Edward Elgar, my sometime publisher, is interested in me updating my 2015 book - Eurozone…

Chaos in Europe and the flawed monetary system

I spend a fair bit of time in various airports each month and hate the onerous security checks, which at times seem petty in the extreme. It always amused (not the right word) me that a passenger could just walk straight on with a bag full of duty free whisky which would make a lethal weapon if smashed, yet characters like me with pins in my legs (old bike crashes) have to nearly strip each time we have to fly. Now I suppose they will have security screening outside the terminal entrance just to enter. The authorities would have been better ensuring that their youth had access to employment rather than allowing them to wallow in unemployment and the resulting social exclusion. It is too simplistic to attribute the growing dangers in Europe and elsewhere to concentrations of high unemployment. But if a society deliberately denies a particular generation of the chance to gain employment and, instead, vilifies them as lazy, wanton individuals then it is easy to see why those characters will conclude that society has nothing to offer. In Europe where these manifestations are becoming increasingly obvious, the flawed monetary system is at the heart of the problem. It has failed categorically and the fall out of that failure is multi-dimensional.

The suburbs of Molenbeek (inner west of Brussels) and Schaerbeek (inner North-East) are both poor areas with elevated levels of unemployment and people on income support. The former has a male unemployment rate of around 29 per cent and a female rate around 33 per cent. The latter has similarly elevated levels of joblessness.

If we look at unemployment rates at the NUTS2 level of disaggregation we see that the Brussels (Région de Bruxelles-Capitale/Brussels Hoofdstedelijk Gewest) region currently has 39.5 per cent of its 15 to 24 year olds without work and 18.3 per cent of all those over 15 years of age, the latter has similarly elevated levels of joblessness.

The Eurozone average is 23.8 per cent and 11.6 per cent, respectively.

It’s easy to see how anger and dislocation could arise and be diverted by more utopian or hopeful messages of the sort that preachers in particular religious institutions might provide.

Further, while I don’t maintain the hypothesis that the seeming increase in incidents of these attacks is directly the result of the Eurozone being created, I would hold that the dysfunction of the Eurozone reflects a Western neo-liberal ideology that has infested the world.

This infestation has not only created economic chaos for an increasing number of disadvantaged people around the world but has also spawned geographically-concentrated regimes that have created the environment to promote these sorts of attacks.

The crisis, which began in 2008, has not really gone away in the Eurozone. The latest Job Vacancy data from Eurostat show that vacancy rates remained depressed in most Member States.

In Greece, the vacancy rate is now 0.6 per cent, whereas in the first quarter 2009, the rate was 2.2 per cent. In Spain the rate has halved. In Finland, the job vacancy rate was 2.7 per cent in the first-quarter 2011, it is now 1.1 per cent.

Of course, this translates into elevated levels of unemployment and growing disadvantage.

Even within the logic of the so-called – Macroeconomic Imbalance Procedure (MIP) – which “is a surveillance mechanism to detect and address economic trends that may adversely affect the proper functioning of a Member State, the euro area, or the EU”, the system has failed to work effectively.

In October 2011, the Member States and the European Parliament approved a major revision of the Stability and Growth Pact (SGP). The so-called ‘reinforced Stability and Growth Pact (SGP)’ became operational on December 13, 2011.

The Official Memorandum said the so-called ‘Six-Pack’ introduced the new Macroeconomic Imbalance Procedure.

A series of interventions were detailed under the so-called Excessive Imbalances Procedure (EIP), which aimed to reduce macroeconomic imbalances and would force nations to submit in the words of the European Commission “a clear roadmap and deadlines for implementing corrective action”.

The whole system was subject to a huge surveillance operation (EU monitoring) with rigorous enforcement (fines equal to 0.1 per cent of GDP) and central intervention in a nation’s budgetary process.

The ‘Macroeconomic Imbalance Procedure’ embedded in the Six-Pack exposed the inherent, anti-people biases that dominate European policy making.

The stated aim of the MIP surveillance mechanism is “to identify potential risks early on, prevent the emergence of harmful macroeconomic imbalances and correct the imbalances that are already in place”.

