It was only a matter of time I suppose but the IMF is now focusing…

Mayday! Mayday! The skies were meant to fall in … what happened?

The British Office for National Statistics, which although recently revamped continues to have the most user-unfriendly homepage and dissemination service of all the national statistical agencies, published the latest – Retail Sales in Great Britain: July 2016 – data last week (August 18, 2016). It looked good to me. In the past week or so there has been a stream of data coming out of Britain or about Britain, which also looks good to me. What the hell is going on? The skies over Britain were meant to have fallen in by now. Unemployment was meant to be going through the roof or was the roof meant to collapse first. All manner of despair was meant to be visiting the shores of Britain after the June 23 vote to get out of the dysfunctional European Union. The reality is that things are looking okay there. Skies are intact and quite blue I believe which has boosted the confidence of British consumers. Tourism is booming. Unemployment is falling or at least those claiming unemployment benefits. One investment bank put out a briefing last month with a Mayday! Mayday! warning that unemployment was about to rise dramatically. Who has been sacked for that piece of public misinformation. George Osborne, remember him, said in mid-June that British public finances were about to collapse and an immediate, emergency fiscal response would be needed. Days have passed – things are looking ok. Eurozone nations should take note! Ignore the neo-liberal scare mongering. Follow Britain’s lead in abandoning the ridiculous notion that there is something special about ‘Europe’. Eurozone nations should get out of the currency union as soon as possible.

In the weeks after the Brexit vote, the sore losers were in abundance – predicting the worst and even worse, accusing those who voted the sensible way (to exit) of being dumb, racist, or regretful, or all three things.

What was going to happen? Scan back in the media and you will spikes of unemployment, financial collapse of the banks, diving sharemarkets, first division soccer teams losing players and the idiocy kept outdoing itself on a daily basis.

Remember back in mid-June, when the then (failed) Chancellor warned British citizens that if they voted to leave the European Union on June 23 it would be disastrous for the government finances.

The BBC report (June 15, 2016) – EU referendum: Osborne warns of Brexit budget cuts – documented the bullyboy tactics that Osborne employed to try to distort voter choice.

Osborne and his creepy partner-in-misinformation (Labour’s Chancellor Alistair Darling) told an audience that the Government would:

… have to slash public spending and increase taxes in an emergency Budget to tackle a £30bn “black hole” if the UK votes to leave the European Union.

Does sick joke come to mind!

In fact, the British ONS released data showing that the UK government actually was in surplus in July 2016.

Even with the evidence emerging to the contrary, they are still at it. William Keegan’s article in the UK Guardian (August 21, 2016) – Leavers should be ashamed of the harm yet to come from Brexit – is an example.

Keegan is playing it safe. He talks up things which are impossible to verify – among them being his claim that there is now ” an outbreak of buyer’s remorse”.

He defers any of his doom predictions to a period in the future where causality will be unclear. So the next recession, whenever it will come, will be Brexit-induced – irrespective of what the policy of the government of the day is at that time.

The likes of Keegan will wax on about having told his fellow citizens what venal dopes they were for “the chaos they have helped to create, not least for their grandchildren” by voting to exit the dysfunctional European Union.

He is already lecturing them – “They should be ashamed of themselves”.

What was interesting was his characterisation of the British economy and the upcoming fiscal statement from the new Chancellor:

Make no mistake, this is going, to all intents and purposes, to be a budget for an economy that is already suffering severe structural damage …

Structural damage doesn’t emerge the day after a vote is taken – one way or another. If the British economy is “suffering severe structural damage” then it has nothing to do with the Brexit vote outcome.

It has more to do with years of stupid policy decisions which promoted the financial sector and starved the productive side of the economy of incentives.

It started with the surrender by the Callagan Labour government to the Monetarist madness in the mid-1970s. The trend was accelerated under Thatcher (who wrecked manufacturing and promoted the banksters) and entrenched by Tony Blair and Gordon Brown’s ‘light touch’ financial market regulation – which basically saw all the unproductive, incompetents run riot.

It is obvious that the British economy has relied too much on household debt and on housing markets to drive growth.

These ‘structural imbalances’ have been a long time in the making and certainly nothing at all to do with the June 23 vote.

The upcoming fiscal statement might have to address some cyclical issues arising from the referendum vote given the amount of doom that was predicted – which may have affected the confidence of households and firms.

But we should reject notion that the Brexit vote has suddenly exposed the structural vulnerabilities of the British economy. They have been there for all to see if one could get free of the denial that accompanies the neo-liberal narrative.

If you then read the rest of Keegan’s article the descriptor ‘vacuous’ comes to mind. He really says nothing despite the alarming headline.

