It was only a matter of time I suppose but the IMF is now focusing…

The neo-liberal colony of Greece takes another step backwards

The Eurozone flash National Accounts estimates for the fourth-quarter 2016 was released yesterday by Eurostat – GDP up by 0.4% in the euro area and by 0.5% in the EU28. The annual growth rate for the Eurozone in 2016 was 1.7. The news also indicated that the Greek economy fell back into its Depression and was followed by the other basket case, Finland. Both recorded negative growth in the December-quarter, Greece -0.4 per cent, Finland -0.5 per cent. Both results reflect the on-going fiscal austerity. Spain, on the other hand, allowed by the European Commission to run large structural deficits (to keep the PPP in power) recorded another strong growth result. Perhaps if Syriza had demonstrated some spine, they too could have got away with the Spanish solution – where Brussels turns a blind eye to the blatant breach of the Stability and Growth Pact rules, while its economy starts to growth strongly. But, then history tells us that Syriza caved in almost immediately and the continued decline of the Greek situation is a direct result of the policies they were then co-opted to inflict on their own people. Deeper analysis of the Greek situation reveals how dire the future is likely to be. I present a few indicators of that future in this blog. As the neo-liberal colony of Greece takes another step backwards, it isn’t hard to understand why? Basically, the Troika conspired to destroy the prosperity of Greece as a nation and its political leadership joined that conspiracy by refusing to broach an exit from the Eurozone. Simple really.

The seasonally adjusted data for Greece shows that:

- Real GDP contracted by 0.4 per cent in the December-quarter 2016.

- Annual growth for the year to December 2016 was a modest 0.3 per cent.

The following graph is taken from the Greek National Statistics Office bulletin released yesterday (February 14, 2017) – Quarterly National Accounts, 4th Quarter 2016 (Flash Estimates).

These estimates were the so-called ‘Flash Estimates’ and will be subject to revision as more data comes in. At this stage we only have the headline figure and so a detailed analysis of expenditure patterns and contributions to growth will have to wait until the next data release.

The Financial Times headline – Greek economy suffers surprise fourth quarter contraction (February 14, 2017) – suggests the journalist has been caught up in the hype of the positive forecasts.

The article said that:

The Greek economy suffered a surprise contraction at the end of last year, reversing tentative signs of sustained growth and inflicting a fresh blow on the hopes of its international creditors …

Greece’s EU creditors have championed the return of economic growth in 2016, heaping praise on the Syriza government’s efforts to boost its public finances through higher taxes and reduced spending. Brussels expects the economy to bounce back strongly this year to expand 2.7 per cent from just 0.3 per cent in 2016, contingent on success in its bailout talks.

Yes, those optimistic EU creditors and all the cheer squads in Brussels, Frankfurt and Washington, who live a life of delusion.

The FT article also notes that while the IMF has acknowledged that “a six-year austerity project has seen it … [Greece] … suffer an economic contraction worse than the US Great Depression”:

The IMF is now demanding Athens legislate for around €3.6bn in additional tax and pension reforms as its condition to stay involved in the bailout …

It is as crazy as it reads.

Surgeons only know one thing, the same goes for these neo-liberal infested international organisations. They should be scrapped.

I guess the European Commission will be surprised

… trapped as they are in their own hype and neo-liberal Groupthink.

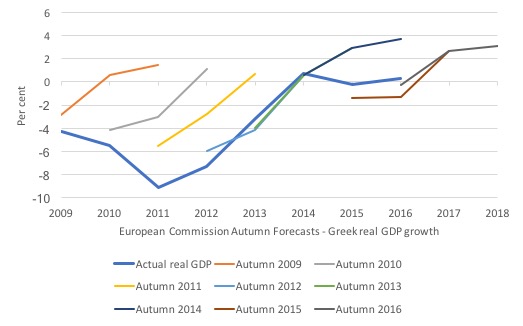

The following graph (apart from being very nice to look out) shows the iterative nature of European Commission forecasting for real GDP growth in Greece, starting with the Autumn 2009 forecasts.