The so-called MIP Scoreboard uses ten “early warning” indicators that provide information about “macroeconomic imbalances and competitiveness losses” which are easy to compute and communicate.

Threshold values (positive and negative) are provided to assess when there is an imbalance. The priorities are clear. A nation that had endured an unemployment rate of say 9.9 per cent for the last three years is not considered to be imbalanced, given the warning threshold is 10 per cent.

The Commission chose this very high threshold due to what it said was a:

… focus on adjustment in labour markets and not on cyclical fluctuations.

Which is Groupthink-speak for the fact that they do not consider the unemployment problem in terms of insufficient jobs being caused by deficient levels of spending but rather consider the only policy concern to be so-called ‘structural’ issues.

This in turn concentrates their attention on “market impediments”, the standard neo-liberal, supply side bias that has failed since it became the dominant approach in the early 1990s.

In the Commission’s annual ‘Alert Mechanism Report’, which is based on a review of the MIP scoreboard, any reference to unemployment is usually accompanied by some conclusion that wages are too high and need to be reduced in line with productivity growth. There is no recognition that the enduring recession has caused both productivity growth to slump and jobs to disappear due to a lack of spending.

The European policy makers are thus ‘content’ with very high levels of unemployment yet they hide their intent in a language of deception.

Another bias is evident in the way they deal with current account deficits and surpluses. They conclude that in relation to current account deficits:

… sustained current account surpluses do not raise the same concerns about the sustainability of external debt and financing capacities, concerns that can affect the smooth functioning of the euro area.

The MIP thus accords “a greater degree of urgency … [to] … countries with large current account deficits and competitiveness losses”.

The upper warning threshold (for a surplus) is 6 per cent of GDP.

If the balanced fiscal rule is satisfied by a nation sitting on the current account surplus threshold, then its private domestic sector will be saving overall 6 per cent of GDP, irrespective of the current growth rate that these spending aggregates imply.

Where will those savings go? History tells ust hat Germany maintained its external competitiveness once it could no longer manipulate the exchange rate by reducing the capacity of its workers to share in the productivity growth of the economy. This, in turn, suppressed domestic demand.

Profitable investment opportunities were limited in the German economy as a result and capital sought profits elsewhere. The persistently large external surpluses (and 6 per cent is large) were the reason that so much debt was incurred in Spain and elsewhere.

In the ‘Alert Mechanism Report 2014’, issued on 3 March 3, 2014, the European Commission concluded that Germany had a macroeconomic imbalance as a result of its current account surplus being above the 6 per cent threshold but praised Germany because the surpluses “provide savings to be invested abroad”.

In the latest – Alert Mechanism Report 2016 – we read that:

The euro area is currently posting one of the world’s largest current account surpluses in value terms. In 2015, it is expected to amount to approximately EUR 390bn, or 3.7% of GDP. The bulk of the surplus is accounted for by Germany and the Netherlands, whose contribution represents 2.5% and 0.7% of the euro area GDP respectively … Former deficit countries are now also recording balanced or surplus positions, which are needed in order to ensure the sustainability of their external positions …

In the case of Germany, when allowing for the position in the business cycle, the cyclically- adjusted surplus is higher than the headline figure.

We note that the “former deficit countries” are achieving these balanced position by suppressing imports as a result of depressed growth rates and elevated unemployment levels.

Germany’s position is ridiculous. In the – Statistical Annex of Alert Mechanism Report 2016, Germany maintains a 3-year average current account surplus of 6.9 per cent up to 2014.

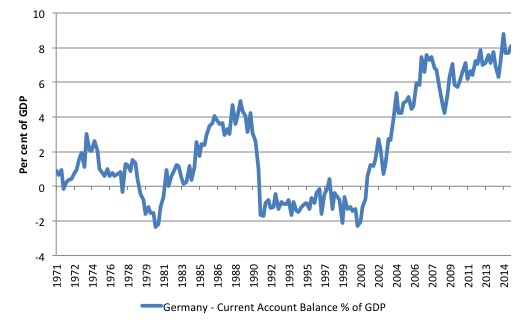

But if you thought that wasn’t too bad then look at the next graph, which shows the current account balance to the third-quarter 2015. In that quarter, the surplus had risen to 8.1 per cent of GDP.

