I have received several E-mails over the last few weeks that suggest that the economics…

The Weekend Quiz – July 16-17, 2016 – answers and discussion

Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of modern monetary theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

A fiscal deficit equivalent to 2 per cent of GDP signals that the government is adopting a less expansionary policy stance than if the fiscal deficit outcome was equivalent to 3 per cent of GDP.

The answer is False.

The question probes an understanding of the forces (components) that drive the fiscal balance that is reported by government agencies at various points in time.

In outright terms, a fiscal deficit that is equivalent to 5 per cent of GDP is more expansionary than a fiscal deficit outcome that is equivalent to 3 per cent of GDP. But that is not what the question asked. The question asked whether that signalled that the government is adopting a less expansionary policy – that is, whether its discretionary fiscal intent was expansionary.

In other words, what does the fiscal outcome signal about the discretionary fiscal stance adopted by the government.

To see the difference between these statements we have to explore the issue of decomposing the observed fiscal balance into the discretionary (now called structural) and cyclical components. The latter component is driven by the automatic stabilisers that are in-built into the fiscal process.

The federal (or national) government fiscal balance is the difference between total federal revenue and total federal outlays. So if total revenue is greater than outlays, the fiscal position is in surplus and vice versa. It is a simple matter of accounting with no theory involved. However, the fiscal balance is used by all and sundry to indicate the fiscal stance of the government.

So if the fiscal position is in surplus it is often concluded that the fiscal impact of government is contractionary (withdrawing net spending) and if the fiscal position is in deficit we say the fiscal impact expansionary (adding net spending).

Further, a rising deficit (falling surplus) is often considered to be reflecting an expansionary policy stance and vice versa. What we know is that a rising deficit may, in fact, indicate a contractionary fiscal stance – which, in turn, creates such income losses that the automatic stabilisers start driving the fiscal position back towards (or into) deficit.

So the complication is that we cannot conclude that changes in the fiscal impact reflect discretionary policy changes. The reason for this uncertainty clearly relates to the operation of the automatic stabilisers.

To see this, the most simple model of the fiscal balance we might think of can be written as:

Budget Balance = Revenue – Spending.

Budget Balance = (Tax Revenue + Other Revenue) – (Welfare Payments + Other Spending)

We know that Tax Revenue and Welfare Payments move inversely with respect to each other, with the latter rising when GDP growth falls and the former rises with GDP growth. These components of the fiscal balance are the so-called automatic stabilisers.

In other words, without any discretionary policy changes, the fiscal balance will vary over the course of the business cycle. When the economy is weak – tax revenue falls and welfare payments rise and so the fiscal balance moves towards deficit (or an increasing deficit). When the economy is stronger – tax revenue rises and welfare payments fall and the fiscal balance becomes increasingly positive. Automatic stabilisers attenuate the amplitude in the business cycle by expanding the fiscal position in a recession and contracting it in a boom.

So just because the fiscal position goes into deficit or the deficit increases as a proportion of GDP doesn’t allow us to conclude that the Government has suddenly become of an expansionary mind. In other words, the presence of automatic stabilisers make it hard to discern whether the fiscal policy stance (chosen by the government) is contractionary or expansionary at any particular point in time.

To overcome this uncertainty, economists devised what used to be called the Full Employment or High Employment Budget. In more recent times, this concept is now called the Structural Balance. The Full Employment Budget Balance was a hypothetical construct of the fiscal balance that would be realised if the economy was operating at potential or full employment. In other words, calibrating the fiscal position (and the underlying fiscal parameters) against some fixed point (full capacity) eliminated the cyclical component – the swings in activity around full employment.

So a full employment fiscal position would be balanced if total outlays and total revenue were equal when the economy was operating at total capacity. If the fiscal position was in surplus at full capacity, then we would conclude that the discretionary structure of the fiscal position was contractionary and vice versa if the fiscal position was in deficit at full capacity.

The calculation of the structural deficit spawned a bit of an industry in the past with lots of complex issues relating to adjustments for inflation, terms of trade effects, changes in interest rates and more.