The thick blue line is actual real GDP growth.

So to interpret the graph start with the Autumn 2009 forecast. It projected that real GDP growth in Greece for 2009 would be -2.9 per cent, but then growth would return in 2010 (0.6 per cent) followed by stronger growth in 2011 (1.5 per cent).

The actual performance over those three years was -4.3 (2009), -5.5 (2010), and -9.1 (2011).

The divergence in what the European Commission thought would happen as it was beginning to bully Greece to impose fiscal austerity, and what actually happened is stark beyond belief.

And in the next two years the Commission was similarly in error, although you can see how its revisions were becoming slightly less optimistic as the crisis deepened.

By 2013, the Commission was getting closer to reality although it was still predicting in 2014growth in 2015 to be 2.9 per cent, when the actual was -0.2 per cent – still the errors were smaller.

The 2.7 per cent prediction seems to be popular in the European Commission forecasting unit. For the last two years it has been predicting that Greece will record that growth rate this year.

With the December-quarter contraction, it would be brave person who would suggest that Greece will grow by 2.7 per cent this year.

Investment has collapsed

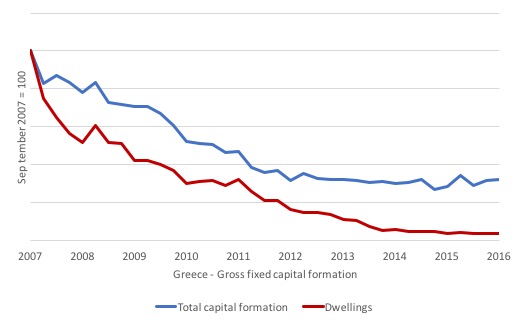

The quarterly national accounts data from the Greek National Statistical Authority (El.Stat) provides quite detailed data on Gross fixed capital formation by asset type.

The following graph shows indexes from the September-quarter 2007 (the peak – index = 100) to the September-quarter 2016 for all gross fixed capital formation (investment spending) and the sub-category dwellings.

For the 9 years shown, total investment has gone from 100 to 32.4 while dwellings investment has gone from 100 to 3.7. Yes, you read that correctly.

Investment in housing stock has shrunk by 96.3 per cent.

Investment in transport equipment has gone from 100 to 12.2 index points. Investment in ICT has gone from 100 to 54.4 index points. Other machinery and equipment from 100 to 61.3.

It is almost impossible to envisage how a government could allow this to happen unless it had lost all authority and an external force, with no long-term vested interests in the welfare of the nation were running the show.

Which, of course is exactly what has happened to Greece. The IMF officials who swan in an out, bullying Greek government bureaucrats have no stake in Greece. The European Commission officials have no real stake.

They will retire on luxurious pensions to some where having left behind a total disaster for the Greek nation.

Even using the term nation in relation to Greece is a misnomer these days. They might still wave the flag but for all intents and purposes they have been colonised by the neo-liberals to the north of them.

In yesterday’s blog – US labour market deteriorating – the losses from GFC will be long-lived – we compared the time paths of various Potential real GDP series for the US to show how recession impacts and via its effect on investment spending (capacity building) leads to long-run negative consequences if allowed to persist.

The lesson was clear – the longer the recession lasts and the weaker is any subsequent recovery is – the more is the likelihood that gross capital formation will deteriorate significantly, which then reduces the long-run growth potential of the nation.

The costs of the recession then multiply and resonate for generations.

Any recession is bad and the income losses are permanent. But a standard V-shaped downturn that sees the economy deteriorate sharply but then recovery just as quickly tends not to create these long-lived hysteresis effects (which I explained in yesterday’s blog).

But a deep and long recession followed by a weak, drawn out recovery is a disaster and leads to the sort of investment profiles shown in the previous graph.

Although, I have to say, the Greek experience is extreme. I cannot recall an historical pattern like this.

A deliberate destruction of a national economy.