Of course, time will tell whether being out of Europe is going to be the millstone that the doomsayers predicted. I think not.

And time is already ticking and the first data is starting to come in – it doesn’t look good for those who are demanding another vote.

You know – we lost the first one because people are stupid – so lets go again until we win – sort of mentality. The sort of nonsense that the contender for Labour Party leadership (Smith) is now trying to get away with. He should be sent to the boondocks by the Labour Party membership and encouraged to seek a different career.

The retail sales data released last week by the ONS covered the period from July 3 to July 30, 2016 – so well after the Brexit vote had concluded and after the doomsayer economists used the week following the vote to predict all manner of crisis and mayhem.

The retail sales data measures first-hand how strong consumer spending is – it is immediate and doesn’t lie. The result for July 2016 didn’t produce the strongest monthly growth rate since the GFC but the result was not far off it.

ONS say that:

In July 2016, the quantity bought (volume) of retail sales is estimated to have increased by 5.9% compared with July 2015; all sectors showed growth with the main contribution coming from non-food stores.

Compared with June 2016, the quantity bought increased by 1.4%; all sectors showed growth with the main contribution again coming from non-food stores.

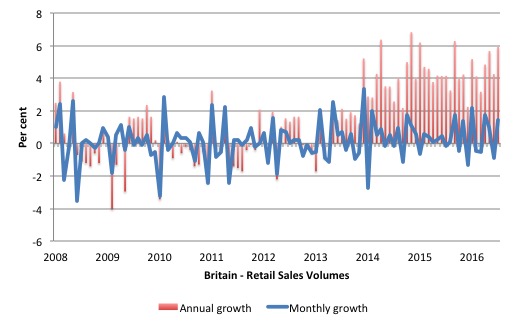

The following graph shows the annualised growth (red bars) and monthly growth (blue line) in retail volumes since January 2008.

So what have we got here?

Those stupid Brits spending up big with their last pounds because they are worried the shops are all going to close and the government is going to run out of money as a result of the Brexit vote?

Or some genuine confidence, aided by good seasonal conditions, a national team going gangbusters at the Rio Olympics (on raw medal tally that is), and a rejection of the nonsense my profession tried to foist onto them leading up to the Brexit vote.

Hmm. What else?

Remember this headline from July 14, 2016 – CREDIT SUISSE: ‘Mayday! Mayday!’ — Britain’s impending recession will kill nearly 500,000 jobs.

The headline was accompanied by a picture of working class men in the Jarrow March (Crusade) which “was a protest march in England in October 1936 against the unemployment and poverty suffered in the northeast Tyneside town of Jarrow during the 1930s.”

The Jarrow March was a response to extreme hardship brought on by the Great Depression. It invokes pain and suffering.

The report tells us that:

In their note, reassuringly titled “Mayday! Mayday!” Credit Suisse’s Boussie et al. also note that they expect rising unemployment to trigger a slackening of the “robust” consumer sector, which in turn could cause even more serious problems for the economy.

Well the retail sales data isn’t quite what they were hoping for when they sent out their Mayday alarms.

And on August 17, 2016, the ONS also released the latest – Total Claimant count SA (UK) – thousands – which provides information about the number of people seeking unemployment benefits.

Changes in this statistic are not a perfect measure of the changes in unemployment but are closely related enough to make inferences.

I was looking for a dramatic rise in claimants (unemployment).

What did I find?

A rather large decline of 8,600 or 1.1 per cent (seasonally adjusted) in July 2016. Oops!

Since January 2016, the claimant count has been rising each month. July marked a break in the trend even though the economists in the financial markets had reached a “consensus prediction” of a rise of 9.5 thousand.

A little matter of a massive prediction error – nothing to worry about. No one will be punished for spreading spurious information designed to alarm the public.

The other labour market data released on August 17, 2016 by the ONS covers the quarter to the end of June and while the unemployment rate was stable, it is not really reasonable to claim that as another piece of evidence that the vote didn’t matter much.

I haven’t looked at the sharemarkets today but last time I looked the aggregate indexes were heading towards the stratosphere – like record high levels.

And other financial market indicators appear to be unaffected – for example, the bid-to-cover for British government gilts is not plunging. The large pension funds are falling over each other to keep stocking up on government debt – yum, lovely public debt, more corporate welfare!

Markit released the latest – Household Finance Index – for the UK on August 17, 2016. This provides a guide to the state of household expectations about their financial situation.

The summary results for August 2016 are:

– Outlook for household finances recovers in August …

– Job insecurities ease amid rising workplace activity levels …

Current inflation perceptions remained broadly steady in August …

The news kept coming in yesterday (August 23, 2016).