Much of the debate centred on how to compute the unobserved full employment point in the economy. There were a plethora of methods used in the period of true full employment in the 1960s. All of them had issues but like all empirical work – it was a dirty science – relying on assumptions and simplifications. But that is the nature of the applied economist’s life.

As I explain in the blogs cited below, the measurement issues have a long history and current techniques and frameworks based on the concept of the Non-

Accelerating Inflation Rate of Unemployment (the NAIRU) bias the resulting analysis such that actual discretionary positions which are contractionary are seen as being less so and expansionary positions are seen as being more expansionary.

The result is that modern depictions of the structural deficit systematically understate the degree of discretionary contraction coming from fiscal policy.

So the data provided by the question could indicate a more expansionary fiscal intent from government but it could also indicate a large automatic stabiliser (cyclical) component.

Therefore the best answer is False because there are circumstances where the proposition will not hold.

You might like to read these blogs for further information:

Question 2:

When the government borrows from the non-government sector to match an increase in net public spending (deficit increase), the resulting increase in aggregate spending is less than would be the case if there was no bond sale.

The answer is False.

The mainstream macroeconomic textbooks all have a chapter on fiscal policy (and it is often written in the context of the so-called IS-LM model but not always).

The chapters always introduces the so-called Government Budget Constraint that alleges that governments have to “finance” all spending either through taxation; debt-issuance; or money creation. The writer fails to understand that government spending is performed in the same way irrespective of the accompanying monetary operations.

The textbook argument claims that money creation (borrowing from central bank) is inflationary while the latter (private bond sales) is less so. These conclusions are based on their erroneous claim that “money creation” adds more to aggregate demand than bond sales, because the latter forces up interest rates which crowd out some private spending.

All these claims are without foundation in a fiat monetary system and an understanding of the banking operations that occur when governments spend and issue debt helps to show why.

So what would happen if a sovereign, currency-issuing government (with a flexible exchange rate) ran a fiscal deficit without issuing debt?

Like all government spending, the Treasury would credit the reserve accounts held by the commercial bank at the central bank. The commercial bank in question would be where the target of the spending had an account. So the commercial bank’s assets rise and its liabilities also increase because a deposit would be made.

The transactions are clear: The commercial bank’s assets rise and its liabilities also increase because a new deposit has been made.

Further, the target of the fiscal initiative enjoys increased assets (bank deposit) and net worth (a liability/equity entry on their balance sheet).

Taxation does the opposite and so a deficit (spending greater than taxation) means that reserves increase and private net worth increases.

This means that there are likely to be excess reserves in the “cash system” which then raises issues for the central bank about its liquidity management. The aim of the central bank is to “hit” a target interest rate and so it has to ensure that competitive forces in the interbank market do not compromise that target.

When there are excess reserves there is downward pressure on the overnight interest rate (as banks scurry to seek interest-earning opportunities), the central bank then has to sell government bonds to the banks to soak the excess up and maintain liquidity at a level consistent with the target.

Some central banks offer a return on overnight reserves which reduces the need to sell debt as a liquidity management operation.

There is no sense that these debt sales have anything to do with “financing” government net spending. The sales are a monetary operation aimed at interest-rate maintenance.

So M1 (deposits in the non-government sector) rise as a result of the deficit without a corresponding increase in liabilities. It is this result that leads to the conclusion that that deficits increase net financial assets in the non-government sector.

What would happen if there were bond sales? All that happens is that the banks reserves are reduced by the bond sales but this does not reduce the deposits created by the net spending. So net worth is not altered. What is changed is the composition of the asset portfolio held in the non-government sector.

The only difference between the Treasury “borrowing from the central bank” and issuing debt to the private sector is that the central bank has to use different operations to pursue its policy interest rate target. If it debt is not issued to match the deficit then it has to either pay interest on excess reserves (which most central banks are doing now anyway) or let the target rate fall to zero (the Japan solution).

There is no difference to the impact of the deficits on net worth in the non-government sector.

