It was only a matter of time I suppose but the IMF is now focusing…

Reforming the international institutional framework – Part 1

This blog continues the unedited excerpts that will appear in my new book (with Italian journalist Thomas Fazi) which is nearing completion. This material will be in Part 3 where we present what we are calling a ‘Progressive Manifesto’, which we hope to provide a coherent Left philosophy to guide policy design and policy choices for governments that are struggling to see a way beyond the neo-liberal macroeconomics. In this blog I examine how the international institutional framework has to be reformed to serve a progressive agenda where rich countries (and the elites within them) do not plunder then pillary poor countries. Central to this new framework is the abolition of the World Bank, the IMF and the OECD, all of which have become so sullied by neo-liberal Groupthink that they are not only dysfunctional in terms of their original charter but downright dangerous to the prosperity and freedoms of people. Former World Bank chief economist Joseph Stiglitz told journalist Greg Palast in an interview in 2001 that the IMF “has condemned people to death” (Source). I will propose a new international institution designed to protect vulnerable nations from damaging exchange rate fluctuations and to provide investment funds for education, health and public infrastructure. We will explore how new institutions protect themselves from developing the sort of dysfunctional Groupthink that has crippled the existing institutions. We will disabuse ourselves of notions that are popular among some progressive voices that a fixed exchange rate, international currency system is required. This will be a two part blog and will also have context for other blogs where I discuss reforms to the global financial system.

Supranationalism versus Internationalism

In this part of the Manifesto we aim to propose a re-writing of the international framework’, with proposals for redesigning the international funds system, including the dismantling of the IMF and replacing it with a new body that will help poor nations survive balance of payments problems (for example, when they are dependent on imported food or energy)

We aim to demonstrate that a progressive manifesto that recognises the power of the state also acknowledges the importance of the international dimension by contrasting internationalism against supranationalism!

It is an important issue. First, we argue that the nation state is alive and well and maintains its sovereignty if it uses its own currency, floats it on international markets, sets its own interest rate and doesn’t borrow in foreign currencies.

In this context, ‘democracy’ can work because the elected legislature determines the policy structure of the nation, which should reflect the will of the people at any point in time. I know with concentrated media and income inequalities and all the rest of it, that the reality is that ‘democracy’ is stretched to the limit.

We argue that in that context, where governments assert their sovereignty, global capitalism has to come to terms with the

government of the day rather than the other way around.

If we can kick a government out of office for failing to meet our expectations that is better than having to be told by some international court that a corporation doesn’t like some regulation or law that our elected government has enacted and so the government has to rescind. That is surrender.

The Right have understood this intrinsically, which is why the Powell Manifesto in the early 1970s outlined a multi-pronged strategy whereby capital could move the legislators to act in their favour.

The rise of the well-funded think tanks and supportive media and the infiltration into academic programs etc were all part of this strategy.

The Right knew they had to deal with the State one way or another.

The Left, unfortunately, conflated globalisation with neo-liberalism and, largely accepted the narrative that the ‘state’ had become powerless in the face of global financial capital and had to ensure its national policies were ticked off by these amorphous ‘markets’.

It was a puerile act of surrender – a ‘jumping at shadows’. It was a reflection of ignorance and inferiority rather than being a well-informed view based on evidence and reality.

As an aside – Jumping At Shadows – is a great Fleetwod Mac track released on the ‘Live In Boston Remastered Volume One’ (1999 release). It highlights the time when Peter Green ruled the guitar world with his beautiful playing. Soothe yourself if you love his playing before reading on!

Unfortunately, the Left still believe in this narrative, which is why we are writing this book.

The ‘state’ is still central to our analysis.

But we also acknowledge that each sovereign ‘state’ operates in an international world and that there are global responsibilities that each nation should accept with respect to each other.

The question is how best to define and enforce those responsibilities.

The problem now is that international institutions have been created which subvert the democratic rights of citizens and usurp the capacity of national governments.

The IMF, the World Bank, to name just two such institutions have outgrown their original purpose and have become oppressive organisations serving the interests of global capital and have demonstrated over many years a capacity to undermine the well-being of citizens as a result.

Governments are increasingly getting lured into so-called ‘free trade’ agreements, which have established even more pernicious institutional structures, including ‘investor-state dispute mechanisms’, which clearly tilt the ground away from the elected legislator towards corporations. The people miss out!

On a less global scale, the previously sovereign Member States of the Eurozone surrendered their independence in the name of European integration with disastrous consequences for millions of European citizens.

