It's Wednesday, and as usual I scout around various issues that I have been thinking…

Finland’s problem is exactly the euro!

I have noticed a creeping trend in the European press over the last 18 months or so claiming that Finland’s economic malaise, which continues to deteriorate, is nothing to do with the euro. The latest effort in this campaign of denial suggests that the real problem is the “the Finnish welfare state and society”. My view is as follows and it couldn’t be any clearer – whatever structural problems there are in the Finnish economy (following the decline of Nokia and the impending decline of its paper industry due to changing patterns with respect to newspaper consumption), Finland’s decline into the status of a Eurozone basket case along with Greece is all down to the euro and the ridiculous fiscal rules that prevent its government from countering a sharp decline in both the export revenue and private capital formation. Without the limitations imposed by euro membership, Finland would be in a position to stimulate its own economy just as it did during the bleak years of its recession in the early 1990s. Certainly, it would not be a sufficient condition just to exit the euro zone. The neo-liberal infestation that interprets the fiscal rules in the harshest manner (that is, denying even the minimal flexibility that is possible within the Stability and Growth Pact) an additional layer of the problem. But if Finland was to restore its own currency then at the political level the neo-liberal politicians would not be able to shift blame onto the Eurozone rules when they deliberately pushed up unemployment through unnecessary fiscal cuts. Then it would be more obvious that the political leadership was responsible which would bring the destructive neo-liberal tendencies into relief.

I have written about Finland before and I won’t repeat the discussion there except by way of summary where necessary:

1. Finland would be better off outside the Eurozone

2. Finland should exit the euro

3. Friday lay day – the Unit Labour Costs obsession in Finland.

4. Finland – more austerity is not the answer.

The latest attempt to excuse the euro from blame comes from a journalist with the main daily newspaper and appeared in English (April 1, 2016) on the euobserver outlet – In Finland, the euro is not the real problem

As it happens, the same journalist interviewed me while I was in Helsinki last October – so the message I presented obviously didn’t gain traction with her.

Lets just take a step back first before we consider her argument and have a look at the data.

On March 31, 2016, Statistics Finland published updated data on the deficit – General government deficit 2.7 per cent and debt 63.1 per cent relative to GDP in 2015

We read that:

… the deficit was below the reference values of the European Union’s Stability and Growth Pact, which is three per cent relative to gross domestic product. In contrast, general government EDP debt, or consolidated gross debt, now rose above the reference value of 60 per cent, and was 63.1 per cent relative to GDP in 2015.

The Finance Minister has indicated that the Government will further cut discretionary net public spending in the upcoming national fiscal (aka ‘budget’) statement.

Finland’s labour market is in an appalling state despite the Government extolling the falling unemployment over the last year. Digging deeper exposes the reality.

On March 22, 2016, Statistics Finland published the latest Labour Force Survey data – Unemployment rate 9.4 per cent in February.

Over the year to February 2016 we see that:

1. The active population has decline by 1.1 per cent (people dropping out of the labour force). That is equivalent to 30 thousand people dropping out.

2. Total employment has fallen by 10 thousand or 0.4 per cent.

3. Unemployment has also fallen by 20 thousand to 9.4 per cent from 10.1 per cent.

4. The inactive population has risen by 2.7 per cent or 39 thousand.

5. Just in case you think the decline in (1) of 30 thousand is partly due to retirement, the estimates of hidden (disguised) unemployment rose by 28.9 per cent or 35 thousand persons over the last year as the participation rate dropped sharply by 0.9 percentage points.

The fall in unemployment is all down to the rise in hidden unemployment and the falling participation rate. There is nothing good about it at all.

Disguised unemployment is defined by Statistics Finland as:

Persons outside the labour force who would like gainful work and would be available for work within a fortnight, but who have not looked for work in the past four weeks are counted as persons in disguised unemployment – had not changed

Some simple calculations suggest that if there had been no change in disguised unemployment and those people were added back into the labour force (that is, adjusting for the decline in the participation rate over the last 12 months) then:

1. The Labour Force in February 2016 would be 2,668 thousand instead of 2,630 thousand – 37.4 thousand higher (after rounding).

2. The adjusted unemployment level (assuming the extra workers would be unemployed) would be 285.4 thousand instead of the official estimate of 248 thousand. Which means that unemployment would have actually increased by 17.4 thousand on the official estimates over the last 12 months.

3. The adjusted unemployment rate would be 10.7 per cent instead of the official estimate of 9.4 per cent. Which again is a 0.6 percentage point rise over the last 12 months rather than the touted 0.7 percentage point decline.

Anyone who tries to tell you that the labour market in Finland is improving is lying.

The Finance Minister released a press statement (January 28, 2016) – Minister Stubb: Support from OECD for Government’s position – concerns about Finland’s employment rate appropriate – where the usual drivel was rehearsed.