Mainstream economists would say that by draining the reserves, the central bank has reduced the ability of banks to lend which then, via the money multiplier, expands the money supply.

However, the reality is that:

- Building bank reserves does not increase the ability of the banks to lend.

- The money multiplier process so loved by the mainstream does not describe the way in which banks make loans.

- Inflation is caused by aggregate demand growing faster than real output capacity. The reserve position of the banks is not functionally related with that process.

So the banks are able to create as much credit as they can find credit-worthy customers to hold irrespective of the operations that accompany government net spending.

This doesn’t lead to the conclusion that deficits do not carry an inflation risk. All components of aggregate demand carry an inflation risk if they become excessive, which can only be defined in terms of the relation between spending and productive capacity.

It is totally fallacious to think that private placement of debt reduces the inflation risk. It does not.

You may wish to read the following blogs for more information:

- Why history matters

- Building bank reserves will not expand credit

- Building bank reserves is not inflationary

- The complacent students sit and listen to some of that

Question 3:

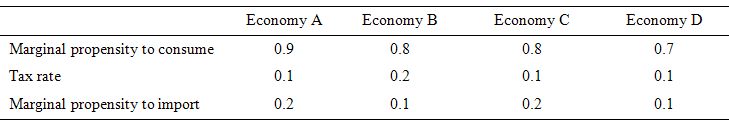

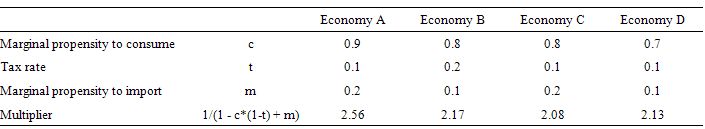

Consider the following table which describes four different economies in terms of the behavioural parameters relating to the leakages to aggregate demand.

Assume that in all four economies, there is idle capacity, the central bank holds all interest rates constant, inflation is constant and there is no changes in international competitiveness.

Which economy would deliver the largest national income bonus for a given discretionary expansion in government spending (ignore the possibility of longer term wealth effects)?

The answer is Economy A.

This question requires you to understand the impact of the different leakages (drains) to aggregate demand that arise from household saving, government taxation and import expenditure.

These leakages combine to determine the spending multiplier.

Students begin to learn about the expenditure multiplier in a very simple model without government or external sector. It sets them up immediately to disregard the crucial relationship between government and non-government sector that really drives the dynamics of the monetary system.

In the text book that Randy Wray and I are currently working on the government/non-government relationship is introduced at the beginning of the learning process to ensure students understand the importance of net positions etc.

So I don’t think it is too hard to explain the expenditure multiplier with government spending, taxes and imports introduced from the start.

The clue is to first of all realise that aggregate demand drives output with generates incomes (via payments to the productive inputs). I won’t go into controversies here about whether the productive inputs are rewarded fairly or whether surplus value is expropriated etc. That is a separate and not unimportant discussion but not germane here to understand the accounting and the dynamics.

Accordingly, what is spent will generate income in that period which is available for use. The uses are further consumption; paying taxes and/or buying imports. We consider imports as a separate category (even though they reflect consumption, investment and government spending decisions) because they constitute spending which does not recycle back into the production process. They are thus considered to be “leakages” from the expenditure system.

So if for every dollar produced and paid out as income, if the economy imports around 20 cents in the dollar, then only 80 cents is available within the system for spending in subsequent periods excluding taxation considerations.

However there are two other “leakages” which arise from domestic sources – saving and taxation. Take taxation first. When income is produced, the households end up with less than they are paid out in gross terms because the government levies a tax. So the income concept available for subsequent spending is called disposable income (Yd).

To keep it simple, imagine a proportional tax of 20 cents in the dollar is levied, so if $100 of income is generated, $20 goes to taxation and Yd is $80 (what is left). So taxation (T) is a “leakage” from the expenditure system in the same way as imports are.