These demonstrations of ‘internationalism’ are detrimental to the well-being of ordinary workers and undermine the democratic process. They enslave the sovereign state into arrangements where the legislative machinery is used to advance the interests of the elites.

Progressive policy advocates thus have to argue for the liquidation of these international institutions and promote, in their state, supranational institutions which do not compromise the democratic rights of workers.

The primacy of supranationalism was a major reason that the earlier attempts at European integration failed. France, in particular, under Charles De Gaulle was unwilling to surrender the national fiscal capacity to a ‘European-level’ body.

He was willing to create intergovernmental institutions to deal with matters that spanned national borders. But these, by there very nature, were still vehicles that the state could participate in if they served national interests. Once the Monetarists took over in France, supranationalism gave way to internationalism and the nation, to their misfortune, entered the Eurozone.

There is clearly a ‘global community’ which is an appropriate arena for determining many issues that span borders – climate change, development aid, rule of law, migration and refugees etc – and international institutions should be designed and created to effectively deal with these matters in the common global interest.

But the ‘state’ has to always be mindful of its responsibilities to its own citizens and not to compromise those responsibilities in favour of one sector or another.

So in this section of our book we will analyse what a new international institutional framework might look like.

We propose liquidating (scrapping) the World Bank, the IMF, the OECD, the Bank of International Settlements among other current institutions, which by their actions have become neo-liberal attack dogs, and have outlived their original functions.

We argue that these institutions have become captured by a dysfunctional neo-liberal Groupthink and have ceased to function effectively. Rather, their performances and international interventions have undermined prosperity and impoverished millions of people across the world – mostly, but not exclusively, in the poorest nations.

Background

As World War 2 was nearing an end with Hitler hopelessly compromised on all fronts, the 44 Allied nations met in the US town of Bretton Woods to design a new international monetary system.

The meetings which extended over 3 weeks (July 1-22, 1944) resulted in three major new developments:

1. The introduction of the fixed exchange rate system backed by US dollar gold convertibility – which meant that all currencies were pegged against the US dollar which was, in turn, valued at a fixed price against gold.

2. The creation of the International Monetary Fund (IMF) to ensure that nations under balance of payments stress could access necessary foreign reserves, which would render the fixed exchange rate system was stable.

3. The creation of the International Bank for Reconstruction and Development (IBRD), which morphed into what we now know as the World Bank, whose charter was to alleviate poverty through economic and social development.

The way in which these two new international institutions were constructed (including their location etc) reflected the domination of the US and the UK at the Bretton Woods conference.

As we will see, the way these institutions have transformed themselves into the leading attack dogs of the neo-liberal paradigm also reflects the fact that Monetarism entered the international policy arena through the Anglo world.

The fixed exchange rate system collapsed in August 1971 after a long period of instability. It was always only a matter of time given the difficulty that disparate trading nations had in maintaining the agreed exchange rate parities.

By the 1960s, the Bretton Woods system was beginning to break down and the IMF involvement in providing foreign reserves increased substantially.

The Bretton Woods system became unworkable because it imposed massive political costs on external deficit nations who were forced to endure persistently high unemployment or lower than necessary economic growth as its central bank defended the currency from depreciation.

The use of the US dollar as a reserve currency eventually exposed the instability of the Bretton Woods system. The economist Robert Triffin warned in the early 1960s that the system required the US to run balance of payments deficits so that other nations, who used the US dollar as the dominant currency in international transactions, were able to acquire them.

In the 1950s, there had been an international shortage of US dollars available as nations recovered from the war and trade expanded. But in the 1960s, the situation changed.

Nations started to worry about the value of their growing US dollar reserve holdings and whether the US would continue to maintain gold convertibility. These fears led nations to increasingly exercise their right to convert their US dollar holdings into gold, which significantly reduced the stock of US held gold reserves.

The so-called Triffin paradox was that the Bretton Woods system required the expansion of US dollars into world markets, which also undermined confidence in the dollar’s value and led to increased demands for convertibility back into gold. The loss of gold reserves further reinforced the view that the US dollar was overvalued and, eventually, the system would come unstuck (Triffin, 1960).

[Reference: Triffin, R. (1960) Gold and the Dollar Crisis. The Future of Convertibility, New Haven, Connecticut, Yale University Press.]

The way out of the dilemma was for the US to maintain higher interest rates and attract the dollars back into investments in US denominated financial assets. But this would push the US economy into recession, which was politically unpalatable.

