about 4 per cent of GDP and not expected to decline further.

Under these circumstances, it is clear that the fiscal deficit is way to small and would have to rise by more than 1.5 to 2 per cent of GDP to increase economic activity significantly.

Any government or political party that claims it will achieve full employment has to also stand ready to increase its net spending (fiscal deficit) and sustain that increase for some years to come.

A commitment to returning the fiscal balance to surplus is not consistent with our commitment to achieve and to sustain full employment.

Is a 5 per cent unemployment rate equivalent to full employment?

The answer is no!

At present, the Australian economy is hundreds of thousands of jobs short of being at full employment and as a consequence the fiscal stance of the Government has been too biased towards austerity.

What does full employment mean?

It used to mean that there should be sufficient jobs to meet the desires of the workers for hours of work. The concept was diminished in the 1950s when the so-called Phillips curve literature evolved and made the concept of full employment conditional on some stable inflation rate.

Then, the neo-liberals hi-jacked the concept when it introduced the so-called ‘natural rate of unemployment’. Please read my blog – The dreaded NAIRU is still about! – for more discussion on this point.

Modern Monetary Theory rejects the NAIRU approach (the current orthodoxy) – that is, the use of unemployment buffer stocks – where inflation is controlled using tight monetary and fiscal policy, which leads to a buffer stock of unemployment. This is a very costly and unreliable target for policy makers to pursue as a means for inflation proofing.

Employment buffer stocks rests on the government exploiting its fiscal power that is embodied in a fiat-currency issuing national government to introduce full employment based on an employment buffer stock approach. The Job Guarantee (JG) approach which is central to MMT is an example of an employment buffer stock policy approach.

Under a Job Guarantee, the inflation anchor is provided in the form of a fixed wage (price) employment guarantee.

Full employment requires that there are enough jobs created in the economy to absorb the available labour supply. Focusing on some politically acceptable (though perhaps high) unemployment rate is incompatible with sustained full employment.

In MMT, a superior use of the labour slack necessary to generate price stability is to implement an employment program for the otherwise unemployed as an activity floor in the real sector, which both anchors the general price level to the price of employed labour of this (currently unemployed) buffer and can produce useful output with positive supply side effects.

So a reasonable definition of full employment policy is that there is only frictional unemployment – that is, workers moving between jobs.

In this age of digital information systems and the Internet, there is no way that a 5 per cent unemployment rate is consistent with any reasonable definition of full employment.

I note the UK Guardian article last week (March 17, 2016) – Full employment is a worthy goal, but it shouldn’t come at any cost – claimed that the 5 per cent “target … sounds about right, if even a little high”.

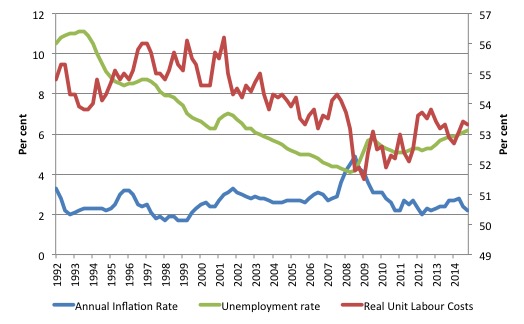

The journalist produces inflation and unemployment time series graphs which he claims shows that:

… the unemployment rate hit 5% in 2006, the underlying inflation rate stayed above 2.5% and once the unemployment rate went below 4.5% inflation began rising sharply – reaching 4.9% in August 2008, at which point the GFC shoved the inflation genie back in its bottle and unemployment rose to 5.8% in trend terms – the same level it is now.

However, here is another version of the graph which includes a time series for the wage share (Real Unit Labour Costs).

At the point, inflation was rising just before the GFC, the wage share was plummeting, which means that the price pressures were not coming from the labour market.

Nominal Wages growth during that period was flat or in decline.

If we examine the data for the period (2006 to 2008), it is clear that the price rises were coming from food (extraordinary environmental conditions including drought and floods), alcohol and tobacco (government charges), transport (oil hikes – average retail petrol price rose by 10.4 per cent in 2007-2008), housing (property boom), health and education (government charges etc), insurance and financial services (financial sector gouging).

The Guardian graph does use the trimmed mean measure of inflation, which reduces some of the outliers but the fact remains that the price spikes in that period did not have anything to do with the evolution of the national unemployment rate.

In fact, the labour market was acting to reduce price pressures even though the unemployment rate had fallen to 4 per cent.

And further, at the time, the unemployment bottomed out at 4 per cent, the total labour underutilisation rate (including underemployment was around 9 per cent).

Is the Guardian journalist really trying to tell us that 9 per cent labour wastage is consistent with full employment or “about right”?

I maintain that with proper public sector job creation, we can define full employment as being around 2-3 per cent unemployment, zero hidden unemployment and zero underemployment.