He claimed that the appalling labour market situation is:

… because benefits and activation measures do not encourage a rapid return to the labour market

Yet employment continues to contract.

Ah, but that is because of excessive unit labour costs and he wants to further erode worker protections to tilt the bargaining further in favour of employers.

This is just the government of Finland doing the dirty work for capital in the class struggle against workers.

Please read the blogs I cited at the outset for discussions about unit labour costs etc.

Now let us take a little journey back in time.

Finland endured a massive collapse in the early 1990s. Real GDP peaked in the March-quarter 1990 and the nation then experienced a massive recession. I have discussed that in earlier blogs.

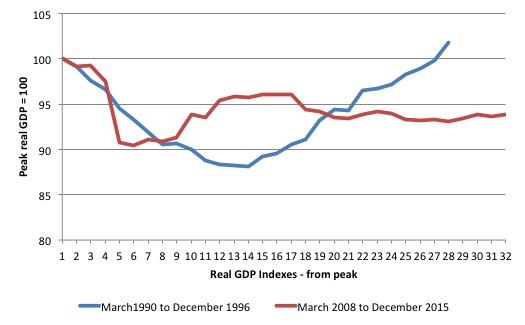

The following graph shows the real GDP index (blue line) from the peak quarter in 1990 to the quarter where it regained that peak level (December 1996). So it took 27 quarters or nearly 7 years to get back to where they were when the crash began.

You can see that once the growth resumed, it was relatively uninterrupted.

The depth of the recession was the result of several factors. But a major contributor was the massive policy failure. The central bank was obsessed with trying to defend the exchange rate as exports collapsed (due to a world downturn in demand and terms of trade) and pushed interest rates up.

It was a futile gesture which only worsened the decline in domestic demand.

Fiscal policy was also tightened between 1992 and 1995 in an attempt to ‘rein in the growing deficit’. Public spending and employment cuts were significant in this period and many income support measures were cut or frozen. Further, taxes rises depleted real disposable incomes.

And it will not surprise you to learn that these attempts were futile. In 1992, the fiscal deficit rose to around 15 per cent of GDP as the automatic stabilisers responded to the massive decline in employment (fell by around 20 per cent).

There was a massive increase in government consumption expenditure (social support) as mass unemployment rose to 18 per cent (by 1994).

Finland was caught in a world recession at at time that its private sector was carrying massive debt burdens. It was a classic balance sheet recession and the policy makers responded poorly and made the situation worse.

As the private debt situation worsened (credit losses in the banking system were around 15 per cent of GDP – that is, massive), the government should have introduced a discretionary fiscal stimulus. Ideology drove it to do the exact opposite and history tells us what the consequences were.

Once the Bank of Finland realised that it could no longer defend the fixed exchange rate (abandoned support in September 1992) the Finnish currency (markka) depreciated by some 40 per cent. The Bank of Finland decreased its policy interest rate from around 15 per cent down to 5 per cent.

Even with that scale of depreciation, the domestic inflation rate fell sharply from 1989 to 1996.

Exports then rose quickly on the back of the depreciation in the currency and industrial production started picking up quickly in 1992.

One would have thought that Finland would have learned its lesson from the costs it endured during this period. The red line in the graph above shows the real GDP index from the March-quarter 2008 (value = 100) to the December-quarter 2015 (value = 93.8).

So after 32 quarters (that is, eight years), real GDP is still 6.2 per cent lower than it was at the onset of the crisis.

The crisis in 2008-09 was worse than the downturn during the horrible 1990 crisis. But as you can see real GDP started growing again fairly quickly in the March-quarter 2010. The reason? Government consumption and investment expenditure was ramped up in the form of stimulus packages in 2009, which led to a reversal of the cycle in early 2010.

And then the European Commission pressured the Finnish government to introduce pro-cyclical fiscal initiatives (a.k.a., fiscal austerity) and the situation deteriorated rapidly after that.

Private capital formation is now 23.1 per cent below what it was in the March-quarter 2008 peak. Household consumption is barely above it 2008 peak level. Exports are 12.2 per cent below the March-quarter 2008 peak.

The only thing that is prevented the ongoing downturn from being worse has been some public infrastructure investment (public capital formation is 8.5 per cent higher than its March-quarter 2008 level).

The euobserver article cited above tells us that:

Finland’s GDP collapsed in 2009, but it quickly recovered for two years due to expansionary macroeconomic policy. However, the government has since tightened its spending, forcing GDP into negative growth for three years. Last year, the Finnish economy grew about 0.5 percent.

The euobserver article cited above tells us that:

Finland’s GDP collapsed in 2009, but it quickly recovered for two years due to expansionary macroeconomic policy. However, the government has since tightened its spending, forcing GDP into negative growth for three years. Last year, the Finnish economy grew about 0.5 percent.