It was also increasingly inconsistent with other domestic developments (the War on Poverty) and the US foreign policy obsession with fighting communism, which was exemplified by the build up of NATO installations in Western Europe and the prosecution of the Vietnam War.

The US spending associated with the Vietnam War had overheated the domestic US economy and expanded US dollar liquidity in the world markets further.

The resulting inflation was then transmitted through the fixed exchange system to Europe and beyond because the increased trade deficits in the US became stimulatory trade surpluses in other nations.

These other nations could not run an independent monetary policy because their central banks had to maintain the exchange parities under the Bretton Woods agreement.

It is important to note that the US balance of payments deficits were also a reflection of choices made by other nations. In the growth period after World War II, other nations demonstrated a strong desire to accumulate US dollar reserves, which required them to run external trade surpluses against the US.

The collapse of the fixed exchange rate system in 1971, and, formally, in 1973, with the failure of the doomed Smithsonian Agreement, meant that the IMF no longer had a role to play. Its raison d’être had been to provide credit to nations with shortages of foreign exchange reserves so that their central banks could maintain the fixed exchange rates.

Once non-convertible, fiat currencies became the norm (after 1971) and exchange rates (largely) floated, the IMF became an institution that history had passed by and at that stage it should have been disbanded.

The IMF should be dissolved

Since the collapse of the Bretton Woods system, the IMF has morphed into a powerful institution that champions ‘free market’ neo-liberalism and ties poor nations into unworkable adjustment programs, all aimed at making it easier for global capital to plunder what real resources of those nations have at their disposable.

The track record of the IMF since the 1970s has been deplorable.

In the recent GFC, the IMFs destructive role has been brought into relief for all to see.

For example, on February 11, 2011, the IMF’s independent evaluation unit – Independent Evaluation Office (IEO) – released a report – IMF Performance in the Run-Up to the Financial and Economic Crisis: IMF Surveillance in 2004-07 – which presented a scathing attack on the Washington-based institution.

It concluded that the Fund was poorly managed, was full of like-minded ideologues and employed poorly conceived models.

In a previous report the IEO had demonstrated how inaccurate the IMF modelling has been.

But the IMF is an organisation that goes into the poorest nations and bullies them into harsh policy agendas which the IEO has now found to be based on poor theory and inadequate model implementation.

That makes the IMF more than an incompetent and biased organisation. By any reasonable standards of assessment, it makes then culpable.

The world is still enduring the crisis that came to realisation in 2008, but was spawned many years before that as the neo-liberal financial and labour market deregulation set up the conditions that would explode sometime later.

As the private debt was building up and the shonky (and criminal) bankers were increasingly defying responsible and ethical business practice, the IMF was part of the cheer squad – urging and bullying governments to deregulate their economies and further undermine the working conditions and to reduce the scope and quality of public services.

They had already inflicted this madness on defenceless less developed countries – pushing huge levels of debt onto them and slashing public services. It is hard to find any evidence that the IMF involvement has improved the lot of the citizens other than that of the top-end-of-town.

It is easy to find evidence of IMF disasters around the world over the last 40 years. First stop in your search might be the experience of Mali in the 1980s under IMF and World Bank structural adjustment programs where poverty and hardship was deliberately exacerbated by privatisation, cuts to government employment and wages, and decimination of its public education system.

IMF austerity was at the forefront of years of political instability and eventually, once the IMF had the ‘man’ in place who would do their bidding without asking questions, it was declared a model nation by the Washington organisation.

Foreign investment returned to boost the cotton industry but most of the returns courtesy of the IMF privatisation policies went to foreigners and living standards remain low for the locals.

More than 50 per cent of people in Mali are poor. There is gross violations of human rights and a trend over the last decades has been for people to abandon their children in the poverty-entrenched cities because they cannot care for them.

The example of Mali is not isolated. It is the norm when the IMF is involved.

The 2011 IMF Evaluation Report:

… finds that the IMF provided few clear warnings about the risks and vulnerabilities associated with the impending crisis before its outbreak. The banner message was one of continued optimism … The belief that financial markets were fundamentally sound and that large financial institutions could weather any likely problem lessened the sense of urgency to address risks or to worry about possible severe adverse outcomes. Surveillance also paid insufficient attention to risks of contagion or spillovers from a crisis in advanced economies.