What about job numbers?

I outlined a way of computing how many jobs would be required to achieve full employment in this blog – The Australian labour market – 815 thousand jobs from full employment.

Here are some updated estimates.

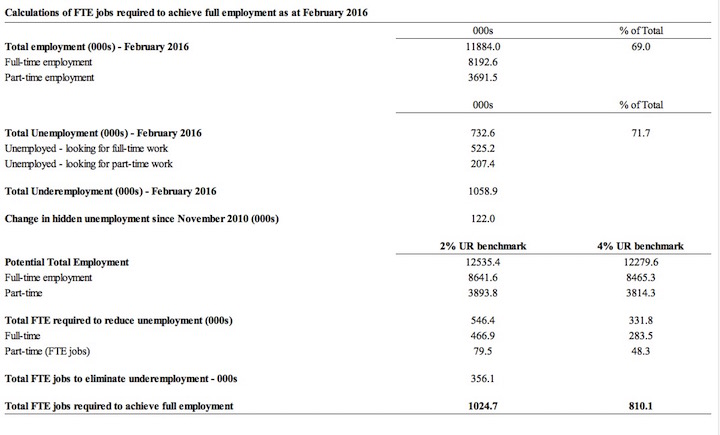

The summary facts as at February 2016 are:

1. Unemployment

There were 732.6 persons unemployed at an official unemployment rate of 5.8 per cent. Of those, 525.2 (or 71.7 per cent) were looking for full-time work, while 207.4 were looking for part-time work.

2. Change in hidden unemployment

The current participation rate of 64.9 is 0.9 percentage points below its recent peak in November 2010, which means that some 174,600 workers have left the workforce since November 2010.

These workers might have retired (as the population ages the participation rate will fall a little due to averaging), but many will have left because of the lack of employment opportunities.

These workers would quickly take jobs if they were offered. My conservative estimate is that at least 70 per cent or 122.2 thousand are in the latter category and represent the change in hidden unemployment since November 2010.

3. Underemployed

There were 1,059.9 thousand persons underemployed.

To be classified as employed by the ABS a person only has to work 1 or more hours per week. The underemployed are workers who want more hours of work but cannot find them.

The ABS publication – 62650DO005_201309 Underemployed Workers, Australia, September 2013 (the most recent) – tells us that on average the preferred number of extra weekly hours” for the underemployed was 14.2 hours.

This figure has been remarkably stable for some years (varying by decimal points).

4. Potential employment

If we assume that the participation rate returned to its November 2010 peak (and adjusted for the changing age composition of the labour force), then the potential labour force would be 12,791.2 thousand as opposed to its current value of 12,616.6 thousand.

If the extra workers were to be employed then total potential employment would be:

(a) 12,535.3 thousand (as opposed to 8,192 thousand) if the 2 per cent unemployment rate full employment benchmark is used.

(b) 12,279.6 thousand (as opposed to 8,192 thousand) if the 4 per cent unemployment rate full employment benchmark is used.

5. Converting to full-time equivalents (FTEs)

To convert the extra jobs required to FTEs we have to do some calculations to convert the part-time jobs based on average hours worked. We assume that the full-time ratio to total employment is constant (69 per cent).

We also have to convert the unemployed numbers into FTEs, noting that 71.7 per cent of unemployed want to work full-time.

Some calculations later we get the following Table:

It shows the current data (upper section) and then the FTE jobs required to meet the relevant full employment benchmark (2 per cent or 4 per cent unemployment).

We assume that there was no hidden unemployment in November 2010 (which is downwardly biasing the total FTE jobs required) and that all the workers who have become hidden unemployed since then would prefer to work full-time (which upwardly biases the estimates of total FTE jobs required). Overall, the impact is not large either way.

So for the Australian Labor Party to achieve full employment it would have to generate an extra 1,024.7 thousand jobs as at February 2016 (at 2 per cent benchmark) and 810.1 thousand jobs (at 4 per cent benchmark).

A tall order given current performance metrics.

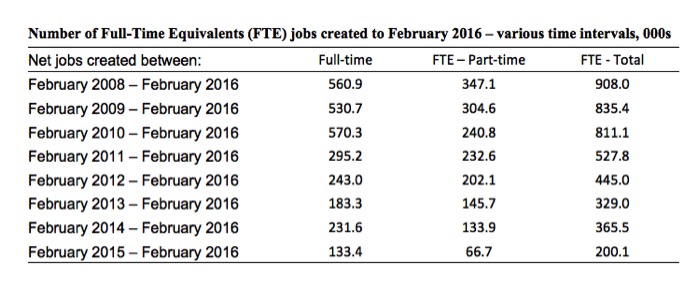

The following Table shows the number of full-time equivalent (FTE) jobs that the Australian labour market has actually created in net terms from the low-point unemployment month of February 2008 to February 2016, with each annual interval to February 2016 in between also shown.