The Commission has repeatedly told Germany (most recently February 2015) that the external surplus requires “decisive action and monitoring” but has failed to do anything about it.

In previous assessments, the commission has told Germany it has to find ways to “strengthen domestic demand and the economy’s growth potential”. However, it always dodges the main issue.

Higher domestic demand will require faster wages growth both to boost the very modest consumption performance and to attract investment into the domestic market.

But such a change would be at odds with the mercantile mindset that dominates the nation because it would reduce the competitive advantage that Germany enjoys over other nations that have treated their workers more equitably.

This also raises the question of inequality. There is no indicator for national income or wealth inequality in the MIP Scoreboard. Despite the neo-liberal denial, income inequalities undermine economic growth.

Even the IMF has now acknowledged that point. According to the German Socio-Economic Panel (SOEP), which is a wide-ranging representative longitudinal study of private households, located at the German Institute for Economic Research, DIW Berlin, income inequality in Germany has risen sharply since it joined the Eurozone.

While the poorest 10 per cent of income earners in Germany achieved 15 per cent gains in their annual median incomes between 1997 and 2008, the richest 10 per cent enjoyed gains of 28 per cent.

The Hartz reforms and the export imperatives were an important part of this rising inequality. A substantial redistribution of income is required within Germany if domestic spending is to increase.

The conclusion arrived at after assessing all the indicators, etc, is that the Eurozone as a monetary system has categorically failed.

the new consensus macroeconomics

Why hasn’t the ECB withdrawn liquidity to German banks (as it did to Greece in June 2015), for deliberately breaching the rules of the Eurozone?

No answer required.

On March 14, 2016, Barry Eichengreen and Charles Wyplosz outlined their – Minimal conditions for the survival of the euro.

At the outset, they reject the mainstream narrative, which sees the creation of a political union to complement the economic union as the way forward.

They believe that political integration, if possible at all, will take much longer than the “timeframe relevant for the euro’s survival” will permit.

They assess that “The euro’s existential crisis is likely to be resolved one way or the other long before that political destination is reached.”

My own research would agree with this assessment.

In my current book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale (published May 2015) – I outlined several ways in which the Eurozone could survive.

One such way would be to create a truly federal system such as we have in Australia or we find in the United States.

The main policy arms and capacities of the federal government (that is, the Treasury and central banking functions) are aligned at the correct level, which means that the elected national government has legislative authority over the central bank.

The national government, thus, always has the financial capacity to redress asymmetric spending shocks across the regional space that it governs.

Regional units within the federal system except, more or less, that redistributive transfers between them will be managed by the Federal government to fulfil national objectives.

The people in these regional units identify with the ‘nation’ as a whole before they identify as belonging to the regional unit. I asked two European friends not long ago what regional identity did they present themselves as – the answer was Dutch and Italian. Not European. They asked me the same question – I replied, obviously, Australian (not the state that I was born in or the state where I mostly live).

This is very significant.

There really is no ‘Europe’. The first decade of the EMU saw the Member States growing apart despite all the analysis in the 1990s that the monetary union would lead to economic convergence.

The graph above shows us how little convergence there is.

Essentially, at present, the German fiscal ideology, which is extreme to be sure, is dominant. But as Eichengreen and Wyplosz note in their article “EU member states have profoundly different preferences with regard to fiscal policy”.

The EU Member States have vastly different attitudes to social policy, cultural policy and other things which influences their attitudes to what they expect from their national governments.

Under the single currency, these differences are suppressed by the iron laws laid down by Germany. As a consequence, mass unemployment and social instability has been a result in many Member States.

While the Germans have a particular cultural way of assimilating economic outcomes and tolerate suppressed real wages, increased poverty rates, and the rest of it. The German ability to accommodate austerity is quite exceptional (and I mean that in the atypical sense rather than the great sense).