In fact, the IMF ignored the advanced economies altogether in their “Vulnerability Exercise” which they undertook after the 1997 Asian Crisis.

The IMF were proponents of the ‘Great Moderation’ myth, which was the dominant neo-liberal macroeconomic narrative during the 1990s and later.

Mainstream macroeconomists – like John Taylor, Robert Barro, Robert Lucas, Ben Bernanke and all the rest of them all preached that the business cycle was contained if not dead and the only interesting questions were how far governments could go in deregulating their labour and product markets and creating free markets.

It was a gloating, pack-mentality. Like dogs, the mainstream profession hunted in packs and at conferences aggressively suppressed alternative views.

What reason did the Evaluation Report give for the IMF incompetence?:

The IMF’s ability to correctly identify the mounting risks was hindered by a high degree of groupthink, intellectual capture, a general mindset that a major financial crisis in large advanced economies was unlikely, and inadequate analytical approaches. Weak internal governance, lack of incentives to work across units and raise contrarian views, and a review process that did not “connect the dots” or ensure follow-up also played an important role, while political constraints may have also had some impact.

The IMF is an ideological church of the mainstream macroeconomics trapped in a dysfunctional Groupthink.

The Evaluation Report criticises the “governance” of the IMF at the senior levels for creating a compliant and passive culture, both essential for the Groupthink behavioural patterns to persist.

The Report said that the IMF staff have no “incentives … to deliver candid assessments” to their managers who operate “silos and ‘fiefdoms'”.

The IMF has had a flawed policy of recruitment into the more senior positions. It hires economists from mainstream backgrounds with doctorates – so you can be sure they have a very narrow (and flawed) conception of the way the macroeconomy works.

Most of them are very capable in a technical sense, which is important, because they seek to obfuscate and gain ‘authority’ using abstract mathematical models, which when really understood are vacuous statements of ideology rather than anything scientific.

It is clear the IMF could have only seen the crisis coming if it had have diversified its staffing.

A progressive international institution cannot rely on recruitment of macroeconomists from the mainstream schools.

The mainstream macroeconomists in the academy, the central banks and the treasuries all failed to understand the unsustainable dynamics that their neo-liberal policy frameworks were generating. They were all part of the club whose memberships extended beyond the front door of 700 19th Street, N.W., Washington, D.C. 20431.

The majority of the financial sector experts and economists with policy-making backgrounds are all tarred with the same brush. Their influence has to be replaced by pluralistic voices drawn from more liberal (in an academic sense) social sciences such as sociology, political science, psychology etc.

As we will argue, a new institution is needed to help poor nations overcome balance of payments problems and to divert funds from rich nations to poor nations but it would look nothing like the structure of the IMF.

The forecasting performance of the IMF has been appalling.

In October 2012, we learned that the IMF had seriously underestimated the ‘expenditure multipliers’, which they had used in their models to design the Greek austerity programs.

Please see the blog – The culpability lies elsewhere … always! – for more discussion.

The conclusion was that they assumed that cutting government spending would stimulate growth, when they later realised that it would have exactly the opposite effect and the design of the austerity intervention was thus deeply flawed.

Tens of thousands of workers have lost jobs as a result. But no IMF official resigned as a result of the errors.

The IMF report on that mistake – Growth Forecast Errors and Fiscal Multipliers said:

… recent efforts among wealthy countries to shrink their deficits – through tax hikes and spending cuts – have been causing far more economic damage than experts had assumed.

For anyone with a semblance of understanding of macroeconomics who is not infested with the neo-liberal ideology, there was never a surprise that the multipliers were “larger” than the IMF predicted. That is because the IMF uses a flawed macroeconomic approach.

The October 2012 IMF paper found:

… a significant negative relation between fiscal consolidation forecasts made in 2010 and subsequent growth forecast errors. In the baseline specification, the estimate … [implies] … that, for every additional percentage point of GDP of fiscal consolidation, GDP was about 1 percent lower than forecast.

In more accessible language, the larger was the planned fiscal consolidation at the start of 2010, the larger the actual decline in real GDP relative to what the IMF thought it would be.