Over the last year, the Australian labour market has created (net) only 200.1 thousand FTE jobs. Over the 8 years, it has generate only 908 thousand FTE jobs.

Compare that to 1007.3 thousand that are required to get to what I call true full employment. Even if we take the 4 per cent unemployment as the full employment benchmark, 792.7 thousand net jobs are required.

Economic principles and full employment

The economic principles that arise from this sort of analysis can be summarised as follows:

1. Mass unemployment and labour underutilisation of the magnitude described above arises because there is insufficient spending in the economy.

2. As a matter of accounting, for aggregate output to be sold, total spending must equal total income (whether actual income generated in production is fully spent or not each period). Involuntary unemployment is idle labour offered for sale with no buyers at current prices (wages).

3. Unemployment occurs when the private sector, in aggregate, desires to earn the monetary unit of account, but doesn’t desire to spend all it earns, other things equal. As a result, involuntary inventory accumulation among sellers of goods and services translates into decreased output and employment. In this situation, nominal (or real) wage cuts per se do not clear the labour market, unless those cuts somehow eliminate the private sector desire to net save, and thereby increase spending.

4. The purpose of government spending is to move real resources from private to public domain. The obvious conclusion is that unemployment occurs when net government spending is too low to accommodate the need to pay taxes and the desire to net save by the non-government sector.

5. These principles also set the limits on government spending. It is clear that government spending has to be sufficient to allow taxes to be paid. In addition, net government spending is required to meet the private desire to save (accumulate net financial assets).

6. Keynesians have used the term demand-deficient unemployment. In our conception, the basis of this deficiency is at all times inadequate net government spending, given the private spending decisions in force at any particular time.

7. The concept of fiscal sustainability cannot be defined independent of the state of the economy. We entrust government to pursue public purpose and one of the most important elements of that is to maximise employment – so that everyone has a chance to realise their potential. Once the private sector has made its spending (and saving decisions) based on its expectations of the future, the government has to render those private decisions consistent with the objective of full employment.

8. Given the non-government sector overall will typically desire to net save (accumulate financial assets in the currency of issue) over the course of a business cycle this means that there will be, on average, a spending gap over the course of the same cycle that can only be filled by the national government. There is no escaping that.

9. So then the national government has a choice – maintain full employment by ensuring there is no spending gap which means that the necessary deficit is defined by this economic goal (the zero waste goal). The budget deficit will then be whatever is required to close the spending gap. However, it is also possible that the political goals may be to maintain some slack in the economy (persistent unemployment and underemployment) which means that the government deficit will be somewhat smaller and perhaps even, for a time, a budget surplus will be possible.

10. However, the second option would introduce fiscal drag (deflationary forces) into the economy which will ultimately cause firms to reduce production and income and drive the budget outcome towards increasing deficits. Ultimately, the spending gap will be closed by the automatic stabilisers because falling national income ensures that that the leakages (saving, taxation and imports) equal the injections (investment, government spending and exports). That is, the sectoral balances hold (being accounting constructs). But at that point, the economy will support lower employment levels and rising unemployment. The budget will also be in deficit – but in this situation, the deficits will be what we call “bad” deficits. Bad deficits are those driven by a declining economy and rising unemployment.

11. Thus the concept of fiscal sustainability requires that the government fills the spending gap with “good” deficits at levels of economic activity consistent with full employment.

12. Fiscal sustainability cannot be defined independently of full employment. Once the link between full employment and the conduct of fiscal policy is abandoned, we are effectively admitting that we do not want government to take responsibility of full employment (and the equity advantages that accompany that end).

Conclusion

So it is time that the Labor leadership outlined clearly how they are going to create that many FTE jobs to honour their pledge that they will achieve full employment.

The fact is that their record and all the public statements over several years tell us that the full employment pledge is hollow.

They should not be trusted to honour anything like it.

FINALLY – Introductory Modern Monetary Theory (MMT) Textbook

I will write a separate blog about this presently, but today we finally published the first version of our MMT textbook – Modern Monetary Theory and Practice: an Introductory Text – today (March 10, 2016).

The long-awaited book is authored by myself, Randy Wray and Martin Watts.

It is available for purchase at:

1. Amazon.com (60 US dollars)

2. Amazon.co.uk (£42.00)

3. Amazon Europe Portal (€58.85)

4. Create Space Portal (60 US dollars)

By way of explanation, this edition contains 15 Chapters and is designed as an introductory textbook for university-level macroeconomics students.