The German industrial machine is also without peer – again, a typical.

Neither the social values or the export model that defines modern Germany can possibly represent a template for other nations to follow.

So without the industrial machine, the austerity becomes intolerable and breeds social instability, depression and other psychological illnesses (with elevated suicide rates) – and, the likelihood of extreme behaviour and attitudes emerging.

There will be no political union that will be sufficient to redress the dramatic design flaws that the Maastricht Treaty engendered.

As a result, I remain an advocate for an orderly dismantling of the monetary union and the restoration of national currency sovereignty at the Member State level.

As I outlined in my Eurozone book, if Brussels cannot agree to such a reform process (I use reform to mean an improvement), then the citizens within individual Member States should demand their governments unilaterally exit the disastrous system. I provided a template for such a strategy in the book.

While Eichengreen and Wyplosz agree (it seems) on the impossibility of a meaningful political union, they still think the Eurozone can be saved if four minimal conditions are met:

1. “a normal central bank able to pursue flexible inflation targeting and backstop financial markets, thereby protecting the Eurozone from potentially self-fulfilling crises”.

They conclude that the ECB has most not provided “these functions” and lists various failures, including the rise in interests in 2008 and 2011, the threats “to terminate the emergency liquidity assistance for Ireland in 2010 unless its government applied for a bailout and agreed to a programme of austerity and bank recapitalisation” and the disastrous failure to supply “liquidity assistance to Greece in 2015”.

In the latter instances, the ECB acted more like a blackmailer than a responsible central bank.

The Germans will, however, never agree to the ECB acting as a true central bank and backing the required fiscal positions of the Member States.

2. “A second minimal condition for the survival of the euro is completing Europe’s banking union”. I have noted before that the recent bank policy is a disaster.

Germany forced the other Member States to avoid creating a pooled bank guarantee system. At the same time, the Member States, given they have no currency-issuing capacity are unable to bailout their own banks if needed.

In other words, there are no real safeguards in place to avoid a major banking collapse. A simple ‘federal’ guarantee scheme would have been sufficient backed by the currency-issuing capacity of the ECB.

That is a bridge to far for the Eurozone (bullied by Germany) so the situation remains chronically risky. Very little progress has been made in the 8 years of the crisis.

Eichengreen and Wyplosz say that:

Some countries, notably Germany, worry that other members will be more prone to draw on the fund (German commentators regularly cite Greece as a case in point). They reject mutualisation of deposit insurance as a de facto fiscal transfer. The response comes in three parts. First, banking stability is a valuable public good subject to sufficiently increasing returns that centralisation of the deposit-insurance function is warranted. Second, all member states, not least Greece, are required to implement the banking union’s new resolution rules to limit taxpayer liability. Third, this is a limited and specific mutualisation of fiscal powers targeted at a specific financial problem intimately associated with monetary union, not the wholesale centralisation of fiscal control at the level of the EU or the Eurozone.

The only way to restore banking security is for the Member States to regain the fiscal capacity necessary to safeguard deposits. That will not happen and as such the banks remain centres of risk and instability.

3. To “renationalise fiscal policy … The fiction that fiscal policy can be centralised should be abandoned, and the Eurozone should acknowledge that, having forsaken national monetary policies, national control of fiscal policy is all the more important for stabilisation.”

They write that “monetary union without fiscal union will not work”. All the so-called ‘reforms’ since the crisis (changes to the SGP, the Six Pack, the Two Pack, etc) have failed.

Eichengreen and Wyplosz say that:

The one thing these measures have in common is that they do not work.

They acknowledge that “EU member states have profoundly different preferences with regard to fiscal policy. They are reluctant to mutualise fiscal resources or delegate decisions over national fiscal policies to the Commission and the European Parliament”.

However, they do not really tell us how that would work, given that the Member States have no currency-issuing capacity to support large deficits if required.