Finally consider saving. Consumers make decisions to spend a proportion of their disposable income. The amount of each dollar they spent at the margin (that is, how much of every extra dollar to they consume) is called the marginal propensity to consume. If that is 0.80 then they spent 80 cents in every dollar of disposable income.

So if total disposable income is $80 (after taxation of 20 cents in the dollar is collected) then consumption (C) will be 0.80 times $80 which is $64 and saving will be the residual – $26. Saving (S) is also a “leakage” from the expenditure system.

It is easy to see that for every $100 produced, the income that is generated and distributed results in $64 in consumption and $36 in leakages which do not cycle back into spending.

For income to remain at $100 in the next period the $36 has to be made up by what economists call “injections” which in these sorts of models comprise the sum of investment (I), government spending (G) and exports (X). The injections are seen as coming from “outside” the output-income generating process (they are called exogenous or autonomous expenditure variables).

Investment is dependent on expectations of future revenue and costs of borrowing. Government spending is clearly a reflection of policy choices available to government. Exports are determined by world incomes and real exchange rates etc.

For GDP to be stable injections have to equal leakages (this can be converted into growth terms to the same effect). The national accounting statements that we have discussed previous such that the government deficit (surplus) equals $-for-$ the non-government surplus (deficit) and those that decompose the non-government sector in the external and private domestic sectors is derived from these relationships.

So imagine there is a certain level of income being produced – its value is immaterial. Imagine that the central bank sees no inflation risk and so interest rates are stable as are exchange rates and domestic wage levels (these simplifications are to to eliminate unnecessary complexity).

The question then is: what would happen if government increased spending by, say, $100? This is the terrain of the multiplier. If aggregate demand increases drive higher output and income increases then the question is by how much?

The spending multiplier is defined as the change in real income that results from a dollar change in exogenous aggregate demand (so one of G, I or X). We could complicate this by having autonomous consumption as well but the principle is not altered.

The spending multiplier is the extra spending that would occur when an autonomous expenditure source changes. So we ask the question: What would be the change in income if I or G or X changed by $1?

To derive the multiplier we need to write out the aggregate demand model and substitute the behavioural parameters into the model.

Aggregate demand (and income)

Y = C + I + G + X – M

Taxes

T = t*Y.

The little t is the marginal tax rate which in this case is the proportional rate. Note here taxes are taken out of total income (Y) which then defines disposable income.

The * sign denotes multiplication. You can do this example in a spreadsheet if you like.

Yd = (1-t)*Y

Consumption and Saving

We define the consumption relationship at the most simple level as a proportional relationship to disposable income (Yd).

C = c*Yd

where little c is the marginal propensity to consume (MPC) or the fraction of every dollar of disposable income consumed.

So using the Yd relationship we can write consumption as:

C = c*(1-t)*Y

Imports

Imports (M) are considered proportional to total income (Y):

M= m*Y

where little m is the marginal propensity to import which is the increase in imports for every real GDP dollar produced.

Multiplier

To derive the multiplier formula we can assemble the aggregate demand relationship with its individual behavioural components as follows:

Y = C + I + G + X – M

Y = c*(1-t)*Y + I + G + X – m*Y

Now, re-arrange the equation to collect the Y terms on the left-hand side:

Y – c*(1-t)*Y + m*Y = I + G + X

You can see the exogenous injections to aggregate demand (those not reliant on national income) are on the right-hand side and all the components of expenditure that rely on national income are collected on the left-hand side.

We simplify this as follows:

Y(1 – c*(1-t)*Y + m) = I + G + X

So the relationship between changes in Y and changes in the exogenous spending components is:

Y = [1/(1 – c*(1-t)*Y + m)]*(I + G + X)

The term in [] brackets on the right-hand side is the multiplier because it shows how much a given change in (I + G + X) multiply to national income Y.

We could write this as:

Y = k*(I + G + X)

where

k = [1/(1 – c*(1-t)*Y + m)]

Or using other symbols:

k = 1/(1 – MPC x (1-t) + MPM)

So the higher is the MPC the lower is the tax rate (t) and the lower is the MPM the higher is the multiplier. That makes sense because taxes and imports drain spending from the income generating system. So as income responds positively to an autonomous injection, the smaller are the drains via taxation and imports and the higher the induced consumption – the higher is the second round spending effect which then continues to generate further income increases.