The shrinking future for Greece

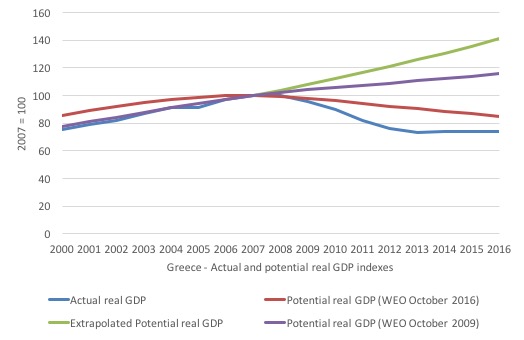

I did a similar exercise for Greece (as was discussed in yesterday’s blog) which is shown in the following graph. One has to do several calculations to build a (relatively) consistent data set.

I used the IMF World Economic Outlook (WEO) data because you can still get archived databases. Be warned though, that the IMF estimates of output gaps are typically biased downwards (too small) because their concept of full employment maintains unemployment rates that could be reduced further without inflationary consequences with proper job creation programs.

But we will use them as the benchmark, keeping the bias in mind.

I computed three times series from 1995 to 2016:

1. Potential real GDP using the 2016 WEO output gap estimates (then reverse engineering them to get potential).

2. Potential real GDP using the 2009 WEO output gap estimates – so what the IMF thought the output gaps would be before the full impact of the GFC occurred. I couldn’t go back to 2007 because there are no output gap measures for Greece at that time.

3. Potential real GDP based on a simple linear extrapolation of the annual real GDP growth rate between 1996-2007 to give some idea of what would have happened if the GFC had not occurred and the Greek economy had have continued to growth beyond 2007. The extraploation begins in 2008.

I had to adjust the IMF-based series to make the constant price base the same (2000 prices converted to 2009 prices for the 2009 WEO estimates) and extrapolate the last three years.

All times series were indexed to 100 at 2007.

None of these data manipulations introduce anything spurious into the analysis. Applied economics is a lot of approximation anyway.

The results are shown in the following graph. The lines correspond with the time series explained above with the actual real GDP index (blue) included.

The results are:

1. Real Greek GDP has shrunk by around 27 per cent (using WEO data) since 2007.

2. If the economy had have maintained its average real GDP growth rate between 1996-2007 then real GDP would have moved out along the green line. We might assume that potential real GDP would have been within that vicinity (depending on the growth rate of investment).

By 2016, the real GDP loss relative to the green line scenario was 168 billion euros (which scales to 67 per cent of the real GDP achieved in 2007).

3. The purple line tells us where the IMF thought potential real GDP would move as time passed (remember this was based on estimates 2 years into the crisis – so pessimism was already being reflected in the estimates).

4. The red line is the current IMF estimate of potential real GDP (as at October 2016) and shows how the Depression that Greece has been enduring for more than 8 years has damaged its long run potential.

If these estimates are close to be the fact then the Greek economy hits full capacity if it expands by 10 per cent of its current size – remember its actual contraction has been around 27 per cent.

So national income will be much lower for many years to come – which is why the IMF has claimed unemployment will remain above 10 per cent until at least 2050.

Remember also that a 1 per cent growth rate in 2017 generates a lot less total extra income than 1 per cent growth in 1995. In 1995, 1 per cent growth would have generated 2.51 billion euros (in real terms) while in 2016 it generates 1.85 billion euros, such has been the contraction in the Greek economy.

So when European Commission and IMF officials are shouting about Greece returning to growth, the base from which that growth is emanating from is around 28 per cent smaller.

Conclusion

Basically, the Troika conspired to destroy the prosperity of Greece as a nation and its political leadership joined that conspiracy by refusing to broach an exit from the Eurozone.

Without the euro, Greece could have returned to growth immediately and sustained that growth without having to endure these crippling capacity contractions which will damage its future generations far into the future.

That is enough for today!

(c) Copyright 2017 William Mitchell. All Rights Reserved.

Greece is now a slave state, and it seems is destined to remain so for a long time.