In fact, they suggest that Member State governments should be restricted in their spending decisions by “market discipline”, which doesn’t really solve anything. I say that because the markets are smart enough to realise that each Member State carries credit risk on any debt it issues, which limits the scale at which it can operate.

We have already seen how the bond markets appraise this credit risk in 2010 – Greece, Portugal then Italy – all experienced sharp increases in the yields they had to offer on their debt, which without ECB intervention would have sent each one of them bankrupt.

It is highly likely that the limits of patients of the private bond investors kick in at deficit levels, which would be insufficient to effectively stabilise economic growth and employment levels in the case of a severe non-government spending collapse (akin to GFC).

4. “Removing … [public debt] … overhangs is … our fourth precondition for survival of the euro”. They advocate a “centrally coordinated, encompassing approach” to such debt restructuring.

What does that mean?

Essentially, the ECB should just write off all the outstanding public debt and use its currency-issuing capacity to fund the necessary fiscal deficits to restore and sustain growth.

Please read my blog – OMF – paranoia for many but a solution for all – for more discussion on this point.

The ECB thinks that negative interest rates and quantitative easing is sufficient to fulfill its role as the currency-issuer. It is sorely wrong.

Please read my blog – The ECB could stand on its head and not have much impact – for more discussion on this point.

The problem is that the Germans will never allow the ECB to play the role that it should be playing as the currency-issuer. The result will be on-going stagnation and deflation.

The German response is exemplified in this report – Causes of the Eurozone Crisis: A nuanced view – which wants to introduce what they call “Maastricht 2.0”.

See also – Consequences of the Greek Crisis for a More Stable Euro Area: Special Report – published in July 2015 by the German Council of Economic Experts.

It will make you weep!

They propose two possible paths:

First, “The transfer of fiscal and economic sovereignty to the European level and simultaneously the assumption of comprehensive joint liability by the European partners”.

But this “central decision-making authority” would have “the power to enforce tax increases, spending cuts and structural reforms” in any Member State.

For the same reasons as I outline above, they reject this option.

They conclude that “it is highly unlikely that a democratically legitimised transfer of fiscal and economic sovereignty to the European level will happen anytime soon. Any half-baked implementation of this option, however, with substantial national control remaining vis-à-vis joint liability, would be the worst of all worlds”.

So the second, they propose:

The continuation of national sovereignty over fiscal and economic policy, excluding any joint liability for government debt.

This means that the no-bailout clause applies.

And this would require in their vision:

1. The Member States would have to “bear the consequences of unsustainable fiscal policies”, which means rising unemployment and poverty would be the adjustment buffer in the absence of rising deficits.

An anti-people stance.

2. “National fiscal policy is monitored on the basis of common fiscal rules defined by the Stability and Growth Pact and infringements are seriously sanctioned”.

So Germany could continue to run these huge external surpluses, but a Member State would be under surveillance and interference from technocrats in Brussels (and Frankfurt and Washington) if they dared run deficits sufficient to bring unemployment down in the event of a nasty (imported) spending shock (as in the case of the GFC).

3. “National debt brakes and their monitoring prevent the accumulation of excessive public debt”. So the restriction on fiscal deficits and the bias towards fiscal surpluses, which has a mirror image of a bias toward greater private debt is deemed appropriate.

This more or less summarises the German position. It is an unsustainable model for Eurozone survival.

Even Eichengreen and Wyplosz would agree with that.

Conclusion

The Eurozone will only continue to survive as long as democratic rights are suppressed and the ECB blackmails Member State government who want to break out of the austerity model.

The stagnation and social dislocation that will follow cannot be a model for a stable society in any Member State.

We are seeing the dysfunction on a daily basis – sometimes in the rising suicide figures, sometimes in airport terminals being blown up.

Music segment

My band – Pressure Drop – released a new video overnight. The track Take Me Higher is on our upcoming CD and will be released as a single track on April 8, 2016 on all the digital platforms including iTunes and GooglePlay.

It is our commentary on the mandatory refugee detention policy of the Australian government (locking innocent people up in penal camps) which is a blatant violation of human rights.