So the journalist clearly understands the impact that discretionary fiscal shifts since the crisis began have had on real GDP growth. That is consistent with my narrative above.

Yes, there has also been “the fall of Nokia” which “made up some 20 percent of Finland’s exports during its best years” and “exports to Russia have decreased drastically as a result of the economic troubles across the border”.

As an aside, readers who do not follow EU politics very closely might be wondereing what “border” she is talking about. The fact is that the drastic decline in exports to Russia have been the result of sanctions imposed by Brussels rather than anything Russia has done in relation to Finland.

At a time, that the Finnish economy is enduring a collapse in non-government spending, partly as a result of political decisions made in the European Commission, the same Commission continues to pressure the Finnish government to exacerbate the situation by intensifying the fiscal austerity.

Sure enough, the ruling, conservative right-wing Centre Party doesn’t need much encouragement to impose oppressive fiscal regimes and attack the welfare state and worker protections.

But ultimately, it is the inability to float the exchange rate and the requirement that the fiscal outcomes be within limits that have no relevance to the current situation that Finland finds itself in that is the problem.

The journalist then takes us through the nasty “internal devaluation” that is “already well under way” in Finland.

1. “The Finnish government has forced the trade unions and business groups early this year to agree on cutting labour costs mainly by transferring social insurance contributions from employers to employees and by increasing annual working time by 24 hours without extra pay.”

2. There have been cuts to “sick leave and cuts on holiday pay”.

The aim of the Government is to deplete the Welfare State and deregulate the labour market as quickly as it can get away with.

We learn that there is now a “polarisation of Finnish society between the’haves’ and the ‘have-nots’, a common manifestation of this period of history. With long-term unemployment rising in addition to rising housing costs the standard of living of poorer Finns is falling quickly.

When the neo-liberals talk about fiscal deficits burdening our grandchildren the reality is that it is fiscal austerity which undermines the future of the next generation and beyond.

Cutbacks to public education and training, increases in poverty rates among children, cutbacks to the health system, and a degradation of public infrastructure or contribute to leaving a diminished legacy for our children and their children.

Conclusion

The euobserver article closes with this:

Finally, the euro is not the issue but the future of the Finnish welfare state and society.

While clearly the future of the Finnish welfare state and broader societal values are at stake and the intent of the current government is clearly to retrench as much of the welfare state as it can, membership of the euro remains the major constraint.

Obviously, the current political climate is favouring the neo-liberals and they would be attempting the same strategy even if they had their own currency restored. Reflect back on the behaviour of the policymakers in the early 1990s.

However, even a progressive government would find the membership of the Eurozone and oppressive constraint on its ambitions to advance the well-being of the Finnish population.

Further, by restoring its own currency, the neo-liberals would have to take responsibility for the scorched earth they are inflicting on the population. They could no longer pass off their policy choices onto rules and dictates coming from Brussels.

It is the euro that is the problem.

FINALLY – Introductory Modern Monetary Theory (MMT) Textbook

We have now published the first version of our MMT textbook – Modern Monetary Theory and Practice: an Introductory Text (March 10, 2016).

The long-awaited book is authored by myself, Randy Wray and Martin Watts.

It is available for purchase at:

1. Amazon.com (60 US dollars)

2. Amazon.co.uk (£42.00)

3. Amazon Europe Portal (€58.85)

4. Create Space Portal (60 US dollars)

By way of explanation, this edition contains 15 Chapters and is designed as an introductory textbook for university-level macroeconomics students.

It is based on the principles of Modern Monetary Theory (MMT) and includes the following detailed chapters:

Chapter 1: Introduction

Chapter 2: How to Think and Do Macroeconomics

Chapter 3: A Brief Overview of the Economic History and the Rise of Capitalism

Chapter 4: The System of National Income and Product Accounts

Chapter 5: Sectoral Accounting and the Flow of Funds

Chapter 6: Introduction to Sovereign Currency: The Government and its Money

Chapter 7: The Real Expenditure Model

Chapter 8: Introduction to Aggregate Supply

Chapter 9: Labour Market Concepts and Measurement

Chapter 10: Money and Banking

Chapter 11: Unemployment and Inflation

Chapter 12: Full Employment Policy

Chapter 13: Introduction to Monetary and Fiscal Policy Operations

Chapter 14: Fiscal Policy in Sovereign nations

Chapter 15: Monetary Policy in Sovereign Nations

It is intended as an introductory course in macroeconomics and the narrative is accessible to students of all backgrounds. All mathematical and advanced material appears in separate Appendices.

A Kindle version will be available the week after next.

Note: We are soon to finalise a sister edition, which will cover both the introductory and intermediate years of university-level macroeconomics (first and second years of study).

The sister edition will contain an additional 10 Chapters and include a lot more advanced material as well as the same material presented in this Introductory text.