“Perhaps if Syriza had demonstrated some spine, they too could have got away with the Spanish solution ”

Unfortunately the ECB threatened to pull the plug on the Greeks because it isn’t big enough. They dared not do that with Spain which would have destroyed the Euro.

The Greeks needed to call the ECB’s bluff but doesn’t have the leverage because its central bank computer systems run in another country. TARGET2 is run by Italy, France and Germany.

Banco de Espana joins that team (the so called 4CB) and runs part of the Eurosystems security clearance mechanism. So the ECB can’t pull the plug on Banco De espana without collapsing the security clearance market.

They can pull the plug on ΤτΕ because it has no systemic leverage.

The dangers of outsourcing. You trade resilience for efficiency.

A few notes:

1) Greek productivity is minimal, especially regarding high added value products. Most things are imported, even a big percentage of needed food (not to mention fertilizers, agricultural machinery etc). A crash would mean, no fuel, no medicines, Caracas queues, and agricultural production using hand-working.

2) Greek mentality is a unique cocktail of 3 parts: one part West, one part of old USSR, one part of Middle East. Bureaucracy, statism, corruption, bribery, Rule of Law not working. The county could develop a healthy services economy (finance, commerce, transport, tourism, culture) and become the European Florida, the European Singapore. But not with the above deficiencies.

Now, could you please elaborate on your statement that “Without the euro, Greece could have returned to growth immediately”?

PS. I am not a euro/EU establishment/German supporter, nor have i any intertwined interests in any of those. But this economist mantra of “Greece gets out of euro and suddenly all is bright”…sorry but i don’t buy that, and neither should your readers.

Hello,

Great blog. I heard on the Max Keiser show yesterday that while in office Yanis Varoufakis began setting up and internal electronic payments system in Greece. So that when the ATMs are shut off by the EU, the Greek government could then run an immediate backup payments system and restore liquidity which they did not have last time around. This was one practical reason the government could not stand up to the troika. This time around they might have this ace up their sleeve.

Thanks

Alan

“……….and its political leadership joined that conspiracy by refusing to broach an exit from the Eurozone.”

The fact is that the majority of the Greek people did not want to quit the EZ.

What else could Syriza do?

Dear Nick Markakis (at 2017/02/15 at 10:32 pm)

Thanks for your comment. However, you went one step too far.

You finished by quoting my blog “Without the euro, Greece could have returned to growth immediately” and then inferred I was buying into the “economist mantra of ‘Greece gets out of euro and suddenly all is bright'”.

The two statements do not necessarily follow. My conclusion is correct – Greece can return to growth immediately outside of the euro.

But I have never said that “suddenly all is bright”. My book on the Eurozone details how bad things are and will be for a long time even once a nation restores sovereignty by exiting the euro. The damage is deep. But the option of staying inside the eurozone is worse.

best wishes

bill

Wow. That reality growth vs. IMF forecast graph shows that they have absolutely no idea about the real economy. How can they be so wrong and still keep their jobs? This is absurd!

This is a massive “scientific”(in quote marks because they don’t know how to do proper science) experiment where Greek people are the guinea pigs.

“Even using the term nation in relation to Greece is a misnomer these days. They might still wave the flag but for all intents and purposes they have been colonised by the neo-liberals to the north of them.”

You are right in that regard. Why call Greece a nation when it doesn’t control its own country. Once people get unemployed for too long, they become discouraged to find work. They also lose their skills over time. I have to agree that this recession’s effect will last a long time for people in Greece ='(.

I once gave my co-worker a scenario and asked him a question:

A village has some unemployed people. Many people in the village would like to have some brick houses to live in. The village elders decide that those unemployed people should build brick houses for everyone. How many houses will be built in a year? Well, the answer is: it depends how many people are available, how fast they can build a brick house, and how many bricks/food/land/other resources the village has in order to support this endeavor.