FINALLY – Introductory Modern Monetary Theory (MMT) Textbook

I will write a separate blog about this presently, but today we finally published the first version of our MMT textbook – Modern Monetary Theory and Practice: an Introductory Text – today (March 10, 2016).

The long-awaited book is authored by myself, Randy Wray and Martin Watts.

It is available for purchase at:

1. Amazon.com (60 US dollars)

2. Amazon.co.uk (£42.00)

3. Amazon Europe Portal (€58.85)

4. Create Space Portal (60 US dollars)

By way of explanation, this edition contains 15 Chapters and is designed as an introductory textbook for university-level macroeconomics students.

It is based on the principles of Modern Monetary Theory (MMT) and includes the following detailed chapters:

Chapter 1: Introduction

Chapter 2: How to Think and Do Macroeconomics

Chapter 3: A Brief Overview of the Economic History and the Rise of Capitalism

Chapter 4: The System of National Income and Product Accounts

Chapter 5: Sectoral Accounting and the Flow of Funds

Chapter 6: Introduction to Sovereign Currency: The Government and its Money

Chapter 7: The Real Expenditure Model

Chapter 8: Introduction to Aggregate Supply

Chapter 9: Labour Market Concepts and Measurement

Chapter 10: Money and Banking

Chapter 11: Unemployment and Inflation

Chapter 12: Full Employment Policy

Chapter 13: Introduction to Monetary and Fiscal Policy Operations

Chapter 14: Fiscal Policy in Sovereign nations

Chapter 15: Monetary Policy in Sovereign Nations

It is intended as an introductory course in macroeconomics and the narrative is accessible to students of all backgrounds. All mathematical and advanced material appears in separate Appendices.

A Kindle version will be available the week after next.

Note: We are soon to finalise a sister edition, which will cover both the introductory and intermediate years of university-level macroeconomics (first and second years of study).

The sister edition will contain an additional 10 Chapters and include a lot more advanced material as well as the same material presented in this Introductory text.

We expect the expanded version to be available around June or July 2016.

So when considering whether you want to purchase this book you might want to consider how much knowledge you desire. The current book, released today, covers a very detailed introductory macroeconomics course based on MMT.

It will provide a very thorough grounding for anyone who desires a comprehensive introduction to the field of study.

The next expanded edition will introduce advanced topics and more detailed analysis of the topics already presented in the introductory book.

That is enough for today!

(c) Copyright 2016 William Mitchell. All Rights Reserved.

Michael Hudson is not far off when he says the whole structure is set up in such a way that America is doing a Rome.

Central bankers have known for over a 100 years how it all works. They have manipulated it to such an extent that countries are now forced to send all their revenues abroad while at the same time financing the American military machine. As Michael puts it countries are being forced to finance their own oppression.

The stability and growth pacts and other self imposed constraints are there to curb Russian and China’s growth.Everything that is happening in the Middle East is American Imperialism at work with Russia and China their targets.

They will not be happy until they own and control everything.

Bill poverty is not the only reason why they are doing this there is a log of unemployed people in greece spain and italy a lot ot them are poor people with diffcult life, also there is a lot of poor people in south america and north america and yet nobody of them try to explode himself to kill other people just because they have different religion or faith.

So radical islam play significant role in this at least like poverty.

The same role which played nazism in germany,of course the great depression horribly affected the world but not every country embraced radical ideology because of that,but germans been ready to embrace radical ideology and its made the great depression even more dangerous than its already been.

Derek, I think Hudson is over-egging the pudding on this one. What is happening in the Middle east is the consequence of a massive cockup. Part of it is due to Cheney misunderstanding what the oil companies thought was in their best interests. Another part is due to not rebuilding what was destroyed. And now Obama is blaming Europe for free riding on the consequences of what the US did, which is a bit rich. And it isn’t quite government policy de novo. They are working for their corporations who due to finance misregulation are facilitated in their buying of politicians. And they are doing it through TTIP and TTP which is having trouble getting past Congress. As for Rome, I don’t see the US offering American citizenship to anyone. His account requires more coordinated, concerted action than I see any evidence for. Which is not to say that the US is not imperialistic. Its general population isn’t, but its elite may be.