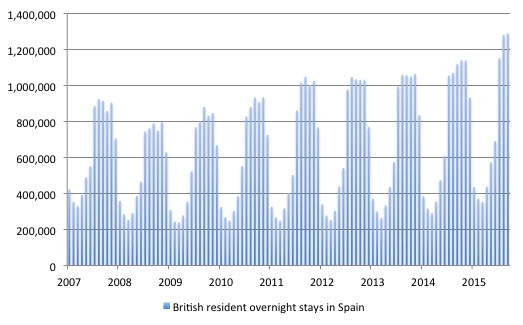

The Instituto Nacional de Estadística is the national statistical office for Spain and publish excellent data on Tourism into Spain.

Guess what? The hotel short terms trends data released yesterday shows that British citizens are flooding to that sunny destination even though travel costs have risen due to the decline in the pound. Overnight stays rose strongly in July 2016.

The following graph shows the data for overnight stays by British residents in Spain since November 2017. You can see the seasonality.

But even with the pound at much lower levels than before the vote, those sun-loving Brits have not been discouraged from heading down to beautiful Espana for vacations.

The GFC slowed the summer vacations down a lot. But Brexit doesn’t seem to have had much affect. July overnight stays pretty much increase by 11 per cent on June each year and so they did in July 2016.

And if that wasn’t enough, the Verband der Sshweizerischen Uhrenindustry aka the Federation of the Swiss Watch Industry, published data on August 20, 2016 that shows that Swiss watch exports to Britain rose to 110.2 million CHF in July 2016, up from 90.6 million CHF in June 2016.

This 21.6 per cent increase was the fastest growth of all the Swiss manufacturers’ major export markets.

What is going on there? Well Britain is now a tourist mecca itself courtesy of the lower pound since Brexit and within that shift the so-called “luxury goods market” is booming.

This shopping boom is part of the retail sales data reported above.

The UK Guardian article (August 22, 2016) – Tourist spending in UK surges after pound’s Brexit slump – summarises trade data (Global Blue) which shows that:

Japan, Indonesia and the US were the nations that accounted for the biggest increase. Despite Japan’s own economic problems, spending by Japanese visitors was up 96% in the UK compared with July 2015, while travellers from Indonesia spent 88% more than last year on tax-free shopping.

Chinese tourists’ spending was up just 6% for July, but the country still accounted for the largest portion of spending overall, with a 32% share.

Whether you judge that to be a desirable trend or not doesn’t evade the reality that the doom predicted is not emerging.

And, finally, the Confederation of British Industry – released the latest monthly – Industrial Trends Survey – which showed for July that:

– 19% of businesses reported total orders to be above normal (compared with 18% in July), and 24% said orders were below normal, giving a balance of -5%

– 21% of businesses reported export orders to be above normal and 27% below, resulting in a balance of -6%, the highest since August 2014 (-3%).

– 34% of businesses reported a rise in output volumes, and 23% a fall, giving a rounded balance of +11%, down from +16% last month, but better than expected (+6%)

– Output growth is expected to remain steady over the next three months, with 30% companies expected a rise and 19% expecting a fall, leaving a balance of +11%

The CBI said that “export order books reached a two-year high, suggesting that the depreciation of sterling since the end of last year may be feeding through to stronger overseas demand … [and] … remained comfortably above the long-run average”.

No collapse there.

Conclusion

As regular readers will know, I am pro-Brexit and scorned the doom predictions at the time.

While the sky may well still fall in – especially if the British government attempts any austerity stunts – I think it is unlikely.

The Government has all the capacity it needs – as a currency-issuer – to divert any tendencies towards recession.

But the current data doesn’t suggest a recession is on its way.

The failure of the doom merchants’ predictions should also be a guide to what might happen if a Eurozone Member State walked out. All the prophecies of doom would follow (and precede) but the nation would soon find out that with renewed currency sovereignty things would settle down fairly quickly and growth would be rapid.

That is enough for today!

(c) Copyright 2016 William Mitchell. All Rights Reserved.

Ha! yes, I enjoyed reading this. Thanks

“He should be sent to the boondocks by the Labour Party membership”

Is ‘boondocks’ Australian for Coventry?

Dear Neil Wilson (at 2016/08/24 at 7:47 pm)

Coventry will do.

“rough or isolated country”.

away from people.

best wishes

bill

“The large pension funds are falling over each other to keep stocking up on government debt”

So much so, that the Bank of England is struggling to find enough long term debt to buy with its billions.