Somehow, in the 21st century, we run out of money! What human/real resources to support building things? WE ARE OUT OF MONEY! We can’t pay unemployed people because we are out of money! INFLATION! We deficit spend to pay for military but no inflation there but I don’t care!!! INFLATION! We can’t pay unemployed people to do anything because it will discourage private investments (who would love to do business to get some of that money by the way haha)! Oh! Also, those who lost employment because their jobs were not needed anymore due to offshoring/technological advancement? People’s own government can’t help its own people to get employed so good luck! Oh yeah, you should go out to get a job since telling people to get jobs while policies’ aim is to maintain unemployment at the same time makes a lot of sense.

I am leaning towards the conservatives’ solution though. They make more sense than the libtards. let’s give the wealthy tax breaks. We are still waiting for top 0.1% to get as much wealth as 80% of the nation instead of the 50% they have now so that they will create jobs! Government BAD! Bad under all circumstances! Government is bad now, then, and forever! But, we need the police, military, and medical research to save our lives though, those are fine.

Nick Markakis : Greek productivity is minimal, especially regarding high added value products. Most things are imported, even a big percentage of needed food (not to mention fertilizers, agricultural machinery etc). A crash would mean, no fuel, no medicines, Caracas queues, and agricultural production using hand-working.

Basically none of this is true. Greek productivity is of course higher than past decades, before the Euro, when nobody scared themselves & others with such horror stories. Greece has not one but two world class trade-in-services industries – shipping & tourism. Most things are not imported. In particular, and by far the most important, most needed food is not imported; Greek food exports are about equal to imports.

At least if one believes sources like PASEGES, the UN FAO & the Economist Food Security Index- which rates Greece, like other European countries, as one of the most food-secure countries on the planet, even after taking stock of political uncertainties. As for fuel, Greece already used its excess refining capacity several years ago, going around bank financing in direct major quasi-barter deals to be paid for refining others oil, in oil – so it has some solid “domestic” source of fuel even.

It is shocking that some economists (none of which were in the Syriza government, though) who may be insightful theoretically, make irresponsible scaremongering statements that lead many to believe the above – imho out of sheer laziness. This is somewhat similar to the situation when the Euro was instituted, when many European post-Keynesians, even circuitistes, went along, in spite of the theoretical objections and the correct arguments of MMT & other colleagues.

Yes, the export-import structure, the elasticities (sensitivities) to demand & income for Greece are not very favorable in the short term. But this is like listening to a doctor saying “You have a troublesome nail fungus” and hearing “YOU’RE GONNA DIE TOMORROW!” Greece has enough exports to pay for needed imports. Period.

Henry: The fact is that the majority of the Greek people did not want to quit the EZ.

The fact is that several polls before and around the time of the referendum and Tsipras’s abject surrender showed that majorities or pluralities did want to leave the EZ. The referendum clearly supported this – especially in the context of massive propaganda at the time from EZ sources that that is exactly what a No vote would mean. This probably made the “No” vote about 10% lower – but it still won overwhelmingly.

Schauble offered a decent deal to Greece – a negotiated Grexit. He even told Varoufakis that he would not have accepted the deals he was offering were he in YV’s shoes. But then Tsipras accepted even worse ones!

The upshot is that Greece’s current problems are primarily due to the stupidity of the brainwashed Tsipras & Co- and that of the Greek people, perhaps in despair, who still support him. For there is an “easy”, “simple” answer – which would make everything suddenly comparatively bright: Leave the Euro.

“The fact is that several polls before and around the time of the referendum and Tsipras’s abject surrender showed that majorities or pluralities did want to leave the EZ.”

Some Guy,

See the following:

[Bill – edited out a series of links that refuted the statement above]

Do you have any references supporting your statement?

I also don’t understand why Greece did not take Schauble’s offer of an orderly exit from the EZ other than that the majority wanted to stay in.

Bill: “Without the euro, Greece could have returned to growth immediately”.

The “immediately” is the word, I strongly disagree with.

Eurozone is a total mess and has been destructive for the country. But as i said in previous comment, Greece is unique among other EZ countries. No other country has such “extensive” structural deficiencies.