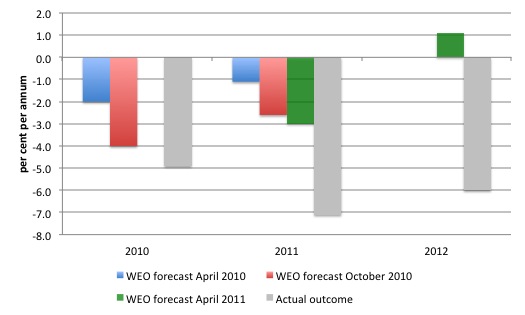

So for Greece, for example, in its – April 2010 WEO – the IMF predicted that Greece would experience a real GDP growth rate of minus 2 per cent in 2010 and -1.1 per cent in 2011.

Six months later, in the October 2010 WEO – it revised these forecasts to -4 per cent (2010) and -2.6 per cent in 2011.

By the – April 2011 WEO – we learned that the IMF thought that the Greek economy would decline by 3 per cent in 2011 but return to a 1.1 per cent growth rate in 2012.

The facts turned out very differently.

The following graph shows the evolution of the IMFs forecasts against the reality (the missing columns relate to the moving nature of the forecast horizons).

The IMF underestimated the contraction by 2.9 per cent in 2010 (based on the April 2010 predictions); by 6 per cent in 2011 (based on April 2010 predictions); and by a staggering 7.1 per cent (based on their April 2011 predictions).

The errors were systematic in direction and very large.

The IMF blithley said:

Our results suggest that actual fiscal multipliers have been larger than forecasters assumed.

They had assumed for their modelling purposes a multiplier of 0.5. However, after inflicting the austerity and seeing what the damage was, they said “that actual multipliers were substantially above 1 early in the crisis”.

That is, the $1 of extra spending would multiply to be much more than $1 (crowding in) because of induced consumption spending and favourable investment response to the initial increases in output.

I detailed the poor IMF forecasting in this blog (among others) – Governments that deliberately undermine their economies.

The point is that while forecasting errors are a fact of life – every forecaster makes mistakes. But the IMF and other major neo-liberal inspired organisations produce systematic errors – which means that they do not arise from the stochastic (random) nature of the underlying forecasting process.

It is easy to trace these systematic mistakes to the underlying ideological biases, which shape the way they create their economic models.

So when advocating austerity, they typically overstate the growth outcomes and understate the impact on unemployment. A systematic bias in favour of austerity.

It was this sort of behaviour that provided the background to the latest (July 8, 2016) evalutation report from the IMF independent evaluation unit – The IMF and the Crises in Greece, Ireland, and Portugal.

It is a damming report.

The IEO concluded that the IMF “did not foresee the magnitude of the risks that would later become paramount” as the crisis unfolded.

The IEO had found in its earlier report that there was:

… a high degree of groupthink, intellectual capture, a general mindset that a major financial crisis in large advanced economies was unlikely, and incomplete analytical approaches

In their recent report they conclude that these factors (p.48):

… were compounded in the case of the euro area by a “Europe is different” mindset that encouraged the view that surveillance was largely the responsibility of euro area institutions and authorities, that large national current account imbalances were little cause for concern, and sudden stops could not happen within a currency union that issues a reserve currency.

Within what the IEO calls a “culture of complacency” (p.27), the IMF surveillance of economic trends in the Eurozone were “ineffective” (p.26).

The IMF ceased to be an “independant and critical observer”, and, instead, became part of the European integration is good narrative, put out by Brussels and the bevvy of economic consultants being funded to promote the monetary union.

But with the Stability and Growth Pact clearly deficient and the failure to create a federal fiscal capacity at the centre of the negative outcomes after the crisis began, the IMF (p.26):

… did not fundamentally criticize the weaknesses of the governance of the euro area, including the design of the SGP and lack of fiscal integration …

Thus, the IMF officials failed to understand the weaknesses that were endemic in the design of the currency union and as a consequence were unable to fully evaluate the damage that the austerity programs they suggested would have. It was a case of professional incompetence.

In terms of program design, the IEO concluded that “the IMF-supported programs involved an unusually strong, front-loaded fiscal adjustment” (p.27), which have had devastating on nations that were forced to engage in “fiscal adjustment … among the largest in recent history” (p.27).

In addition to their harshness, the IEO said the (p.29):

… the most conspicuous weakness of the IMF-supported programs in the euro area was their lack of sufficient flexibility.

In other words, when they were introduced, there was resistance to change despite the consequences being much worse than the IMF had originally assumed.

The upshot was that (p.29) “an increasingly unworkable strategy was maintained for too long.”

The IMF was also found to have breached governance rules, including sharing confidential internal documents despite there being no approval from the IMF management or Board.