It’s almost as though government bond savings with their secure coupon have some sort of insurance effect for pension companies…

Dear Neil

To get back to our earlier discussion, you are of course right in claiming that, even if people on JG produce very little, they will still produce more than when they are sitting at home unemployed. However, my point was that we should avoid such situations. JG should be regarded as transitional and not occupy a significant share of the labor force. If there are important tasks to be carried out by the government, then the government should hire people to do them. People on JG can only perform tasks which aren’t essential. If they are essential, they should be performed by regular government employees.

Regards. James

“However, my point was that we should avoid such situations.”

You can’t. By definition the situation where people are hired by the JG is the situation. Because the JG is a residual.

When everything else in the economy is decided, the JG is what is left.

There is no difference between a JG employee and a regular government employee at the JG wage. They are both hired, given tasks to do and paid. Both may leave if they get a better offer from the private sector, or elsewhere in the higher paid public sector.

The mistake is in believing that JG is somehow different to a normal job at the living wage. It isn’t. It is precisely the same in all respects.

If the rest of the public sector “can’t get the staff”, then it has the same choices as the private sector – automate or pay higher wages to attract the staff. Which, once the JG is in place, requires resource transfers from other parts of the economy via taxation or other co-ercive means.

Two things Keegan is irrational about. One is the referendum, and the other is Gordon Brown. Why he thinks well of Brown escapes me.

As for Smith and the rest of the PLP, they are a kind of Augean stable that should be cleared out and the sooner the better. Three Guardian journalists went to the first hustings and none of them could understand why this leadership election is taking place. One of them thought Smith to be incredibly smug, which put Smith in his bad books. Another thought, why is Smith in this contest if his policies are no different from those of Corbyn. Actually, there isn’t much difference between them in this respect. Part of it appears to consist of a personality contest. Another is neoliberal adherents not being able to adjust to their fave ideology by their fave politician, Blair, being ditched.

Neil, kind of like Coventry but worse. Think of Daniel Boone in the wilderness in the Appalachians when the phrase going to the boonies comes to mind.

The Remain argument has suddenly become ‘But we haven’t exited yet duh !’

Shameless.

Yes British (and the economists of every other eurozone nation) have been doing John Cleese’s Silly Walks and thinking it was intelligent policy….which is funny, not just because its absurd, but because they were being serious. 🙂

I take Bill’s point about the sins of the EU. However as few serious economists forecast the imminent demise of the British economy, this post feels somewhat like a straw man being flogged to death. Most suggested the real problems would come in the medium to long term as the effects of losing access to the Free market began to impact. The current spending of Japanese tourists, who after the terrorist attacks having been avoiding France, is hardly germane to the issue

The EU have been pretty clear that the UK cannot have access to the Free Market without accepting freedom of movement for EU citizens. Since Immigration and control of the UK’s borders was a key plank in the Brexiteers argument, it looks as though the UK is heading for a very hard exit.

Given our geography, the UK cannot NOT have a relationship with the EU. Whilst it takes two to tango the question uppermost in my mind is what sort of relationship should we be aiming to achieve. I dont hear too much agreement on this issue from those who are crowing about the decision to leave the EU

Michael

The more UK acts like the weaker party, the more screwed it is.

Call the bluff. Pass an act of parliament saying we are no longer in and then ask who wants to trade with us ?

“I take Bill’s point about the sins of the EU. However as few serious economists forecast the imminent demise of the British economy, this post feels somewhat like a straw man being flogged to death. Most suggested the real problems would come in the medium to long term as the effects of losing access to the Free market began to impact. The current spending of Japanese tourists, who after the terrorist attacks having been avoiding France, is hardly germane to the issue.”

No, no, no. You cannot have it both ways. You cannot simultaneously have an orgy of propaganda and misinformation on a daily basis by the mainstream media outlets and the ‘serious’ financial press about the already occurring deleterious effects “of Brexit” (even though it has not (yet) taken place) AND claim that the ‘serious’ argument in favor of remain by ‘serious’ people (economists, politicians, financiers) was ONLY about what would happen AFTER the actual official exit of the U.K. from the EU AND assuming that the U.K. government will take no appropriate fiscal and monetary actions (i.e. expansionary ones) to counter-act any reduced injections or increased leakages that may result from no longer being a member of the EU.