We expect the expanded version to be available around June or July 2016.

So when considering whether you want to purchase this book you might want to consider how much knowledge you desire. The current book, released today, covers a very detailed introductory macroeconomics course based on MMT.

It will provide a very thorough grounding for anyone who desires a comprehensive introduction to the field of study.

The next expanded edition will introduce advanced topics and more detailed analysis of the topics already presented in the introductory book.

That is enough for today!

(c) Copyright 2016 William Mitchell. All Rights Reserved.

ISTM that the Euro is taking the place of the Independent Central Bank as the “nothing to do with us” reason why government has no choice but to smash social security and send us all back to the stone age.

But when the alternative narrative is “tax the rich”, it’s hardly surprising that the “rich” vehemently oppose any change in that direction.

Unfortunately “Increase the absolute wealth of everybody and the poor relatively more so by increasing the intensity of domestic output and consumption so inequality is corrected but everybody wins” doesn’t make as good a soundbite.

Also note that Finland has sharply rising private sector debt-to-GDP ratio. It looks like a time bomb. See:

http://debt-economics.org/review-data.php

Knowing that an (documented) self proclaimed extreme neoliberal, former Minister for Finance in the Swedish Government from 2006-2014 Anders Borg, became an “expert” invited to Finland to give advice how to sort things out right after he lost his job 2014, it’s no wonder people in Finland is experiencing their future going down the drain.

Finlands’ “expert” Anders Borg and his team mate former Prime Minister Fredrik Reinfeldt are now both employed by international bank lobby organisations . Who would have thought…

How do journalists get away with quotes like these:

“Finally, the euro is not the issue but the future of the Finnish welfare state and society”

Or

“And government spending is a dead end too.”

Quoted like they are a physical rule of the universe that is proven and can’t be questioned. I guess without these nonsense quotes everything else crumbles yet they write them like its E=mc2.

Like medicine has alternative medicine and real medicine it’s time that economics got it’s the together and we have real economics “heterodox” I assume it would be and our orthodox economics put back in the league of astrology. Unfortunately there’s been decades of big money given to economics departments to teach only one type of economics it sounds like and it’s going to take a long time to break that. Thankfully students are starting to fight back as I listened in a recent bbc4 podcast on the teaching of economics. I’ll try and find the link and post separately as I think it would be well worth MMT getting involved with the global mic of students fighting the established economics teaching discussed in the podcast.

I’m sure the PM in Iceland and his party was the only party against joining the Euro.

Now he’s out of the way is Iceland next ?

My brand new copy of “Modern Monetary Theory and Practice” arrived today! I am happy to report that Chapter 1 (an introduction) is a beautifully written and quite powerful essay in its own right. However, breaking with my recent practice , I don’t plan to ciritique the entire book until I actually read it.

I do have a technical question about your preferred method of attribution- I am planning to cite this work frequently to buttress my complaints about unfair weekend quiz questions. I’m joking here. (mostly).

But I would like to quote something from Chapter 1. “in capitalist economies labour is virtually always in excess supply– that is, many workers are left unemployed. It is ironic that neoclassical economics starts from the presumption that resources are scarce, when the obvious empirical fact is that labour is unemployed. Any theory that begins with the presumption that labour is always fully employed, and hence scarce, is ignoring a glaring inconsistency.” (MMT textbook p7)

Well said. I think I will like this book.

And yet Neil taxing the rich was such a vital component of the success of the post war settlement.

How much more well off do normal folk need to become to compete for real resources with the

current elite?

Jason H, do try and find the BBC Radio4 link and post it.

I think that there is a slight misunderstanding here about the purpose of the EUObserver article. The journalist’s intention seems to be to give an overview of the current situation in the Finnish political and public debate to international, and especially European elite, audiences who mostly read EUObserver. Accordingly, when the journalist writes that “the euro is not the issue”, she – if I undestand correctly – only interprets the general public and political opinion climate in Finland at the moment. It is not meant as an analytical argument concerning the economic situation of Finland. Indeed, as a Finnish observer I can concur with the general thrust of the article: arguments about the euro as a problem for Finland has been almost totally silenced in national political and public debate.

Hi Larry I did post the links but Bill must not have reviewed it yet. If you google “Peter days world of business” the episode is called “economic rebellion”. Hope you enjoy there’s a movement they have called rethinking economics which might be useful to get MMT involved with them?

I can confirm, as a resident of Finland, that discussion of the euro’s role in Finland’s economic problems is virtually taboo here. Possibly due to the legacy of bad habits from the era of Finlandisation, the Finnish media tend to toe the line set for them by the state on issues like this. The EU and Germany, in particular, have taken the place that the Soviet Union once occupied as the powers that set the agenda and boundaries of discussion in this small, vulnerable country. Sadly, one of Europe’s best educated populations is methodically being kept in the dark…