The senior staff running these programs thus breached various internal rules and procedures and the “Executive Board played only a perfunctory role in key decisions related to the IMF’s engagement in the euro area crisis” (p.46). There was “an information asymmetry” (p.47) and a “a good fraction of the Executive Board-and more broadly of the IMF’s membership-was not fully kept informed during the crisis” (p.50).

The ‘cowboy-type’ behaviour of some IMF officials was exposed by the IEO.

They note that in relation to the Greek bailout, the IMF violated its own rules by agreeing to to participate without clear guarantees that the nation’s debt would fall or that the economy would recover.

In the face of many notable commentators screaming that the IMF bailout program would fail the IMF went ahead with its Troika partners.

To get around its own rules, the IEO discovered that the IMF had create a special exemption to the four required conditions that have to be satisfied in order for the IMF to loan funds.

We learn that (p.20) that:

The proposal to change the exceptional access framework was embedded in the staff report for the Greek SBA request, and Executive Directors received no advance notice that such a change was forthcoming. While several Board members had noticed the two sentences tucked into the text on Greece’s overall adherence to the exceptional access criteria, few recognized the implications of the language until one of them raised the issue during the meeting. Otherwise, the decision would have been approved without the Board’s full knowledge … The decision of the IMF to participate in an exceptional access arrangement in an environment where debt was not sustainable with a high probability undermined the very purpose for which the exceptional access framework had been designed.

At the end of all this, the inescapable conclusion is that the IMF’s original function ended when the fixed exchange rate system collapsed in 1971.

In the time since, the organisation has reinvented itself and has become a major proponent and enforcer for neo-liberalism.

It has shown a capacity to deceive governments and the public and its performance has been unprofessional and incompetent.

Given the magnitude of the damage its interventions have caused, it is not too much to accuse it of breaching human rights – it has become a criminal and rogue organisation that doesn’t even obey its own rules.

When Groupthink is so embedded that an organisation becomes so dysfunctional it is hard to revitalise it in any meaningful way to serve a new purpose.

We advocate that a Progressive Manifesto would seek to abolish the IMF as soon as existing financial arrangements can be resolved.

Conclusion

Tomorrow I will consider the World Bank, the OECD, the BIS and push ahead with a proposed new international architecture.

We will also consider calls for an international currency and a return to a fixed exchange rate system.

Reforming the international institutional framework – Part 1

The series so far

This is a further part of a series I am writing as background to my next book on globalisation and the capacities of the nation-state. More instalments will come as the research process unfolds.

The series so far:

1. Friday lay day – The Stability Pact didn’t mean much anyway, did it?

2. European Left face a Dystopia of their own making

3. The Eurozone Groupthink and Denial continues …

4. Mitterrand’s turn to austerity was an ideological choice not an inevitability

5. The origins of the ‘leftist’ failure to oppose austerity

6. The European Project is dead

7. The Italian left should hang their heads in shame

8. On the trail of inflation and the fears of the same ….

9. Globalisation and currency arrangements

10. The co-option of government by transnational organisations

11. The Modigliani controversy – the break with Keynesian thinking

12. The capacity of the state and the open economy – Part 1

13. Is exchange rate depreciation inflationary?

14. Balance of payments constraints

15. Ultimately, real resource availability constrains prosperity

16. The impossibility theorem that beguiles the Left.

17. The British Monetarist infestation.

18. The Monetarism Trap snares the second Wilson Labour Government.

19. The Heath government was not Monetarist – that was left to the Labour Party.

20. Britain and the 1970s oil shocks – the failure of Monetarism.

21. The right-wing counter attack – 1971.

22. British trade unions in the early 1970s.

23. Distributional conflict and inflation – Britain in the early 1970s.

24. Rising urban inequality and segregation and the role of the state.

25. The British Labour Party path to Monetarism.

26. Britain approaches the 1976 currency crisis.

28. The Left confuses globalisation with neo-liberalism and gets lost.

29. The metamorphosis of the IMF as a neo-liberal attack dog.

30. The Wall Street-US Treasury Complex.

31. The Bacon-Eltis intervention – Britain 1976.

32. British Left reject fiscal strategy – speculation mounts, March 1976.

33. The US government view of the 1976 sterling crisis.

34. Iceland proves the nation state is alive and well.

35. The British Cabinet divides over the IMF negotiations in 1976.

36. The conspiracy to bring British Labour to heel 1976.

37. The 1976 British austerity shift – a triumph of perception over reality.

38. The British Left is usurped and IMF austerity begins 1976.

39. Why capital controls should be part of a progressive policy.

40. Brexit signals that a new policy paradigm is required including re-nationalisation.

41. Towards a progressive concept of efficiency – Part 1.

42. Towards a progressive concept of efficiency – Part 2.

43. The case for re-nationalisation – Part 2.

44. Brainbelts – only a part of a progressive future.

45. Reforming the international institutional framework – Part 1.

The blogs in these series should be considered working notes rather than self-contained topics. Ultimately, they will be edited into the final manuscript of my next book due later in 2016.