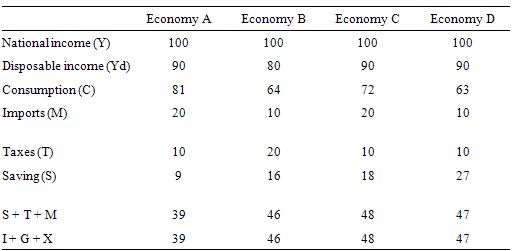

We can then apply this knowledge to the four economies in the Table. The bottom row of the Table provide the solution to the multiplier for the given parameters.

We interpret the data as follows. If government spending increased by $1, then the total change in national income in Economy A would be $2.56, in Economy B $2.17, in Economy C $2.08, and in Economy D $2.13.

The question obviously requires you to think about the different impacts of varying the drains on aggregate demand. The drains are not all equal.

For example, a given change in the marginal propensity to import has a greater impact than a given change in the marginal propensity to consume as you can see by comparing Economy C to Economy D. This is because imports come out of pre-tax income whereas the consumption decision comes out of disposable income.

A rise in the marginal propensity to consume of 0.1 will more than offset the draining impact of an equal rise in the tax rate because the decline in saving is greater than the rise in taxes.

You can construct all sorts of different scenarios to understand the impacts. To give you an idea of the different compositions of aggregate demand and the different leakages and injections the following Table assumes national income is 100 and then solves the model for each economy given the parameters.

I could clearly make the model more complex but the results would not be very different. Some will suggest the model is overly simplistic because it is a “fixed price” model and assumes supply will just meet any new nominal spending. That is true by construction and is a reasonable description of the state of play at present.

There is no inflation threat at present due to the vast quantities of idle resources that can be brought into production should there be a demand for their services.

Some might argue the external sector is too simplistic and that the terms of trade (real exchange rate) should be included in the export and import relationships. In a complex model that is true but in the context of this model the likely changes would just reinforce the results I derive. There is no loss of insight by holding the terms of trade constant.

Some might argue that the interest rate should be modelled and I reply why? The implicit assumption is that the central bank sets the interest rate and it is currently low in most nations and has been for some years. With no real inflation threat, the short-term rates will remain low for some time yet.

As to long rates (and the rising fiscal deficit) – show me where the significant rises in fiscal deficits (for a sovereign nation) are driving up rates. They have actually been falling as a consequence of very strong demand for public debt issues (almost insatiable) by bond markets and the quantitative easing efforts of the large central banks.

For an EMU nation, long-rates are within the control of the ECB as has been demonstrated once it started buying government bonds in the secondary markets. So leaving monetary policy implicit and fixed in this model doesn’t lose any insight or “fix” the results in my favour.

You may wish to read the following blogs for more information:

That is enough for today!

It has now been several weeks since I have had to concoct unrealistic scenarios wherein my answers might be correct. I don’t know how to analyze this observational fact. Is it that I am getting smarter? (very doubtful). Are the questions getting easier? Has Professor Mitchell lost his desire to inflict psychic angst? Or am I just getting good luck?

I will go with answer d- getting lucky as it is the most probable.

In any case, thank you for the quiz. I always enjoy it but like to complain about it.

It is definitely luck. Careful reading of the answer to question 3 proves that the method I used to come up with the correct answer was faulty and would have been useless had “economy A” not been included in the question. So if only “economies B, C, and D had been asked about, then the correct answer would have been economy B?

Jerry, B, C and D all have the same income as a percentage of GDP.

Economy A, B and C all have a leakage of 0.3 and D has a leakage of 0.2.

It is Economy A high level of MPC that keeps its national income high.

Both economy B and C are similar. They have the same MPC and the same rate of leakages.

Economy D only has a leakage of 0.2 but also a higher saving rate or lower MPC.