Yes, when it hits the bottom, those who survive can start rebuilding. But it will be a long process with a lot of pain.

I live and work in Greece for the past 52 years. I have seen all the course since the 60s. After 81 it has been the course of a downbound train. Entering EZ in 2001 only accelerated the course and created additional issues. But it was already a downbound train…

The thing is, even if tomorrow all Greek debt was erased and the sky started raining money, in 10-20 years ww would be again in the same position.

Some Guy: “Greece has not one but two world class trade-in-services industries – shipping & tourism”

Shipping brings very little income to Greece, Ship owners have preferential treatment from the state and pay very little taxes. Their HQ are mostly abroad (mainly London), and most of the ship crews are foreign, so very little local employment.

Tourism, yes it’s big but not developed properly. Cheap charter and backpack tourism. High-class tourism not developed. Other Mediterranean countries are full of marinas – even Turkey (and with cheaper prices) – but not Greece. It would take years to face the local bureaucracy and build a marina here. Some years ago, a Greek-Canadian (i happen to know the guy personally) tried to come back, bring his money in and establish a seaplane service at the islands. Two years after, he departed in despair – could not find his way through the hundreds of permits and signature needed (and the relative briberies).

Nick Markakis, I think you undermine your own argument.

If Greece for its own reasons wants to have really bad supply-side policies, because for democratic reasons that is what they want, well then they really, really need to have their own currency.

You seem to be saying that the Greeks cannot control themselves without some external force being supplied. But numerous sorts of mostly democratic type countries have been able to do just that. I can’t believe that Greece couldn’t if they decided to.

Jerry Brown: “You seem to be saying that the Greeks cannot control themselves without some external force being supplied.”

Correct. I am not saying that Brussels/Berlin is the right external force. I do not imply dictatorship.

But yes, Greece is a failed state in many departments. This is what most foreign people fail to realise, because Greece geographically is part of Europe, and because Greece is a member of EU.

Greece is closer to Latin American countries – similar problems. Rule of Law malfunctions. Justice system has the speed of snail – takes years for a court decision. Corruption and bribery are the norm at all levels. No strong and honest leadership – politicians’ vision extends up to the next elections.

The only thing that’s holding the country from falling apart is that it is part of EU and NATO. The country will collapse if left alone in it’s own fate. Yes we need our own currency. We also need a productive economy, we need a cohesive society decided to endure hardship and build with a long term vision, we need the right leadership. Those prerequisites don’t exist. So the new currency will lose value quickly and become rubbish like the bolivar. You can imagine the rest…it will be chaos for at least a couple of years. That means tourism industry (which another commentator mentioned as the country’s strong asset) will also collapse.

Not to mention the external threats. Balkan unrest is rising (it’s already in the news these days) and Sultan Erdogan has the vision to rebuild the Ottoman Empire…

With euro, with drachma, either way we are doomed. The purpose of my comments is not to appeal for pity – the bed that we made, that’s the one we got to lie on. What i intend to show is that Greece is not the best example to be used as a case study, regarding EU/EZ problems. Spain, Portugal, Italy, France, Ireland, would be more fit.

“The Greeks needed to call the ECB’s bluff but doesn’t have the leverage because its central bank computer systems run in another country. TARGET2 is run by Italy, France and Germany”

what a mess. the dangers of outsourcing too right. think our government is also dealing with similar problems in various departments.

how much truth is there in the rumour that the greeks had their own parallel system they are or were working on?

Also need to mention credit rating of Greece.

The depth of credit information index for Greece is 7, which means that information is mostly sufficient and quite detailed; accessibility is not a problem. According to the S&P credit-rating agency, Greece has a credit rating score of CCC-, and the prospects of this rating are negative. According to the Fitch credit-rating agency, Greece has a credit rating score of CCC, and the prospects of this rating are negative. According to the Moody’s credit-rating agency, Greece has a credit rating score of Caa3, and the prospects of this rating are negative.