Upcoming talk at the New International Bookshop in Melbourne – August 4, 2016

On August 4, 2016, I will be giving a talk at the New International Bookshop in Melbourne (Australia) on the topic – The demise of the Left and towards a Progressive Left Manifesto – which is the topic covered in my latest book project that is nearing completion.

The talk will run between 19:00 and 20:30 and the venue is at 54 Victoria St, Melbourne, Australia 3053 – which is part of the Victorian Trades Hall.

The actual room will now be the Bella Union bar (upstairs from the Bookshop) and drinks will be available there.

There is a Facebook Page for the event.

The Bookshop is staffed by volunteers who appreciate any support they can get.

I spent many hours in my youth sifting through all sorts of radical books in its previous incarnation as the International Bookshop (operated by the now defunct Communist Party of Australia) in Elizabeth Street, Melbourne.

When I was a university student without much cash at all one – great staff member – there used to give me an orange on a regular basis – she always had one available and I guess she knew I haunted the place.

Here is the flyer. It would be great to see people at the event and the small entry fee goes to helping sustain the Bookshop, which has a long history in providing alternative and radical literature to Australian readers.

That is enough for today!

(c) Copyright 2016 William Mitchell. All Rights Reserved.

While we’re eliminating institutions such as the IMF, etc. how about we eliminate government privileges* for private credit creation since the rich are by definition the most so-called worthy of what is currently, in essence, the publics’ credit?

*e.g. Government provided deposit insurance instead of inherently risk-free accounts for all citizens at the central bank, positive interest paying sovereign debt, etc.

In response to Andrew Anderson. I too have wondered about the private (bank) credit system. I want to tease out some understandings from what is actually a very odd and contrived situation, even though we take it for granted. First, we have to review the current situation. The government creates and taxes back fiat money. In that arena it has control of the money supply. However, private banks are permitted to create credit money. Credit money is indistinguishable from fiat money when it is in the precise act of circulation. True, it is distinguishable in book entries. There is a bank debt entry to match the credit which has become money in circulation. This particular difference between government fiat money and credit money is something which projects forward in time and only begins to operate in time. Government fiat money may or may not be withdrawn by taxes in the future. It depends on the government budgets being in surplus or deficit. Credit money however is usually withdrawn at the rate at which loans are paid off, except for the important case of default where they are withdrawn at one stroke as a loss to the lender.

Debt money has a contracted, accelerating half-life as it were. Standard repayments on compound interest debt halve the debt at more and more rapid intervals. However, the “accelerated half-life” of an individual debt is scarcely of any meaning to the money supply. What is of meaning is whether or not credit money overall in the total economy, in the form of a net result, is being created (loaned) or destroyed (paid off). This net number affects the money supply just as does the creation or destruction of fiat money by the state.

In essence, banks are being permitted to create fiat money also. These units become interchangable and indistinguishable from government fiat units when in circulation. Also, loans will create deposits. So other banks can lend on the basis of one bank’s credit creation. Banks also can lend beyond their reserve ability and shore it up from the discount window of the federal reserve (RBA in Australia). There is, in this part of the theory, no limit to money creation in this model. In practice limits are reached. There is a limit to credit-worthy customers. There are also legislated capital requirements.

A person’s income (from any source) may be spent on whatever the person wishes at least so far as discretionary spending goes. However, a loan like a housing loan can only be spent on a house. The money will be lent for a house and secured against the house as an asset. In the primary case, the borrower taking out the mortgage must buy a house with it. Thus house sales in the primary instance are assured. House price inflation (asset inflation) also seems almost assured by this situation. It is true that many other people like builders and real estate salespersons earn income from this process. And this income could become part of their discretionary spending on other items generating general goods and services inflation. However, each of these persons also needs to live somewhere. Both house and apartment prices and rentals will be higher priced due to the asset price inflation in the housing and accommodation market. So each of these persons in turn needs to place a larger proportion (than would otherwise be the case) of their income to purchase or rental of accomodation or the paying off of loans acquired for that purpose. In turn, banks will take earned income from housing loans and leverage it into more housing loans.