Personally, I thought the de facto inability of the EU Commission to ‘discipline’ or ‘punish’ the U.K. for ‘violating’ any of the ‘fiscal restraint’ Treaties (SGP, Six-pack, two-pack) (harsh words and finger-wagging do not count as actual discipline and punishment for sovereign states) meant that the ‘deal’ or special status for the UK that was on offer was ‘acceptable’. I am against this monstrous monetary union and joke of a so-called confederal state, but if it’s still going to be around and one is already a member thereof, retaining one’s monetary sovereignty and being able, effectively de facto, to engage in the appropriate counter-cyclical fiscal policy (protestations and strongly worded statements from the Commission, etc notwithstanding) is not among the least desirable ways of being a member of a dysfunctional union.

Partially agreed Bill. But as Matt Franko at MNE puts it:

“All he can say is that it didn’t turn out like the doomsday people were predicting (which is not without value) but based on what he has technically he cannot make any predictive statement himself…”

All this means nothing as long as the government continues austerity. It has no gotten *better* though.

James & Niel

“When everything else in the economy is decided, the JG is what is left.”

My impression is that another way to say this is that once the net savings decisions of the private sector are made, the JG injects an equal and opposite amount of demand into the economy.

I am not sure what James means by “essential”, but some concerns along those lines to come to mind.

Why would the private sector feel continued need to save in the context of a secure JG?

If the JG becomes trivial in the case of a full employment (<2%) private sector, how does the JG maintain health?

How does the JG cope with idealistic workers who prefer civic service work at minimum wage to mercenary work at higher wages in the private sector? Does this mess up the savings – demand injection balance?

Equally, how is a net dis-saving coped with?

Brendanm:

re the JG injecting demand equal to private sector savings. I don’t think this is correct, in that the JG would be a small part of overall public sector spending. There would still be a gov’t deficit due mainly to items much like the current gov’t budget. Most of the demand to counter-act savings would come from this, which would be stable over the business cycle. The JG would be one of several counter-cyclical mechanisms to increase demand in downturns.

The private sector ( speaking for myself) would still want to save for all the same reasons. Maybe just somewhat less knowing there is a JG. But many might not be satisfied with that level of living standard and would like to live on savings without working in retirement.

I suspect there will be those who would be happy to work at the JG rather than deal with private employers. They would provide some stability to the JG workforce. I don’t see the problem.

By a net dis-saving, I guess you mean a situation where no gov’t deficit spending is needed, no demand injection. So , there would be “full” employment in the private sector. I guess the JG would then have very few workers. The JG office staff would have little to do. What is the problem? That the work that JG people do will not get done? This goes back to the nature of what society considers “essential”. If it is essential, then the solution is to hire permanent staff to do it, which will require raising wages to compete with other offers. However, as Bill has stated many time, private dis-saving cannot go on forever, and the private sector on average desires to save.

In ‘Really Existing Britain’ of course, a substantial devaluation happened but has yet to feed through to consumer prices. Moreover, the long-term, deep-seated British problems (for which the EU has been used as a scapegoat) remain unaddressed. Most likely conditions in really existing Britain will get worse, maybe significantly. We already have our own currency, no gain for Britain there.

Likely everybody in Europe will be poorer, because of reduced trade. And politically, arguably an imperfect Union is infinitely better than none.

‘Political correctness’ is being buried and being replaced by xenophobia. The far-right are clearly greatly energised. What price of these things in Brexit calculations?

Why expect Brexit (or argue in favour of it) to change conditions for which it was not responsible? Why would the British socio-economic landscape change (and why positively) simply by leaving Europe? EU membership had most nothing to do with any of Britain’s structural and cultural problems, as you acknowledge. [In fact the EU was a positive influence in myriad ways – including redistribution, proportional representation, co-operation, planning, ‘social contract’, EU Justice system etc]

Whilst imperfect, the EU is certainly better than anything else on offer. Because there isn’t anything else on offer. One might at least have a viable alternative before sweeping it all away.

Likewise with The City – if there was anything else Britain could do to replace it then why has it not already happened? Why will Brexit make any difference? Reduce its importance by excluding London from EURO business and passporting? Or increase its importance by ‘freeing’ London from the ‘red tape’ of Brussels?

Neither are particularly positive outcomes.

Nor are the prospects for environmental regulation, workers’ rights, Union Laws. Anybody imagining Brexit will improve the lot of Merthyr Tydfil are surely delusional. Including the people of Merthyr, whom voted out. The wind can only blow harsher?

None of this stuff can be reflected in a few months of consumer spending data. And what of such data anyway? It’s all going on credit and to my mind reflects the general feeling of “unreality” pervading the country – why accept it as ‘rational’ behaviour or suggest it vindicates Brexit in anyway? Do you dismiss climate change because ‘the icecaps are still there’?

The prospects for the British working class look significantly worse. And the prospects for turmoil in Europe are enhanced.

What is there to support Brexit?