The EU monetary system is doomed. If it wants to be saved it has to be dismantled and then a new arrangement organised, like the Federal System we have in OZ. The EU is too beholden to the USA and it’s model of society where the “strict father” model holds sway, as explained by George Lakoff in this assessment of Donald Trump;

https://www.socialeurope.eu/2016/03/secret-donald-trumps-success/

I believe that Europe should on-shift all the refugees to the US since that nation is the base cause of the Middle Easter strife. They can fit in OK there too. It’s past due for the US to face its reckoning. Europe will be another casualty if its neo liberal policies are not dismantled. Not having full employment is a dead cert for civil strife, as you point out.

Superb Song Bill on all levels. Complements to the band for that one.

When the only tool you have is a hammer,then everything becomes a nail. It appears economists suffer disproportionately from that disorder of the (narrow) mind.

Ascribing terror attacks in Europe,or anywhere,to unemployment is an example of the narrow mind at work.

The European elite have inflicted this problem on their hapless citizens over many years of deliberate importation of millions of people who are culturally and religiously at odds with Western civil society. I would ascribe this program to greed,ignorance and stupidity.

The careless lack of external EU border control has been recently obvious to all. The deliberate lack of internal border control is now exacerbating that carelessness. Leaders like Hollande and Merkel can’t or won’t see how dangerous this situation is.

It is inevitable that there will be a turn to the right in Europe – possibly the extreme right as in the 1930s. The parallels with the inept governments of that time are obvious. European citizens will not suffer this current nonsense forever.

While Australia has better,but not good,border control,there has been the same deliberate importation of aliens. It’s called multiculturalism in the trendy set. To an Australian citizen with any respect for their native country it is called madness.

Let the games continue.

Daniel, have you turned on the news lately and seen how many mass shootings there has been in the US?

What´s really curious is that the German general population were very happy with their government policy despite the precarious employment provided by the Hartz reforms and the lower living standards and increasing inequality.

Shockingly even finance minster Wolfgang Schaeuble is very popular (65%).

which suggest that to some extent the general population in a democracy is willing to embrace a lack of equitable treatment for themselves and growing income inequality.If they perceive themselves to be doing well,that’s all that matter(politically at least).

Apart from the fact that not everyone can export a surplus(some one has to be in defict),other eurozone could adopt Germany’s industrial policy which has secured Germany’s surplus and excellent industrial base,and export outside of the euro-zone to the rest of the world.

German industrial policy involves:

-a sparkessen,national public industrial bank,long term finance

-public community banks which actively invest in local SME’s

-Local government ownership of large industrial firms (the state of Lower saxony has 20%voting rights in Volksawagon)

-An excellent apprenticeship/vocational education schemes/Public Vocational training system

-Heavy R&D investment/Public R&D infratstructure

a sensible set of policies

Great tune Bill. Nice guitar solo as as well – I might have a crack at it on the Tele when I get home from work.

It is the middle classes that make the revolution not the unemployed masses. 25-40 % unemployment is great tinder but you need socially ambitious children of wealthy families to light the fire.

If you want a left wing revolution, get yourself a lot of unemployed, pissed off lawyers, teachers, army officers, newspaper editors and the like.

If you want a right wing revolution get yourself a lot of broke small businessmen, shop-keepers and ex-army officers.

If you can only get an Islamic revolution because all the left and right wing agitators have been shot, then get yourself some extreme clerics and some pissed off unemployed Islamic masses.

Europe is in the strange position of having the unemployed, discontented Islamic masses with the middle class agitators being parachuted in from Sunni countries.

The Germans knew what they were doing, in a very short sighted way when they sent Lenin off to Imperial Russia in a sealed carriage. But in infecting Russia with a viable ideology they also infected half of Europe with it, including East Germany not to mention losing their own empire along the way. Great tacticians but not so good at long term strategy.