This seems to be a system virtually expressly designed to generate housing asset inflation or appreciation (and stock market appreciation or gains from this and related policies like negative gearing) while keeping general goods and services inflation relatively flat. One has to ask why this deliberate construction or rather deliberately distortion of the economy is so attractive to capital (and capitalists). The answer is easy to find. It is an expressly and consciously engineered situation. Those who possess high assets (and thus income from assets rather than from personal effort) prefer a situation which combines asset appreciation with general goods and services price stability (low consumer inflation). They are most advantaged by this situation. It functions extremely well to allow the rich to become ever richer and the middle and the poor to become relatively poorer, and as is now the case in the US and soon to be in Australia, to become absolutely poorer.

Ikonoclast, no matter what the system used (unless the government allocated housing for all residents), if population is increasing the house prices will increase. We have the opposite market in Perth because of the end of the mining boom where the leaving population has limited the increase in property value. So while it’s true that the private banks may encourage speculation it’s not the whole story. A substantial rethink of the ‘CBD’ nature of cities would be required because most people want to live near where they work.

Matt B,

For sure, the current system is not the whole story about housing prices but it is a big part of it. The thesis “if population is increasing the house prices will increase” does not always follow. If population increased but house construction increased even faster, then house prices could move the other way. If an economic crisis hits house prices can decrease for a time even while population still increases.

There is also the issue of economies of scale. As populations, especially urban populations, get larger economies of scale could very possibly put a downward pressure on housing prices. At the same time, it is true that developing scarcities could put an upward pressure on housing prices also. Actual prices will reflect a sort of sum effect of all endogenous and exogenous pricing forces (including all of market, government and environmental effects).

In response to Iconoclast 8 Aug: There is a pervasive view that the mining industry is responsible for the housing downturn in WA. Taking a drive around the periphery of the WA metro area it is evident that there is a building boom on at the moment. Vast new estates both north and south of the city with houses popping up like mushrooms in enormous numbers – fuelled by low housing interest rates and by land development companies who have had possession of large tracts of land held in waiting for such an opportunity. WA has had some enormous construction projects both in the iron ore and oil and gas sectors over the last 10 years with Gorgon and Wheatstone huge on even an international scale. Vast numbers of workers as well as managers and engineers flooded into the state – they didn’t buy houses, but pushed up the rental market. We have even had a terminal built at Perth Airport exclusively for the FIFO mob. Now that construction is over, construction workers, their managers, engineers, accountants and the supply chain industry have all gone home and those that did not blow their money on drugs have more than likely gone back to Melbourne and Sydney to buy houses – competing there with foreign investment for housing. Otherwise I cant see how the reduction in iron ore earning has impacted the property market. Of course the State Government has been badly hit for royalties – but mineral earnings, now very reduced, go the company profits which go to shareholders who aren’t the great unwashed who determine housing prices. An interesting aside here is the bleeding obvious that Rio and BHP are in a cartel to drive out competition. When Twiggy Forest stated that this was outrageous, that we should limit overproduction, he was shouted down by both federal government ministers and industry – told that we cant to that because it would be a cartel! Also outraged was the WA premier who said that Rio and BHP shouldn’t be allowed to do this because the minerals belong to the people of WA – but in the end he realised there was f-all he could about it.

Also, loans will create deposits. Ikonoclast

But only largely virtual liabilities since only depository institutions in the private sector may have convenient, inherently risk-free accounts at the central bank itself.

So we have the very strange situation where the citizens may not use their nation’s fiat at all except in the form of inconvenient, unsafe physical fiat!

Of course, liabilities between depository institutions are very real so depository institutions are, in essence, a cartel against the general public – competing against each other while driving the population into debt.

“I will propose a new international institution designed to protect vulnerable nations from damaging exchange rate fluctuations and to provide investment funds for education, health and public infrastructure.”

This raises couple of questions. A) how can receiving nation spend foreign currency for education, health and public infrastructure given that local workforce only accepts national currency as a payment? B) why would it need foreign currency given that it can fund these projects by issuing national currency? C) from which income streams loans (I assume funds are loans) plus interest are supposed to be paid back given that receiving nation does not issue foreign currency and these investment do not generate foreign currency earnings?