It is based on the principles of Modern Monetary Theory (MMT) and includes the following detailed chapters:

Chapter 1: Introduction

Chapter 2: How to Think and Do Macroeconomics

Chapter 3: A Brief Overview of the Economic History and the Rise of Capitalism

Chapter 4: The System of National Income and Product Accounts

Chapter 5: Sectoral Accounting and the Flow of Funds

Chapter 6: Introduction to Sovereign Currency: The Government and its Money

Chapter 7: The Real Expenditure Model

Chapter 8: Introduction to Aggregate Supply

Chapter 9: Labour Market Concepts and Measurement

Chapter 10: Money and Banking

Chapter 11: Unemployment and Inflation

Chapter 12: Full Employment Policy

Chapter 13: Introduction to Monetary and Fiscal Policy Operations

Chapter 14: Fiscal Policy in Sovereign nations

Chapter 15: Monetary Policy in Sovereign Nations

It is intended as an introductory course in macroeconomics and the narrative is accessible to students of all backgrounds. All mathematical and advanced material appears in separate Appendices.

A Kindle version will be available the week after next.

Note: We are soon to finalise a sister edition, which will cover both the introductory and intermediate years of university-level macroeconomics (first and second years of study).

The sister edition will contain an additional 10 Chapters and include a lot more advanced material as well as the same material presented in this Introductory text.

We expect the expanded version to be available around June or July 2016.

So when considering whether you want to purchase this book you might want to consider how much knowledge you desire. The current book, released today, covers a very detailed introductory macroeconomics course based on MMT.

It will provide a very thorough grounding for anyone who desires a comprehensive introduction to the field of study.

The next expanded edition will introduce advanced topics and more detailed analysis of the topics already presented in the introductory book.

That is enough for today!

(c) Copyright 2016 William Mitchell. All Rights Reserved.

It has been obvious for the past 30 odd years that the Tory Party,the Tory Lite Party and the Pixie Party do not have a solitary clue about the direction Australia needs to take.That verdict applies not only to economic matters but also to energy,environmental,defence and social concerns.

It now appears that we will have a double dissolution election in July. I applaud that move because it will result in a Senate which is even more obstreperous than it is at present. Of course,that is not the intention,but since when did intentions count for damn all in this imbecilic system run by imbeciles?

In defense of the journalist (Greg Jericho), he’s a good guy who’s very willing to consider new arguments and ideas – I’ve occasionally tried to prod him into looking in detail at MMT with no success yet, but I’d be surprised (and disappointed) if he wasn’t interested in what it brings to the table.

I suspect your analysis of Labor’s likeliness to implement their full employment goals (even if they’re only targeting 5%) are pretty spot on, but it’s hard not to be happy to see an opposition leader putting the idea of full employment front and center. They might not do much about it in the end, but having it under consideration is better than it not even being on any politicians radar.

himi,

Unfortunately at present Labor is the only show in town. The Greens are more of a trendy environment party. Steve Hail presented a talk on MMT in 2014

(https://www.youtube.com/watch?v=qBpm5sVmGYcc)

but I don’t think they “got it”.

Hi Himi,

“They might not do much about it in the end, but having it under consideration is better than it not even being on any politicians radar.”

So this is the best that is on offer from any political party in Australia, what a sad indictment.

Given it looks like we may have an election coming up in the near future, who the hell does the average worker in Australia vote for ?

I fear most of us who currently support MMT will be dead and buried before its picked up by a political party with the wherewithal to do something about it.

Cheers,

Bill,

Sorry to hear you in Oz are also suffering deficit fear – why does no one ask the obvious question if Gov is in surplus who is in deficit? ( the taxpayers?) And then who is suffering ?

Very thorough analysis and excellent article as usual Bill! I remember reading a graph on one of your previous blogs, which demonstrated that unemployment was always higher under Labor. Does Labor also typically come up with smaller deficits than the Liberal Party?

I’m not sure of who to vote for. On the one hand you’ve got the Liberals who are all about privatisation and deregulating the Australian labour market. On the other hand you’ve got the Labor party who are basically the same head of the dragon, but pretend to be the party for the workers and full employment etc. Which party is the lesser of the 2 evils?

Great piece Billy!

Beardsley Ruml (former chair of the New York Fed) wrote an essay in 1946 that goes along the same lines as the 1945 White Paper. Ruml’s essay was ‘Taxes for revenue are obsolete.’ Check it out. WW11 taught a lot of lessons that have since gone to the waste bin of history.

Imbeciles in government is so true and I cannot watch, or listen to them – particularly scoffed, and soon to be scuttled, Scotty Morrison.

I can see it taking years/decades getting the pollies out of their mindless bushwaa. Weren’t witches once conventional wisdom, like asbestos and smoking?

@Michael

Literally every progressive policy we have from medicare, NBN, NDIS etc are the result of labor. I realise they’re both neo-liberal but at least one has ideas to progress even with their brain-washed limitations the media pushes on them and everyone else.

This post is bloody incredible. Tour de force, Bill Mitchell.