These bombings are very nasty, but I think the true revolution in Europe, if it comes will be from the right wing via the AFD and Mme Le Pen. Those are the middle class embers slowly building up at the present time. Those are the people feeling threatened by an influx of low paid immigrant workers.

The German model works to a great extent on the co-operation and understanding of the German people. If the German elites undermine the German social contract, which is that all Germans will benefit from the national prosperity, by undercutting the wages and prospects of future German workers through import of low cost workers and the cutting of welfare benefits, then that model will cease to function.

what a superb irony it would be if the germans were the first leave the euro currency framework.

this is death in slow motion.

im thinking of running a book on who will be first to leave.

I thought Greece might be the first domino to fall, but Italy are starting to firm up a bit ;).

actually I have to find out if any of the bookmakers are running a market on this.

There are some strange comments above which misconstrue the issues of refugees and terrorism. Let me put matters simply. When air forces aerial bomb people, people tend to run away. They run away from areas where bombs are falling and towards areas where bombs are not falling. It is a simple deduction to further conclude that running to shelter among the people who are dropping the bombs is a sensible act. People do not drop bombs on themselves. The refugees are behaving in a perfectly rational fashion. What is not rational is us dropping bombs on people who never attacked us. Why did we attack the Middle East? What have we gained from it?

Another thing happens when you drop bombs on people. Some of them get mad, real mad. And they find a way to return the “favour”. First, let us stop our mass aerial and ground terror attacks on nations which did not in recent history (or ever in most cases) attack us. We can save money, save lives, lower refugee pressure and stop generating murderous rage in other human hearts. This sounds like a win, win, win, win. We would we refuse so many easy wins? Refusing these easy wins is the height of irrationality.

“would reduce the competitive advantage that Germany enjoys over other nations that have treated their workers more equitably.”

A CA surplus can normally be achieved by export more or import less. To import less it’s not necessary to make it by squeezing workers’ pay in the export industry. Especially in a country like Germany that have had high productivity by mechanics, computers and robots, labor cost is a minor part of the industries cost.

As it seems Germany a side from being very good engineers squeezed the general population working in the domestic market to achieve its abnormal CA surplus. Germany aren’t competing with cheap labor.

Mini-wages and the workfare system in Germany and the German top notch export industry is worlds apart.

Unemployment in West Germany has been fairly “low” somewhat above 5 % (don’t know actual numbers) but in East Germany it is persistent around 10 % despite much subsidizes works. Germany is supposed to have put in two trillion €uros for development in the east since reunification.

As I got the sectoral balance thing foreign surpluses is supposed to act as gov. deficits stimulus or at least could do so. There doesn’t seems to be an matching gov. surpluses to counter act the huge permanent foreign surpluses. As it seems these abnormal foreign surpluses doesn’t at surface in the German domestic economy.

@Iconclast

“Why did we attack the Middle East? What have we gained from it? What is not rational is us dropping bombs on people who never attacked us. Why did we attack the Middle East? What have we gained from it?”

“We” didn’t gain anything. The official reasons in general have been “we” bomb them because of humanitarian reasons to “promote” democracy. Leftist around Europe elevated themselves to noble bomber-knights stuffed with imperial propaganda, writing noble articles about saving the savages from them self by humanitarian bombs. Of course war is bad but sometimes there is no other way to dicip … uhm than save the poor bastards by bombs.

And now when we have the result, do they repent. Not the slightest. Now this leftist intelligentsia is surprised that so many disadvantaged around Europe put their hope on hard core nationalists like Marine le Pen and alike and not the noble left.

Dear Prof. Mitchell,

Just one question: may “deficits” be a lapsus in the sentence “So Germany could continue to run these huge external deficits, but a Member State […]”? I think you meant “surpluses”?

I’m reviewing a translation of your article in Italian for our MMT activist association, I just wanted to make sure of this.

Thanks

Dear Andrea (at 2016/10/18 at 1:33 am)

Yes, it is surpluses. Thanks very much for picking up the typo. I have fixed it now.

best wishes

bill